General Dynamics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Dynamics Bundle

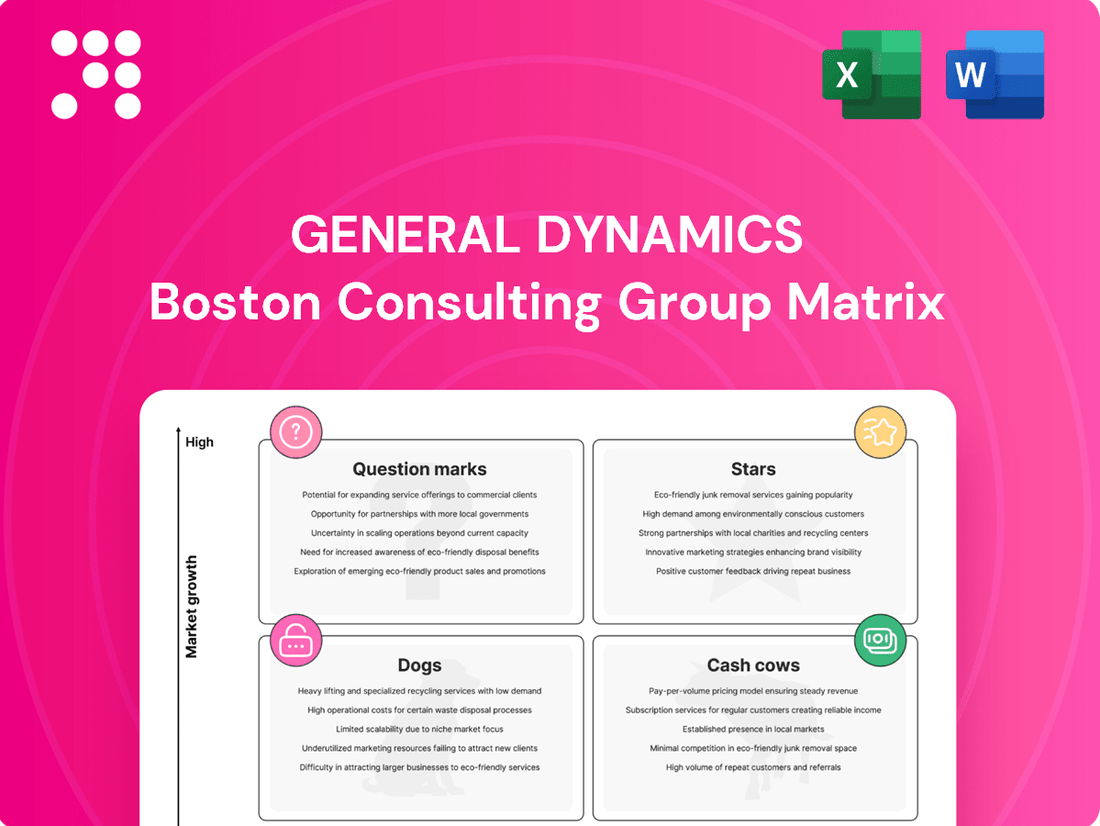

Curious about General Dynamics' strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the power behind this foundational strategic tool and unlock the secrets to optimizing resource allocation and driving future growth.

To truly leverage this analysis, purchase the full General Dynamics BCG Matrix. You'll receive a comprehensive breakdown of each product's position, complete with data-driven insights and actionable recommendations to guide your investment decisions and sharpen your competitive edge.

Stars

The Aerospace segment, powered by the new Gulfstream G700 and G800, is a star in General Dynamics' portfolio. These jets are capturing a larger piece of the high-end business jet market, showing robust growth and increasing share. This segment is clearly a strong performer with significant upside potential.

General Dynamics saw a substantial jump in Gulfstream deliveries in Q1 2025, reaching 36 aircraft, a 50% increase. This surge includes 13 deliveries of the highly anticipated G700 model. This performance underscores the strong demand for these new, premium offerings.

The introduction of the G700 and G800 is directly fueling revenue growth and expanding operating margins for the Aerospace segment. Their successful market entry and strong sales trajectory highlight their position as key revenue drivers and indicators of future profitability for General Dynamics.

General Dynamics' Aerospace segment demonstrated robust operating margin expansion, achieving 14.3% in the first quarter of 2025 and 13.2% in the second quarter. This improvement is a direct result of increased manufacturing efficiencies and higher output for new aircraft models.

The strong performance, particularly from Gulfstream, highlights its market leadership and profitability. The company expects further margin recovery as production ramps up for the G800, a key growth driver.

The global business jet market is thriving, with demand expected to remain strong through 2025 and beyond. This robust environment is particularly beneficial for Gulfstream's premium aircraft, as more clients seek personalized and adaptable travel options.

North America remains the largest market for business jets, a key region for Gulfstream's established customer base. In 2024, new business jet deliveries saw a significant increase, with the pre-owned market also showing strong activity, reflecting sustained interest in private aviation.

Strong and Growing Aerospace Backlog

General Dynamics' Aerospace segment is a strong performer, evidenced by its impressive backlog. As of the second quarter of 2025, this backlog stood at a significant $19.9 billion, marking its highest point since 2022. This level of forward orders offers considerable revenue visibility and underscores the enduring demand for Gulfstream aircraft.

The health of the Aerospace segment is further highlighted by its book-to-bill ratio. In Q2 2025, this ratio was reported at 1.3:1. This means that for every dollar of aircraft delivered, $1.30 in new orders were secured, demonstrating that the company is bringing in more business than it is currently fulfilling.

- Strongest Backlog Since 2022: Aerospace backlog reached $19.9 billion in Q2 2025.

- Sustained Demand: High backlog indicates strong customer confidence and demand for Gulfstream aircraft.

- Positive Book-to-Bill Ratio: A 1.3:1 ratio in Q2 2025 signifies new orders outpacing deliveries.

Strategic Positioning in Premium Aviation

Gulfstream's strategic positioning in premium aviation, focusing on large-cabin, ultra-long-range business jets, places it firmly in the "Star" category of the BCG Matrix. This segment is characterized by high growth and high market share, driven by sustained demand from ultra-high-net-worth individuals and corporations.

General Dynamics' Gulfstream division continues to solidify its leadership through consistent innovation, exemplified by the introduction of advanced models like the G700 and G800. These aircraft represent the pinnacle of business aviation technology and performance, catering to a discerning clientele willing to invest in top-tier capabilities.

- Market Dominance: Gulfstream holds a significant market share in the large-cabin, ultra-long-range segment, a niche that consistently demonstrates robust demand.

- Innovation Pipeline: The continuous development and launch of cutting-edge aircraft, such as the G700 and G800, ensure Gulfstream remains at the forefront of technological advancement.

- Profitability: This strategic focus on a high-value segment allows General Dynamics to capture substantial profits, contributing significantly to the company's overall financial performance.

- 2024 Outlook: In 2024, the business jet market, particularly the large-cabin segment, is expected to remain strong, with Gulfstream anticipated to benefit from its established reputation and product offerings.

The Aerospace segment, spearheaded by the Gulfstream G700 and G800, is a clear star within General Dynamics' portfolio. These aircraft are capturing a substantial portion of the high-end business jet market, showcasing impressive growth and increasing market share. This segment is a top performer with significant future profit potential.

General Dynamics witnessed a notable increase in Gulfstream deliveries in Q1 2025, reaching 36 aircraft, a 50% rise year-over-year, with 13 of these being the highly anticipated G700 model. The segment's operating margin expanded to 14.3% in Q1 2025 and 13.2% in Q2 2025, reflecting improved manufacturing efficiencies and higher output for new aircraft. The backlog for the Aerospace segment reached $19.9 billion in Q2 2025, its highest point since 2022, indicating strong revenue visibility.

| Metric | Q1 2025 | Q2 2025 | 2024 Outlook |

| Gulfstream Deliveries | 36 | N/A | Strong Growth Expected |

| Operating Margin | 14.3% | 13.2% | Continued Improvement |

| Aerospace Backlog | N/A | $19.9 Billion | High and Growing |

| Book-to-Bill Ratio | N/A | 1.3:1 | Positive Momentum |

What is included in the product

Strategic assessment of General Dynamics' business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear, visual General Dynamics BCG Matrix simplifies complex portfolio analysis, easing the burden of strategic decision-making.

Cash Cows

General Dynamics' Marine Systems segment, a powerhouse in submarine and ship construction, commands an impressive backlog of $52.97 billion as of the second quarter of 2025. A significant portion, $39.3 billion, is already funded, underscoring the stability and commitment to these vital projects.

This robust backlog is largely driven by multi-decade, high-value programs, most notably the Virginia-class and Columbia-class submarines for the U.S. Navy. These long-term contracts provide a predictable and substantial revenue stream, cementing General Dynamics' dominant position in a critical defense market.

General Dynamics' defense segments benefit from consistent and growing global defense expenditures, with the United States leading the charge. The U.S. defense budget is set to reach an estimated $886 billion in 2025, underscoring its role as the world's largest military spender.

This substantial and ongoing investment by the U.S. government creates a predictable and robust demand for General Dynamics' key offerings, particularly within its Marine Systems and Combat Systems divisions. These segments are well-positioned to capitalize on this sustained market.

General Dynamics' Marine Systems division thrives on designing and constructing nuclear-powered submarines and surface combatants for the U.S. Navy. These are crucial, long-term projects that provide a steady stream of revenue. The strategic necessity and the scarcity of qualified manufacturers ensure these programs remain profitable.

The U.S. Navy's shipbuilding strategy for 2025 highlights a substantial ramp-up in nuclear submarine construction. This increased demand directly benefits General Dynamics, solidifying its position as a cash cow. For instance, the Columbia-class submarine program, a key component of this strategy, represents a multi-billion dollar investment with significant future revenue potential.

Established Combat Vehicle and Munitions Demand

General Dynamics Combat Systems, a key player in the defense sector, benefits from a steady and robust demand for its established land and amphibious combat vehicles, alongside a consistent need for armaments and munitions. This consistent demand underpins its position as a cash cow within the company's portfolio.

Despite some specific funding fluctuations, the Combat Systems segment demonstrated positive momentum, reporting revenue growth in the first quarter of 2025. This growth was primarily fueled by an increasing demand for its core, mature product lines.

These established product lines are characterized by their significant market share and their reliable contribution to General Dynamics' overall cash generation. Their maturity signifies a stable revenue stream, making them a dependable source of funds for the company.

- Established Demand: Consistent global need for combat vehicles and munitions.

- Revenue Growth: Q1 2025 saw increased revenue driven by core products.

- Market Position: Significant market share in established product lines.

- Cash Generation: Reliable contributor to overall company cash flow.

High Barriers to Entry in Core Defense

General Dynamics' core defense segments, particularly submarines, warships, and advanced combat vehicles, benefit from exceptionally high barriers to entry. The intricate design, precision manufacturing, and extensive testing required for these sophisticated platforms demand immense technical expertise and substantial, long-term capital investment. For instance, the development and production of a single Virginia-class submarine can cost billions of dollars, a figure that deters many potential competitors.

These high entry costs, coupled with rigorous government oversight and security clearances, significantly limit the number of companies capable of competing effectively. This entrenched position allows General Dynamics to maintain a strong market share and predictable revenue streams. In 2024, the defense sector continued to see robust demand, with General Dynamics reporting significant backlog orders for its key defense platforms, underscoring the sustained profitability of these cash cow operations.

- Specialized Expertise: The complex engineering and manufacturing processes for defense assets require highly specialized skills, creating a knowledge moat.

- Capital Intensive: Building facilities and acquiring the technology for defense production demands billions in upfront investment.

- Regulatory Hurdles: Stringent government regulations, security protocols, and lengthy approval processes act as significant deterrents to new entrants.

- Market Dominance: These factors collectively limit competition, allowing General Dynamics to command premium pricing and ensure consistent cash flow from its defense divisions.

General Dynamics' Marine Systems and Combat Systems divisions are prime examples of cash cows. These segments benefit from established, long-term government contracts for critical defense platforms like submarines and combat vehicles. Their maturity, coupled with high barriers to entry due to specialized expertise and capital requirements, ensures stable and predictable revenue streams.

The significant backlog, such as the $52.97 billion in General Dynamics' Marine Systems as of Q2 2025, directly reflects the ongoing demand for these mature, high-revenue products. This consistent demand, supported by substantial government defense spending, solidifies their cash cow status.

These divisions generate substantial cash flow due to their dominant market positions and the limited competition. The predictable nature of their earnings allows General Dynamics to reinvest in other areas or return capital to shareholders, a hallmark of successful cash cow operations.

The U.S. defense budget, projected to reach $886 billion in 2025, provides a strong foundation for these segments. Their ability to consistently deliver on multi-billion dollar programs, like the Columbia-class submarines, demonstrates their capacity to generate sustained profits and cash.

| Segment | BCG Category | Key Products | 2025 Outlook Driver | Cash Generation Strength |

| Marine Systems | Cash Cow | Virginia-class & Columbia-class Submarines | U.S. Navy Shipbuilding Strategy | High, Stable |

| Combat Systems | Cash Cow | Combat Vehicles, Armaments | Global Defense Spending | High, Stable |

What You See Is What You Get

General Dynamics BCG Matrix

The General Dynamics BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive upon purchase. This means you're assessing the exact strategic framework, complete with all analytical components and professional formatting, ready for immediate application to your business planning.

Dogs

Within General Dynamics' Technologies segment, legacy IT solutions are likely positioned as Dogs in the BCG Matrix. These older infrastructure support services face declining demand as government and commercial clients increasingly adopt modern, cloud-based, and AI-driven technologies. While these legacy areas still contribute some revenue, maintaining market share can be challenging and may require significant investment, potentially becoming less profitable over time.

While General Dynamics' Combat Systems segment shows strength, the Stryker combat vehicle program faced underfunding in fiscal year 2025, a critical concern. This underfunding directly impacts production capabilities and future profitability for this key asset.

Persistent underfunding for programs like the Stryker can erode market share and diminish overall segment performance. General Dynamics must actively engage with its customers to establish a more stable and predictable funding stream for these vital platforms.

General Dynamics has a history of portfolio optimization through divestitures of non-core assets. These actions are typically taken when assets no longer align with the company's strategic growth areas or possess low market share and growth potential, fitting the characteristics of 'dogs' in a BCG Matrix analysis.

While specific recent divestitures of 'dog' assets aren't publicly detailed, General Dynamics' strategic approach has historically involved shedding underperforming or non-strategic units. The company's last major acquisition was in 2022, suggesting a focus on consolidation rather than expansion into potentially struggling new ventures.

Segments with Persistent Supply Chain Issues

While General Dynamics is seeing general improvements in its supply chain, persistent issues in specific segments can relegate them to 'dog' status. These problems can significantly impact profitability and delivery schedules, making products less competitive. For instance, the 2024 annual report highlighted that Marine Systems experienced challenges due to cost inflation and ongoing supply chain disruptions.

These persistent supply chain quality issues or delays can erode profit margins and lead to delayed deliveries, directly impacting a product's market position. Such challenges demand excessive resources for management, often without generating proportional returns. This situation can transform a product line into a 'dog' within the BCG matrix.

- Marine Systems: Faced cost inflation and supply chain issues in 2024, impacting results.

- Impact on Competitiveness: Persistent delays and quality issues make products less attractive to customers.

- Resource Drain: Managing these ongoing problems consumes significant resources, hindering overall efficiency.

Highly Saturated or Commoditized Services

Within General Dynamics' Technologies segment, certain IT services have become highly commoditized. This intense competition and lack of differentiation mean these services likely operate with thin profit margins and face limited future growth opportunities. For instance, basic IT support or managed services, where many providers offer similar solutions, often fall into this category. These areas demand rigorous cost control to maintain profitability, offering little in the way of significant expansion for the company.

These 'dog' segments, characterized by low growth and low market share, might see General Dynamics focus on efficiency rather than aggressive expansion. In 2024, the IT services market, while growing, is highly fragmented. Companies in commoditized areas are often pressured to reduce pricing, impacting profitability. For example, a report from late 2023 indicated that while the overall IT services market was projected to grow, segments with low specialization were seeing growth rates below the industry average, potentially in the low single digits.

- Low Profitability: Commoditized IT services often yield profit margins in the single digits, making them less attractive investments.

- Limited Growth: These services typically experience market growth rates below the overall IT sector average.

- Cost Management Focus: Viability in these areas hinges on efficient operations and cost reduction strategies.

- Strategic Re-evaluation: Companies may consider divesting or restructuring these offerings if they do not align with long-term strategic goals.

General Dynamics' legacy IT solutions and commoditized IT services, particularly within the Technologies segment, are prime examples of 'Dogs' in the BCG Matrix. These areas face declining demand and intense competition, leading to low market share and limited growth prospects. The company's historical approach of divesting non-core or underperforming assets further supports this classification, as seen with past portfolio adjustments.

In 2024, the IT services market, while expanding, shows a significant divide between specialized and commoditized offerings. Segments with low differentiation, such as basic IT support, often exhibit growth rates in the low single digits, well below the industry average. Profit margins in these areas can be as low as single digits, necessitating a strong focus on cost management for any remaining viability.

Supply chain disruptions and cost inflation, as experienced by Marine Systems in 2024, can also relegate product lines to 'Dog' status. These operational challenges can erode competitiveness and profitability, consuming resources without commensurate returns. For instance, persistent delays and quality issues make products less attractive to customers, directly impacting market position.

| Segment/Product Area | BCG Classification | Key Challenges | 2024 Market Context |

|---|---|---|---|

| Legacy IT Solutions (Technologies) | Dog | Declining demand, adoption of modern tech | Low single-digit growth in commoditized areas |

| Commoditized IT Services (Technologies) | Dog | Intense competition, low profit margins | Fragmented market, pricing pressure |

| Stryker Combat Vehicle Program (Combat Systems) | Potential Dog (due to underfunding) | Underfunding impacting production, future profitability | Fiscal year 2025 underfunding concerns |

| Marine Systems (specific product lines) | Potential Dog (due to operational issues) | Cost inflation, supply chain disruptions | Impacted results in 2024 |

Question Marks

General Dynamics' Technologies segment is actively engaged in cutting-edge fields such as artificial intelligence and hypersonic missile development. These represent high-growth sectors with substantial research and development investment. For instance, the company supports critical programs like the Navy's Conventional Prompt Strike (CPS) and the Army's Long-Range Hypersonic Weapon (LRHW).

While these markets are emerging and hold significant potential, General Dynamics' current market share in these nascent areas may be relatively modest. Capturing leadership in these rapidly evolving domains necessitates considerable and sustained investment to translate technological advancements into market dominance.

General Dynamics Land Systems is actively developing new robotic combat vehicles, such as the Tracked Robot 10-ton (TRX), for the Army's Robotic Combat Vehicle program. These represent high-growth potential products, crucial for modernizing military capabilities and adapting to future combat scenarios.

While these robotic combat vehicles offer significant promise and are considered stars in the BCG matrix due to their innovative nature and future market demand, their current market share is relatively small. This is primarily because they are still in the development and early production stages, awaiting full-scale adoption and large production orders.

Substantial investment is necessary to scale up production, secure major contracts, and solidify market leadership. For instance, the U.S. Army's RCV program aims for initial operational capability around 2029, indicating a significant lead time before widespread deployment and market penetration for vehicles like the TRX.

The Multi-Utility Tactical Transport (MUTT) robotic platforms, chosen by the U.S. Army for its Small Multipurpose Equipment Transport (S-MET) program, represent a high-growth segment within General Dynamics' Combat Systems. As of 2024, these autonomous vehicles are still in the early stages of widespread adoption, indicating a current limited market share but significant future potential.

The MUTT program signifies a strategic investment in next-generation military logistics, aiming to reduce soldier load and enhance operational efficiency. While specific 2024 revenue figures for MUTT are not publicly detailed, the U.S. Army's commitment to the S-MET program, with initial awards and ongoing development contracts, underscores its perceived value and future growth trajectory.

Strategic Investments in Emerging Technologies

General Dynamics strategically places investments in emerging technologies like AI, space, and hypersonics within the question mark quadrant of the BCG matrix. These are areas with high growth potential but uncertain market adoption, reflecting the speculative nature of their future success. The company's commitment to R&D fuels these ventures, aiming to secure future market leadership.

While General Dynamics demonstrates a commitment to innovation, its research and development spending was noted as being around 3% of revenue in recent years, which is lower than some industry competitors. This emphasizes the critical need for focused, strategic allocation of capital to these high-potential, yet unproven, technological frontiers to maximize their chances of becoming future stars.

- AI and Autonomy: Investments in artificial intelligence and autonomous systems for defense applications, aiming to enhance operational efficiency and decision-making capabilities.

- Space Technologies: Focus on satellite communications, space-based sensing, and related infrastructure, capitalizing on the growing global space economy.

- Hypersonic Technologies: Development of advanced hypersonic weapons and propulsion systems, a critical area for future military capabilities.

New Cybersecurity and Next-Gen Communication Solutions

New cybersecurity solutions and next-generation wireless communications, like 5G, are positioned as question marks within General Dynamics' BCG Matrix. These are high-growth markets, but their rapid evolution and intense competition mean significant investment is needed for innovation and market capture.

General Dynamics is investing in these areas, recognizing their substantial potential. For example, the global cybersecurity market was valued at approximately $217.9 billion in 2023 and is projected to reach $479.3 billion by 2030, growing at a CAGR of 11.5%. Similarly, the 5G services market is expected to grow substantially, with global 5G connections projected to reach 4.8 billion by 2027.

- High Growth Potential: Both cybersecurity and 5G are experiencing rapid market expansion, offering significant revenue opportunities.

- Intense Competition: The evolving nature of these markets necessitates continuous innovation to stay ahead of competitors.

- Investment Needs: Aggressive development and deployment require substantial capital outlay to secure market share.

- Risk of Becoming Dogs: Failure to innovate or gain traction against competitors could lead to these offerings underperforming.

Question Marks represent emerging business areas with high growth potential but currently low market share for General Dynamics. These sectors, such as AI, space technologies, and hypersonics, require significant investment to develop and capture market leadership. The company's strategic focus on these areas aims to secure future revenue streams, though the success of these ventures is not yet guaranteed.

General Dynamics is strategically investing in nascent technologies like AI, space, and hypersonics, which fall into the question mark quadrant of the BCG matrix. These are markets with high growth potential but uncertain market adoption, highlighting the speculative nature of their future success. The company's commitment to research and development is crucial for these ventures to transition into market leaders.

The company's investment in areas like AI and autonomous systems, as well as space technologies and hypersonics, places them firmly in the question mark category. These are high-growth sectors, but General Dynamics' current market share is relatively small, necessitating substantial and sustained investment to achieve market dominance. For example, while specific 2024 figures are not detailed, the U.S. Army's commitment to programs like the Small Multipurpose Equipment Transport (S-MET) program, which utilizes MUTT robotic platforms, underscores the perceived future growth in this segment.

General Dynamics' strategic investments in emerging technologies like AI, space, and hypersonics are positioned as question marks within the BCG matrix. These sectors exhibit high growth potential but currently have uncertain market adoption, reflecting the speculative nature of their future success. The company's dedication to R&D is key to transforming these ventures into future market leaders.

| Business Area | Growth Potential | Current Market Share | Investment Focus | Strategic Goal |

|---|---|---|---|---|

| AI and Autonomy | High | Low | R&D, Program Support | Market Leadership |

| Space Technologies | High | Low | Satellite Comms, Sensing | Growth in Space Economy |

| Hypersonic Technologies | High | Low | Weapon & Propulsion Dev. | Future Military Capability |

| Cybersecurity | High (CAGR ~11.5% projected to 2030) | Low | Innovation, Deployment | Capture Market Share |

| 5G Communications | High (4.8 billion connections projected by 2027) | Low | Development, Deployment | Secure Market Position |

BCG Matrix Data Sources

Our General Dynamics BCG Matrix is constructed using a blend of internal financial disclosures, market research reports, and competitive intelligence to provide a comprehensive view of business unit performance.