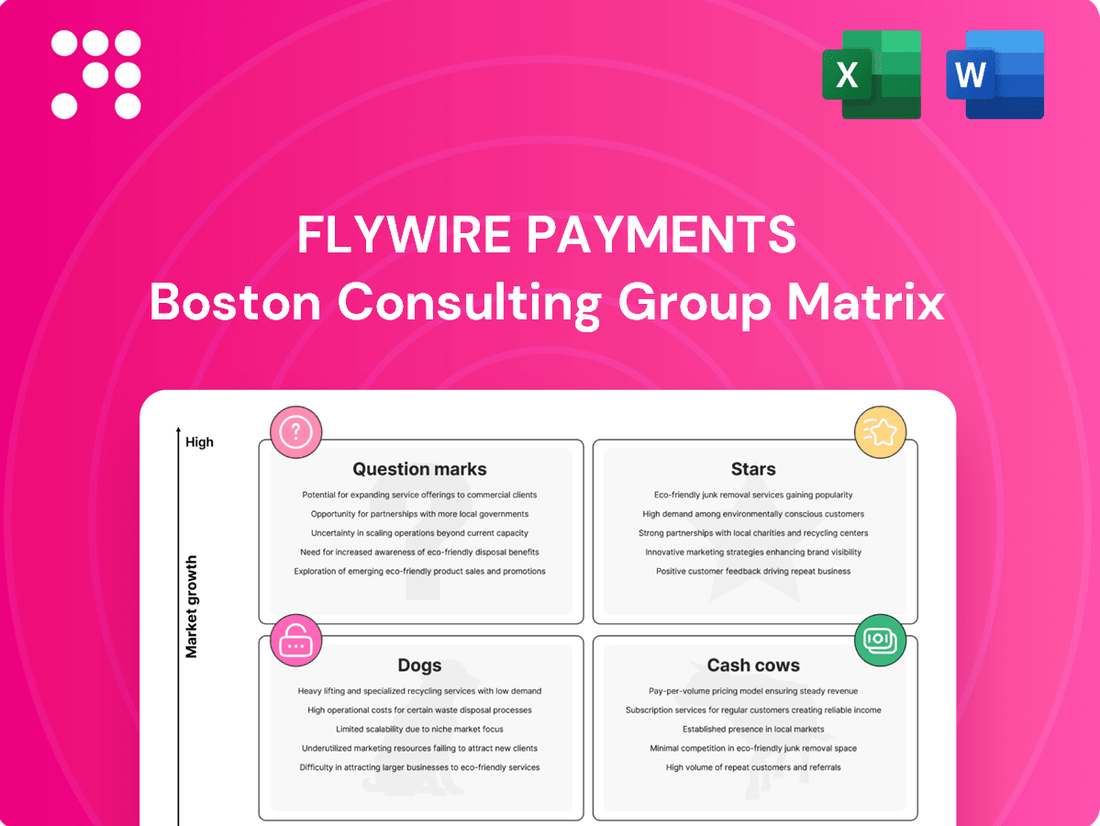

Flywire Payments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Curious about Flywire Payments' strategic positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, or Question Marks, offering a crucial starting point for understanding their product portfolio's market share and growth potential.

Unlock the full strategic advantage by purchasing the complete Flywire Payments BCG Matrix. Gain a comprehensive breakdown of each product's quadrant placement, coupled with actionable insights and data-backed recommendations to guide your investment decisions and optimize your product strategy.

Stars

Flywire's global education payment network is a significant strength, particularly in key markets like the UK. In 2024, this vertical demonstrated robust growth through both acquiring new university clients and retaining existing ones, showing a strong net revenue retention rate.

The company is strategically growing its network of international recruitment agents. This expansion is crucial for linking its clients, agents, and the students paying for education, creating a more connected and efficient payment ecosystem. This integrated approach reinforces Flywire's leading position in the international education payments sector.

The travel vertical is a powerhouse for Flywire, now its second-largest segment. It's not just growing; it's booming, with organic growth projected to surpass 50% in 2024. This impressive expansion is driven by a surge in new client acquisitions and the strategic scaling of its sales force, allowing Flywire to tap into promising new markets like Indonesia and Chile.

Further bolstering this momentum, the recent acquisition of Sertifi significantly boosts Flywire's presence in the hospitality industry. This move brings crucial hotel property management system integrations and expands its reach to over 20,000 hotel properties globally, solidifying its position in the travel sector.

Flywire's B2B payments segment is experiencing rapid expansion, evidenced by a remarkable 69% revenue growth rate. This surge is significantly fueled by strategic acquisitions, with Invoiced being a key contributor.

Although the B2B segment currently represents a smaller portion of Flywire's total revenue, the company is making substantial investments and strategic focus shifts towards this area. This strong commitment underscores the segment's considerable potential for future market share gains and substantial growth.

Strategic Partnerships in Key Markets

Flywire is actively cultivating strategic partnerships in key international markets to bolster its presence and service offerings. For instance, its collaboration with Avanse Financial Services in India is designed to streamline the digitization of student loan disbursements, a critical step in capturing a larger share of the burgeoning education payments sector.

These alliances are not just about expanding reach; they are about leveraging significant payment volumes. By integrating with major players like the State Bank of India, Flywire aims to facilitate seamless, end-to-end education-related payment processes, thereby enhancing its market penetration and operational efficiency in high-growth regions.

- Partnership Focus: Digitizing student loan disbursements and education payments in India.

- Key Partners: Avanse Financial Services and the State Bank of India.

- Strategic Goal: Capitalize on significant payment volumes and enhance market presence.

Innovation in Payment Solutions

Flywire's commitment to innovation is a key driver of its position. By integrating with major ERP systems such as NetSuite, Ellucian, Workday, and Unit4, Flywire empowers organizations to streamline payment processes and overcome operational hurdles. This focus on seamless integration directly addresses a critical need for efficiency in financial operations.

The company's strategic expansion into new acceptance rails and enhanced market localization are crucial for its growth. This approach allows Flywire to cater to diverse global payment preferences and regulatory landscapes, thereby broadening its appeal and client base. For instance, its expansion into new markets in 2024 has seen a significant uptick in cross-border transaction volumes.

- ERP Integration: Flywire's partnerships with NetSuite, Ellucian, Workday, and Unit4 streamline payment workflows for clients.

- New Acceptance Rails: Expanding payment options beyond traditional methods enhances user convenience and reach.

- Market Localization: Adapting payment solutions to specific regional needs and regulations is a core innovation strategy.

- Network Expansion: Increased global network coverage directly supports higher transaction volumes and new client acquisition, with Flywire reporting a 25% increase in new international payment corridors in the first half of 2024.

Flywire's global education payment network, particularly strong in the UK, showed robust growth in 2024, driven by new university clients and high retention rates. The travel vertical, now its second-largest segment, is experiencing explosive organic growth, projected to exceed 50% in 2024, fueled by new client acquisitions and sales force expansion into markets like Indonesia and Chile.

The B2B payments segment, though smaller, is rapidly expanding with a 69% revenue growth rate, significantly boosted by acquisitions like Invoiced. Flywire's strategic investments and focus shifts highlight this segment's substantial future growth potential.

Flywire's strategic partnerships, such as with Avanse Financial Services in India, are digitizing student loan disbursements, aiming to capture more of the education payments market. The company's integration with major ERP systems and expansion into new payment rails and localized markets are key innovation drivers, with a reported 25% increase in new international payment corridors in the first half of 2024.

| Vertical | 2024 Growth Drivers | Key Developments |

|---|---|---|

| Education | UK market strength, new university clients, agent network expansion | Digitizing student loan disbursements in India via partnerships |

| Travel | Surging demand, new client acquisition, sales force scaling | Acquisition of Sertifi, expanding hospitality reach to 20,000+ hotels |

| B2B Payments | Strategic acquisitions (e.g., Invoiced), significant investment | 69% revenue growth, focus on future market share gains |

What is included in the product

The Flywire Payments BCG Matrix analyzes its payment solutions, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on investment, divestment, or maintenance for each Flywire payment product.

The Flywire Payments BCG Matrix offers a clear, quadrant-based visualization, simplifying complex payment portfolios to pinpoint areas needing strategic focus and investment.

Cash Cows

Flywire's established education vertical outside the US is a clear cash cow. In 2024, this segment contributed a substantial 54% of Flywire's total revenue, underscoring its dominance in a mature market.

Although this sector experienced a minor dip compared to the prior year, its consistent ability to generate strong cash flow solidifies its position as a core revenue generator for the company. This high market share in a stable segment is characteristic of a cash cow.

Flywire's success in attracting and keeping clients is a key driver of its Cash Cow status. In fiscal year 2024, the company onboarded over 800 new clients, a testament to its expanding market reach.

This momentum carried into the first quarter of 2025, with an additional 200+ new clients joining. This consistent client acquisition, combined with a notably low churn rate, indicates a deeply satisfied and loyal customer base.

This stable, growing client base translates directly into predictable and robust revenue streams, solidifying Flywire's position as a strong Cash Cow within the payments sector.

Flywire's adjusted EBITDA margins demonstrate a robust upward trend, reaching 14.8% in Q4 2024 and further strengthening to 16.8% in Q1 2025. This significant improvement highlights exceptional operational efficiency and a strong capacity to translate revenue into substantial profits, characteristic of a mature and highly profitable cash cow business.

Diversified Global Payment Network

Flywire's extensive global payment network is a true cash cow. It supports a vast array of payment methods, handling over 140 currencies and operating in more than 240 countries and territories. This broad reach minimizes dependence on any single region, creating a robust and reliable system for intricate international transactions.

This network's strength lies in its diversification and scale, allowing Flywire to process a high volume of payments efficiently. In 2023, Flywire reported total payment volume exceeding $35 billion, a testament to the network's substantial cash-generating capacity. The ability to manage complex cross-border payments across numerous markets solidifies its position as a mature and highly profitable business segment.

- Proprietary Network: Facilitates payments in over 140 currencies across 240+ countries.

- Reduced Market Reliance: Diversification across geographies provides stability.

- High Volume Processing: Supported by over $35 billion in payment volume in 2023.

- Mature Business: Generates consistent and significant cash flow.

Strategic Share Repurchase Program

Flywire's strategic share repurchase program, which saw the company buy back 3.6 million shares for roughly $49 million in the first quarter of 2025, highlights its robust cash generation capabilities. This move is a clear signal of financial strength and a dedication to enhancing shareholder value, characteristic of a mature business in a strong cash flow position.

This repurchase activity is a key indicator for Flywire’s position as a Cash Cow within the BCG Matrix. Companies with such strong, consistent cash flows often reinvest in their core businesses or return capital to investors, reinforcing their status as stable, high-performing assets.

- Share Repurchases: Flywire repurchased 3.6 million shares for approximately $49 million in Q1 2025.

- Financial Health: This action demonstrates a healthy cash position and strong cash flow generation.

- Shareholder Value: The repurchase program signifies a commitment to returning value to shareholders.

- BCG Matrix Status: Such activities are typical of companies classified as Cash Cows, indicating market leadership and strong profitability.

Flywire's established education vertical outside the US is a clear cash cow, contributing a substantial 54% of total revenue in 2024. Despite a minor dip from the prior year, its consistent cash flow generation and high market share in a stable segment solidify its position.

The company's success in onboarding over 800 new clients in 2024, with an additional 200+ in Q1 2025, coupled with a low churn rate, indicates a loyal customer base and predictable revenue streams.

Flywire’s adjusted EBITDA margins saw a significant improvement, reaching 16.8% in Q1 2025, showcasing exceptional operational efficiency and strong profitability, characteristic of a cash cow.

The company's robust global payment network, processing over $35 billion in payment volume in 2023 across 140 currencies and 240+ countries, demonstrates its scale and cash-generating capacity.

| Segment | 2024 Revenue Contribution | 2023 Payment Volume | Q1 2025 Adjusted EBITDA Margin | Key Characteristic |

|---|---|---|---|---|

| Education (International) | 54% | N/A | N/A | Mature, High Market Share |

| Global Payment Network | N/A | >$35 Billion | N/A | Diversified, High Volume |

| Overall Operations | N/A | N/A | 16.8% | Strong Profitability, Cash Generation |

Preview = Final Product

Flywire Payments BCG Matrix

The Flywire Payments BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive, analysis-ready strategic tool. You can trust that the insights and professional design you see here are precisely what you will download to inform your business planning and competitive analysis.

Dogs

Flywire's Canadian education segment has seen a substantial downturn, with a 35% decrease in business during 2024. This decline is largely attributed to shifts in student visa regulations and the implementation of new limits on student admissions, impacting overall enrollment numbers.

The segment is currently navigating persistent macroeconomic challenges and anticipates a more cautious market environment in 2025. This outlook positions the Canadian education sector within Flywire's portfolio as a low-growth area with a relatively small market share, indicating a potential need for strategic re-evaluation.

The Australian education segment, much like Canada, has seen its international student volumes dampened by recent government policy shifts. Specifically, increased fees for foreign student visas have contributed to a decline in overall activity.

While Q1 2025 showed a glimmer of outperformance, the broader 2024 trend points to a market facing significant headwinds. This challenging environment positions the Australian education segment as a potential 'Dog' in the BCG matrix, especially if sustained growth cannot be re-established.

The US education market is projected by Flywire to experience low single-digit revenue growth. This is largely attributed to ongoing geopolitical tensions and complexities surrounding student visas, which can impact international student enrollment.

Despite Flywire's strategic push for its student financial software with a revamped sales approach in the US, the market's current state points to a mature, low-growth environment. In such conditions, gaining substantial market share presents a significant challenge for the company.

Healthcare Vertical (Past Performance)

Flywire's healthcare vertical experienced a slight downturn, with revenue decreasing by 1% in 2023. This performance, coupled with a lack of readily available explicit growth data for 2024 and early 2025, raises concerns about its position within the BCG matrix. If this trend continues without substantial strategic shifts or new market penetration, the healthcare segment could be classified as a 'Dog' if its market share and growth prospects remain low.

The challenge for Flywire's healthcare segment lies in reversing this trajectory. Without significant innovation or a successful expansion into new healthcare markets or payment solutions, the segment risks continued stagnation.

- 2023 Revenue Decline: The healthcare vertical saw a 1% revenue decrease in 2023.

- Growth Uncertainty: Limited explicit data for 2024-2025 performance makes future outlook unclear.

- Potential 'Dog' Classification: A continued lack of growth and market share could place this segment in the 'Dog' category.

Legacy Payment Methods

Legacy payment methods represent segments or clients still heavily reliant on traditional, less efficient processes like manual check processing. These areas, while potentially stable, offer diminishing returns as digital alternatives gain traction. Flywire's platform is designed to transition these clients to more streamlined, cost-effective digital solutions.

Flywire's impact on reducing legacy methods is significant. In 2024 alone, the company facilitated the elimination of over 200,000 paper checks through its digital payment solutions. This demonstrates a clear trend away from older, manual processes toward more automated and efficient systems.

- Diminishing Growth Potential: Segments relying on paper checks and manual reconciliation have limited future growth prospects due to inherent inefficiencies.

- Digital Transformation Driver: Flywire actively converts clients from legacy systems to digital platforms, enhancing operational efficiency.

- 2024 Impact: Over 200,000 paper checks were replaced by digital solutions by Flywire in 2024, underscoring the shift.

The Canadian and Australian education segments, along with the US education market, are exhibiting characteristics of 'Dogs' within Flywire's portfolio. These segments face low growth due to regulatory changes, visa policies, and macroeconomic headwinds. For instance, Canadian education saw a 35% business decrease in 2024, and Australian education is impacted by increased visa fees.

Flywire's healthcare vertical also shows potential 'Dog' traits, with a 1% revenue decline in 2023 and unclear 2024-2025 growth data, suggesting a need for strategic intervention to avoid stagnation.

Segments still reliant on legacy payment methods, like paper checks, represent low-growth areas that Flywire aims to transform. In 2024, Flywire facilitated the elimination of over 200,000 paper checks, highlighting the shift towards more efficient digital solutions.

| Segment | 2024 Performance/Outlook | BCG Classification | Key Factors |

|---|---|---|---|

| Canadian Education | 35% business decrease in 2024; low growth outlook | Dog | Student visa regulations, admission limits |

| Australian Education | Dampened international student volumes; increased visa fees | Potential Dog | Government policy shifts |

| US Education | Low single-digit revenue growth projected | Dog | Geopolitical tensions, visa complexities |

| Healthcare | 1% revenue decrease in 2023; uncertain 2024-2025 growth | Potential Dog | Lack of explicit growth data, potential stagnation |

| Legacy Payment Methods | Diminishing returns, reliance on manual processes | Dog | Inefficiency of paper checks, need for digital transformation |

Question Marks

Flywire's B2B vertical, while experiencing robust growth, is still in its nascent stages, contributing less than 10% to the company's overall payment volumes and revenue as of early 2024. This positions it as a 'Question Mark' within the BCG matrix, signifying high growth potential but a current low market share.

The company itself recognizes the inherent complexities and higher risk associated with B2B transactions compared to its established consumer verticals. Flywire's relative inexperience in this specific segment further reinforces its 'Question Mark' status, despite the significant market opportunity and anticipated future expansion.

Flywire's strategic expansion into Germany, France, and Japan within its education sector represents a significant push into key international markets. These regions present substantial growth potential, driven by robust higher education systems and a large student population seeking international study opportunities.

However, these new ventures are characterized by considerable investment requirements and an uncertain market reception. Flywire's existing market share in these territories is nascent, meaning the path to establishing a dominant presence is costly and the ultimate success is not guaranteed, placing these initiatives in the question mark category of the BCG matrix.

Flywire's Student Financial Services (SFS) and StudyLink in the UK education market show early success, indicating potential but not yet widespread adoption. These offerings are in the "Question Mark" category of the BCG Matrix, requiring significant investment to scale and capture larger market shares globally. For instance, while SFS has seen positive traction, its contribution to Flywire's overall revenue is still nascent compared to established offerings.

Post-Acquisition Integration of Sertifi

Flywire's acquisition of Sertifi positions it as a 'Question Mark' within the BCG matrix, primarily due to the significant revenue potential that hinges on successful post-acquisition integration and market penetration. The company anticipates Sertifi will contribute an additional $35-$40 million in revenue for 2025, a substantial figure that could bolster Flywire's standing in the travel sector.

The key challenge lies in effectively monetizing Sertifi's existing customer base, which includes over 20,000 hotel locations. Realizing this potential through cross-selling Flywire's broader payment solutions will be critical in determining if the investment leads to a dominant market share in the travel vertical.

- Revenue Target: Sertifi acquisition projected to add $35-$40 million in revenue for 2025.

- Integration Risk: Success depends on effectively integrating Sertifi's capabilities and cross-selling to its 20,000+ hotel clients.

- Market Share Potential: High market share is contingent on successful monetization and customer adoption of Flywire's expanded offerings.

- BCG Classification: Sertifi is a 'Question Mark' until its growth potential is fully realized through integration and market capture.

Expansion of Healthcare Solutions

Given Flywire's historical decline in healthcare revenue in 2023, any renewed focus or new solutions within this vertical would likely be considered a question mark.

Significant investment and market penetration would be required to shift this segment from a potential 'Dog' to a high-growth, higher market share offering.

For instance, if Flywire were to re-enter the healthcare market with innovative payment solutions, it would need to demonstrate substantial growth and capture a significant portion of the market to move out of the question mark phase.

- Healthcare Revenue Trend: Flywire's healthcare revenue experienced a decline in 2023, indicating a need for strategic re-evaluation.

- Market Position: Without significant improvements, the healthcare segment risks being categorized as a 'Dog' in the BCG matrix.

- Investment Requirement: Shifting to a 'Star' or 'Cash Cow' status necessitates substantial investment in new solutions and aggressive market penetration strategies.

- Potential for Growth: A successful turnaround could position Flywire's healthcare solutions as a future growth driver, but this requires overcoming past performance challenges.

Flywire's B2B payments and its recently acquired Sertifi platform are prime examples of 'Question Marks' in its BCG matrix. While B2B holds high growth potential, it represented less than 10% of Flywire's payment volumes in early 2024, indicating a low current market share. Similarly, Sertifi, acquired to bolster the travel vertical, is projected to add $35-$40 million in revenue for 2025, but its success hinges on effective integration and capturing market share among its 20,000+ hotel clients.

| Business Unit | BCG Category | Key Factors | Data Point / Projection |

| B2B Payments | Question Mark | High market growth potential, low current market share | Contributed <10% of payment volumes in early 2024 |

| Sertifi (Travel) | Question Mark | Acquisition for growth, integration & market penetration risk | Projected $35-$40 million revenue in 2025; serves 20,000+ hotels |

| New International Education Markets (e.g., Germany, France, Japan) | Question Mark | Significant investment required, uncertain market reception | Focus on expanding presence in robust higher education systems |

| Student Financial Services (SFS) & StudyLink (UK Education) | Question Mark | Early success, requires scaling for global market share | Nascent revenue contribution compared to established offerings |

BCG Matrix Data Sources

Our Flywire Payments BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market research, and competitive landscape analysis. This data integration ensures accurate representation of Flywire's product portfolio and market positioning.