The Friedkin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

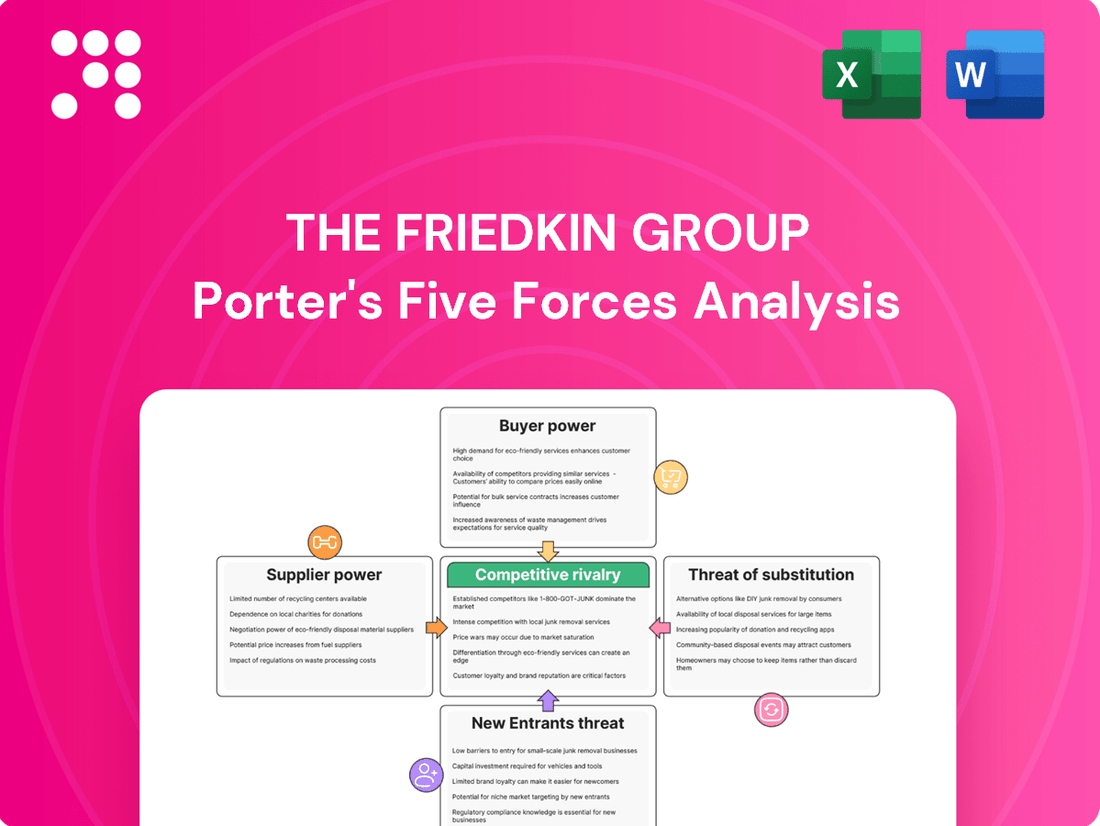

The Friedkin Group navigates a complex landscape shaped by intense rivalry and the constant threat of substitutes. Understanding the power of their buyers and suppliers is crucial for strategic advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Friedkin Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Friedkin Group's reliance on Toyota as its primary supplier for Gulf States Toyota significantly concentrates supplier power. This dependency means The Friedkin Group has limited leverage in negotiating terms for vehicle inventory and essential parts, directly impacting its operational costs and profitability.

The broader automotive supplier industry is experiencing challenges, including stagnating growth in certain segments and a pressing need for technological transformation. These industry-wide pressures can translate into increased costs or altered supply conditions for distributors like The Friedkin Group, further amplifying supplier bargaining power.

The bargaining power of suppliers is significantly amplified by high switching costs, particularly evident in the automotive sector. For a distributor like Gulf States Toyota, transitioning away from its primary vehicle and parts supplier, Toyota, would incur substantial financial and operational burdens. This difficulty in finding and integrating alternative sources solidifies Toyota's strong position.

Consider the sheer scale: Gulf States Toyota supports over 150 dealerships across five states. Establishing new supply chain relationships, retooling service centers, and retraining technicians for a different manufacturer represents a massive undertaking, creating a high barrier to entry for potential new suppliers and reinforcing Toyota's leverage.

In entertainment production, the bargaining power of specialized talent is substantial. Directors, actors, and writers with proven track records and unique creative visions can command significant fees, impacting production budgets. For instance, top-tier talent can negotiate multi-million dollar deals, a trend that continued to be a major factor in 2024 film and television productions.

Similarly, in luxury hospitality, the availability of renowned chefs, skilled artisans, and providers of high-quality, unique materials significantly influences costs. The Auberge Resorts Collection, for example, relies on these specialized suppliers to maintain its premium brand image. In 2024, the demand for unique, locally-sourced luxury materials and celebrity chefs continued to drive up supplier costs in the high-end hospitality sector.

Proprietary Technology and Content for Entertainment

Suppliers of proprietary technology and unique content rights in the entertainment sector hold significant sway. As AI and advanced production tools become indispensable, providers of these cutting-edge solutions gain leverage and can dictate terms. For instance, in 2024, the market for AI-powered content creation tools is projected to reach several billion dollars, highlighting the growing dependence on such suppliers.

The Friedkin Group, like other entertainment companies, faces this reality. Their reliance on specialized software for film production, animation, or digital distribution means that key technology providers can command higher prices or favorable contract terms. This is particularly true for companies offering unique intellectual property or patented production processes.

- Dependence on AI and Advanced Production Tools: The increasing integration of AI in content creation and post-production amplifies the bargaining power of suppliers offering these specialized technologies.

- Proprietary Content Rights: Suppliers who own exclusive rights to popular intellectual property or unique content formats can leverage this exclusivity to negotiate favorable terms.

- Market Growth of Tech Solutions: The burgeoning market for entertainment technology, estimated to see substantial growth through 2025, indicates a strong demand that empowers key suppliers.

Fragmented Supply Chain for General Goods in Hospitality/Travel

For general goods and services within the hospitality and travel sectors, including luxury operations and golf course management, The Friedkin Group often encounters a fragmented supplier landscape. This means that while some highly specialized providers might hold significant sway, the majority of everyday operational needs are met by a broad base of suppliers.

This fragmentation directly translates to reduced bargaining power for individual suppliers of common items. Consequently, The Friedkin Group is in a stronger position to negotiate favorable pricing and terms for these essential operational requirements, contributing to cost efficiencies.

For instance, in 2024, the global hospitality market saw a significant number of small to medium-sized enterprises (SMEs) supplying everything from linens to food services. This wide distribution of suppliers for non-specialized goods limits the ability of any single entity to dictate terms, benefiting large buyers like The Friedkin Group.

- Fragmented Supplier Base: Many suppliers for general hospitality goods lack significant market concentration.

- Reduced Supplier Leverage: Individual suppliers of common items have less power to demand higher prices or unfavorable terms.

- Negotiating Advantage: The Friedkin Group can secure better deals on operational necessities due to this market structure.

- Cost Efficiencies: This dynamic allows for lower procurement costs, boosting profitability.

The bargaining power of suppliers for The Friedkin Group is notably high in its automotive distribution segment due to its deep reliance on Toyota. This concentration of supplier power means limited negotiation leverage for Gulf States Toyota, impacting inventory and parts costs.

In the entertainment sector, suppliers of proprietary technology and unique content rights wield significant influence. The increasing demand for AI-driven production tools, a market projected to grow substantially through 2025, further empowers these specialized providers, allowing them to dictate terms and pricing.

Conversely, for general goods and services in hospitality, The Friedkin Group benefits from a fragmented supplier base, which diminishes individual supplier leverage. This allows for more favorable negotiations on everyday operational needs, contributing to overall cost efficiencies.

| Supplier Segment | Key Factors Amplifying Power | Impact on The Friedkin Group | 2024 Data/Trend |

|---|---|---|---|

| Automotive (Toyota) | High switching costs, exclusive supply agreements | Limited negotiation leverage, potential for higher inventory costs | Continued strong demand for Toyota vehicles, impacting distributor purchasing power. |

| Entertainment Technology (AI Tools) | Proprietary technology, growing market demand | Increased costs for essential production software, favorable contract terms for suppliers | Market for AI in content creation projected to reach billions, increasing dependence. |

| Hospitality (General Goods) | Fragmented supplier landscape | Stronger negotiation position, favorable pricing for operational necessities | Numerous SMEs supplying linens, food, etc., limiting individual supplier price control. |

What is included in the product

The Friedkin Group's Porter's Five Forces analysis uncovers the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes within its diverse business portfolio.

Instantly grasp the competitive landscape of The Friedkin Group's industries with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

The Friedkin Group’s customer base is remarkably varied, spanning individual consumers purchasing vehicles from its Toyota dealerships to affluent clients engaging its luxury hospitality services. This diversity means customer bargaining power isn't uniform. For example, in the hospitality sector, large corporate clients or those booking significant events can leverage their volume to negotiate preferential rates, directly impacting revenue per booking.

End consumers in the automotive market, including those purchasing Toyota vehicles distributed by Gulf States Toyota, exhibit significant price sensitivity. This is exacerbated by a competitive landscape and fluctuating economic conditions. For instance, in 2024, the average transaction price for a new vehicle in the US hovered around $47,000, a figure that makes consumers highly attuned to discounts and financing options.

Dealers, as the primary customers of Gulf States Toyota, are also acutely aware of pricing. They face their own pressures from competing dealerships and the need to maintain healthy profit margins. Consequently, they actively seek favorable wholesale pricing and robust support from distributors to remain competitive in their local markets.

Customers of Auberge Resorts Collection, being in the luxury segment, possess exceptionally high expectations for personalized service and distinctive experiences. This translates to significant bargaining power, as their willingness to pay a premium for tailored offerings directly influences service standards and the pace of innovation.

This elevated demand for bespoke luxury means customers can easily switch to competitors if their expectations for unique, curated stays are not met, putting pressure on Auberge to consistently deliver exceptional and differentiated value. For instance, in 2024, the luxury travel market continued to see robust demand, with reports indicating that over 70% of luxury travelers prioritize unique experiences over traditional amenities, underscoring the power of these discerning customers.

Audience Choice in Entertainment

In the entertainment sector, audiences wield significant power due to an overwhelming abundance of choices. Content saturation across numerous streaming platforms, traditional media, and independent creators means consumers can easily switch or opt out if their preferences aren't met. This dynamic directly influences content demand and distribution strategies.

The sheer volume of available content empowers audiences to dictate trends and demand specific types of programming. For instance, by 2024, the global streaming market is projected to reach over $300 billion, a testament to the diverse offerings available. This vast selection allows consumers to be highly selective, impacting the success of individual productions and platforms.

- Content Abundance: The proliferation of streaming services like Netflix, Disney+, Max, and Amazon Prime Video, alongside traditional broadcast and cable, creates a highly competitive landscape.

- Consumer Selectivity: Audiences can easily compare offerings and switch between platforms, forcing content providers to constantly innovate and cater to evolving tastes.

- Data-Driven Decisions: Platforms leverage viewing data to understand audience preferences, influencing future content production and acquisition strategies to retain subscribers.

- Impact on Distribution: The power of choice compels distributors to adapt release windows and promotional strategies to capture audience attention in a crowded market.

Demand for Unique Experiences in Adventure Travel

Customers in the adventure travel sector, whether traveling alone or in groups, are increasingly prioritizing unique, deeply engaging, and high-value experiences. This shift gives them more leverage, as they are prepared to spend more for specialized and authentic adventures.

This growing demand for distinctiveness means companies like The Friedkin Group’s adventure travel divisions must constantly enhance their product lines to meet these evolving expectations. For instance, in 2024, the adventure travel market saw a significant uptick in demand for sustainable and eco-conscious tours, with reports indicating a 15% year-over-year increase in bookings for such offerings.

- Customer Demand: A growing preference for authentic, immersive, and unique adventure travel experiences.

- Willingness to Pay: Customers are demonstrating a higher willingness to pay premium prices for specialized and high-value adventures.

- Provider Innovation: This trend pressures adventure travel providers to continuously innovate and differentiate their offerings.

- Market Trends: In 2024, sustainable and eco-friendly adventure tours experienced a notable surge in popularity, reflecting a key customer priority.

The Friedkin Group faces varying customer bargaining power across its diverse portfolio. In the automotive sector, price-sensitive consumers and competitive dealerships exert pressure, particularly given average new vehicle prices around $47,000 in 2024, pushing for discounts. Conversely, the luxury hospitality segment sees affluent clients leverage their high expectations for personalized service, with over 70% of luxury travelers prioritizing unique experiences in 2024, giving them significant sway.

The entertainment division contends with audiences empowered by content abundance, where a market exceeding $300 billion in 2024 allows consumers to easily switch platforms, demanding constant innovation. Similarly, adventure travel customers, prioritizing unique and eco-conscious experiences (a segment seeing 15% growth in 2024 bookings), demonstrate a higher willingness to pay premium prices, pushing providers to innovate.

| Segment | Customer Type | Bargaining Power Driver | 2024 Data Point | Impact on The Friedkin Group |

|---|---|---|---|---|

| Automotive (Gulf States Toyota) | End Consumers | Price Sensitivity, Competition | Avg. New Vehicle Transaction Price: ~$47,000 | Pressure for discounts, financing offers |

| Automotive (Gulf States Toyota) | Dealers | Wholesale Pricing, Profit Margins | N/A (Industry-wide pressure) | Demand for favorable wholesale terms |

| Hospitality (Auberge Resorts) | Affluent Clients, Corporate Bookings | High Expectations, Volume | >70% Luxury Travelers Prioritize Unique Experiences | Need for exceptional, differentiated service; premium pricing justification |

| Entertainment | Audiences | Content Abundance, Choice | Global Streaming Market: >$300 Billion | Demand for tailored content, platform loyalty challenges |

| Adventure Travel | Travelers | Demand for Unique/Eco-conscious Experiences | Sustainable Tour Bookings: +15% YoY | Pressure for product innovation, premium pricing flexibility |

What You See Is What You Get

The Friedkin Group Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of The Friedkin Group provides an in-depth examination of the competitive landscape, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no surprises and complete readiness for your strategic planning needs.

Rivalry Among Competitors

The Friedkin Group operates in sectors characterized by fierce competition. In automotive distribution, for instance, the U.S. market saw over 17 million new vehicles sold in 2023, with dealerships like Gulf States Toyota, a Friedkin subsidiary, navigating intense rivalry among numerous brands and independent sellers.

The hospitality and entertainment industries also present formidable competitive landscapes. Global hotel occupancy rates, while recovering, remain a battleground for market share, with established luxury brands and emerging boutique hotels constantly innovating to attract travelers.

New entrants and disruptive technologies continually challenge existing players across all of Friedkin's domains. This dynamic environment demands constant adaptation and strategic differentiation to maintain and grow market position.

The automotive distribution landscape, even for significant players like Gulf States Toyota, is characterized by intense rivalry. This is amplified by the overarching strategies of Original Equipment Manufacturers (OEMs) and the presence of other substantial regional distributors, creating a competitive arena where scale and market penetration are critical.

The broader automotive supplier industry is currently grappling with what can be described as 'stagflationary' pressures. This environment features both sluggish economic growth and persistent inflation, leading to heightened competition and considerable strain on profit margins for distributors.

In 2024, the automotive sector continued to see consolidation trends. For instance, major dealership groups often acquire smaller ones to gain economies of scale and enhance their negotiating power with OEMs, directly impacting the competitive intensity for independent distributors.

The luxury hospitality sector is characterized by significant fragmentation, featuring a wide array of established high-end hotel chains alongside a growing number of independent boutique operators. This dynamic landscape means Auberge Resorts Collection faces competition not just from direct luxury hotel rivals but also from exclusive private villa rentals and innovative experiential travel companies. For instance, the global luxury hotel market was valued at approximately $125 billion in 2023 and is projected to reach over $200 billion by 2028, highlighting both its growth and the sheer number of players vying for market share.

Content Saturation in Entertainment Production

The entertainment sector is drowning in content, with a relentless stream of new shows and films from major studios, burgeoning streaming platforms, and nimble independent creators. This saturation means fierce competition for viewer attention, making it a constant challenge to capture and retain an audience.

Imperative Entertainment, like its peers, faces the critical need to consistently deliver captivating and high-quality productions. In 2024, the sheer volume of content means that mediocrity gets lost. For instance, the global streaming market is projected to exceed $200 billion by 2025, a testament to the massive investment and output, but also highlighting the crowded landscape.

- Content Overload: The market is flooded with new releases, making it harder for any single production to gain traction.

- High Production Costs: To stand out, Imperative Entertainment must invest significantly in quality, driving up operational expenses.

- Audience Fragmentation: Viewers have more choices than ever, leading to fragmented viewership and increased marketing costs to reach target demographics.

- Talent Competition: Securing top creative talent is essential for producing standout content, further intensifying rivalry and costs.

Emerging Trends in Sports and Adventure Travel

The Friedkin Group's foray into sports, notably acquiring Everton FC and establishing Pursuit Sports, intensifies rivalry within the global sports arena. This move into multi-club ownership introduces a new competitive dimension, challenging traditional club structures and fan engagement models. The sports industry, already characterized by fierce competition for talent, media rights, and fan loyalty, now faces increased strategic maneuvering from diversified conglomerates.

In parallel, the adventure travel sector is experiencing a surge in competition. This growth is fueled by new entrants offering specialized and niche experiences, alongside established players diversifying their portfolios. The market is seeing a greater variety of offerings, from eco-tourism to extreme sports, putting pressure on existing companies to innovate and differentiate their services to capture market share.

- Everton FC's valuation, as of early 2024, is estimated to be around $700 million, highlighting the significant capital investment involved in top-tier sports club acquisitions.

- The global adventure tourism market was valued at approximately $1.5 trillion in 2023 and is projected to grow significantly in the coming years, indicating a highly attractive but increasingly crowded space.

- Multi-club ownership models, like those pursued by The Friedkin Group, aim to leverage synergies across different clubs, potentially impacting player development, scouting networks, and commercial operations.

Competitive rivalry is a significant force across The Friedkin Group's diverse portfolio. In automotive distribution, the sheer volume of new vehicle sales in the U.S., exceeding 17 million in 2023, underscores the intense competition among numerous brands and dealerships. The luxury hospitality sector, valued at around $125 billion in 2023, is similarly fragmented, with established chains and boutique operators vying for market share. The entertainment industry faces saturation, with a constant influx of content from various sources, making it challenging to capture audience attention amidst projected global streaming market growth exceeding $200 billion by 2025.

| Industry Sector | Key Competitive Factors | Illustrative Data Point (2023-2024) |

|---|---|---|

| Automotive Distribution | Brand proliferation, dealership competition, OEM strategies, consolidation trends | Over 17 million new vehicles sold in the U.S. (2023) |

| Hospitality (Luxury) | Brand differentiation, service innovation, experiential offerings, market fragmentation | Global luxury hotel market valued at ~$125 billion (2023) |

| Entertainment (Content Creation) | Content volume, audience attention, production quality, talent acquisition | Global streaming market projected to exceed $200 billion by 2025 |

| Sports (Club Ownership) | Talent acquisition, media rights, fan loyalty, multi-club synergies | Everton FC valuation estimated at ~$700 million (early 2024) |

| Adventure Travel | Niche specialization, diverse offerings, innovation, market growth | Global adventure tourism market valued at ~$1.5 trillion (2023) |

SSubstitutes Threaten

For Gulf States Toyota's automotive distribution, substitutes extend beyond rival car manufacturers to encompass broader transportation solutions. These include public transit systems, ride-sharing platforms like Uber and Lyft, and the increasing adoption of electric scooters and bicycles for urban commuting. The rise of remote work also diminishes the necessity for personal vehicle ownership, further intensifying this competitive pressure.

The entertainment sector is flooded with substitutes, making it a significant challenge for companies like Imperative Entertainment. Consider that in 2024, global spending on video games alone was projected to reach over $200 billion, a massive draw on consumer leisure time and budget.

Beyond gaming, user-generated content on platforms like TikTok and YouTube offers a constant stream of free entertainment, directly competing for audience eyeballs. Podcasts have also seen immense growth, with an estimated 400 million podcast listeners worldwide in 2024, further fragmenting the entertainment market.

This proliferation of alternatives means Imperative Entertainment must continually innovate and offer compelling content to stand out. The sheer volume of digital media, streaming services, and even traditional live events creates a highly competitive environment where capturing and retaining audience attention is paramount.

The threat of substitutes for Auberge Resorts Collection, part of The Friedkin Group, is significant due to the rise of luxury vacation rentals and boutique guesthouses. These alternatives often provide a more personalized or unique experience, sometimes at a more competitive price point. For instance, platforms like Airbnb Luxe and specialized luxury rental agencies saw continued growth in 2024, offering discerning travelers curated, high-end private residences.

Other Recreational Activities for Golf/Adventure Travel

The threat of substitutes for golf and adventure travel is significant, as consumers have numerous other recreational options. Activities like hiking, cycling, and even indoor virtual golf simulators can offer comparable enjoyment and skill development at potentially lower costs or with greater accessibility. For instance, the global adventure tourism market, which encompasses many substitute activities, was valued at approximately $628.8 billion in 2023 and is projected to grow, indicating a strong demand for diverse outdoor experiences.

Furthermore, the rise of fitness centers with advanced golf training technology presents a direct substitute for traditional golf practice and skill enhancement. These facilities often provide controlled environments and immediate feedback, appealing to those seeking efficient improvement. The increasing popularity of general fitness and wellness activities also diverts discretionary spending and leisure time away from specialized pursuits like golf.

- Hiking and Biking: These activities offer accessible outdoor recreation with growing participation rates, drawing potential customers away from golf courses.

- Virtual Golf Simulators: Technological advancements have made these a viable alternative for practice and social play, especially in urban areas or during inclement weather.

- Fitness Centers: These facilities provide alternative avenues for physical activity and skill development, including golf-specific training, competing for leisure time and budgets.

- Other Outdoor Recreation: A broad spectrum of activities, from water sports to team sports, competes for consumer interest and spending in the recreational sector.

Do-It-Yourself Travel and Online Planning

The rise of do-it-yourself travel planning presents a significant threat of substitutes for traditional adventure travel packages offered by companies like The Friedkin Group. The increasing ease and accessibility of online platforms and direct booking sites empower travelers to independently research, plan, and book their trips. This allows them to bypass tour operators entirely, curating personalized itineraries that often come at a lower cost. For instance, in 2024, online travel agencies (OTAs) and direct booking channels continued to dominate the travel industry, with many travelers opting for à la carte bookings over bundled packages.

This shift means that adventure travel companies must continually demonstrate the unique value proposition of their curated experiences. While independent planning is feasible for many destinations, specialized, high-value adventure tours that offer exclusive access, expert guidance, and logistical support still hold considerable appeal. The key differentiator for traditional providers lies in the quality of the experience, safety, and the removal of planning complexities for the traveler.

- DIY Travel Growth: Online travel booking platforms saw continued robust growth in 2024, with a significant percentage of travelers preferring to build their own itineraries.

- Cost Sensitivity: Many consumers actively seek ways to reduce travel costs, making self-directed planning an attractive alternative to package deals.

- Niche Adventure Appeal: The threat is somewhat mitigated for highly specialized or remote adventure tours where expert planning and local knowledge are crucial.

- Value Proposition: Adventure travel companies must emphasize the added value of their services, such as safety, unique access, and expert guides, to counter the DIY trend.

The threat of substitutes for Gulf States Toyota's automotive distribution is substantial, encompassing a range of alternatives to traditional car ownership. Beyond rival manufacturers, these include public transportation, ride-sharing services, and micro-mobility options like electric scooters and bikes, especially in urban settings. The increasing prevalence of remote work also reduces the perceived need for personal vehicles.

For Imperative Entertainment, the entertainment sector's substitute landscape is vast and constantly evolving. In 2024, global video game spending was projected to exceed $200 billion, directly competing for consumer leisure time. User-generated content platforms like TikTok and YouTube, alongside the booming podcast industry, which boasted an estimated 400 million listeners in 2024, further fragment the audience, demanding continuous innovation from content creators.

Auberge Resorts Collection faces significant substitute threats from the growing luxury vacation rental market and boutique guesthouses. These alternatives often provide a more personalized experience, sometimes at a competitive price. Platforms like Airbnb Luxe saw continued expansion in 2024, offering discerning travelers high-end private residences that rival traditional luxury hotel offerings.

The adventure travel segment, including golf and other outdoor pursuits, contends with numerous recreational substitutes. Activities such as hiking, cycling, and even virtual golf simulators offer comparable enjoyment and skill development. The broader adventure tourism market, valued at approximately $628.8 billion in 2023, highlights a strong demand for diverse outdoor experiences, all of which compete for consumer leisure time and budget.

| Industry Segment | Key Substitutes | 2024/2023 Data Point | Impact on The Friedkin Group |

|---|---|---|---|

| Automotive Distribution (Gulf States Toyota) | Public Transit, Ride-Sharing, Micro-mobility | Remote work growth impacting vehicle demand | Reduced demand for new vehicle sales |

| Entertainment (Imperative Entertainment) | Video Games, User-Generated Content, Podcasts | Video game spending > $200 billion (2024 proj.), 400M podcast listeners (2024) | Audience fragmentation, need for compelling content |

| Hospitality (Auberge Resorts Collection) | Luxury Vacation Rentals, Boutique Guesthouses | Growth of Airbnb Luxe | Competition for luxury travelers |

| Recreation (Golf & Adventure Travel) | Hiking, Cycling, Virtual Golf, General Fitness | Adventure tourism market ~$628.8 billion (2023) | Diversion of leisure time and spending |

Entrants Threaten

The automotive distribution landscape presents formidable challenges for newcomers, largely due to substantial upfront capital needs. Establishing the necessary infrastructure, such as vehicle processing centers and sophisticated parts distribution networks, demands millions of dollars. For instance, setting up a regional distribution hub can easily cost tens of millions, making it a significant hurdle for smaller players.

Beyond the physical assets, building an extensive and effective dealer network requires considerable investment in marketing, training, and support. Furthermore, navigating complex regulatory environments and securing favorable terms with Original Equipment Manufacturers (OEMs) are additional barriers. Existing players, like The Friedkin Group's Gulf States Toyota, benefit from established relationships and economies of scale that are difficult for new entrants to replicate.

For The Friedkin Group's Auberge Resorts Collection, brand loyalty and reputation act as a significant barrier to new entrants in the luxury hospitality sector. Auberge has cultivated a strong image associated with exclusive, high-quality experiences, which translates into repeat business and premium pricing power. For instance, in 2024, the luxury travel market continued to show resilience, with brands like Auberge commanding higher occupancy rates and average daily rates compared to less established competitors.

New players entering this segment must overcome the immense challenge of building comparable trust and prestige. This involves not only securing prime, often scarce, real estate but also investing heavily in service standards and marketing to match Auberge's established reputation. The time and capital required to achieve this level of brand equity are substantial, making it difficult for newcomers to compete effectively against a well-entrenched leader.

The entertainment production sector presents significant hurdles for newcomers due to the difficulty in securing top-tier talent and established distribution networks. For instance, in 2024, major studios continued to dominate with extensive talent rosters and global distribution capabilities, making it hard for emerging players to gain traction.

Furthermore, the capacity to consistently create and finance high-value intellectual property (IP) acts as a substantial barrier. While independent productions have seen growth, replicating the continuous IP development and financial backing of established entities like The Friedkin Group's Imperative Entertainment is a formidable challenge for new entrants.

Niche Market Opportunities in Golf/Adventure Travel

While the broader golf and adventure travel sectors show promise, specific niche markets within them could draw new, smaller competitors. These specialized areas, perhaps focusing on eco-tourism or high-end golf experiences, might have lower initial barriers compared to the overall market. For instance, the global adventure tourism market was valued at approximately $1.4 trillion in 2023 and is projected to grow significantly, indicating potential for specialized players.

However, the threat of new entrants is somewhat mitigated by the substantial capital and expertise required to establish a strong brand presence in these sectors. Securing desirable locations, whether prime golf course real estate or unique adventure travel destinations, often necessitates considerable investment. Furthermore, developing a robust network of suppliers, guides, and logistical support for adventure travel, or building a reputation for quality in golf tourism, demands time and specialized knowledge, acting as a deterrent to casual entrants.

- Niche Market Attractiveness: Specific segments within golf and adventure travel, such as luxury eco-lodges or specialized golf clinics, may present opportunities for new, focused entrants.

- Capital Investment Barriers: Acquiring prime real estate for golf resorts or securing exclusive access to adventure locations requires significant upfront capital.

- Brand Reputation and Network Effects: Building a trusted brand and an extensive operational network in travel and hospitality is a lengthy and costly process, deterring rapid new entry.

- Expertise Requirements: Operating successfully in adventure travel demands specialized skills in safety, logistics, and local knowledge, while high-quality golf tourism requires expertise in course management and hospitality.

Regulatory and Financial Hurdles in Sports Ownership

The Friedkin Group's foray into professional sports, notably with Pursuit Sports, faces immense barriers to entry. These include staggering acquisition prices, with top-tier football clubs often valued in the hundreds of millions or even billions of dollars. For instance, the sale of Chelsea Football Club in 2022 reportedly reached £2.5 billion (approximately $3 billion USD).

Beyond the initial purchase, significant ongoing operational costs, encompassing player salaries, stadium maintenance, and marketing, deter potential newcomers. Furthermore, securing approval from sports leagues and governing bodies, a process often involving stringent financial checks and ownership suitability assessments, adds another layer of complexity.

- High Acquisition Costs: Recent major sports franchise sales highlight the substantial capital required, making it difficult for smaller or less capitalized entities to compete.

- Operational Expenditures: Continuous investment in talent, infrastructure, and fan engagement represents a significant ongoing financial commitment.

- League Approval Processes: Governing bodies like the NFL, NBA, and Premier League have rigorous approval procedures that can delay or prevent new ownership groups from entering the market.

The threat of new entrants across The Friedkin Group's diverse portfolio is generally low, primarily due to substantial capital requirements and established brand equity. In automotive distribution, the need for extensive infrastructure and OEM relationships creates significant barriers, while luxury hospitality demands immense investment in reputation and service. Similarly, entertainment production requires deep pockets for intellectual property development and distribution networks.

For professional sports, the barriers are exceptionally high, involving multi-billion dollar acquisition costs and rigorous league approvals. While niche opportunities exist in adventure travel, these still demand considerable investment in prime locations and operational expertise. Overall, The Friedkin Group benefits from high entry barriers across its key business segments, protecting its market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Friedkin Group leverages a comprehensive mix of data, including annual reports, investor presentations, and industry-specific market research from reputable firms like IBISWorld and Statista.