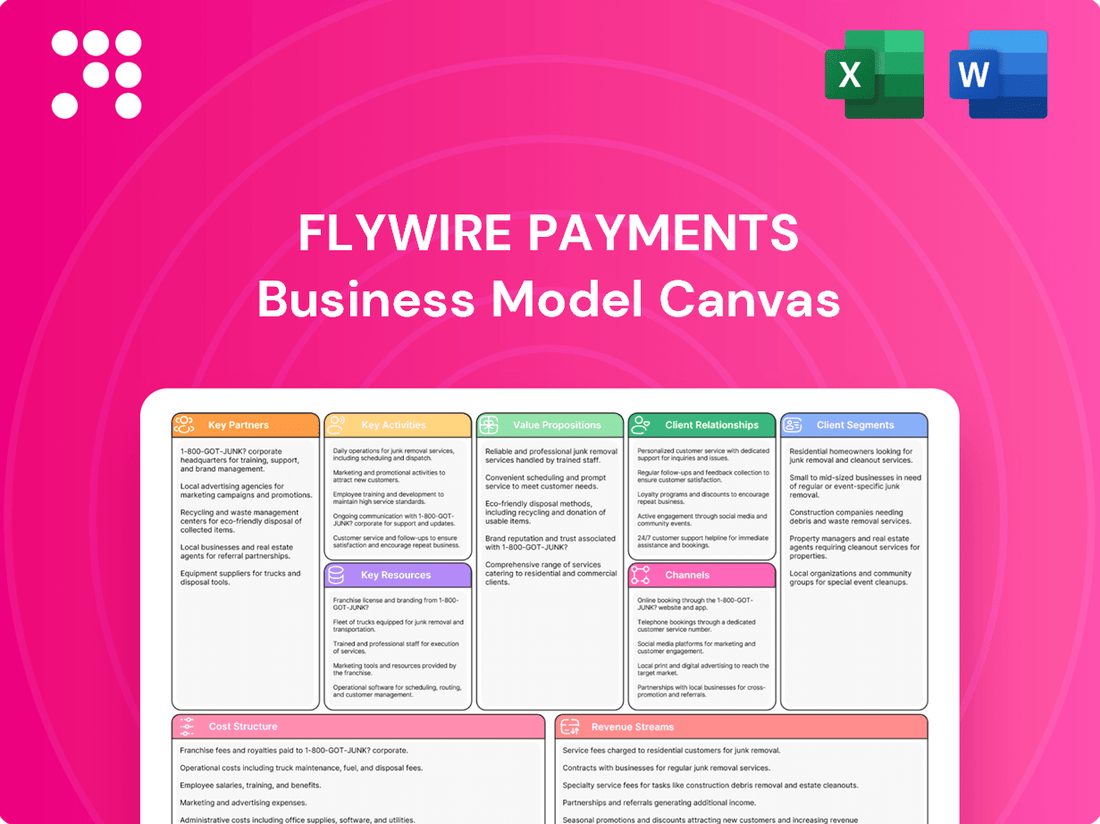

Flywire Payments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Unlock the strategic blueprint behind Flywire Payments's innovative business model. This comprehensive Business Model Canvas reveals how they connect global payers and receivers through specialized payment solutions. Discover their key partners, revenue streams, and customer relationships.

Dive deeper into Flywire Payments’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Get the full picture today!

Partnerships

Flywire collaborates with a vast array of global banks and financial institutions. This network is essential for processing both international and local transactions across numerous currencies, underpinning Flywire's extensive payment capabilities.

These strategic alliances empower Flywire's proprietary payment infrastructure, enabling clients to transact in over 140 currencies. As of early 2024, Flywire's reach extends to more than 240 countries and territories, demonstrating the critical role of these financial partnerships.

Flywire's strategic partnerships with major ERP and software providers are foundational to its business model. Collaborations with giants like Ellucian, Workday, Unit4, Oracle NetSuite, Sage Intacct, and Microsoft Business Dynamics ensure Flywire's payment solutions are seamlessly integrated into client systems.

These deep integrations are crucial as they embed Flywire's capabilities directly within clients' accounts receivable (A/R) processes. This native integration streamlines the entire payment journey for customers, reducing friction and enhancing operational efficiency for businesses.

For instance, by connecting with Ellucian, a leading provider for higher education, Flywire enables universities to manage tuition payments more effectively within their existing student information systems. This direct embedding reduces manual workarounds and improves the overall student payment experience.

Flywire cultivates vital relationships with education and healthcare ecosystem partners. These include recruitment agencies that funnel international students, educational associations that set industry standards, and healthcare providers managing patient billing.

These collaborations are crucial for expanding Flywire's specialized payment offerings, like simplifying tuition payments for overseas students and streamlining financial interactions for patients. For instance, Flywire reported a significant increase in its education segment in 2023, driven by strong demand for its cross-border payment solutions.

Travel Industry Platforms and Providers

Flywire's strategic expansion into the travel sector is significantly bolstered by its acquisition of Sertifi, enhancing its network of key partnerships. This move allows Flywire to integrate directly with a wide array of hotel property management systems, streamlining payment processes for these businesses.

The company now collaborates with diverse hospitality providers, ranging from large branded hotel chains to exclusive luxury and independent boutique accommodations. This broadens Flywire's reach and service capabilities across the entire spectrum of the travel industry.

- Expanded Hotel Integrations: Flywire now connects with numerous hotel property management systems, facilitating seamless payment collection for hotels.

- Diverse Hospitality Network: Partnerships include major branded hotels, luxury properties, and unique boutique accommodations, covering a wide market segment.

- Sertifi Acquisition Impact: The integration of Sertifi has been a catalyst for these deeper relationships within the travel and hospitality ecosystem.

Payment Security and Compliance Organizations

Flywire's position on the PCI Security Standards Council (PCI SSC) Board of Advisors for 2025-2027 underscores its dedication to robust payment security. This collaboration is vital for establishing and maintaining industry-wide security protocols.

Maintaining PCI DSS Level 1 certification and undergoing SOC II Type II audits are critical partnerships for Flywire. These certifications demonstrate a commitment to protecting sensitive payment data, fostering trust with clients and consumers alike.

- PCI SSC Board of Advisors: Flywire's appointment for 2025-2027 signifies a leadership role in shaping payment security standards.

- PCI DSS Level 1 Compliance: This certification is the highest level of compliance for organizations handling cardholder data, ensuring stringent security measures.

- SOC II Type II Audits: These audits validate the effectiveness of Flywire's internal controls related to security, availability, processing integrity, confidentiality, and privacy of customer data.

Flywire's key partnerships extend to payment processors and technology providers, crucial for executing its global payment solutions. These collaborations ensure the smooth and secure flow of funds across diverse payment networks.

The company actively partners with technology firms to enhance its platform's capabilities, integrating new payment methods and improving user experience. This focus on technological alliances keeps Flywire at the forefront of payment innovation.

Flywire's strategic relationships with acquirers and gateways are fundamental to its operational success. These partnerships enable the acceptance and processing of a wide range of payment types globally, supporting its expansive client base.

| Partner Type | Examples | Impact |

| Global Banks & Financial Institutions | Various unnamed institutions | Facilitate transactions in 140+ currencies across 240+ countries. |

| ERP & Software Providers | Ellucian, Workday, Oracle NetSuite, Microsoft Dynamics | Seamless integration into client A/R processes, reducing friction. |

| Ecosystem Partners (Education/Healthcare) | Recruitment agencies, industry associations | Expand specialized payment offerings, drive segment growth. |

| Travel & Hospitality Providers | Hotel property management systems, branded and boutique hotels | Streamline payment collection via Sertifi integration. |

| Security Standards Bodies | PCI Security Standards Council | Shape payment security protocols, maintain PCI DSS Level 1 compliance. |

What is included in the product

This Business Model Canvas provides a detailed overview of Flywire's strategy, focusing on its core customer segments, value propositions, and revenue streams in cross-border payments.

It outlines Flywire's operational structure, key partnerships, and cost drivers, offering insights for strategic decision-making and investor presentations.

Flywire's Payments Business Model Canvas acts as a pain point reliever by streamlining complex cross-border payment processes for businesses and individuals.

It offers a clear, one-page snapshot that simplifies the often-frustrating journey of international transactions, addressing key pain points in currency conversion, fees, and speed.

Activities

Flywire's core activity centers on the ongoing development and refinement of its proprietary global payments network and its next-generation, vertical-specific software solutions. This continuous innovation is crucial for maintaining a robust, secure, and highly adaptable platform capable of tackling intricate payment challenges across various industries.

In 2024, Flywire continued to invest heavily in its technology infrastructure, aiming to enhance transaction speeds and expand its capabilities in areas like real-time payments and embedded finance. The company's commitment to platform development ensures it can effectively serve its diverse client base, from healthcare and education to travel and B2B markets.

Flywire's core activity involves facilitating both cross-border and domestic payments, acting as a crucial bridge for clients and their customers. This means handling a wide array of payment methods, from credit cards to bank transfers, across numerous currencies, ensuring a smooth transaction experience.

A key aspect is the management of currency exchange and compliance with international regulations, simplifying complex financial processes for businesses and individuals alike. For instance, in 2024, Flywire continued to expand its network, processing billions of dollars in transactions for its clients in sectors like education and healthcare.

Real-time tracking and transparency are paramount, offering clients and their customers visibility into every step of the payment journey. This commitment to transparency builds trust and reduces payment friction, a critical factor in today's globalized economy.

Flywire's sales and client acquisition strategy focuses on penetrating key global verticals like education, healthcare, travel, and B2B payments. This involves direct sales teams, channel partnerships, and targeted marketing campaigns to reach institutions and businesses seeking simplified cross-border payment solutions.

The company demonstrated significant growth in client acquisition during early 2025, onboarding more than 200 new clients in the first quarter. This expansion was notably strong in the Travel and Education sectors, indicating successful market penetration and demand for Flywire's services in these areas.

Customer Support and Relationship Management

Flywire's commitment to customer support and relationship management is central to its business model. This involves offering robust, multilingual assistance to a global client base, ensuring seamless communication and problem resolution. For instance, in 2024, Flywire continued to invest in its support infrastructure, aiming to reduce average response times for customer inquiries.

A significant aspect of their strategy is streamlining complex processes, such as refunds, to enhance the customer experience and build trust. By making these operations efficient and transparent, Flywire fosters loyalty and reduces churn. This focus on operational excellence directly contributes to their high client retention rates.

- Multilingual Support: Providing assistance in numerous languages to cater to a diverse international clientele.

- Streamlined Refunds: Simplifying and accelerating the refund process for a better customer experience.

- Workflow Integration: Embedding Flywire solutions deeply into client operational workflows to maximize utility and retention.

- Client Retention Focus: Proactive relationship management aimed at ensuring long-term partnerships and satisfaction.

Strategic Acquisitions and Integrations

Flywire actively pursues strategic acquisitions to bolster its capabilities and reach. A prime example is the acquisition of Invoiced, a B2B accounts receivable automation platform, which significantly enhanced Flywire's offering in this critical business segment. This move, completed in 2022, aimed to streamline the entire payment lifecycle for businesses.

Further expanding its vertical expertise, Flywire acquired Sertifi, a digital agreement and payment solution provider. This integration is particularly impactful for the travel industry, a key sector for Flywire, allowing for more seamless booking and payment processes. The company consistently works to integrate these acquired technologies.

- Invoiced Acquisition: Enhanced B2B A/R automation capabilities.

- Sertifi Acquisition: Strengthened vertical solutions, especially in travel.

- Integration Focus: Continuous effort to combine acquired platforms for comprehensive solutions.

Flywire's key activities revolve around maintaining and enhancing its global payment network and specialized software. This includes ongoing investment in technology to boost transaction speed and expand into areas like real-time payments. The company also focuses on managing currency exchange and regulatory compliance, simplifying complex financial transactions for its diverse clientele.

Delivered as Displayed

Business Model Canvas

The Flywire Payments Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally structured, and ready-to-use content that will be delivered to you, ensuring no surprises and full transparency in your acquisition.

Resources

Flywire's proprietary global payments network is a cornerstone of its business model, facilitating transactions in over 140 currencies across more than 240 countries and territories. This extensive reach allows for seamless processing of complex international payments, a key differentiator in the cross-border payment market.

This robust network is crucial for handling the diverse and often intricate payment flows encountered by Flywire's clients in sectors like education, healthcare, and travel. By owning and operating this infrastructure, Flywire ensures greater control over transaction speed and reliability, which is vital for customer satisfaction and operational efficiency.

Flywire's core strength lies in its proprietary next-generation payments platform. This sophisticated technology simplifies complex payment processes, making transactions smoother for both clients and their customers. It's the engine that powers their specialized solutions.

The platform is augmented by vertical-specific software designed for industries like education, healthcare, travel, and B2B. This tailored approach ensures deep integration into client workflows, addressing unique payment challenges within each sector. For example, in education, it streamlines tuition payments and financial aid disbursement.

In 2024, Flywire continued to expand its reach, processing billions of dollars in transactions across these key verticals. Their platform's ability to handle diverse payment methods and currencies, coupled with regulatory compliance features, represents significant intellectual property and a competitive advantage.

Flywire's deep industry expertise is a cornerstone of its business model. This specialized knowledge allows them to craft payment solutions tailored to the intricate needs of sectors like education, healthcare, and travel.

For instance, in the education sector, Flywire understands the complexities of international student payments, including currency conversion, regulatory compliance, and diverse payment methods. This allows them to offer a seamless experience for both students and institutions.

The company also leverages significant technical and operational talent. This skilled workforce is essential for developing and maintaining their robust payment platform, ensuring security, efficiency, and compliance across all transactions.

This combination of industry insight and technical prowess is a key differentiator, enabling Flywire to effectively address the unique payment challenges faced by its clients, a critical resource for their continued growth and success.

Client Base and Data

Flywire's client base, exceeding 4,000 organizations across diverse sectors like education, healthcare, and travel, is a cornerstone of its business model. This extensive network fuels recurring revenue streams and presents ample opportunities for expanding services to existing clients.

The sheer volume of transactions processed through Flywire generates valuable data. This data is not just a byproduct; it's a strategic asset that can be analyzed to refine services, identify market trends, and enhance customer experiences, ultimately driving further growth and efficiency.

- Over 4,000 organizations rely on Flywire for payment solutions.

- The client base spans critical industries including education, healthcare, and travel.

- Transaction data offers insights for service improvement and market analysis.

- A broad client base supports recurring revenue and cross-selling opportunities.

Financial Capital and Funding

As a publicly traded entity, Flywire relies heavily on its financial capital to fuel growth and innovation. This capital encompasses revenue derived from its core payment processing services and funds generated through strategic financial activities like share repurchases. For instance, Flywire reported Q1 2025 revenue of $133.5 million, demonstrating a strong operational performance that directly contributes to its financial resources.

This robust financial foundation is critical for Flywire to invest in key areas such as enhancing its technology infrastructure, pursuing strategic acquisitions that broaden its service offerings or market reach, and facilitating its ongoing global expansion initiatives. The company reaffirmed its fiscal year 2025 guidance, signaling confidence in its ability to generate and manage capital effectively to support these strategic objectives.

- Revenue Generation: Flywire's primary financial capital comes from its transaction fees and service charges within its payment solutions.

- Shareholder Equity: Funds raised through the issuance of stock or retained earnings also form a significant part of its financial capital.

- Debt Financing: While not explicitly mentioned, access to credit lines or other forms of debt can supplement capital for specific projects.

- Investment Capacity: The $133.5 million in Q1 2025 revenue directly enables investments in product development and market penetration.

Flywire's key resources are its proprietary global payments network, its advanced platform, deep industry expertise, extensive client base, and strong financial capital. These elements work in concert to enable seamless, specialized payment solutions across various sectors.

The proprietary network, spanning over 140 currencies and 240+ countries, ensures efficient cross-border transactions. This infrastructure, combined with vertical-specific software, addresses unique industry needs, as seen in streamlined tuition payments for education clients. By processing billions of dollars in 2024, Flywire leverages this data for continuous service enhancement.

Flywire's over 4,000 clients provide recurring revenue and cross-selling opportunities, while its financial capital, bolstered by $133.5 million in Q1 2025 revenue, fuels ongoing investment in technology and global expansion.

| Key Resource | Description | Impact |

|---|---|---|

| Proprietary Payments Network | Global reach (140+ currencies, 240+ countries) | Facilitates complex cross-border transactions efficiently. |

| Next-Generation Platform | Vertical-specific software and advanced technology | Simplifies complex payments, offers tailored solutions. |

| Industry Expertise | Deep understanding of education, healthcare, travel | Enables solutions addressing unique sector challenges. |

| Client Base | Over 4,000 organizations | Drives recurring revenue and data insights for improvement. |

| Financial Capital | Q1 2025 Revenue: $133.5M | Supports investment in technology, expansion, and acquisitions. |

Value Propositions

Flywire excels at making complicated payment processes, particularly those involving international money transfers and significant sums, much easier to manage. This is a huge relief for sectors like education, healthcare, and business-to-business transactions, where these complexities can bog down operations.

By streamlining these intricate payment flows, Flywire significantly cuts down on the administrative hassle for its clients. This efficiency boost is critical, especially when dealing with the nuances of global finance. For instance, in 2024, many educational institutions reported substantial time savings on processing international student tuition fees thanks to integrated payment solutions.

Flywire's platform delivers unparalleled transparency through real-time payment tracking and detailed, easily accessible reports. This visibility empowers both businesses and their customers, offering a clear understanding of every transaction's journey and status, which is crucial for managing finances effectively.

This enhanced transparency directly translates to increased efficiency. Businesses benefit from streamlined reconciliation processes and optimized financial workflows, reducing manual effort and the potential for errors. For instance, in 2023, companies utilizing Flywire reported an average reduction of 30% in reconciliation time, freeing up valuable resources.

The combined effect of transparency and efficiency provides significant peace of mind. Clients can trust that their payments are being processed smoothly and accurately, while their customers gain better financial control and a more predictable experience. This fosters stronger relationships and reduces payment-related friction, a key driver for customer satisfaction.

Flywire prioritizes secure and compliant payment experiences, holding PCI DSS Level 1 certification and undergoing SOC II Type II audits. This commitment to robust security builds essential trust with clients and payers alike, reducing the risk of data breaches and financial fraud.

By adhering to global regulations like GDPR and HIPAA, Flywire ensures that sensitive data is handled with the utmost care and legal compliance. This proactive approach to regulatory adherence is critical for businesses operating across international borders, safeguarding both their reputation and their customers.

Diverse Payment Methods and Currencies

Flywire’s value proposition centers on providing a vast selection of payment methods and supporting over 140 currencies. This global reach, spanning more than 240 countries and territories, ensures that clients can accommodate diverse customer preferences and local payment habits.

This extensive network directly translates to improved payment conversion rates for businesses. By offering familiar and convenient payment options, Flywire helps reduce friction in the checkout process, making it easier for customers worldwide to complete transactions.

- Global Reach: Supports payments in over 140 currencies across 240+ countries and territories.

- Diverse Payment Options: Caters to local preferences, enhancing customer convenience.

- Increased Conversion: Facilitates higher payment completion rates by reducing friction.

Vertical-Specific Solutions and Integration

Flywire crafts specialized software, deeply integrated with clients' existing ERP and accounts receivable systems. This tailored approach ensures solutions are perfectly suited to the distinct demands of sectors like education, healthcare, travel, and B2B commerce.

By embedding its payment capabilities directly into core business workflows, Flywire optimizes operations and tackles industry-specific hurdles head-on. For example, in the education sector, this means streamlined tuition payments and alumni donations, while healthcare benefits from simplified patient billing and insurance claim processing.

- Tailored Software: Flywire develops payment solutions designed for specific industry needs, not generic ones.

- Deep System Integration: The platform seamlessly connects with existing ERP and A/R systems, reducing disruption.

- Industry Optimization: This integration enhances efficiency and addresses unique challenges within education, healthcare, travel, and B2B.

- Streamlined Processes: Flywire's approach simplifies complex payment flows, improving user experience and operational effectiveness.

Flywire simplifies complex, cross-border payments, particularly for high-value transactions in sectors like education and healthcare. This ease of use reduces administrative burdens, allowing organizations to focus on core operations rather than payment intricacies.

The platform offers enhanced transparency through real-time tracking and detailed reporting, fostering trust and enabling efficient financial management. This visibility is crucial for businesses and their customers alike, ensuring clarity on every transaction.

Security and compliance are paramount, with Flywire adhering to stringent global standards like PCI DSS Level 1 and SOC II Type II. This commitment provides a secure payment environment, protecting sensitive data and mitigating financial risks.

Flywire's extensive global network supports over 140 currencies and operates in more than 240 countries, accommodating diverse customer preferences and boosting conversion rates. This broad reach ensures businesses can serve a global clientele effectively.

| Value Proposition | Description | Impact |

|---|---|---|

| Simplified Cross-Border Payments | Handles complex international transactions and large sums with ease. | Reduces administrative overhead and operational friction. |

| Enhanced Transparency | Provides real-time tracking and detailed reporting for all transactions. | Builds trust and improves financial management for clients and payers. |

| Robust Security & Compliance | Adheres to PCI DSS Level 1 and SOC II Type II, plus global data regulations. | Ensures secure transactions and protects sensitive customer information. |

| Global Reach & Payment Options | Supports 140+ currencies across 240+ countries with diverse local payment methods. | Increases payment conversion rates and customer convenience worldwide. |

Customer Relationships

Flywire prioritizes robust customer connections via dedicated account managers and 24/7 multilingual support. This approach guarantees clients receive tailored help and swift solutions for any payment challenges they encounter.

Flywire deepens customer relationships by embedding its payment solutions directly into clients' existing software systems. This seamless integration makes Flywire an indispensable part of daily operations, fostering a sticky customer base. For instance, in 2023, Flywire reported a significant increase in client retention, a direct result of these deep software ties.

This software-driven engagement strategy significantly reduces client churn. By becoming an integral component of a client's workflow, switching providers becomes a complex and disruptive undertaking. This operational entanglement translates into high client satisfaction and loyalty, a cornerstone of Flywire's business model.

Flywire's consultative sales approach dives deep into understanding the intricate payment challenges faced by clients across various industries. This personalized strategy allows them to showcase how their tailored solutions directly address specific pain points, fostering trust and demonstrating value from the outset.

This method is crucial for acquiring new clients, especially in complex sectors like education and healthcare where payment processes are highly specialized. For instance, by understanding a university's international student tuition collection issues, Flywire can propose a solution that simplifies currency conversion and compliance, leading to a signed agreement.

Furthermore, the consultative process is key to deepening existing relationships. By proactively engaging with current clients to identify evolving needs or new opportunities, Flywire can expand its service offerings, leading to increased revenue. In 2023, Flywire reported a 32% increase in total revenue, partly driven by successful expansion within its existing client base.

Continuous Product Enhancement Based on Feedback

Flywire actively cultivates customer loyalty by consistently refining its payment platform and software. This dedication to improvement is directly fueled by valuable client feedback and an ongoing assessment of shifting market demands.

This iterative enhancement process ensures Flywire's solutions stay cutting-edge and deeply relevant, providing sustained value to its diverse customer base. For instance, in 2024, Flywire reported a significant uptick in feature requests related to cross-border payment transparency, which directly informed their Q3 software update.

- Client-Driven Innovation: Flywire's product roadmap is heavily influenced by direct input from its clients, ensuring features address real-world pain points.

- Market Responsiveness: The company proactively adapts its technology to meet evolving regulatory landscapes and payment processing trends.

- 2024 Focus: A key enhancement in 2024 was the introduction of a more intuitive reconciliation tool, a direct response to feedback from financial controllers.

- Long-Term Value: Continuous enhancement fosters deeper customer relationships by demonstrating a commitment to providing superior and adaptable payment solutions.

Strategic Partnerships for Ecosystem Growth

Flywire cultivates strategic partnerships across education, healthcare, and travel sectors. These collaborations allow Flywire to embed its payment solutions within broader client workflows, offering a more seamless and integrated experience. For instance, by partnering with student information systems or hospital management platforms, Flywire becomes an indispensable part of the client's operational fabric.

These alliances significantly bolster client relationships by delivering enhanced value. When Flywire integrates with other critical service providers, it moves beyond a simple payment processor to become a comprehensive solution provider. This co-creation of value strengthens loyalty and deepens engagement with Flywire's customer base.

- Ecosystem Integration: Flywire partners with software providers in its target verticals to embed payment capabilities directly into existing client systems, streamlining operations.

- Enhanced Client Value: These partnerships allow Flywire to offer bundled solutions that address a wider range of client needs, increasing the stickiness of its services.

- Market Expansion: Collaborations with established players in education and healthcare, for example, provide Flywire with access to new client segments and distribution channels.

- 2024 Data Insight: Flywire's strategic focus on ecosystem growth is evidenced by its continued investment in platform integrations, aiming to process an increasing volume of cross-border transactions for its global partners.

Flywire nurtures customer loyalty through dedicated support, including 24/7 multilingual assistance and assigned account managers. This ensures clients receive personalized attention and swift resolutions to any payment-related issues.

By integrating its payment solutions directly into clients' existing software, Flywire becomes an essential part of their daily operations, significantly boosting retention. This deep integration makes switching providers a complex and disruptive process for clients, fostering strong loyalty.

Flywire's consultative sales approach focuses on understanding and solving specific client pain points across industries like education and healthcare. This tailored strategy builds trust and demonstrates clear value from the initial engagement, driving both acquisition and expansion within existing accounts.

Continuous platform enhancement, driven by client feedback and market analysis, keeps Flywire's offerings relevant and valuable. For example, a key 2024 update introduced an improved reconciliation tool, directly addressing client requests.

| Customer Relationship Aspect | Description | Impact | 2024 Data/Focus |

|---|---|---|---|

| Dedicated Support | 24/7 multilingual support, dedicated account managers | Tailored assistance, swift problem resolution, high satisfaction | Ongoing investment in support infrastructure |

| Software Integration | Embedding solutions into client systems | Operational indispensability, reduced churn, increased stickiness | Continued development of API integrations |

| Consultative Sales | Understanding and addressing specific industry pain points | Effective client acquisition, expansion of services within existing accounts | Focus on vertical-specific solutions |

| Client-Driven Innovation | Incorporating client feedback into product development | Relevant and cutting-edge solutions, sustained value | Introduction of enhanced reconciliation tools based on feedback |

Channels

Flywire's direct sales force is crucial for penetrating its key markets: education, healthcare, travel, and B2B payments. This team builds relationships by offering customized demonstrations of Flywire's payment solutions, directly addressing the unique challenges within each sector.

Flywire leverages strategic partnerships with Enterprise Resource Planning (ERP) providers, software companies, and industry associations to expand its reach and distribute its payment solutions. These collaborations act as vital conduits to new client segments, effectively embedding Flywire’s offerings within existing business workflows and industry networks.

Key integrations with major platforms such as Ellucian, Workday, and Blackbaud are crucial. For instance, Flywire’s integration with Ellucian Banner and Colleague allows educational institutions to streamline tuition payments directly within their student information systems, enhancing user experience and operational efficiency.

These deep integrations mean Flywire’s services are not standalone but are part of the essential technology stack clients already rely on. This embedded approach, demonstrated by its presence in systems used by a significant portion of the higher education market, solidifies Flywire's position as a preferred payment partner.

Flywire cultivates a robust online presence, leveraging its corporate website, a dedicated investor relations portal, and active social media profiles on platforms like X, LinkedIn, and Facebook. These digital channels serve as crucial touchpoints for marketing its payment solutions, disseminating financial performance updates, and fostering engagement with prospective clients and the investment community. For instance, in Q1 2024, Flywire reported a 26% increase in revenue year-over-year, a testament to their effective digital outreach.

Industry Conferences and Events

Flywire leverages industry conferences and investor events as a crucial channel for business development and brand visibility. Participation in events like the Raymond James Institutional Investors Conference and the Morgan Stanley Technology, Media & Telecom Conference provides direct access to potential clients, partners, and investors. These gatherings are instrumental for showcasing thought leadership and engaging with key stakeholders in the payments and technology sectors.

These events facilitate direct engagement, allowing Flywire to articulate its value proposition and gather market intelligence. For instance, in 2024, Flywire executives actively participated in numerous such forums, highlighting their innovative solutions for cross-border payments in education, healthcare, and travel. This direct interaction helps in acquiring new clients and strengthening existing relationships.

- Networking Opportunities: Connect with potential clients, partners, and industry influencers.

- Thought Leadership: Present insights and strategies to establish Flywire as an industry leader.

- Client Acquisition: Directly engage with prospective customers to demonstrate product value and secure new business.

- Market Intelligence: Gain insights into industry trends, competitor activities, and customer needs.

Referral Networks (e.g., Student Recruitment Agents)

In the education sector, Flywire effectively utilizes a robust network of international student recruitment agents. These agents serve as crucial referral channels, connecting prospective students with educational institutions and promoting Flywire as a secure and reliable payment solution for tuition and associated fees.

These partnerships are vital for Flywire's global reach, tapping into established student pipelines. For instance, in 2024, the international student market continued its growth trajectory, with millions of students seeking education abroad, underscoring the importance of these agent networks in facilitating cross-border transactions.

- Global Reach: Agents provide access to diverse student demographics across various countries.

- Trust and Credibility: Established agents lend credibility to Flywire's payment services.

- Market Penetration: Networks enable Flywire to enter and expand within key international education markets.

- Student Acquisition: Agents directly influence student choice of payment methods, driving transaction volume.

Flywire's channels are a multi-pronged approach, combining direct sales, strategic partnerships, and digital outreach. Their direct sales force is key to penetrating specific industries like education and healthcare by offering tailored solutions. Strategic alliances with ERP providers and software companies embed Flywire into existing business workflows, expanding their reach significantly.

Online presence through their website and social media, alongside participation in industry conferences, amplifies brand visibility and client acquisition. For example, in Q1 2024, Flywire reported a 26% revenue increase year-over-year, reflecting the effectiveness of these diverse channels.

Furthermore, leveraging international student recruitment agents provides crucial access to global markets and builds trust within student communities. These agents are vital for facilitating cross-border tuition payments, a key revenue driver for Flywire.

Flywire's channel strategy effectively combines direct engagement with indirect reach through partnerships and digital platforms, driving growth across its key verticals.

| Channel Type | Description | Key Benefit | 2024 Relevance/Example |

|---|---|---|---|

| Direct Sales Force | Dedicated sales teams targeting specific industries. | Customized solutions and deep client relationships. | Penetration in education and healthcare sectors. |

| Strategic Partnerships | Collaborations with ERP providers, software firms, industry associations. | Expanded reach and integration into existing workflows. | Integration with Workday and Ellucian for seamless payments. |

| Digital Channels | Website, investor relations portal, social media. | Marketing, financial updates, and stakeholder engagement. | Q1 2024 revenue up 26% YoY, aided by digital outreach. |

| Industry Events | Conferences, investor meetings. | Thought leadership, client acquisition, market intelligence. | Participation in Raymond James and Morgan Stanley conferences. |

| Recruitment Agents | International student referral networks. | Access to global markets and student trust. | Facilitating millions of cross-border tuition payments annually. |

Customer Segments

Higher education institutions, including universities and colleges worldwide, represent a key customer segment for Flywire Payments. These organizations, especially those with a substantial international student body, face intricate payment processing challenges.

Flywire facilitates the management of complex tuition payments for these institutions, streamlining cross-border transactions. In 2024, the global higher education market continued to see robust international student enrollment, with millions of students pursuing studies abroad, highlighting the ongoing need for efficient international payment solutions.

Furthermore, Flywire supports the disbursement of funds from sources like 529 plans, simplifying financial aid and tuition payment processes for both the institutions and the students they serve.

Healthcare providers, including hospitals and health systems in the U.S., are a key customer segment for Flywire. These organizations face challenges in managing patient payments, and Flywire offers solutions to streamline this process.

Flywire enables healthcare providers to enhance the patient payment experience by offering convenient and flexible payment options. This can lead to improved patient satisfaction and reduced administrative burden for the providers.

By simplifying the collection of medical bills, Flywire helps healthcare providers boost their revenue cycle management. In 2023, the healthcare industry in the U.S. saw significant focus on improving patient payment experiences, with many providers adopting digital solutions to increase collections.

Travel companies and hospitality businesses, including tour operators, hotel chains, and luxury travel groups, represent a key customer segment for Flywire. These businesses often deal with complex payment flows for bookings, deposits, and ancillary services. In 2024, the global travel and tourism sector is projected to contribute significantly to GDP, highlighting the substantial payment volumes these companies manage.

Flywire's expansion, particularly with the acquisition of Sertifi, directly addresses the need for streamlined payment processing within this industry. This allows travel and hospitality firms to simplify how they collect payments for various travel-related expenses, from initial deposits to final payments for accommodations and tours. The integration aims to reduce friction in the payment lifecycle for both the business and the customer.

B2B Enterprises

Flywire’s B2B Enterprises segment is a cornerstone of their business, offering specialized solutions for complex cross-border and domestic payment processing. They cater to a wide array of industries, including education, healthcare, and travel, enabling businesses to manage their accounts receivable more efficiently. This focus on streamlining invoicing and payment reconciliation is critical for companies dealing with high transaction volumes and diverse payment methods.

Businesses within this segment gain significant advantages through Flywire’s platform. Key benefits include automated reconciliation processes, which reduce manual effort and potential errors, and seamless integration with existing Enterprise Resource Planning (ERP) systems. This integration ensures data accuracy and provides a holistic view of financial operations. For example, in 2024, many educational institutions leveraging Flywire reported a reduction in processing time for international student tuition payments by up to 40%.

- Streamlined B2B Payments: Facilitates complex domestic and international transactions for businesses.

- Accounts Receivable Automation: Reduces manual effort in invoicing, payment processing, and reconciliation.

- ERP System Integration: Connects with existing financial systems for enhanced data flow and efficiency.

- Industry Specialization: Tailored solutions for sectors like education, healthcare, and travel.

International Payers (Students, Patients, Business Customers)

International payers, encompassing students, patients, and business customers, represent a vital end-user segment for Flywire's clients. These individuals and entities rely on Flywire's technology for seamless cross-border transactions. In 2024, the demand for simplified international payments continued to grow, with global cross-border e-commerce expected to reach trillions of dollars, highlighting the importance of user-friendly payment solutions.

- Global Reach: Facilitates payments for over 2,800 institutions and businesses worldwide, serving millions of payers annually.

- User Experience: Offers payment options in over 150 currencies, enhancing convenience for international students and patients.

- Transparency: Provides clear fee structures and exchange rates, building trust with business customers making international payments.

- Security: Employs robust security measures to protect sensitive financial data during transactions.

Flywire's customer segments are diverse, encompassing higher education institutions, healthcare providers, and travel and hospitality businesses. These organizations often grapple with complex, cross-border payment processes and administrative burdens. By offering tailored solutions, Flywire aims to simplify these operations, enhance customer experience, and improve revenue cycle management. The company's platform is designed to handle high transaction volumes and diverse payment methods, making it a valuable partner for businesses operating in these sectors.

Cost Structure

Flywire invests heavily in creating and maintaining its sophisticated global payment network and specialized software for various industries. These significant expenses cover the salaries of engineers and developers, as well as the upkeep of essential IT infrastructure, ensuring the platform remains robust and innovative.

In 2023, Flywire reported research and development expenses of $138.4 million, a notable increase from the previous year, reflecting ongoing investment in its technology. This commitment to technology development is crucial for supporting their complex, multi-currency payment processing capabilities and expanding their vertical-specific solutions.

Flywire's sales and marketing expenses are significant, reflecting the substantial costs of client acquisition and market expansion. These expenditures cover essential activities like compensating sales teams, executing targeted marketing campaigns, and maintaining a presence at key industry events.

In 2024, a notable portion of Flywire's operational budget was dedicated to these growth-driving initiatives. For instance, investments in digital marketing and content creation aimed at reaching new customer segments were prioritized, alongside traditional outreach methods.

The company's strategy involves building strong relationships with educational institutions, healthcare providers, and other enterprise clients, which necessitates considerable investment in direct sales efforts and tailored promotional materials.

Personnel and operational costs are a significant driver for Flywire. These expenses encompass employee salaries, comprehensive benefits packages, and the overhead associated with maintaining a global office presence. In early 2025, Flywire initiated a restructuring that affected roughly 10% of its workforce, a move aimed at improving operational efficiency.

Payment Network and Processing Fees

Flywire incurs significant costs by operating its extensive global payment network. These expenses include transaction processing fees, which are standard for any payment facilitator, and foreign exchange costs, particularly crucial given Flywire's cross-border payment focus.

Furthermore, Flywire pays fees to its network of partner banks and financial institutions. These entities are essential for facilitating payments across different countries and currencies. In 2023, the global payments market was valued at over $2.5 trillion, highlighting the scale of operations and associated costs for companies like Flywire.

- Transaction processing fees for each payment handled.

- Foreign exchange costs related to currency conversions.

- Fees paid to partner banks and financial institutions for network access and payment facilitation.

Acquisition and Integration Costs

Flywire incurs significant expenses related to strategic acquisitions and their subsequent integration. These costs encompass thorough due diligence, legal and advisory fees associated with deal structuring, and the often substantial outlays required to merge acquired technologies and operational teams. For instance, the acquisition of Sertifi and Invoiced in 2022 involved considerable investment to bring their platforms and talent into Flywire's existing ecosystem.

These integration efforts are critical for realizing the full value of acquisitions. They include standardizing systems, aligning product roadmaps, and harmonizing employee benefits and cultures. The financial impact of these activities directly affects Flywire's overall cost structure, influencing profitability and cash flow in the short to medium term as these strategic moves mature.

- Acquisition Expenses: Costs associated with due diligence, legal fees, and advisory services for transactions like Sertifi and Invoiced.

- Integration Costs: Investment in merging acquired technologies, IT systems, and operational processes.

- Talent Integration: Expenses related to harmonizing teams, including HR, benefits, and cultural alignment.

Flywire's cost structure is heavily influenced by its technology investments, including R&D and platform maintenance. Personnel and operational overhead, such as salaries and global office expenses, also represent a significant portion of their outlays. Transaction processing fees, foreign exchange costs, and partner bank fees are inherent to their payment facilitation model.

| Cost Category | Description | 2023 Data/Impact |

|---|---|---|

| Technology & Development | Global payment network, specialized software, R&D | R&D expenses: $138.4 million |

| Personnel & Operations | Salaries, benefits, global office overhead | Restructuring affecting ~10% of workforce in early 2025 |

| Transaction & Network Fees | Processing fees, FX costs, partner bank fees | Global payments market > $2.5 trillion in 2023 |

| Sales & Marketing | Client acquisition, market expansion, sales teams | Significant budget allocation in 2024 for digital marketing |

| Acquisitions & Integration | Due diligence, legal fees, system merging | Integration of Sertifi and Invoiced (2022) |

Revenue Streams

Flywire's main way of making money comes from charging fees on all the payments that go through its system. These fees aren't the same for everyone; they can change depending on how someone pays, what currency is used, and what deal Flywire has with its clients.

Flywire leverages a Software-as-a-Service (SaaS) model, charging clients recurring fees for access to its specialized, vertical-specific software solutions. This includes offerings like Accounts Receivable (A/R) automation for business-to-business (B2B) transactions, providing clients ongoing value through platform access and integrated tools.

Flywire generates revenue by applying a margin on foreign exchange (FX) conversions for its cross-border payment services. When a customer pays in one currency and the funds are received in another, Flywire facilitates this exchange and earns income from the spread between the buy and sell rates.

This FX margin is a crucial revenue driver, particularly within its significant international education sector. For instance, in 2023, Flywire processed billions of dollars in cross-border payments, with a substantial portion of that volume involving currency exchange, directly contributing to their FX-based earnings.

Value-Added Services and Solutions

Flywire generates revenue not just from core payment processing but also by providing advanced services. These include sophisticated reporting capabilities, streamlined reconciliation tools, and tailored financial engagement platforms designed for specific sectors like healthcare. These offerings enhance the value proposition for clients, driving additional income streams.

For instance, in the healthcare sector, Flywire's specialized platforms can facilitate more efficient patient billing and payment collection, a critical area for hospitals and clinics. This focus on industry-specific solutions allows Flywire to capture a larger share of client spending beyond basic transaction fees.

- Enhanced Reporting: Providing clients with deeper insights into their payment data.

- Reconciliation Tools: Simplifying the complex process of matching payments to accounts.

- Industry-Specific Platforms: Offering tailored solutions for sectors like healthcare and education.

- Financial Engagement: Creating tools that improve how businesses interact with their customers financially.

Partnership and Integration Fees

While not always a direct line item, Flywire's strategic partnerships and integrations are crucial for expanding its reach and increasing transaction volumes, indirectly boosting revenue. These collaborations can unlock new customer segments and payment corridors.

For instance, integrating with educational institutions or healthcare providers allows Flywire to process a higher volume of cross-border payments, generating revenue through transaction fees. In 2023, Flywire reported a 25% increase in total revenue, reaching $342.1 million, partly driven by its expanding network of partners and the increased adoption of its platform by clients in key verticals.

- Strategic Integrations: Partnerships with software providers and financial institutions streamline payment processes, attracting more users and increasing transaction volume.

- Expanded Network: Collaborations with global universities and hospitals broaden Flywire's customer base, leading to higher payment processing volumes.

- Indirect Revenue Generation: While specific partnership fees aren't always disclosed, the increased client acquisition and payment volume from these alliances directly contribute to Flywire's overall revenue growth.

Flywire's revenue streams are multifaceted, primarily driven by transaction fees on payments processed through its platform. These fees are dynamic, influenced by payment method, currency, and client agreements.

In addition to transaction fees, Flywire generates income from foreign exchange (FX) margins on cross-border payments. This is a significant contributor, especially given the substantial volume of international transactions facilitated by the company.

Furthermore, Flywire offers Software-as-a-Service (SaaS) subscriptions for its vertical-specific solutions, such as Accounts Receivable automation, providing recurring revenue from ongoing platform access and integrated tools.

The company also earns from value-added services like enhanced reporting, reconciliation tools, and industry-specific financial engagement platforms, particularly in sectors like healthcare and education.

| Revenue Stream | Description | Example/Impact |

|---|---|---|

| Transaction Fees | Charges applied to each payment processed. | Varies based on payment type, currency, and client contract. |

| FX Margins | Profit earned from currency exchange spreads. | Crucial for cross-border payments; significant in education sector. |

| SaaS Subscriptions | Recurring fees for access to specialized software. | Accounts Receivable automation for B2B clients. |

| Value-Added Services | Fees for enhanced reporting, reconciliation, and industry platforms. | Tailored solutions for healthcare billing and education payments. |

Business Model Canvas Data Sources

The Flywire Payments Business Model Canvas is informed by a blend of internal financial data, customer transaction analytics, and market research on cross-border payments. This ensures a robust understanding of revenue streams, customer acquisition costs, and market opportunities.