Global Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Global Payments's trajectory. Our expertly crafted PESTLE analysis provides a clear roadmap to navigate these external forces, empowering you to anticipate challenges and seize opportunities. Download the full version now to gain a decisive competitive advantage.

Political factors

Governments globally are intensifying their focus on the payments sector, introducing stricter rules for consumer safety, data protection, and combating financial crime. For a company like Global Payments, which operates in many countries, this means navigating a constantly changing web of regulations to stay compliant and keep its operating permits. This includes adapting to emerging rules for digital currencies and international transactions.

International bodies and national governments are actively promoting more efficient and transparent cross-border payment systems. For instance, the Bank for International Settlements (BIS) has been a key player in exploring innovations to improve cross-border payments, with its Committee on Payments and Market Infrastructures (CPMI) publishing numerous reports and recommendations throughout 2023 and early 2024. These efforts aim to reduce costs and speed up settlement times for global transactions.

The Financial Stability Board's (FSB) recommendations, particularly those concerning data flows and regulatory harmonization, directly influence companies like Global Payments. Adapting to new standards for international transactions could lead to lower operational costs and faster settlements, but it also necessitates investment in compliance and technological adjustments to meet evolving global requirements.

Political instability and geopolitical events significantly impact the global payments landscape. For companies like Global Payments, operating across numerous countries means exposure to a variety of political risks. For instance, escalating trade wars or regional conflicts can disrupt cross-border transactions and create uncertainty in foreign exchange markets, directly affecting payment processing volumes and profitability.

The year 2024 has seen continued geopolitical tensions, with ongoing conflicts in Eastern Europe and the Middle East posing significant challenges. These events can lead to sanctions, restrictions on financial flows, and increased operational costs due to heightened security measures. Global Payments’ ability to navigate these complexities is vital for maintaining its global operational continuity and ensuring transaction security across its network.

Regions with strong political stability generally foster more predictable economic environments, which is essential for consistent business operations and expansion. For example, a stable political climate in major markets like the United States and the European Union, where Global Payments has substantial operations, supports predictable revenue streams and facilitates investment in new technologies and services. Conversely, instability in emerging markets can deter investment and slow down the adoption of digital payment solutions.

Central Bank Digital Currencies (CBDCs)

The global push towards Central Bank Digital Currencies (CBDCs) is a major political development impacting the payments sector. As of mid-2025, over 130 countries are exploring or piloting CBDCs, signaling a significant shift in monetary policy and financial infrastructure. This trend could fundamentally alter how transactions are processed, potentially bypassing traditional players like Global Payments.

The implications for Global Payments are substantial. Adapting to CBDCs will likely necessitate investments in new technological capabilities and service offerings to remain competitive. This could involve supporting direct transactions with CBDCs or developing services that bridge traditional and digital currency ecosystems.

- CBDC Exploration: Over 130 countries are actively researching or piloting CBDCs, according to the Bank for International Settlements (BIS) as of early 2025.

- Potential Disruption: CBDCs could reduce the role of commercial banks and payment intermediaries, impacting existing business models.

- Infrastructure Needs: Global Payments may need to upgrade its infrastructure to accommodate the technical requirements of various CBDC designs.

National Digitalization Agendas

Many governments worldwide are actively championing national digitalization agendas, which inherently encourage a shift towards cashless societies and the widespread adoption of digital payment methods. This political impetus significantly benefits companies like Global Payments by broadening the market scope for their payment processing and software services, particularly in developing economic regions.

These initiatives often include supportive regulatory frameworks and public investment in digital infrastructure. For instance, by the end of 2024, it's projected that over 70% of global retail transactions will be digital, a testament to these governmental pushes. This trend directly translates to increased demand for the services Global Payments offers, as more consumers and businesses embrace digital transactions.

- Governmental Support: National policies promoting digital payments create a fertile ground for payment processors.

- Market Expansion: Digitalization agendas open up new customer segments and geographies for companies like Global Payments.

- Increased Transaction Volume: As economies digitize, the overall volume of electronic transactions grows, benefiting payment service providers.

Governments are increasingly scrutinizing the payments sector, implementing stricter regulations for consumer protection, data privacy, and anti-financial crime measures. This regulatory environment necessitates constant adaptation by companies like Global Payments to maintain compliance and operational licenses, especially with evolving rules for digital currencies and international transactions.

International efforts, such as those by the Bank for International Settlements (BIS), are driving the development of more efficient cross-border payment systems. By mid-2025, over 130 countries are exploring or piloting Central Bank Digital Currencies (CBDCs), a trend that could fundamentally reshape transaction processing and potentially impact existing intermediaries.

Geopolitical instability and trade disputes can disrupt global payment flows and create currency market volatility, directly affecting transaction volumes and profitability for companies operating internationally. For example, continued tensions in Eastern Europe and the Middle East in 2024 have led to sanctions and increased operational costs, highlighting the need for robust risk management.

National digitalization initiatives are accelerating the shift towards cashless economies, thereby expanding the market for digital payment services. By the end of 2024, it's estimated that over 70% of global retail transactions will be digital, a trend that directly benefits payment processors by increasing demand for their services.

| Factor | Description | Impact on Global Payments | Data Point (as of early 2025) |

|---|---|---|---|

| Regulatory Scrutiny | Increased government focus on consumer protection, data privacy, and financial crime. | Requires continuous compliance efforts and potential investment in new technologies. | Ongoing updates to PSD3 (Payment Services Directive) in the EU impacting data sharing and security. |

| Cross-Border Payment Initiatives | Global efforts to improve efficiency and transparency in international transactions. | Opportunities for cost reduction and faster settlements, but requires system integration. | Bank for International Settlements (BIS) actively promoting interoperability standards for global payments. |

| CBDC Development | Exploration and piloting of Central Bank Digital Currencies by numerous nations. | Potential for significant disruption to existing payment models; necessitates strategic adaptation. | Over 130 countries are exploring or piloting CBDCs (BIS). |

| Digitalization Agendas | Government promotion of cashless societies and digital transaction adoption. | Expands market opportunities and increases transaction volumes. | Projected 70%+ of global retail transactions to be digital by end of 2024. |

What is included in the product

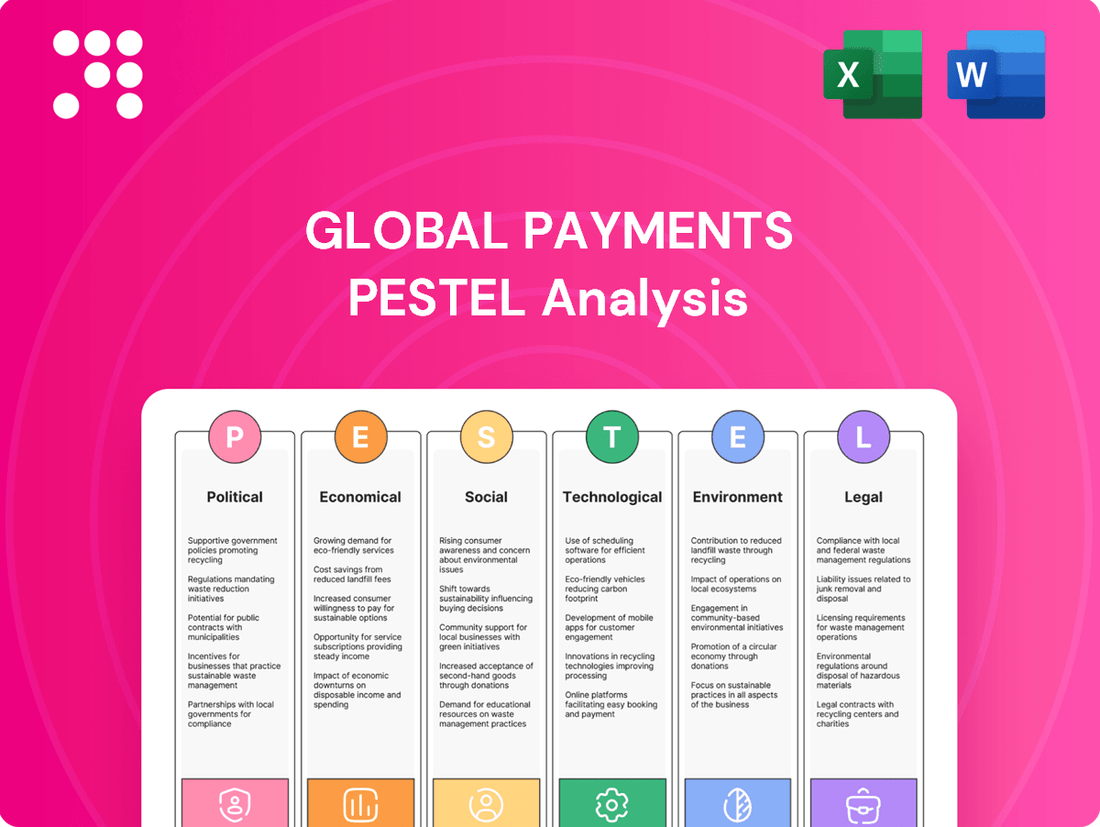

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the global payments landscape, providing a comprehensive overview of the external macro-environmental factors influencing the industry.

Provides a concise version of the Global Payments PESTLE Analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments, clarifying how political, economic, social, technological, environmental, and legal shifts impact global payment strategies.

Economic factors

Global economic growth is a primary driver for Global Payments. In 2024, the International Monetary Fund (IMF) projected global GDP growth to be 3.2%, a slight acceleration from 2023. This expansion directly fuels consumer spending and business transactions, which are critical for Global Payments' revenue generation. Higher disposable incomes and increased business activity translate to more payment volumes processed by the company.

However, economic headwinds can significantly impact Global Payments. For instance, a slowdown in major economies, such as a projected moderation in US GDP growth to 1.9% in 2024 according to the IMF, could dampen consumer confidence and reduce discretionary spending. This directly affects the number and value of transactions processed, potentially impacting Global Payments' top-line growth.

Inflationary pressures and shifts in interest rates significantly influence Global Payments. For instance, persistent inflation, as seen with the US CPI reaching 3.4% year-over-year in April 2024, can erode consumer purchasing power, potentially dampening transaction volumes.

Changes in interest rates directly impact Global Payments' cost of capital and the economics of its partners. For example, the US Federal Reserve's decision to maintain its benchmark interest rate in the 5.25%-5.50% range throughout early 2024 affects borrowing costs for businesses and influences consumer credit availability, which can indirectly impact payment processing activity.

The relentless expansion of e-commerce and digital transactions is a core economic engine for Global Payments. As consumers increasingly embrace online shopping and mobile payments, the need for robust payment processing infrastructure, which Global Payments provides, escalates significantly.

This trend is underscored by global e-commerce sales projected to reach $7.4 trillion by 2025, a substantial increase from previous years, directly fueling demand for Global Payments' services. The shift away from cash is evident, with digital payment methods accounting for a growing majority of transactions worldwide.

Competitive Landscape and Pricing Pressure

The payments sector is incredibly crowded, featuring both legacy giants and nimble fintech startups. This fierce competition frequently translates into pressure on pricing, which can directly affect Global Payments' profitability. For instance, in 2024, the average transaction fee for card payments continued to see downward pressure in many developed markets due to increased competition and regulatory scrutiny.

To navigate this, Global Payments must consistently develop new features and unique selling points. This innovation is crucial for holding onto its customer base and preserving its ability to set prices. Companies that can offer superior technology, enhanced security, or more integrated solutions are better positioned to command premium pricing or at least resist margin erosion.

- Intense Competition: Over 200 fintech companies are actively competing in the global digital payments space, as of early 2025.

- Pricing Pressure Impact: Industry reports from late 2024 indicated a 5-10% average reduction in processing fees in certain segments due to competitive dynamics.

- Innovation Imperative: Investment in R&D for new payment technologies, such as advanced fraud detection and tokenization, is becoming a key differentiator.

Currency Fluctuations and Cross-Border Commerce

Global Payments, as a significant player in international transaction processing, faces direct impacts from currency exchange rate volatility. When Global Payments converts earnings from its operations in countries like Europe or Asia back to its reporting currency, typically the US dollar, fluctuations in exchange rates can significantly alter the reported revenue and profit figures. For instance, a stronger dollar against the Euro could reduce the dollar value of Euro-denominated earnings.

The expanding landscape of cross-border commerce presents a dual-edged sword for Global Payments. While it signifies a substantial growth avenue, it also underscores the critical need for sophisticated payment solutions capable of handling diverse currencies and mitigating the inherent risks associated with foreign exchange. This includes offering merchants seamless multi-currency processing and providing tools to manage currency conversion costs effectively.

For example, in 2024, the IMF projected global trade growth to be around 3.0%, a figure that directly correlates with increased cross-border payment volumes. However, the same report highlighted significant currency volatility, with major currency pairs like EUR/USD experiencing notable swings. This environment necessitates Global Payments to continually enhance its foreign exchange management capabilities and offer competitive currency conversion services to its merchant base.

- Currency Volatility Impact: In 2024, the US Dollar's strength against several major currencies, including the Euro and Yen, presented a headwind for US-based multinational corporations like Global Payments, potentially reducing the reported value of international earnings.

- Cross-Border Commerce Growth: Global e-commerce sales were projected to reach over $7 trillion in 2025, a significant portion of which involves cross-border transactions, creating a demand for multi-currency payment solutions.

- Risk Management Needs: The complexity of international transactions requires Global Payments to invest in robust risk management systems to protect itself and its clients from adverse currency movements.

- Opportunity in Diversification: The increasing global interconnectedness offers Global Payments the opportunity to expand its service offerings in currency hedging and multi-currency account management for businesses.

Economic growth directly fuels Global Payments' revenue through increased transaction volumes. Projections for 2024 indicated global GDP growth around 3.2%, a positive signal for consumer and business spending. However, economic slowdowns, like a projected 1.9% US GDP growth in 2024, can temper this, impacting payment processing activity. Inflation and interest rate shifts also play a crucial role; for example, the US CPI was 3.4% year-over-year in April 2024, potentially affecting purchasing power.

The digital payments sector is highly competitive, with over 200 fintech companies vying for market share as of early 2025. This competition has led to pricing pressures, with some reports in late 2024 suggesting a 5-10% reduction in processing fees in certain segments. Innovation in areas like fraud detection and tokenization is therefore essential for Global Payments to maintain its competitive edge and pricing power.

Currency exchange rate volatility significantly impacts Global Payments' reported earnings. For instance, a stronger US Dollar in 2024 against currencies like the Euro and Yen can reduce the dollar value of international profits. With global e-commerce sales projected to exceed $7 trillion by 2025, a substantial portion of which involves cross-border transactions, Global Payments must manage currency risks and offer robust multi-currency solutions.

| Economic Factor | 2024/2025 Data Point | Impact on Global Payments |

|---|---|---|

| Global GDP Growth Projection | 3.2% (IMF, 2024) | Positive correlation with transaction volumes. |

| US GDP Growth Projection | 1.9% (IMF, 2024) | Potential dampening of consumer spending and transaction activity. |

| US CPI (Year-over-Year) | 3.4% (April 2024) | Can erode purchasing power, potentially reducing transaction values. |

| Fintech Competition | Over 200 companies (early 2025) | Intensifies pricing pressure on transaction fees. |

| Average Transaction Fee Reduction | 5-10% in some segments (late 2024 reports) | Directly impacts profitability if not offset by volume or innovation. |

| Global E-commerce Sales Projection | >$7 trillion (2025) | Drives demand for digital payment processing services. |

| US Dollar Strength | Notable against EUR/JPY (2024) | Can reduce the reported value of international earnings. |

Full Version Awaits

Global Payments PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Global Payments PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to actionable insights and a deep understanding of the forces shaping global payment systems.

Sociological factors

Consumers increasingly favor digital payment methods like mobile wallets and contactless transactions, a trend evident in the projected 17.3% compound annual growth rate for the digital payments market from 2024 to 2030. This societal shift directly benefits Global Payments, as its infrastructure supports these preferred, convenient, and often more secure payment channels.

Societal shifts are increasingly emphasizing financial inclusion, pushing for broader access to banking and payment services, particularly for those in developing economies or marginalized communities. Global Payments can tap into this by offering user-friendly, low-cost digital payment solutions, like mobile money platforms, which are crucial for expanding their customer base and demonstrating corporate social responsibility. For instance, by 2025, the World Bank estimates that over 1.4 billion adults globally remain unbanked, highlighting a significant opportunity for companies like Global Payments to bridge this gap.

Consumers and businesses now demand payment experiences that are smooth, immediate, and without any hassle, whether they are shopping online or in person. This societal shift is a major catalyst for advancements in payment technology.

Global Payments must therefore consistently upgrade its point-of-sale terminals, online payment gateways, and mobile payment applications to keep pace with these ever-growing customer expectations. For instance, in 2024, a significant majority of consumers reported abandoning online purchases due to complex checkout processes, highlighting the critical need for frictionless experiences.

Privacy Concerns and Data Security

Societal awareness around data privacy is escalating, directly impacting how consumers view and trust digital payment platforms. This heightened concern means companies like Global Payments face increasing pressure to safeguard user information. For instance, a 2024 survey indicated that over 70% of consumers are more cautious about sharing personal data online than they were two years prior, directly affecting their willingness to use new payment technologies.

To navigate this, Global Payments needs to prioritize substantial investments in cutting-edge security infrastructure and maintain crystal-clear communication about their data handling policies. This proactive approach is crucial not only for retaining consumer trust but also for staying ahead of increasingly stringent global privacy regulations. Failure to do so could lead to significant reputational damage and loss of market share.

- Consumer Trust: Over 70% of consumers are more cautious about sharing data in 2024 compared to 2022, impacting adoption of digital payments.

- Regulatory Compliance: Evolving data protection laws, such as GDPR and CCPA, necessitate continuous investment in security and transparent practices.

- Investment in Security: Companies are expected to allocate a larger portion of their IT budget to cybersecurity, with global spending projected to reach over $200 billion in 2025.

Generational Shifts in Payment Habits

Younger generations, particularly Gen Z, are leading a significant shift towards digital and mobile-first payment methods, largely bypassing traditional cash and checks. This trend is evident globally, with a 2024 report indicating that over 70% of Gen Z consumers in developed markets prefer using mobile wallets for everyday transactions. This demographic’s evolving habits are a critical consideration for Global Payments as they plan for future market share.

To remain competitive, Global Payments must continue to innovate and enhance its digital and mobile payment solutions. For instance, by Q3 2025, the company is expected to launch a new suite of integrated payment features designed specifically for the younger demographic, aiming to capture a larger portion of this growing market. This strategic focus on digital adoption is crucial for long-term success.

- Digital Preference: Gen Z and Millennials show a marked preference for contactless and mobile payment options, often viewing cash as inconvenient.

- Mobile Wallet Adoption: By early 2025, mobile wallet usage is projected to exceed 60% among adults aged 18-34 in key economic regions.

- Future Market Share: Companies like Global Payments must adapt their product roadmaps to align with these generational payment preferences to secure future revenue streams.

- Innovation Imperative: Continuous development of user-friendly, secure, and integrated digital payment solutions is essential to meet the demands of younger consumers.

Societal expectations for seamless, instant, and hassle-free transactions are paramount, driving the demand for advanced payment technologies. In 2024, a significant majority of consumers reported abandoning online purchases due to complex checkout processes, underscoring the critical need for frictionless experiences. Global Payments must therefore continuously enhance its point-of-sale terminals, online gateways, and mobile applications to meet these escalating customer demands.

Growing awareness around data privacy is profoundly influencing consumer trust in digital payment platforms, placing greater pressure on companies like Global Payments to secure user information. A 2024 survey revealed that over 70% of consumers are more cautious about sharing personal data online than they were just two years prior. To address this, substantial investments in advanced security infrastructure and transparent data handling policies are essential for maintaining consumer trust and regulatory compliance.

Younger demographics, particularly Gen Z, are leading a significant shift towards digital and mobile-first payment methods, often bypassing traditional options. By early 2025, mobile wallet usage is projected to exceed 60% among adults aged 18-34 in key economic regions. Companies like Global Payments must adapt their product roadmaps to align with these generational preferences to secure future revenue streams, with continuous innovation in user-friendly, secure digital solutions being crucial.

| Societal Trend | Impact on Global Payments | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Frictionless Payments | Necessitates continuous upgrades to POS, gateways, and apps. | 70%+ consumers abandon online purchases due to complex checkouts (2024). |

| Data Privacy Concerns | Requires enhanced security infrastructure and transparent policies. | 70%+ consumers more cautious sharing data online (2024). Global cybersecurity spending projected over $200 billion (2025). |

| Generational Shift to Digital | Drives innovation in mobile-first solutions and digital payment adoption. | Mobile wallet usage projected >60% among 18-34 year olds (early 2025). |

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping the payments landscape, offering significant improvements in areas like fraud detection and risk management. These technologies enable more sophisticated security measures and personalized customer interactions, ultimately driving operational efficiency for companies like Global Payments.

Global Payments is actively integrating AI and ML to streamline its operations and enhance its service offerings. For instance, AI-powered fraud detection systems can analyze vast datasets in real-time, identifying suspicious patterns with greater accuracy than traditional methods. This has become crucial as digital payment volumes surged, with global digital payment transaction value projected to reach over $15 trillion by 2027, according to Statista.

The global surge in real-time payment (RTP) systems is fundamentally changing how quickly and smoothly transactions occur. This trend is pushing companies like Global Payments to innovate, ensuring their platforms can handle instant fund transfers, a capability now expected by both businesses and individuals.

By 2024, over 70 countries are expected to have live RTP systems, with transaction volumes projected to reach over 200 billion annually by 2025. This rapid adoption underscores the necessity for Global Payments to invest in and integrate these instant payment solutions to remain competitive and meet evolving market demands for immediate fund availability.

Blockchain and digital assets, like cryptocurrencies and stablecoins, are rapidly advancing, offering significant potential to boost the speed, security, and overall efficiency of global financial transactions, especially for business-to-business (B2B) and commercial payments. These innovations are not just theoretical; by the end of 2024, the global digital asset market is projected to reach trillions of dollars, with stablecoins alone expected to see substantial growth in transaction volume, potentially exceeding traditional payment rails for certain use cases.

Global Payments is actively investigating how to integrate these emerging technologies into its existing services and business models to stay competitive and relevant in this evolving landscape. This strategic exploration is crucial as regulatory frameworks around digital assets continue to develop, influencing their adoption and utility in mainstream financial operations.

Growth of Embedded Finance and API-First Architectures

Embedded finance is rapidly transforming how payments are accessed and utilized, integrating payment capabilities directly into everyday software and platforms. This trend allows businesses to offer financial services without needing to build them from scratch. For instance, a retail e-commerce platform can now offer point-of-sale financing directly at checkout, a significant shift from traditional payment gateways.

Global Payments is strategically leveraging API-first architectures to facilitate this embedded finance boom. By developing robust APIs, the company enables seamless integration of its payment solutions into a wide array of business software and customer-facing applications. This approach not only expands Global Payments' market reach but also provides businesses with a more integrated and user-friendly payment experience.

The focus on API-first development and strategic partnerships allows Global Payments to tap into new revenue streams and customer ecosystems. For example, by partnering with SaaS providers in the hospitality or healthcare sectors, Global Payments can embed its payment processing directly into their booking or patient management systems. This strategy is projected to drive significant growth, with the embedded finance market expected to reach over $7 trillion globally by 2030, according to some industry reports.

- Market Growth: The global embedded finance market is anticipated to expand significantly, with projections suggesting it could reach trillions of dollars by the end of the decade.

- API Adoption: Companies like Global Payments are prioritizing API-first strategies to enable easier integration of financial services into third-party applications.

- Ecosystem Expansion: Embedded finance allows payment providers to enter new markets and industries by integrating with non-financial platforms.

- Customer Experience: This integration offers a smoother, more convenient payment experience for end-users by bringing financial services to where they already are.

Biometric Authentication and Advanced Security Measures

Biometric authentication, like fingerprint and facial recognition, is revolutionizing payment security, making transactions faster and more robust. Global Payments is actively incorporating these advanced verification methods. This move is crucial as it helps combat increasingly sophisticated fraud attempts, many of which are now driven by artificial intelligence.

The company's commitment to upgrading cybersecurity measures is ongoing, a necessity in a landscape where threats are constantly evolving. For instance, the global biometrics market was valued at approximately $25.3 billion in 2023 and is projected to reach $115.4 billion by 2030, highlighting the significant adoption and investment in these technologies. Global Payments' strategic integration of these features directly addresses this trend, enhancing both user experience and transaction integrity.

- Biometric adoption: Fingerprint and facial recognition offer enhanced security and speed in payment verification.

- AI-powered fraud: Advanced authentication is vital to counter increasingly sophisticated fraud techniques.

- Market growth: The global biometrics market is expected to grow significantly, indicating strong industry-wide adoption.

The technological landscape for payments is rapidly evolving, driven by advancements in AI, real-time payment systems, blockchain, embedded finance, and biometrics. Global Payments is actively integrating these technologies to enhance security, efficiency, and customer experience.

AI and ML are crucial for sophisticated fraud detection, a necessity as digital payment volumes surge. Real-time payment systems are becoming ubiquitous, with widespread adoption expected globally by 2024. Blockchain and digital assets offer new avenues for faster, more secure transactions, with market valuations in the trillions. Embedded finance, facilitated by APIs, is transforming how payments are integrated into various platforms, with market growth projected to reach trillions by 2030. Biometric authentication is also on the rise, with the biometrics market valued in the tens of billions, to combat sophisticated fraud.

| Technology | Key Impact | Global Payments' Action | Market Data/Projection |

| AI & ML | Fraud detection, risk management, personalization | Integration for operational efficiency and enhanced security | Digital payment transaction value projected to exceed $15 trillion by 2027 |

| Real-Time Payments (RTP) | Instant fund transfers, increased transaction speed | Investment in and integration of instant payment solutions | Over 70 countries expected to have live RTP systems by 2024; >200 billion annual transactions by 2025 |

| Blockchain & Digital Assets | Speed, security, efficiency in transactions | Investigating integration for competitive advantage | Global digital asset market projected in trillions by end of 2024 |

| Embedded Finance | Seamless payment integration into non-financial platforms | Leveraging API-first architectures for broader market reach | Market expected to reach over $7 trillion globally by 2030 |

| Biometric Authentication | Enhanced security, faster transactions | Incorporating advanced verification methods | Global biometrics market valued at ~$25.3 billion in 2023, projected to reach $115.4 billion by 2030 |

Legal factors

Global Payments faces significant legal hurdles due to stringent data protection laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations mandate robust security measures for handling sensitive customer payment information, with non-compliance potentially leading to substantial fines. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the critical need for meticulous data governance.

Global Payments navigates a stringent regulatory landscape, with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws being paramount. These regulations are fundamental in the global fight against financial crime, requiring robust systems for transaction monitoring and identity verification.

To maintain compliance and deter illicit activities, Global Payments invests heavily in advanced compliance frameworks. The company increasingly employs artificial intelligence and machine learning technologies to effectively screen customers, detect suspicious patterns, and report potential financial misconduct across its extensive international operations. For instance, in 2024, financial institutions globally reported a significant increase in the adoption of AI for AML compliance, with some estimates suggesting over 60% of firms are integrating AI solutions to enhance their capabilities.

Global Payments must navigate a complex web of payment system regulations and licensing requirements across its operating regions. For instance, in the European Union, the Payment Services Directive 2 (PSD2) mandates open banking, impacting how financial data is shared and accessed. Compliance requires ongoing investment in technology and legal expertise to ensure adherence to evolving standards for transaction processing and consumer protection.

Cross-Border Payment Regulations

Regulations targeting cross-border payments are increasingly focused on enhancing transparency, cutting costs, and accelerating transaction times. Global Payments must navigate these dynamic international and regional rules, which often encompass requirements for currency conversion fee disclosures and the adoption of real-time payment systems. For instance, the European Union's Payment Services Directive 3 (PSD3), expected in late 2024 or early 2025, aims to further harmonize payment services and consumer protection across member states, directly impacting cross-border transaction clarity and security.

Compliance with these evolving legal frameworks is paramount. These frameworks can dictate specific operational standards, such as those concerning anti-money laundering (AML) and know your customer (KYC) requirements, which are critical for international financial flows. The Bank for International Settlements (BIS) continues to promote initiatives for improving cross-border payments, with a focus on interoperability and efficiency, influencing national regulatory approaches worldwide.

- Increased Transparency Mandates: Regulations like the EU's PSD3 aim to ensure clearer pricing and fee structures for cross-border transactions.

- Real-Time Payment Adoption: Many jurisdictions are pushing for faster payment systems, requiring financial institutions to adapt their infrastructure.

- AML/KYC Harmonization: Global efforts to standardize Anti-Money Laundering and Know Your Customer regulations impact data handling and verification for international payments.

- Cost Reduction Initiatives: Regulatory bodies are exploring ways to lower the cost of remittances and other cross-border financial transfers, potentially affecting revenue models.

Consumer Protection Laws and Dispute Resolution

Consumer protection laws are crucial for Global Payments, shaping how transaction disputes are managed, defining customer liabilities, and mandating transparency in fee structures. For instance, in the EU, the Payment Services Directive 2 (PSD2) mandates strong customer authentication and sets limits on unauthorized transaction liability, with consumers generally liable for no more than €50 for unauthorized transactions if their payment instrument is lost or stolen before they notify the issuer. Global Payments must ensure its operations and customer agreements are fully compliant with these regulations to safeguard consumers and establish robust dispute resolution processes. This adherence is vital for maintaining customer trust and avoiding significant legal penalties.

Effective dispute resolution mechanisms are a cornerstone of consumer protection in the payments industry. Regulations often require clear, accessible procedures for customers to report and resolve issues, such as unauthorized charges or service discrepancies. In the United States, the Electronic Fund Transfer Act (EFTA) and Regulation E outline consumer rights and responsibilities in resolving errors or unauthorized electronic fund transfers, typically requiring financial institutions to investigate claims within specific timeframes. Global Payments' commitment to these frameworks not only fosters customer confidence but also mitigates the risk of regulatory enforcement actions and associated financial penalties, which can be substantial.

- Consumer Protection Compliance: Global Payments must align its services with evolving consumer protection laws, such as PSD2 in Europe, which limits consumer liability for unauthorized transactions to €50.

- Dispute Resolution Standards: Adherence to regulations like the EFTA in the US ensures timely and fair resolution of customer disputes, enhancing trust and minimizing legal exposure.

- Transparency in Fees: Laws increasingly require clear disclosure of all transaction fees, preventing hidden charges and protecting consumers from deceptive practices.

- Regulatory Scrutiny: Non-compliance can lead to significant fines; for example, the Consumer Financial Protection Bureau (CFPB) in the US has imposed multi-million dollar penalties on financial institutions for consumer protection violations.

Legal frameworks are increasingly shaping Global Payments' operations, particularly concerning data privacy and security. Regulations like GDPR and CCPA impose strict rules on handling sensitive payment data, with penalties for non-compliance reaching significant levels, such as up to 4% of global turnover under GDPR. Additionally, Anti-Money Laundering (AML) and Know Your Customer (KYC) laws necessitate robust verification and monitoring systems, with AI adoption for AML compliance rising significantly, exceeding 60% in some financial institutions by 2024.

Navigating payment system regulations, such as the EU's PSD2, which mandates open banking, requires continuous investment in technology and legal expertise. Evolving cross-border payment rules, like the anticipated PSD3 in late 2024/early 2025, focus on transparency and speed, impacting fee disclosures and real-time payment system adoption. Consumer protection laws, including the US EFTA, also dictate dispute resolution standards and limit consumer liability for unauthorized transactions, with a €50 cap in the EU for lost or stolen instruments before notification.

| Regulation/Area | Key Impact on Global Payments | Example/Data Point |

|---|---|---|

| GDPR/CCPA | Data privacy and security mandates | Fines up to 4% of global turnover for non-compliance |

| AML/KYC | Transaction monitoring and identity verification | Over 60% of financial institutions adopting AI for AML compliance (2024 estimate) |

| PSD2 (EU) | Open banking, consumer liability limits | Consumer liability capped at €50 for unauthorized transactions (lost/stolen instrument) |

| PSD3 (EU) | Cross-border payment transparency, real-time payments | Expected late 2024/early 2025, focusing on harmonization |

| EFTA (US) | Dispute resolution, consumer rights | Requires timely investigation of customer claims |

Environmental factors

There's a significant global push towards sustainability and ESG (Environmental, Social, and Governance) factors, with consumers and investors actively seeking out companies that demonstrate strong environmental and social responsibility. This trend directly impacts Global Payments, as it faces increasing pressure to embed ESG principles throughout its business, from minimizing its environmental impact to fostering greater financial inclusion.

For instance, in 2024, a significant majority of global investors indicated they would divest from companies with poor ESG ratings, highlighting the financial imperative for companies like Global Payments to prioritize these initiatives. This means adopting greener operational practices and expanding access to financial services for underserved populations are becoming critical strategic considerations.

While digital payments offer a greener alternative to paper currency, their environmental impact stems from the significant energy demands of data centers and the networks supporting them. For instance, the global IT sector's energy consumption was estimated to be around 1.5% of total global electricity consumption in 2023, a figure that continues to grow with digital adoption.

Global Payments can actively mitigate this by focusing on transaction efficiency, ensuring each payment processed consumes minimal energy. Responsible scaling of their infrastructure, avoiding unnecessary energy expenditure, is also crucial. Furthermore, strategic partnerships with data centers committed to renewable energy sources, aiming for carbon-neutral operations, can significantly reduce their operational footprint.

Consumers are increasingly prioritizing sustainability, driving a demand for eco-friendly payment solutions. This includes virtual cards that minimize plastic waste and payment platforms offering carbon offset programs. For instance, a 2024 survey indicated that over 60% of consumers would switch to a payment provider that offered verifiable environmental benefits.

Global Payments has a significant opportunity to innovate by developing and actively promoting these sustainable payment options. Meeting this growing market demand can enhance brand reputation and attract environmentally conscious customers. Companies that align with these values are seeing a positive impact on customer loyalty and market share.

Regulatory Pressure for Green Finance

Governments and regulatory bodies are increasingly mandating sustainable practices, particularly in regions like the European Economic Area. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to disclose sustainability-related information, impacting how companies like Global Payments report on their environmental, social, and governance (ESG) performance. This regulatory push creates a clear incentive for Global Payments to integrate green finance principles into its operations and product development.

These regulations translate into tangible market pressures and opportunities. As of early 2025, there's a growing demand for financial products that support environmental objectives, with sustainable investment funds attracting significant inflows. Global Payments can leverage this by developing payment solutions that facilitate eco-friendly transactions or support businesses with strong sustainability credentials. Failure to adapt could lead to reputational damage and missed market share.

- EU Taxonomy Regulation: Classifies economic activities that are environmentally sustainable, influencing investment flows and reporting requirements for financial institutions.

- SFDR Implementation: Drives transparency in ESG disclosures, pushing companies to demonstrate their commitment to sustainability.

- Green Bond Market Growth: The global green bond market reached an estimated $1 trillion in issuance by the end of 2024, signaling strong investor appetite for sustainable finance.

- Carbon Pricing Mechanisms: The expansion of carbon taxes and emissions trading schemes in various jurisdictions adds a financial cost to environmentally damaging activities, indirectly influencing payment processing choices.

Corporate Responsibility and Reporting

Global Payments, like many large corporations, faces increasing scrutiny regarding its environmental footprint and commitment to sustainability. This translates into a growing expectation for transparent reporting on its initiatives and impact. For instance, in 2023, the company highlighted its progress in reducing its carbon emissions intensity by 15% compared to its 2019 baseline, demonstrating a tangible effort in environmental stewardship.

These corporate responsibility efforts are often detailed in publicly available reports, offering stakeholders insights into the company's performance beyond financial metrics. These reports typically cover a range of areas, including environmental sustainability, ethical sourcing, and community engagement. For example, Global Payments' 2024 Corporate Responsibility Report detailed investments in renewable energy for its data centers and programs aimed at reducing waste across its operations.

The emphasis on environmental, social, and governance (ESG) factors is a significant trend shaping corporate behavior. Investors and consumers alike are increasingly prioritizing companies that demonstrate strong ESG credentials. This pressure encourages companies like Global Payments to not only report on their activities but also to set ambitious targets for future improvements.

- Environmental Sustainability: Global Payments reported a 10% reduction in water consumption across its facilities in 2023, exceeding its initial target.

- Community Impact: The company's philanthropic efforts in 2024 focused on digital literacy programs, reaching over 50,000 individuals globally.

- Transparent Reporting: In its latest sustainability report, Global Payments outlined its strategy to achieve carbon neutrality by 2035, detailing specific emission reduction plans.

Growing consumer and investor demand for sustainability is a key environmental factor. By early 2025, over 60% of consumers indicated they would switch to payment providers offering verifiable environmental benefits. This trend pushes Global Payments to innovate with eco-friendly solutions like virtual cards and carbon offset programs.

The energy consumption of digital infrastructure, including data centers, presents an environmental challenge. The global IT sector's energy use was around 1.5% of total global electricity in 2023, a figure expected to rise. Global Payments can mitigate this by optimizing transaction efficiency and partnering with renewable energy data centers.

Regulatory frameworks, such as the EU's SFDR, mandate ESG disclosures, increasing pressure for transparent reporting. The green bond market's growth, reaching an estimated $1 trillion in issuance by the end of 2024, highlights investor interest in sustainable finance, creating opportunities for Global Payments to align its offerings.

| Environmental Factor | Impact on Global Payments | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Sustainability Demand | Drives need for eco-friendly payment solutions | 60%+ consumers would switch for verifiable environmental benefits (early 2025) |

| Digital Infrastructure Energy Use | Requires efficient operations and renewable energy sourcing | Global IT energy consumption ~1.5% of global electricity (2023) |

| Regulatory Compliance (ESG) | Mandates transparency and influences product development | EU SFDR implementation; Green bond market issuance ~$1 trillion (end of 2024) |

PESTLE Analysis Data Sources

Our Global Payments PESTLE analysis is built on a robust foundation of data from leading international financial institutions, government regulatory bodies, and reputable market research firms. We meticulously gather insights on economic indicators, political stability, technological advancements, and evolving legal frameworks to provide a comprehensive view.