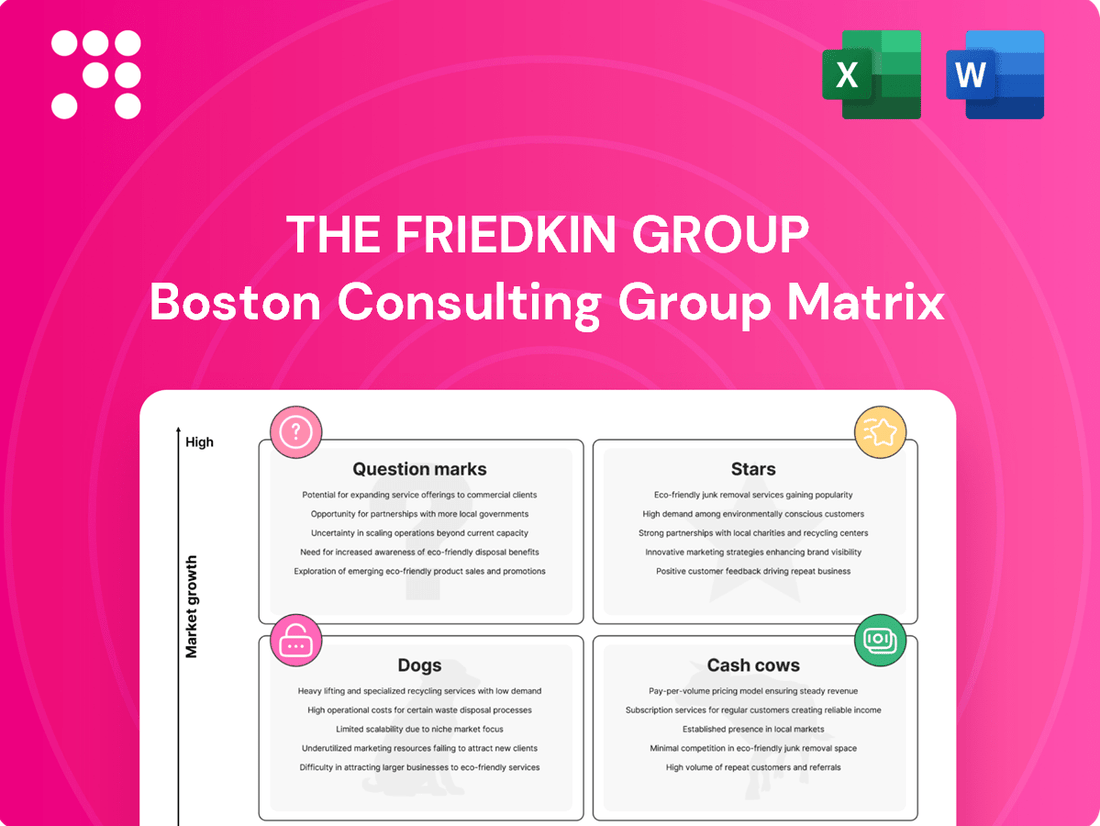

The Friedkin Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Curious about The Friedkin Group's strategic positioning? This BCG Matrix preview highlights key product categories, revealing potential market leaders and areas needing attention. Ready to unlock a comprehensive understanding of their portfolio and make informed decisions?

Purchase the full BCG Matrix for The Friedkin Group to gain detailed quadrant placements for each of their business units. Discover which are your Stars, Cash Cows, Dogs, and Question Marks, and receive data-backed recommendations for optimal resource allocation and future growth strategies.

Stars

Auberge Resorts Collection, a prominent luxury hospitality brand under The Friedkin Group, operates in a high-growth market segment. The global luxury hotel market is experiencing robust expansion, with projections indicating a compound annual growth rate of 10.5% through 2030. This sector is anticipated to reach approximately $166.41 billion in 2025 and is expected to grow to $238.4 billion by 2030.

Auberge's strong market presence is underscored by its consistent recognition in esteemed travel publications. For instance, in 2025, 15 of its 23 eligible properties were featured on Travel + Leisure's Top 500 Hotels list. This consistent acclaim reflects Auberge's leadership position and significant market share within the thriving luxury hospitality industry.

Legendary Expeditions operates within the adventure travel sector, a market projected for substantial expansion. The adventure tourism market is expected to see a compound annual growth rate (CAGR) of 20.7% between 2024 and 2025, with forecasts indicating it will reach $890.1 billion by 2029.

This company specializes in high-end safari experiences in secluded locations, placing it squarely in the luxury segment of this rapidly growing industry. Given its affiliation with The Friedkin Group's established luxury brand and the prevailing market dynamics, Legendary Expeditions is likely a star product with significant potential in its specialized niche.

The Friedkin Group's acquisition of AS Roma in 2020 marked a significant entry into the sports sector, further solidified by the recent formation of Pursuit Sports. This move suggests a strategic intent to cultivate and grow assets within the sports industry, including potentially high-growth areas like NHL franchises, indicating a focus beyond just the mature global football market.

AS Roma, with its substantial and passionate global fanbase, holds a strong market presence within the football club ecosystem. In the 2023-2024 season, AS Roma reported revenues of approximately €217 million, showcasing its commercial appeal and established position in a competitive market.

Pursuit Sports (New Sports Division)

The Friedkin Group's recent establishment of Pursuit Sports as a distinct division for its professional sports holdings, such as Everton FC and AS Roma, highlights a strategic focus on a rapidly expanding sector. This move consolidates their presence in a market experiencing substantial valuation growth for top-tier franchises.

The global sports industry is a significant growth engine, with major football clubs consistently seeing their valuations rise. For instance, in 2024, Forbes reported that the average value of a Premier League club reached $3.7 billion, a testament to the sector's financial appeal. Pursuit Sports is positioned to leverage this momentum, aiming to enhance market share and influence within this lucrative arena.

- Strategic Focus: Pursuit Sports consolidates The Friedkin Group's investments in high-potential sports franchises.

- Market Growth: The global sports industry, particularly professional football, continues to demonstrate robust valuation increases.

- Valuation Trends: Premier League clubs, for example, averaged $3.7 billion in value in 2024, underscoring the sector's financial strength.

- Future Positioning: This division is designed to drive growth and expand market influence for The Friedkin Group in sports ownership.

Certain Luxury Residential Offerings (Auberge)

Auberge Resorts Collection extends beyond hotels to include luxury residences and private clubs. This segment taps into the high-growth luxury real estate and fractional ownership market, especially for properties offering exclusive experiences. The demand for tangible assets among affluent travelers positions these Auberge offerings to capture a significant share in a niche that's benefiting from the broader luxury market expansion.

The luxury residential market, particularly fractional ownership, saw robust growth leading up to 2024. For instance, the global luxury real estate market was valued at over $300 billion in recent years, with fractional ownership representing a growing portion. Properties associated with strong hospitality brands like Auberge often command premium pricing and enjoy higher occupancy or sales rates compared to standalone developments.

- Market Growth: The luxury real estate sector, including fractional ownership, has demonstrated consistent year-over-year growth, with projections indicating continued expansion through 2025.

- Brand Association: Auberge's established reputation in luxury hospitality directly translates to increased desirability and pricing power for its residential offerings.

- Affluent Traveler Trends: A growing trend among high-net-worth individuals is the desire for experiential assets, which Auberge's integrated resort and residential model effectively addresses.

Stars in The Friedkin Group's BCG Matrix represent high-growth, high-market-share businesses. Auberge Resorts Collection and Legendary Expeditions fit this profile due to their strong performance in expanding luxury and adventure travel markets. Pursuit Sports, with its investments in valuable sports franchises, also aligns with the characteristics of a star.

These entities benefit from favorable market trends and The Friedkin Group's strategic focus on premium segments. Their established brand recognition and market presence, as evidenced by accolades and revenue figures, position them for continued growth and profitability.

The luxury hospitality sector, where Auberge operates, is projected for significant expansion, with market values expected to climb. Similarly, adventure tourism is experiencing a substantial CAGR, benefiting companies like Legendary Expeditions.

Pursuit Sports leverages the booming global sports industry, where top franchises consistently increase in value, indicating strong market share potential.

What is included in the product

Provides a strategic overview of The Friedkin Group's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Friedkin Group BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis.

Cash Cows

Gulf States Toyota, a major independent distributor for Toyota in the U.S., operates within a large but mature automotive market. Projections for new-vehicle sales in 2025 suggest a modest growth rate of 1.6% to 3%, signaling a stable, low-growth environment.

Given its dominant market share and essential function in Toyota's distribution network, Gulf States Toyota is positioned as a Cash Cow. Its established operations are expected to generate consistent, significant cash flow, requiring minimal capital for expansion within this mature market.

Westside Lexus and Northside Lexus, as integral parts of Gulf States Toyota, hold a commanding market share within their regional luxury automotive sectors. Despite a generally subdued automotive market, these dealerships thrive on Lexus's robust brand loyalty and premium positioning.

In 2024, the luxury automotive segment continued to demonstrate resilience. Lexus, for instance, reported strong sales figures, with the RX SUV remaining a consistent performer, contributing significantly to dealership revenue. This sustained demand allows these dealerships to operate as robust cash cows for The Friedkin Group.

Their high profitability stems from consistent cash flow generation, enabling them to support other business units within the group without needing substantial new investment for growth. This financial stability makes them a cornerstone of The Friedkin Group's diversified portfolio.

GSFSGroup, a key player in The Friedkin Group's automotive financial services sector, leverages its position within a mature market to generate consistent revenue. These ancillary services, including financing and insurance, are typically high-margin and stable, providing a reliable income stream.

With a significant distribution advantage through Gulf States Toyota's extensive network, GSFSGroup benefits from a captive customer base. This integration ensures predictable demand for its financial products, solidifying its strong market standing and consistent cash flow generation.

Established Golf Course Management (e.g., Diamond Creek, Congaree)

The Friedkin Group's ownership of established golf course management entities, such as Diamond Creek and Congaree, positions them firmly within the Cash Cow quadrant of the BCG Matrix. These properties represent mature assets in a market characterized by stable, albeit not explosive, growth.

While the broader golf industry sees shifts, the management of prestigious, high-end courses benefits from consistent demand and the ability to generate substantial, predictable revenue streams. This stability makes them ideal Cash Cows.

- Stable Revenue Generation: Established golf courses like Congaree Golf Club, known for its exclusive membership and significant capital investment, typically generate consistent fee income.

- Mature Market Dynamics: The market for high-end golf course management is mature, meaning growth is slow but predictable, characteristic of a Cash Cow.

- Investment Focus: Capital allocation for these assets is primarily directed towards maintenance, operational efficiency, and enhancing the member experience, rather than high-risk expansion initiatives.

- Brand Equity and Exclusivity: The strong brand reputation and exclusivity of clubs like Diamond Creek allow them to command premium pricing, ensuring sustained profitability.

US AutoLogistics (Automotive Logistics)

US AutoLogistics (USAL) operates within The Friedkin Group's automotive segment, specializing in logistics. In the automotive distribution landscape, efficient logistics are paramount, often characterized by high asset utilization.

USAL's role in supporting entities like Gulf States Toyota positions it within a mature, low-growth market for essential logistics services. This strategic placement allows USAL to generate consistent operational cash flow, a hallmark of a cash cow in a BCG matrix analysis.

- Market Position: USAL benefits from a strong market share in automotive logistics, a segment vital for efficient vehicle distribution.

- Growth Rate: The automotive logistics sector is generally considered to have low growth, typical for a cash cow.

- Cash Flow Generation: High utilization rates and steady demand contribute to reliable and substantial cash flow for USAL.

- Strategic Importance: By underpinning key distribution networks, USAL plays a critical role in the overall profitability and operational stability of The Friedkin Group's automotive interests.

These established businesses, like Gulf States Toyota and its associated dealerships, generate substantial and consistent profits with minimal need for further investment. Their strong market positions in mature sectors allow them to serve as reliable cash generators for The Friedkin Group.

The automotive distribution and luxury dealership segments, where Gulf States Toyota and its Lexus dealerships operate, are characterized by stable demand and established customer bases. For instance, Lexus sales in 2024 remained robust, with models like the RX continuing to be top performers, ensuring consistent revenue for these dealerships.

Similarly, GSFSGroup, providing financial services within the automotive sector, benefits from this stable demand, offering high-margin products with predictable income streams. The golf course management entities, such as Diamond Creek and Congaree, also fall into this category, providing steady revenue from their exclusive memberships and operations.

US AutoLogistics, crucial for the automotive supply chain, leverages high asset utilization in a low-growth logistics market to deliver consistent cash flow, supporting the group's broader automotive interests.

| Business Unit | Market | BCG Category | Key Financial Characteristic | 2024 Data Point |

|---|---|---|---|---|

| Gulf States Toyota | Automotive Distribution (US) | Cash Cow | Stable, high cash flow generation | Projected 1.6%-3% market growth for new vehicles in 2025 |

| Westside/Northside Lexus | Luxury Automotive Dealerships | Cash Cow | Consistent revenue from brand loyalty | Lexus RX SUV remains a strong sales performer |

| GSFSGroup | Automotive Financial Services | Cash Cow | Reliable income from financing/insurance | Benefits from captive customer base via Gulf States Toyota |

| Diamond Creek/Congaree Golf Clubs | High-End Golf Course Management | Cash Cow | Predictable revenue from premium services | Mature market with stable demand for exclusive memberships |

| US AutoLogistics (USAL) | Automotive Logistics | Cash Cow | Consistent cash flow from high asset utilization | Essential support for automotive distribution networks |

What You’re Viewing Is Included

The Friedkin Group BCG Matrix

The Friedkin Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready strategic tool designed for immediate application.

Dogs

Imperative Entertainment's smaller productions, often characterized by their project-based nature, can be classified as Dogs within The Friedkin Group's BCG Matrix. These ventures operate in a fiercely competitive entertainment landscape where success is far from guaranteed, leading to potential underperformance.

Projects that fail to resonate with audiences, evidenced by low box office returns or limited streaming viewership, represent these Dogs. For instance, a film that cost $20 million to produce and market but only grossed $5 million globally would be a prime example, exhibiting a low market share and minimal revenue generation.

Within The Friedkin Group's portfolio, legacy or niche golf course properties with declining interest represent potential 'Dogs' in a BCG-like analysis. These might be smaller clubs in less desirable locations or those catering to an aging demographic without modern upgrades. For instance, while the overall golf industry saw a resurgence in participation in the early 2020s, with rounds played in the US increasing significantly from 2019 levels, some older, less adaptable courses may not have benefited from this trend.

These types of assets often face stagnant or declining revenue due to reduced membership or visitor numbers, coupled with ongoing operational costs. In 2024, many golf courses are grappling with rising expenses for maintenance, staffing, and utilities, making it challenging for underperforming properties to remain profitable. Such holdings would likely require substantial investment to revitalize or would represent a drain on capital with little prospect for future growth.

The adventure travel market is booming, with projections indicating continued strong growth. However, if The Friedkin Group's adventure travel offerings aren't evolving to meet demand for unique, sustainable, and tech-forward experiences, they risk becoming outdated. For instance, a 2024 report from Grand View Research valued the global adventure tourism market at $1.4 trillion and expects it to grow significantly.

If specific adventure travel ventures within The Friedkin Group are not innovating or attracting new traveler demographics, they could see declining market share within their niches. This stagnation would hinder their ability to capitalize on the overall market expansion, potentially turning them into underperforming assets that consume resources without generating proportional returns.

Non-core, Stagnant Real Estate Holdings

Non-core, stagnant real estate holdings within The Friedkin Group would represent assets not directly contributing to its primary hospitality growth drivers. These could include undeveloped land parcels or underutilized commercial properties in markets experiencing minimal economic expansion. For instance, if a portion of their real estate portfolio is in a region where commercial property vacancy rates have hovered around 15% or higher in 2024, and rental growth is projected to be less than 2% annually, these holdings would fit this category.

- Low Market Share: These properties likely occupy a small niche within a mature or declining real estate sector.

- Low Growth Potential: Situated in markets with limited demand or economic activity, offering little prospect for capital appreciation.

- Capital Tie-up: These assets consume financial resources for maintenance and taxes without generating substantial income or strategic value.

- Risk of Obsolescence: Older or poorly located properties may face increasing difficulty in attracting tenants or buyers, further diminishing their value.

Certain Traditional Media Production Segments (Imperative Entertainment)

Within the vast entertainment landscape, certain traditional media production segments, especially those tied to older distribution methods or facing intense rivalry from streaming services, could be categorized as question marks or even dogs for Imperative Entertainment. These areas might exhibit low market growth and a limited share for the company. For instance, a studio heavily invested in producing broadcast television dramas without a strong digital strategy might fall into this category.

If Imperative Entertainment's strategic emphasis is on producing critically acclaimed, high-profile content, then smaller productions within these slower-growing, traditional niches that don't significantly boost the portfolio's overall performance could be considered dogs. These might be projects with limited audience reach or those that haven't garnered substantial critical or commercial success. For example, a niche documentary film with a small distribution footprint might fit this description.

Consider the impact of evolving consumer habits. In 2024, the global box office, while recovering, still faces challenges from the dominance of streaming platforms. Traditional TV advertising revenue also continues to see shifts. A production segment solely reliant on these, without adaptation, could represent a low-growth area.

- Limited Streaming Integration: Segments of traditional media production that have not effectively integrated with or pivoted towards digital streaming platforms may experience stagnant or declining growth.

- Declining Traditional Revenue Streams: Reliance on revenue models like broadcast syndication or physical media sales, which are seeing reduced consumer engagement in 2024, can place these segments in a low-growth category.

- High Production Costs, Low Return: Productions in these traditional segments that incur high costs but fail to achieve significant market share or critical acclaim can become underperforming assets.

- Intense Competition: Facing strong competition from digital-first content creators and established streaming giants can further marginalize traditional media production segments, pushing them towards a dog classification.

Imperative Entertainment's smaller, niche productions that struggle to gain traction in a crowded market represent 'Dogs' in The Friedkin Group's BCG Matrix. These ventures often have a low market share and minimal growth potential, such as a documentary film with limited distribution and viewership. For instance, a film costing $10 million to produce and market but only earning $2 million at the box office exemplifies this category.

Legacy golf course properties with declining membership and facing rising operational costs in 2024 also fall into the 'Dog' category. These assets, like older clubs in less desirable locations, generate stagnant revenue and require significant investment to revitalize. Many courses are grappling with increased expenses for maintenance and utilities, making profitability a challenge for underperforming properties.

Similarly, adventure travel offerings that fail to innovate or attract new demographics, despite a booming market, can become 'Dogs'. If The Friedkin Group's adventure travel ventures aren't adapting to demand for unique and sustainable experiences, they risk becoming outdated. The global adventure tourism market was valued at $1.4 trillion in 2024, but uninnovative offerings could see declining market share.

Question Marks

The Friedkin Group's reported exploration of acquiring new sports franchises, including a potential NHL team, places these ventures squarely in the question mark category of the BCG Matrix. This signifies a high-growth market where their initial market share would be low.

These acquisitions require significant capital outlay for the franchise itself, player development, and potentially new infrastructure like an arena, consuming substantial cash. For instance, the average NHL team valuation in 2024 reached approximately $1.35 billion, highlighting the immense financial commitment. The group's investment in a new NHL team would be a prime example of this cash drain.

While the potential for these ventures to become Stars is considerable, given the lucrative nature of successful sports franchises, their current unproven market position and high investment needs make them classic question marks. Their future success hinges on building a competitive team and capturing fan interest in a specific market, a process that is inherently uncertain and capital-intensive.

Imperative Entertainment's ventures into emerging digital entertainment, such as AR/VR experiences or innovative content platforms, would likely be classified as question marks in the BCG matrix. These areas represent high-growth potential within the evolving media landscape, driven by digital transformation and new monetization strategies.

While the overall digital entertainment market is expanding, Imperative's specific new initiatives would likely start with a low market share. For instance, the global augmented reality market was valued at approximately $30.7 billion in 2023 and is projected to reach $357.7 billion by 2030, indicating substantial growth but also intense competition for new entrants.

These question mark ventures would necessitate significant investment to build brand recognition, develop proprietary technology, and capture market share. Success hinges on the ability to adapt to rapidly changing consumer preferences and technological advancements, a common challenge in the dynamic digital entertainment sector.

Auberge Resorts Collection's expansion into new, untested luxury markets presents a classic "Question Mark" scenario within The Friedkin Group's BCG Matrix. These ventures demand significant upfront capital, with projections indicating that a single luxury resort development can easily exceed $100 million, and face the inherent risk of uncertain market reception and brand recognition in unfamiliar territories.

The success of these new developments hinges on achieving rapid market adoption and securing a substantial share within the nascent luxury segment. For instance, a recent report from STR in 2024 highlighted that emerging luxury destinations often experience slower initial occupancy rates compared to established markets, sometimes 15-20% lower in the first year of operation.

If these properties can overcome the initial hurdles of building brand awareness and attracting the target clientele, they possess the potential to transition into "Stars." This would involve achieving high occupancy, strong revenue per available room (RevPAR), and establishing a loyal customer base, thereby justifying the initial investment and paving the way for future growth.

Expansion into Niche Adventure Travel Segments

The adventure travel market is booming, with projections indicating continued strong growth. For The Friedkin Group's Legendary Expeditions, this presents an opportunity to expand into niche segments like extreme sports or deep cultural immersion tours. These ventures would likely start with a small market share but offer significant growth potential.

Entering these specialized areas requires substantial initial investment. This capital would be allocated to acquiring specialized gear, establishing complex logistical networks, and targeted marketing efforts to reach a specific customer base. Such investments position these new ventures as question marks within the BCG matrix, demanding careful resource allocation and strategic development.

- Market Growth: The global adventure tourism market was valued at approximately $1.4 trillion in 2023 and is forecast to reach over $2.2 trillion by 2030, growing at a CAGR of around 7.5%.

- Niche Potential: Specialized segments like heli-skiing or remote arctic expeditions cater to high-net-worth individuals willing to pay a premium for unique experiences.

- Investment Needs: Developing expertise and infrastructure for these niche tours can involve upfront costs in the millions for specialized vehicles, safety equipment, and highly trained guides.

- Strategic Focus: The Friedkin Group would need to carefully assess the return on investment for each niche, balancing the high growth potential against the significant initial capital outlay and market development required.

Technologically Advanced Golf Experiences (e.g., Simulators, Virtual Golf)

Technologically advanced golf experiences, such as simulators and virtual golf, represent a burgeoning segment within the golf industry. These innovations are particularly appealing to younger golfers and those seeking more social and time-efficient ways to play. The Friedkin Group's ventures in this area, if pursued with significant investment in new facilities or technology integration, would likely be classified as Question Marks in a BCG Matrix.

These ventures are positioned in a high-growth market, reflecting the increasing demand for tech-infused entertainment. However, they require substantial capital to establish and scale, and their future success hinges on the ability to quickly capture market share. For example, the global golf simulator market was valued at approximately $1.1 billion in 2023 and is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 8% through 2030.

- High Growth Potential: The increasing adoption of technology in sports, particularly among millennials and Gen Z, fuels rapid expansion in virtual golf.

- Market Uncertainty: Despite growth, the segment is competitive, with established players and new entrants vying for dominance, making market share acquisition critical.

- Investment Needs: Significant capital is required for developing or acquiring advanced simulator technology and prime real estate for new facilities.

- Strategic Focus: Success depends on differentiating offerings, building brand loyalty, and adapting to evolving consumer preferences in the entertainment and sports sectors.

The Friedkin Group's ventures into new sports franchises, like the potential NHL team, and Imperative Entertainment's exploration of emerging digital entertainment platforms, such as AR/VR, are classic Question Marks. These represent high-growth markets with low initial market share, demanding substantial capital investment. For example, the average NHL team valuation in 2024 was around $1.35 billion, and the global AR market was valued at $30.7 billion in 2023, highlighting the significant financial commitment required for these uncertain but potentially high-reward endeavors.

| Venture Area | BCG Category | Market Growth | Initial Market Share | Capital Requirement | Key Challenge |

| New NHL Franchise | Question Mark | High (Sports Entertainment) | Low | Very High (e.g., $1.35B avg. valuation in 2024) | Building competitive team, fan engagement |

| Imperative Entertainment (AR/VR) | Question Mark | Very High (Global AR market $30.7B in 2023, projected $357.7B by 2030) | Low | High (Technology development, market penetration) | Adapting to rapid tech changes, competition |

| Auberge Resorts (New Luxury Markets) | Question Mark | High (Emerging luxury destinations) | Low | High (>$100M per resort development) | Market reception, brand recognition |

| Legendary Expeditions (Niche Adventure Travel) | Question Mark | High (Global adventure tourism market $1.4T in 2023) | Low | High (Specialized gear, logistics) | Developing expertise, niche marketing |

| Technologically Advanced Golf | Question Mark | High (Golf simulator market $1.1B in 2023, CAGR >8%) | Low | High (Simulator tech, real estate) | Differentiation, brand loyalty |

BCG Matrix Data Sources

Our Friedkin Group BCG Matrix is constructed using a blend of financial statements, market research reports, and internal performance data to provide a comprehensive view of business unit standing.