Global Payments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

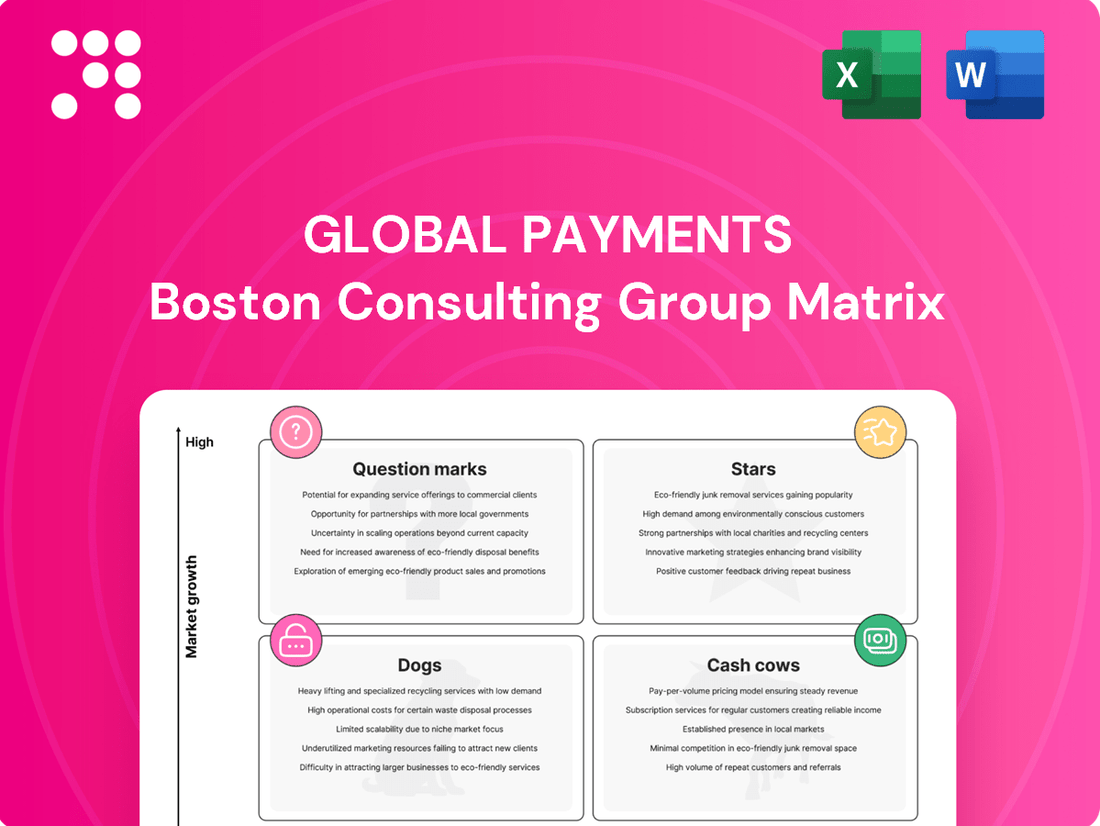

Uncover the strategic positioning of global payment solutions with our BCG Matrix analysis. See which payment methods are market leaders (Stars), which are reliably generating revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into the dynamic world of global payments, highlighting key areas for growth and potential challenges. Don't miss out on the actionable insights that can shape your investment and product strategies.

Purchase the full Global Payments BCG Matrix today to gain a comprehensive understanding of market share and growth rates, empowering you to make informed decisions and secure a competitive edge in this rapidly evolving industry.

Stars

Global Payments is strategically integrating its payment processing capabilities with robust software solutions, targeting both small and medium-sized businesses (SMBs) and larger enterprises. This move is designed to offer a more holistic suite of tools, extending beyond simple payment acceptance to encompass broader operational management. For instance, in 2024, the company continued to enhance its offerings for merchants seeking unified commerce platforms, aiming to streamline customer interactions and back-office functions.

The Merchant Solutions segment stands out as a significant engine for Global Payments' expansion, consistently delivering robust revenue growth. This area is central to the company's strategy, as evidenced by its focus on unifying its worldwide merchant operations.

Global Payments is strategically consolidating its global merchant business, including point-of-sale (POS) solutions, under the unified 'Genius' brand. This consolidation aims to simplify product offerings and capitalize on the company's broad distribution network, driving efficiency and market penetration.

The performance of the Merchant Solutions segment is a critical determinant of Global Payments' overall adjusted net revenue growth trajectory. For instance, in the first quarter of 2024, this segment reported a substantial revenue increase, underscoring its importance to the company's financial health and strategic objectives.

Global Payments' acquisition of Worldpay, completed in July 2019 for approximately $43 billion, was a monumental step aimed at creating a dominant force in payment processing. This move significantly bolstered Global Payments' global scale and positioned it as a leading pure-play commerce solutions provider for merchants worldwide.

The integration of Worldpay was expected to unlock substantial cost and revenue synergies, projected to contribute significantly to future earnings growth. By combining their strengths, Global Payments aimed to enhance its market position and deliver greater value to its customers.

Expansion in Digital Wallets and Mobile Payments

The global digital wallet and mobile payment sector is experiencing robust expansion, a key area where Global Payments is strategically positioned. The company's commitment to accepting all major digital wallet types directly addresses the growing consumer demand for convenient, cashless transactions. This segment represents a significant opportunity for Global Payments to capture further market share as digital payment adoption accelerates worldwide.

Global Payments' involvement in the burgeoning digital wallet and mobile payment market is a testament to its forward-thinking strategy. By ensuring broad acceptance of various digital wallets, the company caters to evolving consumer behaviors and the global trend towards reduced reliance on physical currency. This focus is crucial for sustained growth and competitive advantage in the payments industry.

- Market Growth: The global digital payment market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $3 trillion by 2027, indicating substantial growth potential.

- Consumer Adoption: Mobile payment usage has seen a significant uptick, with studies showing over 70% of consumers in developed markets using mobile payments at least once a month.

- Global Payments' Role: Global Payments facilitates transactions for a wide array of digital wallets, including Apple Pay, Google Pay, and others, supporting over 150 currencies.

- Future Outlook: Continued innovation in payment technology and increasing smartphone penetration are expected to drive further expansion in this sector, benefiting companies like Global Payments.

AI-Powered Solutions and Fraud Prevention

Global Payments is strategically investing in AI-driven solutions to bolster its fraud prevention capabilities. This focus on advanced technology is crucial as cyber threats continue to evolve, making robust security a paramount concern for consumers and businesses alike.

Their commitment to innovation is evident in their adoption of cutting-edge security measures. For instance, the company is enhancing its fraud detection systems by integrating AI algorithms that can analyze transaction patterns in real-time, identifying anomalies that might indicate fraudulent activity. This proactive approach is vital in an era where financial fraud losses are substantial; in 2023, global losses from payment fraud were estimated to exceed $48 billion.

- AI-driven fraud detection: Real-time analysis of transactions to identify suspicious patterns.

- Biometrics and tokenization: Implementing advanced security protocols to safeguard digital transactions.

- Addressing market needs: Meeting the growing demand for secure and trustworthy payment solutions.

Stars in the Global Payments BCG Matrix represent business segments with high growth and high market share. These are typically the company's most successful and profitable units, requiring significant investment to maintain their leading positions and capitalize on market expansion. Global Payments' Merchant Solutions segment, particularly its unified commerce offerings and digital wallet integration, aligns with this classification due to strong market growth and the company's dominant presence.

The company's strategic focus on expanding its merchant services, bolstered by the Worldpay acquisition, has solidified its high market share in a rapidly growing industry. For example, Global Payments reported strong revenue growth in its Merchant Solutions segment throughout 2023 and into early 2024, demonstrating its ability to capture market share in a high-growth environment. This segment's performance directly contributes to the company's overall growth and profitability, positioning it as a key Star.

Global Payments' proactive integration of AI for fraud prevention and its broad acceptance of digital wallets further solidify its Star status. These initiatives address critical market needs in a high-growth sector, enhancing customer trust and transaction volume. The company's commitment to innovation in these areas ensures it remains at the forefront of the digital payments revolution.

| Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Merchant Solutions | High | High | Star |

| Digital Wallet & Mobile Payments | High | High | Star |

What is included in the product

The Global Payments BCG Matrix analyzes payment services by market share and growth rate.

It identifies Stars, Cash Cows, Question Marks, and Dogs to guide investment and resource allocation.

A clear BCG Matrix visualizes the global payments portfolio, easing the pain of understanding complex market positions.

Cash Cows

Global Payments' traditional merchant acquiring and processing segment is a cornerstone of its operations, generating consistent revenue. This mature business benefits from a substantial market share, ensuring a predictable and reliable cash flow as businesses continue to rely on traditional card payment acceptance.

While not experiencing rapid expansion, this segment remains a vital and profitable contributor to Global Payments' overall financial health. For instance, in 2024, the company continued to leverage its extensive network to process billions of transactions, underscoring the enduring demand for these foundational services.

Global Payments' Issuer Solutions business is a prime example of a cash cow within its BCG matrix. This segment, focused on processing transactions for banks and other financial institutions that issue cards, consistently delivers strong revenue streams. In 2024, this segment continued to demonstrate resilience, leveraging its high market share and the stability provided by long-term contracts with key clients.

The Issuer Solutions segment benefits from established relationships and a significant market presence, making it a reliable generator of cash for Global Payments. These factors contribute to its position as a mature business with consistent demand, allowing it to fund other growth initiatives within the company.

Global Payments' established POS systems, like the Desk/5000 and Move/5000, are strong cash generators. These widely adopted systems are vital for businesses, especially in mature markets, and provide consistent revenue from transaction fees and associated services.

Global Reach and Scale

Global Payments' extensive worldwide reach, operating in 38 countries with approximately 27,000 team members, allows it to leverage its scale for operational efficiencies and cost management.

This broad geographic presence in established markets contributes to consistent cash flow generation and reinforces its position as a market leader.

- Global Footprint: Operates in 38 countries, offering broad market access.

- Workforce Size: Employs roughly 27,000 individuals worldwide, enabling significant operational leverage.

- Market Leadership: Established presence in key markets drives consistent revenue.

- Efficiency Gains: Scale facilitates cost management and operational improvements.

Recurring Revenue from Core Services

Global Payments' core payment processing and software solutions generate a substantial portion of its revenue through recurring fees. This consistent income stream, built on a broad customer base reliant on essential services, functions as a robust cash cow. For instance, in the first quarter of 2024, Global Payments reported adjusted net revenue of $2.27 billion, with a significant portion attributable to its established technology and software offerings.

- Recurring revenue from core payment processing and software solutions forms a stable foundation for Global Payments.

- This predictable income provides capital for strategic investments in emerging growth opportunities.

- In Q1 2024, the company's adjusted net revenue reached $2.27 billion, underscoring the scale of its operations.

- The reliability of these core services supports the company's ability to fund innovation and market expansion.

Global Payments' established merchant acquiring and processing segment, along with its Issuer Solutions business, represent significant cash cows. These mature operations benefit from substantial market share and long-term client relationships, ensuring consistent and predictable revenue streams. For instance, in the first quarter of 2024, Global Payments reported adjusted net revenue of $2.27 billion, with a large portion stemming from these stable, recurring income sources.

The company's extensive global footprint, operating in 38 countries, and its workforce of approximately 27,000 employees contribute to operational efficiencies that bolster these cash cow businesses. This scale allows for effective cost management, further enhancing the profitability of these foundational segments.

These reliable cash generators, such as the Desk/5000 and Move/5000 POS systems, provide the necessary capital to fund Global Payments' investments in emerging growth areas. The consistent demand for core payment processing and software solutions underpins the company's financial stability and capacity for innovation.

| Segment | Characteristics | 2024 Relevance |

| Merchant Acquiring & Processing | Mature, high market share, consistent revenue | Processed billions of transactions, demonstrating enduring demand. |

| Issuer Solutions | Stable, long-term contracts, predictable cash flow | Leveraged high market share and client stability for resilience. |

| POS Systems (e.g., Desk/5000) | Widely adopted, recurring fees, vital for businesses | Provided consistent revenue from transaction fees and services. |

What You’re Viewing Is Included

Global Payments BCG Matrix

The Global Payments BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, provides actionable insights into the strategic positioning of key players within the global payments landscape. You can confidently expect the same level of detail and professional formatting in the downloaded file, ready for immediate integration into your strategic planning and decision-making processes.

Dogs

Global Payments, like many established players in the financial technology space, grapples with legacy systems. These older infrastructures, while functional, can be expensive to maintain and lack the flexibility of modern cloud-based solutions. For instance, in 2023, a significant portion of IT spending for companies of Global Payments' size is often allocated to simply keeping these aging systems operational, a cost that can stifle innovation.

These legacy systems may not be contributing much to new revenue streams and could demand considerable capital for modernization. This investment might tie up valuable resources without guaranteeing high returns, a characteristic that places them in the 'Cash Cow' or potentially 'Dog' quadrant of the BCG matrix depending on their current market share and growth prospects.

Global Payments has strategically divested non-core assets, including the consumer segment of its Netspend business and its payroll operations. These moves signal a shift towards higher-growth opportunities.

The divested segments, likely classified as 'dogs' in the BCG matrix, were not major growth drivers and may have consumed resources without substantial future potential. For instance, in 2023, Global Payments completed the sale of its consumer business for Netspend, a move aimed at streamlining operations.

Global Payments likely faces highly competitive, low-margin segments within traditional payment processing. These areas, characterized by basic services and a crowded provider landscape, often see limited growth and a smaller market share for the company. Such segments can offer minimal profit margins, making them candidates for strategic review, potentially leading to deprioritization or consolidation to prevent them from becoming financial drains.

Services with Limited Innovation or Differentiation

Global Payments' portfolio might include legacy payment processing services with minimal technological advancements, operating in mature and highly competitive markets. These could be considered dogs if they struggle to attract new customers or retain existing ones without significant investment. For instance, some older, less feature-rich point-of-sale (POS) systems that haven't been updated to support newer payment methods or security standards could fall into this category.

These 'dog' services often require substantial operational support and maintenance, consuming resources that could otherwise be allocated to more promising growth areas. Their contribution to overall revenue and profit may be minimal, and their market share could be declining. In 2024, companies in the payment processing sector that haven't adapted to the rise of digital wallets and contactless payments might be experiencing this challenge.

- Stagnant Market Presence: Offerings in payment processing that haven't evolved with market trends, such as those lacking robust fraud prevention or integration with e-commerce platforms, are likely to be classified as dogs.

- Resource Drain: Maintaining these services often demands disproportionate operational and technical resources, hindering the company's ability to invest in high-growth areas.

- Low Growth Potential: Products with limited differentiation and operating in saturated markets typically exhibit very low or negative growth rates, contributing minimally to overall company expansion.

- Competitive Disadvantage: In 2024, payment solutions that do not offer advanced features like tokenization or real-time analytics are at a significant disadvantage against more innovative competitors.

Segments Heavily Reliant on Declining Payment Methods

Segments heavily reliant on declining payment methods, like cash or basic card-present transactions in digitally advanced regions, can be categorized as dogs in the Global Payments BCG Matrix. These areas are experiencing a natural shift as consumers and businesses increasingly adopt newer, more efficient payment solutions.

For instance, while cash transactions still hold a share, their dominance is waning in many developed economies. In the US, the share of cash payments in consumer transactions fell to an estimated 19% in 2023, down from 26% in 2020. This decline directly impacts businesses and services that primarily cater to cash-based transactions, potentially limiting their growth prospects.

- Declining Cash Usage: Many developed nations are seeing a steady decrease in cash as a preferred payment method.

- Reduced Card-Present Transactions: In markets with high contactless adoption, traditional swipe or dip card transactions may see slower growth.

- Impact of Digitalization: The rise of mobile payments, digital wallets, and instant payment systems directly challenges the relevance of older payment methods.

- Market Share Erosion: Businesses focusing solely on these declining methods risk losing market share to more innovative payment service providers.

Within Global Payments' portfolio, 'dogs' likely represent legacy payment processing services or those operating in highly saturated, low-growth markets with minimal differentiation. These segments often require significant operational support, consuming resources without generating substantial returns or future growth potential. For example, in 2024, payment solutions lacking advanced security features or integration capabilities with emerging e-commerce trends might be considered dogs.

These offerings are characterized by a stagnant market presence and a competitive disadvantage against more innovative providers. Their low growth potential means they contribute minimally to the company's overall expansion. Companies that haven't adapted to the rise of digital wallets and contactless payments in 2024 might be experiencing this challenge, leading to market share erosion.

Segments heavily reliant on declining payment methods, such as cash or basic card-present transactions in digitally advanced regions, are prime candidates for the 'dog' classification. The decreasing usage of cash, estimated at 19% of consumer transactions in the US in 2023, directly impacts services built around these methods, limiting their growth prospects.

| BCG Category | Characteristics | Example for Global Payments (Hypothetical) | Market Growth | Relative Market Share |

|---|---|---|---|---|

| Dogs | Low market share, low growth potential, often require significant resources for maintenance, limited competitive advantage. | Legacy point-of-sale (POS) systems in mature, cash-heavy markets; basic card processing services with outdated technology. | Low | Low |

Question Marks

Global Payments is strategically expanding into emerging markets, recognizing their substantial growth potential driven by rising internet access and rapid digital adoption. For instance, by the end of 2024, internet penetration in many of these regions is projected to exceed 70%, fueling demand for digital payment solutions.

However, these markets present distinct challenges. Local payment preferences, evolving regulatory frameworks, and intense competition mean Global Payments' current market share in these developing areas may be modest. This necessitates substantial investment to build infrastructure and secure a strong foothold.

Global Payments is actively developing and introducing embedded finance solutions, integrating payment capabilities directly into non-financial platforms and business processes. This strategic move targets a burgeoning market where payments become an invisible, inherent part of customer journeys.

While the embedded finance market is experiencing significant expansion, Global Payments' current market share in these newer offerings may be modest. This necessitates substantial investment to gain traction and establish a strong foothold, underscoring the need to validate the long-term potential of these innovative solutions.

Global Payments is exploring advanced AI and blockchain beyond their current fraud detection capabilities. These technologies hold promise for revolutionizing payment infrastructure and cross-border transactions, areas where their market share is still nascent.

The company's investments in these cutting-edge, yet unproven, applications position them as question marks within the BCG matrix. This signifies a need for strategic evaluation regarding continued investment or potential divestment as these markets mature.

For instance, while AI can enhance fraud prevention, its application in real-time payment network optimization or the development of novel programmable money solutions is still in early stages, representing a significant opportunity but also a substantial risk for Global Payments.

Central Bank Digital Currencies (CBDCs) Initiatives

Central Bank Digital Currencies (CBDCs) represent a significant evolution in payment systems, with many nations actively exploring or piloting their own digital currencies. For instance, by early 2024, over 130 countries were engaged in some form of CBDC exploration, according to the Atlantic Council's GeoEconomics Center. This trend could fundamentally alter cross-border transactions and domestic payment infrastructures.

Global Payments, as a major player in the payments ecosystem, is undoubtedly observing these developments closely. While their direct involvement in CBDC issuance is unlikely, they are strategically positioned to facilitate transactions and provide infrastructure for CBDC adoption once these currencies become more widespread. Their current market share in the nascent CBDC space is therefore minimal, but the potential for future integration is substantial.

- CBDC Exploration: Over 130 countries were exploring CBDCs as of early 2024, indicating a global shift towards digital currencies.

- Potential Impact: CBDCs could streamline cross-border payments and create new avenues for financial inclusion.

- Global Payments' Role: The company is likely developing capabilities to support CBDC transactions, aiming to maintain relevance in evolving payment landscapes.

- Market Position: Global Payments' current market share in CBDC is undefined, reflecting the early stage of this technology.

Real-Time Payments Infrastructure in Developing Regions

Real-time payments (RTP) infrastructure in developing regions presents a classic 'question mark' scenario within the Global Payments BCG Matrix. While the potential for rapid growth is immense, the current market share and established infrastructure are often nascent, demanding strategic investment to unlock future value.

Global Payments is actively exploring and investing in these corridors, recognizing that early adoption and system adaptation are crucial for long-term competitive advantage. This focus is driven by the significant shift towards digital and instant transactions in emerging markets, often leapfrogging traditional payment methods.

- Developing regions are seeing a surge in RTP adoption, with some countries already reporting high transaction volumes. For instance, by the end of 2023, India's Unified Payments Interface (UPI) handled over 117 billion transactions, a testament to the rapid uptake of real-time payment systems in emerging economies.

- Global Payments' investment in adapting its systems for these markets is a strategic move to capture future market share in high-growth areas. This involves building or integrating with local RTP networks, which can be complex due to varying regulatory landscapes and technological capabilities.

- The 'question mark' designation highlights the uncertainty and the need for careful evaluation of return on investment, as infrastructure development and customer adoption rates can be unpredictable. However, the potential rewards in terms of increased transaction volume and market penetration are substantial.

Question marks represent business units or product lines with low relative market share in high-growth industries. Global Payments' ventures into emerging markets with new payment technologies, like real-time payments (RTP) infrastructure in developing regions, fit this category.

These areas offer significant growth potential, but Global Payments' current market share is often nascent, requiring substantial investment to build infrastructure and gain traction. For example, while India's UPI handled over 117 billion transactions by the end of 2023, Global Payments' specific share in facilitating these is still developing.

The company's exploration of AI and blockchain for payment innovations, alongside its strategic positioning for Central Bank Digital Currencies (CBDCs), also falls under question marks. With over 130 countries exploring CBDCs by early 2024, Global Payments is investing in future capabilities, though its current market share in this evolving space is minimal.

The success of these question marks hinges on strategic investment and careful evaluation of their potential to become stars, or the risk of them becoming dogs if market conditions or adoption rates don't materialize as expected.

| Business Unit/Initiative | Industry Growth | Relative Market Share | BCG Category | Strategic Consideration |

|---|---|---|---|---|

| Emerging Market RTP Infrastructure | High | Low | Question Mark | Invest to build share, monitor adoption |

| AI/Blockchain Payment Innovations | High | Low | Question Mark | Invest in R&D, validate use cases |

| CBDC Facilitation Capabilities | High | Low (Nascent) | Question Mark | Develop infrastructure, await widespread adoption |

BCG Matrix Data Sources

Our Global Payments BCG Matrix leverages a comprehensive data foundation, integrating financial statements, market research reports, and payment volume data to provide strategic insights.