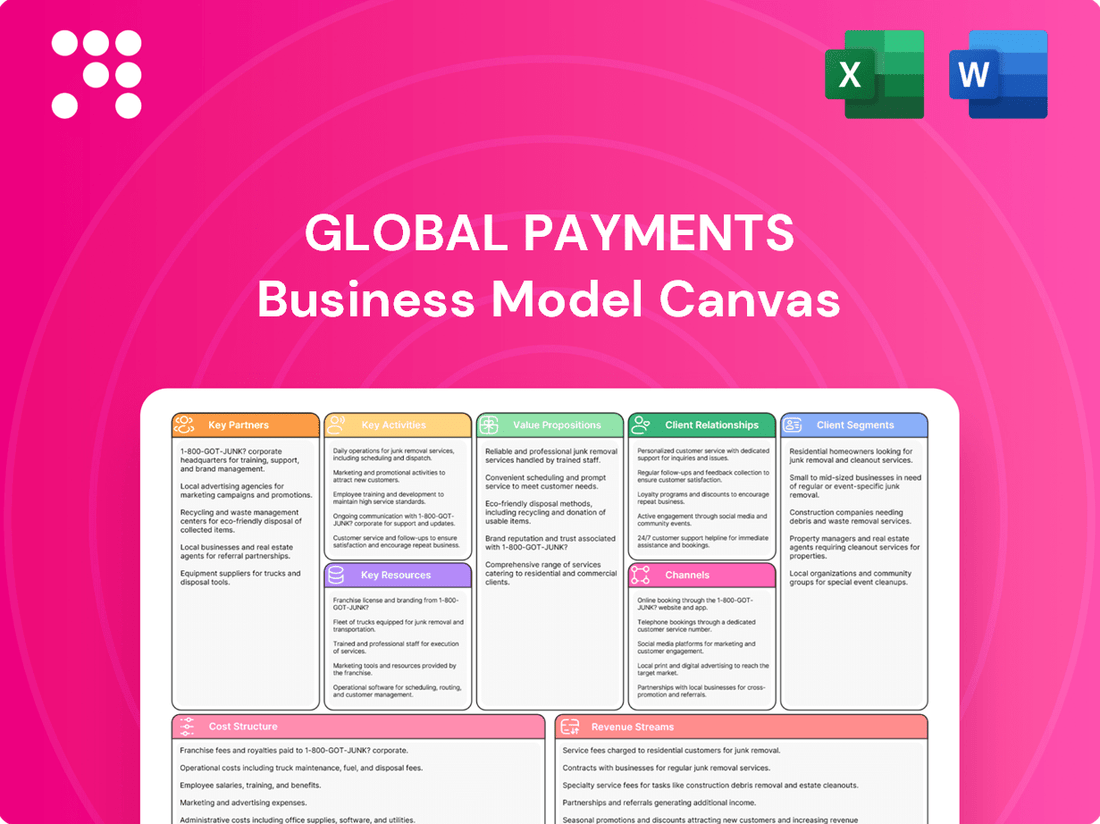

Global Payments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Unlock the full strategic blueprint behind Global Payments's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Global Payments actively cultivates relationships with financial institutions and banks, treating them as vital partners. These collaborations are essential for embedding payment processing capabilities directly into banking services, creating a seamless experience for merchants. A prime example is their renewed strategic partnership with Banamex, which aims to enhance the integrated payment offerings available to businesses.

These alliances are instrumental in widening Global Payments' market presence and delivering holistic financial solutions. By integrating payment processing with core banking functions, they empower merchants with streamlined operations and expanded customer reach. For instance, in 2024, Global Payments continued to emphasize these partnerships as a cornerstone of its strategy to provide comprehensive financial ecosystems.

Global Payments collaborates with Independent Software Vendors (ISVs) to integrate payment processing capabilities directly into their software applications. This strategic alliance benefits ISVs by enabling them to offer seamless, secure payment experiences to their clients across diverse sectors such as retail, hospitality, and healthcare. For instance, by partnering with Global Payments, ISVs can provide their customers with features like point-of-sale integrations and online checkout functionalities, thereby enhancing customer value and reducing the burden of payment system management.

Global Payments strategically partners with technology and platform providers to bolster its embedded commerce, issuer processing, and risk management capabilities. These alliances are crucial for delivering a robust and integrated suite of financial solutions to a diverse client base.

A prime example is the commercial relationship with FIS, which Global Payments acquired in 2023 for approximately $4.7 billion. This partnership is designed to offer a comprehensive range of payment processing and technology solutions on a global scale, enhancing service delivery and market reach.

Point-of-Sale (POS) System Providers

Global Payments collaborates with Point-of-Sale (POS) system providers to ensure seamless payment acceptance for businesses, whether online or in physical stores. These partnerships are crucial for merchants to manage transactions efficiently.

For instance, Global Payments' Genius™ POS platform is designed to integrate with various retail POS systems, offering merchants enhanced payment processing capabilities and business management tools. This integration simplifies operations and broadens payment options for customers.

- Enhanced Payment Acceptance: Partnerships with POS providers allow Global Payments to offer integrated payment solutions, covering credit cards, debit cards, and emerging payment methods.

- Merchant Solutions: Global Payments' focus on retail includes developing POS solutions like Genius™ that streamline checkout processes and improve customer experience.

- Market Reach: By integrating with popular POS systems, Global Payments expands its reach to a wider base of small and medium-sized businesses.

- 2024 Data Insight: As of early 2024, the global POS market is projected to continue its growth, driven by the increasing adoption of digital payments and the need for efficient transaction processing by businesses of all sizes.

Payment Networks and Schemes

Global Payments relies heavily on its partnerships with major payment networks like Visa and Mastercard. These alliances are crucial for enabling seamless, worldwide transaction processing, ensuring broad merchant acceptance and consumer convenience.

Beyond global players, collaborations with local payment schemes are vital for market penetration and compliance. These regional partnerships allow Global Payments to cater to specific customer preferences and navigate diverse regulatory landscapes effectively.

These relationships are foundational, ensuring interoperability and adherence to industry standards, which is critical for maintaining trust and security in the payment ecosystem. For instance, in 2024, Visa reported processing over 200 billion transactions, highlighting the sheer volume and importance of these network partnerships.

- Visa and Mastercard: Core partnerships for international transaction processing and broad acceptance.

- Local Payment Schemes: Essential for regional market access and compliance with local payment preferences.

- Interoperability and Compliance: Ensuring smooth transactions and adherence to global financial regulations.

- Transaction Volume: In 2024, Visa alone processed over 200 billion transactions, underscoring the scale of these network relationships.

Global Payments' key partnerships are critical for its operational success and market expansion. These include collaborations with financial institutions, Independent Software Vendors (ISVs), technology providers, and point-of-sale (POS) system developers. These alliances are fundamental to embedding payment processing into various business workflows and enhancing merchant services.

The company also relies on strategic relationships with major payment networks like Visa and Mastercard, as well as local payment schemes. These partnerships ensure broad transaction acceptance, regulatory compliance, and access to diverse markets. In 2024, Visa's processing of over 200 billion transactions highlights the immense scale and importance of these network affiliations.

| Partner Type | Key Contribution | Example/Impact |

|---|---|---|

| Financial Institutions | Seamless payment integration into banking services | Partnership with Banamex for enhanced merchant offerings |

| ISVs | Embedding payment processing into software applications | Enabling ISVs to offer integrated POS and online checkout |

| Technology Providers | Enhancing embedded commerce and risk management | Acquisition of FIS for comprehensive payment solutions |

| POS System Providers | Facilitating efficient payment acceptance | Genius™ POS platform integration with retail systems |

| Payment Networks (Visa, Mastercard) | Global transaction processing and broad acceptance | Facilitating over 200 billion transactions in 2024 (Visa) |

What is included in the product

A structured framework detailing customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure for a global payments business.

This canvas provides a holistic view of how a global payments company operates, generates revenue, and manages its resources and relationships to serve diverse markets.

Simplifies complex global payment flows by visually mapping key elements, alleviating the pain of understanding intricate cross-border transactions.

Activities

Global Payments' primary function revolves around processing a massive volume of transactions and bringing merchants into their network, allowing businesses to accept payments through various methods. This involves maintaining the sophisticated technical systems and financial pipelines essential for smooth payment acceptance.

In 2024, Global Payments continued to be a major player in facilitating these transactions. For instance, their operations support millions of merchants worldwide, processing billions of dollars in payments annually, underscoring the scale of their payment processing and merchant acquiring activities.

Global Payments dedicates significant resources to software development and innovation, focusing on payment technology and solutions. This includes advancements in point-of-sale systems and the integration of payment capabilities directly into business operations. For instance, in 2024, the company continued to invest heavily in research and development to enhance its digital offerings.

This ongoing commitment to R&D is crucial for maintaining a competitive edge in the rapidly evolving payments landscape. By developing cutting-edge tools, Global Payments empowers businesses to streamline operations and improve customer engagement through seamless payment experiences.

Implementing robust risk management and fraud prevention is paramount for global payments. This involves sophisticated systems to safeguard cardholder data and combat financial crime. For instance, in 2024, the global financial sector continued to invest heavily in AI-driven fraud detection, with some reports indicating a significant reduction in fraudulent transactions compared to previous years due to these advanced technologies.

Advanced technologies, particularly artificial intelligence and machine learning, are central to securing transactions. These tools analyze vast datasets in real-time to identify suspicious patterns, thereby maintaining trust and integrity within the payment ecosystem. The effectiveness of these measures is crucial, as a single major data breach can severely damage customer confidence and incur substantial financial penalties.

Customer Onboarding and Support

Global Payments prioritizes a smooth onboarding experience for new merchants and partners. This includes offering dedicated support and resources, with a particular focus on Independent Software Vendors (ISVs) to facilitate seamless integration.

The company provides comprehensive assistance throughout the client lifecycle. This support covers everything from initial integration to ongoing technical assistance, which is crucial for building and maintaining successful client relationships.

- Streamlined Onboarding: Global Payments aims to simplify the process for new businesses joining their platform.

- Dedicated ISV Support: Special attention is given to ISVs to ensure they can easily integrate Global Payments' solutions.

- Comprehensive Assistance: Support extends from initial setup to continuous technical help.

- Client Relationship Focus: Effective support is seen as vital for fostering long-term partnerships.

Strategic Acquisitions and Divestitures

Global Payments actively pursues strategic acquisitions and divestitures to refine its market position and boost profitability. A prime example is the 2019 acquisition of Worldpay for approximately $43 billion, a move designed to significantly expand its global reach and service offerings in the payments processing sector. This integration aimed to capture substantial market share and leverage economies of scale.

Further demonstrating this strategy, Global Payments divested its Issuer Solutions business in 2023 to One Identity for $1.1 billion. This divestiture allowed the company to concentrate on its core merchant acquiring and payment technology segments, streamlining its operations and focusing resources on higher-growth areas. Such portfolio adjustments are crucial for maintaining competitive advantage and optimizing financial performance.

- Strategic Focus: Divesting non-core assets like Issuer Solutions allows Global Payments to concentrate on its primary revenue streams.

- Market Expansion: Acquisitions, such as Worldpay, are key to entering new geographic markets and customer segments.

- Synergy Creation: Integrating acquired businesses aims to realize cost savings and revenue enhancements through operational efficiencies.

- Portfolio Optimization: Regularly reviewing and adjusting the business portfolio ensures resources are allocated to the most promising opportunities.

Global Payments' core activities involve processing transactions and bringing merchants onto their platform, supported by robust technology and financial infrastructure. In 2024, the company continued to facilitate billions of dollars in payments for millions of merchants globally, highlighting the sheer volume and importance of their transaction processing and merchant acquiring functions.

A significant part of their operations includes investing in and developing advanced payment technologies, such as point-of-sale systems and integrated payment solutions. This focus on innovation, evident in their continued R&D investments in 2024, is vital for staying competitive and offering businesses streamlined payment experiences.

Ensuring transaction security through advanced risk management and fraud prevention is paramount. Global Payments employs sophisticated systems, often leveraging AI and machine learning, to protect data and combat financial crime. The industry's ongoing emphasis on AI-driven fraud detection in 2024 has shown positive results in reducing fraudulent activities.

The company also prioritizes a smooth onboarding process for new merchants and partners, particularly Independent Software Vendors (ISVs), offering dedicated support to ensure seamless integration and foster strong, lasting client relationships through comprehensive lifecycle assistance.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Transaction Processing & Merchant Acquiring | Facilitating payments for businesses and bringing them onto the network. | Supports millions of merchants, processing billions of dollars in payments annually. |

| Technology Development & Innovation | Creating and enhancing payment technologies, POS systems, and integrated solutions. | Continued significant investment in R&D for digital offerings. |

| Risk Management & Fraud Prevention | Implementing systems to protect data and combat financial crime. | Utilizes AI/ML for real-time transaction analysis and fraud detection. |

| Merchant & Partner Onboarding/Support | Streamlining integration and providing ongoing assistance to clients. | Focus on ISV integration and comprehensive lifecycle support. |

Full Version Awaits

Business Model Canvas

The Global Payments Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the final deliverable, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use canvas, allowing you to immediately begin strategizing for your global payments business.

Resources

Global Payments leverages its sophisticated proprietary payment technology and robust software platforms, such as the Genius POS system, to deliver comprehensive payment processing and commerce enablement solutions. This technological backbone is crucial for its operations, facilitating a wide array of services for its diverse client base.

In 2024, the company continued to invest in these core technological assets, recognizing their importance in maintaining a competitive edge and driving innovation in the rapidly evolving payments landscape. These platforms are designed for scalability and efficiency, supporting Global Payments' mission to simplify commerce for businesses worldwide.

A global processing infrastructure is absolutely critical for a company operating in the payments space. This isn't just about having servers; it's about a vast network that can securely and efficiently manage billions of transactions every single day. Think about the sheer volume and the need to operate seamlessly across different countries and currencies. For instance, Visa, a major player, processed an astounding 252 billion transactions in 2023, highlighting the immense scale required.

This robust infrastructure is the backbone, enabling reliable worldwide operations. It's what allows a company to offer its services consistently, regardless of where a customer is or what currency they are using. The reliability factor is paramount; any downtime or processing error can lead to significant financial losses and damage to reputation. Companies invest heavily in this to ensure high availability and low latency, crucial for customer satisfaction and business continuity.

Global Payments leverages its approximately 27,000 team members, operating in 38 countries, as a core resource. This diverse workforce brings critical expertise in payment technology, software development, and the nuances of global commerce, essential for driving innovation and delivering robust client support.

Merchant and Partner Network

Global Payments leverages a massive ecosystem of over 6 million merchant customers, acting as a direct channel for its payment processing services. This extensive customer base is a primary asset, enabling significant transaction volume and revenue generation.

The company also relies on a diverse range of partners to expand its market reach and distribution capabilities. These include Independent Software Vendors (ISVs) who integrate payment solutions into their platforms, financial institutions that offer Global Payments' services to their clients, and independent sales organizations (ISOs) that drive merchant acquisition.

This robust network is fundamental to Global Payments' business model, facilitating widespread adoption of its payment technologies and services. For instance, in 2024, the company continued to see strong growth in its merchant services segment, driven by these established relationships and ongoing expansion efforts.

- Merchant Customer Base: Exceeding 6 million businesses, providing a vast foundation for transaction processing.

- ISV Partnerships: Integration with software providers amplifies reach into diverse business verticals.

- Financial Institution Alliances: Collaboration with banks and credit unions extends service offerings to their existing customer bases.

- ISO Network: Independent sales organizations act as key agents for merchant acquisition and sales support.

Intellectual Property and Patents

Global Payments leverages its intellectual property, particularly patents on payment technologies and software, as a cornerstone of its competitive strategy. These patents safeguard its innovations, offering a distinct advantage in the fast-paced digital payments landscape. For instance, as of early 2024, the company actively manages a robust portfolio of patents protecting its advancements in areas like real-time transaction processing and fraud detection.

This strong IP foundation is crucial for maintaining market leadership and deterring competitors from replicating its proprietary solutions. The company's commitment to innovation, evidenced by its ongoing patent filings, ensures its offerings remain at the forefront of the industry. In 2023, Global Payments invested significantly in research and development, a portion of which directly contributes to expanding and strengthening its patent portfolio.

Key aspects of Global Payments' intellectual property strategy include:

- Patented Payment Technologies: Innovations in areas such as tokenization, secure payment gateways, and cross-border transaction processing are protected.

- Software Solutions: Proprietary software for merchant onboarding, data analytics, and customer relationship management are safeguarded.

- Competitive Differentiation: The patent portfolio provides a unique selling proposition, allowing Global Payments to offer advanced and secure solutions that competitors cannot easily replicate.

- Future Innovation: Ongoing R&D efforts, supported by patent protection, fuel the development of next-generation payment services.

Global Payments' key resources extend beyond technology and people to include its extensive merchant customer base, which numbered over 6 million in 2024. This vast network serves as a direct sales channel and a significant source of transaction volume. The company also cultivates strategic partnerships with Independent Software Vendors (ISVs), financial institutions, and Independent Sales Organizations (ISOs). These alliances are vital for expanding market reach and driving merchant acquisition, as evidenced by continued growth in merchant services throughout 2024 fueled by these relationships.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Merchant Customer Base | Over 6 million businesses globally | Direct sales channel, drives transaction volume and revenue. |

| ISV Partnerships | Integration with software providers | Amplifies reach into diverse business verticals, facilitating seamless payment integration. |

| Financial Institution Alliances | Collaboration with banks and credit unions | Extends service offerings to their existing customer bases, broadening market penetration. |

| ISO Network | Independent sales organizations | Crucial for merchant acquisition and providing localized sales support. |

Value Propositions

Global Payments empowers businesses to accept payments seamlessly across in-store, online, and mobile platforms. This comprehensive approach offers merchants unparalleled flexibility, catering to diverse customer preferences and transaction methods. In 2024, the company continued to expand its omnichannel capabilities, supporting businesses in reaching a wider customer base.

Global Payments provides businesses with more than just payment processing. Their suite of tools and software solutions are designed to optimize operations, simplify workflows, and boost overall efficiency. This extends to robust reporting, insightful analytics, and even access to business funding, creating a comprehensive operational support system.

Global Payments offers secure and reliable transaction processing, a cornerstone of its value proposition. This ensures businesses can confidently handle sensitive cardholder data, thereby building trust with their customers and adhering to stringent regulatory requirements. For instance, in 2024, the company continued to invest heavily in advanced fraud detection systems, which are crucial in an environment where payment fraud losses are projected to exceed $340 billion globally by 2027.

The reliability of Global Payments' processing infrastructure is paramount. Businesses depend on seamless transaction flows to maintain customer satisfaction and operational efficiency. In 2024, Global Payments maintained an uptime of 99.99% for its core processing services, a figure that underscores its commitment to uninterrupted service delivery. This resilience is vital for merchants, especially during peak sales periods.

Integrated and Embedded Payment Capabilities

Global Payments offers integrated and embedded payment capabilities, allowing businesses to seamlessly incorporate payment processing directly into their existing software and workflows. This provides a frictionless experience for both merchants and their end customers, especially benefiting Independent Software Vendors (ISVs) who can offer a complete solution.

This integration is crucial for modern commerce, as seen in the growing trend of embedded finance. For instance, in 2024, the global embedded finance market was projected to reach hundreds of billions of dollars, highlighting the demand for such seamless payment solutions.

- Seamless Integration: Payments are built directly into business software, eliminating the need for separate systems.

- Enhanced Customer Experience: Customers can complete transactions without leaving their preferred application or platform.

- ISV Partnership Focus: Global Payments empowers ISVs to deliver value-added payment services to their client base.

Global Reach and Scalability

Global Payments' extensive network, operating in over 175 countries, provides businesses with unparalleled global reach. This vast footprint allows companies to seamlessly process transactions and expand their operations across diverse international markets. In 2024, the company continued to enhance its cross-border payment capabilities, facilitating smoother international commerce for its clients.

The company's solutions are designed for scalability, meaning businesses can grow their transaction volumes and adapt to evolving market needs without encountering significant operational hurdles. This adaptability is crucial for enterprises looking to expand internationally. For instance, Global Payments' infrastructure supports millions of transactions daily, demonstrating its capacity to handle significant growth.

- Global Presence: Operates in over 175 countries, facilitating international business expansion.

- Scalable Solutions: Infrastructure supports growing transaction volumes and market adaptation.

- Cross-Border Capabilities: Enhances international commerce by streamlining global transactions.

- Transaction Capacity: Handles millions of daily transactions, showcasing robust scalability.

Global Payments provides a unified platform for accepting payments across all channels, from physical stores to online and mobile. This omnichannel approach ensures businesses can cater to customer preferences wherever they shop, a capability that saw significant expansion in 2024 to support broader market reach.

Beyond basic processing, Global Payments offers a suite of tools that enhance business operations, including analytics and reporting. These solutions streamline workflows and provide valuable insights, contributing to overall efficiency. In 2024, the company continued to bolster its data analytics capabilities to offer more actionable business intelligence.

Security and reliability are paramount, with Global Payments investing in advanced fraud detection systems. This focus on safeguarding transactions builds customer trust and ensures compliance with evolving regulations. By 2024, Global Payments maintained high uptime rates, critical for uninterrupted business operations, especially during peak demand periods.

The integration of payment solutions directly into business software, known as embedded payments, offers a frictionless experience. This is particularly valuable for Independent Software Vendors (ISVs) looking to add payment capabilities to their offerings. The demand for such seamless financial integration was a key market driver throughout 2024.

| Value Proposition | Key Features | 2024 Data/Insights |

|---|---|---|

| Omnichannel Payment Acceptance | In-store, online, mobile processing | Expanded omnichannel capabilities to support wider customer reach. |

| Operational Enhancement Tools | Analytics, reporting, workflow optimization | Continued investment in data analytics for actionable business intelligence. |

| Security and Reliability | Advanced fraud detection, high uptime | Maintained high uptime rates, crucial for uninterrupted service. |

| Integrated & Embedded Payments | Seamless integration into business software | Focus on embedded finance solutions to meet growing market demand. |

Customer Relationships

Global Payments prioritizes strong client connections through dedicated account management, offering personalized support for diverse payment technology requirements. This commitment extends to specialized technical assistance for Independent Software Vendors (ISVs), a crucial segment for their platform integration.

Global Payments cultivates strong partner relationships through dedicated programs designed for Independent Software Vendors (ISVs) and financial institutions. These structured initiatives equip partners with essential tools, comprehensive resources, and ongoing support, ensuring seamless integration and effective distribution of Global Payments' innovative solutions. For instance, in 2024, Global Payments continued to expand its partner ecosystem, reporting that over 70% of its new merchant acquisitions were driven by its partner channels, highlighting the critical role these relationships play in its growth strategy.

Global Payments excels in consultative sales, partnering with businesses to deeply understand their specific payment and software needs. This involves a hands-on approach to designing solutions that directly tackle operational hurdles and enhance customer interactions.

In 2024, this consultative model proved particularly effective. For instance, their work with a major retail chain resulted in a streamlined omnichannel payment system that reduced checkout times by an average of 15%, directly impacting customer satisfaction and sales conversion rates.

Self-Service Portals and Resources

Global Payments offers robust self-service portals and a wealth of online resources to empower its diverse customer base. These platforms allow clients and partners to efficiently manage their accounts, access critical documentation, and quickly find answers to frequently asked questions, reducing reliance on direct support.

This commitment to self-service was evident in 2024, where Global Payments saw a significant uptick in portal usage for account management and transaction inquiries. For instance, their online knowledge base, updated regularly with new product information and troubleshooting guides, handled millions of customer queries, demonstrating its effectiveness in providing immediate assistance.

- Customer Empowerment: Self-service portals provide 24/7 access for account management and issue resolution.

- Efficiency Gains: Online resources significantly reduce the need for direct customer support interactions.

- Data-Driven Improvement: In 2024, Global Payments observed a substantial increase in self-service portal engagement for routine tasks.

- Resource Accessibility: An extensive online knowledge base and documentation library ensures customers can find information independently.

Ongoing Innovation and Updates

Global payment providers are actively investing in ongoing innovation to maintain strong customer relationships. This includes frequent updates to their payment technology and software, ensuring clients always have access to the most current features and security protocols.

For instance, by mid-2024, a significant portion of leading payment processors had rolled out enhancements focused on improving transaction speed and data analytics capabilities. This commitment to advancement helps customers adapt to evolving market demands.

Key areas of innovation include:

- Artificial Intelligence Integration: Implementing AI for fraud detection, personalized customer experiences, and operational efficiency. For example, many platforms are now offering AI-powered dispute resolution tools.

- Real-Time Payments: Expanding capabilities for instant fund transfers, a feature that saw substantial growth in adoption during 2023 and early 2024, with some regions reporting over 50% of domestic transactions occurring in real-time.

- Enhanced Security Features: Continuously updating security measures, such as tokenization and biometric authentication, to protect against emerging cyber threats.

- API Development: Providing robust APIs that allow businesses to seamlessly integrate payment solutions into their existing systems, fostering greater flexibility and customization.

Global Payments fosters enduring client connections through dedicated account management and specialized technical support for ISVs, ensuring seamless integration of their payment technologies. Their consultative sales approach involves deeply understanding client needs to craft tailored solutions that address operational challenges and enhance customer experiences.

In 2024, Global Payments saw over 70% of new merchant acquisitions come through partner channels, underscoring the strength of these relationships. Furthermore, their consultative work with a major retailer led to a 15% reduction in checkout times, directly boosting customer satisfaction.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Account Management | Personalized support, technical assistance | Crucial for ISV integration |

| Partner Programs (ISVs, Financial Institutions) | Tools, resources, ongoing support | Drove over 70% of new merchant acquisitions |

| Consultative Sales | Needs assessment, solution design | Reduced retail checkout times by 15% |

| Self-Service Portals & Online Resources | Account management, knowledge base access | Millions of customer queries handled |

Channels

Global Payments leverages its dedicated direct sales force to cultivate strong relationships with merchants, offering personalized onboarding for POS solutions and payment processing services. This hands-on approach allows them to directly address business needs.

In 2024, Global Payments continued to invest in its sales infrastructure, recognizing the direct sales channel as a key driver for merchant acquisition and retention. This strategy is crucial for expanding their footprint in competitive markets.

Independent Software Vendor (ISV) partnerships are a cornerstone for Global Payments, acting as a vital channel to reach diverse business segments. By integrating their payment solutions into the software applications that businesses already rely on, Global Payments significantly expands its market presence and customer acquisition.

In 2024, the fintech landscape continued to see robust growth in embedded finance, with ISVs playing a crucial role. Many ISVs reported increased revenue streams by offering integrated payment processing, with some seeing a 15-20% uplift in their own service offerings. This highlights the value proposition for both the ISV and the end-user business.

These partnerships allow Global Payments to tap into niche markets and serve businesses that might not directly seek out a payment processor. For instance, a restaurant management ISV embedding Global Payments’ technology provides a seamless checkout experience for restaurateurs, directly connecting Global Payments to thousands of potential merchant accounts without direct sales efforts.

Global Payments effectively utilizes financial institution referrals and partnerships as a key channel, tapping into established networks to acquire new business clients. These alliances allow Global Payments to offer its payment processing and technology solutions to a broader customer base, leveraging the trust and existing relationships of partner banks.

A significant example of this strategy is the partnership with Banamex. This collaboration not only expands Global Payments' reach within Mexico but also demonstrates the value of integrating with major financial players to drive customer acquisition and service expansion.

Online Presence and Digital Marketing

Global Payments leverages a strong online presence to connect with its audience. Its website serves as a central hub for information, detailing services and solutions for businesses. Digital marketing initiatives, including search engine optimization and targeted advertising, are crucial for reaching potential clients and partners.

Social media platforms are actively used to engage with customers, share industry insights, and promote new offerings. This multi-channel approach ensures broad reach and consistent communication. In 2024, digital marketing spend across the financial services sector saw continued growth, with companies like Global Payments investing heavily in online channels to acquire new customers and build brand loyalty.

- Website: A comprehensive platform detailing services, solutions, and company news.

- Digital Marketing: Campaigns focusing on SEO, SEM, and content marketing to attract and convert leads.

- Social Media Engagement: Active presence on platforms like LinkedIn to foster community and share expertise.

- Customer Acquisition: Digital channels are key drivers for onboarding new merchants and financial institutions.

Strategic Acquisitions and Integrations

Strategic acquisitions, like the significant Worldpay deal, act as a powerful channel for Global Payments to rapidly broaden its reach. This strategy injects new customers and market share by absorbing the acquired entity's established merchant relationships and partner ecosystems. For instance, the Worldpay acquisition in 2019 was a transformative move, significantly bolstering Global Payments' presence in key markets and payment processing segments.

These integrations are crucial for expanding the customer base and market share. By bringing acquired companies into the Global Payments fold, the company gains immediate access to their existing merchant networks and valuable partner channels. This accelerates growth far beyond what organic expansion alone could achieve.

The impact of such strategic moves is substantial. For example, following the Worldpay integration, Global Payments saw a notable increase in its transaction volumes and revenue. In 2023, the company reported substantial revenue growth, partly attributable to the continued synergy realization from its major acquisitions.

- Acquisition Strategy: Worldpay acquisition in 2019 significantly expanded Global Payments' customer base and market share.

- Channel Expansion: Integrates acquired companies' merchant and partner networks, providing immediate access to new markets.

- Financial Impact: Acquisitions contribute to substantial revenue growth and increased transaction volumes, as evidenced by 2023 financial reports.

Global Payments utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are crucial for building merchant relationships, while partnerships with Independent Software Vendors (ISVs) embed payment solutions into widely used business applications.

Financial institution referrals and strategic acquisitions, such as the Worldpay integration, further amplify its market reach. Digital channels, including a robust website and targeted online marketing, are also key for customer acquisition and engagement.

In 2024, Global Payments continued to emphasize these channels, recognizing their importance in a competitive fintech landscape. The company reported strong revenue growth, with a significant portion attributed to the ongoing synergies from its strategic acquisitions and the expansion of its partner ecosystems.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Personalized outreach and onboarding for merchants. | Key driver for merchant acquisition and retention. |

| ISV Partnerships | Integration into business software applications. | Expands market presence and customer acquisition in niche segments. |

| Financial Institution Referrals | Leveraging existing banking networks. | Access to broader customer bases through trusted relationships. |

| Digital Channels | Website, SEO, SEM, social media engagement. | Crucial for attracting and converting leads, building brand loyalty. |

| Strategic Acquisitions | Integrating acquired companies' networks. | Rapidly broadens reach, customer base, and market share. |

Customer Segments

Global Payments is a key partner for small and medium-sized businesses (SMBs), offering them the tools they need to process payments, manage sales, and streamline operations. In 2024, the company continued to focus on this vital segment, recognizing that SMBs represent a significant portion of the global economy, driving innovation and employment.

These businesses, ranging from local retailers to growing service providers, rely on Global Payments for reliable transaction processing, secure data handling, and integrated point-of-sale (POS) solutions. For instance, a substantial percentage of SMBs in the US, estimated to be over 60% by late 2023, utilize digital payment methods, highlighting the demand for the services Global Payments provides.

Large enterprises and corporations represent a core customer segment for global payment providers. These businesses require robust, scalable payment solutions capable of managing substantial transaction volumes and intricate financial operations, including cross-border transactions. For instance, in 2024, major corporations are increasingly leveraging integrated payment platforms to streamline accounts payable and receivable processes, aiming to reduce processing costs and improve cash flow visibility.

The demand for sophisticated payment capabilities, such as real-time payment processing and advanced fraud detection, is particularly high among these large organizations. Many are adopting solutions that offer API connectivity for seamless integration with their existing enterprise resource planning (ERP) systems. In 2024, companies are actively seeking partners that can provide comprehensive support for global commerce, including multi-currency processing and compliance with diverse international regulations.

Independent Software Vendors (ISVs) represent a crucial customer segment for Global Payments. These businesses integrate payment processing capabilities directly into their software solutions, allowing their end-users to conduct transactions seamlessly within the ISV's platform. This partnership benefits ISVs by adding value to their software, creating new revenue streams, and enhancing customer loyalty.

For example, a business management software provider might embed Global Payments' technology to enable their clients to accept credit card payments directly through the software. This not only simplifies operations for the end-user but also positions the ISV as a comprehensive solution provider. Global Payments' robust APIs and developer-friendly tools are key to attracting and supporting these ISVs.

In 2024, the market for embedded payments continued its strong growth trajectory. Many ISVs reported increased revenue from payment services, with some seeing payment facilitation contribute as much as 10-15% of their total income. This trend highlights the significant opportunity for Global Payments to expand its reach by partnering with a diverse range of software developers.

Financial Institutions and Banks

Financial institutions and banks are key partners, leveraging Global Payments' technology to enhance their existing payment infrastructures and expand their merchant services. This collaboration allows banks to offer more robust and competitive payment solutions to their business clients, thereby deepening customer relationships.

For instance, in 2024, many banks are actively seeking to integrate advanced payment processing capabilities to meet the growing demand for digital transactions. Global Payments provides the necessary technological backbone, enabling these institutions to process a higher volume of transactions efficiently and securely. This partnership is crucial for banks looking to stay competitive in a rapidly evolving financial landscape.

- Enhanced Merchant Services: Banks can offer integrated payment solutions, including point-of-sale systems and online payment gateways, to their business customers.

- Technology Integration: Global Payments provides the processing technology that banks need to support a wide range of payment methods, from card transactions to digital wallets.

- Revenue Growth: By partnering, banks can generate new revenue streams through payment processing fees and by attracting and retaining more business clients.

- Customer Retention: Offering comprehensive payment services helps banks solidify their relationships with existing business clients and attract new ones looking for all-in-one financial solutions.

Developers and Platform Providers

Developers and platform providers are crucial customer segments for global payments businesses. These entities need robust Application Programming Interfaces (APIs) and Software Development Kits (SDKs) to seamlessly embed payment functionalities into their own applications, websites, and services. This allows them to create comprehensive e-commerce solutions and enhance user experiences.

By offering these tools, payment providers empower developers to build innovative commerce solutions. For instance, in 2024, Stripe reported that over 100,000 businesses were using its APIs to process payments, highlighting the significant demand from this segment. These integrations are vital for streamlining transactions and expanding the reach of digital commerce.

- API Access: Providing well-documented and flexible APIs for payment processing, subscription management, and fraud detection.

- SDKs and Libraries: Offering Software Development Kits for various programming languages to simplify integration.

- Developer Support: Ensuring comprehensive documentation, sandbox environments, and responsive technical assistance.

- Partnership Programs: Creating programs that foster collaboration and offer incentives for developers building on the platform.

Global Payments serves a diverse range of customer segments, from small businesses needing basic payment processing to large enterprises requiring complex, scalable solutions. Independent Software Vendors (ISVs) and developers are also key partners, integrating payment capabilities into their own platforms. Financial institutions and banks leverage Global Payments' technology to enhance their merchant services and customer offerings.

| Customer Segment | Key Needs | 2024 Focus/Trends |

|---|---|---|

| Small and Medium-sized Businesses (SMBs) | Reliable transaction processing, POS solutions, secure data handling | Continued focus on digital payment adoption, with over 60% of US SMBs using digital methods by late 2023. |

| Large Enterprises | Scalable, cross-border solutions, real-time processing, fraud detection, API integration | Increased adoption of integrated payment platforms for AP/AR, demand for multi-currency processing. |

| Independent Software Vendors (ISVs) | Embedded payment functionality, new revenue streams, enhanced software value | Strong growth in embedded payments, with some ISVs seeing 10-15% of income from payment services in 2024. |

| Financial Institutions/Banks | Enhanced merchant services, technology integration, revenue growth, customer retention | Integrating advanced processing to meet digital transaction demand and stay competitive. |

| Developers/Platform Providers | Robust APIs/SDKs, seamless integration, innovative commerce solutions | Over 100,000 businesses using APIs for payment processing, indicating significant demand for developer tools. |

Cost Structure

Global payment companies invest heavily in technology, with significant expenses dedicated to the continuous development of payment processing software and innovative solutions. These costs are essential for staying competitive and meeting evolving customer demands.

Maintaining a robust global processing infrastructure is a major expenditure. This includes the upkeep and upgrades of data centers, network security, and the complex systems that handle billions of transactions worldwide. For instance, in 2024, many leading payment processors are allocating substantial portions of their R&D budgets to enhancing cloud-native platforms and integrating advanced AI capabilities to improve efficiency and fraud detection.

Personnel and employee compensation is a significant cost driver for Global Payments, reflecting its substantial global workforce. With approximately 27,000 team members worldwide, expenses related to salaries, comprehensive benefits packages, and ongoing training programs form a core component of the company's operational expenditures.

Global Payments incurs significant costs in its sales, marketing, and partnership efforts. These expenses cover maintaining direct sales teams who engage with merchants, as well as broad-reaching marketing campaigns designed to build brand awareness and attract new customers. For instance, in 2024, many payment processors saw marketing budgets increase to combat rising customer acquisition costs in a competitive landscape.

Managing and nurturing strategic partnerships is also a substantial cost. This includes collaborations with Independent Software Vendors (ISVs) to integrate payment solutions, financial institutions to expand network reach, and other key entities that drive transaction volume. These relationships require ongoing investment in support, co-marketing initiatives, and revenue-sharing agreements.

Compliance, Risk Management, and Security Costs

Global Payments, operating within the heavily regulated financial services sector, dedicates substantial resources to its compliance, risk management, and security functions. These costs are critical for maintaining operational integrity and customer trust. For instance, in 2023, the company reported significant investments in technology and personnel to adhere to evolving global data protection regulations and anti-money laundering (AML) frameworks.

These expenditures are multifaceted, encompassing:

- Regulatory Compliance: Costs associated with adhering to payment card industry data security standards (PCI DSS), Know Your Customer (KYC) protocols, and various international financial regulations.

- Risk Management: Investments in fraud detection systems, credit risk assessment tools, and operational risk mitigation strategies to protect against financial losses.

- Cybersecurity: Expenses for advanced threat detection, data encryption, network security, and incident response capabilities to safeguard sensitive customer information and prevent breaches.

Merger, Acquisition, and Integration Costs

Merger, acquisition, and integration costs significantly shape the cost structure for global payment companies. These expenses encompass everything from the initial due diligence and legal negotiations to the complex process of merging IT systems and operational workflows. For instance, the acquisition of Worldpay by FIS involved substantial upfront costs, but also a strategic focus on realizing significant synergies.

These integration efforts are crucial for unlocking the full value of such transactions. The goal is to streamline operations, eliminate redundancies, and leverage combined scale to reduce overall expenses.

- Acquisition Expenses: Costs associated with identifying, negotiating, and closing strategic deals, like the Worldpay acquisition.

- Integration Costs: Investments in merging IT infrastructure, systems, and operational processes post-acquisition.

- Legal and Advisory Fees: Significant outlays for legal counsel, investment bankers, and consultants during M&A activities.

- Synergy Realization: While an ongoing benefit, initial efforts to achieve projected cost savings of $600 million annually from deals like Worldpay contribute to the overall cost management strategy.

Global Payments' cost structure is heavily influenced by its substantial investments in technology and infrastructure, including ongoing R&D for payment processing software and maintaining a robust global network. Personnel costs, driven by a large workforce, and significant spending on sales, marketing, and strategic partnerships are also key components. Furthermore, the company dedicates considerable resources to regulatory compliance, risk management, and cybersecurity to ensure operational integrity and customer trust.

| Cost Category | Description | 2024 Focus/Examples |

|---|---|---|

| Technology & Development | Payment processing software, AI integration, cloud platforms | Enhancing cloud-native platforms, AI for efficiency |

| Infrastructure | Data centers, network security, transaction systems | Upgrades for billions of transactions |

| Personnel | Salaries, benefits, training for global workforce | Supporting ~27,000 employees worldwide |

| Sales & Marketing | Direct sales, brand awareness campaigns | Increased budgets to combat rising acquisition costs |

| Partnerships | ISV integration, financial institution collaboration | Co-marketing, support for network expansion |

| Compliance & Risk | PCI DSS, KYC, AML, fraud detection, cybersecurity | Adherence to global data protection and AML frameworks |

| M&A Integration | Due diligence, system merging, legal fees | Synergy realization from acquisitions like Worldpay |

Revenue Streams

Global Payments primarily generates revenue through transaction processing fees. These fees are typically structured as a percentage of the total transaction value, or a flat fee for each individual transaction, or a combination of both. This forms the bedrock of their merchant services segment.

In 2024, the company continued to leverage its extensive network to facilitate a vast volume of payments. While specific segment revenue figures for transaction processing fees are not always broken out separately in public reports, it's understood to be the dominant driver of their overall income, supporting their role as a critical payment infrastructure provider.

Global Payments generates significant revenue through software and subscription fees. This includes licensing its proprietary point-of-sale (POS) systems and various business management tools designed for merchants. In 2024, the company continued to see strong adoption of its cloud-based solutions, contributing to recurring revenue streams.

Merchant acquiring fees are a core revenue stream for Global Payments, generated by enabling businesses to accept credit and debit card transactions. These fees are typically a percentage of the transaction value, plus a fixed fee per transaction. In 2024, Global Payments continued to leverage its extensive network and technology to process billions of transactions for merchants worldwide, solidifying this as a significant contributor to its overall revenue.

Embedded and Integrated Payment Royalties/Fees

Global Payments generates revenue by charging fees or royalties for enabling other software providers, known as Independent Software Vendors (ISVs), to embed payment processing directly into their own platforms. This allows businesses using those platforms to accept payments seamlessly without needing separate payment gateways.

This embedded model is a significant growth area. For instance, in 2024, many fintech companies reported substantial increases in revenue from these integrated payment solutions. These fees can be structured as a percentage of transaction volume or a fixed per-transaction charge.

- Transaction-Based Fees: A percentage of each payment processed through the integrated system.

- Subscription/Licensing Fees: Recurring charges for access to the embedded payment technology and its features.

- Value-Added Service Fees: Additional revenue from offering enhanced services like fraud detection or loyalty programs within the integrated solution.

- Onboarding and Setup Fees: Initial charges for integrating the payment functionality into the ISV's platform.

Value-Added Services and Consulting

Global Payments generates additional revenue beyond core transaction processing by offering a suite of value-added services. These services are designed to enhance a merchant's business operations and profitability, creating deeper customer relationships and recurring income.

Key among these are advanced analytics, providing businesses with insights into customer spending patterns and transaction trends. Fraud prevention tools are also a significant revenue driver, offering merchants protection against financial losses.

Furthermore, Global Payments offers business funding solutions, acting as a financial partner for its clients. Consulting services, aimed at optimizing payment acceptance and operational efficiency, round out these lucrative offerings.

- Analytics: Providing businesses with data-driven insights into payment trends and customer behavior.

- Fraud Prevention: Offering robust tools to safeguard merchants against fraudulent transactions.

- Business Funding: Facilitating access to capital for businesses to support growth and operations.

- Consulting Services: Expert advice to help businesses streamline payment processes and improve financial performance.

Global Payments diversifies its revenue through software and subscription fees for its point-of-sale (POS) systems and business management tools. In 2024, the strong adoption of cloud-based solutions continued to bolster these recurring income streams, providing merchants with essential operational capabilities.

Merchant acquiring fees remain a cornerstone, generated by enabling businesses to accept card payments. These fees, typically a percentage of transaction value plus a fixed component, were bolstered in 2024 by Global Payments' extensive network processing billions of transactions worldwide.

The company also generates revenue from Independent Software Vendors (ISVs) embedding payment processing into their platforms. This embedded finance model saw significant growth in 2024, with fees structured by transaction volume or per-transaction charges.

Value-added services, including advanced analytics, fraud prevention, business funding, and consulting, create additional revenue streams by enhancing merchant operations and profitability. These services solidify customer relationships and contribute to recurring income.

Business Model Canvas Data Sources

The Global Payments Business Model Canvas is built upon a foundation of extensive market research, financial performance data, and regulatory analysis. These sources are critical for accurately defining customer segments, value propositions, and revenue streams within the dynamic payments landscape.