Flywire Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Navigate the complex global landscape affecting Flywire Payments with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are shaping its future. Gain the strategic foresight needed to capitalize on opportunities and mitigate risks. Download the full PESTLE analysis now to unlock actionable intelligence and sharpen your competitive edge.

Political factors

Governments globally are tightening their grip on cross-border payments, driven by a strong desire to curb illicit financial activities like money laundering and terrorist financing. This increased scrutiny means companies like Flywire, which operate on an international scale, must constantly update their compliance systems to meet a wide array of changing rules.

Flywire's operations are directly impacted by evolving regulations, such as the upcoming full implementation of PSD3 and ISO 20022 in 2025. These directives necessitate substantial investments in technology upgrades and stricter adherence to reporting mandates to ensure greater transparency in financial transactions.

Geopolitical stability is a critical factor for Flywire, as tensions and evolving trade pacts directly influence international payment flows. New sanctions or trade restrictions can emerge, impacting Flywire's ability to operate smoothly in various markets.

Flywire's core business, facilitating cross-border payments in sectors like education and healthcare, is particularly vulnerable to these shifts. For instance, a significant geopolitical event could lead to the imposition of sanctions on a key operating region, thereby limiting market access or escalating compliance burdens. The company's reliance on global networks means that disruptions in one area can have ripple effects across its entire service offering.

In 2024, ongoing geopolitical events, such as the conflict in Eastern Europe and trade disputes between major economic blocs, continue to create uncertainty for global financial transactions. These situations underscore the paramount importance of maintaining secure and stable payment channels, a core aspect of Flywire's value proposition.

The increasing global focus on data privacy, exemplified by regulations like the EU's GDPR and California's CCPA, significantly impacts how Flywire manages sensitive customer and payment data. Compliance with these evolving and strict legal frameworks is essential for retaining customer confidence and preventing substantial fines.

Flywire's dedication to strong security measures, underscored by its PCI DSS Level 1 certification, shows a proactive stance in meeting these data protection mandates. This commitment is vital in the 2024-2025 period as regulatory scrutiny intensifies worldwide.

Government Support for Digital Payment Infrastructure

Governments worldwide are increasingly investing in and promoting digital payment infrastructure. For instance, many nations are exploring or piloting central bank digital currencies (CBDCs), with over 130 countries discussing or developing them as of early 2024. This political focus on digitalization directly benefits companies like Flywire, whose business model centers on facilitating efficient digital transactions.

This governmental support translates into a more conducive market for digital payment providers. Initiatives like real-time payment systems, which are being adopted by countries like India with its Unified Payments Interface (UPI) processing billions of transactions monthly, reduce operational friction and foster greater interoperability. Such advancements create a more streamlined environment for businesses and consumers alike, increasing the demand for sophisticated payment solutions.

- Governmental Investment: Many countries are allocating significant resources to upgrade national payment systems, aiming for greater efficiency and security in digital transactions.

- CBDC Development: Over 130 countries are actively exploring or developing Central Bank Digital Currencies, signaling a broad political commitment to digital finance.

- Real-Time Payment Adoption: The proliferation of real-time payment systems, like India's UPI processing over 10 billion transactions in a single month in late 2023, highlights a global trend towards faster, more accessible payments.

Education and Healthcare Policy Changes

Government policies concerning international student admissions and healthcare payment reforms represent significant political factors for Flywire. For example, shifts in student visa regulations, such as those observed in Canada affecting international student numbers, can directly influence Flywire's education payment vertical.

These policy changes necessitate ongoing monitoring and strategic adaptation by Flywire to navigate potential headwinds and capitalize on emerging opportunities within its core markets.

- Canadian International Student Policy Impact: Changes in student visa policies in Canada have been cited as a headwind, impacting the volume of international student payments processed by Flywire.

- Healthcare Payment Reforms: Evolving government regulations in healthcare, particularly those aimed at streamlining cross-border patient payments or reforming insurance landscapes, can create new avenues or challenges for Flywire's healthcare segment.

- Cross-Border Education Trends: Political decisions influencing international student mobility and tuition fee regulations in key markets like the US, UK, and Australia directly shape the demand for Flywire's services.

Governments worldwide are increasingly focused on regulating cross-border payments to combat financial crime, requiring companies like Flywire to adapt to evolving compliance landscapes. This includes adherence to directives like PSD3 and ISO 20022, necessitating technological investments and stricter reporting. Geopolitical stability also plays a crucial role, as trade pacts and sanctions can directly impact international payment flows and market access.

The push for digital payment infrastructure, including the exploration of Central Bank Digital Currencies (CBDCs) by over 130 countries as of early 2024, creates a favorable environment for digital payment providers like Flywire. Real-time payment systems, such as India's UPI which processed over 10 billion transactions in a single month in late 2023, further reduce friction and increase demand for efficient payment solutions.

Government policies on international student admissions and healthcare payment reforms can significantly influence Flywire's core business. For example, shifts in student visa regulations, as seen with potential impacts on international student numbers in Canada, directly affect Flywire's education payment vertical.

| Political Factor | Impact on Flywire | Data/Example |

|---|---|---|

| Regulatory Tightening | Increased compliance costs and need for system upgrades. | PSD3 and ISO 20022 implementation by 2025. |

| Geopolitical Instability | Disruption to payment flows and potential market access limitations. | Ongoing conflicts and trade disputes in 2024 impacting global transactions. |

| Digital Payment Promotion | Growth opportunities in a more digitized financial landscape. | Over 130 countries exploring CBDCs; India's UPI processing 10B+ monthly transactions (late 2023). |

| Education/Healthcare Policies | Direct influence on transaction volumes in key verticals. | Canadian student visa policy changes impacting international student payments. |

What is included in the product

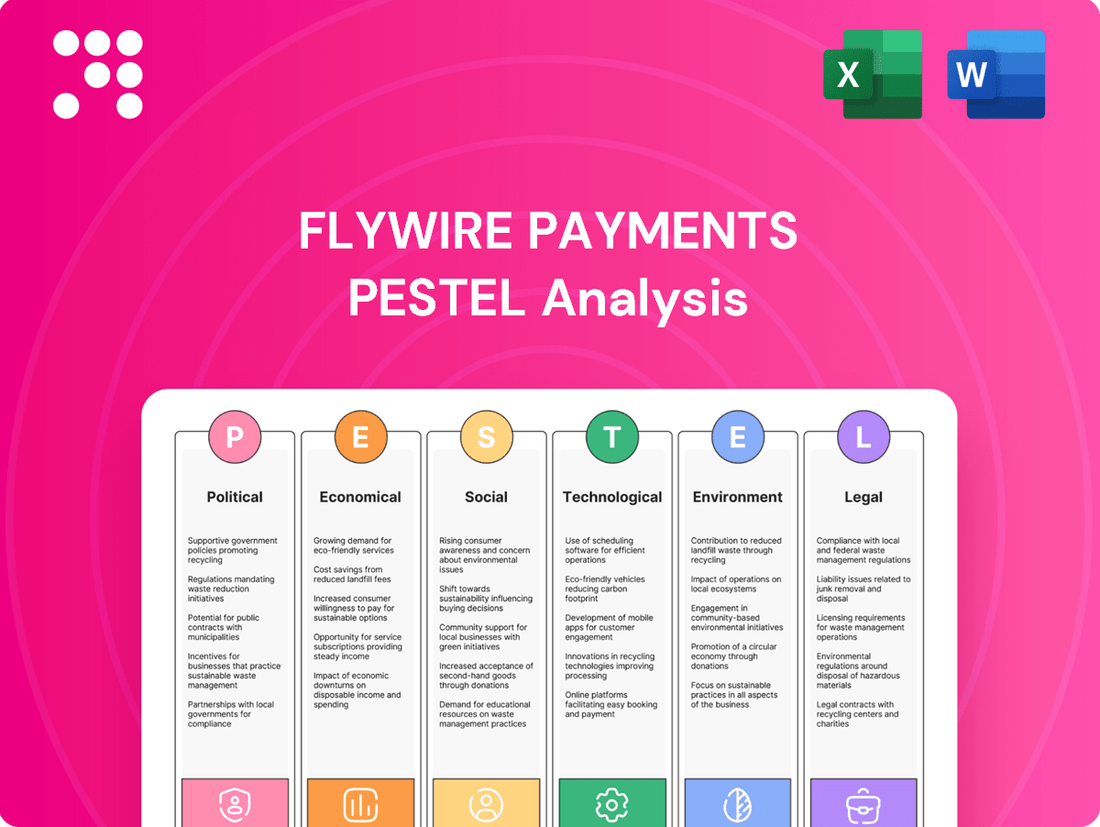

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Flywire Payments across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key opportunities and threats within Flywire's operating landscape.

Flywire Payments' PESTLE analysis highlights how navigating complex regulatory environments (Political) and adapting to evolving digital payment technologies (Technological) can be mitigated by their streamlined, compliant solutions, easing the burden of cross-border transactions for businesses.

Economic factors

Global economic growth projections for 2024 and 2025 indicate a moderate but steady expansion. The International Monetary Fund (IMF) forecast for global GDP growth in 2024 is around 3.2%, with a similar outlook for 2025. This generally positive environment supports increased transaction volumes for payment providers like Flywire.

Inflationary pressures remain a key consideration. While inflation has shown signs of moderating in many developed economies throughout 2024, it still hovers above central bank targets in several regions. For instance, the US Consumer Price Index (CPI) saw an annual increase of 3.4% in April 2024, and similar trends are observed in the Eurozone. This can impact Flywire's operational costs and the real value of transactions processed.

A slowdown in key markets, potentially driven by persistent inflation or geopolitical uncertainties, could temper Flywire's revenue growth. For example, if major education or healthcare markets experience reduced international student enrollment or slower healthcare spending due to economic headwinds, it would directly affect the payment volumes Flywire handles. The purchasing power of end-customers, particularly those paying tuition or medical bills, is also sensitive to inflation.

Currency exchange rate volatility directly impacts Flywire's business as a cross-border payment facilitator. Fluctuations can alter the cost for clients and influence Flywire's earnings when converting currencies. For instance, the US dollar strengthened significantly against many major currencies throughout 2023 and into early 2024, which could have compressed margins on transactions where Flywire held foreign currency balances.

Managing foreign exchange risk is a constant operational challenge for Flywire. The company likely employs hedging strategies to mitigate the impact of unpredictable currency movements. For example, if a significant portion of Flywire's revenue is denominated in euros but its operating costs are primarily in US dollars, a weakening euro would directly reduce its profitability if unhedged.

The ongoing digital transformation is a major economic force, with e-commerce sales expected to reach $7.4 trillion globally by 2025, up from an estimated $5.7 trillion in 2023. This shift means more transactions are happening online, directly benefiting companies like Flywire that provide the infrastructure for these digital payments.

Consumers and businesses alike are embracing digital payment methods, from mobile wallets to online invoicing. This trend is particularly strong in cross-border transactions, where the complexity of traditional methods is a significant barrier. For instance, the B2B cross-border payments market is anticipated to grow significantly, offering a substantial opportunity for Flywire's specialized services.

Increased Adoption of Real-Time Payments

The global economy is witnessing a significant surge in the adoption of real-time payments, a trend that directly benefits Flywire. This shift, driven by both consumers and businesses, highlights a clear demand for faster transaction settlements and enhanced liquidity management. For instance, by the end of 2024, it's projected that over 70% of all payment transactions in major economies will be digital, with real-time rails capturing an increasing share.

This growing preference for immediate fund availability is a key economic factor for Flywire, as its platform is designed to facilitate these swift cross-border transactions. Businesses are actively seeking solutions that reduce processing times and improve cash flow, making Flywire's real-time payment capabilities highly attractive. The market for real-time payments is expanding rapidly, with projections indicating a compound annual growth rate (CAGR) of over 30% through 2027, underscoring the move away from legacy payment systems.

The economic implications are substantial:

- Accelerated Liquidity: Businesses gain faster access to funds, improving working capital and operational efficiency.

- Reduced Costs: Real-time payments can lower transaction fees and eliminate costs associated with delayed settlements.

- Enhanced Customer Experience: For B2C transactions, immediate payment confirmation improves customer satisfaction.

- Growing Market Share: The increasing volume of real-time transactions represents a significant revenue opportunity for payment providers like Flywire.

Competition and Market Share in Payment Processing

The global payments landscape is intensely competitive, with established financial institutions and a growing number of fintech companies actively pursuing market share. Flywire faces this dynamic environment, necessitating continuous innovation to differentiate its payment solutions and secure client loyalty. This is particularly critical as non-banking entities increasingly capture market share from traditional banks in the B2B cross-border payments sector.

Flywire's strategic approach includes leveraging acquisitions to bolster its market presence and unlock new revenue streams. A prime example is the acquisition of Sertifi, a move designed to enhance its capabilities and broaden its reach within the payments ecosystem. This strategy is crucial for staying ahead in a market where agility and expanded service offerings are key differentiators.

- Market Competition: The payments industry is crowded, with fintechs like Stripe and Adyen, alongside traditional banks, vying for dominance.

- Fintech Growth: Fintechs are projected to capture a larger share of the global B2B cross-border payments market, estimated to reach $35.5 trillion by 2024, up from $29.7 trillion in 2021.

- Acquisition Strategy: Flywire's acquisition of Sertifi in 2023 aimed to integrate e-signature and contract management capabilities, enhancing its value proposition.

- Customer Retention: In 2024, maintaining a competitive edge requires offering seamless, secure, and cost-effective payment solutions to retain existing clients and attract new ones.

Global economic growth is projected to be moderate but steady, with the IMF forecasting around 3.2% GDP growth for both 2024 and 2025, supporting increased transaction volumes for Flywire. Inflation, while moderating, remains a key factor; for example, US CPI was 3.4% in April 2024, impacting operational costs and transaction values.

A slowdown in key markets like education or healthcare due to economic headwinds could temper Flywire's revenue growth by reducing payment volumes. Currency exchange rate volatility directly impacts Flywire's cross-border business, affecting transaction costs and earnings. For instance, the US dollar's strength in early 2024 could have compressed margins on foreign currency balances.

The ongoing digital transformation is a major economic driver, with global e-commerce sales expected to reach $7.4 trillion by 2025, benefiting companies like Flywire that facilitate online payments. Consumers and businesses are increasingly adopting digital payment methods, especially for cross-border transactions, a trend that offers substantial opportunities for Flywire's specialized services.

The surge in real-time payments is a significant economic benefit for Flywire, as businesses seek faster settlements and improved liquidity. By the end of 2024, over 70% of transactions in major economies are expected to be digital, with real-time rails gaining share, indicating a strong market for Flywire's capabilities.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Flywire | Supporting Data |

| Global GDP Growth | ~3.2% | ~3.2% | Supports transaction volume growth | IMF Forecast |

| US Inflation (CPI) | 3.4% (April 2024) | Moderating but above targets | Impacts operational costs, transaction value | Bureau of Labor Statistics |

| Global E-commerce Sales | ~$6.5 trillion (est.) | $7.4 trillion | Increases digital transaction opportunities | Statista |

| Real-Time Payments Adoption | Increasing share of digital transactions | Projected >70% digital transactions | Drives demand for fast cross-border solutions | Industry reports |

Full Version Awaits

Flywire Payments PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flywire Payments PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Flywire's strategic landscape.

Sociological factors

There's a significant societal move towards digital and contactless payments, fueled by their convenience, speed, and perceived security. This isn't just a fleeting trend; it's becoming the norm for how people want to transact.

This preference is strongly felt across all of Flywire's key markets. For instance, in healthcare and education, patients and students are increasingly looking for easy-to-use online portals and mobile apps to manage their bills and make payments. A 2024 survey indicated that over 70% of consumers prefer digital payment options for everyday transactions.

Flywire's core offering directly aligns with this evolving consumer behavior. By providing a robust platform that supports these digital and contactless payment methods, Flywire is well-positioned to meet the demands of a growing segment of the population that prioritizes seamless, modern payment experiences.

Consumers and businesses are increasingly vocal about wanting to see exactly where their money is going, what fees are involved, and how long payments will take, particularly when sending money across borders. This demand for clarity is a significant sociological trend.

Flywire's core offering directly taps into this by promising clearer payment processes and simplifying what can often be complicated transactions, which builds confidence and makes the whole experience smoother. For instance, in 2024, studies showed that over 60% of consumers found hidden fees in international payments to be a major deterrent.

This desire for straightforward billing isn't limited to commerce; it's also a growing expectation in sectors like healthcare, where patients want to understand their medical bills without confusion, improving patient satisfaction and reducing payment disputes.

Students and patients increasingly expect flexible payment options and digital self-service for educational and healthcare expenses. This shift is driven by a desire for greater control and convenience in managing significant financial commitments.

Flywire's platform directly addresses this by facilitating customized payment plans and integrating with digital billing systems, thereby simplifying high-value transactions. For instance, the adoption of digital wallets for medical payments is on the rise, with some reports indicating a significant percentage of healthcare providers now offering such options by 2024.

Globalization and Mobility of Individuals

The growing interconnectedness of the world fuels a constant need for easier international money transfers. As more people study abroad or travel extensively, the demand for payment systems that handle different currencies and methods smoothly keeps rising. Flywire's business directly addresses this trend by simplifying cross-border payments for a mobile global population.

In 2023, over 1 million international students enrolled in U.S. higher education institutions, a significant number representing a key demographic for cross-border payment services. Furthermore, global tourism continues its strong recovery, with international tourist arrivals projected to reach 1.1 billion in 2024, indicating sustained demand for international payment solutions.

- Growing International Student Market: The number of international students pursuing education abroad is a key driver for Flywire's services.

- Resurgence of Global Travel: Increased international travel creates ongoing opportunities for facilitating payments across borders.

- Demand for Seamless Transactions: Individuals expect efficient and user-friendly payment experiences, regardless of location.

Trust and Security Concerns in Digital Transactions

Despite the undeniable convenience of digital transactions, a significant portion of the public harbors persistent concerns about online security and the ever-present threat of fraud. In 2024, reports indicated that over 60% of consumers cited data breaches as a primary worry when making online payments. This societal apprehension directly impacts the adoption of new payment technologies.

Flywire's strategic emphasis on stringent security protocols, such as its PCI DSS Level 1 certification and the deployment of advanced AI for fraud detection, is a direct response to these widespread anxieties. By prioritizing security, Flywire aims to cultivate a foundation of trust, which is absolutely essential for gaining widespread customer confidence and encouraging deeper engagement with its digital payment ecosystem.

The company's commitment to security is not merely a compliance issue; it’s a core tenet for fostering user adoption. For instance, in early 2025, a survey revealed that security features were the top deciding factor for 75% of individuals when choosing a payment provider. Flywire's proactive stance in addressing these trust and security concerns positions it favorably in a market where user confidence is paramount.

- Public Concern: Over 60% of consumers expressed concerns about online transaction security and fraud in 2024.

- Flywire's Solution: Robust security measures including PCI DSS Level 1 certification and AI-powered fraud detection.

- Impact on Adoption: Security features are a key deciding factor for 75% of consumers choosing payment providers (early 2025 data).

- Goal: To build and maintain trust, driving widespread adoption and customer confidence in digital payments.

Societal expectations are increasingly geared towards seamless, digital payment experiences, with a strong preference for transparency regarding fees and transaction timelines. Flywire's platform directly addresses this by simplifying cross-border payments and offering clearer processes, aligning with consumer demand for straightforward financial interactions.

Concerns about online security and fraud remain a significant societal factor influencing payment method adoption. Flywire's commitment to robust security measures, including advanced fraud detection, is crucial for building trust and encouraging user engagement with its digital payment ecosystem.

The growing global interconnectedness, evidenced by increasing international student numbers and recovering global travel, fuels a continuous need for efficient international money transfer solutions. Flywire is well-positioned to cater to this demand by simplifying cross-border transactions for a mobile global population.

| Sociological Factor | Description | Impact on Flywire | Supporting Data (2023-2025) |

|---|---|---|---|

| Digital Payment Preference | Consumers increasingly favor convenient, fast, and secure digital and contactless payment methods. | Aligns with Flywire's core digital payment offerings. | Over 70% of consumers prefer digital options for everyday transactions (2024). |

| Demand for Transparency | Growing expectation for clear information on fees, exchange rates, and payment durations, especially for international transactions. | Flywire's focus on simplifying complex transactions addresses this need. | Over 60% of consumers found hidden fees in international payments a major deterrent (2024). |

| Security Concerns | Persistent anxieties about online security and fraud impact the adoption of new payment technologies. | Necessitates Flywire's strong emphasis on security protocols and fraud detection. | Over 60% of consumers cited data breaches as a primary worry (2024); Security features are a top deciding factor for 75% of payment provider choices (early 2025). |

| Global Mobility & Interconnectedness | Increased international student enrollment and global travel create demand for cross-border payment solutions. | Expands Flywire's market opportunity in education and travel sectors. | Over 1 million international students in U.S. higher education (2023); International tourist arrivals projected to reach 1.1 billion (2024). |

Technological factors

The rapid evolution and global adoption of real-time payment (RTP) systems represent a significant technological shift. By July 2025, we anticipate further acceleration in RTP adoption worldwide, with many countries actively developing or expanding their domestic RTP infrastructures. This trend directly benefits Flywire by facilitating quicker, more streamlined cross-border and domestic transactions, improving overall payment efficiency.

The growing interoperability between diverse real-time payment networks is another key technological factor. As more RTP systems become capable of communicating with each other, Flywire's capacity to deliver truly seamless payment experiences across various geographies and financial institutions will be significantly enhanced. This interconnectedness is crucial for reducing friction in global commerce.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping payment processing. These technologies are crucial for bolstering fraud detection, streamlining compliance, and boosting overall operational efficiency. Flywire actively utilizes AI and ML to scrutinize payment data, pinpoint unusual patterns, and refine anti-money laundering (AML) protocols. This strategic application significantly enhances their security posture and risk management, especially when confronting advanced cyber threats.

In 2024, the global AI in fintech market was valued at over $30 billion, with projections indicating substantial growth. Flywire's investment in these areas directly addresses the increasing sophistication of financial crime. For instance, AI-powered fraud detection systems can identify fraudulent transactions with greater accuracy than traditional methods, potentially reducing chargebacks and associated losses for businesses. Furthermore, AI assists in automating repetitive tasks within compliance departments, freeing up human resources for more complex analytical work.

Beyond security, AI also plays a vital role in personalizing the customer payment journey. By analyzing user behavior and preferences, Flywire can tailor payment options and communication, leading to improved customer satisfaction and higher conversion rates. This data-driven approach to personalization is becoming a key differentiator in the competitive payments landscape, with companies reporting up to a 15% increase in customer engagement through personalized experiences.

Blockchain technology's ongoing development and the growing adoption of digital assets, like stablecoins and tokenized securities, are creating new possibilities for faster, more secure, and efficient payments, especially in business-to-business (B2B) contexts. For instance, the global stablecoin market capitalization reached over $150 billion by early 2024, demonstrating significant commercial traction.

These advancements could unlock innovative payment solutions for Flywire, potentially improving cross-border transaction speeds and reducing costs. The tokenization of real-world assets, a trend gaining momentum, also presents opportunities for new financial products and services that Flywire could integrate into its offerings.

Growth of Embedded Finance and API-driven Solutions

The surge in embedded finance, driven by Application Programming Interfaces (APIs), is fundamentally reshaping how businesses manage transactions. By integrating payment functionalities directly into platforms like Enterprise Resource Planning (ERP) systems, companies can facilitate real-time payments and streamline financial operations. This technological shift directly supports Flywire's mission to simplify intricate payment processes across sectors such as B2B and healthcare.

This trend is not just about convenience; it's about driving efficiency and enhancing data flow. For instance, by mid-2024, a significant portion of businesses were actively exploring or implementing embedded finance solutions to improve their financial workflows. This integration allows for seamless data exchange between payment systems and core business applications, leading to better financial visibility and control.

- Embedded Finance Adoption: Projections suggest the global embedded finance market could reach over $7 trillion by 2030, indicating strong growth.

- API Economy Growth: The increasing reliance on APIs for financial services is a key enabler, with businesses leveraging them for faster integration and innovation.

- Efficiency Gains: Companies adopting embedded payments report improvements in payment processing times and a reduction in manual reconciliation efforts.

Cloud-Native Platforms and Scalability

The payments industry's move to cloud-native platforms is a game-changer for scalability, flexibility, and overall agility. Flywire's strategic adoption of these platforms is key to its success, allowing it to manage a growing number of transactions and quickly roll out new features. This technological backbone is essential for supporting its worldwide operations and catering to a broad range of clients.

By utilizing cloud-native architecture, Flywire can efficiently scale its services up or down based on demand. This adaptability is vital in the fast-paced payments sector, where transaction volumes can fluctuate significantly. For instance, during peak shopping seasons or major global events, the ability to instantly increase processing power without significant infrastructure investment is a major advantage. This ensures uninterrupted service for its customers.

- Scalability: Cloud-native platforms enable Flywire to handle millions of transactions daily, a capability crucial for its expanding global reach.

- Agility: The architecture allows for rapid deployment of new payment methods and features, keeping Flywire competitive.

- Cost Efficiency: Leveraging cloud infrastructure often translates to more predictable and potentially lower operational costs compared to traditional on-premises solutions.

- Resilience: Cloud-native designs typically incorporate redundancy and failover mechanisms, enhancing service reliability.

The increasing sophistication of AI and machine learning is a critical technological factor for Flywire. By July 2025, these technologies will be even more integral to fraud detection, compliance, and operational efficiency, with AI in fintech projected to exceed $40 billion globally. Flywire's strategic use of AI helps it identify complex fraud patterns and enhance its anti-money laundering efforts, a vital capability given the evolving threat landscape.

The continued development and adoption of blockchain and digital assets present new avenues for Flywire. By mid-2025, the stablecoin market capitalization, already over $150 billion by early 2024, is expected to see further growth, potentially enabling faster and more cost-effective cross-border payments.

The rise of embedded finance, powered by APIs, is transforming transaction management. By 2024, many businesses were integrating payment functionalities directly into their core systems, a trend that Flywire supports by simplifying complex payment flows across various industries.

Legal factors

Flywire navigates a complex web of global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These laws mandate rigorous Know Your Customer (KYC) processes and ongoing transaction monitoring to thwart illegal financial flows. For instance, in 2024, financial institutions globally are investing heavily in advanced analytics for suspicious activity detection, with some reports indicating a 15% year-over-year increase in AML compliance spending.

Staying ahead of evolving regulatory landscapes is crucial for Flywire. The European Union's ongoing efforts to harmonize AML rules, coupled with the Financial Action Task Force's (FATF) updated recommendations, necessitate continuous adaptation of compliance programs. Failure to comply can result in substantial fines; for example, a major payment processor faced a $10 million penalty in early 2025 for insufficient AML controls.

The evolving landscape of payment services, particularly the upcoming PSD3 and PSR in Europe, finalized by 2025, presents significant operational shifts for Flywire. These regulations mandate stricter fraud prevention measures and advanced customer authentication, requiring ongoing adjustments to Flywire's payment infrastructure.

Flywire operates under stringent data protection and privacy regulations globally, such as the EU's GDPR and California's CCPA. These laws dictate how Flywire must handle sensitive financial and personal data, particularly in sectors like education and healthcare where it processes information for institutions and individuals. Failure to comply can result in significant fines, with GDPR penalties potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust compliance with these evolving legal frameworks, including specific regulations like HIPAA for healthcare data in the US, is critical for Flywire's continued operation and reputation. Adherence ensures the security of client and payer information, fostering trust and enabling continued business relationships. For instance, the increasing focus on data privacy in 2024 and 2025 means ongoing investment in compliance measures is a necessity.

Cross-Border Payment Reporting and Standardization (e.g., ISO 20022)

The global shift towards standardized cross-border payment messaging, particularly the adoption of ISO 20022, presents a significant legal and operational challenge for Flywire. With a critical deadline looming in November 2025, Flywire must ensure its systems are fully compliant with this new standard. Failure to do so could lead to transaction disruptions and penalties.

ISO 20022 is designed to enhance security, streamline compliance processes, and improve the overall efficiency of international payments. For Flywire, this means adapting its infrastructure to generate and interpret these advanced message formats. This migration is not just a technical upgrade; it's a legal imperative to maintain seamless cross-border transactions.

- ISO 20022 Adoption: The global payment industry is migrating to ISO 20022, with a key deadline in November 2025.

- Legal Obligations: Flywire faces legal requirements to integrate and support ISO 20022 messaging for all cross-border transactions.

- Operational Impact: Non-compliance can result in transaction failures, increased manual processing, and potential regulatory fines.

- Industry Trend: Over 70% of global payment traffic is expected to use ISO 20022 by 2027, highlighting its widespread adoption and necessity.

Consumer Protection and Dispute Resolution Regulations

Legal frameworks safeguarding consumers, especially concerning unauthorized transactions and resolving disputes, are paramount for payment service providers like Flywire. These regulations ensure fair practices and build trust. For instance, the ongoing development and implementation of PSD3 are refining the timelines and responsibilities for faster reimbursement of consumers who fall victim to fraud. Flywire's commitment to adhering to these evolving legal requirements is essential for both protecting its users and managing potential financial and reputational risks effectively.

Key aspects of these consumer protection and dispute resolution regulations include:

- Enhanced consumer rights: Mandates for clear information disclosure regarding fees, transaction details, and recourse options in case of errors or fraud.

- Streamlined dispute resolution processes: Requirements for payment providers to offer accessible and efficient mechanisms for consumers to report and resolve transaction disputes.

- Liability for unauthorized transactions: Regulations often define the extent of a consumer's liability for unauthorized payments, with providers typically bearing responsibility beyond a certain threshold or in cases of negligence.

- Regulatory oversight and penalties: Government bodies monitor compliance and can impose fines or other sanctions for violations, emphasizing the importance of robust internal controls.

Flywire must adhere to evolving global data privacy laws, including GDPR and CCPA, impacting how it handles sensitive payment and personal information. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue. In 2024, companies are increasing investment in data privacy compliance, recognizing its critical role in maintaining customer trust and operational continuity.

The global push for standardized cross-border payment messaging, particularly ISO 20022, presents a critical legal and operational challenge for Flywire, with a key deadline in November 2025. Failure to comply with this new standard can result in transaction disruptions and regulatory penalties, underscoring the imperative for system adaptation.

Consumer protection laws, such as those being refined under PSD3, mandate stricter protocols for fraud prevention and dispute resolution. Flywire is legally obligated to implement advanced customer authentication and ensure fair practices, including timely reimbursement for fraudulent transactions, to maintain user trust and avoid sanctions.

| Regulation | Key Requirement | Impact on Flywire | 2024/2025 Focus |

| GDPR/CCPA | Data Privacy & Protection | Strict handling of sensitive data; potential fines up to 4% global revenue | Increased investment in compliance measures; enhanced data security protocols |

| ISO 20022 | Standardized Payment Messaging | Mandatory integration for cross-border transactions by Nov 2025; risk of disruption | System upgrades to support new message formats; ensuring interoperability |

| PSD3/PSR | Consumer Protection & Fraud Prevention | Stricter authentication, faster dispute resolution, liability for unauthorized transactions | Refining fraud detection algorithms; improving customer support for disputes |

Environmental factors

Flywire, despite being a digital-first company, relies heavily on data centers and digital infrastructure that consume substantial energy, directly contributing to its carbon footprint. The increasing global focus on environmental sustainability means Flywire is under growing pressure to measure and reduce these emissions. For instance, the company conducted its inaugural greenhouse gas audit in 2023, a critical step in understanding and mitigating its environmental impact, with a focus on improving the energy efficiency of its technology operations.

Investors, clients, and employees increasingly expect businesses to showcase robust environmental, social, and governance (ESG) commitments. Flywire recognizes that ESG considerations significantly affect its operations and stakeholders, actively enhancing its dedication to these areas. This includes releasing its first ESG report and prioritizing environmental sustainability, which can bolster brand image and attract investors.

While Flywire, as a financial technology company, doesn't directly engage in heavy industrial pollution, the global push for environmental, social, and governance (ESG) reporting is significantly impacting all sectors. Governments worldwide are increasingly mandating more comprehensive environmental disclosures from corporations, even those in service-based industries. This means Flywire could face future requirements to report on its carbon footprint, energy consumption, and waste management practices, aligning with broader sustainability goals.

Impact of Climate Change on Global Operations and Supply Chains

While Flywire's digital payment processing infrastructure isn't directly exposed to physical environmental risks like extreme weather, climate change poses indirect threats. These can manifest as disruptions to the global operations and supply chains of its clients, particularly in sectors like travel. For instance, increased frequency of severe weather events in 2024 and projected for 2025 could impact air travel, a key industry for Flywire, affecting transaction volumes and payer stability.

Economic shifts driven by climate change can also influence the ability of Flywire's clients and their customers to make and receive payments. This necessitates robust operational planning and risk management to ensure continuous service delivery. A report by the World Economic Forum in early 2025 highlighted that climate-related risks are increasingly impacting global economic stability, potentially affecting cross-border payment flows.

- Increased operational resilience is crucial for payment processors like Flywire to navigate climate-induced economic volatility.

- Disruptions in client industries, such as travel due to extreme weather, can directly impact transaction volumes and revenue.

- The interconnectedness of global economies means climate-related economic shifts can indirectly affect payer capabilities and payment processing stability.

Promotion of Paperless Transactions and Digital Efficiency

Flywire's digital payment platform inherently champions paperless transactions, directly contributing to environmental sustainability. By facilitating digital checks and eliminating paper-based billing, the company actively reduces resource consumption and waste generation. This aligns with global environmental objectives focused on conservation and minimizing ecological footprints.

The shift towards digital transactions is gaining significant momentum. For instance, in 2024, the global digital payments market was valued at over $2.5 trillion and is projected to grow substantially. This trend underscores the environmental benefits Flywire offers, as more businesses and consumers embrace digital alternatives, leading to a tangible reduction in paper usage across various industries.

- Reduced Paper Consumption: Flywire's core service directly decreases reliance on paper for payments and billing.

- Lower Carbon Footprint: Eliminating physical mail and processing reduces transportation emissions and energy usage associated with paper production.

- Alignment with ESG Goals: The company's digital-first approach supports environmental, social, and governance (ESG) initiatives for its clients and its own operations.

- Growing Market Trend: The increasing adoption of digital payments globally, projected to reach over $3.5 trillion by 2027, amplifies the positive environmental impact of companies like Flywire.

Flywire's digital-first model inherently promotes environmental sustainability by reducing paper consumption and the associated waste and emissions. As the global digital payments market surged past $2.5 trillion in 2024 and continues its upward trajectory, Flywire's role in facilitating paperless transactions becomes increasingly significant. This aligns with growing stakeholder expectations for robust ESG performance, making digital efficiency a key environmental differentiator.

| Environmental Factor | Impact on Flywire | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Reduced Paper Consumption | Directly lowers operational footprint and supports client ESG goals. | Global digital payments market valued over $2.5 trillion in 2024; projected growth significant. |

| Energy Consumption | Data centers and digital infrastructure contribute to carbon footprint. | Flywire conducted inaugural greenhouse gas audit in 2023; focus on energy efficiency. |

| Climate Change Risks | Indirectly impacts client industries (e.g., travel) affecting transaction volumes. | World Economic Forum highlighted increasing climate-related economic volatility impacting global stability in early 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Flywire Payments is grounded in a comprehensive review of data from major financial institutions like the IMF and World Bank, alongside reports from leading market research firms and regulatory bodies. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting global payments.