Flywire Payments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

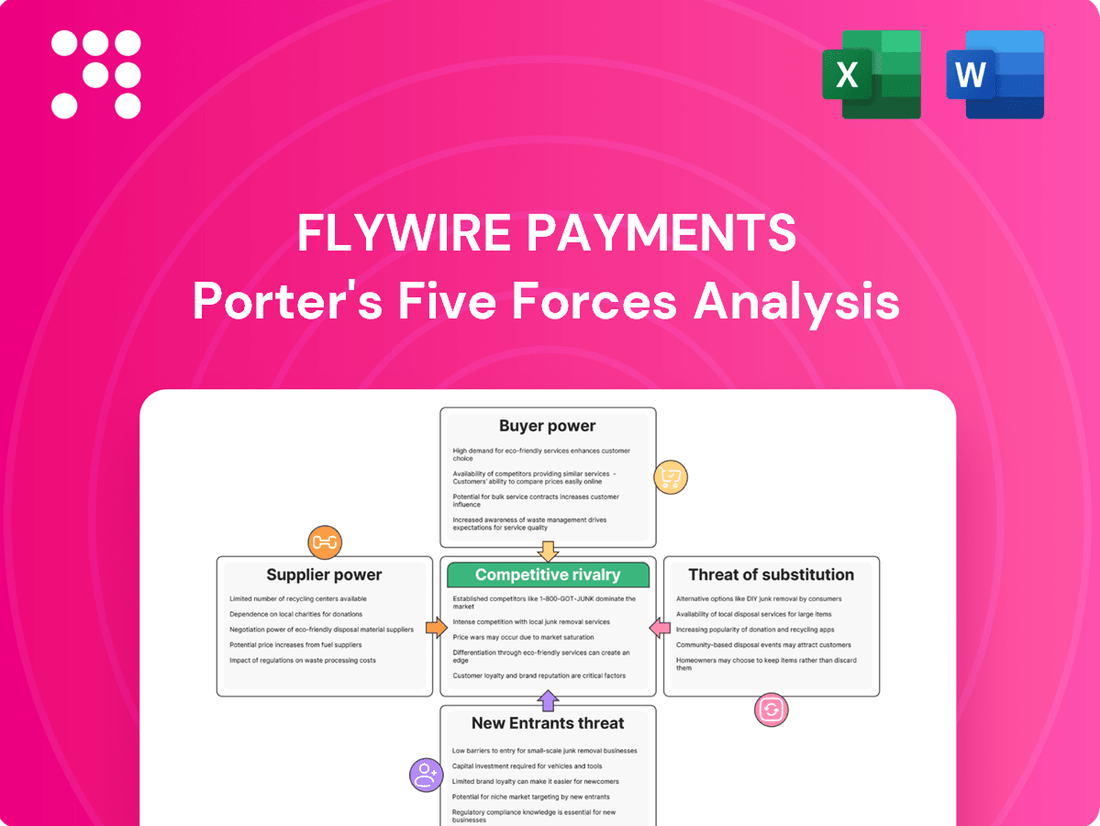

Flywire Payments operates within a dynamic fintech landscape, where understanding the intensity of competitive rivalry and the threat of new entrants is crucial for strategic planning. Our analysis delves into the bargaining power of both buyers and suppliers, as well as the ever-present threat of substitute solutions. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flywire Payments’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Flywire's operations are deeply intertwined with global payment networks and banking partners, forming the backbone of its transaction processing capabilities. The concentration of these networks means a limited number of key players hold significant sway. For instance, in 2024, major card networks like Visa and Mastercard continue to dominate global transaction volume, processing trillions of dollars annually. This concentration grants them substantial bargaining power, potentially influencing the fees Flywire incurs for using their infrastructure.

If a few dominant payment networks control the essential rails for international money movement, they can dictate terms, thereby increasing their leverage over Flywire. This could translate into higher processing fees or stricter operational requirements. While Flywire actively works to diversify its banking relationships and payment integrations, the fundamental reliance on these core infrastructure providers remains a critical factor in supplier bargaining power.

Suppliers of specialized technology, software, and secure infrastructure are vital for Flywire's payment platform. When these suppliers provide unique or proprietary solutions, their bargaining power can be significant. For instance, the integration of Flywire with major ERP systems like Ellucian and Workday highlights the importance of these technology partners.

Flywire's own development of proprietary software and integrations helps mitigate supplier power by fostering self-sufficiency and strategic partnerships. This approach allows them to manage dependencies and ensure platform stability and innovation, a crucial aspect in the competitive fintech landscape.

The ease with which Flywire can switch between payment processors, banking partners, or technology vendors significantly influences supplier power. A broad selection of alternative providers inherently diminishes the leverage any single supplier holds over Flywire. For instance, in 2024, the global payments market continued to see new entrants and consolidation, offering Flywire a dynamic landscape of potential partners.

However, for highly specialized cross-border payment solutions, the pool of truly equivalent suppliers might be smaller. This limited availability can increase the bargaining power of existing, highly capable suppliers, making established relationships more critical for Flywire to maintain. The complexity of integrating with specific regulatory frameworks in different countries further narrows the practical alternatives for specialized services.

Switching Costs for Flywire

The bargaining power of suppliers for Flywire is influenced by switching costs. If it becomes difficult or expensive for Flywire to change its payment gateway providers or migrate data, suppliers gain leverage. This is because Flywire is then more dependent on its existing relationships.

Flywire's deep integrations with its clients' systems mean that altering its own fundamental payment infrastructure would likely be a complex undertaking. This complexity further solidifies the position of its current suppliers, as the effort required to switch could be substantial.

- High Switching Costs: Integrating new payment gateways or migrating extensive data sets can be costly and time-consuming, increasing supplier leverage.

- Client Integration Dependency: Flywire's embedded solutions mean that changing core payment processors could disrupt client operations, making such changes less likely.

- Data Migration Challenges: Moving sensitive financial data securely and efficiently between different payment processing systems presents a significant hurdle, reinforcing supplier relationships.

Uniqueness of Supplier Offerings

Suppliers offering highly unique or critical services without easy alternatives wield significant influence. For example, a banking partner holding exclusive regulatory licenses or access to a vital market significantly boosts their leverage. Flywire's specialization in intricate, high-value cross-border payments often necessitates unique capabilities from its banking and payment network partners.

This reliance on specialized partners means Flywire cannot easily switch providers without incurring substantial costs or operational disruptions. In 2024, the increasing complexity of global financial regulations and the demand for niche payment solutions further solidify the bargaining power of these specialized suppliers.

- Unique Regulatory Licenses: Suppliers holding specific licenses required for Flywire's target markets, such as certain cross-border payment licenses in emerging economies, possess considerable power.

- Proprietary Technology: Partners offering unique payment processing technologies or fraud detection systems that are integral to Flywire's service delivery can command higher terms.

- Exclusive Market Access: Banking institutions or payment networks with exclusive partnerships or deep penetration in specific, high-growth verticals where Flywire operates have increased bargaining power.

The bargaining power of suppliers for Flywire is significant, particularly from major card networks and specialized technology providers. In 2024, the dominance of networks like Visa and Mastercard, processing trillions annually, allows them to influence fees. Specialized partners offering unique solutions, such as integrations with ERP systems like Workday, also hold considerable sway.

High switching costs for Flywire, due to deep client integrations and complex data migration, further empower existing suppliers. This dependency is amplified when suppliers possess unique regulatory licenses or exclusive market access, critical for Flywire's niche cross-border payment operations.

| Supplier Type | Influence Factor | Example for Flywire (2024) |

|---|---|---|

| Payment Networks | Market Dominance, Transaction Volume | Visa, Mastercard (processing trillions annually) |

| Technology Providers | Proprietary Solutions, System Integration | ERP system integrators (e.g., Workday) |

| Banking Partners | Regulatory Licenses, Market Access | Institutions with specific cross-border licenses |

What is included in the product

This analysis of Flywire Payments delves into the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes, providing a comprehensive view of its competitive environment.

Streamline complex payment flows by directly addressing the threat of new entrants with a robust, integrated platform.

Customers Bargaining Power

Flywire's focus on large institutions within education, healthcare, travel, and B2B sectors means that client concentration can be a significant factor in customer bargaining power. If a handful of these major clients account for a substantial percentage of Flywire's overall revenue, they gain considerable leverage to negotiate better pricing or demand bespoke service offerings.

These powerful clients can leverage their volume and importance to secure more favorable terms, potentially impacting Flywire's profitability. For instance, a large university or hospital system might have the negotiating strength to push for lower transaction fees or specialized integration support.

To mitigate this, Flywire actively works to diversify its client base. The addition of over 200 new clients in the first quarter of 2025 is a key strategy to dilute the influence of any single large customer, spreading revenue across a broader network and thereby reducing the impact of any one client's demands.

The difficulty and expense clients face when moving from Flywire to another payment solution directly influence their bargaining power. High integration costs, the complexities of migrating data, or the potential for significant disruption to established operational processes can make switching a costly endeavor for businesses, thereby diminishing their leverage.

Flywire's strategy of deeply embedding its services within clients' existing workflows and enterprise resource planning (ERP) systems further elevates these switching costs. This deep integration means that a client’s daily operations are intrinsically linked to Flywire’s platform, making a transition a substantial undertaking.

The availability of alternative payment solutions significantly influences customer bargaining power. Customers can readily switch between traditional methods like bank transfers and credit cards, or opt for newer fintech solutions. This broad spectrum of choices, exemplified by competitors such as Stripe and PayPal, empowers customers to demand better terms and pricing.

Price Sensitivity of Customers

Customers in sectors like education and healthcare often scrutinize payment processing fees, particularly when dealing with substantial transaction volumes. This price sensitivity directly impacts Flywire, potentially creating downward pressure on its service charges. For instance, a university processing millions in tuition payments annually will likely compare pricing models closely.

Flywire's strategy to counter this involves highlighting its broader value proposition. This includes offering enhanced transparency in transactions, simplifying reconciliation processes for institutions, and improving the overall payment experience for students and patients. These benefits can help justify pricing beyond simple transaction costs.

- Price Sensitivity in Education: In 2023, the global education technology market, which includes payment solutions, saw significant growth, yet institutions remain cost-conscious, especially with increasing operational expenses.

- Healthcare Transaction Volumes: Healthcare providers manage vast numbers of patient payments, making even small per-transaction fees impactful across their entire revenue cycle.

- Flywire's Differentiated Value: By offering integrated solutions that streamline international student payments or patient billing, Flywire aims to capture value through efficiency and customer satisfaction, not just price.

Customer Information and Transparency

When customers can easily see pricing and service details from various payment providers, their ability to negotiate better terms, or switch to a cheaper alternative, grows significantly. This transparency is a key driver of customer bargaining power in the payments industry.

Flywire's commitment to providing clearer information about its services, while a customer benefit, also means customers can more readily compare Flywire's pricing and features against those of its competitors. For instance, in 2023, the average transaction fee for cross-border payments varied widely, with some providers charging up to 5% while others offered rates closer to 1-2%, highlighting the impact of transparency on customer choice.

- Increased Customer Leverage: Transparent pricing empowers customers to seek out the most cost-effective payment solutions.

- Competitive Pressure: Providers like Flywire face pressure to remain competitive when their service details are easily accessible for comparison.

- Market Efficiency: Greater transparency leads to a more efficient market where providers must offer value to retain customers.

The bargaining power of Flywire's customers is influenced by their ability to switch providers and the availability of alternatives. High switching costs, often due to deep integration with existing systems, can mitigate this power. However, the presence of numerous fintech competitors and traditional payment methods means customers have choices, driving Flywire to offer competitive pricing and value.

In 2024, the fintech landscape continued to mature, with an increasing number of payment processors offering specialized services. This broad availability of alternatives means clients, especially larger ones like universities processing millions in tuition or hospitals managing extensive patient billing, can exert significant pressure on transaction fees. Flywire counters this by emphasizing its integrated solutions that enhance efficiency and user experience, aiming to justify its pricing beyond mere cost per transaction.

| Factor | Impact on Flywire | Mitigation Strategy |

|---|---|---|

| Client Concentration | High leverage for major clients, potential for pricing pressure. | Client base diversification; adding over 200 new clients in Q1 2025. |

| Switching Costs | Lowers customer bargaining power if integration is deep. | Deep integration into client workflows and ERP systems. |

| Availability of Alternatives | Increases customer bargaining power, driving competitive pricing. | Highlighting value beyond price (transparency, efficiency, user experience). |

| Price Sensitivity | Downward pressure on fees, especially with high transaction volumes. | Differentiated value proposition; focus on streamlining complex payments. |

| Transparency | Empowers customers to compare and negotiate terms more effectively. | Clear service information to build trust and demonstrate value. |

What You See Is What You Get

Flywire Payments Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Flywire Payments' Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The global payments arena is intensely crowded, featuring a wide array of competitors from established financial institutions to agile fintech innovators and new entrants. Flywire navigates this landscape by facing off against both broad-spectrum payment giants and niche specialists.

For instance, Flywire directly contends with major payment facilitators such as Stripe and Adyen, which offer comprehensive solutions across various business needs. Simultaneously, it encounters specialized providers focusing on specific market segments or transaction types, further diversifying the competitive set.

This broad and deep competitive field necessitates Flywire's continuous innovation and strategic positioning to maintain its market share. The sheer number and varied capabilities of these rivals underscore the dynamic nature of the payments industry.

The cross-border payments market is a hotbed of activity, with robust growth fueling intense competition. This expanding market presents a significant opportunity, but it also acts as a magnet for new players, all eager to capture a piece of the action. Flywire itself saw its revenue climb by 17% in the fourth quarter of 2024, and the company expects this upward trend to continue with a projected revenue growth of 10-14% for the full fiscal year 2025.

Flywire stands out by concentrating on intricate, high-value transactions and offering tailored software for sectors like education, healthcare, and travel. This niche focus helps it sidestep direct clashes with broad-spectrum payment providers. For instance, in 2023, Flywire reported a 30% increase in its education segment revenue, highlighting the success of its specialized approach.

While this specialization creates a barrier, the payments landscape is dynamic. Competitors can and do develop their own specialized offerings or adapt existing platforms to enter these lucrative niches. For example, Stripe has been expanding its industry-specific solutions, potentially increasing rivalry in areas Flywire currently dominates.

Switching Costs for Clients

Flywire's robust integrations with client systems are a significant factor in creating switching costs. These deep ties make it complex and potentially expensive for clients to move to a competitor, fostering client stickiness. This is a key element in managing competitive rivalry.

However, this advantage is challenged if rivals offer substantial incentives to overcome these integration hurdles. For instance, competitors might present significantly lower transaction fees, cutting into Flywire's cost advantage. Alternatively, a competitor with demonstrably superior technology or a more comprehensive suite of payment and financial services could entice clients to absorb the switching costs.

Flywire's reported low client churn rate, often cited as a testament to its service value, indicates that clients find the benefits of staying with Flywire outweigh the potential disruption of switching. For example, in 2023, Flywire reported a client retention rate exceeding 95%, highlighting the effectiveness of its integrated solutions and customer support in mitigating competitive pressures.

- High Integration Value: Flywire's deep system integrations create significant barriers to switching for its clients, locking them into its platform.

- Competitive Threats: Rival payment processors can still attract Flywire's clients by offering substantially lower fees, cutting-edge technology, or a wider array of integrated financial services.

- Client Retention Evidence: Flywire's strong client retention, with over 95% retention reported in 2023, suggests clients perceive high value in its current offerings, mitigating the impact of competitive switching incentives.

Strategic Acquisitions and Partnerships

The payments industry is dynamic, with frequent mergers, acquisitions, and strategic partnerships constantly reshaping the competitive terrain. These consolidations can rapidly alter market share and introduce new competitive pressures.

Flywire's acquisition of Sertifi in early 2024 exemplifies this trend. This strategic move aimed to bolster Flywire's standing within the lucrative travel sector, a key vertical for the company, and simultaneously broaden its overall market reach and service offerings.

- Strategic Acquisitions: Flywire's acquisition of Sertifi in early 2024 cost an undisclosed amount but was designed to enhance its capabilities in the travel and hospitality industry.

- Market Expansion: This acquisition allows Flywire to offer more integrated solutions for travel businesses, potentially capturing a larger share of this market.

- Competitive Landscape Shift: Such M&A activities in the payments space can lead to increased consolidation, potentially intensifying rivalry among larger, more integrated players.

Flywire faces intense rivalry from both broad payment providers and niche specialists, necessitating continuous innovation. The company's strategy of focusing on complex, high-value transactions in sectors like education and healthcare helps differentiate it, as seen in its 30% revenue increase in the education segment in 2023. However, rivals are increasingly developing specialized offerings, and Flywire's strong client retention, exceeding 95% in 2023, highlights the effectiveness of its integrated solutions in mitigating competitive threats.

| Competitor Type | Examples | Flywire's Strategy | Impact on Rivalry |

|---|---|---|---|

| Broad Payment Facilitators | Stripe, Adyen | Niche focus, tailored software | Reduces direct competition, but rivals expand into niches |

| Niche Specialists | Various | Deep integration, high-value transactions | Creates switching costs, but rivals offer incentives |

| Industry Consolidation | Acquisitions (e.g., Sertifi) | Strategic M&A to bolster verticals | Can intensify rivalry among larger, integrated players |

SSubstitutes Threaten

Traditional banks provide wire transfers and other international payment solutions, acting as a direct substitute for Flywire's specialized cross-border payment platform. While these legacy services might lack the transparency and efficiency of newer fintech solutions, particularly for intricate or high-value international transactions, they still represent a significant and accessible alternative for a broad customer base.

For domestic payments, consumers and businesses have several direct alternatives to services like Flywire. Bank transfers, Automated Clearing House (ACH) payments, and even traditional checks can be used, particularly for business-to-business transactions. These methods bypass intermediaries, offering a seemingly simpler route for moving funds domestically.

However, Flywire differentiates itself by adding significant value beyond basic fund transfer. For instance, in 2024, many businesses still grapple with inefficient reconciliation processes, which can consume considerable resources. Flywire's platform is designed to automate and simplify this, providing enhanced transparency and reducing the manual effort associated with tracking payments, thereby mitigating the threat of these more rudimentary substitutes.

Large payment processors such as PayPal, Stripe, and Adyen present a significant threat of substitutes for Flywire. These platforms offer broad, generalized payment solutions that can be adopted by clients seeking a less specialized approach. For instance, a small business might find PayPal's ease of integration and widespread consumer recognition a sufficient substitute for Flywire's more tailored services.

While these generic processors provide extensive functionality, they often lack the deep vertical-specific customizations that Flywire offers, particularly in sectors like education or healthcare. This differentiation is key, as clients requiring highly specific workflows or compliance features may not view these broader platforms as direct substitutes.

In 2024, the global digital payments market continued its robust growth, with major players like Stripe reporting significant transaction volumes, indicating their widespread adoption. This broad market penetration by substitutes underscores the importance for Flywire to continually highlight its unique value proposition in specialized payment processing.

Alternative Payment Methods (APMs)

The proliferation of Alternative Payment Methods (APMs) poses a significant threat of substitution for Flywire. Digital wallets like Apple Pay and Google Pay, alongside Buy Now Pay Later (BNPL) services such as Klarna and Afterpay, offer increasingly seamless transaction experiences. Furthermore, the growing interest in cryptocurrencies for payments, though still nascent in many sectors, presents another avenue for bypassing traditional payment processors.

These APMs can reduce the reliance on specialized payment solutions like Flywire, particularly in cross-border transactions where Flywire has a strong presence. For instance, BNPL services are gaining traction in e-commerce, allowing consumers to split payments without necessarily using a dedicated platform for international purchases. By 2024, the global BNPL market was projected to reach over $3.2 trillion, indicating a substantial shift in consumer payment preferences.

- Digital Wallets: Continued growth in mobile payment adoption, with projections suggesting over 2 billion users globally by 2025, directly impacts traditional payment flows.

- Buy Now Pay Later (BNPL): The BNPL market experienced a significant surge, with transaction values expected to grow substantially year-over-year, offering consumers installment payment options outside of traditional credit.

- Cryptocurrencies: While regulatory hurdles remain, the increasing acceptance of cryptocurrencies for certain types of transactions, particularly in niche markets, offers an alternative to fiat currency payment rails.

- Impact on Flywire: Widespread adoption of these APMs, especially those that facilitate direct peer-to-peer or merchant-to-consumer transactions without intermediaries, could diminish the perceived value of Flywire's integrated payment solutions.

In-house Payment Solutions

For very large institutions, building proprietary in-house payment processing systems represents a potential substitute for services like Flywire. This approach, while demanding significant capital investment and technical expertise, can appeal to organizations with unique operational needs and the financial capacity to manage such complexity. For instance, a global bank with extensive transaction volumes might consider this route to gain complete control over its payment infrastructure.

Flywire's core value proposition directly addresses this threat by offering a managed, end-to-end solution that absorbs the inherent complexity and cost associated with developing and maintaining such systems. This allows clients to focus on their core business rather than payment infrastructure management.

- In-house Development Costs: Building a robust payment system can cost millions, with ongoing maintenance and compliance adding further expense.

- Complexity Management: Handling regulatory compliance, security protocols, and technological upgrades for a proprietary system is a significant undertaking.

- Flywire's Advantage: Flywire abstracts this complexity, offering a scalable and compliant platform, which is particularly valuable for organizations without specialized internal payment expertise.

The threat of substitutes for Flywire is significant, encompassing traditional banks, other large payment processors, alternative payment methods (APMs), and even in-house payment systems. While Flywire specializes in cross-border and complex payments, these substitutes offer varying degrees of accessibility and functionality for different customer segments.

In 2024, the continued expansion of digital wallets and Buy Now Pay Later (BNPL) services, with the BNPL market projected to exceed $3.2 trillion, directly challenges Flywire's market share by offering consumers simpler, often interest-free, payment options. Furthermore, generalist payment platforms like PayPal and Stripe, boasting widespread adoption in the global digital payments market, present a viable alternative for businesses seeking less specialized solutions.

| Substitute Type | Key Characteristics | 2024 Market Context/Data | Impact on Flywire |

|---|---|---|---|

| Traditional Banks | Wire transfers, established infrastructure | Still a significant channel, though often less efficient for cross-border | Lower transparency and speed compared to Flywire |

| Large Payment Processors (e.g., PayPal, Stripe) | Broad functionality, ease of integration | Stripe reported significant transaction volumes in 2024 | Can serve as a generalized alternative for less specialized needs |

| Alternative Payment Methods (APMs) | Digital wallets, BNPL, cryptocurrencies | BNPL market projected over $3.2 trillion by 2024; 2 billion+ digital wallet users by 2025 | Offer seamless transactions, potentially bypassing specialized platforms |

| In-house Payment Systems | Full control, customization | High capital investment and technical expertise required | A viable option for very large institutions, but Flywire offers managed complexity |

Entrants Threaten

Building a global payment enablement and software company, particularly one handling intricate cross-border transactions, demands substantial capital. This investment is crucial for developing robust technology, ensuring strict compliance with diverse financial regulations, and establishing a widespread operational infrastructure. For instance, in 2024, companies entering the payment processing space often need to allocate hundreds of millions of dollars for regulatory licenses, secure data centers, and building out global networks.

These high initial capital requirements act as a significant barrier, deterring potential new competitors from entering the market. The sheer scale of investment needed to match existing players like Flywire, which has established extensive compliance frameworks and technology platforms over years, makes it exceedingly difficult for startups to compete effectively from the outset.

The payments industry faces significant hurdles for newcomers due to its intricate regulatory landscape. Companies must grapple with a complex web of international regulations, including stringent anti-money laundering (AML) protocols and evolving data privacy laws like GDPR and CCPA. For instance, in 2024, the global financial crime compliance market was valued at approximately $35 billion, highlighting the substantial investment required to meet these obligations.

Specifically for cross-border transactions, which are a core area for companies like Flywire, the compliance burden is amplified. Different countries have unique licensing requirements, reporting standards, and consumer protection laws. Failure to adhere to these can result in hefty fines and reputational damage, making it a daunting challenge for new entrants to establish a compliant operational framework.

Flywire's robust network effects significantly deter new entrants. As more educational institutions, healthcare providers, and businesses adopt Flywire, the platform becomes inherently more valuable to all users due to increased payment options and streamlined reconciliation. This growing ecosystem creates a powerful barrier.

The company's deep-seated client relationships, serving over 4,000 clients globally, are a critical defense. These are not just transactional links; they often involve complex integrations with clients' existing ERP systems. Such entrenched partnerships are time-consuming and costly for new competitors to dislodge or replicate, requiring substantial investment and proven reliability.

Technological Expertise and Specialization

The threat of new entrants due to technological expertise and specialization is moderate for Flywire. Developing and maintaining a sophisticated, secure, and specialized payment platform for intricate global transactions demands significant technological prowess and ongoing innovation. New players would face substantial R&D investment hurdles to replicate Flywire's established capabilities, especially with the increasing integration of AI in payment systems, which further elevates the technological barrier to entry.

Consider these factors:

- High R&D Investment: Competitors need substantial capital to match Flywire's specialized payment processing technology, which handles complex cross-border transactions in sectors like education and healthcare.

- AI Integration: The growing adoption of AI in payment systems, aiming for enhanced fraud detection and customer experience, necessitates advanced AI development skills, a costly undertaking for newcomers.

- Platform Security: Maintaining robust security protocols to protect sensitive financial data in a highly regulated environment is paramount and requires continuous investment in cybersecurity expertise.

Brand Reputation and Trust

In the financial services sector, brand reputation and trust are foundational. Flywire has cultivated a strong standing by making intricate payment processes straightforward and transparent for its users. This hard-won credibility is a significant barrier for any new competitor aiming to enter the market.

New entrants would face the considerable challenge of building similar levels of trust and perceived reliability. This process is not only time-consuming but also resource-intensive, requiring substantial investment in marketing, customer service, and demonstrating consistent performance. For instance, in 2023, customer acquisition cost in fintech often exceeded $100, highlighting the expense of gaining trust.

- Brand Reputation as a Barrier: Flywire's established trust is a significant deterrent to new players.

- Time and Investment: Building credibility in financial services requires years and substantial capital.

- Customer Acquisition Costs: High costs in fintech, often over $100 per customer in 2023, underscore the difficulty.

- Transparency as a Differentiator: Flywire's focus on transparency further solidifies its trusted position.

The threat of new entrants for Flywire is generally low, primarily due to the substantial capital investment required to establish operations. Developing the necessary technology, navigating complex global regulations, and building a robust infrastructure often necessitate hundreds of millions of dollars, as seen in the significant investments required for compliance and network build-out in 2024.

Furthermore, the intricate regulatory landscape, particularly for cross-border payments, presents a formidable barrier. Adhering to diverse international anti-money laundering (AML) protocols and data privacy laws, such as GDPR, demands considerable expertise and financial resources, with the global financial crime compliance market valued around $35 billion in 2024.

Flywire's established network effects and deep client relationships, often involving complex system integrations with over 4,000 clients, create significant switching costs and deter new entrants. Building comparable trust and reliability in financial services is a lengthy and expensive process, with customer acquisition costs in fintech sometimes exceeding $100 in 2023.

Porter's Five Forces Analysis Data Sources

Our Flywire Payments Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports, and insights from leading financial news outlets.

We also leverage data from regulatory filings and investor relations materials to thoroughly assess the competitive landscape, supplier power, buyer bargaining, threat of new entrants, and the intensity of substitutes.