Feihe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Feihe Bundle

Feihe's market leadership in infant formula is built on strong brand loyalty and a commitment to quality, but it faces intense competition and evolving regulatory landscapes. Our comprehensive SWOT analysis delves into these critical factors, revealing the strategic advantages and potential hurdles that define Feihe's trajectory.

Want the full story behind Feihe's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Feihe's dominant market position in China's infant formula sector is a significant strength, holding an estimated 17% market share as of the previous year. This leadership has been sustained for six consecutive years, underscoring its deep penetration and brand loyalty within the domestic market.

This strong foothold is further bolstered by an extensive distribution network, encompassing over 80,000 retail points of sale across diverse channels, ensuring wide accessibility for its products.

The company's successful 'more suitable for Chinese babies' marketing strategy has deeply resonated with local consumers, reinforcing its market leadership and brand equity.

Feihe's commitment to a vertically integrated supply chain, established as early as 2006, provides a significant competitive advantage. This end-to-end control, from managing its own pastures and collecting raw milk to sophisticated processing and distribution, directly translates into enhanced product quality and safety. This is paramount in the dairy sector, where consumer trust is hard-won, particularly in China, given historical food safety incidents.

The company's investment in a fully automated, aseptic production process, covering everything from raw milk to the final milk powder, sets Feihe apart. This advanced manufacturing capability not only meets but exceeds international benchmarks for fresh milk quality, reinforcing its reputation for producing premium infant formula. For instance, in 2023, Feihe reported that its proprietary milk source quality index was 1.5 times higher than the national average, underscoring the benefits of its integrated model.

Feihe has showcased impressive financial resilience, with revenues climbing 6.2% to RMB20.75 billion and net profit surging 11.1% to RMB3.65 billion for the fiscal year ending December 31, 2024, even amidst a challenging market environment. This strong performance underscores the company's ability to navigate economic headwinds effectively and maintain profitability.

The company's dedication to rewarding its shareholders is evident through its proposed final dividend and a planned share buyback program for fiscal year 2025. These actions signal robust financial health and reinforce investor confidence in Feihe's future prospects.

Commitment to Research and Innovation

Feihe's dedication to research and development is a significant strength, as demonstrated by its impressive portfolio of 659 domestic and foreign authorized patents as of 2024. This commitment fuels the company's ability to bring innovative products to market.

The company actively integrates advanced scientific findings into its product development. This strategy has led to the successful launch of offerings such as Xingfeifan Zhuorui, a prominent customized brain nutrition product for infants, and Aiben, a functional nutrition product designed for adults.

- Significant Patent Portfolio: 659 domestic and foreign authorized patents by 2024.

- Product Innovation: Launch of Xingfeifan Zhuorui (infant brain nutrition) and Aiben (adult functional nutrition).

- Market Differentiation: Innovation allows Feihe to stand out and meet changing consumer demands.

Expanding Product Portfolio and Global Presence

Feihe is strategically broadening its product range beyond its traditional infant formula stronghold. The company is making significant inroads into adult milk powder, liquid milk, and nutritional supplements, demonstrating a clear commitment to diversification. This expansion is already yielding results, with sales from these 'other dairy products' experiencing notable growth, indicating a successful market penetration beyond its core offering.

The company's global ambitions are also a key strength. Feihe's investment in its Canadian plant is a prime example, enabling it to serve North American consumers with infant formula. More importantly, this facility underscores Feihe's capacity to meet and integrate with stringent international industry standards, paving the way for broader global market access and competitiveness.

- Diversification: Feihe is expanding beyond infant formula into adult milk powder, liquid milk, and nutritional supplements, with 'other dairy products' sales showing significant growth.

- Global Expansion: The Canadian plant allows Feihe to supply North American markets and adhere to international industry standards.

Feihe's dominant market position in China's infant formula sector, holding an estimated 17% market share for six consecutive years, is a significant strength. This leadership is reinforced by an extensive distribution network of over 80,000 retail points and a successful 'more suitable for Chinese babies' marketing strategy.

The company's vertically integrated supply chain, operational since 2006, and its fully automated, aseptic production process provide a competitive edge in product quality and safety. For instance, in 2023, Feihe's proprietary milk source quality index was 1.5 times higher than the national average.

Financially, Feihe demonstrated resilience in 2024, with revenues up 6.2% to RMB20.75 billion and net profit up 11.1% to RMB3.65 billion, signaling strong profitability amidst market challenges. The company also plans a share buyback program for fiscal year 2025, indicating robust financial health.

Feihe's dedication to R&D is evident in its 659 authorized patents by 2024 and the launch of innovative products like Xingfeifan Zhuorui. The company is also diversifying into adult milk powder and nutritional supplements, with 'other dairy products' sales showing notable growth, and expanding globally with its Canadian plant.

| Metric | 2023 Data | 2024 Data | 2025 Projection |

|---|---|---|---|

| Market Share (Infant Formula) | 17% | 17%+ | Stable/Slight Growth |

| Retail Points of Sale | 80,000+ | 80,000+ | Expansion |

| Revenue | RMB 19.54 Billion | RMB 20.75 Billion (+6.2%) | Growth expected |

| Net Profit | RMB 3.28 Billion | RMB 3.65 Billion (+11.1%) | Growth expected |

| Authorized Patents | N/A | 659 | Increasing |

What is included in the product

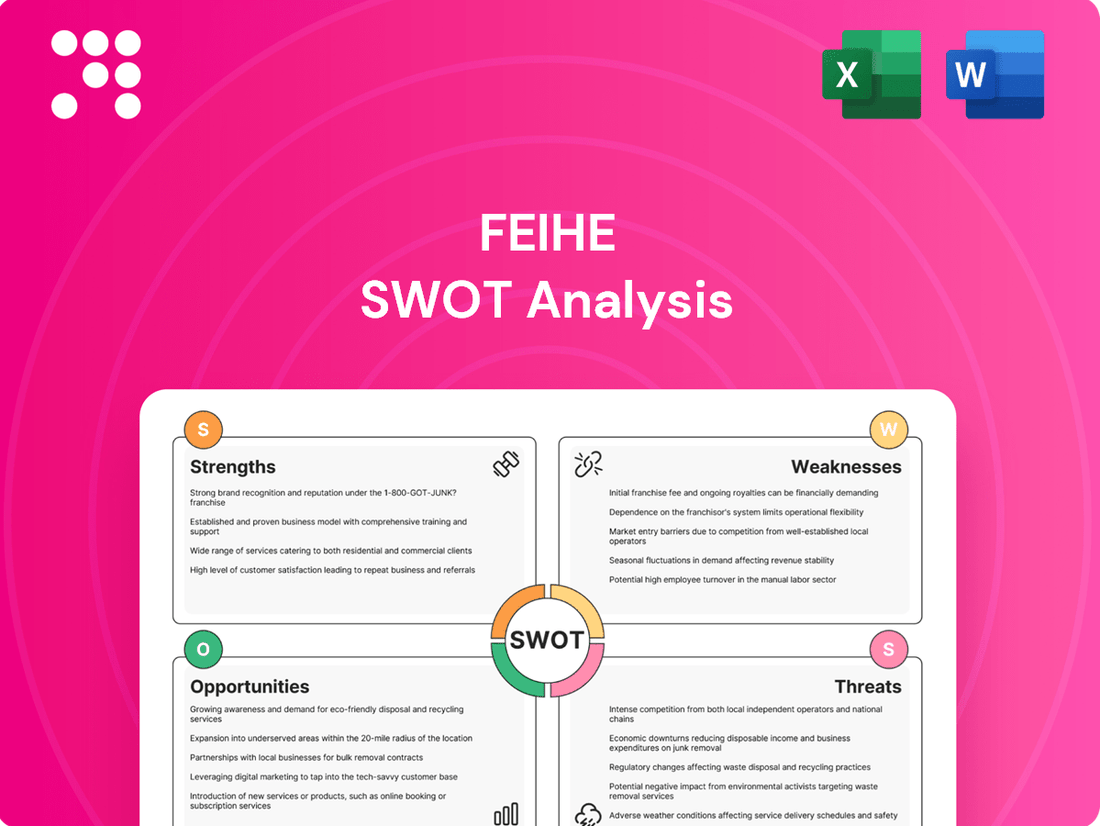

Analyzes Feihe’s competitive position through key internal and external factors, detailing its strengths in brand loyalty and market share, weaknesses in product diversification, opportunities in international expansion, and threats from regulatory changes and intense competition.

Provides a clear, actionable SWOT analysis to identify and address key challenges in the competitive infant formula market.

Weaknesses

Feihe's business model shows a significant concentration in infant milk formula, a segment that captured approximately 92% of its revenue in fiscal year 2024. This heavy dependence makes the company particularly susceptible to shifts in the infant formula market and changes in birth rates.

While Feihe has been working to diversify its product offerings, the contribution from 'other dairy products' to its total revenue remains minimal. This limited diversification means that challenges within the core infant formula business could disproportionately impact Feihe's overall financial performance.

Feihe's core business is directly threatened by China's persistent decline in birth rates. In 2023, the number of newborns in China fell to around 9 million, a stark indicator of this demographic challenge.

This shrinking market for infant formula directly impacts Feihe's revenue, as evidenced by previous profit declines. The ongoing trend puts continuous pressure on demand for their primary products.

The overall infant formula market in China is contracting, with even imported brands experiencing a downturn, highlighting the systemic nature of this weakness for Feihe.

Feihe faces a fiercely competitive Chinese infant formula market, even as a leader. Giants like Danone and Yili are significant rivals, alongside a growing presence of foreign brands in the premium segment. This intense rivalry often triggers price wars and escalates marketing costs, which can put considerable pressure on Feihe's profit margins.

Exposure to Regulatory Changes and Food Safety Scrutiny

Feihe operates within China's highly regulated dairy sector, particularly infant formula, where government oversight is intense and constantly evolving. These stringent safety standards, including mandatory re-certification processes, present ongoing operational hurdles and can escalate compliance expenses. For instance, in 2023, the Chinese government continued to emphasize stricter quality control measures for infant formula, impacting all domestic producers.

Any misstep or perceived lapse in food safety could have devastating consequences for Feihe, eroding hard-won consumer trust and brand loyalty. The company's reliance on domestic market confidence makes it particularly vulnerable to such scrutiny. In 2024, reports indicated that consumer sentiment towards domestic dairy brands remains sensitive to any safety concerns, underscoring this vulnerability.

- Evolving Regulatory Landscape: Feihe must continuously adapt to new safety protocols and quality standards mandated by Chinese authorities, which can lead to increased operational complexity.

- Compliance Costs: Meeting these rigorous standards, including potential re-certifications, adds to Feihe's operational expenses, potentially impacting profitability.

- Reputational Risk: A single food safety incident, however minor, could severely damage Feihe's brand image and consumer trust, a critical asset in the infant formula market.

- Market Sensitivity: Consumer confidence in the Chinese dairy market is highly attuned to safety issues, making Feihe susceptible to market downturns following any negative publicity.

Profit Warnings and Inventory Adjustments

Feihe has faced significant headwinds, leading to profit warnings. For instance, in July 2025, the company projected a substantial decline in net profit for the first half of the year. This downturn is attributed to a confluence of factors, including the phasing out of childbirth subsidies, a reduction in government grants, and challenges related to inventory adjustments.

These profit warnings highlight Feihe's susceptibility to shifts in government policy and its ongoing struggles with effective inventory management. Such volatility can erode investor confidence, creating uncertainty around the company's short-term financial performance and its ability to navigate market fluctuations.

- Profit Warning Issued: July 2025 saw Feihe issue a profit warning for H1 2025.

- Projected Net Profit Drop: Anticipated a significant decrease in net profit for the first half of the year.

- Contributing Factors: Childbirth subsidies, reduced government grants, and inventory adjustments cited as key reasons.

- Impact on Confidence: These issues signal financial volatility and operational challenges, potentially impacting investor sentiment.

Feihe's substantial reliance on the infant milk formula segment, which accounted for approximately 92% of its revenue in fiscal year 2024, exposes it to significant market risks. This concentration makes the company highly vulnerable to demographic shifts, such as China's declining birth rate, which saw only around 9 million newborns in 2023. The limited contribution from other dairy products, remaining minimal, further amplifies the impact of any downturn in its core business.

The intense competition within China's infant formula market, with major players like Danone and Yili, pressures Feihe's profit margins through potential price wars and increased marketing expenditures. Furthermore, operating under China's stringent and evolving dairy regulations, particularly concerning infant formula safety, necessitates continuous adaptation and can lead to escalating compliance costs. A single food safety lapse could severely damage Feihe's brand reputation and consumer trust, which is critical in this sensitive market.

Feihe's financial stability is also threatened by its susceptibility to policy changes and inventory management issues, as evidenced by a profit warning issued in July 2025 for the first half of the year. This warning cited the phasing out of childbirth subsidies, reduced government grants, and inventory adjustments as key factors, signaling potential volatility and impacting investor confidence.

Full Version Awaits

Feihe SWOT Analysis

The preview you see is the actual Feihe SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete Feihe SWOT analysis. Once purchased, you’ll receive the full, editable version, offering comprehensive insights.

You’re viewing a live preview of the actual Feihe SWOT analysis file. The complete version, detailing all strategic aspects, becomes available after checkout.

Opportunities

The demand for premium infant milk formula is a significant driver in China, with urbanization and rising incomes boosting consumer spending on high-end products. Feihe's strategic emphasis on premium offerings, such as its Astrobaby line, and its marketing message of being "more suitable for Chinese babies" are well-aligned with this trend. This focus has allowed Feihe to effectively tap into a growing segment of the market, evidenced by the expanding market share of premium products.

Feihe can tap into the growing adult nutrition market, a strategic move given China's declining birth rate. This includes expanding its offerings in adult milk powder, liquid milk, and health supplements, catering to a wider demographic.

The company's 'other dairy products' category already shows promising growth, with sales increasing significantly. This suggests a strong market reception for Feihe's diversification efforts beyond infant formula, potentially offsetting any slowdowns in its core segment.

By leveraging its dairy expertise, Feihe can capture a larger share of the overall dairy market, serving consumers throughout their life stages. This diversification strategy is crucial for long-term sustainability and revenue stability.

The Chinese government's commitment to boosting domestic infant milk formula production, targeting a 60% self-sufficiency rate, presents a significant opportunity for Feihe. This initiative, outlined in the 'Action Plan for the Promotion of Domestic Infant Milk Formula,' directly supports leading national brands like Feihe.

By aligning with these government objectives, Feihe can expect enhanced consumer trust and potentially more favorable regulatory and market conditions. This policy shift aims to build confidence in Chinese-made baby milk, creating a stronger foundation for domestic brands to thrive.

Strategic Expansion into International Markets

Feihe's strategic expansion into international markets, exemplified by its Canadian production base and successful entry into North American retailers like Walmart and Loblaws, highlights significant growth opportunities. This global push can diversify revenue streams, lessening dependence on the Chinese market, which has seen fluctuating growth rates in infant formula sales. By establishing a presence in developed markets, Feihe can bolster its brand image as a premium global dairy producer, potentially capturing a larger share of the international infant nutrition market, which is projected to reach over $100 billion by 2027.

- Diversification of Revenue: Reducing reliance on the Chinese market, which faced regulatory shifts impacting infant formula sales in recent years.

- Brand Enhancement: Positioning Feihe as a high-quality global dairy producer, appealing to international consumers seeking trusted brands.

- Market Penetration: Leveraging established channels like Walmart and Loblaws to reach a broader consumer base in North America.

- Global Sales Growth: Capitalizing on the expanding global infant nutrition market, estimated to grow at a CAGR of approximately 6.5% through 2027.

Digital Transformation and E-commerce Growth

The burgeoning social e-commerce and online sales channels for maternal and baby products in China offer a significant avenue for Feihe. This trend allows Feihe to bolster its digital sales infrastructure and deepen consumer interaction. For instance, in 2023, China's online retail sales of physical goods reached over 11.4 trillion yuan, with the maternal and infant category showing robust growth.

Feihe can capitalize on this by enhancing its presence on comprehensive e-commerce platforms and embracing content e-commerce strategies. This approach is crucial for reaching a broader consumer base and aligning with shifting purchasing behaviors. The company's ability to adapt to these digital shifts will be key to sustained growth in a competitive market.

- Social E-commerce Expansion: Leveraging platforms like Douyin and Kuaishou for direct sales and influencer marketing.

- Content-Driven Sales: Developing engaging content that educates and promotes Feihe's products, driving online purchases.

- Omnichannel Integration: Seamlessly connecting online and offline channels to provide a consistent customer experience.

- Data Analytics: Utilizing consumer data from e-commerce activities to personalize marketing and product development.

Feihe is well-positioned to capitalize on the growing demand for premium infant milk formula in China, a trend supported by increasing urbanization and consumer spending on high-quality products. The company's focus on premium offerings, like its Astrobaby line, and its marketing message tailored to Chinese babies align perfectly with this market dynamic.

Expanding into the adult nutrition market, including adult milk powder, liquid milk, and health supplements, presents a significant opportunity for Feihe, especially given China's demographic shifts. This diversification leverages the company's dairy expertise to cater to a broader consumer base across different life stages, enhancing long-term revenue stability.

The Chinese government's push for increased domestic infant milk formula production, aiming for 60% self-sufficiency, directly benefits leading national brands like Feihe. This policy support fosters greater consumer trust in domestic products and can lead to more favorable market conditions.

Feihe's international expansion, including its Canadian production facilities and presence in North American retailers like Walmart and Loblaws, offers a crucial avenue for diversifying revenue streams and reducing reliance on the fluctuating Chinese infant formula market. This global strategy aims to enhance Feihe's brand image as a premium international dairy producer.

The company can also leverage the booming social e-commerce and online sales channels in China for maternal and baby products. By bolstering its digital infrastructure and engaging in content-driven sales strategies, Feihe can reach a wider audience and adapt to evolving consumer purchasing habits, as evidenced by China's substantial online retail sales.

| Opportunity | Description | Supporting Data/Trend |

|---|---|---|

| Premium Infant Formula Demand | Growing consumer preference for high-quality, specialized infant nutrition. | Urbanization and rising incomes drive spending on premium products. |

| Adult Nutrition Market Expansion | Catering to an aging population and health-conscious consumers. | China's demographic shifts create demand for adult milk powder and supplements. |

| Government Support for Domestic Brands | Favorable policies aimed at increasing self-sufficiency in infant formula production. | Government target of 60% self-sufficiency in domestic infant formula. |

| International Market Growth | Expanding global reach beyond the Chinese market. | Presence in North American retailers like Walmart and Loblaws; global infant nutrition market projected to exceed $100 billion by 2027. |

| Digital Sales Channels | Leveraging e-commerce and social media for direct consumer engagement. | China's online retail sales of physical goods exceeded 11.4 trillion yuan in 2023. |

Threats

The persistent drop in China's birth rate presents a significant long-term challenge for Feihe's primary infant formula market. Despite government efforts to encourage more births, the number of newborns has continued its downward trend, directly impacting the size of the target demographic and leading to an overall contraction in the infant formula sector.

China's declining birth rate, which saw a further drop to 6.39 births per 1,000 people in 2023, exacerbates the threat of intensifying price competition. This shrinking market, coupled with a crowded infant formula sector, forces companies like Feihe to engage in aggressive pricing strategies to capture market share.

The pressure to attract consumers in a smaller market can lead to price wars, potentially impacting profitability across the industry. For instance, if Feihe initiates significant promotional campaigns or price reductions, it could trigger similar responses from competitors, squeezing profit margins for all players.

China's economy is facing headwinds, with a significant property sector downturn and elevated youth unemployment rates impacting overall consumer sentiment. These broader economic challenges, coupled with deflationary pressures, could translate into more cautious consumer spending habits throughout 2024 and into 2025.

This cautious spending environment poses a direct threat to companies like Feihe, particularly those focused on premium products. Consumers may become more price-sensitive, potentially leading to reduced demand for Feihe's high-end infant formula as they seek more budget-friendly alternatives.

Supply-Demand Imbalance in Chinese Dairy Industry

China's dairy industry faces a significant supply-demand imbalance, with raw milk production outstripping consumption due to declining birth rates. This oversupply has driven down farmgate milk prices, impacting dairy producers like Feihe. For instance, while China's birth rate fell to a record low of 6.39 births per 1,000 people in 2023, raw milk output increased. This situation could pressure Feihe's raw material costs and necessitate adjustments to inventory levels, potentially leading to impairment charges on unsold milk products.

The persistent oversupply of raw milk in China, coupled with falling prices, presents a notable threat to Feihe's operational stability. As of early 2024, the average farmgate milk price in China has seen a downward trend, creating a challenging environment for dairy farmers and, by extension, milk purchasers. This dynamic could force Feihe to re-evaluate its supply chain strategies and manage potential overstocking, which might result in financial write-downs if demand does not recover or if production is not curtailed effectively.

Feihe must navigate the complexities arising from the dairy industry's oversupply. The continued growth in raw milk production, even amidst a shrinking consumer base for infant formula due to lower birth rates, creates a surplus. This imbalance directly affects Feihe by potentially lowering the cost of raw milk but also introduces risks related to inventory management and the need for potential impairment provisions on excess stock. The ongoing demographic shifts in China underscore the urgency of adapting to these market realities.

Key concerns for Feihe stemming from the supply-demand imbalance include:

- Decreasing Farmgate Milk Prices: The surplus of raw milk has led to a decline in prices paid to farmers, which, while potentially reducing input costs for Feihe, also signals weaker demand in the broader dairy market.

- Inventory Management Challenges: With production exceeding demand, Feihe may face difficulties in managing its inventory, risking obsolescence and the need for write-downs.

- Supply Chain Stability: The financial strain on upstream milk producers due to low prices could impact the long-term stability and reliability of Feihe's raw milk supply.

Evolving Regulatory Environment and Compliance Risks

Feihe faces significant challenges from China's evolving regulatory environment. Stricter standards for infant formula, including enhanced safety protocols and rigorous re-registration audits for manufacturers, mean continuous adaptation and investment are necessary. These regulations, while aimed at bolstering consumer trust, can also lead to market consolidation, potentially disadvantaging smaller competitors but requiring leading firms like Feihe to maintain high compliance levels.

The implementation of these new regulations, particularly the enhanced safety testing and traceability requirements introduced in recent years, places a direct burden on manufacturers. For instance, the 2023 regulatory updates emphasized stricter controls on raw material sourcing and finished product testing, demanding substantial operational adjustments. Feihe's ability to navigate these changes efficiently, ensuring full compliance across its product lines, is critical for maintaining market access and consumer confidence.

- Stricter Baby Food Standards: China's updated infant formula regulations, effective from 2023, mandate more comprehensive testing for contaminants and nutritional content, increasing operational costs.

- Re-registration Audits: Manufacturers must undergo periodic re-registration audits, a process that can be resource-intensive and potentially disruptive if not managed proactively.

- Market Consolidation Risk: While aiming for safety, regulatory tightening can force smaller, less compliant players out of the market, intensifying competition among established brands like Feihe.

- Investment in Compliance: Feihe must continually invest in upgrading production facilities, quality control systems, and R&D to meet and exceed these evolving national standards.

The intensifying competition within China's infant formula market, driven by a declining birth rate, presents a significant threat. With fewer newborns, companies like Feihe face increased pressure to capture market share, potentially leading to price wars that erode profit margins.

China's economic slowdown, marked by property sector issues and high youth unemployment, is dampening consumer sentiment. This economic uncertainty could lead consumers to become more price-sensitive, opting for cheaper alternatives over Feihe's premium infant formula products throughout 2024 and into 2025.

An oversupply of raw milk in China, with production exceeding demand due to lower birth rates, is driving down farmgate milk prices. This imbalance, as evidenced by the record low birth rate of 6.39 per 1,000 in 2023, creates inventory management challenges for Feihe and risks potential write-downs on excess stock.

Feihe must also contend with China's increasingly stringent regulatory landscape for infant formula. New standards, including enhanced safety testing and re-registration audits implemented from 2023, necessitate continuous investment in compliance and can lead to market consolidation, intensifying competition among established players.

SWOT Analysis Data Sources

This Feihe SWOT analysis is built upon a robust foundation of reliable data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis. These sources ensure the insights are accurate, current, and strategically relevant for informed decision-making.