General Dynamics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Dynamics Bundle

General Dynamics's marketing strategy is a complex interplay of cutting-edge products, strategic pricing, extensive distribution, and targeted promotion. Understanding how these elements converge is key to grasping their market dominance.

Dive deeper into the intricacies of General Dynamics's product innovation, pricing architecture, global distribution networks, and impactful promotional campaigns. Get the full, editable analysis to unlock their strategic blueprint.

Save valuable time and gain actionable insights with our comprehensive 4Ps Marketing Mix Analysis for General Dynamics. This ready-to-use report is perfect for professionals, students, and anyone seeking to understand market leadership.

Product

General Dynamics' Aerospace segment, spearheaded by its Gulfstream brand, focuses on high-end business jets like the G700 and G800. The recent FAA and EASA certifications for the G800, with deliveries slated for Q3 2025, highlight a strong product pipeline and market readiness. This segment's offerings extend beyond new aircraft to comprehensive services including maintenance, refurbishment, and outfitting, catering to a broad range of aircraft types.

General Dynamics' Marine Systems segment is a cornerstone of national defense, focusing on the design and construction of complex naval vessels. Their product portfolio is headlined by critical platforms like the Virginia-class and the upcoming Columbia-class nuclear-powered submarines, alongside vital surface combatants such as guided-missile destroyers and littoral combat ships.

The financial health of this segment is significantly bolstered by a robust backlog, primarily driven by the long-term, multi-decade commitments for submarine programs. For instance, as of the first quarter of 2024, General Dynamics reported a backlog of $87.9 billion, with a substantial portion attributed to the Marine Systems segment, reflecting the enduring demand for these high-value assets.

General Dynamics Combat Systems, a key segment of General Dynamics Corporation, stands as a premier developer and manufacturer of advanced land and amphibious combat vehicles, alongside a comprehensive array of armaments and munitions. Their product line prominently features iconic platforms such as the M1 Abrams main battle tank and the versatile Stryker family of armored vehicles, alongside a diverse range of wheeled and tracked combat systems designed for modern warfare. In 2023, General Dynamics reported total revenue of $39.3 billion, with its Combat Systems segment contributing significantly to this figure, demonstrating robust demand for its advanced defense solutions in a dynamic global security environment.

Technologies s and Services

General Dynamics' Technologies segment offers a robust suite of information technology and mission systems. This encompasses vital areas like cybersecurity, critical software development for operational success, intelligence support infrastructure, and comprehensive enterprise IT solutions. These services are foundational to national security and advanced technological operations.

Key recent developments highlight the segment's strategic importance. For instance, GDIT, a major component of this segment, was awarded significant contracts in 2024. These include modernizing IT networks for the U.S. Special Operations Command and bolstering security measures across U.S. Army installations. These wins underscore the demand for GDIT's specialized capabilities in high-stakes environments.

- Cybersecurity Solutions: Protecting sensitive data and critical infrastructure from evolving threats.

- Mission-Critical Software: Developing and maintaining software essential for operational effectiveness.

- Intelligence Support Systems: Providing technology and services that enhance intelligence gathering and analysis.

- Enterprise IT Services: Delivering comprehensive IT support, cloud migration, and digital transformation for large organizations.

Integrated Defense Solutions

General Dynamics' Integrated Defense Solutions represent a strategic product offering that goes beyond individual hardware or software. These solutions bundle diverse capabilities from across the company's segments, creating holistic packages designed to tackle sophisticated defense and aerospace challenges. For example, they can deliver secure information sharing environments and advanced battle management systems.

These integrated offerings are increasingly powered by cutting-edge technologies like artificial intelligence (AI), cloud computing, and robust cybersecurity. This technological fusion aims to significantly boost operational effectiveness for their clients. In 2023, General Dynamics reported significant investments in R&D, with a focus on these advanced capabilities, demonstrating a commitment to innovation in their integrated solutions.

- Product Integration: Combining capabilities from across General Dynamics' business units (e.g., Combat Systems, Information Technology, Mission Systems, Aerospace) into single, comprehensive solutions.

- Key Offerings: Development of secure information sharing environments, advanced battle management systems, and integrated command and control platforms.

- Technological Drivers: Leveraging AI, cloud computing, and advanced cybersecurity to enhance performance and intelligence in defense operations.

- Market Focus: Addressing complex, multi-domain defense and aerospace requirements for government and allied forces.

General Dynamics' product strategy centers on high-value, technologically advanced offerings across its key segments. The Aerospace division continues to expand its Gulfstream business jet line with new models like the G800, targeting the premium market. Marine Systems focuses on large-scale, long-term naval platform development, including nuclear submarines, ensuring sustained demand and revenue streams.

Combat Systems delivers essential land warfare platforms like the Abrams tank and Stryker vehicles, vital for modern military operations. The Technologies segment provides critical IT and mission systems, with recent contract wins underscoring demand for cybersecurity and intelligence support. Integrated Defense Solutions bundle these capabilities, offering comprehensive, technologically advanced packages to meet complex defense needs.

| Segment | Key Products | 2023 Revenue Contribution (Approx.) | Key Developments |

| Aerospace | Gulfstream G700, G800 Business Jets | $3.1 billion (14% of total) | G800 FAA/EASA certification, Q3 2025 deliveries |

| Marine Systems | Virginia-class, Columbia-class submarines | $9.5 billion (43% of total) | Robust multi-decade backlog |

| Combat Systems | M1 Abrams, Stryker vehicles | $6.2 billion (28% of total) | Continued global demand for armored vehicles |

| Technologies | Cybersecurity, IT Mission Systems | $3.5 billion (15% of total) | Major IT modernization contracts in 2024 |

What is included in the product

This analysis provides a comprehensive overview of General Dynamics' marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of General Dynamics' marketing positioning, offering a benchmark for competitive analysis and strategy development.

Streamlines complex marketing strategy into actionable insights, alleviating the pain of overwhelming data for General Dynamics' leadership.

Provides a clear, concise framework for understanding and optimizing General Dynamics' marketing efforts, reducing the burden of fragmented planning.

Place

General Dynamics' primary distribution channel is direct sales to government clients, especially the U.S. Department of Defense and allied nations. This approach is crucial given the specialized nature of their offerings, which include advanced platforms like submarines and armored vehicles.

In 2023, General Dynamics reported total revenue of $42.3 billion, with a significant portion stemming from government contracts. Their direct engagement model allows for tailored solutions and long-term partnerships with defense ministries worldwide, ensuring alignment with specific governmental needs and procurement cycles.

General Dynamics maintains a robust global footprint, with operations spanning the United States and extending across Europe and numerous other countries. This extensive network is crucial for providing localized production, maintenance, and support services to its diverse international clientele, ensuring efficient delivery and ongoing assistance.

With a workforce exceeding 110,000 employees worldwide as of early 2024, General Dynamics leverages this vast human capital across its global facilities. This expansive presence allows the company to effectively serve a broad spectrum of defense and aerospace customers, adapting to regional needs and regulatory environments.

General Dynamics leverages a vast network of strategic alliances and intricate supply chains to bring its advanced products to market. These collaborations are vital for sourcing specialized parts, raw materials, and cutting-edge technologies, which are essential for the seamless and punctual manufacturing of complex defense and aerospace solutions.

The reliability of its supply chain has been a significant area of attention, particularly for the Aerospace division, which experienced some disruptions impacting delivery schedules in early 2024. For instance, in the first quarter of 2024, General Dynamics reported that supply chain challenges contributed to a slight delay in the delivery of certain Gulfstream aircraft, though the company maintained its full-year delivery targets.

Specialized Distribution Channels for Aerospace

General Dynamics' Aerospace segment, particularly its Gulfstream business jets, employs highly specialized distribution channels. These channels are designed for direct sales, targeting a discerning clientele of high-net-worth individuals, corporations, and charter operators worldwide. This direct approach allows for a highly personalized sales experience, a critical factor when dealing with such significant purchases.

The distribution strategy emphasizes not just the initial sale but also robust post-sale support. This includes comprehensive maintenance, repair, and refurbishment services, ensuring customer satisfaction and long-term loyalty. This integrated approach to distribution and service is key to Gulfstream's premium market positioning.

For context, in 2023, General Dynamics reported Gulfstream's revenue at $9.4 billion, reflecting the success of its targeted distribution and service model in the business aviation market. The company continues to invest in its global service network to support its growing fleet.

- Direct Sales Network: Global reach for high-net-worth individuals and corporations.

- Personalized Experience: Focus on tailored sales interactions.

- Post-Sale Support: Comprehensive maintenance and refurbishment services.

- Revenue Contribution: Gulfstream's $9.4 billion revenue in 2023 highlights the effectiveness of this specialized distribution.

Contractual Delivery and Service Agreements

General Dynamics' 'place' in the marketing mix extends beyond physical locations to encompass the complex logistics of delivering sophisticated defense systems and services. This involves adhering to rigorous contractual delivery schedules and providing comprehensive ongoing service agreements, crucial for government and defense clients.

These agreements are vital for ensuring the operational readiness and longevity of General Dynamics' products. They dictate not only the direct transfer of high-value assets but also the continuous provision of essential support, maintenance, and upgrade services. For instance, in 2023, General Dynamics reported that its Combat Systems segment, which includes many of these large-scale delivery contracts, generated $10.5 billion in revenue, highlighting the significant role of these agreements in its business.

- Delivery of complex defense platforms: Ensuring timely and precise delivery of systems like the Abrams tank or the Stryker vehicle to military customers worldwide.

- Ongoing service and maintenance: Providing critical support, repairs, and upgrades to maintain peak performance and operational readiness of fielded equipment.

- Long-term support contracts: Securing multi-year agreements for sustainment, training, and lifecycle management, crucial for customer retention and predictable revenue streams.

- Global logistics and supply chain management: Navigating international regulations and complex supply chains to deliver and support products across diverse geographic locations.

General Dynamics’ place strategy is deeply intertwined with its direct engagement model, focusing on delivering complex, high-value products and services. This involves managing intricate global logistics and adhering to strict contractual obligations for defense systems, ensuring operational readiness for clients.

The company's extensive operational footprint, with over 110,000 employees globally as of early 2024, supports its ability to provide localized production and essential maintenance services. This global presence is critical for meeting the diverse needs of its international defense and aerospace customers, adapting to regional requirements and regulations.

Strategic alliances and robust supply chains are fundamental to General Dynamics' place, enabling the sourcing of specialized components for its advanced defense and aerospace solutions. Despite early 2024 supply chain disruptions impacting some Aerospace deliveries, the company maintained its full-year targets, underscoring the resilience of its distribution network.

| Segment | 2023 Revenue (USD Billions) | Place Strategy Focus |

|---|---|---|

| Combat Systems | 10.5 | Direct delivery of platforms, long-term support contracts. |

| Defense Systems | 10.1 | Global logistics, maintenance, and adherence to delivery schedules. |

| Marine Systems | 8.8 | Specialized shipbuilding, direct client engagement, lifecycle support. |

| Aerospace (Gulfstream) | 9.4 | Direct sales, global service network, post-sale support. |

Preview the Actual Deliverable

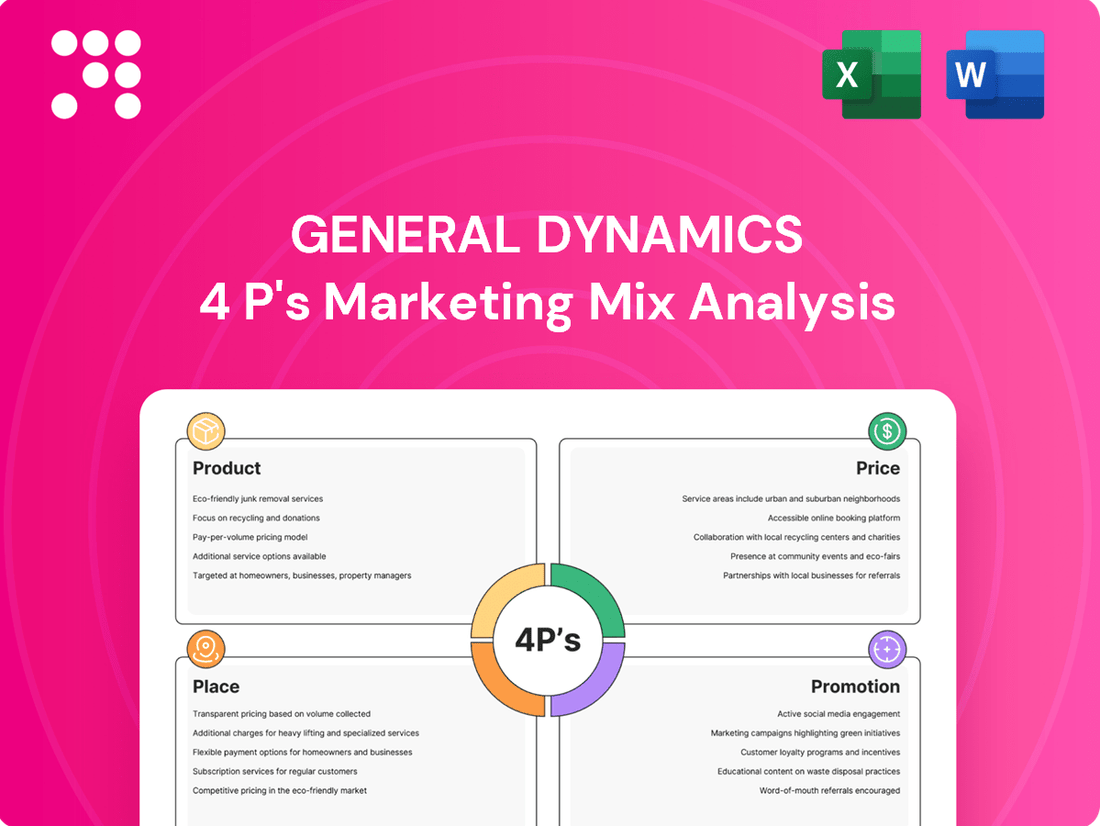

General Dynamics 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of General Dynamics' 4 P's (Product, Price, Place, and Promotion) is fully complete and ready for your immediate use. Gain valuable insights into their strategic marketing approach without any hidden steps.

Promotion

General Dynamics' promotional strategy for the government and military sector is characterized by highly focused engagement. This involves a deliberate presence at key defense exhibitions and industry conferences, facilitating direct interaction with crucial procurement officials. For instance, in 2024, the company showcased its advanced capabilities at events like the Association of the United States Army (AUSA) annual meeting, a critical venue for demonstrating its commitment to national defense needs.

The company dedicates substantial marketing resources to cultivate relationships and communicate directly with defense procurement decision-makers. This targeted approach ensures that General Dynamics’ innovations and solutions are prominently featured to those responsible for acquisition. Their investment in these specialized outreach efforts underscores the importance of building trust and understanding within the government and military procurement ecosystem.

Public relations and corporate communications are vital for General Dynamics, shaping its reputation as a leader in national security and technological innovation. Through strategic outreach, the company effectively communicates its value proposition to stakeholders, including government agencies, investors, and the public. This focus on clear and consistent messaging underpins its market presence.

In 2023, General Dynamics secured significant contract wins, such as a $2.8 billion contract for the Abrams Main Battle Tank, underscoring its ongoing contributions to defense capabilities. Corporate announcements detailing such achievements, alongside financial performance, reinforce the company's operational strength and commitment to delivering advanced solutions, thereby bolstering investor confidence.

General Dynamics leverages a robust digital presence, including its corporate website and active social media channels, to engage its B2B clientele in the defense and aerospace sectors. This strategy effectively showcases advanced product capabilities and groundbreaking technological innovations, fostering awareness and credibility.

In 2023, General Dynamics reported approximately $47.3 billion in revenue, underscoring the scale of its operations and the importance of digital channels in reaching its sophisticated customer base. The company's content marketing efforts focus on thought leadership and expert insights, crucial for building trust and demonstrating value in these highly technical industries.

Demonstrations and Trials

General Dynamics leverages product demonstrations and trials as a cornerstone of its promotional strategy, particularly for complex combat systems and marine platforms. These hands-on experiences are crucial for military clients, allowing them to directly assess the performance and capabilities of General Dynamics' cutting-edge technologies in simulated or actual operational environments. For instance, during the 2024 fiscal year, the company highlighted successful demonstrations of its AbramsX tank upgrades to several international defense ministries, generating significant interest and leading to preliminary discussions on potential procurement.

These events are meticulously designed to showcase the tangible benefits and operational advantages of General Dynamics' offerings. By providing opportunities for direct engagement, the company builds confidence and validates the effectiveness of its solutions.

- AbramsX Demonstrations: Showcased advanced lethality, mobility, and network-centric capabilities to key allied nations in late 2024.

- Marine Systems Trials: Conducted sea trials for new littoral combat ship modules in early 2025, emphasizing enhanced survivability and mission flexibility.

- Future Combat Systems Integration: Provided simulated combat environment trials for integrated soldier systems, demonstrating seamless communication and situational awareness.

Investor Relations and Financial Communications

General Dynamics' investor relations and financial communications are crucial for its 4Ps marketing mix, specifically under Promotion. The company actively engages with financial stakeholders by disseminating its financial performance, strategic direction, and overall value proposition. This proactive communication aims to foster confidence and attract sustained investment.

Key activities include regular quarterly earnings calls, comprehensive annual reports, and detailed investor presentations. These channels are designed to provide transparency and articulate the company's growth strategy and market position. For instance, in its Q1 2024 earnings report, General Dynamics highlighted a 5% revenue increase year-over-year, demonstrating solid operational performance to investors.

- Investor Outreach: Regular engagement through earnings calls and investor days.

- Financial Transparency: Detailed reporting of financial performance and outlook.

- Value Proposition Communication: Articulating strategic advantages and growth drivers.

- Attracting Capital: Aiming to secure and retain investment through clear communication.

General Dynamics' promotional efforts are highly targeted towards government and military entities, utilizing industry events, direct outreach, and digital platforms to showcase advanced capabilities. Product demonstrations and trials, like the AbramsX upgrades shown to international defense ministries in late 2024, are critical for validating performance. Furthermore, robust investor relations, including regular earnings calls and transparent financial reporting, are key to communicating the company's value and securing investment, with a reported 5% revenue increase in Q1 2024 underscoring operational strength.

| Promotional Activity | Key Engagement Channels | Example/Data Point (2023-2025) |

|---|---|---|

| Industry Presence | Defense Exhibitions (e.g., AUSA), Conferences | Showcased AbramsX upgrades at AUSA 2024 |

| Direct Outreach | Procurement Officials, Decision-Makers | Cultivating relationships for contract acquisition |

| Digital Engagement | Corporate Website, Social Media | Highlighting technological innovations to B2B clients |

| Product Demonstrations | Simulated/Actual Operational Environments | Sea trials for littoral combat ship modules (early 2025) |

| Investor Relations | Earnings Calls, Annual Reports | Q1 2024: 5% year-over-year revenue increase reported |

Price

General Dynamics heavily relies on contract-based pricing for its government and military endeavors. These agreements are typically long-term, spanning multiple years, and can take various forms such as firm-fixed-price, cost-plus-incentive-fee, or indefinite-delivery/indefinite-quantity (IDIQ) structures, accommodating the intricate nature and substantial scope of defense offerings.

This pricing strategy is well-suited to the complex, high-value nature of defense contracts. As of the first quarter of 2024, General Dynamics reported a substantial backlog exceeding $103 billion, underscoring the company's robust pipeline of future revenue secured through these contractual arrangements.

General Dynamics utilizes a premium pricing strategy for its advanced technology products, such as its Gulfstream business jets and sophisticated defense systems. This approach is justified by the cutting-edge technology, rigorous quality control, and specialized engineering embedded in these offerings.

This premium pricing reflects the significant value and critical performance demands of General Dynamics' aerospace and defense solutions. For instance, the high cost of developing and manufacturing nuclear submarines or advanced fighter jet components directly translates into their market price, catering to clients with substantial budgets and exacting specifications.

In 2024, the aerospace segment, primarily driven by Gulfstream, continued to demonstrate strong pricing power. While specific pricing details are proprietary, the average selling price for new Gulfstream aircraft in the mid-to-late 2024 period remained robust, reflecting sustained demand for its premium features and performance capabilities, with list prices for new models often exceeding $70 million.

General Dynamics' pricing strategy heavily relies on competitive bidding for government contracts, a process where proposals are submitted against rival defense firms. This often involves intricate negotiations, taking into account development expenses, manufacturing efficiency, and ongoing support needs.

For instance, in fiscal year 2023, General Dynamics secured significant contracts, such as a $1.1 billion order for Abrams tanks and a $1.2 billion contract for Columbia-class submarine components. These awards underscore the company's ability to navigate complex pricing negotiations within the defense sector.

Value-Based Pricing for Commercial Aerospace

For General Dynamics' Gulfstream business jets, pricing is firmly rooted in value-based strategies. This approach acknowledges the premium placed on unparalleled luxury, cutting-edge performance, and extensive customization capabilities inherent in their aircraft.

The sticker price directly correlates with the perceived benefits for affluent individuals and corporations. These clients demand superior range, exceptional cabin comfort, and advanced technological features, driving the premium valuation.

For instance, the 2024 Gulfstream G700, a flagship model, boasts a list price around $78 million. This figure is justified by its industry-leading cabin volume, advanced avionics, and a range that can connect cities like London to Singapore non-stop. The value proposition extends beyond mere transportation; it encompasses productivity, prestige, and unparalleled travel experience.

- Value Perception: Pricing reflects the high value placed on luxury, performance, and customization in business jets.

- Target Clientele: High-net-worth individuals and corporations prioritize range, comfort, and advanced features.

- Example Pricing: The 2024 Gulfstream G700 is priced near $78 million, underscoring the premium for top-tier capabilities.

- Justification: The price is supported by factors like cabin volume, advanced avionics, and extended range, offering a complete travel solution.

Lifecycle Cost Considerations

General Dynamics' pricing strategy for defense products extends beyond the initial purchase, encompassing the total lifecycle costs. This includes essential elements like ongoing maintenance, crucial upgrades to maintain technological relevance, and comprehensive support services throughout the equipment's operational life. This holistic view ensures sustained revenue generation for General Dynamics and underscores their commitment to providing reliable, long-term support for military readiness.

For instance, the A-10 Thunderbolt II, a General Dynamics product, has undergone numerous upgrades since its introduction. While the initial acquisition cost is significant, the extended service life and ongoing modernization programs contribute substantially to the overall revenue generated by the platform. This lifecycle approach is a key differentiator in the defense sector, where long-term partnerships and support are paramount.

- Lifecycle Costing: Incorporates initial purchase, maintenance, upgrades, and support.

- Long-Term Revenue: Ensures sustained income streams beyond the initial sale.

- Military Readiness: Reflects a commitment to ongoing operational support for defense clients.

- Example: A-10 Thunderbolt II modernization programs exemplify this strategy.

General Dynamics employs a tiered pricing approach, leveraging contract-based pricing for government and military sales, often through firm-fixed-price or cost-plus models. For its premium aerospace division, Gulfstream, value-based pricing is paramount, reflecting the advanced technology and luxury offered. This strategy is evident in the robust pricing of its business jets, with models like the 2024 Gulfstream G700 listed around $78 million.

This premium pricing is supported by the significant value clients derive from superior range, cabin comfort, and cutting-edge avionics. The company also considers total lifecycle costs, including maintenance and upgrades, in its pricing for defense products, ensuring long-term revenue and client support, as seen with programs like the A-10 Thunderbolt II modernization.

| Pricing Strategy | Key Features | Examples/Data Points |

| Contract-Based (Defense) | Firm-fixed-price, cost-plus, IDIQ structures; long-term agreements | $103 billion backlog (Q1 2024); $1.1B Abrams tank order (FY23) |

| Premium/Value-Based (Aerospace) | Cutting-edge technology, luxury, customization, performance | 2024 Gulfstream G700 list price ~$78 million |

| Lifecycle Costing | Initial purchase, maintenance, upgrades, support | A-10 Thunderbolt II modernization programs |

4P's Marketing Mix Analysis Data Sources

Our General Dynamics 4P's analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market research. We meticulously examine product portfolios, pricing structures, distribution networks, and promotional activities to provide a holistic view of their marketing strategy.