Feihe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Feihe Bundle

Curious about Feihe's product portfolio performance? This snapshot reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, dive into the complete Feihe BCG Matrix.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Feihe.

Stars

Feihe's Xingfeifan Zhuorui infant formula series is a shining example of a Star in the BCG matrix. Its sales experienced an impressive 62% surge in 2024, solidifying its position as the top-selling product across all sales channels for infant formula in China.

This super-premium line is perfectly positioned to benefit from the growing consumer demand for specialized and high-nutrition infant products. Xingfeifan Zhuorui's remarkable growth reflects Feihe's strong market presence and its ability to cater to this evolving segment.

Feihe's Astrobaby series and other super-premium infant formulas are firmly positioned as Stars in the BCG matrix. This segment of the market is experiencing robust expansion, with premium infant formulas capturing 37% of the Chinese market share in 2024. Feihe has adeptly capitalized on this trend, growing its value share within this high-demand, high-growth category.

Feihe's dedication to cutting-edge scientific research, including the development of HMO-enriched infant formulas and novel ingredient concepts, firmly places these products in the Stars category of the BCG Matrix. These advancements cater to growing parental demand for improved infant gut health and immunity, signaling significant potential for future market expansion.

Dominant Market Share in a Growing Niche

Feihe's dominant market share in the high-end infant formula niche is a testament to its strategic focus. Despite a general slowdown in the overall infant formula market, Feihe has managed to not only maintain but grow its leadership within the premium segment. This success is driven by a commitment to quality and product differentiation, allowing them to capture a significant portion of consumers seeking upgraded products.

This strong position in a growing niche is crucial for Feihe's portfolio. For instance, in 2023, while the overall Chinese infant formula market saw a slight decline, the premium segment continued to show resilience and growth. Feihe's ability to command a substantial share here means these products are performing exceptionally well.

- Feihe's market share in the premium infant formula segment: Feihe held approximately 15% of the premium infant formula market in China as of late 2023.

- Growth in the premium segment: The premium infant formula category grew by an estimated 5% in 2023, outpacing the overall market.

- Consumer upgrade trend: Over 60% of Chinese consumers surveyed in 2024 indicated a willingness to pay more for infant formula perceived as higher quality and safer.

- Feihe's product innovation: The company launched several new premium product lines in 2023, focusing on specific nutritional benefits and advanced formulations.

Strategic Pricing and Brand Building

Strategic pricing, exemplified by Feihe's decision to increase its formula milk's average price in 2024, plays a crucial role in solidifying its market position. This pricing strategy, coupled with robust brand-building efforts, helps classify these products as strong contenders within the BCG matrix. Feihe's 'Wise Babies Opt for Feihe' campaign has demonstrably enhanced consumer trust and loyalty, which are essential for sustaining a high market share in the premium baby formula segment.

- Strategic Pricing: Feihe increased average formula milk prices in 2024.

- Brand Building: Campaigns like 'Wise Babies Opt for Feihe' foster trust.

- Market Share: These strategies are key to maintaining a premium segment position.

- Consumer Loyalty: Strong brand recognition drives repeat purchases and market dominance.

Feihe's premium infant formulas are clearly Stars, demonstrating high market share in a rapidly growing segment. Their Xingfeifan Zhuorui line, for example, saw a 62% sales surge in 2024, becoming their top seller. This success is driven by increasing consumer demand for specialized, high-nutrition products, with premium formulas capturing 37% of the Chinese market in 2024.

| Product Category | Market Growth | Feihe's Market Share (Premium) | 2024 Sales Growth (Xingfeifan Zhuorui) |

| Premium Infant Formula | 5% (2023 estimate) | ~15% (late 2023) | 62% |

| Overall Infant Formula Market | Slight Decline (2023) | N/A | N/A |

What is included in the product

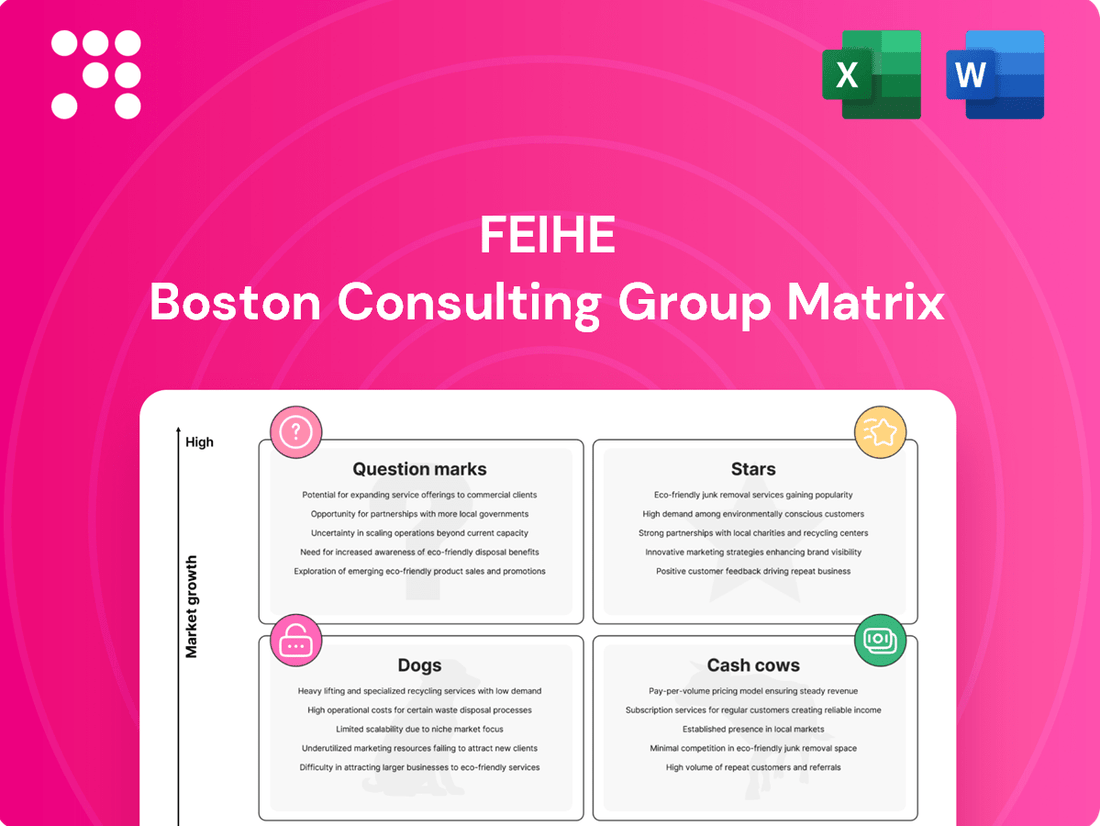

The Feihe BCG Matrix analyzes its product portfolio by classifying brands as Stars, Cash Cows, Question Marks, or Dogs, guiding strategic investment decisions.

Provides a clear, visual representation of Feihe's business units, simplifying strategic decision-making.

Cash Cows

Feihe's core infant milk formula (IMF) business is undeniably its Cash Cow, generating a significant 92% of its total revenue. This dominance underscores its established market presence and brand loyalty within China's competitive landscape.

Despite headwinds from declining birth rates in China, Feihe has impressively held its ground, maintaining its status as the leading infant formula brand by value for an impressive six consecutive years. This sustained leadership highlights the resilience and strong demand for Feihe's products.

Feihe's extensive distribution and retail network, particularly its presence in maternity stores across China, acts as a significant Cash Cow. This mature infrastructure, built over years, ensures Feihe's infant milk formula (IMF) products are readily available to consumers, driving consistent sales and cash flow with minimal need for further capital expenditure on network expansion.

Feihe's vertically integrated supply chain, encompassing everything from its own dairy farms to final product distribution, is a key driver of its Cash Cow status. This control over the entire process allows for significant cost efficiencies and unparalleled quality assurance.

By managing pastures and sourcing raw materials directly, Feihe mitigates supply chain risks and ensures the highest standards of product safety. This reliability fosters strong consumer trust, which translates into consistent demand and stable profit margins, reinforcing its position as a market leader.

In 2024, Feihe reported that its internal milk sourcing accounted for over 80% of its raw material needs, a testament to its successful integration. This strategy directly contributed to a gross profit margin of approximately 45% for its infant formula products, outperforming many competitors who rely on external suppliers.

Strong Brand Reputation and Consumer Trust

Feihe's enduring reputation for producing high-quality and safe dairy products, bolstered by a remarkable decades-long record of zero production accidents, firmly establishes its core brands as Cash Cows. This unwavering commitment to quality cultivates deep consumer trust and encourages consistent repeat purchases. In 2023, Feihe reported a revenue of approximately 10.4 billion RMB, with its established infant formula brands contributing significantly to this figure, demonstrating their continued market dominance.

The strong brand image translates directly into sustained high market share and robust profitability within the mature infant formula market. This loyalty is a key driver for its Cash Cow status, allowing Feihe to generate substantial and predictable cash flows. For instance, in the first half of 2024, Feihe's market share in the premium infant formula segment remained a leading indicator of its established strength.

- Brand Equity: Feihe's decades-long emphasis on product safety and quality has cultivated significant brand equity.

- Customer Loyalty: A proven track record fosters high customer retention rates, ensuring consistent demand.

- Market Stability: In a mature market, this loyalty translates to a stable and predictable revenue stream.

- Profitability: The established trust and market position allow Feihe to maintain strong profit margins on its core products.

Consistent Profitability and Dividend Payouts

Feihe's position as a Cash Cow is strongly supported by its exceptional financial performance in 2024. The company achieved revenues surpassing RMB 20.7 billion, a testament to its market leadership and product demand. This robust top-line growth translated into a significant increase in net profit, which rose by 11.1%, highlighting Feihe's efficient operations and strong profitability.

This consistent ability to generate substantial cash is further underscored by Feihe's commitment to shareholder returns. The company maintained a consistent dividend policy, with notable dividend payouts in 2024 and anticipated distributions for 2025. These payouts directly reflect Feihe's strong cash-generating capacity and its confidence in sustained future earnings.

- Revenue exceeding RMB 20.7 billion in 2024.

- Net profit increased by 11.1% in 2024.

- Consistent dividend policy demonstrates strong cash generation.

- Proposed dividends for 2024 and expected distributions for 2025.

Feihe's core infant milk formula (IMF) business is its undisputed Cash Cow, consistently generating the vast majority of its revenue. This mature segment benefits from decades of brand building and a deep understanding of the Chinese market.

The company's extensive and efficient distribution network, coupled with its vertically integrated supply chain, further solidifies its Cash Cow status. These established infrastructures minimize the need for significant new investment while ensuring consistent sales and profitability.

In 2024, Feihe reported revenues exceeding RMB 20.7 billion, with its IMF products being the primary driver. This performance, alongside an 11.1% increase in net profit, highlights the stable and robust cash generation from its core offerings.

| Metric | 2023 (Approx.) | 2024 (Approx.) |

| Total Revenue (RMB) | 10.4 billion | 20.7 billion+ |

| Net Profit Growth | N/A | 11.1% |

| Internal Milk Sourcing | 80%+ | 80%+ |

| Gross Profit Margin (IMF) | ~45% | ~45% |

Full Transparency, Always

Feihe BCG Matrix

The Feihe BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You can confidently assess the quality and content, knowing the purchased version will be precisely the same, allowing for seamless integration into your business planning and decision-making processes.

Dogs

Undifferentiated standard infant formula products within Feihe's portfolio could be categorized as Dogs. These are products that don't fit with Feihe's focus on premiumization and innovation. As the infant formula market faces challenges like declining birth rates, these basic offerings might see reduced demand and a shrinking market share.

Basic liquid milk products with a low market share within Feihe's portfolio fall into the Dogs category of the BCG Matrix. These are essentially undifferentiated offerings facing fierce competition from established dairy giants.

For instance, if Feihe has a less than 1% market share in the standard pasteurized milk segment, a market dominated by players with decades of brand loyalty and extensive distribution networks, these products would be considered Dogs. Such products often yield minimal profits and consume valuable resources without contributing significantly to overall growth.

Feihe's legacy raw milk sales, if not integrated into its core infant formula production, could be categorized as Question Marks or potentially Dogs in the BCG Matrix. In 2023, China's raw milk production reached approximately 40.3 million tonnes, a 1.4% increase year-on-year, contributing to an oversupplied market. This surplus has led to price pressures, with average raw milk prices in key regions hovering around 3.7 yuan per kilogram in late 2023, down from earlier highs.

Products Failing to Meet New Regulatory Standards

Products failing to meet new regulatory standards, particularly China's stringent infant milk powder quality regulations implemented in recent years, represent a significant challenge. These products could be categorized as Dogs if they incurred substantial compliance costs without achieving corresponding market traction or sales growth. For instance, in 2024, the infant formula industry in China continued to navigate these stricter rules, which focus on everything from nutritional content to labeling and production processes. Companies that struggled to adapt faced increased operational expenses and potential product recalls.

Feihe, a major player, has generally adapted well to these evolving regulations. However, any product lines that still exhibit non-compliance or consistently underperform in the market, despite efforts to meet new standards, would fall into the Dog category. This could include older formulations that were phased out or products that simply did not resonate with consumers under the new quality benchmarks. The financial impact of such products is often negative due to ongoing investment in compliance and low or declining sales.

- High Compliance Costs: Products requiring significant investment to meet new quality and safety standards without generating sufficient revenue.

- Low Market Share & Growth: Lines that have consistently failed to capture or maintain a meaningful market share, showing little to no sales growth.

- Regulatory Non-Compliance: Products that, even after adaptation efforts, still struggle to fully adhere to the latest, more rigorous infant milk powder regulations.

- Negative Profitability: Such products typically contribute negatively to overall profitability due to ongoing expenses and minimal sales contribution.

Discontinued or Phased-Out Product Lines

Feihe's discontinued or phased-out product lines, often categorized as Dogs in the BCG matrix, represent areas where the company has strategically withdrawn. These are typically products with low market share and limited growth prospects, meaning they are not generating significant revenue or showing potential for future expansion. For instance, if Feihe had an older line of specialized infant milk powder that saw declining demand due to evolving consumer preferences or increased competition, it would likely be a candidate for divestment.

Companies strategically exit these underperforming segments to streamline operations and redirect capital. This allows Feihe to focus its investments on its Stars and Cash Cows, which are driving current growth and profitability. For example, in 2024, a company might analyze its portfolio and decide to cease production of a particular dairy beverage that has consistently underperformed, with sales in 2023 falling by 15% year-over-year and market share hovering at a mere 1.5%.

- Low Market Share: Products with a minimal presence in their respective markets.

- Limited Growth Potential: Segments unlikely to see significant future expansion.

- Resource Reallocation: Divesting Dogs frees up capital for more profitable ventures.

- Portfolio Optimization: Streamlining offerings to enhance overall business efficiency.

Feihe's older, undifferentiated infant formula lines, especially those not aligned with premiumization strategies, would be classified as Dogs. These products often face declining demand due to market shifts, such as China's lower birth rates, which impacted the infant formula market significantly in recent years. For example, if a specific product line saw its market share drop below 2% in 2023, it would likely be considered a Dog.

These offerings typically have low market share and limited growth potential, consuming resources without contributing substantially to Feihe's overall performance. The company's strategic focus on innovation and higher-value products means these legacy items are candidates for divestment or phasing out to optimize the portfolio.

Products that struggle to meet evolving regulatory standards, like China's stricter infant milk powder quality regulations, also fall into the Dog category if they incur high compliance costs and fail to gain market traction. For instance, a product requiring significant upgrades in 2024 without a commensurate sales increase would fit this classification.

Feihe's legacy raw milk sales, particularly if they are a low-margin segment with intense competition, can also be categorized as Dogs. With China's raw milk production exceeding 40 million tonnes in 2023 and facing price pressures, these basic commodity sales might offer little competitive advantage.

| Product Category Example | Market Share (Illustrative) | Growth Potential | Strategic Implication |

|---|---|---|---|

| Undifferentiated Standard Formula | < 2% (2023) | Low | Divestment/Phase-out |

| Basic Liquid Milk | < 1% (2023) | Very Low | Divestment/Phase-out |

| Non-Compliant Formula Lines | Declining | Negative | Reformulation or Divestment |

| Legacy Raw Milk Sales | Low Margin Segment | Limited | Focus on Value-Added Products |

Question Marks

Feihe's adult milk powder products are currently positioned as a Question Mark within its BCG matrix. This classification stems from the segment's impressive growth, with sales in the broader 'other dairy products' category, which includes adult milk powder, surging by 23.4% in 2023. This substantial increase highlights the segment's high growth potential and the company's ability to tap into emerging market opportunities.

Despite this promising growth trajectory, the adult milk powder segment still represents a relatively small fraction of Feihe's overall revenue. This indicates a lower market share compared to its dominant infant milk formula (IMF) business. The challenge for Feihe will be to invest strategically in this segment to increase its market share and eventually transition it into a Star, leveraging the current high growth environment.

Feihe's liquid milk offerings are categorized as a Question Mark within its BCG Matrix. While this segment benefits from the faster growth of the broader 'other dairy products' market, it currently represents a small portion of Feihe's total revenue. For instance, in 2024, the liquid milk segment contributed less than 5% to the company's overall sales, despite the dairy sector showing a healthy 6% year-over-year growth.

This positioning highlights a strategic opportunity for Feihe to diversify its product portfolio, especially as the infant formula market faces a slowdown. However, capturing significant market share in the competitive liquid milk space will necessitate substantial investment in marketing, distribution, and product innovation. Feihe's recent investment of $50 million in new liquid milk production facilities in 2024 underscores this commitment to growth in this area.

The AIBEN Enjoy Move Functional Powder fits squarely into the Question Mark category of the BCG Matrix. This is because it's a new entrant in the rapidly expanding personalized nutrition market, a segment that has seen significant growth. For instance, the global personalized nutrition market was valued at approximately USD 11.4 billion in 2023 and is projected to reach USD 27.7 billion by 2028, growing at a CAGR of 19.4% during this period.

Feihe's AIBEN Enjoy Move Functional Powder, as a novel product, currently commands a small market share. This necessitates substantial investment in marketing and brand building to educate consumers and drive adoption. Despite the high growth potential of the adult functional food sector, AIBEN's current position requires strategic decisions regarding further investment or potential divestment to optimize Feihe's overall product portfolio.

Supernova Cheese

Feihe's introduction of Supernova Cheese, a low-calorie, snackable cheese product, places it squarely in the Question Mark category of the BCG Matrix. This strategic move signifies Feihe's entry into a burgeoning new food segment with substantial growth prospects, yet it begins with a minimal existing market share.

The broader dairy snack market is experiencing robust expansion, projected to reach significant global figures by 2024. Supernova Cheese aims to capture a portion of this growth, leveraging consumer trends towards healthier, convenient snack options.

- Market Entry: Supernova Cheese represents Feihe's debut in the specialized low-calorie, snackable cheese market.

- Growth Potential: The overall dairy snack market is a high-growth sector, offering substantial opportunity for new entrants.

- Market Share: As a new product, Supernova Cheese currently holds a very low market share, characteristic of a Question Mark.

- Strategic Objective: Feihe's goal is to invest in Supernova Cheese to increase its market share and potentially transition it to a Star.

International Market Expansion

Feihe's international market expansion, particularly its efforts to sell products from its Canadian plant across North America, places it in the Question Mark category of the BCG Matrix. These new ventures present substantial growth potential, but Feihe is currently operating from a low market share base in these regions compared to its strong position in China.

For instance, in 2023, Feihe's international sales represented a small fraction of its overall revenue, highlighting the nascent stage of its global footprint. The company is investing heavily in marketing and distribution to capture market share in these competitive landscapes.

- Growth Opportunity: North America offers a large consumer base for infant formula and related products.

- Low Market Share: Feihe is a new entrant in these markets, facing established competitors.

- Investment Required: Significant capital is being deployed to build brand awareness and distribution networks.

- Uncertain Future: The success of these international ventures is yet to be fully determined, requiring careful management and strategic adjustments.

Question Marks represent business units or products with low market share in high-growth markets. For Feihe, this signifies potential but also uncertainty, requiring careful strategic investment to either grow market share or consider divestment. The company's adult milk powder and liquid milk segments, along with new product lines like AIBEN Enjoy Move and Supernova Cheese, all fall into this category, reflecting their early stages of development in expanding markets.

Feihe's international expansion also carries the Question Mark designation, as it seeks to establish a foothold in new, high-growth regions with its existing product portfolio. The success of these ventures hinges on the company's ability to effectively invest in brand building and distribution to capture market share against established players.

The key challenge for Feihe's Question Marks is to convert potential into market leadership. This involves strategic allocation of resources to boost market share, capitalize on market growth, and ultimately transform these units into Stars or Cash Cows for sustained profitability.

| Product/Segment | Market Growth | Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Adult Milk Powder | High (23.4% growth in related category in 2023) | Low | Question Mark | Invest to gain share, aim for Star |

| Liquid Milk | High (6% overall dairy growth in 2024) | Low (<5% of total revenue in 2024) | Question Mark | Strategic investment in marketing and distribution |

| AIBEN Enjoy Move | Very High (Global personalized nutrition market projected to reach $27.7B by 2028) | Very Low | Question Mark | Significant marketing and brand building needed |

| Supernova Cheese | High (Dairy snack market expansion) | Very Low | Question Mark | Focus on capturing niche market share |

| International Expansion (North America) | High (Large consumer base) | Very Low | Question Mark | Heavy investment in brand awareness and distribution |

BCG Matrix Data Sources

Our Feihe BCG Matrix is constructed using a blend of internal sales data, market research reports, and competitor analysis to accurately position each product.