General Dynamics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Dynamics Bundle

General Dynamics, a titan in defense and aerospace, boasts formidable strengths in its diversified portfolio and technological prowess, but also faces significant opportunities in emerging markets and government spending shifts. However, understanding the full scope of its competitive landscape, potential threats from geopolitical instability, and internal vulnerabilities is crucial for informed decision-making.

Want the full story behind General Dynamics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

General Dynamics boasts a robustly diversified business portfolio, strategically operating across four key segments: Aerospace, Marine Systems, Combat Systems, and Technologies. This broad operational scope, encompassing everything from Gulfstream business jets to advanced IT and mission systems, ensures balanced revenue streams. For instance, in the first quarter of 2024, General Dynamics reported total revenue of $10.7 billion, with each segment contributing significantly to this figure, mitigating over-reliance on any single market and allowing the company to capitalize on opportunities across defense and commercial sectors.

General Dynamics boasts a remarkably robust order backlog, a key strength that underpins its financial stability. This substantial backlog offers excellent revenue visibility, ensuring a predictable stream of income for future operational periods. The company finished 2024 with a backlog of $90.6 billion, and projected total contract value reached $144 billion, highlighting strong and sustained demand for its products and services.

Further solidifying this strength, General Dynamics reported its backlog had grown to an impressive $103.7 billion by the second quarter of 2025. This continued expansion of future commitments provides a solid foundation for sustained business activity and growth, offering significant reassurance to stakeholders regarding the company's long-term prospects.

General Dynamics maintains a commanding presence in several critical defense and aerospace sectors. Its Gulfstream division, for instance, continues to set benchmarks in business aviation with models like the G700 and G800, showcasing advanced technology and performance. This market leadership is underpinned by consistent innovation and a strong reputation for quality.

In the maritime domain, General Dynamics Electric Boat is a cornerstone of naval power, currently constructing the highly advanced Columbia-class submarines, vital for future strategic deterrence. This segment highlights the company's ability to execute complex, long-term defense programs, reinforcing its position as a key supplier to the U.S. Navy.

The company's dedication to research and development fuels its innovative edge, ensuring it remains at the forefront of technological advancements. This focus allows General Dynamics to anticipate and meet evolving customer needs, particularly within the demanding defense industry, thereby solidifying its competitive advantage and market leadership.

Consistent Financial Performance

General Dynamics has a track record of robust and consistent financial performance, showcasing impressive revenue and earnings growth across its diverse business segments. This stability is a key strength, providing a solid foundation for future investments and operations.

For instance, in the fourth quarter of 2024, the company reported a significant year-over-year increase in both revenue and net earnings, exceeding 14%. Building on this momentum, the first quarter of 2025 saw revenue climb by 13.9%, accompanied by a substantial 27.1% rise in diluted earnings per share. These figures underscore the company's effective operational management and its ability to adapt to market dynamics, translating into strong shareholder value.

- Consistent Revenue Growth: Demonstrated by over 14% year-over-year increases in Q4 2024 and 13.9% in Q1 2025.

- Strong Earnings Performance: Net earnings grew over 14% in Q4 2024, with diluted EPS up 27.1% in Q1 2025.

- Operational Efficiency: Consistent financial results point to effective management and market responsiveness.

Strong Shareholder Returns

General Dynamics has a proven track record of rewarding its investors. The company consistently delivers value through a combination of growing dividends and strategic share repurchases, demonstrating its financial stability and shareholder-centric approach.

This commitment is highlighted by its impressive streak of dividend increases. In the first quarter of 2025, General Dynamics celebrated its 28th consecutive annual dividend hike, a testament to its robust financial performance and dedication to returning capital to its owners.

The company's proactive approach to shareholder returns was particularly evident in 2024. During that year, General Dynamics allocated approximately $3 billion back to shareholders, primarily through dividends and share buybacks, reinforcing its position as a reliable investment.

- Consistent Dividend Growth: General Dynamics announced its 28th consecutive annual dividend increase in Q1 2025.

- Significant Shareholder Returns in 2024: The company returned $3 billion to shareholders through dividends and share repurchases.

- Financial Health Indicator: The sustained dividend increases signify strong financial health and management confidence.

General Dynamics benefits from a strong and diversified product portfolio, spanning aerospace, marine systems, combat systems, and technologies. This broad operational base, evidenced by its significant presence in both defense and commercial markets, ensures a stable revenue foundation. The company's market leadership in key areas, such as Gulfstream business jets and advanced naval platforms like the Columbia-class submarines, further solidifies its competitive advantage.

The company's substantial order backlog is a significant strength, providing excellent revenue visibility and financial predictability. As of the second quarter of 2025, this backlog reached an impressive $103.7 billion, a testament to sustained demand for its offerings. This robust pipeline of future work underpins the company's stability and capacity for continued growth.

General Dynamics consistently demonstrates strong financial performance, marked by impressive revenue and earnings growth. For example, Q1 2025 saw a 13.9% increase in revenue and a 27.1% rise in diluted earnings per share, following a Q4 2024 where revenue and net earnings grew by over 14%. This consistent financial health highlights effective operational management and market adaptability.

The company's commitment to shareholder value is evident in its consistent dividend growth and strategic share repurchases. General Dynamics celebrated its 28th consecutive annual dividend increase in Q1 2025 and returned approximately $3 billion to shareholders in 2024. This focus on rewarding investors underscores the company's financial strength and management confidence.

| Metric | Q4 2024 | Q1 2025 |

| Revenue Growth (YoY) | >14% | 13.9% |

| Diluted EPS Growth (YoY) | >14% | 27.1% |

| Backlog (End of Q2 2025) | - | $103.7 billion |

| Shareholder Returns (2024) | $3 billion | - |

| Consecutive Dividend Increases | 27 | 28 |

What is included in the product

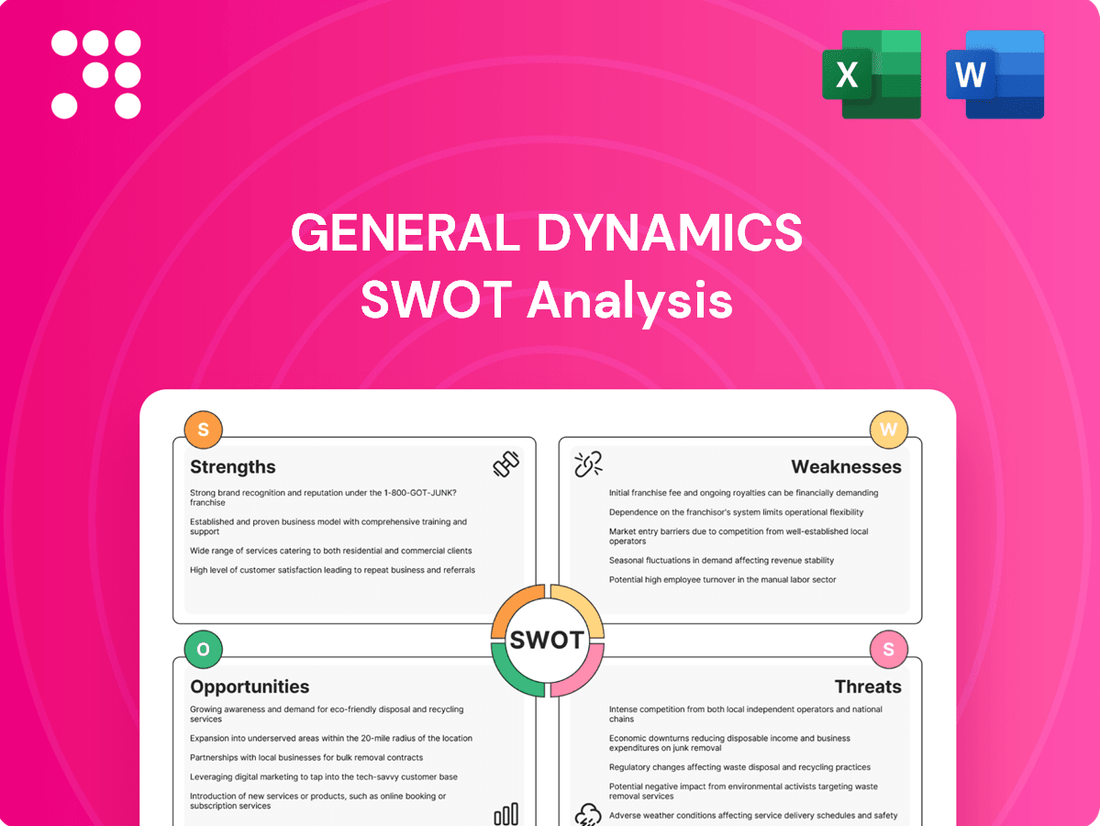

Delivers a strategic overview of General Dynamics’s internal and external business factors, identifying its core strengths, potential weaknesses, promising opportunities, and significant threats.

Offers a clear, actionable framework to identify and leverage General Dynamics' competitive advantages while mitigating potential threats.

Weaknesses

General Dynamics' considerable reliance on U.S. government contracts, particularly from the Department of Defense, presents a notable weakness. In 2023, approximately 60% of the company's total revenue was tied to defense spending, highlighting a significant concentration risk. This dependence makes the company susceptible to shifts in federal budgets, evolving defense priorities, and potential program cancellations.

General Dynamics has grappled with persistent supply chain disruptions, notably affecting its Marine Systems segment. These issues have directly translated into production delays and quality control challenges, impacting the timely delivery of key projects.

These ongoing disruptions have a tangible effect on production timelines and can inflate operational expenses. For instance, the company has highlighted how these issues have affected the workflow and delivery rhythm for its shipbuilding operations.

While General Dynamics actively works on mitigation strategies and reports some progress in addressing these bottlenecks, the inherent volatility of global supply chains remains a significant weakness. This continued vulnerability can hinder efficiency and potentially impact revenue recognition for delayed projects.

General Dynamics' Aerospace segment has faced significant headwinds, notably with the G700 aircraft program. Delays in certification and subsequent deliveries have directly impacted financial results, pushing back anticipated revenue streams and straining production capabilities. For instance, the company had to revise its delivery forecast for the G700 in late 2023, signaling the ongoing challenges in navigating complex regulatory approvals and scaling production efficiently.

These persistent delivery delays, particularly for high-value aircraft like the G700, represent a key weakness. They not only affect immediate financial performance by deferring revenue but also raise questions about the company's ability to manage complex manufacturing ramp-ups and regulatory timelines effectively. While Gulfstream is targeting an increase in deliveries for 2025, the historical issues underscore a potential vulnerability in their production and certification processes.

Intense Market Competition

General Dynamics operates in aerospace and defense sectors characterized by fierce competition from both established giants and agile new entrants. This intense rivalry, particularly in areas like naval shipbuilding and information technology, exerts significant pricing pressure, potentially impacting profitability. For instance, in 2023, the defense sector saw increased bidding activity across major platforms, highlighting the constant need for cost-efficiency and technological superiority to secure contracts.

The company faces a landscape populated by numerous domestic and international competitors, each vying for market share. This dynamic necessitates substantial investment in research and development to stay ahead of the curve. In 2024, General Dynamics' competitors, like Lockheed Martin and Northrop Grumman, continued to invest heavily in advanced technologies, forcing GD to match these efforts to maintain its competitive edge.

Maintaining market share and profitability in these crowded segments, such as Combat Systems, demands continuous innovation and operational efficiency. The pressure to deliver cutting-edge solutions at competitive price points is relentless. In the first quarter of 2024, General Dynamics reported that while revenue in its Combat Systems segment grew, it also highlighted the ongoing need to manage costs effectively amidst competitive bidding for new programs.

- Intense Rivalry: General Dynamics competes with major players like Lockheed Martin, Northrop Grumman, and BAE Systems, as well as numerous smaller, specialized firms.

- Pricing Pressures: High competition in areas like naval construction and IT services can limit profit margins, as seen in the bidding for large government contracts.

- Innovation Imperative: Sustaining market position requires ongoing investment in R&D to counter competitors' technological advancements, particularly in areas like cybersecurity and autonomous systems.

Underinvestment in Emerging Technologies

General Dynamics' commitment to research and development, especially in cutting-edge fields like artificial intelligence and autonomous systems, appears less aggressive compared to some competitors. For instance, in 2023, the company's R&D spending represented approximately 2.5% of its total revenue, a figure that lags behind some peers who are investing upwards of 5% in these critical innovation areas. This disparity could hinder its ability to maintain a leadership position in the rapidly advancing defense and aerospace landscape.

While General Dynamics has ongoing innovation efforts, a notable investment gap in emerging technologies might impact its long-term competitive advantage. This underinvestment could mean slower development cycles for next-generation capabilities, potentially putting the company at a disadvantage as the defense sector increasingly prioritizes AI-driven solutions and advanced autonomous platforms. For example, while competitors are heavily investing in AI for battlefield management and drone swarming technologies, General Dynamics' allocation to these specific sub-sectors remains comparatively modest.

The strategic implications of this underinvestment are significant, potentially affecting General Dynamics' ability to secure future contracts that demand the latest technological advancements. As defense budgets increasingly favor systems incorporating advanced AI, quantum computing, and sophisticated autonomous capabilities, a more substantial R&D allocation would be crucial. The company's 2024 strategic outlook indicates a focus on existing platforms, with less emphasis on pioneering entirely new technological frontiers.

- R&D as a Percentage of Revenue (2023): General Dynamics ~2.5%, Industry Peers ~5%+ in high-growth areas.

- Focus Areas for Underinvestment: Advanced AI, autonomy, space technologies.

- Potential Impact: Limited competitive edge, slower development of next-generation capabilities.

- Strategic Implication: Risk of falling behind in contracts prioritizing advanced technologies.

General Dynamics' significant reliance on U.S. government contracts, particularly from the Department of Defense, exposes it to budget fluctuations and shifting defense priorities, a concentration risk evident in its 2023 revenue where approximately 60% was tied to defense spending.

Supply chain disruptions have continued to plague General Dynamics, impacting production timelines and quality control, especially within its Marine Systems segment, leading to delays in critical shipbuilding projects and increased operational costs.

The Aerospace segment, particularly the G700 aircraft program, has faced certification and delivery delays, as seen with revised forecasts in late 2023, which directly affect revenue streams and highlight challenges in scaling production and navigating regulatory approvals.

Intense competition across its operating sectors, including naval shipbuilding and IT services, exerts considerable pricing pressure, potentially impacting profit margins, as evidenced by increased bidding activity in 2023 for major defense platforms.

General Dynamics' R&D spending, around 2.5% of revenue in 2023, lags behind some competitors investing over 5% in critical areas like AI and autonomous systems, potentially hindering its long-term competitive edge in these rapidly advancing fields.

| Weakness | Description | Impact | Supporting Data (2023/2024) |

|---|---|---|---|

| Government Contract Dependence | Heavy reliance on U.S. DoD contracts. | Vulnerability to budget cuts and policy changes. | ~60% of revenue from defense spending. |

| Supply Chain Disruptions | Ongoing issues affecting production and quality. | Production delays, increased costs, missed delivery targets. | Impact on Marine Systems shipbuilding timelines. |

| Aerospace Program Delays | Challenges with G700 certification and delivery. | Deferred revenue, strained production capacity. | Revised G700 delivery forecasts (late 2023). |

| Competitive Pressures | Intense rivalry in defense and aerospace markets. | Pricing pressure, potential impact on profit margins. | Increased bidding activity for major platforms (2023). |

| R&D Investment Gap | Lower investment in emerging technologies vs. peers. | Risk of falling behind in innovation and future contracts. | R&D ~2.5% of revenue vs. peers ~5%+ in key areas. |

Preview the Actual Deliverable

General Dynamics SWOT Analysis

This preview reflects the real General Dynamics SWOT analysis document you'll receive—professional, structured, and ready to use. You're viewing an actual excerpt from the complete report. Once purchased, you’ll receive the full, detailed analysis, allowing you to leverage its insights immediately.

Opportunities

Rising geopolitical tensions globally are fueling a surge in defense spending, creating a fertile ground for General Dynamics. Nations are prioritizing security, leading to expanded military budgets. This heightened global focus on defense directly translates into increased demand for the advanced systems and services General Dynamics provides.

The U.S. Department of Defense's fiscal year 2025 budget request underscores this trend, proposing $849.8 billion for defense. This substantial allocation signals ongoing and significant investment in military modernization and readiness. Such robust government funding directly benefits General Dynamics' core defense-related business segments, driving opportunities for new contracts and sustained revenue streams.

The business jet market is showing strong upward momentum, directly benefiting Gulfstream, a key General Dynamics subsidiary. This growth translates into increased demand for new aircraft and, importantly, a robust aftermarket services sector.

The aftermarket services segment is particularly valuable as it offers a consistent and high-margin revenue stream, providing stability even during cyclical shifts in new aircraft sales. This segment includes maintenance, repair, and upgrades, all essential for business jet operators.

General Dynamics' projection of delivering 150-155 Gulfstream jets in 2025 highlights this positive market trend. This anticipated increase from prior years underscores healthy demand and presents a significant opportunity for margin expansion for the company.

General Dynamics is well-positioned to capitalize on the growing global demand for defense solutions, with significant opportunities to expand its international contract base. The company's combat systems and Gulfstream business jets are particularly attractive to markets worldwide. For instance, in 2023, General Dynamics reported international sales contributing a notable portion to its overall revenue, showcasing the potential for further growth as defense spending rises in key regions.

Expanding its international footprint offers a strategic advantage by diversifying revenue streams and mitigating risks associated with over-reliance on any single government customer. This diversification is crucial for long-term stability and growth, especially as geopolitical landscapes evolve and necessitate increased defense capabilities across various nations. The company's proven track record and technological expertise in areas like armored vehicles and naval systems are key differentiators in securing these international contracts.

Advancements in Emerging Technologies

General Dynamics is positioned to capitalize on the aerospace and defense sector's swift embrace of cutting-edge technologies. The company can leverage opportunities in areas like artificial intelligence and advanced air mobility, which are seeing significant investment and development. For instance, General Dynamics' GDIT segment is actively involved in cloud and AI solutions, and the company supports crucial hypersonic missile programs.

By further integrating and developing these emerging technologies across its diverse business units, General Dynamics can unlock substantial growth potential. This strategic focus on innovation is vital for enhancing its product portfolio and streamlining operational efficiencies in a competitive landscape.

- AI Integration: General Dynamics is exploring AI applications to improve data analysis and operational decision-making, potentially boosting efficiency in areas like cybersecurity and mission planning.

- Advanced Air Mobility (AAM): The company has opportunities to develop or support AAM platforms, tapping into a growing market for new aerial transportation solutions.

- Hypersonic Capabilities: Continued investment in and development of hypersonic technologies, like those supported by General Dynamics, present a significant opportunity in advanced defense systems.

Strategic Acquisitions and Partnerships

The government contracting landscape is vibrant with mergers and acquisitions, particularly in areas like cybersecurity, IT upgrades, and defense logistics. General Dynamics can leverage this trend by strategically acquiring companies or forming partnerships to bolster its expertise, secure enduring contracts, and tap into novel technologies or markets. For instance, in 2023, the defense sector saw significant M&A deals, with companies like RTX completing its acquisition of SEAKR Engineering to enhance its space capabilities, demonstrating the ongoing consolidation and strategic focus on advanced technologies.

By engaging in these strategic moves, General Dynamics can solidify its competitive standing. Consider the potential for acquiring niche cybersecurity firms to integrate advanced threat detection capabilities, or partnering with AI specialists to enhance its autonomous systems offerings. Such actions align with the projected growth in defense IT spending, which is anticipated to reach hundreds of billions globally in the coming years, providing ample opportunities for expansion and market share gains.

These opportunities can be further broken down:

- Expand capabilities in high-demand sectors such as AI, cloud computing, and advanced manufacturing through targeted acquisitions.

- Form strategic alliances with technology startups to accelerate the development and integration of cutting-edge defense solutions.

- Pursue partnerships that provide access to new geographic markets or government agencies, broadening the company's revenue streams.

- Acquire companies with established long-term government contracts to ensure a stable and predictable revenue base.

General Dynamics is well-positioned to benefit from increased global defense spending driven by geopolitical instability. The U.S. FY2025 defense budget of $849.8 billion highlights this trend, directly supporting the company's core business segments. Furthermore, the robust growth in the business jet market, as evidenced by Gulfstream's projected delivery of 150-155 jets in 2025, offers substantial opportunities for both new aircraft sales and high-margin aftermarket services.

The company can also capitalize on emerging technologies like AI and advanced air mobility, integrating them across its diverse units to enhance its offerings and operational efficiencies. Strategic acquisitions and partnerships within the dynamic government contracting landscape, particularly in cybersecurity and IT, present further avenues for expanding capabilities and securing long-term contracts.

| Opportunity Area | Key Driver | General Dynamics' Relevance | Example/Data Point |

| Increased Global Defense Spending | Geopolitical Tensions | Boosts demand for combat systems, vehicles, and naval solutions. | U.S. FY2025 Defense Budget: $849.8 billion |

| Aerospace Market Growth | Strong Business Jet Demand | Drives Gulfstream aircraft sales and aftermarket services. | Projected 150-155 Gulfstream deliveries in 2025 |

| Technological Advancements | AI, Advanced Air Mobility | Opportunities for innovation in GDIT and other segments. | GDIT's involvement in cloud and AI solutions |

| Strategic Mergers & Acquisitions | Defense Sector Consolidation | Enhances capabilities in cybersecurity, IT, and new markets. | RTX acquisition of SEAKR Engineering (2023) |

Threats

General Dynamics faces significant risk from political uncertainties and fluctuations in government budgets, especially concerning the U.S. defense sector. In fiscal year 2023, defense spending represented a substantial portion of the company's revenue, making it vulnerable to policy shifts.

Changes in administration or congressional priorities can lead to program adjustments, impacting General Dynamics' order backlog and future revenue streams. For instance, a shift towards different defense priorities could de-emphasize existing contracts, creating planning challenges.

General Dynamics faces fierce competition in the aerospace and defense arenas from both established domestic giants and emerging international entities. Competitors' rapid technological advancements, coupled with aggressive pricing tactics, can directly threaten General Dynamics' market share and squeeze profit margins. For instance, in 2024, the global defense market saw significant investment in advanced technologies like AI and drone warfare, areas where competitors are actively innovating.

General Dynamics, like many in the defense sector, still grapples with supply chain snags and rising costs. These aren't just minor inconveniences; they directly impact how quickly and affordably they can build their products. For instance, the defense industry has seen significant price hikes for critical components and raw materials throughout 2024, with some specialized electronics seeing double-digit percentage increases.

These persistent challenges can stretch out production schedules, meaning a delay in delivering vital equipment to customers. This not only affects revenue streams but also puts a strain on meeting contractual obligations. The company's ability to maintain its profit margins is directly tested when input costs climb faster than they can pass those costs along, a delicate balancing act in a competitive market.

Geopolitical Risks

Global geopolitical instability remains a significant threat to General Dynamics. Ongoing conflicts and trade tensions worldwide can directly disrupt international sales, a key revenue stream for the company. For instance, the company's defense segment, which accounted for a substantial portion of its revenue in recent years, is particularly susceptible to shifts in global defense spending influenced by these geopolitical dynamics.

Supply chain disruptions stemming from international conflicts or trade disputes present another considerable risk. General Dynamics relies on a complex global network for its components and materials. A disruption in this network, perhaps due to sanctions or regional instability, could lead to production delays and increased costs. The company's reliance on international suppliers means that geopolitical events in one region can have ripple effects across its entire operations.

Shifts in defense priorities by allied nations, often a direct consequence of evolving geopolitical landscapes, can also negatively impact General Dynamics. If global powers redirect their defense budgets or focus on different types of military capabilities, demand for General Dynamics' existing product lines might decrease. For example, a sudden emphasis on cyber warfare over traditional armored vehicles could necessitate significant strategic adjustments for the company.

- Disrupted International Sales: Geopolitical events can directly impact General Dynamics' ability to sell its products and services in key international markets.

- Supply Chain Vulnerabilities: Conflicts and trade tensions can interrupt the flow of critical components and materials, leading to production delays and cost increases.

- Shifting Defense Priorities: Evolving global security concerns can alter the demand for General Dynamics' specific defense offerings, requiring strategic adaptation.

Cybersecurity and Data Security Risks

General Dynamics operates in sectors where data security is paramount, making it a prime target for sophisticated cyber threats. A successful breach could expose classified government data, proprietary technology, or disrupt critical operations, resulting in severe financial penalties and a significant blow to its reputation and client trust. The company's commitment to safeguarding sensitive information necessitates continuous, substantial investment in advanced cybersecurity measures to counter evolving attack vectors.

The escalating sophistication of cyberattacks, particularly those targeting defense contractors, presents a persistent challenge. In 2023, the U.S. Department of Defense reported a notable increase in cyber incidents affecting its supply chain, highlighting the broader industry risk. General Dynamics' proactive approach involves significant spending on threat detection, prevention, and rapid response capabilities. For instance, the company's 2024 projected cybersecurity budget reflects an anticipated increase to address these growing threats. This ongoing investment is crucial to maintain the integrity of its systems and the trust of its government and commercial clients.

- Heightened Risk Profile: Operating in defense and intelligence means General Dynamics handles highly sensitive data, making it an attractive target for nation-state actors and sophisticated criminal enterprises.

- Financial and Reputational Impact: A major cybersecurity incident could lead to billions in financial losses from remediation, legal liabilities, and lost contracts, alongside irreparable damage to its brand and client relationships.

- Evolving Threat Landscape: The constant emergence of new malware, phishing techniques, and zero-day exploits demands continuous adaptation and significant R&D investment in cybersecurity solutions.

- Supply Chain Vulnerabilities: Like many large defense contractors, General Dynamics relies on a complex supply chain, introducing potential vulnerabilities that require rigorous vetting and monitoring of third-party vendors.

General Dynamics faces significant threats from evolving geopolitical landscapes, which can directly impact its international sales and supply chain stability. Shifting defense priorities by allied nations, driven by global security concerns, also pose a risk, potentially reducing demand for existing product lines and requiring strategic adjustments.

SWOT Analysis Data Sources

The data sources for this General Dynamics SWOT analysis include publicly available financial reports, comprehensive industry analysis from reputable market research firms, and insights from expert commentary and defense sector publications to ensure a robust and informed assessment.