The Friedkin Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

The Friedkin Group's diversified portfolio presents significant strengths, but understanding their market vulnerabilities and untapped opportunities is crucial. Our comprehensive SWOT analysis delves deep into these dynamics, offering a clear roadmap for strategic advantage.

Want the full story behind The Friedkin Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Friedkin Group's strength lies in its exceptionally diverse business portfolio, encompassing automotive distribution, luxury hospitality, entertainment production, and professional sports. This broad spectrum of investments significantly reduces overall business risk, as the group isn't dependent on any single industry for revenue. For instance, Gulf States Toyota's consistent performance can offset potential challenges in the entertainment sector, creating a more resilient financial structure.

The Friedkin Group's ownership of Auberge Resorts Collection provides a significant advantage in the luxury hospitality sector. This segment is experiencing robust global growth, with projections indicating continued expansion through 2029, driven by a rising consumer appetite for exclusive and personalized travel experiences.

Auberge Resorts Collection is strategically broadening its footprint with several new properties scheduled to debut in 2025. These upcoming openings in key markets like London, Florence, Miami Beach, Dallas, and San Francisco underscore the group's commitment to capturing market share in a high-growth, high-margin industry.

The Friedkin Group's strategic expansion into global sports, highlighted by the February 2025 establishment of Pursuit Sports, signals a deliberate move to consolidate and grow its professional sports portfolio. This new entity will manage key assets like AS Roma and the recently acquired Everton FC.

This multi-club ownership approach is designed to foster global brand synergy across its sports franchises and unlock opportunities for future expansion within the rapidly growing international sports market. The acquisition of Everton, a club with a rich history and significant fanbase, further solidifies this ambition.

Established and Resilient Automotive Presence

The Friedkin Group's automotive strength is anchored by Gulf States Toyota, a distributor since 1969. This long-standing relationship has positioned it as one of the globe's largest independent distributors of Toyota vehicles and parts, ensuring a consistent and significant revenue stream. The automotive sector, while evolving, maintains robust demand in many markets, with Toyota consistently demonstrating strong sales performance.

This established presence translates into tangible market advantages:

- Deep Market Penetration: Gulf States Toyota's decades of operation have fostered extensive distribution networks and strong customer loyalty.

- Brand Strength: Association with Toyota, a globally recognized and trusted automotive brand, provides inherent credibility and demand.

- Resilient Revenue: The consistent demand for Toyota vehicles, particularly in key markets, offers a stable financial foundation, even amidst industry fluctuations. For instance, Toyota reported global sales of approximately 11.2 million vehicles in 2023, underscoring the brand's enduring appeal.

Proactive Investment in Emerging Sectors

The Friedkin Group demonstrates a clear strength in its proactive investment strategy within emerging sectors. This forward-thinking approach is exemplified by initiatives like Copilot Capital, which successfully raised $200 million in June 2024 specifically for European software scale-ups. This strategic allocation of capital positions The Friedkin Group to capitalize on burgeoning technological advancements.

Further bolstering this strength is TFGI Ventures, which concentrates on high-potential areas such as technology, transportation, and industrial AI. By actively seeding new ventures in these dynamic markets, the group is building a diversified portfolio that extends beyond conventional industries, ensuring future growth and resilience.

- Copilot Capital's $200 million raise in June 2024 targets European software scale-ups.

- TFGI Ventures focuses on technology, transportation, and industrial AI.

- This strategy allows diversification into high-growth technology markets.

The Friedkin Group's diversified holdings across automotive, hospitality, entertainment, and sports create a robust and resilient business model. This broad industry presence, exemplified by Gulf States Toyota's consistent performance, mitigates risks associated with any single market downturn. The group's strategic expansion into global sports, including the February 2025 establishment of Pursuit Sports to manage AS Roma and Everton FC, further diversifies revenue streams and builds significant brand synergy.

The ownership of Auberge Resorts Collection positions The Friedkin Group advantageously in the luxury hospitality sector, which is projected for continued growth through 2029. The planned 2025 openings in London, Florence, Miami Beach, Dallas, and San Francisco demonstrate a clear strategy to expand market share in this high-margin industry.

Gulf States Toyota, a distributor since 1969, stands as one of the largest independent distributors of Toyota vehicles globally, providing a stable and substantial revenue base. Toyota's consistent global sales, such as the 11.2 million vehicles sold in 2023, highlight the brand's enduring market strength and The Friedkin Group's solid foundation.

The group's proactive investment in emerging sectors, such as the June 2024 $200 million raise by Copilot Capital for European software scale-ups and TFGI Ventures' focus on technology and AI, positions it for future growth and diversification into high-potential markets.

| Business Segment | Key Asset/Initiative | 2024/2025 Data/Significance |

|---|---|---|

| Automotive Distribution | Gulf States Toyota | One of the largest independent Toyota distributors globally; Toyota sold ~11.2M vehicles in 2023. |

| Luxury Hospitality | Auberge Resorts Collection | Projected growth through 2029; new properties opening in 2025 (London, Florence, etc.). |

| Global Sports | Pursuit Sports (est. Feb 2025) | Manages AS Roma and Everton FC; aims for global brand synergy. |

| Venture Capital | Copilot Capital | Raised $200M in June 2024 for European software scale-ups. |

What is included in the product

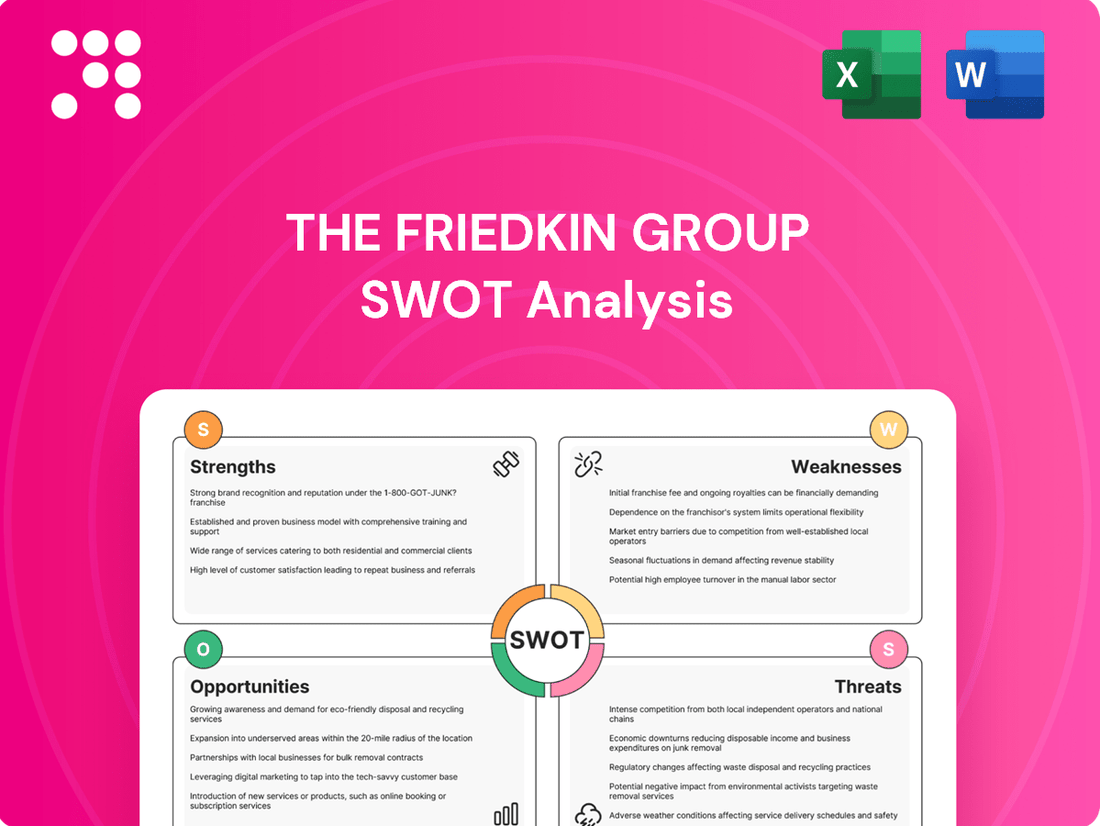

Delivers a strategic overview of The Friedkin Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear visual representation of The Friedkin Group's strategic landscape, simplifying complex internal and external factors for actionable insights.

Weaknesses

The Friedkin Group's extensive diversification across industries like automotive, entertainment, and professional sports presents a significant challenge in managing such a broad portfolio. This wide operational scope can create substantial complexity, making it difficult to maintain consistent oversight and effectively allocate resources across disparate business units.

This diversity may hinder the group's capacity to foster meaningful cross-segment synergies, as the unique operational demands of each sector, from automotive manufacturing to sports team management, require specialized expertise and distinct strategic approaches. For instance, optimizing supply chains in automotive differs vastly from managing player contracts in professional sports, demanding tailored management strategies.

As a privately held consortium, The Friedkin Group's limited public transparency presents a notable weakness. Unlike publicly traded companies, it doesn't face the same rigorous disclosure requirements, making it harder for external parties to access detailed financial and operational data.

This reduced visibility can complicate due diligence processes for potential partners or investors, who may struggle to gain a comprehensive understanding of the group's financial standing and performance metrics. For instance, while specific figures for 2024 or early 2025 are not publicly available, the inherent nature of private ownership means such data remains internal.

While The Friedkin Group's diversification strategy can spread risk, it also presents a significant weakness: the potential for diluted strategic focus. Managing a broad portfolio across disparate industries, from automotive to entertainment and cybersecurity, demands substantial management bandwidth and capital allocation. This can prevent the group from achieving deep specialization and maintaining a sharp competitive edge in any single market.

Vulnerability to Industry-Specific Headwinds

While The Friedkin Group boasts a diverse portfolio, individual business units are still vulnerable to sector-specific challenges. For example, the automotive segment, which includes Gulf States Toyota Distributors, continues to navigate supply chain bottlenecks that impacted vehicle availability throughout 2024. Rising costs for components and the significant investment required for the electric vehicle transition also present ongoing headwinds for this sector.

Similarly, the entertainment arm, Friedkin Conservation Fund and its associated businesses, faces its own set of industry-specific pressures. Increased production expenses for film and television projects, coupled with shifting consumer preferences towards streaming and new media formats, can directly affect revenue streams. In 2024, production costs for major Hollywood films averaged over $100 million, highlighting the financial strain.

- Automotive Sector Vulnerabilities: Continued supply chain disruptions and escalating raw material prices in 2024 impacted vehicle manufacturing and distribution.

- EV Transition Costs: The significant capital investment needed for electric vehicle development and production poses a financial challenge for automotive operations.

- Entertainment Industry Pressures: Rising content creation costs and evolving consumer viewing habits in the entertainment sector create revenue uncertainty.

Challenges in Cross-Sector Synergy Realization

The Friedkin Group's diverse portfolio, spanning automotive, entertainment, and sports, presents a significant challenge in realizing cross-sector synergies. For instance, integrating operations between Gulf States Utility (energy infrastructure) and Alpharetta Road (automotive retail) requires distinct strategic approaches, potentially hindering the creation of unified efficiencies. This lack of inherent operational overlap can lead to the group's various businesses functioning as independent entities, thereby diminishing the potential for shared resources or combined market influence.

Without robust integration strategies, the disparate nature of The Friedkin Group's holdings can result in operational silos. This was a common challenge observed across conglomerates in the early 2000s, where many struggled to leverage shared services or cross-promotional opportunities effectively. For example, a 2024 analysis of diversified holding companies indicated that those with more than five distinct industry verticals often saw a 5-10% reduction in potential synergistic gains due to integration complexities.

- Operational Disparity: Achieving seamless integration between sectors as varied as automotive distribution, film production, and professional sports is inherently complex, demanding tailored strategies for each segment.

- Siloed Operations: The risk of individual business units operating independently, limiting the realization of shared efficiencies and combined market power, is a significant weakness.

- Integration Costs: Implementing effective synergy strategies across such diverse sectors can incur substantial costs and require specialized management expertise, potentially offsetting initial gains.

The Friedkin Group's broad diversification, while spreading risk, can dilute strategic focus. Managing distinct sectors like automotive, entertainment, and cybersecurity requires significant bandwidth, potentially hindering deep specialization and competitive edge in any single market.

Individual business units face sector-specific challenges. For instance, the automotive segment grappled with supply chain issues and rising component costs throughout 2024, impacting vehicle availability. The entertainment arm, meanwhile, contends with increasing production expenses and evolving consumer habits, as seen in the average $100 million production cost for major films in 2024.

The group's private status limits public transparency, making external due diligence more challenging. This reduced visibility can complicate assessments of financial standing and performance for potential partners or investors, as detailed figures for 2024/2025 remain internal.

Achieving meaningful cross-sector synergies is difficult due to the disparate nature of its holdings. Integrating operations between automotive retail and energy infrastructure, for example, demands unique strategies, potentially leading to operational silos and diminished shared efficiencies.

| Weakness Category | Specific Challenge | Impact/Example (2024/2025 Data) |

|---|---|---|

| Strategic Focus | Dilution from broad diversification | Difficulty achieving deep specialization across automotive, entertainment, etc. |

| Sector-Specific Risks | Automotive: Supply chain, EV transition costs | Impacted vehicle availability in 2024; significant capital needed for EV development. |

| Sector-Specific Risks | Entertainment: Production costs, changing consumer habits | Average major film production costs exceeded $100M in 2024; revenue uncertainty from streaming shifts. |

| Transparency | Limited public disclosure (private ownership) | Complicates due diligence for external parties; financial data not publicly available for 2024/2025. |

| Synergies | Operational disparity across diverse sectors | Risk of operational silos and reduced potential for shared efficiencies between distinct business units. |

What You See Is What You Get

The Friedkin Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of The Friedkin Group's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors impacting The Friedkin Group's business operations and future growth.

Opportunities

The luxury hospitality sector is booming, with global market value projected to reach $134.4 billion by 2027, growing at a compound annual growth rate of 4.8%. This presents a significant opportunity for The Friedkin Group's Auberge Resorts Collection to expand its presence.

By strategically developing new, distinctive properties and focusing on personalized, wellness-centric experiences, Auberge can tap into the increasing demand from affluent travelers seeking unique and rejuvenating getaways.

The Friedkin Group's strategic move with Pursuit Sports positions it for significant growth in the global sports arena. This platform allows for aggressive expansion, potentially through acquiring additional sports franchises and capitalizing on multi-club ownership benefits. For instance, by 2024, the global sports market was valued at over $500 billion, indicating substantial room for expansion.

Imperative Entertainment is well-placed to leverage the dynamic entertainment industry, fueled by advancements in AI and increasing advertising expenditures. This presents an opportunity to produce a wide array of content, catering to evolving consumer preferences and capturing a larger share of the projected $1 trillion global advertising market by 2025.

The Friedkin Group's strategic ventures into European software via Copilot Capital, alongside investments in advanced materials and AI solutions through TFGI Ventures, represent a substantial opportunity. This diversification into high-growth tech sectors positions the group to capitalize on emerging market trends and secure early access to potentially disruptive innovations.

Leverage Digitalization and E-commerce in Automotive

The automotive distribution sector is rapidly embracing digitalization and e-commerce, with a notable shift towards omnichannel sales experiences. Gulf States Toyota can significantly benefit by bolstering its digital sales platforms and customer relationship management systems. This strategic move is crucial for capturing future market share and improving operational efficiency.

By investing in enhanced online showrooms, virtual test drives, and streamlined digital purchasing processes, Gulf States Toyota can cater to evolving consumer preferences. For instance, a report from Statista indicated that global automotive e-commerce sales were projected to reach over $100 billion by 2025, highlighting the immense potential of this channel.

- Enhanced Digital Presence: Investing in user-friendly websites and mobile apps for browsing, configuring, and purchasing vehicles.

- Omnichannel Integration: Seamlessly connecting online and offline customer journeys, from initial inquiry to after-sales service.

- Data-Driven Customer Engagement: Utilizing CRM systems to personalize offers and improve customer loyalty in the digital space.

Geographic and Market Segment Expansion

The Friedkin Group can leverage its established brands, like Auberge Resorts, to enter new geographic territories. For instance, Auberge Resorts has been actively expanding, with new properties anticipated in locations like the Maldives and Mexico by late 2024 and early 2025, signaling strong international growth potential.

Beyond hospitality, the group's sports ventures offer avenues for diversification. The acquisition of new sports teams, particularly in emerging markets or underserved sports segments, presents an opportunity to replicate success and build new revenue streams. This strategy aligns with the trend of increasing global interest in sports franchises.

Key opportunities include:

- Expanding Auberge Resorts to untapped luxury travel destinations in Asia and South America.

- Acquiring stakes in or full ownership of professional sports teams in rapidly growing international leagues.

- Developing niche hospitality offerings under the Auberge brand to cater to specific demographics or interests.

- Exploring partnerships for sports-related media rights or fan engagement platforms in new regions.

The Friedkin Group is well-positioned to capitalize on the expanding global luxury travel market, with Auberge Resorts Collection poised for further international growth. The group can also leverage its sports ventures, like Pursuit Sports, to acquire additional franchises and tap into the multi-club ownership model, mirroring the over $500 billion global sports market value in 2024.

Imperative Entertainment has an opportunity to create diverse content, benefiting from increased advertising spend projected to reach $1 trillion by 2025. Diversification into high-growth tech sectors through Copilot Capital and TFGI Ventures offers early access to innovations in AI and advanced materials.

| Opportunity Area | Market Trend/Data Point | Friedkin Group Venture |

|---|---|---|

| Luxury Hospitality Expansion | Global luxury travel market projected to reach $134.4 billion by 2027 (CAGR 4.8%) | Auberge Resorts Collection |

| Sports Market Growth | Global sports market valued over $500 billion (2024) | Pursuit Sports |

| Digital Automotive Sales | Global automotive e-commerce sales projected over $100 billion by 2025 | Gulf States Toyota |

| Entertainment & Advertising | Global advertising market projected at $1 trillion by 2025 | Imperative Entertainment |

Threats

Global economic uncertainties, including persistent inflationary pressures, present a considerable threat to The Friedkin Group's diversified portfolio. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, indicating a challenging environment for consumer spending.

A potential slowdown in consumer spending directly impacts sectors like luxury hospitality and automotive sales, where discretionary income plays a crucial role. Higher inflation, which averaged 4.1% in the OECD countries in 2023, erodes purchasing power, making consumers more hesitant to engage in high-value transactions or leisure activities.

The Friedkin Group faces significant competitive pressures across its diverse portfolio. In the automotive sector, the rise of electric vehicle startups and changing dealership models intensifies rivalry, while the luxury hospitality market sees established brands constantly innovating to attract discerning travelers. The entertainment industry, already a crowded space, is further strained by escalating content production costs and the rapid shift in consumer viewing preferences.

The Friedkin Group's global operations, spanning automotive, entertainment, and sports, face significant threats from shifting regulatory landscapes and geopolitical tensions. For example, the European Union's ongoing review of competition laws could impact its multi-club ownership model in football, a sector where regulations are becoming increasingly stringent. Furthermore, trade disputes between major economic blocs, such as those involving the US and China, could disrupt supply chains critical to its automotive ventures, potentially increasing costs and delivery times throughout 2024 and into 2025.

Industry-Specific Disruptions and Technological Shifts

The automotive sector is undergoing a significant transformation driven by the global shift towards electric vehicles (EVs). By the end of 2024, EV sales are projected to reach approximately 17 million units worldwide, representing a substantial portion of the market and demanding considerable investment in new technologies and manufacturing capabilities from companies like Friedkin. Furthermore, persistent supply chain vulnerabilities, as evidenced by the semiconductor shortages that impacted automotive production throughout 2023, continue to pose a threat, potentially delaying product launches and increasing costs.

Simultaneously, the entertainment division faces its own set of industry-specific disruptions. The rapid advancement of Artificial Intelligence (AI) is poised to revolutionize content creation, potentially altering production workflows and the very nature of creative output. For instance, AI-powered scriptwriting tools and virtual production techniques are becoming more sophisticated, raising questions about traditional roles and requiring adaptation. Changing media consumption habits, with a continued migration towards streaming services and on-demand content, also necessitate ongoing strategic adjustments to reach and engage audiences effectively, impacting revenue models and content distribution strategies.

- EV Transition: Global EV sales are expected to hit around 17 million units in 2024, forcing traditional automakers to invest heavily in electrification.

- Supply Chain Volatility: Lingering semiconductor shortages and other logistical challenges continue to disrupt production schedules and inflate costs.

- AI in Entertainment: AI's growing role in content creation presents both opportunities for efficiency and threats to established production methods and creative roles.

- Shifting Media Consumption: The dominance of streaming and on-demand platforms requires continuous adaptation of content strategies and distribution channels.

Potential Conflicts in Multi-Club Football Ownership

The Friedkin Group's ownership of both AS Roma and Everton FC presents a significant threat due to potential conflicts of interest. If both clubs qualify for European competitions, UEFA's regulations on multi-club ownership could lead to restrictions. For instance, UEFA's "club conflict of interest" rules, updated in 2024, aim to prevent any entity from controlling or influencing more than one club participating in its competitions. This could mean limitations on player transfers, management decisions, or even exclusion from tournaments if deemed to create an unfair competitive advantage.

These regulatory hurdles are not hypothetical. In the 2023-2024 season, several multi-club ownership groups navigated complex compliance pathways. The potential for sanctions, including fines or bans from European competitions, poses a direct financial and strategic risk to The Friedkin Group's sports portfolio. For example, in 2024, a European Commission investigation into multi-club ownership models highlighted concerns about market fairness.

- Regulatory Scrutiny: UEFA's 2024 regulations on multi-club ownership are designed to prevent conflicts of interest, potentially limiting The Friedkin Group's operational autonomy with both AS Roma and Everton FC.

- European Competition Conflicts: If both clubs qualify for the same European tournaments, they may face restrictions on player transfers, financial dealings, and strategic alignment.

- Potential Sanctions: Non-compliance with UEFA rules could result in penalties, impacting the financial performance and competitive standing of both clubs.

- Strategic Adjustments Required: The group may need to implement complex governance structures or make difficult strategic choices to satisfy regulatory requirements, potentially diluting investment focus.

The Friedkin Group faces significant threats from a volatile global economic climate. Persistent inflation, with the IMF projecting global growth to slow to 2.9% in 2024, directly impacts consumer spending, particularly in discretionary sectors like luxury hospitality and automotive sales. This slowdown, coupled with average OECD inflation of 4.1% in 2023, erodes purchasing power, making consumers more cautious about high-value purchases and leisure activities.

Intensifying competition across its diverse portfolio presents another major challenge. The automotive sector is being reshaped by EV startups and evolving dealership models, while luxury hospitality brands continuously innovate. The entertainment industry, already crowded, is further pressured by rising production costs and shifting consumer viewing habits towards streaming services, as highlighted by the projected 17 million EV sales globally in 2024, indicating a rapid market shift.

Geopolitical tensions and evolving regulatory landscapes pose substantial risks. For instance, UEFA's 2024 regulations on multi-club ownership could restrict The Friedkin Group's operations with AS Roma and Everton FC if both clubs qualify for European competitions, potentially leading to sanctions. Trade disputes, such as those between the US and China, could also disrupt critical automotive supply chains, increasing costs and delivery times throughout 2024 and 2025.

The rapid advancement of AI in entertainment, with tools like AI scriptwriting becoming more sophisticated, presents threats to established production methods and creative roles. This, combined with the ongoing shift in media consumption towards on-demand content, necessitates continuous strategic adaptation to maintain audience engagement and revenue streams.

| Threat Category | Specific Threat | Impacted Sector(s) | Data/Projection |

|---|---|---|---|

| Economic Uncertainty | Global Economic Slowdown | Hospitality, Automotive | IMF projects 2.9% global growth in 2024. |

| Economic Uncertainty | Inflationary Pressures | Hospitality, Automotive | OECD average inflation 4.1% in 2023. |

| Competition | EV Transition | Automotive | Global EV sales projected at 17 million units in 2024. |

| Competition | Shifting Media Consumption | Entertainment | Continued migration to streaming services. |

| Regulatory/Geopolitical | Multi-Club Ownership Rules | Sports | UEFA 2024 regulations on club conflicts. |

| Regulatory/Geopolitical | Supply Chain Disruptions | Automotive | Lingering semiconductor shortages, trade disputes. |

| Technological Disruption | AI in Content Creation | Entertainment | Increasing sophistication of AI tools. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including The Friedkin Group's official financial filings, extensive market research reports, and expert industry analyses to provide a robust and accurate assessment.