Global Payments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Global Payments operates in a dynamic landscape shaped by intense competition, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for navigating the complexities of the payments industry.

The complete report reveals the real forces shaping Global Payments’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The payment technology sector often depends on a select few providers for critical software and hardware, like those for point-of-sale terminals or robust payment gateway infrastructure. This concentration means these suppliers can wield considerable power in dictating prices and contract conditions for companies like Global Payments.

For instance, in 2024, the global market for payment processing hardware, a key area for such suppliers, was valued at an estimated $30 billion, with a significant portion of this driven by a handful of dominant players.

However, Global Payments actively mitigates this supplier power by investing in and developing its own proprietary payment solutions. This internal development capability allows them to reduce reliance on external technology providers and negotiate more favorable terms.

The availability of alternative technologies significantly influences supplier bargaining power. For Global Payments, the emergence of blockchain for cross-border transactions or sophisticated AI for fraud detection can empower suppliers offering these innovations. If a supplier possesses proprietary technology that is critical and difficult for Global Payments to replicate, their leverage grows.

Global Payments' strategic investment in technology, including AI for enhanced fraud detection and operational efficiency, aims to mitigate this. By adopting and developing advanced solutions, Global Payments can reduce its reliance on any single technology supplier, thereby moderating their bargaining power.

Global Payments faces significant supplier bargaining power if its integration with existing providers runs deep. For instance, if switching from a core payment processing platform involves substantial re-engineering of Global Payments' own systems, the cost and time involved could deter a change. This dependence grants suppliers considerable leverage.

The company's strategic push for global system unification, while beneficial for operational efficiency, could paradoxically amplify supplier power. By standardizing on fewer, key partners, Global Payments might deepen its reliance on those specific vendors, making it harder to negotiate favorable terms or switch if necessary.

Uniqueness of Supplier Offerings

Suppliers offering highly differentiated or proprietary payment processing components, security features, or data analytics tools can exert significant bargaining power. Global Payments' strategy of providing innovative solutions often necessitates collaboration with unique technology providers, potentially increasing supplier leverage.

For instance, if a key partner develops a novel fraud detection algorithm that becomes industry standard, Global Payments might face higher costs or less favorable terms to retain access. This uniqueness in offerings directly translates to a supplier's ability to command better prices or conditions.

- Supplier Differentiation: The degree to which a supplier's product or service is unique or has few substitutes.

- Proprietary Technology: Exclusive access to advanced payment processing or security technologies.

- Partnership Dependence: Global Payments' reliance on specific technology providers for its innovative solutions.

Potential for Forward Integration by Suppliers

If suppliers can realistically move into the payment processing space themselves, they gain leverage over Global Payments. This is less likely for typical tech providers but could be a consideration for major banks or financial services firms that also provide payment solutions. For instance, a large bank with a robust existing customer base could potentially develop its own integrated payment processing services, directly competing with Global Payments for merchant accounts.

- Supplier Threat: Suppliers with the capability for forward integration can exert greater influence.

- Competitive Landscape: This threat is more pronounced when suppliers are also large financial institutions.

- Market Dynamics: A bank offering its own payment processing could directly challenge Global Payments' market share.

The bargaining power of suppliers for Global Payments is a key consideration, particularly concerning specialized technology and infrastructure. When suppliers offer unique or proprietary solutions, like advanced fraud detection algorithms or critical payment gateway software, their leverage increases significantly.

In 2024, the global market for payment processing software, a segment where such specialized suppliers operate, was projected to reach over $100 billion, indicating substantial value and potential for supplier influence. Companies like Global Payments must manage relationships with these providers to ensure favorable terms and access to essential technologies.

Global Payments mitigates this by investing in in-house development and seeking diverse supplier relationships to reduce dependence on any single entity, thereby moderating supplier power.

| Supplier Factor | Impact on Global Payments | Mitigation Strategy |

|---|---|---|

| Proprietary Technology | High leverage if critical and hard to replicate | In-house development, strategic partnerships |

| Supplier Concentration | Increased power for dominant players | Diversifying supplier base, long-term contracts |

| Switching Costs | High if integration is deep | Modular system design, continuous platform updates |

What is included in the product

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and substitute products within the global payments industry, providing strategic insights for Global Payments.

Effortlessly identify and prioritize competitive threats and opportunities within the global payments landscape, enabling proactive strategic adjustments.

Customers Bargaining Power

Global Payments' diverse customer base, spanning SMBs to large enterprises in retail, hospitality, and e-commerce, generally dilutes individual customer bargaining power. This broad reach means no single client typically dominates revenue, limiting their ability to dictate terms.

However, large enterprise clients, particularly those with exceptionally high transaction volumes, can exert considerable influence. For instance, a major retail chain processing millions of transactions annually might negotiate preferential pricing or customized service level agreements, directly impacting Global Payments' margins for that segment.

The payment processing industry is intensely competitive, featuring a multitude of providers like Stripe, PayPal, and Square. This robust competition significantly empowers customers, allowing them to readily compare pricing and service offerings across various platforms. As of 2024, the global digital payments market is projected to reach over $10 trillion, highlighting the sheer volume of transactions and the importance of competitive processing fees.

Customers can easily switch payment processors if their current provider fails to meet their needs or raises prices, a key driver of their bargaining power. Many businesses, particularly small and medium-sized enterprises (SMEs), strategically utilize multiple payment processors to maximize this leverage and secure favorable terms. This fragmentation of service usage further intensifies competition among payment providers.

The increasing adoption of digital wallets and mobile payments significantly shifts consumer behavior, directly enhancing their bargaining power. As consumers become more accustomed to frictionless payment experiences offered by platforms like Apple Pay and Google Pay, they expect merchants to accommodate these methods. This forces businesses to adapt their payment infrastructure to meet these evolving preferences, thereby increasing customer leverage.

Customer's Ability to Integrate Payment Solutions

Businesses, especially larger enterprises and Independent Software Vendors (ISVs), are increasingly embedding payment solutions directly into their software and platforms. This move towards embedded finance can significantly alter the bargaining power dynamics. For instance, by controlling the entire customer journey, including payments, businesses can reduce reliance on third-party payment processors.

This integration allows companies to offer a more seamless user experience, potentially capturing a larger share of the payment processing revenue. As of 2024, the global embedded finance market is projected to reach hundreds of billions of dollars, indicating a strong trend towards this integration.

- Embedded Finance Growth: The embedded finance market is experiencing rapid expansion, with projections suggesting it will become a dominant force in financial services by the end of the decade.

- ISV Advantage: Independent Software Vendors are particularly well-positioned to leverage embedded payments, as they already have direct relationships with end-users and control the software environment.

- Reduced Reliance on Processors: As more businesses bring payment processing in-house or through integrated partnerships, the bargaining power of traditional, standalone payment processors may diminish.

- Customer Experience Focus: The primary driver for this integration is the enhancement of the customer experience, making payments a natural, unobtrusive part of the overall transaction.

Demand for Transparent Pricing and Value-Added Services

Customers are increasingly pushing for crystal-clear pricing structures and services that go beyond just processing payments. They want more, like sophisticated data analysis, robust fraud protection, and tools to help manage their operations more smoothly. This shift means payment providers who can deliver these all-in-one, easy-to-understand packages are in a stronger position.

In 2024, this trend is particularly evident as businesses look to optimize every aspect of their operations. For instance, a significant portion of businesses surveyed in late 2023 indicated that integrated data analytics alongside payment processing was a key factor in their provider selection. Providers failing to offer these enhanced capabilities risk losing business to competitors who do.

The bargaining power of customers is amplified by this demand for transparency and added value. They can more easily compare offerings and switch to providers that better meet their evolving needs. This puts pressure on payment processors to innovate and differentiate themselves by offering superior, integrated solutions.

- Demand for Transparency: Customers expect clear, upfront pricing with no hidden fees, making it easier to compare providers.

- Value-Added Services: Beyond basic processing, customers seek analytics, fraud prevention, and operational tools.

- Competitive Pressure: Providers not offering comprehensive solutions face pressure from customers seeking better overall value.

- Provider Differentiation: Offering integrated, transparent solutions becomes a key competitive advantage in 2024.

The bargaining power of customers in the global payments landscape is a significant factor, driven by intense competition and evolving business needs. While individual small customers have limited sway, larger enterprises can negotiate favorable terms due to their transaction volume.

The sheer number of payment processors available in 2024, with the global digital payments market exceeding $10 trillion, empowers businesses to switch providers easily if dissatisfied with pricing or services. This competitive environment forces processors to offer attractive packages.

Furthermore, the rise of embedded finance and demand for integrated value-added services like data analytics and fraud protection means customers can increasingly dictate the features and pricing they expect, intensifying pressure on payment providers to innovate and offer comprehensive solutions.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Customer Concentration | Low for SMBs, High for Large Enterprises | Large retail chains processing millions of transactions annually can negotiate preferential pricing. |

| Switching Costs | Generally Low to Moderate | Businesses can easily compare and switch processors due to the availability of numerous providers. |

| Competitive Landscape | High | The global digital payments market, projected over $10 trillion in 2024, features intense competition from players like Stripe, PayPal, and Square. |

| Demand for Value-Added Services | Increasingly High | Customers seek integrated data analytics, fraud protection, and operational tools beyond basic processing. |

What You See Is What You Get

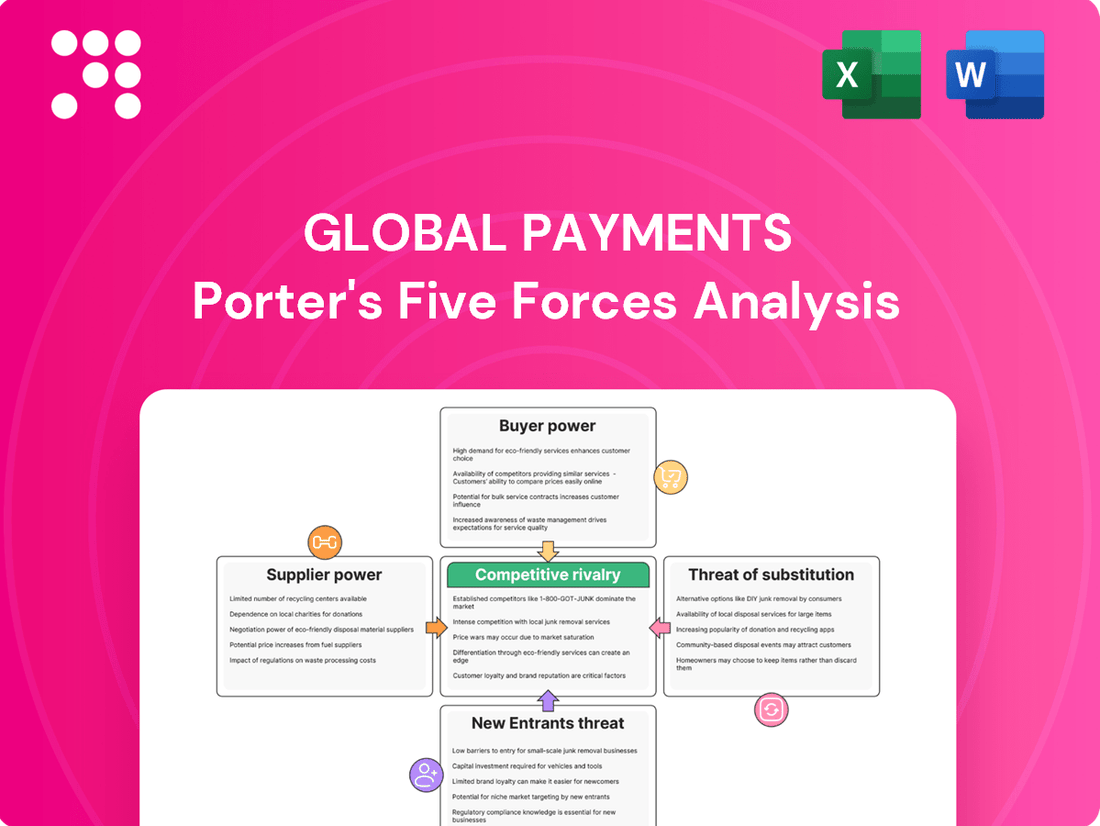

Global Payments Porter's Five Forces Analysis

This preview showcases the complete Global Payments Porter's Five Forces Analysis, offering a detailed examination of competitive forces shaping the industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring no discrepancies or missing information. This comprehensive analysis is ready for immediate download and use, providing valuable strategic insights without any further setup.

Rivalry Among Competitors

The global payment processing and merchant acquiring landscape is intensely competitive, featuring a broad spectrum of players. This includes established banks, major fintech innovators, and a multitude of niche service providers, creating a highly fragmented market. This intense competition drives aggressive strategies as companies battle for merchant accounts and transaction volume.

In 2024, the market continues to see significant competition. For instance, Visa and Mastercard, while dominant in card networks, face increasing pressure from alternative payment methods and emerging players in digital wallets and buy-now-pay-later services. The sheer number of companies vying for market share means that differentiation and customer acquisition costs remain high.

The payments sector is a hotbed of innovation, with technologies like AI, blockchain, and real-time payment systems constantly reshaping the landscape. This relentless pace of change fuels intense competition as companies vie to introduce cutting-edge solutions and enhance existing offerings. For instance, in 2024, the global digital payments market was projected to reach over $13 trillion, underscoring the immense value and rapid growth driving this innovation.

The payment processing industry is intensely competitive, driving significant price pressure, particularly for standardized services. This often forces companies to adopt aggressive pricing tactics to win and keep customers, which in turn squeezes profit margins. For instance, in 2024, many smaller payment processors found themselves competing with larger players offering lower transaction fees, leading to a noticeable dip in average revenue per transaction for some segments.

Mergers, Acquisitions, and Strategic Partnerships

The global payments industry is characterized by robust merger and acquisition (M&A) activity and the formation of strategic partnerships. These moves are driven by companies aiming to broaden their market presence, integrate cutting-edge technologies, and solidify their competitive standing.

Global Payments, a key player, has actively participated in this trend, undertaking substantial acquisitions and divestitures to enhance its market position. For instance, in 2019, Global Payments completed its acquisition of TSYS for approximately $21.5 billion, creating a larger entity with expanded capabilities in payment processing. This consolidation reflects a broader industry trend toward scale and technological integration.

- Increased Consolidation: M&A activity leads to fewer, larger players, intensifying rivalry among these consolidated entities.

- Technological Integration: Acquisitions often focus on acquiring new technologies, such as real-time payment solutions or advanced fraud detection, to gain a competitive edge.

- Market Share Expansion: Companies merge or partner to access new geographic markets or customer segments, increasing their overall market share and competitive intensity.

- Synergies and Efficiencies: Strategic alliances and mergers aim to achieve cost savings and operational efficiencies, which can be passed on as competitive pricing or reinvested in innovation.

Global Reach and Cross-Border Capabilities

The increasing volume of e-commerce and global trade significantly amplifies competitive rivalry. Companies possessing robust international networks and advanced cross-border payment functionalities gain a distinct advantage. This trend fuels an intensified competitive landscape as payment providers actively expand their global footprints and refine their offerings in multi-currency transactions and diverse payment rails.

Key aspects of this intensifying rivalry include:

- Global Network Expansion: Major payment processors are investing heavily in establishing or strengthening their presence in key international markets, aiming to capture a larger share of cross-border transaction volumes. For instance, Visa and Mastercard continue to forge partnerships with local financial institutions worldwide to facilitate seamless international payments.

- Enhanced Cross-Border Solutions: The demand for faster and more cost-effective cross-border payments is driving innovation. Providers are enhancing their capabilities in areas like real-time currency exchange, streamlined compliance for international transactions, and supporting multiple payment methods to cater to diverse customer needs.

- Competitive Pricing and Fees: As more players enter the global payment space, competitive pressure on pricing and transaction fees intensifies. Companies are pressured to offer more attractive fee structures to retain existing customers and attract new ones, particularly for high-volume international transactions.

- Technological Advancements: The adoption of new technologies, such as blockchain and open banking, is also a significant factor. Companies that can effectively integrate these technologies into their cross-border payment solutions can offer improved speed, transparency, and security, thereby gaining a competitive edge.

The competitive rivalry in the global payments sector is fierce, driven by a crowded marketplace and constant innovation. Companies like Global Payments, Visa, and Mastercard, alongside numerous fintech challengers, are locked in a battle for market share, pushing for technological advancements and aggressive pricing strategies.

In 2024, this rivalry is particularly evident as companies focus on expanding their global reach and enhancing cross-border payment capabilities. The drive for scale through mergers and acquisitions, such as Global Payments' acquisition of TSYS, further intensifies competition among the larger, consolidated entities.

The sheer volume of transactions, fueled by e-commerce, means that providers offering efficient, cost-effective international payment solutions have a significant advantage, leading to ongoing price wars and a relentless pursuit of technological superiority.

| Key Player | 2024 Market Focus | Competitive Strategy Example |

|---|---|---|

| Global Payments | Cross-border solutions, technology integration | Acquisitions to expand capabilities and market presence |

| Visa | Digital wallets, alternative payments | Partnerships with local institutions for global network expansion |

| Mastercard | Real-time payments, blockchain integration | Investing in innovative payment technologies to enhance offerings |

| Fintech Challengers | Niche services, buy-now-pay-later | Aggressive pricing and user-centric digital experiences |

SSubstitutes Threaten

The increasing adoption of direct bank transfers and Account-to-Account (A2A) payments presents a growing threat of substitution for traditional payment methods. These A2A solutions, often powered by open banking frameworks and real-time payment networks, allow consumers to pay directly from their bank accounts, bypassing intermediaries like card schemes.

This shift is particularly impactful in e-commerce, where the allure of lower transaction fees and faster settlement times for merchants is significant. For instance, by 2024, many regions are seeing a substantial uptick in A2A payment volumes, with some projections indicating they could capture a notable share of digital payment transactions, directly impacting revenue streams for established payment processors.

While digital payment methods continue their ascent, cash and checks remain persistent, albeit diminishing, substitutes. In 2024, cash still accounted for a significant portion of transactions in some emerging markets, and checks, though less common, persist for specific B2B payments and certain demographic segments. This enduring presence, even with declining usage, presents a continued, albeit weaker, threat to purely digital payment ecosystems.

Very large enterprises, particularly those with significant transaction volumes, may evaluate building their own in-house payment processing systems. This strategy aims to bypass third-party fees and gain greater control over the payment lifecycle. For instance, a company processing billions of dollars annually might find the upfront investment in proprietary technology justifiable to save on per-transaction costs, potentially impacting the margins of traditional payment processors.

Barter and Alternative Value Exchange Systems

While not dominant, alternative value exchange systems like barter and emerging decentralized finance (DeFi) platforms present a subtle threat. These systems, including direct cryptocurrency payments bypassing traditional rails, could substitute for specific payment needs, particularly in niche markets or for cross-border transactions seeking lower fees.

The growth of peer-to-peer lending and crowdfunding platforms also represents a form of value exchange that can substitute for traditional payment services, especially for smaller business financing or personal loans. For instance, the global crowdfunding market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly.

- Emerging DeFi: Platforms offer direct peer-to-peer value transfer, circumventing traditional intermediaries.

- Cryptocurrency Payments: Direct crypto payments can substitute for fiat currency transactions in certain contexts.

- Crowdfunding and P2P Lending: These platforms facilitate alternative value exchange for financing needs.

- Barter Systems: Though less common, direct exchange of goods and services remains a substitute in specific economic environments.

Embedded Finance Solutions by Non-Financial Entities

Embedded finance, where financial services like payments are built directly into non-financial platforms, presents a significant threat of substitution in the global payments landscape. For instance, e-commerce giants integrating their own payment gateways or buy-now-pay-later options directly at checkout bypass traditional payment processors. This seamless integration, often bundled with loyalty programs or other platform benefits, can diminish customer reliance on standalone payment solutions.

These embedded offerings act as potent substitutes by absorbing transaction volume that might otherwise flow through established payment networks. By offering convenience and often preferential terms within their ecosystems, these non-financial entities can capture a substantial share of payment activity. This trend is accelerating, with projections indicating continued growth in the embedded finance market.

- Market Growth: The global embedded finance market was valued at approximately $4.2 trillion in 2023 and is projected to reach over $10 trillion by 2030, demonstrating a substantial shift towards integrated financial services.

- User Experience: Platforms like Shopify have seen significant uptake in their payment solutions, with a large percentage of merchants utilizing Shopify Payments, highlighting the appeal of embedded convenience.

- Competitive Pressure: Traditional payment providers face increased competition as non-financial companies leverage their customer relationships and data to offer integrated payment experiences.

- Reduced Transaction Fees: Embedded solutions can sometimes offer lower transaction fees to merchants by cutting out intermediary payment processors, further incentivizing adoption.

The rise of Account-to-Account (A2A) payments, fueled by open banking, directly challenges traditional card networks and payment processors by offering a cheaper, faster alternative. By 2024, A2A adoption is growing significantly, particularly in e-commerce, where merchants benefit from lower fees and quicker settlements.

Embedded finance, where payments are integrated into non-financial platforms, is another major substitute. Companies like Shopify have seen substantial adoption of their payment solutions, demonstrating the consumer preference for seamless, in-context transactions. This trend is projected to see the embedded finance market grow from approximately $4.2 trillion in 2023 to over $10 trillion by 2030.

While less prevalent, alternatives like direct cryptocurrency payments and P2P lending platforms offer niche substitution opportunities, especially for cross-border transactions or alternative financing needs. The global crowdfunding market, valued at around $3.5 billion in 2023, illustrates this trend.

Even traditional methods like cash, though declining, still represent a substitute in certain markets and for specific demographics, maintaining a persistent, albeit reduced, competitive pressure.

| Substitute Method | Key Drivers | Impact on Traditional Payments | 2024 Relevance/Data Point |

|---|---|---|---|

| Account-to-Account (A2A) Payments | Open banking, real-time payment networks, lower merchant fees | Reduced transaction volume for card networks, pressure on interchange fees | Significant growth in e-commerce A2A volumes observed |

| Embedded Finance | Seamless user experience, platform loyalty, bundled services | Disintermediation of payment processors, capture of transaction data | Embedded finance market projected to exceed $10 trillion by 2030 (from $4.2T in 2023) |

| Cryptocurrency Payments | Decentralization, lower cross-border fees, niche adoption | Potential for bypassing traditional financial rails | Growing use in specific international transactions and digital asset exchanges |

| Crowdfunding & P2P Lending | Alternative financing, direct value exchange | Substitution for traditional loan and payment services for funding | Global crowdfunding market ~ $3.5 billion in 2023 |

| Cash & Checks | Habit, specific B2B needs, emerging market prevalence | Continued, though diminishing, competition for digital payment dominance | Still significant in certain geographic regions and for specific transaction types |

Entrants Threaten

The global payments industry demands immense upfront capital for robust technology, including secure processing systems and sophisticated fraud detection. For instance, building a payment gateway capable of handling international transactions often involves millions in infrastructure development and ongoing maintenance.

Navigating the complex web of financial regulations across different countries presents a significant hurdle. In 2024, companies must adhere to diverse data privacy laws like GDPR and varying anti-money laundering (AML) regulations, which require substantial legal and compliance resources, effectively deterring many potential entrants.

Established network effects are a significant barrier for new entrants in the payment processing industry. Global Payments, for instance, leverages a vast network of merchants and financial institutions, where each new participant enhances the platform's utility for all users. This creates a powerful moat that is challenging and costly for newcomers to replicate.

Brand loyalty further solidifies this advantage. Building trust and recognition within the financial ecosystem requires substantial investment in marketing, customer service, and reliable infrastructure, a process that can take years. For example, in 2024, the continued reliance on established players like Global Payments by a majority of large enterprises underscores the difficulty new entrants face in displacing existing relationships and ingrained operational processes.

Established payment giants possess a treasure trove of transactional data, a critical asset for refining fraud detection, tailoring consumer experiences, and bolstering risk management. For instance, Visa reported processing over 200 billion transactions in 2023, a scale that fuels sophisticated AI models. New entrants, conversely, begin with a data deficit, hindering their ability to compete on these crucial fronts.

Technological Expertise and Innovation Pace

The global payments industry is characterized by a relentless demand for cutting-edge technology, including advancements in artificial intelligence, robust cybersecurity measures, and efficient real-time processing capabilities. This necessitates substantial research and development (R&D) investment and the cultivation of a highly skilled workforce, creating a significant barrier for potential new entrants. For instance, companies investing in AI for fraud detection saw a reduction in false positives by up to 30% in 2023, highlighting the critical need for such expertise.

New players must therefore possess or rapidly acquire specialized technological know-how to effectively compete. This includes not only the development of new platforms but also the integration of existing, sophisticated systems. The pace of innovation is rapid; companies like Stripe and Square continually update their offerings, requiring newcomers to match this agility. In 2024, fintech investment in AI for financial services reached an estimated $25 billion globally, underscoring the capital required.

- High R&D Expenditure: Significant capital is required for developing and maintaining advanced payment technologies.

- Talent Acquisition Costs: Securing and retaining engineers and data scientists with expertise in AI and cybersecurity is expensive.

- Rapid Technological Obsolescence: The need to constantly update systems to remain competitive demands ongoing investment.

- Intellectual Property: Patents and proprietary algorithms can further deter new entrants.

Potential for Niche Market Entry and Disruptive Business Models

While the global payments industry generally presents high barriers to entry, the threat of new entrants remains significant, particularly through niche market targeting and disruptive innovations. Fintech companies, for instance, frequently emerge by focusing on specific underserved segments or by leveraging novel technologies, such as blockchain for particular cross-border payment corridors.

These agile players can initially gain traction by offering specialized services, thereby chipping away at incumbent market share. For example, by 2024, the global fintech market was projected to reach over $1.1 trillion, indicating substantial growth and opportunities for new entrants with innovative solutions.

- Niche Focus: New entrants can bypass high capital requirements by concentrating on specific, profitable niches within the broader payments landscape, such as B2B cross-border payments or specific e-commerce payment gateways.

- Technological Disruption: Advances in areas like blockchain, AI-powered fraud detection, and open banking APIs enable new companies to offer more efficient, secure, or cost-effective payment solutions, challenging traditional models.

- Fintech Agility: Many fintech startups have demonstrated the ability to scale rapidly, attracting significant venture capital funding and user adoption by addressing pain points overlooked by established financial institutions. In 2023, global fintech funding reached approximately $70 billion, highlighting investor confidence in disruptive payment technologies.

- Regulatory Arbitrage: Some new entrants may initially exploit less stringent regulatory environments in certain jurisdictions to gain a foothold before expanding into more regulated markets.

The threat of new entrants in the global payments sector is generally low due to substantial capital requirements for technology and regulatory compliance. For instance, building a secure payment gateway in 2024 can cost millions in infrastructure. Furthermore, navigating diverse international financial regulations, such as GDPR and AML laws, demands significant legal resources, acting as a strong deterrent.

Established network effects and brand loyalty also pose significant barriers. Global Payments, for example, benefits from a vast network of users, making it difficult for newcomers to gain traction. Building trust and recognition requires years of investment in marketing and reliable service, a challenge compounded by the fact that in 2024, large enterprises still heavily rely on established payment providers.

New entrants face a steep learning curve in acquiring specialized technological know-how, including AI for fraud detection and cybersecurity. Companies investing in AI for fraud detection saw up to a 30% reduction in false positives in 2023. The rapid pace of innovation, exemplified by companies like Stripe and Square, necessitates continuous R&D investment, with global fintech investment in AI reaching an estimated $25 billion in 2024.

| Barrier | Description | Example/Data Point (2023-2024) |

|---|---|---|

| Capital Requirements | High upfront investment in technology, infrastructure, and regulatory compliance. | Building a payment gateway can cost millions; fintech AI investment reached ~$25 billion in 2024. |

| Regulatory Hurdles | Navigating complex and varying financial regulations across jurisdictions. | Adherence to GDPR and AML laws requires substantial legal and compliance resources. |

| Network Effects | The value of a payment platform increases with the number of users and merchants. | Global Payments leverages a vast existing network, difficult for newcomers to replicate. |

| Brand Loyalty & Trust | Established players benefit from existing customer relationships and a reputation for reliability. | Large enterprises continue to rely on established providers, underscoring trust barriers. |

| Data Advantage | Incumbents possess large datasets for improving services and risk management. | Visa processed over 200 billion transactions in 2023, fueling advanced AI models. |

Porter's Five Forces Analysis Data Sources

Our Global Payments Porter's Five Forces analysis is built upon a robust foundation of data, including financial reports from leading payment processors, market research from reputable firms like Gartner and Forrester, and regulatory filings from central banks and financial authorities worldwide.