Flywire Payments Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Flywire Payments leverages a robust marketing mix, focusing on its innovative payment solutions (Product), competitive pricing models (Price), extensive global reach (Place), and targeted digital campaigns (Promotion). This strategic alignment drives their success in simplifying complex cross-border transactions.

Ready to uncover the full strategic blueprint behind Flywire Payments' market dominance? Dive deeper into their product innovation, pricing architecture, distribution channels, and promotional tactics. Gain actionable insights and a competitive edge.

Product

Flywire's product, its global payment network and platform, is the engine driving its value proposition. This sophisticated infrastructure enables businesses to navigate the complexities of international transactions, handling over 140 currencies and reaching clients in more than 240 countries and territories. This extensive reach is a significant differentiator, simplifying cross-border payments for clients.

The platform's core strength lies in its ability to manage diverse payment types and currencies through a single, integrated connection. This streamlined approach reduces operational friction for businesses, allowing them to focus on their core operations rather than payment complexities. Flywire's commitment to innovation is evident in its next-generation platform, designed for scalability and enhanced transparency in both domestic and international payment flows.

In 2023, Flywire reported facilitating over $27 billion in total payment volume, underscoring the scale and adoption of its network. The platform's efficiency is further highlighted by its ability to support a wide array of payment methods, catering to the specific needs of diverse industries like education, healthcare, and travel. This robust network is central to Flywire's ability to deliver seamless payment experiences globally.

Flywire's Product strategy extends beyond its payment network to offer specialized software solutions for key verticals like education, healthcare, travel, and B2B. These solutions are designed to integrate seamlessly into a client's existing accounts receivable processes, enhancing efficiency and user experience.

For instance, in the education sector, Flywire's software provides interactive dashboards for managing student payments and streamlines communication, addressing the unique complexities of tuition and fee collection. This deep integration aims to simplify the payment journey for both institutions and their students.

The company's commitment to optimizing the payment experience is evident in its focus on eliminating operational friction. By embedding these tailored software tools, Flywire helps clients reduce administrative burdens and improve cash flow, a critical factor for businesses in 2024 and beyond.

In the education sector, Flywire's Specialized Education Solutions, particularly its Student Financial Software (SFS), are designed to enhance the student payment experience and improve institutional financial operations. This offering directly addresses the Product and Promotion aspects of the marketing mix by providing a digital-first approach to tuition payments and financial aid management.

SFS empowers educational institutions by streamlining the entire student financial journey, from initial enrollment to graduation. It offers dynamic payment plans that cater to diverse student needs, making tuition more manageable and accessible. Furthermore, the software actively works to accelerate the collection of past-due tuition, a critical pain point for many schools.

The impact of these solutions is significant. Flywire's platform has a proven track record of recovering substantial amounts of overdue tuition, thereby improving institutional cash flow. They have digitized billions in tuition payments, including facilitating 529 plan disbursements and managing third-party invoicing, which drastically cuts down on manual administrative work and associated collection fees for educational providers.

Travel and B2B Payment Enablement

Flywire's Travel and B2B Payment Enablement product is a cornerstone of its business, demonstrating significant growth and market penetration. The company's strategic focus on the travel sector has propelled it to become its second-largest revenue vertical. This expansion is notably bolstered by acquisitions, such as Sertifi, which broadened Flywire's reach within the hotel and hospitality management sectors.

For B2B clients, Flywire offers sophisticated payment solutions designed to streamline intricate financial transactions. These offerings are crucial for enhancing operational efficiency and ensuring greater transparency in business dealings. In 2023, Flywire reported that its travel vertical saw a substantial increase in transaction volume, driven by a growing demand for integrated payment solutions in the industry.

- Travel Vertical Growth: Flywire's travel segment is now its second-largest revenue generator, highlighting its success in this market.

- Acquisition Impact: The acquisition of Sertifi expanded Flywire's footprint in the hospitality industry, integrating more hotel brands and management companies.

- B2B Payment Solutions: Flywire provides robust tools that simplify complex B2B payments, boosting efficiency and transparency for businesses.

- Market Position: Flywire is recognized for its ability to handle cross-border and complex payment flows, a critical need for global travel and B2B operations.

Enhanced Security and Compliance Features

Flywire places a strong emphasis on security and compliance, which is a critical aspect of its product offering. This commitment is underscored by its PCI DSS Level 1 certification and regular annual SOC II Type II audits. These certifications are not just badges; they represent a deep integration of security protocols into their payment processing infrastructure.

The company’s proactive role in shaping future security standards is evident through its appointment to the PCI Security Standards Council 2025-2027 Board of Advisors. This position allows Flywire to directly influence the evolution of payment security, ensuring its platform remains at the forefront of best practices. For instance, the Council's work often involves updating standards to address emerging threats, a process Flywire actively participates in.

This dedication to robust security directly translates into protected transactions for users, guarding against fraud. Furthermore, Flywire ensures adherence to a range of global data privacy regulations, including GDPR, CCPA, and HIPAA. This comprehensive approach to compliance provides peace of mind for businesses and consumers alike, knowing their sensitive financial information is handled with the utmost care.

- PCI DSS Level 1 Certification: Demonstrates adherence to the highest security standards for handling cardholder data.

- SOC II Type II Audits: Guarantees that Flywire's systems and controls are designed to protect customer data and maintain operational security.

- PCI Security Standards Council Board Membership (2025-2027): Positions Flywire as a leader in developing future payment security protocols.

- Global Regulatory Compliance: Ensures adherence to critical data privacy laws like GDPR, CCPA, and HIPAA, safeguarding user information worldwide.

Flywire's product is a comprehensive global payment network and platform designed to simplify complex, cross-border transactions. It supports over 140 currencies and reaches clients in more than 240 countries, offering a single, integrated connection for diverse payment types. This robust infrastructure is key to its value proposition, reducing operational friction for businesses across various sectors.

The platform's specialized software solutions for verticals like education, healthcare, and travel are integral to its product strategy. These solutions, such as the Student Financial Software (SFS) in education, are built to integrate seamlessly with existing accounts receivable processes, enhancing efficiency and the user experience by digitizing payment journeys and accelerating collections.

Flywire's commitment to security is paramount, evidenced by its PCI DSS Level 1 certification and SOC II Type II audits. Its active participation in the PCI Security Standards Council, including its board appointment for 2025-2027, highlights its role in shaping future payment security standards and ensuring robust protection against fraud and data breaches.

| Product Feature | Key Benefit | 2023 Data Point |

|---|---|---|

| Global Payment Network | Facilitates cross-border transactions in 140+ currencies | Total Payment Volume: $27 billion+ |

| Vertical Solutions (e.g., Education, Travel) | Streamlines industry-specific payment processes | Travel vertical is second-largest revenue generator |

| Security & Compliance | Protects sensitive financial data | PCI DSS Level 1 Certified, SOC II Type II Audits |

What is included in the product

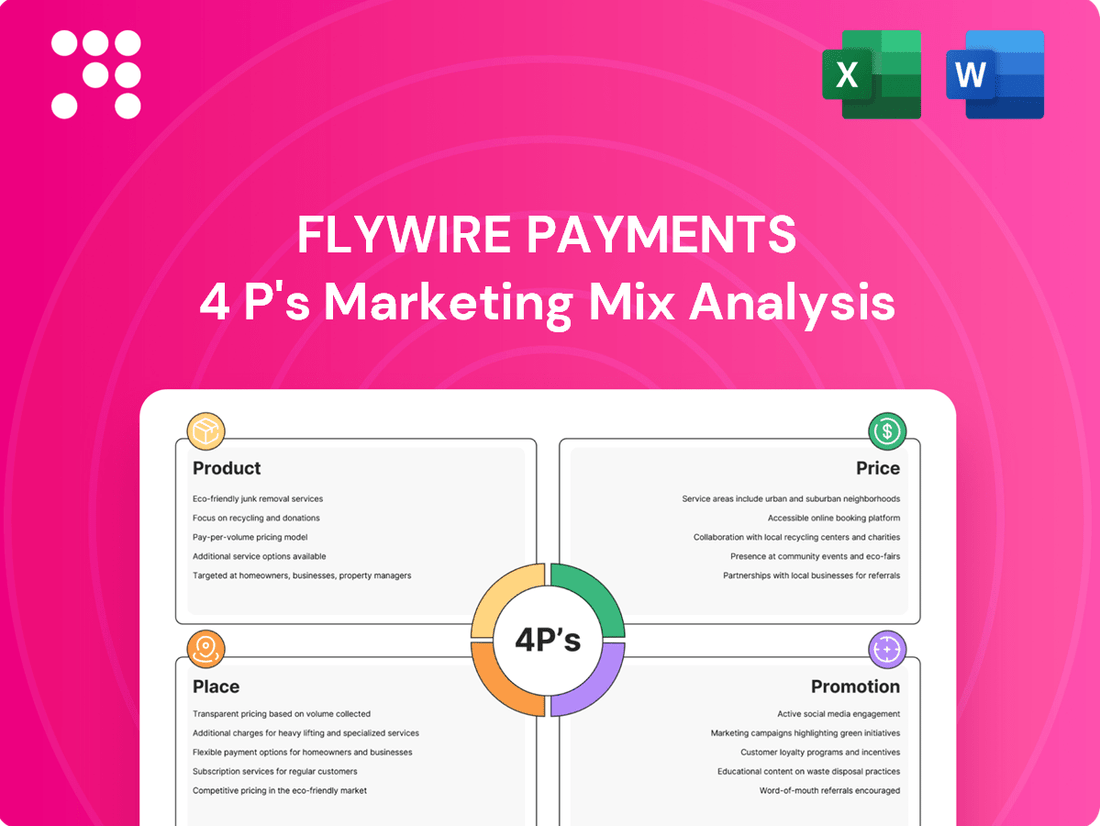

This analysis provides a comprehensive breakdown of Flywire Payments' marketing mix, examining its innovative product offerings, competitive pricing strategies, global distribution channels, and targeted promotional activities.

This analysis distills Flywire's 4Ps into a clear, actionable framework, highlighting how each element alleviates customer pain points in global payments.

It serves as a concise, visual guide for understanding Flywire's strategic approach to solving complex payment challenges.

Place

Flywire's distribution hinges on direct integrations with client ERP systems like Ellucian, Workday, and Oracle. This strategy embeds payment solutions directly into existing workflows, enhancing user experience and removing operational friction. For instance, by integrating with Ellucian, educational institutions can streamline tuition payments directly within their student information systems.

Flywire's proprietary global payment network is a cornerstone of its offering, connecting clients to over 240 countries and territories. This vast reach, supporting more than 140 currencies, is facilitated by deep integrations with leading banking institutions and regional payment partners. The company reported processing billions of dollars in transactions across various industries in 2023, highlighting the scale and efficiency of its network for cross-border payments.

Flywire strategically expands its market presence by forming alliances with influential entities across its core sectors. These partnerships, encompassing educational bodies, software providers, and global recruitment firms, are crucial for reaching new customer segments and enhancing service offerings. For instance, in 2024, Flywire announced a significant collaboration with Avanse Financial Services and the State Bank of India to streamline student loan disbursements, a move expected to bolster its position in the lucrative Indian education market.

Online Payment Portals for End-Users

Flywire's online payment portals are designed for the end-user, offering a streamlined and accessible experience. These portals allow customers to pay in their local currency, utilizing familiar payment methods, which is crucial for global transactions. For instance, in 2024, Flywire's platform facilitated payments for over 3,000 institutions, demonstrating broad adoption and user trust.

The emphasis on convenience and support is a key differentiator. End-users benefit from real-time payment status updates, reducing uncertainty, and access to 24/7 multilingual customer support. This approach is vital in building confidence, especially when dealing with international payments for education or healthcare services. Flywire reported a 95% customer satisfaction rate for its support services in early 2025.

- User-Friendly Interface: Simplifies the payment process for diverse end-users.

- Local Currency & Methods: Enhances accessibility and reduces friction for international payers.

- Real-Time Tracking: Provides transparency and peace of mind regarding payment status.

- 24/7 Multilingual Support: Ensures assistance is available across different time zones and languages.

Global and Regional Offices

Flywire's strategic placement of global and regional offices is a cornerstone of its Place strategy within the 4Ps marketing mix. Headquartered in Boston, Massachusetts, USA, the company has cultivated a significant international footprint. This physical presence is crucial for supporting its diverse global operations and extensive client base.

These offices are not just administrative hubs; they are vital for delivering localized support and fostering a deep understanding of regional market nuances. This approach allows Flywire to tailor its payment solutions effectively to the specific needs of businesses and consumers in different geographies. As of early 2024, Flywire continues to expand its network, with significant operations and client support teams across North America, Europe, and Asia-Pacific, reinforcing its commitment to global accessibility and localized expertise.

- Global Reach: Offices in key financial centers facilitate cross-border transactions.

- Localized Support: Regional teams provide culturally relevant customer service.

- Market Insight: Physical presence enables better understanding of local regulations and payment preferences.

- Operational Efficiency: Distributed offices enhance service delivery and response times for international clients.

Flywire's Place strategy focuses on embedding its payment solutions directly into client systems and establishing a robust global operational network. This dual approach ensures seamless integration for businesses and accessible, localized support for end-users worldwide.

By integrating with major ERP systems, Flywire makes its payment capabilities a natural extension of existing workflows, reducing friction for institutions and their customers. This deep integration, evident in partnerships with giants like Workday and Oracle, is key to its market penetration.

Furthermore, Flywire's physical presence through regional offices is critical. These hubs, spanning North America, Europe, and Asia-Pacific as of early 2024, provide essential localized support and market insights, reinforcing its commitment to global accessibility and tailored service delivery.

| Aspect | Description | Impact | Data Point (as of early 2024/2025) |

|---|---|---|---|

| Direct Integrations | Embedding payments into client ERPs (e.g., Ellucian, Workday) | Streamlined user experience, operational efficiency | Supports over 3,000 institutions |

| Global Network | Connecting clients across 240+ countries and 140+ currencies | Facilitates seamless cross-border transactions | Processed billions in transactions in 2023 |

| Regional Offices | Physical presence in key markets (North America, Europe, Asia-Pacific) | Localized support, market understanding, operational efficiency | Expanding network with significant operations in key regions |

Full Version Awaits

Flywire Payments 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Flywire Payments' 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to actionable insights to understand their strategic approach.

Promotion

Flywire actively cultivates relationships with investors and analysts, providing timely updates on its financial health and strategic direction. This includes participation in key industry events and clear communication of quarterly results, such as their Q1 2025 performance, to ensure transparency for stakeholders.

Through earnings calls and investor conferences, Flywire addresses the financial community, detailing its progress in areas like cross-border payments and digital health solutions. Their commitment to open communication, exemplified by their Q1 2025 financial disclosures, helps build confidence among investors and financial professionals.

Flywire leverages client success stories and testimonials as a powerful element of its promotion strategy, demonstrating the real-world value of its payment solutions. These narratives highlight how Flywire tackles intricate payment obstacles, offering tangible benefits and positive results for its diverse clientele.

For instance, Purdue University's experience in recovering past-due tuition showcases a significant financial uplift, illustrating the direct impact of Flywire's services on institutional efficiency. Such case studies provide concrete evidence of problem-solving capabilities.

Furthermore, widespread user praise for Flywire's ease of use and robust security measures reinforces its market positioning. These testimonials act as social proof, building trust and encouraging adoption by prospective clients who seek reliable and user-friendly payment processing.

Flywire's commitment to industry engagement is evident through its active participation in key events and advisory roles. For instance, its continued appointment to the PCI Security Standards Council Board of Advisors underscores its influence in payment security standards.

This strategic positioning allows Flywire to showcase its expertise and foster trust within the payments ecosystem. Such thought leadership is crucial for building brand authority and attracting new business opportunities.

By contributing to industry discussions and shaping best practices, Flywire reinforces its image as an innovator and reliable partner in the complex world of global payments.

Digital Marketing and Content Strategy

Flywire leverages a robust digital marketing and content strategy to connect with its global audience. Its corporate website serves as a central hub for detailed solution information, industry analysis, and company news, while active engagement on platforms like X and LinkedIn fosters brand awareness and thought leadership. This multi-channel approach is crucial for educating potential clients on Flywire's value proposition in complex payment environments.

The company's content marketing efforts focus on delivering valuable insights, such as case studies and white papers, which directly address the pain points of its target sectors, including education and healthcare. For instance, Flywire's commitment to providing accessible financial solutions was highlighted in their 2024 outreach, emphasizing streamlined cross-border tuition payments for international students. This educational content aims to build trust and position Flywire as a go-to partner.

Flywire's digital presence is designed to support its growth objectives by attracting and nurturing leads. Their strategic use of social media and informative content marketing directly contributes to lead generation and customer acquisition. In 2024, Flywire reported significant engagement on its LinkedIn page, showcasing client success stories and updates on regulatory compliance, further solidifying its expertise.

- Website: Centralized information hub for solutions and company updates.

- Social Media: Active presence on X and LinkedIn for brand building and thought leadership.

- Content Marketing: Delivery of valuable insights through case studies and white papers to educate and attract clients.

- Digital Reach: Aimed at building brand awareness and educating potential clients about Flywire's value proposition.

Partnership and Integration Announcements

Flywire's partnership and integration announcements are a key part of its promotion strategy. These efforts highlight new and strengthened collaborations with major technology providers and financial institutions. For instance, integrations with Ellucian and partnerships for student loan disbursements in India underscore this commitment.

These strategic alliances are crucial for Flywire's embedded strategy, allowing it to expand its reach within vital client ecosystems. By integrating with platforms like Ellucian, a leader in higher education technology, Flywire can seamlessly offer its payment solutions directly to institutions and their students. This deepens its presence and value proposition within the education sector, a significant market for the company.

The expansion into new markets, such as facilitating student loan disbursements in India, further broadens Flywire's promotional reach. These partnerships not only increase visibility but also provide tangible solutions to underserved or growing segments, reinforcing Flywire's role as a comprehensive payment facilitator. In 2024, such strategic integrations are critical for achieving market penetration and driving revenue growth in a competitive landscape.

- Strategic Integrations: Deepened collaborations with technology providers like Ellucian enhance Flywire's embedded payment capabilities.

- Market Expansion: Partnerships for student loan disbursements in India open new avenues for growth and visibility.

- Ecosystem Penetration: These announcements reinforce Flywire's strategy to become an integral part of client workflows and platforms.

- Promotional Impact: Showcasing these alliances effectively communicates Flywire's commitment to seamless, global payment solutions.

Flywire's promotional efforts are multi-faceted, focusing on building investor confidence through transparent financial reporting, exemplified by their Q1 2025 disclosures. They also highlight client success stories, such as Purdue University's tuition recovery, to demonstrate tangible value and foster trust through social proof.

The company actively engages in industry events and thought leadership, underscored by its role on the PCI Security Standards Council Board of Advisors. This strategic positioning reinforces its image as an innovator and reliable partner in global payments.

A robust digital marketing strategy, including a comprehensive website and active social media presence on platforms like X and LinkedIn, educates potential clients and drives lead generation. Content marketing, featuring case studies and white papers, directly addresses industry pain points, such as streamlining cross-border tuition payments, as seen in their 2024 outreach.

Strategic partnerships and integrations, like those with Ellucian and for student loan disbursements in India, are crucial promotional tools. These alliances expand Flywire's reach within key client ecosystems and demonstrate their commitment to seamless global payment solutions.

Price

Flywire's pricing strategy for complex payments is deeply rooted in the value it delivers. The company aims to simplify high-value transactions across sectors like education, healthcare, and travel, meaning its fees are justified by the significant operational efficiencies and cost savings clients achieve. For instance, by streamlining cross-border tuition payments, Flywire can reduce administrative burdens for universities, allowing them to focus on student services rather than payment processing complexities.

Transaction-based fees form the bedrock of Flywire's revenue generation. These fees are dynamic, influenced by the chosen payment method, the currencies involved in the transaction, and the overall volume processed. This model directly links Flywire's success to the activity of its clients and their customers.

Flywire's financial performance, as reflected in its reports, shows a consistent upward trend in transaction payment volume. For instance, in the first quarter of 2024, Flywire reported processing $17.3 billion in total payment volume, a significant increase from the previous year, underscoring the direct correlation between payment volume growth and revenue expansion.

Flywire's payment solutions directly translate into significant cost savings for its clients. By streamlining payment processes and offering flexible options, Flywire helps businesses and institutions reduce the overall cost of accepting and processing payments, often avoiding costly transaction fees associated with traditional methods.

A key benefit is the avoidance of expensive collection fees for overdue payments. For example, Flywire's Student Financial Software is designed to improve student payment compliance, thereby reducing the need for costly external collection agencies and recovering revenue that might otherwise be written off. This directly impacts the bottom line by minimizing lost revenue.

Competitive Exchange Rates and Guarantees

Flywire distinguishes itself with competitive exchange rates, particularly in the education sector, often providing a 'Best Rate Guarantee' for local currency bank transfers. This strategy directly addresses the Price element of the marketing mix by offering tangible cost savings to customers, making international payments more affordable and predictable. For instance, in 2024, many cross-border education payments processed through platforms like Flywire saw average savings of 1-3% on exchange rates compared to standard bank offerings.

This focus on favorable pricing aims to attract new clients and foster loyalty by ensuring customers receive more value for their money. By undercutting traditional financial institutions on exchange rates, Flywire enhances its value proposition significantly.

- Competitive Edge: Offering better exchange rates than traditional banks.

- Customer Attraction: The 'Best Rate Guarantee' serves as a strong incentive for new users.

- Cost Savings: Customers benefit from reduced fees on international transactions.

- Market Penetration: Favorable pricing aids in capturing market share in key segments like education.

Tailored Pricing Models

Flywire's pricing likely adapts to the specific industries and intricate payment needs of its clients. This approach allows them to serve a broad range of customers, from major organizations to smaller enterprises, aligning costs with the value and breadth of services offered.

This tailored strategy is crucial for a company like Flywire, which operates in diverse sectors such as education, healthcare, and travel. For instance, a large university processing thousands of international student payments might have a different pricing structure than a mid-sized hospital managing cross-border medical billing.

- Tiered Pricing: Offering different service levels with corresponding price points based on volume, features, and support.

- Volume-Based Discounts: Reducing per-transaction fees as client payment volumes increase.

- Customized Solutions: Developing bespoke pricing for unique or complex client requirements, reflecting the specialized nature of their payment flows.

Flywire's pricing strategy is fundamentally value-driven, directly tying its fees to the significant efficiencies and cost reductions clients experience. This is evident in their competitive exchange rates, often featuring a 'Best Rate Guarantee' for international transfers, which in 2024 provided average savings of 1-3% for cross-border education payments compared to traditional banks.

The company employs a dynamic, transaction-based fee model that fluctuates with payment method, currency, and volume. This approach ensures Flywire's revenue grows in lockstep with client transaction activity, as demonstrated by their Q1 2024 total payment volume of $17.3 billion, a substantial increase year-over-year.

Flywire also offers customized pricing structures, including tiered options and volume-based discounts, to accommodate the diverse needs of sectors like education, healthcare, and travel. This flexibility allows them to align costs with the specific value and complexity of services rendered to each client, fostering market penetration through attractive pricing.

| Pricing Strategy Element | Description | Key Benefit | Example Data (2024) |

|---|---|---|---|

| Value-Based Pricing | Fees justified by operational efficiencies and cost savings. | Reduced administrative burden for clients. | Streamlined cross-border tuition payments for universities. |

| Transaction-Based Fees | Dynamic fees influenced by payment method, currency, and volume. | Direct correlation between client activity and Flywire revenue. | Q1 2024 Total Payment Volume: $17.3 billion. |

| Competitive Exchange Rates | Offering favorable rates, often with a 'Best Rate Guarantee'. | Tangible cost savings for customers on international payments. | Average savings of 1-3% on cross-border education payments. |

| Customized & Tiered Pricing | Tailored structures based on industry, volume, and features. | Attracts diverse client segments and encourages loyalty. | Volume-based discounts for large educational institutions. |

4P's Marketing Mix Analysis Data Sources

Our Flywire Payments 4P's Marketing Mix Analysis is constructed using a blend of public company disclosures, including investor relations materials and press releases, alongside proprietary market research and competitive intelligence reports. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.