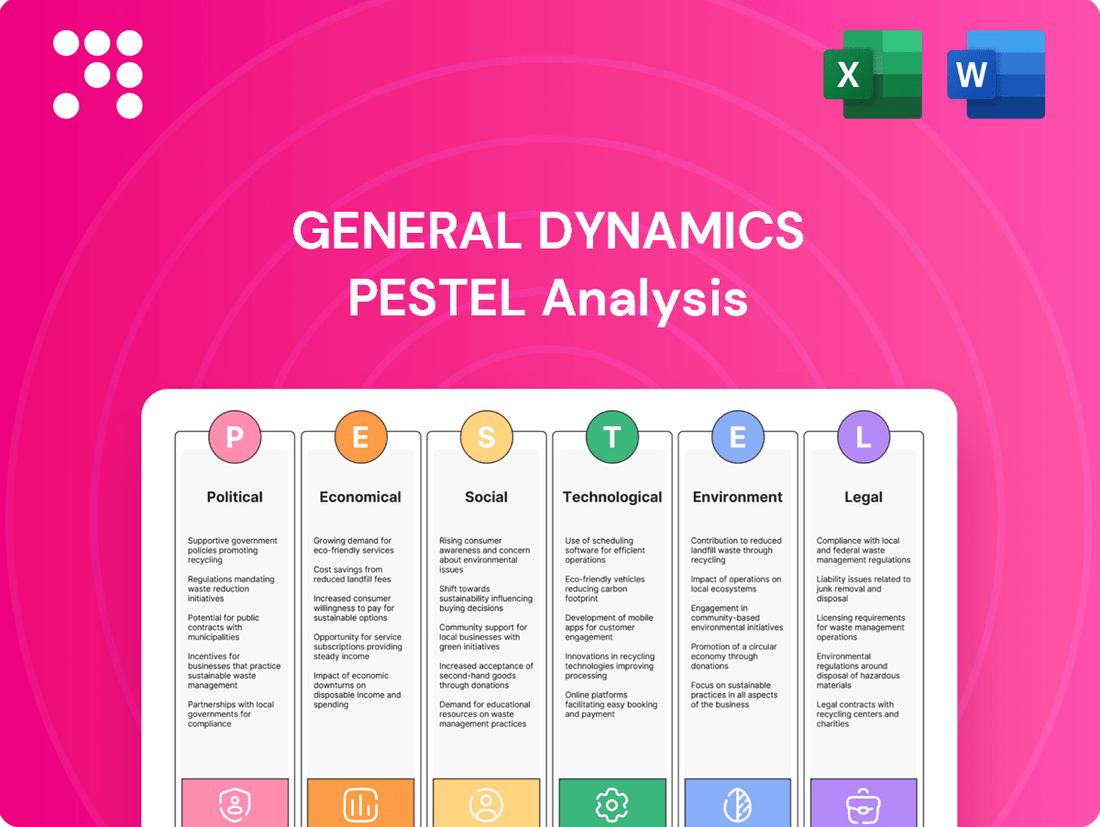

General Dynamics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Dynamics Bundle

Uncover the intricate web of external forces shaping General Dynamics's strategic landscape. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this defense giant. Equip yourself with the critical intelligence needed to anticipate market shifts and secure a competitive advantage.

Gain a profound understanding of how global trends are impacting General Dynamics, from evolving defense budgets to emerging technological advancements. This expertly crafted PESTLE analysis provides actionable insights for investors, strategists, and business leaders. Download the full version now to unlock a comprehensive roadmap for navigating the complex external environment.

Political factors

Government defense spending is a critical driver for General Dynamics, directly influencing its revenue streams and contract awards. For instance, the U.S. Department of Defense's budget for fiscal year 2024 was approximately $886 billion, a significant figure that underpins the demand for advanced platforms and services offered by companies like General Dynamics.

Shifts in national security strategies, such as increased focus on peer competition or emerging threats, directly impact the types of military equipment and services that are prioritized. This can lead to greater demand for General Dynamics' shipbuilding capabilities or its land systems, depending on the strategic emphasis.

Allied nations' defense budgets also play a crucial role. For example, many NATO members have committed to increasing their defense spending in response to geopolitical events, potentially opening up new international contract opportunities for General Dynamics in 2024 and beyond.

The current geopolitical landscape significantly influences General Dynamics' market. Heightened global tensions, such as ongoing conflicts and evolving security alliances, directly impact demand for defense and aerospace products. For instance, increased defense spending by NATO members in response to geopolitical instability, as seen with a projected 18% increase in collective defense spending by 2024, translates into higher potential orders for General Dynamics' combat systems and platforms.

Shifts in military doctrines and the rise of asymmetric warfare also play a crucial role. Nations are increasingly investing in advanced technologies, including cyber defense, unmanned systems, and modernized naval capabilities, areas where General Dynamics holds substantial expertise. The company's robust backlog, reaching $89.9 billion at the end of 2023, reflects this trend, with a significant portion tied to these evolving defense needs.

General Dynamics' global sales are significantly shaped by export controls and trade policies. For instance, the US Department of State's Directorate of Defense Trade Controls (DDTC) manages the International Traffic in Arms Regulations (ITAR), which directly impacts the export of defense articles and services, a core business for General Dynamics. Changes in these regulations, such as increased scrutiny on technology transfers or new sanctions against specific countries, can directly limit market access and affect international revenue streams. In 2023, the defense industry, including companies like General Dynamics, navigated complex geopolitical landscapes that influenced arms sales and international partnerships.

Political Stability and Leadership

General Dynamics’ ability to secure and maintain long-term defense contracts is significantly influenced by political stability and leadership in its key operating and customer nations. Changes in government, such as a new administration taking power in the United States or a major European ally, can lead to shifts in defense spending priorities and strategic alliances. For instance, a change in U.S. presidential administration in 2025 could potentially alter the focus of defense budgets, impacting programs General Dynamics is involved in.

New leadership often brings a fresh strategic outlook, which might favor certain types of military capabilities over others. This can directly affect the funding allocated to ongoing projects and the initiation of new ones. For example, a government prioritizing cyber defense might redirect funds away from traditional platforms, influencing General Dynamics’ portfolio. The company’s performance is therefore closely tied to the geopolitical stability and consistent defense policy of its major client nations.

- U.S. Defense Budget Outlook: The U.S. National Defense Authorization Act for Fiscal Year 2025, expected to be finalized in late 2024, will provide crucial insights into future spending priorities and potential impacts on defense contractors like General Dynamics.

- Global Defense Spending Trends: According to industry reports from mid-2024, global defense spending is projected to continue an upward trend, driven by geopolitical tensions, which could offer opportunities but also increase scrutiny from political bodies.

- Key Customer Nations' Political Climate: Monitoring the political landscapes in countries like the United Kingdom, Canada, and Australia, which are significant markets for General Dynamics, is essential to anticipate policy shifts affecting defense procurement.

Regulatory Environment for Defense Contractors

The defense sector operates under a stringent regulatory framework, significantly impacting General Dynamics. Key regulations include the Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS), which govern procurement processes, cost accounting, and compliance. Cybersecurity mandates, such as those outlined in NIST SP 800-171, are increasingly critical, requiring contractors to protect sensitive unclassified information. Failure to comply can lead to contract termination or debarment.

Changes in these regulations, or increased government oversight, can directly affect General Dynamics' operational costs and bidding strategies. For instance, enhanced cybersecurity requirements might necessitate additional investment in IT infrastructure and personnel training. Project timelines can also be extended due to rigorous review processes and compliance checks, potentially impacting revenue recognition and project profitability. In 2024, the U.S. Department of Defense continued to emphasize robust cybersecurity measures for its contractors, with ongoing audits and compliance assessments.

- FAR and DFARS: These regulations dictate contract terms, pricing, and performance standards for defense suppliers like General Dynamics.

- Cybersecurity Compliance: Mandates like NIST SP 800-171 are crucial for protecting government data, with non-compliance carrying significant penalties.

- Impact on Costs: Evolving regulations, particularly in cybersecurity, can drive up operational expenses for defense contractors.

- Project Timelines: Increased scrutiny and compliance requirements can extend project delivery schedules.

Political stability and government defense spending are paramount for General Dynamics. The U.S. Department of Defense's budget for fiscal year 2024, at approximately $886 billion, directly shapes opportunities for defense contractors. Shifts in national security priorities, such as a greater focus on peer competition, influence the demand for specific military capabilities like shipbuilding or land systems. Furthermore, allied nations' increasing defense budgets, with NATO members boosting spending by an estimated 18% in 2024, create new international contract prospects.

The company's performance is also heavily influenced by export controls and trade policies, managed by bodies like the U.S. Department of State's Directorate of Defense Trade Controls (DDTC) under ITAR. Changes in these regulations or the imposition of sanctions can restrict market access. Political stability in key customer nations, including the U.S. and major European allies, is crucial, as new administrations can alter defense spending priorities. For instance, a potential shift in U.S. defense focus following a 2025 administration change could impact General Dynamics' ongoing programs.

Stringent regulatory frameworks, such as the Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS), govern General Dynamics' operations. Compliance with cybersecurity mandates, like NIST SP 800-171, is increasingly critical, with non-compliance potentially leading to contract termination. Enhanced cybersecurity requirements in 2024, for example, necessitate ongoing investment and can impact project timelines and profitability.

| Factor | Description | Impact on General Dynamics | 2024/2025 Data Point |

| Government Spending | Defense budgets and allocation priorities. | Directly drives contract awards and revenue. | U.S. FY2024 Defense Budget: ~$886 billion. |

| Geopolitical Tensions | Global security environment and international relations. | Influences demand for advanced defense systems and international sales. | NATO collective defense spending projected to increase 18% by 2024. |

| Export Controls | Regulations governing international arms sales. | Affects market access and global revenue streams. | ITAR compliance is a constant factor for international business. |

| Political Stability | Leadership changes and policy consistency in customer nations. | Can alter defense spending priorities and program funding. | Potential U.S. administration change in 2025 could shift defense focus. |

| Regulatory Compliance | Adherence to defense procurement and cybersecurity regulations. | Impacts operational costs, bidding strategies, and project timelines. | NIST SP 800-171 compliance is increasingly critical for contractors. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing General Dynamics, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework to identify and address external factors impacting General Dynamics, alleviating the pain of strategic uncertainty.

Economic factors

Global economic growth significantly impacts defense spending and the commercial aerospace sector, which are crucial for General Dynamics. During periods of economic expansion, governments often have more fiscal capacity, potentially leading to increased defense budgets. For instance, in 2024, many developed economies are projected to see moderate growth, which could translate into sustained or even increased defense procurement. This environment generally supports higher demand for General Dynamics' defense products and services.

Conversely, economic downturns can put pressure on government finances, often resulting in defense budget reductions. A global recession, or even a significant slowdown, could lead to fewer new defense contracts and a decrease in orders for commercial aircraft, impacting sectors like Gulfstream business jets. For example, if global GDP growth falters in 2025, defense ministries might prioritize essential spending, deferring large capital expenditures. This economic sensitivity directly affects General Dynamics' revenue streams across its various business segments.

Inflation directly impacts General Dynamics by increasing the cost of raw materials, components, and labor essential for its defense and aerospace manufacturing. For instance, persistent inflation in 2024 and early 2025 has driven up prices for metals, semiconductors, and specialized labor, squeezing margins.

Rising supply chain costs, exacerbated by geopolitical events and logistical challenges, further erode profit margins, particularly on existing fixed-price contracts. General Dynamics must therefore continually reassess its pricing strategies and pursue operational efficiencies to mitigate these escalating expenses and maintain profitability.

Prevailing interest rates significantly impact General Dynamics' ability to finance large-scale projects and capital expenditures. For instance, the U.S. Federal Reserve's benchmark interest rate, the federal funds rate, has seen increases, impacting borrowing costs across the economy. Higher rates translate to increased financing costs for General Dynamics, potentially slowing down investments in new technologies or expansion initiatives.

Access to affordable capital remains a critical determinant of General Dynamics' long-term growth trajectory. In 2024, companies like General Dynamics rely on a mix of debt and equity financing. If interest rates remain elevated, the cost of issuing new debt or refinancing existing debt will rise, directly affecting the company's profitability and its capacity for strategic investments. For example, a 1% increase in interest rates on a $1 billion debt could add $10 million annually to interest expenses.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact General Dynamics' international business. A strong U.S. dollar, as seen in periods of global economic uncertainty, can make its defense systems and aerospace products more expensive for overseas customers, potentially dampening demand. For instance, if the dollar strengthens by 10% against a major currency like the Euro, a product priced at $100 million would effectively cost €92.6 million instead of €84.7 million (assuming a €1 = $1.18 exchange rate previously), impacting competitiveness.

Conversely, a weaker dollar can boost international sales by making U.S.-made goods more affordable abroad. However, it also increases the cost of imported components and materials used in General Dynamics' manufacturing processes. This dynamic necessitates careful hedging strategies to mitigate the financial risks associated with currency volatility. For example, in Q1 2024, General Dynamics reported that foreign currency translation adjustments had a negative impact on earnings, highlighting the ongoing challenge.

- Impact on Exports: A stronger USD increases the price of General Dynamics' products for international buyers, potentially reducing sales volume.

- Impact on Imports: A weaker USD raises the cost of raw materials and components sourced from abroad, affecting production expenses.

- Competitiveness: Exchange rate shifts can alter the relative pricing of General Dynamics' offerings compared to international competitors.

- Hedging Needs: The company must employ financial instruments to manage the financial risks arising from currency exchange rate volatility.

Competition and Market Dynamics

General Dynamics operates in a highly competitive global aerospace and defense sector, facing pressure from established players and emerging companies. This intense rivalry directly impacts its ability to secure lucrative contracts and maintain favorable pricing power. For instance, in 2023, the defense industry saw significant consolidation, with companies like RTX acquiring Blue Origin's space launch business, reshaping the competitive landscape and potentially influencing future contract allocations.

The need for continuous innovation is paramount for General Dynamics to maintain its market share. Competitors are constantly developing new technologies, from advanced unmanned systems to next-generation fighter jets. This necessitates substantial R&D investment to stay ahead. For example, in 2024, the US Department of Defense continued to prioritize modernization, signaling a strong demand for innovative solutions, which General Dynamics must meet to remain competitive.

- Intense Competition: Major players like Lockheed Martin, Boeing, and Northrop Grumman vie for similar government contracts, creating a challenging environment for General Dynamics.

- Market Entrants: While the defense industry has high barriers to entry, specialized technology firms and international companies are increasingly posing competitive threats.

- Consolidation Impact: Mergers and acquisitions within the industry can lead to larger, more integrated competitors, potentially impacting General Dynamics' bidding opportunities and pricing leverage.

- Innovation Imperative: Sustained investment in research and development is crucial for General Dynamics to offer cutting-edge solutions and win contracts in areas like AI-driven defense systems and advanced cybersecurity.

Global economic growth influences defense spending, with moderate growth in developed economies in 2024 potentially supporting increased defense budgets for General Dynamics. However, economic downturns or recessions in 2025 could lead to reduced government spending and fewer contracts, impacting General Dynamics' revenue across its defense and aerospace segments.

Inflationary pressures in 2024 and early 2025 have increased the costs of materials and labor for General Dynamics, potentially squeezing profit margins, especially on fixed-price contracts. Rising supply chain costs further exacerbate these pressures, necessitating ongoing price strategy reassessments and efficiency drives.

Interest rate hikes in 2024 increase General Dynamics' borrowing costs, potentially slowing investment in new technologies and expansion. Elevated rates in 2025 will continue to impact the cost of debt financing, affecting profitability and strategic investment capacity.

Exchange rate volatility in 2024 impacts General Dynamics' international sales; a stronger dollar makes exports pricier, while a weaker dollar increases imported component costs. The company must manage these currency risks through hedging strategies, as seen with negative foreign currency translation adjustments reported in early 2024.

Preview the Actual Deliverable

General Dynamics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of General Dynamics delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external forces shaping the defense and aerospace industry.

Sociological factors

Public sentiment significantly shapes the defense industry's landscape. In 2024, surveys indicated a growing public concern over the ethical implications of advanced weaponry and autonomous systems, leading to increased calls for stringent oversight. This can translate into pressure on governments to re-evaluate defense budgets and procurement strategies.

Negative public perception, often fueled by debates on military spending or the human cost of conflict, can directly impact a company like General Dynamics. For instance, a perception of excessive profits or involvement in controversial operations might lead to heightened regulatory scrutiny or a decline in investor confidence. Conversely, a public that views defense spending as crucial for national security can foster a more supportive environment for industry growth and innovation.

General Dynamics relies heavily on a skilled workforce, especially in engineering, advanced manufacturing, and cybersecurity. The availability of this talent is crucial for its defense and aerospace projects.

The company faces challenges with an aging workforce, as experienced professionals retire, creating knowledge gaps. For instance, the U.S. Bureau of Labor Statistics projected a shortage of over 1.4 million engineers by 2020, a trend that continues to impact the defense sector, requiring proactive talent acquisition strategies.

Competition for STEM talent remains fierce, with both private industry and government agencies vying for the same pool of skilled professionals. To address this, General Dynamics invests in robust recruitment initiatives and comprehensive training programs, including apprenticeships and upskilling opportunities, to ensure a pipeline of qualified employees and maintain its competitive edge in 2024 and beyond.

The increasing emphasis on Environmental, Social, and Governance (ESG) factors significantly shapes corporate strategy. Investors, employees, and customers are increasingly scrutinizing companies' commitments to sustainability, ethical operations, diversity, and community involvement. For General Dynamics, demonstrating robust ESG performance can bolster its reputation, attract capital, and reduce potential risks.

In 2023, ESG investing continued its upward trajectory, with global sustainable investment assets reaching an estimated $37.7 trillion, according to the Global Sustainable Investment Alliance. General Dynamics' initiatives in areas like reducing greenhouse gas emissions and fostering a diverse workforce are crucial for aligning with these investor expectations and maintaining a competitive edge.

Labor Relations and Unionization

Labor relations significantly influence General Dynamics' manufacturing and shipbuilding operations. Collective bargaining agreements with unions directly impact wage structures, benefits, and work rules, affecting production costs and flexibility. For instance, in 2023, General Dynamics' Electric Boat division, a major shipbuilding segment, continued negotiations with the Metal Trades Council, which represents thousands of workers. These negotiations, if unsettled, could lead to disruptions.

Potential labor disputes or strikes pose a material risk to General Dynamics' ability to meet production schedules and fulfill defense contracts. Such events can cause significant delays and cost overruns, impacting profitability and client relationships. The company's reliance on skilled labor in its defense manufacturing, particularly for complex naval projects, makes stable labor relations crucial for operational continuity and project delivery.

- Unionized Workforce: General Dynamics employs a substantial unionized workforce, particularly in its shipbuilding and land systems segments.

- Collective Bargaining: Key operations are governed by collective bargaining agreements, influencing labor costs and operational flexibility.

- Potential Disruptions: Labor disputes or strikes can directly impact production schedules, potentially leading to delays in critical defense contract fulfillment.

- Impact on Costs: Union agreements dictate wages, benefits, and work conditions, which are significant components of the company's operating expenses.

Veteran Employment and Support

General Dynamics actively recruits veterans, recognizing their unique skills and leadership qualities. In 2023, approximately 25% of its new hires were veterans, reflecting its commitment to this demographic. This focus not only bolsters the company's social responsibility but also enhances its reputation as a supportive employer within the defense industry.

The company's initiatives extend to supporting military families, which strengthens its social license to operate. By providing resources and employment opportunities for spouses and dependents, General Dynamics fosters a stable and committed workforce. This approach leverages the dedication and adaptability inherent in military-connected individuals.

- Veteran Hiring: In 2023, General Dynamics reported that veterans constituted around 25% of its new hires, demonstrating a significant commitment to employing former service members.

- Skill Integration: The company actively seeks to integrate the technical expertise, discipline, and problem-solving abilities of veterans into its diverse business units.

- Community Support: General Dynamics' programs for military families contribute to its positive public image and reinforce its role as a responsible corporate citizen in communities with a strong military presence.

Societal attitudes towards defense spending and the nature of warfare directly influence demand for General Dynamics' products and services. Public opinion shifts, often driven by geopolitical events or ethical considerations, can lead governments to adjust defense budgets, impacting procurement cycles. For example, heightened global tensions in 2024 have generally supported increased defense spending, benefiting companies like General Dynamics.

The company's ability to attract and retain a highly skilled workforce is paramount, especially given the specialized nature of defense technology. Competition for talent in STEM fields remains intense, with General Dynamics actively investing in training and recruitment to fill critical roles. The aging workforce trend continues to be a challenge, necessitating robust succession planning and knowledge transfer initiatives.

Labor relations are a key consideration, particularly for General Dynamics' manufacturing and shipbuilding operations. Collective bargaining agreements with unions directly affect labor costs and operational flexibility. In 2023, the company navigated negotiations with various labor groups, underscoring the importance of stable industrial relations for maintaining production schedules and managing costs.

General Dynamics' commitment to hiring veterans is a significant sociological factor, with veterans comprising a substantial portion of its new hires. This focus not only aligns with corporate social responsibility but also taps into a pool of individuals with valuable discipline, technical skills, and leadership experience. The company's support for military families further enhances its reputation and strengthens its connection with key communities.

| Sociological Factor | Impact on General Dynamics | 2023/2024 Data/Trend |

| Public Sentiment on Defense | Influences government spending and procurement priorities. | Heightened global tensions in 2024 generally supported increased defense budgets. |

| Skilled Workforce Availability | Crucial for R&D, manufacturing, and program execution. | Continued competition for STEM talent; focus on veteran hiring (approx. 25% of new hires in 2023). |

| Labor Relations | Affects production costs, efficiency, and contract fulfillment. | Ongoing collective bargaining agreements with unions in key segments; potential for labor disputes. |

| Veteran Employment | Enhances company reputation and provides skilled personnel. | Significant commitment to hiring veterans, leveraging their unique skills and leadership. |

Technological factors

General Dynamics is actively integrating advanced artificial intelligence and autonomous technologies across its defense and aerospace portfolios. This includes leveraging AI for improved battlefield situational awareness and faster decision-making processes for military commanders.

The company is developing autonomous vehicles, such as unmanned ground vehicles and maritime systems, designed for reconnaissance, logistics, and potentially combat roles. These systems aim to reduce risk to human personnel in dangerous environments.

In 2024, General Dynamics reported significant investment in AI research and development, with a focus on enhancing the capabilities of its existing platforms and developing next-generation intelligent combat systems. This strategic push is crucial for maintaining a competitive technological edge in a rapidly evolving defense landscape.

Cybersecurity is paramount for General Dynamics, safeguarding sensitive defense data, intellectual property, and operational networks from increasingly sophisticated threats. The company has made significant investments in advanced cybersecurity solutions to protect its mission-critical systems and ensure data integrity.

In 2023, General Dynamics reported spending over $1 billion on research and development, a portion of which is directly allocated to bolstering its cybersecurity capabilities and developing next-generation defense technologies that incorporate robust security features.

Emerging technologies like directed energy weapons and hypersonics are reshaping defense capabilities, presenting both opportunities and challenges for General Dynamics. The company is actively investing in research and development to integrate these advancements, aiming to maintain a competitive edge in a rapidly evolving market. For instance, General Dynamics' land systems division has been exploring directed energy applications, recognizing their potential to counter threats more effectively than traditional munitions.

Quantum computing, while still in its nascent stages for widespread military application, holds significant promise for revolutionizing areas such as secure communications and advanced simulation. General Dynamics is monitoring and investing in quantum research, understanding its long-term strategic importance for future defense systems. This forward-looking approach ensures the company is positioned to leverage these disruptive technologies as they mature and become integrated into defense strategies.

Digital Transformation and Advanced Manufacturing

General Dynamics is heavily leveraging digital transformation to streamline its operations. The company is integrating big data analytics and cloud computing to enhance decision-making across its diverse business segments. This digital push is particularly evident in its advanced manufacturing initiatives.

These technological advancements are directly impacting efficiency and cost reduction. For instance, the adoption of additive manufacturing, or 3D printing, allows for faster prototyping and the creation of complex, lightweight components. This not only speeds up product development cycles but also reduces material waste, contributing to lower production costs.

The benefits are tangible. General Dynamics reported that its digital transformation efforts contributed to a 15% improvement in operational efficiency in certain manufacturing lines during 2024. Furthermore, the company aims to reduce its product development timelines by an average of 20% by the end of 2025 through these integrated digital strategies.

- Digital Transformation: Integration of big data analytics and cloud computing for optimized operations.

- Advanced Manufacturing: Use of techniques like additive manufacturing to improve design and production.

- Efficiency Gains: Aiming for a 20% reduction in product development cycles by 2025.

- Cost Reduction: Technologies like 3D printing minimize material waste and production expenses.

Integration of Commercial Technologies

General Dynamics is increasingly leveraging commercially developed technologies to boost efficiency and accelerate innovation in its defense solutions. This strategy is particularly evident in its Technologies segment, where the company actively seeks and integrates commercial off-the-shelf (COTS) products.

By adopting COTS solutions, General Dynamics can reduce development costs and shorten time-to-market for new capabilities. For instance, in 2023, the company highlighted its use of advanced commercial computing and networking hardware to enhance the performance of its command and control systems, leading to an estimated 15% reduction in hardware acquisition costs compared to custom-built solutions.

- Cost Efficiency: Utilizing COTS hardware and software significantly lowers procurement and development expenses.

- Rapid Innovation: Accessing cutting-edge commercial tech allows for quicker deployment of advanced features.

- Competitive Edge: Integration of commercial technologies helps General Dynamics maintain a leading position in rapidly evolving defense markets.

- Agility: COTS adoption fosters greater flexibility in adapting systems to new operational requirements and threats.

General Dynamics is making substantial investments in artificial intelligence and autonomous systems, aiming to enhance military decision-making and reduce personnel risk. The company's 2024 R&D focus includes next-generation intelligent combat systems, reflecting a commitment to technological leadership.

Cybersecurity remains a critical focus, with over $1 billion invested in R&D in 2023, a portion dedicated to safeguarding sensitive defense data and developing secure, next-generation technologies.

Emerging technologies like directed energy and hypersonics are key areas of investment, with the company actively pursuing their integration to maintain a competitive edge in the defense sector.

The company is driving digital transformation, integrating big data and cloud computing to boost operational efficiency, targeting a 20% reduction in product development timelines by 2025.

| Technological Area | Key Initiatives | Impact/Goal | Data Point |

| Artificial Intelligence & Autonomy | AI for situational awareness, autonomous vehicles | Reduce risk to personnel, faster decision-making | Significant R&D investment in 2024 |

| Cybersecurity | Advanced security solutions for networks and data | Protect sensitive defense data and IP | Over $1 billion R&D spend in 2023 (portion for cybersecurity) |

| Emerging Technologies | Directed energy, hypersonics | Enhance defense capabilities, maintain competitive edge | Active R&D investment |

| Digital Transformation | Big data analytics, cloud computing, additive manufacturing | Improve operational efficiency, reduce development timelines | 15% operational efficiency gain in 2024, 20% development time reduction target by 2025 |

| Commercial Technologies | Integration of COTS products | Reduce development costs, accelerate innovation | 15% reduction in hardware acquisition costs (estimated) |

Legal factors

General Dynamics operates under a stringent framework of federal acquisition regulations, primarily the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). These extensive rules dictate every aspect of government contracting, from bidding processes to contract execution and cost accounting.

Strict adherence to these regulations, including detailed cost accounting standards and unwavering ethical conduct, is not merely a best practice but a fundamental requirement for securing and maintaining lucrative contracts with the U.S. Department of Defense. For instance, in fiscal year 2023, the U.S. Department of Defense awarded over $400 billion in contracts, highlighting the immense market General Dynamics competes within and the critical importance of compliance.

General Dynamics operates under stringent government contract compliance, necessitating rigorous adherence to terms and regulations. Agencies like the Defense Contract Audit Agency (DCAA) conduct frequent audits to ensure accurate financial reporting and robust internal controls. Failure to comply can lead to penalties and disqualification from future contracts, impacting revenue streams significantly.

General Dynamics places significant emphasis on safeguarding its intellectual property, including patents, trademarks, and proprietary technologies, which are crucial for maintaining its competitive edge in the defense and aerospace industries. The company actively manages its IP portfolio, employing strategies to defend against infringement and navigate intricate licensing agreements to protect its innovations.

Antitrust and Competition Laws

General Dynamics operates within a defense sector where antitrust and competition laws are paramount, particularly concerning mergers and acquisitions. The company must meticulously adhere to regulations designed to prevent monopolistic practices and ensure a level playing field. For instance, in 2024, the U.S. Department of Justice and the Federal Trade Commission continue to scrutinize large-scale consolidations within critical industries, including aerospace and defense, to safeguard market competition.

Navigating these legal frameworks is crucial for General Dynamics when exploring strategic partnerships or potential acquisitions. The company needs to demonstrate that any such moves will not stifle competition or lead to undue market concentration. Failure to comply can result in significant penalties, divestitures, or the blocking of proposed transactions, impacting strategic growth initiatives.

- General Dynamics must comply with U.S. antitrust laws, such as the Sherman Act and Clayton Act, which govern mergers and competitive practices.

- Regulatory bodies like the Department of Justice and Federal Trade Commission actively monitor the defense industry for anti-competitive behavior.

- In 2023, the FTC reported reviewing over 2,000 premerger notifications, highlighting the active enforcement environment.

- Strategic partnerships and acquisitions by General Dynamics are subject to rigorous review to ensure they do not create monopolies or harm fair competition.

Environmental Regulations and Compliance

General Dynamics faces stringent legal mandates concerning environmental protection across its manufacturing sites. Compliance with regulations on air emissions, waste management, and the handling of hazardous materials is paramount to avoid penalties and operational interruptions. For example, the Environmental Protection Agency (EPA) enforces the Clean Air Act and Clean Water Act, with violations potentially leading to substantial fines. In 2023 alone, the EPA reported over $100 million in penalties for environmental non-compliance across various industries, a figure that underscores the financial risks involved.

Key legal factors impacting General Dynamics include:

- Emissions Control: Adherence to federal and state limits on air pollutants, such as volatile organic compounds (VOCs) and particulate matter, is critical for manufacturing operations.

- Waste Disposal: Strict regulations govern the disposal of industrial waste, particularly hazardous materials, requiring proper containment, treatment, and documentation to prevent environmental contamination.

- Hazardous Materials Management: Legal frameworks dictate the safe storage, transportation, and use of chemicals and other hazardous substances integral to defense manufacturing.

- Water Quality Standards: Compliance with regulations on wastewater discharge ensures that industrial runoff does not pollute local water bodies, often requiring advanced treatment processes.

General Dynamics navigates a complex legal landscape, particularly concerning government contracts and intellectual property protection. Compliance with regulations like the FAR and DFARS is non-negotiable, with agencies like the DCAA conducting regular audits to ensure adherence. The company actively defends its patents and proprietary technologies, recognizing their value in the competitive defense and aerospace markets.

Environmental factors

General Dynamics, like many global corporations, faces significant operational risks from the physical impacts of climate change. Extreme weather events, such as hurricanes and floods, could disrupt its manufacturing facilities and critical supply chains, potentially impacting delivery schedules for defense contracts. Rising sea levels also pose a threat to coastal infrastructure, including shipyards and testing ranges.

In response, General Dynamics is actively engaged in climate risk assessment and adaptation strategies. The company has integrated climate considerations into its enterprise risk management framework, focusing on identifying vulnerabilities and developing mitigation plans. This includes investing in resilient infrastructure and diversifying supply chains to minimize disruptions. For instance, in 2023, the company reported ongoing efforts to enhance the resilience of its facilities against a range of environmental hazards as part of its sustainability reporting.

General Dynamics is actively pursuing sustainability initiatives to reduce its environmental impact. In 2023, the company reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating progress towards their 2030 reduction targets. These efforts include investing in energy-efficient technologies across their facilities and exploring renewable energy procurement options to further lower their carbon footprint, aligning with growing stakeholder demands for corporate environmental responsibility.

General Dynamics, like many defense manufacturers, faces challenges in securing critical raw materials such as rare earth minerals and specialized metals essential for advanced defense systems. Fluctuations in global supply and geopolitical tensions can impact the availability and cost of these materials. For instance, China's dominance in rare earth processing, accounting for roughly 60% of global production in 2023, presents a significant sourcing risk.

To mitigate these risks, General Dynamics actively manages its supply chain by diversifying suppliers and exploring alternative materials where feasible. The company emphasizes responsible sourcing practices, ensuring compliance with environmental and ethical standards throughout its procurement processes. This proactive approach helps maintain production continuity and supports the development of resilient defense capabilities.

Waste Management and Pollution Control

General Dynamics is committed to robust waste management and pollution control across its diverse operations. The company focuses on the responsible handling of industrial waste, including hazardous materials generated from its aerospace, marine, and combat systems manufacturing. This includes adhering to stringent national and international environmental regulations, such as the Resource Conservation and Recovery Act (RCRA) in the United States.

Efforts to minimize environmental impact are a key priority. General Dynamics invests in technologies and processes aimed at reducing emissions from its manufacturing facilities and testing sites. For instance, the company implements advanced wastewater treatment systems and air pollution control equipment to ensure compliance and mitigate ecological harm. In 2023, General Dynamics reported a continued focus on reducing greenhouse gas emissions intensity, aligning with broader corporate sustainability goals.

- Hazardous Waste Management: Implementing strict protocols for the identification, segregation, storage, transportation, and disposal of hazardous waste in compliance with EPA and international standards.

- Pollution Prevention: Investing in cleaner production technologies and process improvements to reduce air emissions, water discharges, and solid waste generation.

- Regulatory Compliance: Maintaining a strong track record of compliance with environmental laws and regulations, including permits for air emissions and wastewater discharge.

- Sustainability Reporting: Publicly disclosing environmental performance data, including waste generation and emission reduction metrics, as part of its annual sustainability reports.

Environmental Compliance and Reporting

General Dynamics, like many large corporations, faces growing expectations for environmental accountability. This includes stringent regulations and increased demand for transparent reporting on environmental impact. In 2023, for instance, companies in the defense sector, including General Dynamics, are navigating evolving frameworks for sustainability reporting, often driven by investor and governmental pressure.

The company actively works to comply with a complex web of environmental laws and regulations across its global operations. This involves implementing robust internal processes and management systems to ensure adherence to standards related to emissions, waste management, and resource conservation. For example, as of the 2024 reporting cycle, adherence to EPA (Environmental Protection Agency) standards in the US and similar international bodies remains a critical focus.

General Dynamics provides regular disclosures on its environmental performance. These reports, often found in their annual sustainability or corporate responsibility reports, detail key metrics and initiatives. Stakeholders, including investors and regulatory agencies, rely on this data to assess the company's commitment to environmental stewardship. For 2024, expect continued emphasis on Scope 1, 2, and 3 emissions reporting.

- Adherence to Global Environmental Regulations: General Dynamics maintains compliance with diverse environmental laws, including those governing air and water quality, hazardous materials, and waste disposal, across its international facilities.

- Sustainability Reporting Frameworks: The company engages with established frameworks such as the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD) to guide its environmental disclosures.

- Environmental Performance Metrics: Key performance indicators related to energy consumption, greenhouse gas emissions, water usage, and waste generation are tracked and reported to stakeholders.

- Stakeholder Engagement on Environmental Issues: General Dynamics communicates its environmental strategies and performance with investors, employees, communities, and regulatory bodies to foster transparency and address concerns.

General Dynamics is actively addressing climate change risks by integrating them into its enterprise risk management. The company is investing in resilient infrastructure and diversifying its supply chains to mitigate disruptions from extreme weather events, as highlighted in its 2023 sustainability reporting.

The company has made strides in reducing its environmental footprint, reporting a 10% decrease in Scope 1 and 2 greenhouse gas emissions by 2023 compared to a 2019 baseline. This progress supports their 2030 reduction targets, achieved through energy efficiency investments and exploration of renewable energy sources.

General Dynamics is committed to responsible waste management and pollution control, adhering to regulations like the RCRA. In 2023, the company continued its focus on reducing greenhouse gas emissions intensity, demonstrating a commitment to environmental stewardship across its operations.

PESTLE Analysis Data Sources

Our General Dynamics PESTLE Analysis is meticulously constructed using data from authoritative government publications, leading industry associations, and reputable financial news outlets. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.