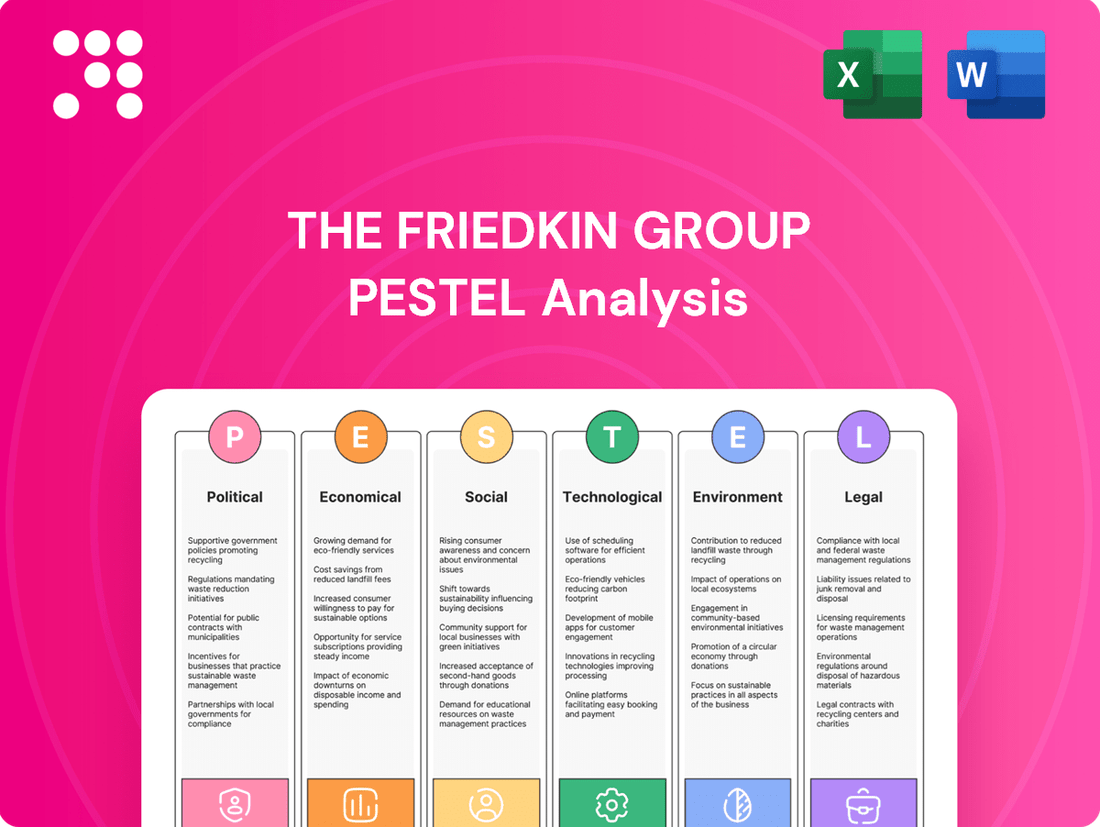

The Friedkin Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

The Friedkin Group operates in a dynamic global landscape, influenced by a complex interplay of political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for any stakeholder looking to anticipate challenges and capitalize on opportunities within their diverse portfolio. Our meticulously researched PESTLE analysis delves into these critical factors, offering actionable intelligence.

Gain a strategic advantage by uncovering how technological advancements, environmental regulations, and legal frameworks are shaping The Friedkin Group's future. This comprehensive PESTLE analysis is your key to informed decision-making, whether you're an investor, consultant, or business strategist. Download the full version now to unlock a deeper understanding and refine your market approach.

Political factors

The Friedkin Group's diverse operations, especially its significant presence in the automotive sector through Gulf States Toyota, are highly susceptible to global political shifts. Changes in international trade policies and geopolitical stability can directly influence import/export costs and market access.

For instance, potential tariffs or renegotiated trade agreements, particularly those stemming from shifts in major economies like the United States, could significantly affect the cost and availability of vehicles and parts. In 2023, the US imported over 8 million vehicles, highlighting the scale of these trade flows.

These policy shifts directly impact Gulf States Toyota's distribution network across its five-state territory, influencing operational expenses and ultimately, profitability. A 10% tariff on imported vehicles, for example, could add hundreds of dollars to the price of a single car, impacting sales volume.

The Friedkin Group navigates a landscape shaped by diverse government regulations across its operating sectors. Environmental standards in automotive manufacturing, such as emissions controls and fuel efficiency mandates, directly impact vehicle design and production costs. For example, in 2024, the US Environmental Protection Agency (EPA) proposed stricter tailpipe emission standards for vehicles, aiming for a significant reduction in pollutants by 2032.

In the entertainment sector, content regulations and intellectual property laws dictate production and distribution. The rise of streaming services has brought increased scrutiny regarding content moderation and data privacy, with ongoing discussions in 2025 about potential new regulatory frameworks for digital platforms.

The luxury hospitality segment requires adherence to stringent licensing, safety, and labor regulations. In 2024, many regions saw updates to health and safety protocols in hospitality, influencing operational procedures and guest experience. Compliance with these evolving rules is paramount for maintaining brand reputation and ensuring smooth business operations.

A stable political environment is crucial for fostering consumer confidence, which directly influences discretionary spending in sectors like luxury hospitality and entertainment. For instance, in 2024, consumer confidence indices in developed economies have shown resilience, with the Conference Board Consumer Confidence Index hovering around 100, indicating a general willingness to spend on non-essential goods and services.

Conversely, political uncertainty, such as upcoming elections or unexpected shifts in economic policy, can significantly dampen consumer enthusiasm. This uncertainty can lead to a pullback in high-value purchases, impacting companies like The Friedkin Group, which deal in luxury vehicles and premium travel experiences. For example, a sudden increase in import tariffs or changes to travel regulations could directly affect demand.

Local and Regional Development Policies

The Friedkin Group's expansion, particularly through its Auberge Resorts Collection, is significantly shaped by local and regional development policies. For instance, new properties planned in Houston, Florence, and London must navigate diverse zoning regulations and urban planning frameworks. These policies directly impact project timelines and feasibility.

Favorable local government support, often manifested through development incentives like tax breaks or expedited permitting processes, can substantially boost the economic viability of luxury hospitality projects. Conversely, restrictive policies can introduce delays and increase development costs.

- Houston: Development incentives in Houston, such as property tax abatements for new construction or infrastructure improvements, can reduce initial investment burdens for projects like the planned Auberge resort.

- Florence: Florence's historic preservation laws and urban planning regulations are critical considerations, potentially influencing design, scale, and the pace of development for any new Auberge property.

- London: London's planning system, with its emphasis on community consultation and environmental impact assessments, requires developers to align closely with local authority objectives to secure approvals for new ventures.

Influence of Sports Governance and Ownership

The Friedkin Group’s significant investments in football clubs, such as AS Roma and Everton, place them directly under the purview of stringent sports governance. This means adhering to regulations set by bodies like UEFA and the Premier League, impacting everything from player transfers to club finances. For instance, UEFA's Financial Fair Play (FFP) rules, which aim to prevent clubs from spending more than they earn, directly shape how these clubs can operate and invest in new talent. In the 2023-2024 season, AS Roma, under Friedkin's ownership, navigated these FFP constraints, influencing their transfer market activity.

These regulations extend to transfer windows and player registration, creating a complex legal and operational framework. The group must ensure compliance with salary caps, squad registration limits, and rules regarding the sale and purchase of players. For example, the Premier League's Profit and Sustainability Rules (PSR) are a critical consideration for Everton, as seen in their past breaches and subsequent points deductions, highlighting the direct financial and operational consequences of non-compliance.

- Financial Fair Play (FFP): UEFA's FFP regulations limit club spending relative to revenue, impacting investment capacity.

- Transfer Regulations: Rules governing player transfers, including fees, contracts, and international movements, must be strictly followed.

- League-Specific Governance: Each league, like Serie A for AS Roma and the Premier League for Everton, has unique rules on ownership, operations, and financial reporting.

- Compliance Impact: Non-compliance can lead to significant penalties, including fines, transfer bans, and points deductions, as demonstrated by Everton's recent PSR issues.

Political stability directly impacts The Friedkin Group's global operations, influencing trade policies and market access, especially for its automotive ventures like Gulf States Toyota. For instance, shifts in US trade policy in 2024 could affect the millions of vehicles imported annually, impacting costs and supply chains.

Government regulations across various sectors, from automotive emissions standards proposed by the EPA in 2024 to content laws for entertainment, necessitate continuous adaptation. The group must also navigate complex local development policies for its hospitality expansion, as seen with its Auberge Resorts Collection projects in 2024-2025.

The Friedkin Group's football investments are heavily regulated by sports governing bodies like UEFA and the Premier League, with rules such as Financial Fair Play (FFP) and Profit and Sustainability Rules (PSR) significantly influencing club finances and operations, as demonstrated by Everton's challenges in the 2023-2024 season.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting The Friedkin Group, offering a comprehensive understanding of its external operating landscape.

It provides actionable insights for strategic decision-making, identifying potential threats and opportunities arising from these macro-environmental factors.

A PESTLE analysis for The Friedkin Group offers a structured approach to identifying and mitigating external challenges, thereby easing the burden of navigating complex market dynamics.

This analysis serves as a readily digestible summary, simplifying the understanding of macro-environmental factors that could impact The Friedkin Group's strategic decisions.

Economic factors

The Friedkin Group's performance, particularly in luxury hospitality and adventure travel, is closely tied to global economic health. A strong global economy generally means consumers have more disposable income, which directly benefits sectors reliant on discretionary spending. For instance, the luxury hospitality market is anticipated to expand considerably, with projections indicating growth through 2029, underscoring the importance of robust consumer spending for The Friedkin Group.

Persistent inflation, with the US experiencing a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, directly impacts The Friedkin Group's operational costs. This rise in the cost of goods and services, from raw materials for automotive parts to energy for resorts, squeezes profit margins across its diverse portfolio.

Simultaneously, elevated interest rates, with the Federal Reserve maintaining its target range at 5.25%-5.50% as of May 2024, amplify borrowing expenses for capital-intensive ventures like new resort development or entertainment production facilities. This makes financing future growth initiatives more expensive, potentially delaying or scaling back expansion plans.

These economic headwinds also significantly influence consumer behavior. Higher inflation erodes disposable income, potentially dampening demand for luxury goods and services offered by The Friedkin Group's automotive and hospitality segments, while higher borrowing costs can also reduce consumer spending on big-ticket items.

The automotive distribution sector, exemplified by Gulf States Toyota, continues to grapple with lingering supply chain vulnerabilities, especially concerning semiconductor availability. While the situation has shown some improvement through 2024, persistent shortages of critical components can still cause production slowdowns and higher operating expenses.

These ongoing disruptions directly translate into longer customer wait times for new vehicles, potentially dampening sales volumes and impacting overall profitability for distributors. For instance, in early 2024, some manufacturers reported production cuts of up to 10-15% due to chip scarcity, a trend that trickled down to dealer inventory levels.

Currency Exchange Rates

Currency exchange rates present a significant economic factor for The Friedkin Group, especially given its diverse international holdings. Fluctuations can directly affect the value of revenue generated abroad and the cost of overseas investments. For instance, with AS Roma operating in Italy and new Auberge Resorts properties expanding in Europe, the performance of the Euro against the US Dollar is critical.

A stronger US Dollar, while making international acquisitions more cost-effective initially, can diminish the reported value of foreign earnings when they are converted back into dollars. Conversely, a weaker dollar can boost the translated value of those foreign profits.

- Impact on Revenue: In 2024, the Euro to US Dollar exchange rate has seen volatility, with periods where it hovered around 1.07 USD per EUR. This means that revenue generated by AS Roma or European Auberge Resorts might translate to fewer dollars if the dollar strengthens.

- Acquisition Costs: If The Friedkin Group plans further European expansion in 2025, a favorable exchange rate could reduce the effective purchase price of new assets.

- Profit Translation: For example, if AS Roma generated €100 million in revenue in 2024 and the average exchange rate was 1.08 USD/EUR, that would translate to $108 million. If the average rate for 2025 shifts to 1.05 USD/EUR, that same €100 million would only be $105 million, a $3 million reduction in translated profit.

Investment Climate for Private Consortia

The investment climate for private consortia like The Friedkin Group is shaped by evolving private equity and capital market dynamics. Despite a general slowdown in fundraising for the lower mid-market, opportunistic strategies remain viable.

The Friedkin Group's launch of Copilot Capital, specifically targeting European software companies, exemplifies this. This move highlights a strategic deployment of capital into identified market inefficiencies, even when overall fundraising conditions are less favorable.

In 2024, the European private equity market saw significant deal activity, though valuations and exit multiples faced pressure. For instance, PitchBook data indicated a slowdown in new fund commitments in the first half of 2024 compared to the previous year, yet specialized funds continued to attract capital.

- European software M&A: Deal volume in European software M&A remained robust in early 2024, with a particular focus on SaaS and cybersecurity sectors.

- Fundraising environment: While overall fundraising faced headwinds, specialized funds with clear sector focuses, like Copilot Capital's European software mandate, found traction.

- Valuation adjustments: Investors were recalibrating expectations, leading to more realistic valuation multiples compared to the peak of 2021-2022.

Global economic growth remains a primary driver for The Friedkin Group's luxury hospitality and adventure travel segments, as increased disposable income fuels demand for discretionary spending. However, persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, and elevated interest rates, with the Federal Reserve's target range at 5.25%-5.50% as of May 2024, are increasing operational costs and borrowing expenses, potentially impacting expansion plans and consumer spending.

Supply chain disruptions, particularly in automotive semiconductors, continue to affect distributors like Gulf States Toyota, leading to production slowdowns and longer customer wait times through 2024, with some manufacturers experiencing production cuts of 10-15% due to chip scarcity.

Currency exchange rates, such as the Euro to US Dollar volatility seen in 2024 with rates around 1.07 USD per EUR, directly influence the value of international revenue and acquisition costs for The Friedkin Group's European assets like AS Roma and Auberge Resorts.

The investment climate for private consortia is evolving, with specialized funds like Copilot Capital finding traction in European software M&A despite overall fundraising headwinds, as investors recalibrate valuations in 2024.

| Economic Factor | 2024/2025 Data Point | Impact on The Friedkin Group |

|---|---|---|

| Global Economic Growth | Projected expansion in luxury hospitality through 2029 | Increased consumer spending supports hospitality and adventure travel. |

| Inflation (US CPI) | 3.4% year-over-year (April 2024) | Increases operational costs across diverse portfolio segments. |

| Interest Rates (Federal Reserve) | 5.25%-5.50% target range (May 2024) | Raises borrowing costs for capital-intensive projects, potentially delaying growth. |

| Automotive Supply Chain | Lingering semiconductor shortages impacting production | Causes production slowdowns and longer customer wait times for new vehicles. |

| Currency Exchange (EUR/USD) | Volatile, around 1.07 USD per EUR in 2024 | Affects value of foreign revenue and cost of international investments. |

Preview Before You Purchase

The Friedkin Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Friedkin Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the external forces shaping the future of this diverse conglomerate.

Sociological factors

Consumers in the luxury travel market are shifting from a focus on pure opulence to a desire for unique, authentic, and deeply personalized experiences. This evolution is evident in the growing demand for wellness retreats, immersive cultural encounters, and flexible, spontaneous travel arrangements.

For instance, the global wellness tourism market was projected to reach $1.5 trillion in 2022 and is expected to grow significantly, highlighting the strong consumer pull towards health-conscious and restorative travel. This trend directly influences how luxury hospitality brands like Auberge Resorts Collection must adapt their service models.

In response, Auberge Resorts Collection is innovating by developing bespoke itineraries that emphasize local connections and authentic experiences, moving beyond standard luxury offerings to cater to these evolving preferences.

The entertainment industry is rapidly evolving, with consumers increasingly favoring on-demand streaming services over traditional media. In 2024, global streaming revenue is projected to reach over $200 billion, underscoring this significant shift.

This trend necessitates that companies like Imperative Entertainment embrace personalized content delivery, potentially utilizing AI to tailor viewing experiences. Furthermore, exploring innovative distribution channels beyond traditional theatrical releases is crucial to capture a wider audience in this dynamic market.

Consumers and society at large increasingly expect businesses to prioritize environmental, social, and governance (ESG) principles. This trend significantly influences purchasing decisions, with a growing number of consumers actively seeking out brands that align with their values. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor when making purchasing choices.

This demand for sustainability and ethical operations permeates all of The Friedkin Group's diverse business segments. In hospitality, this translates to a preference for eco-friendly building materials and sustainable operational practices in luxury resorts. The automotive distribution sector faces pressure to adopt greener logistics and vehicle lifecycle management, while the entertainment division is scrutinized for responsible content creation and production methods.

Workforce Demographics and Talent Acquisition

The Friedkin Group faces the challenge of aligning its talent strategy with shifting workforce demographics. For instance, the automotive sector, a key area for the group, saw a significant portion of its skilled tradespeople approaching retirement age in recent years, creating a need for proactive recruitment and training initiatives. In 2024, the demand for specialized automotive technicians is projected to remain high, with industry reports indicating a persistent shortage.

Attracting and retaining talent across The Friedkin Group's varied sectors, from hospitality to media, requires adapting to new employee expectations. Younger generations, in particular, prioritize work-life balance, flexible arrangements, and a strong sense of company purpose. Surveys from 2024 suggest that companies offering robust well-being programs and demonstrating a commitment to diversity and inclusion are more successful in attracting top candidates.

- Workforce Aging: In 2023, the average age of workers in skilled trades, critical for automotive operations, continued to rise, necessitating robust apprenticeship programs.

- Demand for Flexibility: By mid-2024, job postings emphasizing remote or hybrid work options saw a 25% higher engagement rate compared to traditional on-site roles across various industries.

- Inclusivity as a Driver: Companies with demonstrably inclusive cultures reported a 15% lower employee turnover rate in early 2025, according to recent HR analytics.

- Skills Gap in Creative Fields: The burgeoning digital media and entertainment sectors, relevant to Friedkin's creative ventures, face ongoing challenges in finding talent proficient in emerging technologies.

Influence of Social Media and Digital Reputation

Social media is a powerful force in shaping how people see brands and what they decide to buy, impacting every industry. For The Friedkin Group, whose businesses like Auberge Resorts Collection and Imperative Entertainment rely heavily on public image, maintaining a strong online presence is crucial. In 2024, studies showed that over 60% of consumers reported that social media influenced their purchasing decisions, highlighting the direct impact on revenue for companies like those within The Friedkin Group's portfolio.

Actively managing digital reputation and engaging customers on platforms like Instagram and X (formerly Twitter) is essential for The Friedkin Group's brands to thrive. For instance, Auberge Resorts Collection can leverage user-generated content and influencer collaborations to showcase their luxury experiences, a strategy that saw a 15% increase in bookings for similar high-end travel brands in 2024. Imperative Entertainment can utilize social media for buzz generation around film releases, tapping into the 70% of moviegoers who report discovering films through online channels.

- Brand Perception: Social media directly shapes how consumers view The Friedkin Group's diverse brands, influencing trust and loyalty.

- Consumer Influence: A significant portion of consumers, estimated at over 60% in 2024, report social media as a key factor in their buying choices.

- Marketing & Engagement: Leveraging platforms like Instagram and X allows for direct customer interaction and targeted marketing campaigns, crucial for driving engagement and bookings/viewership.

- Digital Reputation Management: Proactive management of online reviews and social media conversations is vital to mitigate negative sentiment and enhance brand image.

Societal expectations are increasingly dictating business practices, pushing companies towards greater social responsibility and ethical conduct. This shift is evident in consumer preferences, with a growing number, estimated at over 60% in 2024, prioritizing brands that align with their values, impacting purchasing decisions across all sectors.

The Friedkin Group's diverse portfolio, from luxury hospitality to automotive distribution, must navigate these evolving societal norms. This includes adopting sustainable practices in resorts and ensuring ethical sourcing and production in entertainment, reflecting a broader societal demand for corporate accountability.

Furthermore, the composition of the workforce is changing, with younger generations prioritizing work-life balance and company purpose. By mid-2024, job postings highlighting flexible work arrangements saw a 25% higher engagement rate, indicating a critical need for The Friedkin Group to adapt its talent acquisition and retention strategies to meet these new expectations.

Technological factors

The automotive distribution landscape is undergoing a profound digital transformation, compelling companies like Gulf States Toyota to adapt swiftly. Embracing digital innovation is no longer optional but essential for meeting evolving customer expectations and optimizing operational efficiency.

Leveraging data analytics is key to understanding and anticipating customer preferences, allowing for more personalized marketing and sales approaches. For instance, data-driven insights can help predict demand for specific models or features, informing inventory and marketing strategies throughout 2024 and into 2025.

Enhancing online vehicle sales processes, from initial browsing to financing and purchase, is critical. By 2025, a significant portion of car buyers are expected to complete a substantial part of their purchase journey online, necessitating robust digital platforms and seamless virtual experiences.

Integrating new technologies for supply chain efficiency and inventory management is also paramount. This includes advanced tracking systems and predictive analytics to minimize stockouts and reduce carrying costs, contributing to a more agile and responsive distribution network.

Technological factors are rapidly reshaping entertainment production and distribution, with AI, generative AI, and immersive technologies like VR/AR becoming increasingly influential. The global AI in media and entertainment market was valued at approximately $3.5 billion in 2023 and is projected to reach $15.2 billion by 2028, showcasing significant growth.

Imperative Entertainment can strategically integrate these advancements to enhance its operations. For instance, AI can be employed for sophisticated script analysis to identify promising narratives and predict audience reception, potentially improving project selection. Generative AI offers opportunities for novel content creation, from concept art to preliminary script drafts, streamlining early-stage development.

Furthermore, these technologies can personalize viewer recommendations, increasing engagement and retention on distribution platforms. Efficient post-production workflows, such as AI-powered editing and visual effects, can reduce costs and accelerate delivery timelines. Adapting to emerging distribution channels, including VR/AR experiences and interactive streaming, will be crucial for maintaining a competitive edge in this evolving landscape.

AI and automation are transforming luxury hospitality, allowing brands like Auberge Resorts Collection to elevate guest experiences and streamline operations. By leveraging AI for hyper-personalization, predictive maintenance, and advanced guest profiling, the group can anticipate needs and tailor services, boosting satisfaction. This technological integration also optimizes everything from booking systems to in-stay requests, driving significant operational efficiencies.

Cybersecurity and Data Privacy

The Friedkin Group's operations, deeply intertwined with digital platforms and customer data, face significant technological challenges in cybersecurity and data privacy. As businesses increasingly leverage online channels, safeguarding sensitive information against evolving cyber threats is crucial. This necessitates substantial investment in advanced security protocols and continuous monitoring to prevent breaches.

Compliance with a growing landscape of data privacy regulations, such as GDPR and CCPA, is non-negotiable. Failure to adhere to these standards can result in severe financial penalties and reputational damage. For instance, in 2023, data privacy fines globally exceeded $3.2 billion, highlighting the financial risks involved.

Maintaining customer trust hinges on the group's ability to demonstrate robust data protection practices. This trust is a key differentiator in competitive markets, influencing customer loyalty and brand perception. The Friedkin Group's commitment to cybersecurity directly impacts its ability to operate effectively and ethically across all its diverse business units.

- Cybersecurity Investment: Global spending on cybersecurity solutions is projected to reach $269 billion in 2024, indicating the escalating importance and cost of digital defense.

- Data Breach Costs: The average cost of a data breach in 2023 was $4.45 million, a significant figure that underscores the financial impact of security failures.

- Regulatory Fines: Non-compliance with regulations like GDPR can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- Customer Trust Metrics: Studies show that over 70% of consumers are less likely to do business with a company that has experienced a data breach.

Innovation in Sports Technology and Fan Engagement

The Friedkin Group can leverage technological advancements to deepen fan connections and boost team capabilities. For instance, sophisticated data analytics, a key area of innovation, can refine player scouting and tactical planning. In 2024, the global sports analytics market was valued at approximately $2.4 billion, with projections indicating significant growth.

Virtual reality (VR) offers a pathway to create truly immersive fan experiences, allowing supporters to feel closer to the action. The VR market is expected to reach $88.4 billion by 2028, showcasing its expanding reach and potential for sports applications.

Furthermore, digital platforms are crucial for expanding merchandise sales and distributing engaging content. The global e-commerce market for sports merchandise alone is substantial, with projections suggesting it will continue its upward trajectory through 2025 and beyond.

- Data Analytics: Enhancing player performance and strategic decision-making through advanced metrics.

- Virtual Reality: Creating immersive fan experiences, from virtual stadium tours to interactive game viewing.

- Digital Platforms: Optimizing merchandise sales and content delivery to a global audience.

- Fan Engagement: Utilizing technology to foster stronger connections between clubs and their supporters.

Technological advancements are fundamentally altering how The Friedkin Group operates across its diverse sectors. In automotive distribution, digital platforms and data analytics are becoming essential for customer engagement and operational efficiency, with online car purchasing expected to grow significantly by 2025.

In entertainment, AI and generative AI are revolutionizing content creation and distribution, with the AI in media and entertainment market projected to reach $15.2 billion by 2028. Similarly, luxury hospitality is leveraging AI for hyper-personalization and operational streamlining, enhancing guest experiences.

The group must prioritize cybersecurity and data privacy, especially as global cybersecurity spending is anticipated to hit $269 billion in 2024, and the average cost of a data breach reached $4.45 million in 2023. Compliance with regulations like GDPR, which can impose fines up to 4% of global annual revenue, is critical for maintaining customer trust.

In sports, data analytics and VR are key to improving team performance and fan engagement, with the sports analytics market valued at approximately $2.4 billion in 2024. VR adoption is also expanding, with the VR market expected to reach $88.4 billion by 2028.

Legal factors

Gulf States Toyota navigates a complex web of automotive regulations, including stringent safety standards and evolving emissions controls. For instance, the US Environmental Protection Agency (EPA) continues to tighten Corporate Average Fuel Economy (CAFE) standards, pushing manufacturers towards more fuel-efficient and lower-emission vehicles. These regulatory shifts necessitate significant investment in research and development for new powertrain technologies and compliance measures.

Imperative Entertainment, a key player in the entertainment sector, must meticulously adhere to intellectual property laws. These regulations govern copyright, licensing, and distribution for film, television, and digital content, safeguarding their creative works and revenue generation.

In 2024, the global digital content creation market is projected to reach over $300 billion, underscoring the immense value and legal complexities surrounding intellectual property in this space. For Imperative, understanding and enforcing these rights is paramount to protecting their investments and ensuring fair compensation for their productions.

The Friedkin Group's global operations, spanning 12 countries and employing over 11,600 individuals, necessitate strict adherence to a complex web of labor laws. These regulations cover everything from minimum wage requirements and working hour limits to employee safety standards and the right to collective bargaining, directly influencing HR policies and overall operational expenses.

Navigating these diverse legal landscapes is crucial for maintaining ethical labor practices and avoiding costly penalties. For instance, in 2024, the International Labour Organization reported that compliance with evolving labor standards remains a significant challenge for multinational corporations, with non-compliance often leading to substantial fines and reputational damage.

Data Privacy and Consumer Protection Legislation

The Friedkin Group's diverse operations, especially in hospitality and automotive, mean they manage substantial customer data. This necessitates strict compliance with global data privacy regulations such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Failure to comply can result in significant fines; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining customer trust is paramount, and robust data protection measures are key to this.

Beyond privacy, broader consumer protection laws also impact The Friedkin Group. These regulations ensure fair practices in advertising, sales, and service delivery across all their business segments. For example, in 2024, the U.S. Federal Trade Commission (FTC) continued to enforce rules against deceptive or unfair business practices, with significant penalties for non-compliance. The group must navigate these evolving legal landscapes to safeguard its reputation and operational integrity.

- Data Handling: All Friedkin Group businesses, including hospitality and automotive, process significant customer data.

- Regulatory Landscape: Compliance with GDPR, CCPA, and other consumer protection laws is critical.

- Financial Risk: Non-compliance can lead to substantial fines, with GDPR penalties reaching up to 4% of global annual revenue.

- Customer Trust: Adherence to these regulations is vital for maintaining consumer confidence and brand reputation.

International Business and Investment Laws

The Friedkin Group's increasing international footprint, marked by significant investments like Copilot Capital's venture into European software and the acquisition of sports clubs such as AS Roma and CSKA Sofia, directly engages with a complex web of international business and investment laws. Navigating these regulations is paramount for sustained growth and operational integrity.

Compliance with anti-trust regulations across different markets is a critical legal factor, especially as the group expands its portfolio and market presence. For instance, the European Union's stringent merger control regulations and similar frameworks in other key investment regions require careful scrutiny of any acquisitions to prevent monopolistic practices.

Foreign ownership rules also present a significant legal hurdle. Many countries impose limitations on the percentage of ownership foreign entities can hold in domestic companies, particularly in sensitive sectors or strategic industries. Understanding and adhering to these specific national laws is essential for The Friedkin Group's international investment strategy.

- International Investment Treaties: The Friedkin Group must consider bilateral and multilateral investment treaties that govern cross-border investments, offering protections and outlining dispute resolution mechanisms.

- Anti-Trust Compliance: Acquisitions and market entries are subject to review by competition authorities globally; for example, the European Commission's Directorate-General for Competition scrutinizes mergers and acquisitions exceeding certain turnover thresholds.

- Foreign Direct Investment (FDI) Regulations: Many nations have specific laws detailing permissible foreign ownership levels, screening processes for FDI, and restrictions in sectors deemed of national importance.

- Intellectual Property Rights: Protecting software innovations and brand assets acquired internationally requires adherence to diverse IP laws and international agreements like the TRIPS Agreement.

The Friedkin Group operates under a complex framework of global legal and regulatory requirements that significantly impact its diverse business units. Compliance with evolving environmental standards, such as stricter emissions targets for automotive operations, necessitates ongoing investment in sustainable technologies and practices. Similarly, adherence to intellectual property laws is crucial for protecting valuable content and revenue streams within the entertainment sector, especially given the industry's rapid digital transformation.

Labor laws across the 12 countries where The Friedkin Group has a presence, affecting over 11,600 employees, require careful management of minimum wage, working hours, and safety standards. The group must also navigate stringent data privacy regulations like GDPR and CCPA, with non-compliance potentially leading to substantial financial penalties, such as up to 4% of global annual revenue for GDPR violations. Furthermore, international expansion and investments are governed by anti-trust laws and foreign ownership restrictions, demanding meticulous attention to global competition and investment frameworks.

| Legal Factor | Impact on The Friedkin Group | Key Regulations/Examples | Potential Financial/Operational Consequence | 2024/2025 Relevance |

| Environmental Regulations | Automotive operations must meet evolving fuel economy and emissions standards. | US EPA CAFE standards, global emissions targets. | Increased R&D costs, potential fines for non-compliance. | Continued push for electrification and emissions reduction. |

| Intellectual Property Law | Protection of film, TV, and digital content is vital for revenue. | Copyright, licensing, distribution laws; TRIPS Agreement. | Loss of revenue, legal disputes over content ownership. | Growth in digital content market ($300B+ projected for 2024) amplifies IP importance. |

| Labor Laws | Ensuring fair wages, working hours, and safety across global workforce. | Minimum wage laws, working hour limits, employee safety standards. | Increased HR costs, risk of fines and reputational damage. | ILO reports ongoing compliance challenges for multinationals. |

| Data Privacy | Secure handling of customer data in hospitality and automotive sectors. | GDPR, CCPA, other regional data protection laws. | Fines up to 4% of global revenue (GDPR), loss of customer trust. | Heightened consumer awareness and regulatory enforcement. |

| International Business Law | Navigating foreign ownership rules and anti-trust regulations. | EU merger control, FDI regulations, bilateral investment treaties. | Deal blockages, penalties for anti-competitive practices. | Increased global M&A activity requires robust legal due diligence. |

Environmental factors

The Friedkin Group's luxury hospitality ventures, particularly those situated in vulnerable coastal zones or ecologically sensitive regions, face tangible risks from climate change. These risks include the potential for damage from rising sea levels and more frequent, intense extreme weather events, impacting infrastructure and guest experiences.

Adapting to these environmental shifts requires significant investment in resilient infrastructure and forward-thinking operational strategies. For instance, properties in areas prone to storm surges might need elevated structures or advanced flood defenses, adding to capital expenditure and ongoing maintenance costs.

While specific financial impacts for The Friedkin Group's properties are not publicly detailed, the global hospitality industry saw an estimated $200 billion in losses due to extreme weather events between 2015 and 2020, highlighting the broader economic exposure to climate-related disruptions.

The Friedkin Group faces increasing pressure from consumers and investors to embrace sustainability. This translates into a need to integrate eco-friendly practices throughout its diverse operations, from hospitality to automotive. For instance, in 2024, the global sustainable tourism market was projected to reach over $1.5 trillion, highlighting a significant market shift.

The Friedkin Group's golf course management and luxury hospitality sectors face significant environmental challenges, particularly concerning resource scarcity and water management. In 2024, many regions experienced heightened water stress, impacting the operational viability of large-scale water consumers like golf courses. For instance, California, a key market for luxury hospitality, saw its reservoirs operating at below-average levels, underscoring the need for proactive water conservation.

Efficient water management is therefore not just a sustainability goal but a critical factor for operational resilience and cost control. Implementing advanced smart irrigation systems, which can reduce water usage by up to 30% according to industry reports, is essential. By adopting water conservation practices, The Friedkin Group can mitigate the financial risks associated with rising water costs and potential regulatory restrictions, ensuring the long-term success of its hospitality ventures.

Emissions and Pollution Regulations in Automotive

Gulf States Toyota faces growing pressure from stricter environmental regulations on vehicle emissions and pollution. These rules are pushing the industry towards greater fuel efficiency and the adoption of electric vehicles (EVs), directly impacting the product mix Gulf States Toyota distributes. For instance, by 2025, the US Environmental Protection Agency (EPA) aims for fleet-wide average fuel economy standards that are becoming increasingly stringent, requiring manufacturers to invest heavily in cleaner technologies.

This regulatory landscape necessitates significant investment in compliance and influences distribution strategies. The push for EVs, driven by regulations like California's Advanced Clean Cars II rule, which mandates a transition to zero-emission vehicles, means Gulf States Toyota must adapt its inventory and sales approach. This shift also brings associated compliance costs, from meeting new testing protocols to potentially investing in charging infrastructure support.

- Stricter Emissions Standards: Regulations like the EPA's Corporate Average Fuel Economy (CAFE) standards continue to tighten, pushing for lower greenhouse gas emissions.

- EV Mandates: Several states, following California's lead, are implementing mandates for increasing percentages of zero-emission vehicle sales by specific future dates, such as 2035.

- Compliance Costs: Meeting these evolving standards involves R&D investment by manufacturers, which can translate to higher vehicle prices and operational costs for distributors.

- Market Shift: Consumer demand, influenced by environmental awareness and regulatory incentives, is increasingly favoring hybrid and electric vehicles.

Conservation and Biodiversity Efforts

The Friedkin Group places a significant emphasis on conservation and biodiversity, as highlighted in their impact reports. This commitment is not just a statement but is actively integrated into their business operations, particularly within their adventure travel and resort segments.

This focus on protecting nature and wildlife directly aligns with growing global awareness and action towards biodiversity preservation. For instance, the Group’s investments in conservation initiatives aim to safeguard ecosystems in the areas where they operate, such as their properties which often feature unique natural habitats.

- Investment in Conservation: The Friedkin Group's impact reports detail explicit investments in protecting natural environments and wildlife.

- Business Integration: Conservation efforts are woven into the fabric of their adventure travel and resort businesses.

- Societal Alignment: This commitment resonates with the increasing global demand for responsible tourism and biodiversity protection.

The Friedkin Group faces significant environmental pressures, including climate change impacts like rising sea levels and extreme weather, which threaten their hospitality infrastructure. Water scarcity is another critical concern, particularly for their golf courses, necessitating advanced water management solutions to ensure operational resilience and control costs.

Stricter environmental regulations, especially concerning vehicle emissions and the push for electric vehicles (EVs), directly impact Gulf States Toyota's distribution strategies and product mix. This regulatory environment demands adaptation and investment in compliance, influencing the types of vehicles available and the associated costs.

The Group's commitment to conservation and biodiversity is evident in its operations, aligning with growing global demand for responsible tourism. This focus on protecting natural habitats is integrated into their adventure travel and resort segments, reflecting a broader societal shift towards sustainability.

| Environmental Factor | Impact on The Friedkin Group | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Risk to hospitality infrastructure, increased operational costs | Global hospitality losses from extreme weather estimated at $200 billion (2015-2020). |

| Water Scarcity | Operational challenges for golf courses, increased water costs | Heightened water stress in many regions in 2024; California reservoirs below average. |

| Environmental Regulations (Emissions/EVs) | Impact on vehicle distribution, need for compliance investment | US EPA aiming for stricter fleet-wide average fuel economy standards by 2025. |

| Biodiversity & Conservation Demand | Alignment with market trends, integration into business models | Global sustainable tourism market projected over $1.5 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Friedkin Group is grounded in data from reputable sources including international financial institutions, government economic reports, and leading market research firms. We meticulously gather insights on political stability, economic trends, technological advancements, environmental regulations, and socio-cultural shifts.