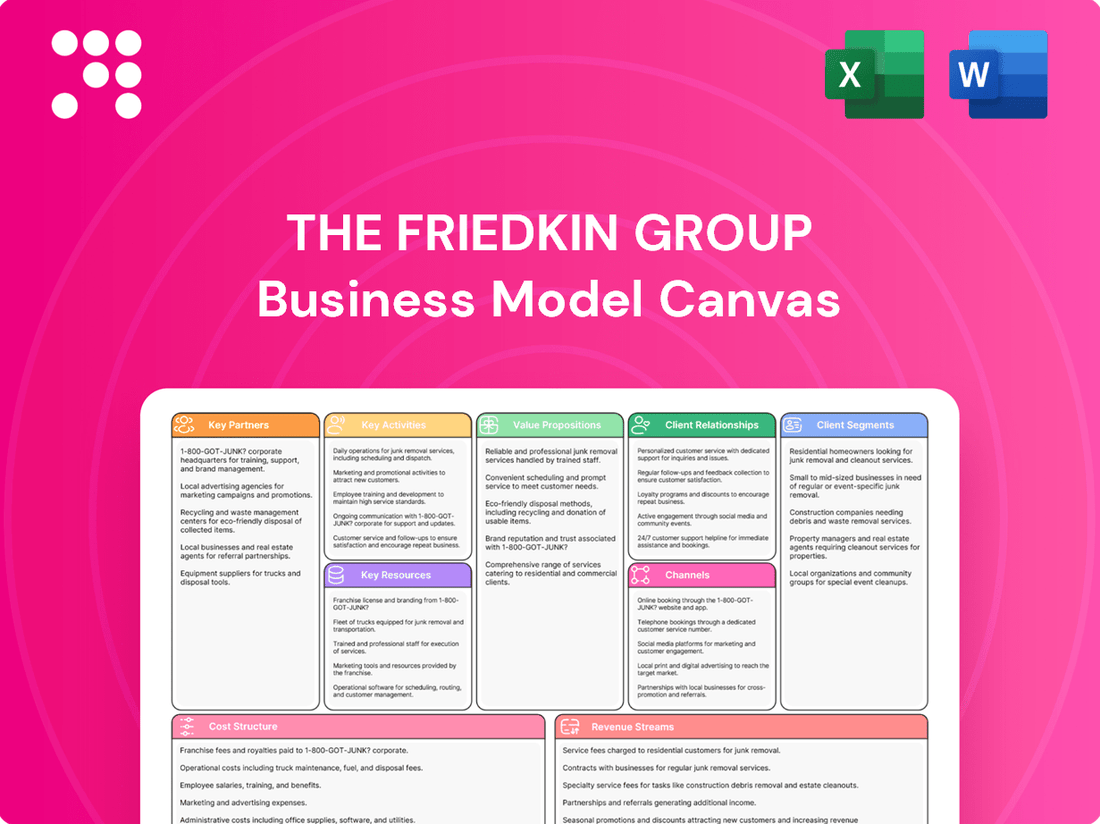

The Friedkin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Uncover the strategic brilliance behind The Friedkin Group's diverse portfolio with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for success. Download the full version to gain actionable insights for your own ventures.

Partnerships

The Friedkin Group's primary automotive operations, through Gulf States Toyota, are built upon a foundational partnership with Toyota Motor Corporation. This exclusive distribution agreement is paramount, ensuring a consistent supply of vehicles and maintaining brand integrity across the five states Gulf States Toyota serves. In 2024, Toyota continued its strong market presence, with Gulf States Toyota playing a significant role in its regional sales performance.

Beyond the direct manufacturer relationship, a robust network of independent Toyota dealerships is crucial. These dealerships are the frontline for customer engagement, driving sales and providing essential after-sales service. The success of Gulf States Toyota is intrinsically linked to the operational health and sales volume of these retail partners.

Imperative Entertainment, a significant holding within The Friedkin Group, actively cultivates partnerships with major film studios, production companies, and distribution networks. These alliances are fundamental to securing the necessary financing, facilitating the production process, and ensuring the widespread distribution of film, television, and documentary content to a global audience.

Co-production deals and distribution agreements form the bedrock of their entertainment strategy, enabling them to leverage external expertise and market reach. For instance, in 2024, the global box office revenue reached an estimated $90 billion, highlighting the immense scale and potential of these partnerships in reaching diverse consumer bases.

The Friedkin Group, through its Auberge Resorts Collection, strategically partners with property owners and developers to manage and grow its portfolio of luxury hotels and resorts. These collaborations are crucial for expanding market reach and ensuring consistent high-end guest experiences.

These partnerships often take the form of management contracts, joint ventures, and strategic alliances. For instance, Auberge Resorts Collection actively seeks to align with brands that share its commitment to bespoke luxury and exceptional service, thereby enhancing its overall value proposition.

In 2024, the luxury hospitality sector continued to see strong demand, with brands like Auberge Resorts Collection leveraging these key partnerships to open new properties in sought-after destinations. This expansion strategy is vital for capturing a larger share of the affluent traveler market.

Professional Sports Leagues and Clubs

The Friedkin Group actively cultivates key partnerships with professional sports leagues and clubs, notably through its ownership of AS Roma and Everton FC. These collaborations extend to entities like Serie A and the Premier League, as well as various sports marketing agencies.

These strategic alliances are fundamental to The Friedkin Group's operations, facilitating competitive participation, player recruitment, and the securing of lucrative commercial sponsorships. For instance, AS Roma's participation in Serie A in the 2023-2024 season involved navigating league regulations and broadcast agreements, while Everton FC's presence in the Premier League mirrored these dynamics. In 2024, the Premier League's revenue reached an estimated £6 billion, highlighting the significant commercial opportunities within these leagues.

- League Affiliations: Partnerships with Serie A and the Premier League enable participation in top-tier football competitions.

- Club Collaborations: Working with other clubs can facilitate player transfers and shared league initiatives.

- Marketing Agencies: Collaborations with sports marketing agencies are vital for sponsorship acquisition and fan engagement strategies.

Financial Institutions and Investment Partners

The Friedkin Group, as a multifaceted entity, relies heavily on a robust network of financial institutions for essential capital, diverse financing options, and sophisticated investment management services. These partnerships are crucial for supporting the operational needs and strategic growth initiatives across its extensive portfolio.

Strategic investment partnerships are also a cornerstone of The Friedkin Group's expansion strategy. A prime example is BDT & MSD's significant minority investment in Auberge Resorts Collection. This 2023 investment, reportedly valued in the hundreds of millions of dollars, provided Auberge Resorts with substantial capital to accelerate its development pipeline and enhance its global presence, showcasing the power of these collaborations.

- Capital Access: Securing diverse funding streams from banks, credit unions, and other lending institutions to finance acquisitions, operational expenses, and new ventures.

- Investment Management: Collaborating with asset managers and wealth management firms to optimize the financial performance and allocation of capital within the group's diverse holdings.

- Strategic Alliances: Forming joint ventures and co-investment agreements with private equity firms, venture capital funds, and other strategic partners to leverage expertise and capital for specific growth opportunities, such as the Auberge Resorts Collection expansion.

- Financing Solutions: Utilizing a range of financial instruments, including debt financing, equity investments, and structured finance, tailored to the specific needs of each business unit within the group.

The Friedkin Group's Key Partnerships are diverse and critical for its operational success across its various sectors. These collaborations provide essential resources, market access, and strategic alignment, enabling growth and competitive advantage. In 2024, the group continued to leverage these relationships to expand its reach and enhance its offerings.

| Partner Type | Example | Sector | 2024 Relevance/Data | Impact |

|---|---|---|---|---|

| Automotive Manufacturer | Toyota Motor Corporation | Automotive | Continued strong sales for Gulf States Toyota. | Ensures vehicle supply and brand consistency. |

| Film Studios & Distributors | Major production companies | Entertainment | Global box office revenue ~ $90 billion. | Facilitates financing, production, and distribution. |

| Luxury Hotel Brands | Auberge Resorts Collection | Hospitality | Growth in luxury travel demand. | Expands market reach and guest experience. |

| Sports Leagues | Premier League, Serie A | Sports | Premier League revenue ~ £6 billion. | Enables competition and commercial opportunities. |

| Financial Institutions | Banks, Private Equity | Finance | BDT & MSD investment in Auberge Resorts. | Provides capital and strategic investment. |

What is included in the product

This Business Model Canvas provides a comprehensive, pre-written overview of The Friedkin Group's diversified operations, detailing its customer segments, revenue streams, and key partnerships across its various industries.

It reflects the real-world operations and strategic growth of The Friedkin Group, offering a clear framework for understanding its multifaceted business approach and competitive positioning.

The Friedkin Group's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview that simplifies complex strategic planning.

It offers a digestible, one-page snapshot, alleviating the pain of information overload and facilitating rapid understanding of their core business components.

Activities

The Friedkin Group's vehicle distribution and sales activities are centered around Gulf States Toyota, their exclusive Toyota distributor for Texas, Oklahoma, Arkansas, and Louisiana. This involves the complex logistics of importing vehicles and parts, managing inventory across a vast region, and ensuring efficient delivery to over 150 dealerships. Their dealer support extends to training, marketing assistance, and operational guidance, all aimed at maximizing Toyota's market share and sales performance.

In 2024, Gulf States Toyota continued to be a powerhouse within the automotive distribution sector. The group's strategic focus on efficient supply chain management and robust dealer network support contributed to significant sales volumes. While specific 2024 revenue figures for this segment are part of ongoing reporting, the historical performance indicates this division is a substantial contributor to The Friedkin Group's overall financial health, consistently driving a large portion of its income through new vehicle and parts sales.

Imperative Entertainment, a key player for The Friedkin Group, is deeply involved in creating original film, television, and podcast content. This means they're not just making shows; they're actively finding captivating stories, bringing in the right actors and directors, and managing all the behind-the-scenes work to bring these projects to life.

The process involves meticulous planning and execution, from initial concept to final cut. In 2024, the entertainment industry saw significant investment in original content, with major studios and streaming platforms allocating billions to production. For instance, the global content creation market was projected to reach over $300 billion in 2024, highlighting the scale of these operations.

Auberge Resorts Collection, a key part of The Friedkin Group, focuses on managing and enhancing its portfolio of ultra-luxury hotels, resorts, and residences. Their core activities revolve around delivering exceptional guest experiences and maintaining impeccable service standards across all properties.

Identifying and executing on new luxury property development projects is another critical activity. This includes everything from site selection and acquisition to overseeing the entire construction and design process, aiming to expand Auberge's prestigious global presence.

In 2024, Auberge Resorts Collection continued its strategic expansion, with several new properties slated to open in sought-after destinations, further solidifying its position in the luxury hospitality market.

Sports Club Operations and Management

The Friedkin Group's key activities in sports club operations and management are centered around the comprehensive oversight of professional football clubs, notably AS Roma and Everton FC. This involves strategic player acquisition and transfers, cultivating top-tier coaching talent, and orchestrating seamless matchday experiences. A significant focus is placed on robust fan engagement initiatives to foster loyalty and drive revenue.

Financial stewardship is paramount, ensuring the clubs maintain competitiveness on the pitch while adhering to financial regulations and pursuing long-term sustainability. For instance, AS Roma's revenue for the 2022-2023 season was reported at €234.7 million, highlighting the scale of financial management required. Everton FC, facing its own financial considerations, has also been a key focus for operational and strategic planning.

- Player Recruitment and Transfers: Strategic identification and acquisition of talent to enhance team performance and market value. This includes managing transfer fees and player contracts, a critical component in football club economics.

- Coaching and Technical Staff Management: Overseeing the recruitment, development, and retention of high-caliber coaching and support staff to implement effective playing strategies and player development programs.

- Matchday Operations and Fan Engagement: Ensuring smooth execution of all aspects of home and away matches, from ticketing and stadium operations to creating engaging experiences for a global fanbase. This directly impacts revenue through ticket sales, merchandise, and hospitality.

- Financial Management and Sustainability: Implementing sound financial practices, including budgeting, revenue generation, cost control, and compliance with league financial fair play rules to ensure the long-term viability and competitiveness of the clubs.

Strategic Investment and Portfolio Management

The Friedkin Group's strategic investment and portfolio management is a core activity, focused on identifying, evaluating, and integrating new business acquisitions. This process is crucial for expanding their reach and enhancing the overall value of their holdings.

They conduct thorough due diligence and financial structuring for each potential investment. This meticulous approach ensures that new ventures align with the group's long-term objectives and possess strong growth potential.

Ongoing oversight and management are vital to maximizing the performance and synergy across their diverse portfolio companies. This active management style aims to unlock operational efficiencies and foster collaborative growth.

- Acquisition Pipeline: The Friedkin Group maintains a dynamic pipeline of potential acquisitions, actively seeking opportunities in sectors aligned with their strategic vision.

- Due Diligence: Rigorous financial, operational, and market due diligence is performed on all prospective investments to assess risk and return.

- Portfolio Synergy: Emphasis is placed on identifying and cultivating synergies between existing and new portfolio companies to drive collective growth and efficiency.

- Performance Optimization: Continuous monitoring and strategic intervention are employed to optimize the financial and operational performance of all group assets.

The Friedkin Group's key activities involve managing a diverse portfolio across automotive distribution, entertainment, luxury hospitality, and sports club operations. These operations are underpinned by strategic investment and active portfolio management, aiming for synergy and optimized performance across all ventures.

In 2024, the group's commitment to these sectors remained strong, with continued investment in content creation, luxury property development, and sports club competitiveness. The automotive division, Gulf States Toyota, continued its significant sales volumes, contributing substantially to the group's financial health.

The sports club operations, including AS Roma and Everton FC, involved intricate financial management and player strategy, with AS Roma reporting €234.7 million in revenue for the 2022-2023 season. Auberge Resorts Collection also saw strategic expansion with new property openings.

| Sector | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Automotive Distribution | Vehicle Import, Inventory Management, Dealer Support | Continued significant sales volumes via Gulf States Toyota |

| Entertainment | Film, TV, Podcast Content Creation | Industry saw billions invested in content creation globally in 2024 |

| Luxury Hospitality | Resort Management, Property Development | Strategic expansion with new property openings planned |

| Sports Club Operations | Player Acquisition, Coaching, Fan Engagement, Financial Management | AS Roma revenue: €234.7 million (2022-2023) |

| Investment & Portfolio Management | Acquisition Pipeline, Due Diligence, Synergy Cultivation | Focus on optimizing performance and identifying new ventures |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for The Friedkin Group that you are previewing is the authentic document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis, not a simplified sample. Once your transaction is complete, you'll gain full access to this exact file, ready for your immediate use and application.

Resources

The Friedkin Group leverages significant financial capital, underpinned by Dan Friedkin's substantial net worth, estimated to be in the billions. This financial strength is crucial for executing strategic acquisitions and investments across its varied portfolio.

This deep well of capital acts as a core enabler for The Friedkin Group, directly funding day-to-day operations, ambitious expansion projects, and sustained long-term growth strategies across its diverse business interests.

Gulf States Toyota's exclusive distribution rights for Toyota vehicles across five U.S. states represent a significant tangible asset, enabling consistent revenue streams and market control. This exclusivity is a cornerstone of their automotive segment's operational strength.

The Friedkin Group leverages brand licenses and intellectual property from its entertainment ventures, such as Imperative Entertainment and Neon, as key resources. These assets provide access to creative content and distribution channels, driving value in the media sector.

In the luxury hospitality domain, the Auberge Resorts Collection brand license is a vital intangible resource. This brand equity attracts high-net-worth clientele and supports premium pricing strategies, contributing significantly to the group's service-oriented businesses.

The Friedkin Group's ownership of the Auberge Resorts Collection represents a significant investment in high-value luxury real estate. This collection includes premier hotels, resorts, and undeveloped land strategically located in sought-after global destinations, forming the bedrock of their hospitality operations.

These physical assets are crucial for delivering exclusive, high-end guest experiences, enabling Auberge Resorts to command premium pricing. For instance, in 2024, luxury hospitality properties continued to show resilience, with average daily rates in the luxury segment often exceeding those of other hotel tiers, reflecting the strong demand for unique and premium accommodations.

Talent and Intellectual Property in Entertainment

Imperative Entertainment, a key part of The Friedkin Group's business, relies heavily on its talent network. This includes writers, directors, actors, and producers, forming the human capital needed to bring stories to life. Their ability to attract and retain top-tier talent directly impacts the quality and marketability of the content produced.

Crucially, Imperative Entertainment also secures intellectual property rights to the stories and scripts they develop. This ownership of creative assets, like original screenplays or adapted novels, is fundamental to their value proposition. By controlling these rights, they can develop and monetize content across various platforms, ensuring long-term revenue streams.

The financial success of Imperative Entertainment is directly tied to the strength of this talent and IP. For instance, in 2024, the global film and television industry saw significant investment in content creation, with major studios spending billions to acquire and develop compelling narratives and secure top creative talent. This highlights the critical nature of these resources.

- Human Capital: Access to a deep bench of experienced writers, directors, actors, and producers.

- Intellectual Property: Ownership of rights to a diverse portfolio of stories and scripts.

- Content Creation Engine: The synergy between talent and IP drives the production of high-quality, marketable entertainment.

- Industry Investment: The entertainment sector's continued high spending on talent and IP underscores their value.

Sports Club Infrastructure and Brand Equity

The Friedkin Group's ownership of AS Roma and Everton FC represents a core resource, leveraging the immense brand equity and historical significance of these football clubs. This includes tangible assets like stadiums, such as the under-construction Everton stadium, and extensive training facilities, all contributing to operational capacity and fan engagement.

The established fan bases, numbering in the millions for each club, are a critical intangible asset. This widespread support translates into consistent matchday revenue, merchandise sales, and a powerful platform for commercial partnerships. For instance, AS Roma's average attendance in the 2023-2024 Serie A season was over 56,000, highlighting significant fan loyalty.

The brand equity derived from these clubs is invaluable for attracting top-tier talent, securing lucrative sponsorship deals, and expanding global reach. In 2023, AS Roma's commercial revenue was reported to be around €80 million, demonstrating the financial power of its brand.

- Iconic Club Ownership: AS Roma and Everton FC provide a foundation of global recognition and passionate fan bases.

- Physical Assets: Ownership includes state-of-the-art training grounds and iconic stadiums, with Everton's new stadium a significant future asset.

- Brand Value: The historical legacy and established brand equity of these clubs are key to attracting players, fans, and commercial partners.

The Friedkin Group's key resources are multifaceted, encompassing substantial financial capital, exclusive distribution rights, valuable brand licenses, and ownership of prime real estate. These tangible and intangible assets form the bedrock of their diverse operations, from automotive and entertainment to luxury hospitality and professional sports.

The group's financial strength, bolstered by Dan Friedkin's significant net worth, fuels strategic investments and daily operations. Gulf States Toyota's exclusive distribution rights for Toyota vehicles across five U.S. states provide a consistent revenue stream and market control. Furthermore, the Auberge Resorts Collection's brand equity and luxury properties are vital for high-end hospitality, while ownership of AS Roma and Everton FC taps into global fan bases and brand recognition.

| Resource Category | Specific Asset | Description | 2024 Relevance/Data Point |

|---|---|---|---|

| Financial Capital | Dan Friedkin's Net Worth | Enables strategic acquisitions and investments. | Estimated in the billions, providing substantial funding capacity. |

| Distribution Rights | Gulf States Toyota Exclusivity | Exclusive rights for Toyota vehicles in 5 U.S. states. | Underpins consistent automotive segment revenue. |

| Brand Licenses & IP | Imperative Entertainment, Neon | Access to creative content and distribution channels. | Secures rights to stories and scripts, driving content monetization. |

| Hospitality Assets | Auberge Resorts Collection | Luxury hotels, resorts, and land in prime locations. | Luxury segment average daily rates remained strong in 2024, reflecting demand. |

| Sports Franchises | AS Roma, Everton FC | Iconic clubs with significant brand equity and fan bases. | AS Roma's commercial revenue was approx. €80 million in 2023; AS Roma's average attendance exceeded 56,000 in 2023-24. |

Value Propositions

Gulf States Toyota, a key part of The Friedkin Group, ensures customers have dependable access to Toyota vehicles and genuine parts. This commitment translates into a reliable automotive ecosystem for its service areas.

In 2024, Gulf States Toyota continued its focus on operational efficiency, aiming to maintain high inventory levels across its dealerships. This strategy directly addresses customer needs for immediate availability, reinforcing the value of accessibility.

The proposition centers on building trust through consistent product quality and readily available service. This comprehensive approach makes Gulf States Toyota a convenient, one-stop solution for automotive needs.

Imperative Entertainment, a key part of The Friedkin Group's strategy, delivers captivating and critically acclaimed films, television shows, and podcasts. Their value proposition centers on engaging storytelling and high production standards across diverse content platforms.

In 2024, the entertainment industry continues to see significant investment. For instance, major studios are allocating billions to content creation, with streaming services alone projected to spend over $100 billion globally on original content in the coming years, underscoring the demand for high-quality entertainment.

The Friedkin Group's commitment to diverse content, from gripping dramas to insightful podcasts, caters to a broad audience. This focus on quality and variety ensures they remain competitive in a rapidly evolving media landscape, attracting viewers and critical acclaim alike.

The Auberge Resorts Collection, a key part of The Friedkin Group's strategy, provides discerning travelers with exclusive and curated luxury experiences. This means offering more than just a place to stay; it's about crafting unforgettable moments through exceptional service and unique locations.

Their value proposition centers on bespoke service, ensuring each guest's needs are anticipated and met with personalized attention. This commitment to detail creates a sense of true exclusivity and luxury that sets them apart in the hospitality market.

By focusing on authentic local experiences and memorable stays, Auberge Resorts Collection taps into a desire for genuine connection and discovery. This approach appeals to a clientele seeking more than just opulent surroundings, but rather a deeper engagement with the destinations they visit.

Competitive and Engaging Sports Entertainment

The Friedkin Group delivers competitive and engaging sports entertainment by owning and operating professional football clubs, most notably AS Roma. This ownership translates into thrilling on-field action and a deeply ingrained sense of community and passion among supporters. Fans experience the value through the club's pursuit of on-field success, its strong historical identity, and the powerful sense of belonging it cultivates.

For the 2023-2024 Serie A season, AS Roma demonstrated its competitive spirit, finishing sixth in the league. This performance directly contributes to the engaging entertainment value provided to fans, who connect with the team's efforts and aspirations.

- Competitive Performance: AS Roma's participation in top-tier leagues like Serie A ensures a high level of competition.

- Club Identity: The club's rich history and established brand resonate deeply with its fanbase, fostering loyalty.

- Community and Belonging: The Friedkin Group cultivates a strong connection between the club and its supporters, creating a shared sense of identity and passion.

Diversified Investment and Sustainable Growth

The Friedkin Group's diversified investment strategy aims to provide robust value to its stakeholders. By spreading investments across various sectors, the group effectively mitigates risk while pursuing long-term capital appreciation. This approach ensures stability even when certain industries face downturns, a key factor in sustainable growth.

This diversification means The Friedkin Group can tap into opportunities in both established, stable markets and emerging, high-growth sectors. For instance, in 2024, while traditional sectors like automotive manufacturing continued to be a core focus, the group also made strategic investments in renewable energy and technology ventures. This dual approach is designed to deliver consistent returns and foster significant expansion.

- Risk Mitigation: A broad portfolio across industries like automotive, entertainment, and technology reduces reliance on any single market's performance.

- Long-Term Capital Appreciation: Investments are strategically selected for their potential to grow in value over extended periods.

- Strategic Expansion: The group actively seeks opportunities to expand its reach and capabilities through targeted acquisitions and partnerships.

- Stakeholder Value: This balanced approach aims to deliver reliable returns and enhance the overall financial health of the group and its investors.

The Friedkin Group's value proposition is built on delivering excellence across its diverse portfolio. Through Gulf States Toyota, it ensures reliable automotive solutions. Imperative Entertainment provides engaging, high-quality content. Auberge Resorts Collection offers unparalleled luxury travel experiences, and AS Roma delivers thrilling sports entertainment.

Customer Relationships

Gulf States Toyota cultivates robust business-to-business relationships with its independent Toyota dealerships. This is achieved through specialized sales support, comprehensive training initiatives, and attractive incentive programs designed to foster loyalty and drive performance.

These strong dealer relationships are crucial for ensuring efficient product distribution across its territory and maintaining consistent brand representation and customer experience. In 2024, Gulf States Toyota continued to invest in dealer development, with over 1,500 dealership personnel participating in specialized training sessions focused on sales techniques and product knowledge.

Imperative Entertainment, a key component of The Friedkin Group's strategy, actively nurtures enduring connections with creative talent, including writers, directors, and actors. These relationships are foundational, fostering a collaborative environment essential for producing compelling content.

Beyond talent, Imperative Entertainment prioritizes strong ties with pivotal industry figures such as agents, major studios, and influential streaming platforms. This network is crucial for effective content distribution and market penetration.

The company's approach to these relationships is rooted in building trust and ensuring mutual success, recognizing that collaborative efforts in content creation and distribution yield the best results. For instance, in 2024, Imperative Entertainment secured key talent for multiple upcoming projects, demonstrating the ongoing strength of these industry partnerships.

The Friedkin Group's Auberge Resorts Collection cultivates deep customer loyalty through meticulously personalized guest services. This approach centers on anticipating and exceeding the expectations of its luxury clientele, fostering a strong connection that drives repeat business.

A key element is tailoring each guest's experience, from pre-arrival preferences to on-site activities, creating a unique and memorable stay. This bespoke service model makes guests feel valued and understood, a critical factor in the high-end hospitality sector.

Auberge Resorts actively engages guests through direct communication and exclusive loyalty programs, reinforcing a sense of belonging and community. For instance, in 2023, Auberge Resorts reported a significant increase in repeat guest bookings, a direct testament to the effectiveness of their personalized service strategy.

Fan Engagement and Community Building (Sports)

The Friedkin Group cultivates robust fan engagement for its sports clubs, AS Roma and Everton FC, by fostering deep emotional connections. This is achieved through consistent direct communication, impactful community initiatives, and the strategic offering of merchandise that resonates with supporters. Ultimately, this approach aims to solidify fan loyalty and a powerful sense of shared identity.

In 2024, AS Roma reported a significant increase in matchday attendance, with an average of over 60,000 fans per home game at the Stadio Olimpico, highlighting strong fan commitment. Everton FC, despite facing challenges, maintained a passionate fanbase, with season ticket renewals remaining high, demonstrating the enduring emotional bond. These clubs actively involve fans through digital platforms, offering exclusive content and opportunities for interaction, which strengthens the community fabric.

- Direct Communication: Regular updates, behind-the-scenes content, and fan forums via official club channels.

- Community Initiatives: Local outreach programs, charity partnerships, and fan events that integrate the club into the community fabric.

- Merchandise: High-quality, desirable club apparel and memorabilia that allow fans to express their affiliation and pride.

- On-Field Performance: While not solely controllable, consistent efforts towards competitive success are a cornerstone of maintaining fan enthusiasm and loyalty.

Strategic Partner and Investor Relations

The Friedkin Group cultivates strategic partnerships and investor relations through open dialogue and clear performance metrics. They ensure alignment with financial institutions and acquired businesses by emphasizing a shared vision and common fiscal objectives.

This approach fosters trust and collaboration, crucial for long-term growth and value creation. For instance, in 2024, The Friedkin Group continued to strengthen its ties with key financial backers, reporting consistent positive returns across its diverse portfolio, which includes interests in automotive, entertainment, and hospitality sectors.

- Transparent Communication: Regular updates and detailed financial reports are provided to all investment partners.

- Performance Reporting: Clear, data-driven insights into the performance of acquired entities and overall group investments are shared.

- Strategic Alignment: Ensuring that the goals of partners and acquired businesses are in sync with The Friedkin Group's overarching strategy.

- Shared Vision: Building relationships on a foundation of mutual understanding and a collective commitment to long-term financial success.

The Friedkin Group's customer relationships are multifaceted, spanning B2B, B2C, and fan engagement across its diverse portfolio. For its automotive distribution arm, Gulf States Toyota, strong relationships with dealerships are maintained through dedicated support and training, crucial for market penetration. In hospitality, Auberge Resorts cultivates loyalty via highly personalized guest experiences, driving repeat bookings.

The group also prioritizes deep emotional connections with fans of AS Roma and Everton FC through consistent communication and community involvement, fostering a strong sense of belonging. Imperative Entertainment builds lasting ties with creative talent and industry partners, essential for content creation and distribution.

These varied relationship strategies underscore The Friedkin Group's commitment to nurturing long-term engagement and mutual success across all its ventures.

Channels

Gulf States Toyota leverages its vast network of authorized dealerships, spanning Texas, Arkansas, Louisiana, Mississippi, and Oklahoma, as its primary channel. These dealerships are the direct touchpoints for customer sales and after-sales service.

In 2024, the automotive retail sector saw continued reliance on these physical locations. Dealerships are crucial for test drives, financing arrangements, and immediate vehicle delivery, representing the core of customer interaction.

The efficiency and reach of this dealership network are vital for The Friedkin Group's automotive segment. For instance, in 2023, the U.S. automotive industry reported over 15.5 million new vehicle sales, with dealerships facilitating the majority of these transactions.

Imperative Entertainment, a part of The Friedkin Group, strategically leverages both traditional theatrical releases and a robust network of digital streaming platforms and broadcast networks for its film and television content. This dual approach is crucial for maximizing audience engagement and diversifying revenue streams.

In 2024, the global box office revenue was projected to reach approximately $100 billion, highlighting the continued importance of theatrical releases. Simultaneously, the digital streaming market continued its rapid expansion, with major platforms reporting billions in subscription revenue, underscoring the necessity of a strong digital presence.

The Friedkin Group's Auberge Resorts Collection leverages its branded website for direct bookings, aiming to cultivate stronger customer relationships and capture higher margins. This strategy is crucial as direct bookings can significantly reduce commission costs typically paid to Online Travel Agencies (OTAs).

Complementing direct channels, Auberge Resorts partners with select high-end OTAs and luxury travel advisors. In 2024, the luxury travel market continued its robust recovery, with many affluent travelers seeking curated experiences, making these partnerships vital for reaching specific, high-spending segments of the market.

Sports Stadiums, Broadcast Media, and Digital Platforms

The Friedkin Group leverages sports stadiums, broadcast media, and digital platforms to connect with fans of its football clubs, such as AS Roma and Everton FC. This multi-channel approach ensures broad reach for sports entertainment and club updates.

Live matches at stadiums offer an immersive fan experience, while global broadcast rights extend the reach of games to millions worldwide. In 2024, AS Roma's Stadio Olimpico has a capacity of over 70,000, and Everton FC's Goodison Park, while undergoing transition to a new stadium, continues to be a significant venue. Broadcast revenue remains a critical component of football club finances, with Premier League broadcast deals alone valued in the billions of pounds annually.

Digital platforms, including official club websites and social media channels, provide direct engagement opportunities. These platforms deliver news, behind-the-scenes content, and merchandise sales. For instance, AS Roma boasts millions of followers across Instagram, X (formerly Twitter), and Facebook, fostering a strong online community and driving digital revenue streams.

- Stadiums: Provide matchday revenue and fan engagement.

- Broadcast Media: Generate significant revenue through global rights sales and reach a vast audience.

- Digital Platforms: Facilitate direct fan interaction, brand building, and e-commerce opportunities.

Corporate Websites and Investor Relations

The Friedkin Group leverages its corporate website and investor relations channels to disseminate its overarching strategy and showcase portfolio performance. These platforms act as crucial information conduits for stakeholders, including partners, investors, and the general public, ensuring transparency and accessibility.

In 2024, companies increasingly focused on digital transparency. For instance, many publicly traded companies reported significant engagement on their investor relations portals, with website traffic often increasing by double-digit percentages following major announcements or financial releases.

The Friedkin Group's approach emphasizes clear communication regarding its diverse business units and their contributions to the group's overall financial health. This includes detailing strategic investments and operational successes across its various holdings.

- Corporate Website: Serves as the primary digital storefront for The Friedkin Group, detailing its mission, values, and business segments.

- Investor Relations Portal: Provides a dedicated space for financial reports, press releases, and shareholder information, fostering direct communication with investors.

- Portfolio Updates: Regular updates on the performance and strategic direction of individual companies within The Friedkin Group's portfolio are crucial for stakeholder confidence.

- Transparency Initiatives: The group's commitment to open communication is reflected in its accessible reporting and engagement with the financial community.

The Friedkin Group utilizes a multi-channel strategy for its diverse portfolio. For Gulf States Toyota, authorized dealerships remain the primary sales and service channel, crucial for the physical customer experience. Imperative Entertainment blends traditional theatrical releases with digital streaming, capitalizing on both the projected $100 billion global box office revenue for 2024 and the expanding digital subscription market.

Auberge Resorts Collection prioritizes direct bookings via its branded website to enhance customer relationships and reduce OTA commissions, while also partnering with select luxury travel advisors to reach affluent clients. The group's football clubs, AS Roma and Everton FC, engage fans through stadiums, extensive broadcast media, and active digital platforms, leveraging millions of social media followers for brand building and revenue.

| Business Segment | Primary Channels | Key 2024 Data/Trends |

|---|---|---|

| Gulf States Toyota | Authorized Dealerships | Dealerships are vital for test drives, financing, and immediate delivery. The U.S. auto industry saw over 15.5 million new vehicle sales in 2023. |

| Imperative Entertainment | Theatrical Releases, Digital Streaming, Broadcast Networks | Global box office projected at $100 billion in 2024; digital streaming market continues rapid expansion. |

| Auberge Resorts Collection | Branded Website (Direct Bookings), Select Luxury OTAs, Travel Advisors | Direct bookings reduce commission costs; luxury travel market robust in 2024. |

| Football Clubs (AS Roma, Everton FC) | Stadiums, Broadcast Media, Digital Platforms (Social Media, Websites) | AS Roma's Stadio Olimpico capacity >70,000; Premier League broadcast deals are multi-billion pound annually. Millions of followers on social media. |

Customer Segments

Individual vehicle purchasers in the Gulf States region are a key customer segment for Gulf States Toyota. These consumers are primarily looking for new or used Toyota vehicles, with a strong emphasis on reliability, fuel efficiency, and the enduring reputation of the Toyota brand. This broad demographic seeks dependable personal transportation solutions to meet their daily needs.

In 2024, the demand for reliable vehicles in the Gulf States remained robust, with Toyota consistently ranking among the top brands for overall customer satisfaction and resale value. For instance, Toyota's market share in the region continued to be significant, reflecting consumer trust in its product offerings. This segment represents a substantial portion of the automotive market, driven by a desire for quality and long-term value.

Imperative Entertainment's customer base is a global audience with a strong appetite for compelling film and television. This segment spans demographics and geographic locations, united by a desire for high-quality, engaging content across a spectrum of genres.

Consumers access this content through multiple channels, including traditional theatrical releases, the rapidly expanding streaming service landscape, and established broadcast networks. In 2024, the global box office saw a significant rebound, with worldwide revenue projected to reach over $90 billion, indicating a robust demand for cinematic experiences.

The streaming market also continues its impressive growth, with major platforms reporting substantial subscriber increases throughout 2024. For instance, Netflix alone added over 9 million new subscribers in the first quarter of 2024, demonstrating the enduring appeal of episodic content delivered digitally.

The Friedkin Group's Auberge Resorts Collection specifically targets affluent and luxury travelers, a demographic that prioritizes exclusivity and highly personalized service. This segment includes high-net-worth individuals, families, and corporate clients who are willing to pay a premium for unique, high-end destinations and experiences.

In 2024, the luxury travel market continued its strong recovery. Reports indicated that spending on luxury travel was projected to reach over $200 billion globally by the end of the year, with a significant portion of this growth driven by demand from high-net-worth individuals seeking bespoke itineraries and exceptional service, aligning perfectly with Auberge's offerings.

Dedicated Sports Fans and Supporters

Dedicated sports fans, particularly those of professional football clubs like AS Roma and Everton FC, represent a core customer segment. These individuals exhibit deep loyalty and an emotional connection to their teams, actively participating through match attendance, merchandise purchases, and engagement with club-related content. Their support extends both locally and globally, forming a passionate community around the sport.

This segment's engagement is a significant revenue driver. For instance, AS Roma's fan base is estimated to be in the tens of millions worldwide, contributing to matchday revenue, broadcasting rights, and commercial partnerships. Everton FC also boasts a strong, historically significant fanbase, with season ticket holders and a robust demand for club merchandise, reflecting the enduring appeal of established clubs.

- Fan Loyalty: High emotional investment drives consistent engagement and spending.

- Global Reach: Support transcends geographical boundaries, opening up diverse revenue streams.

- Revenue Streams: Direct contributions through ticket sales, merchandise, and indirect support via broadcasting deals and sponsorships.

- Community Engagement: Fans actively participate in club events and digital platforms, fostering brand advocacy.

Strategic Business Partners and Investors

Strategic Business Partners and Investors represent a crucial customer segment for The Friedkin Group, encompassing a range of entities actively seeking to align with the group's diverse portfolio. These include corporate entities looking for strategic alliances, financial institutions providing capital or specialized financial services, and high-net-worth individuals or family offices pursuing diversified investment avenues.

This segment is driven by a dual objective: achieving robust financial returns and capitalizing on synergistic growth opportunities that arise from collaborations across The Friedkin Group's operational sectors. For instance, a partnership could leverage expertise in automotive manufacturing with advancements in digital entertainment, creating new revenue streams.

Key motivations for this segment include access to The Friedkin Group's established market presence and its ability to navigate complex industry landscapes. Their investment decisions are often informed by factors such as:

- Projected ROI: Analyzing the financial viability and potential profitability of joint ventures or direct investments.

- Market Synergies: Identifying opportunities for cross-sector collaboration that enhance competitive advantage.

- Risk Mitigation: Assessing the stability and diversification of The Friedkin Group's holdings as a hedge against market volatility.

- Strategic Alignment: Ensuring that partnership goals are congruent with their own long-term business or investment strategies.

The Friedkin Group's customer segments are diverse, ranging from individual car buyers in the Gulf States to global audiences for entertainment, luxury travelers, dedicated sports fans, and strategic business partners. Each segment is characterized by specific needs and motivations, from reliable transportation and high-quality content to exclusive experiences and profitable investments.

Cost Structure

The Friedkin Group incurs substantial costs in managing its automotive inventory and distribution for Gulf States Toyota. These expenses include the purchase of new Toyota vehicles and genuine parts, as well as the logistics of importing these goods into the Gulf States region.

Significant outlays are also directed towards maintaining this inventory, encompassing storage, security, and insurance. In 2024, the global automotive supply chain continued to face volatility, impacting inventory holding costs and the efficiency of inbound logistics for dealerships.

Distribution logistics, including warehousing and transportation, represent another major cost component. Getting vehicles and parts from ports to dealerships across the vast Gulf States territory requires a robust and often expensive network, with fuel prices and carrier availability significantly influencing these expenditures throughout 2024.

Imperative Entertainment, a key part of The Friedkin Group, faces significant expenses in bringing films and TV shows to life. These costs include paying writers, directors, and actors, alongside the everyday operational costs of production and the intricate work of post-production. In 2023, the average budget for a major studio film exceeded $100 million, with talent fees often accounting for a substantial portion of that figure.

Auberge Resorts Collection incurs substantial capital expenditures for acquiring prime real estate and developing ultra-luxury properties, often exceeding tens of millions per project. These developments demand meticulous attention to detail and premium materials, driving up initial investment.

Ongoing operational costs are significant, encompassing highly skilled staffing for personalized guest experiences, extensive property maintenance to uphold luxury standards, and the continuous need for high-quality amenities. In 2024, the average operational cost per occupied room for luxury hotels globally can range from $250 to $500 daily, reflecting these demands.

Furthermore, property taxes, which vary greatly by location but can represent a considerable percentage of a property's value, and substantial marketing budgets to reach affluent clientele are critical expenses. These marketing efforts often involve global campaigns and exclusive partnerships to maintain brand prestige.

Sports Club Player Salaries and Transfer Fees

The Friedkin Group's operation of sports clubs, particularly AS Roma, incurs significant expenses in player acquisition and remuneration. Transfer fees, the cost of purchasing player contracts, represent a major outlay. For instance, AS Roma's acquisition of players like Romelu Lukaku in 2023 involved substantial loan fees and potential future transfer obligations, reflecting the high market value of top talent.

Player salaries form another substantial component of the cost structure. These are ongoing commitments that directly impact profitability. In 2024, AS Roma's wage bill was a considerable portion of their operating expenses, a common characteristic of elite football clubs competing at the highest levels.

- Player Salaries: A significant portion of operating costs, reflecting player talent and market demand.

- Transfer Fees: Upfront costs for acquiring new players, often involving multi-million euro transactions.

- Coaching and Support Staff: Expenses related to managers, technical staff, medical teams, and administrative personnel.

- Youth Academy Investment: Funding for scouting, development, and infrastructure for future talent.

General Administrative and Acquisition Costs

The Friedkin Group, as a diversified consortium, incurs significant general administrative expenses. These include costs for executive leadership, legal counsel, financial advisory services, and overall corporate overhead necessary to manage its varied portfolio. In 2024, managing such a broad range of operations typically involves substantial investment in central support functions.

Furthermore, the group's growth strategy often involves strategic acquisitions, which carry considerable costs. These acquisition expenses encompass thorough due diligence processes to assess potential targets, as well as the costs associated with integrating new businesses into the existing Friedkin Group structure. Such integration efforts are critical for realizing synergies and ensuring operational alignment across acquired entities.

- Central Administrative Costs: Covering executive salaries, legal fees, financial services, and corporate overhead for a diverse portfolio.

- Acquisition Expenses: Including substantial costs for due diligence and integration of newly acquired businesses.

- Operational Efficiency: Management of these costs is key to maintaining profitability across the group's various holdings.

The Friedkin Group's cost structure is multifaceted, reflecting its diverse business interests. For Gulf States Toyota, significant expenses are tied to inventory acquisition, import logistics, and warehousing, with supply chain volatility in 2024 impacting these costs. Imperative Entertainment faces substantial production outlays, including talent fees, with major film budgets often exceeding $100 million as of 2023.

Auberge Resorts Collection's costs are driven by high capital expenditures for luxury property development and ongoing operational expenses, including premium staffing and maintenance. In 2024, luxury hotel operational costs per occupied room could range from $250 to $500 daily. Sports club operations, particularly AS Roma, involve considerable player acquisition and salary expenses, with player wages forming a significant portion of operating costs in 2024.

General administrative costs, encompassing executive, legal, and financial services, are essential for managing the group's varied portfolio. Strategic acquisitions also incur substantial due diligence and integration expenses, vital for realizing synergies.

| Business Segment | Key Cost Drivers | Illustrative Cost Data (Approx.) |

|---|---|---|

| Gulf States Toyota | Vehicle/Parts Acquisition, Import Logistics, Warehousing | Supply chain costs impacted by 2024 volatility |

| Imperative Entertainment | Talent Fees, Production, Post-Production | Major film budgets >$100M (2023) |

| Auberge Resorts Collection | Property Acquisition/Development, Staffing, Maintenance | Operational costs $250-$500/occupied room daily (2024) |

| Sports Clubs (AS Roma) | Player Salaries, Transfer Fees, Staffing | Significant wage bill impact on operating expenses (2024) |

| Corporate | General Administration, Acquisition Expenses | Costs for due diligence and business integration |

Revenue Streams

Gulf States Toyota's core revenue comes from selling new Toyota vehicles and genuine parts to its dealerships. This wholesale model is the bedrock of their operations.

Beyond vehicle and parts sales, the group also generates income through financing and insurance products offered via its automotive services division, adding a layer of financial services to its core business.

Imperative Entertainment, a key component of The Friedkin Group's business model, generates significant revenue from its film and television productions. This income stream is diversified, encompassing box office receipts from theatrical releases, licensing fees from streaming services and traditional broadcasters, and sales from home entertainment formats.

The company's reach extends globally, with revenue generated from both domestic and international markets for its content. For example, in 2024, the film industry saw a strong rebound, with worldwide box office revenue projected to exceed $70 billion, underscoring the potential for successful productions to capture substantial audience engagement and financial returns.

The Friedkin Group’s luxury hospitality arm, Auberge Resorts Collection, generates revenue through a multi-faceted approach. This includes direct bookings for room nights, which form the core of their income. In 2024, the luxury travel sector continued its robust recovery, with high-end resorts seeing strong occupancy rates, often exceeding 80% during peak seasons.

Beyond accommodation, Auberge Resorts Collection diversifies its income with sales from food and beverage, spa treatments, and various on-site amenities and activities. Furthermore, revenue is bolstered by fees earned from managing other properties, allowing them to leverage their brand and operational expertise across a wider portfolio.

Sports Club Matchday, Broadcast, and Commercial Revenue

Sports clubs, such as those owned by The Friedkin Group like AS Roma, tap into multiple revenue streams from their operations. Matchday revenue, primarily from ticket sales, forms a core component. Broadcast rights, a significant income generator in modern football, are secured through complex negotiations with media companies.

Commercial activities further diversify income. This includes partnerships with sponsors, sales of team merchandise, and premium offerings like corporate hospitality packages. For instance, in the 2022-2023 season, AS Roma's broadcast revenue was substantial, reflecting the value of Serie A broadcasting deals.

- Matchday Revenue: Ticket sales for home and away games, concessions, and parking fees.

- Broadcast Revenue: Income from domestic and international television rights, league distributions, and cup competitions.

- Commercial Revenue: Sponsorship deals, kit manufacturing agreements, merchandising, stadium naming rights, and hospitality services.

Investment Returns and Portfolio Dividends

As a holding company, The Friedkin Group actively generates revenue through the investment returns, dividends, and capital appreciation derived from its varied portfolio of businesses. This income stream is bolstered by profits realized from the successful operation and strategic divestment of its ventures.

In 2024, the performance of diversified holding companies often hinges on market conditions and the specific sectors in which they operate. For instance, companies with significant stakes in technology or renewable energy sectors have shown robust growth. The Friedkin Group's own portfolio, encompassing automotive, hospitality, and entertainment, likely experienced varied contributions to its overall investment returns.

- Investment Returns: Income generated from the appreciation of assets and successful business operations across its subsidiaries.

- Portfolio Dividends: Cash distributions received from the profitable entities within The Friedkin Group's holdings.

- Capital Appreciation: Gains realized from the increase in market value of its various business investments.

- Strategic Exits: Profits earned from the sale or divestment of portfolio companies that have reached maturity or offer strategic advantages upon exit.

The Friedkin Group's revenue streams are as diverse as its portfolio. Gulf States Toyota is a primary contributor, generating income from wholesale vehicle and parts sales to dealerships, alongside revenue from financing and insurance products. Imperative Entertainment adds to this through film and television productions, capturing revenue from box office, licensing, and home entertainment sales.

The hospitality sector, represented by Auberge Resorts Collection, earns through room bookings, food and beverage sales, spa services, and property management fees. Sports clubs like AS Roma generate revenue from matchday ticket sales, broadcast rights, sponsorships, and merchandise.

The overarching holding company structure also yields income from investment returns, dividends, and capital appreciation across its various business units, augmented by profits from strategic divestments.

| Business Unit | Primary Revenue Source | Ancillary Revenue Streams | 2024 Market Context |

|---|---|---|---|

| Gulf States Toyota | Wholesale Vehicle & Parts Sales | Financing, Insurance | Automotive sector recovery |

| Imperative Entertainment | Film/TV Production Revenue | Licensing, Home Entertainment | Global box office rebound |

| Auberge Resorts Collection | Accommodation Bookings | F&B, Spa, Management Fees | Luxury travel sector growth |

| Sports Clubs (e.g., AS Roma) | Matchday Revenue | Broadcast Rights, Sponsorships, Merchandising | Strong broadcast rights value |

| Holding Company | Investment Returns, Dividends | Capital Appreciation, Strategic Exits | Varied sector performance |

Business Model Canvas Data Sources

The Friedkin Group's Business Model Canvas is informed by a robust combination of internal financial data, extensive market research across its diverse portfolio, and strategic insights derived from operational performance. This multi-faceted approach ensures each component of the canvas is grounded in verifiable information and forward-looking analysis.