Feihe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Feihe Bundle

Navigate the complex global landscape impacting Feihe with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping Feihe's market position. Gain a critical edge by leveraging these expert insights to inform your strategic decisions and investment plans. Download the full PESTLE analysis now for actionable intelligence that drives success.

Political factors

The Chinese government is actively promoting domestic infant formula brands, aiming to enhance national self-sufficiency in the dairy sector. This strategic push is evident in initiatives like the 'Action Plan for the Promotion of Domestic Infant Milk Formula,' which targets a 60% self-sufficiency rate.

These government policies directly benefit local manufacturers such as Feihe by creating a more favorable operating environment and reducing dependence on foreign suppliers. By prioritizing homegrown products, the government strengthens the competitive standing of domestic players in the market.

China's government is actively trying to boost its birth rate, notably with the introduction of the three-child policy and various financial incentives for childcare. These measures are directly relevant to the infant formula market.

While China has seen a general decline in birth rates over recent years, there was a slight uptick in newborns in 2024. The government's ongoing commitment to providing financial support for families with children is anticipated to positively influence the future growth of the infant formula sector.

China's commitment to enhancing food safety is evident in its progressively stringent regulations for dairy and infant formula. For instance, the implementation of new GB standards in recent years has significantly impacted the industry. These updated standards, such as the prohibition of reconstituted milk in sterilized milk, aim to bolster consumer trust in domestically produced goods.

These evolving regulatory landscapes necessitate that companies like Feihe invest heavily in quality control and safety protocols to meet these higher benchmarks. The government's focus on food safety, particularly for infant nutrition, means compliance is not just a legal requirement but a critical factor for market access and brand reputation. For 2024, reports indicate continued scrutiny and potential updates to these standards, requiring ongoing adaptation from manufacturers.

Trade Policies and Import Tariffs

Changes in import procedures and tariffs can significantly reshape the competitive environment for companies like Feihe. For instance, China's imposition of a 10% tariff on US dairy products, effective March 2025, directly impacts the cost of raw materials for infant formula manufacturers. This policy aims to bolster domestic production by making imported alternatives less attractive financially.

These trade policies can create a more favorable market for domestic infant formula producers. While the overall dairy import market is projected to recover in 2025, specific tariffs on key ingredients can elevate the price of imported infant formula. This cost differential can steer consumers towards locally sourced products, potentially benefiting companies with strong domestic supply chains.

- Tariff Impact: A 10% tariff on US dairy products from March 2025 increases the cost of imported raw materials.

- Market Advantage: Higher import costs for foreign infant formula can favor domestic brands like Feihe.

- Import Trends: Despite an expected rebound in overall dairy imports for 2025, targeted tariffs can alter specific product segment competitiveness.

Political Stability and Geopolitical Relations

Feihe's operations are significantly influenced by China's political stability. In 2023, China maintained a generally stable domestic political environment, which is crucial for consistent business operations and supply chain reliability. However, ongoing geopolitical tensions, particularly with Western nations, present potential risks. These tensions could lead to trade barriers or affect international investor sentiment towards Chinese companies, impacting Feihe's access to global markets and its ability to attract foreign investment.

The evolving geopolitical landscape directly impacts Feihe's international trade dynamics. For instance, the ongoing trade friction between China and the United States, which saw tariffs imposed on various goods, could indirectly affect the cost of imported raw materials or components Feihe might utilize. Conversely, China's Belt and Road Initiative, while aimed at fostering economic ties, also carries geopolitical implications that could open new markets but also introduce new regulatory complexities for companies like Feihe operating in participating countries.

- China's domestic political stability provides a predictable operational environment for Feihe.

- Geopolitical tensions, particularly with Western economies, pose risks to Feihe's supply chains and market access.

- Trade disputes can influence the cost of imported inputs, impacting Feihe's production expenses.

- International relations shape investor confidence and the overall global economic outlook for Chinese companies.

The Chinese government's strategic focus on boosting domestic infant formula production and food safety standards creates a supportive environment for companies like Feihe. Initiatives to increase the national birth rate, such as the three-child policy, are also expected to positively influence market demand.

Trade policies, including tariffs on imported dairy products, can directly impact raw material costs and create a competitive advantage for local producers. For example, a 10% tariff on US dairy products effective March 2025 raises the cost of imported ingredients.

Geopolitical stability within China ensures operational continuity, though international trade tensions may pose risks to supply chains and market access. China's commitment to food safety, with increasingly stringent regulations, necessitates ongoing investment in quality control for manufacturers.

What is included in the product

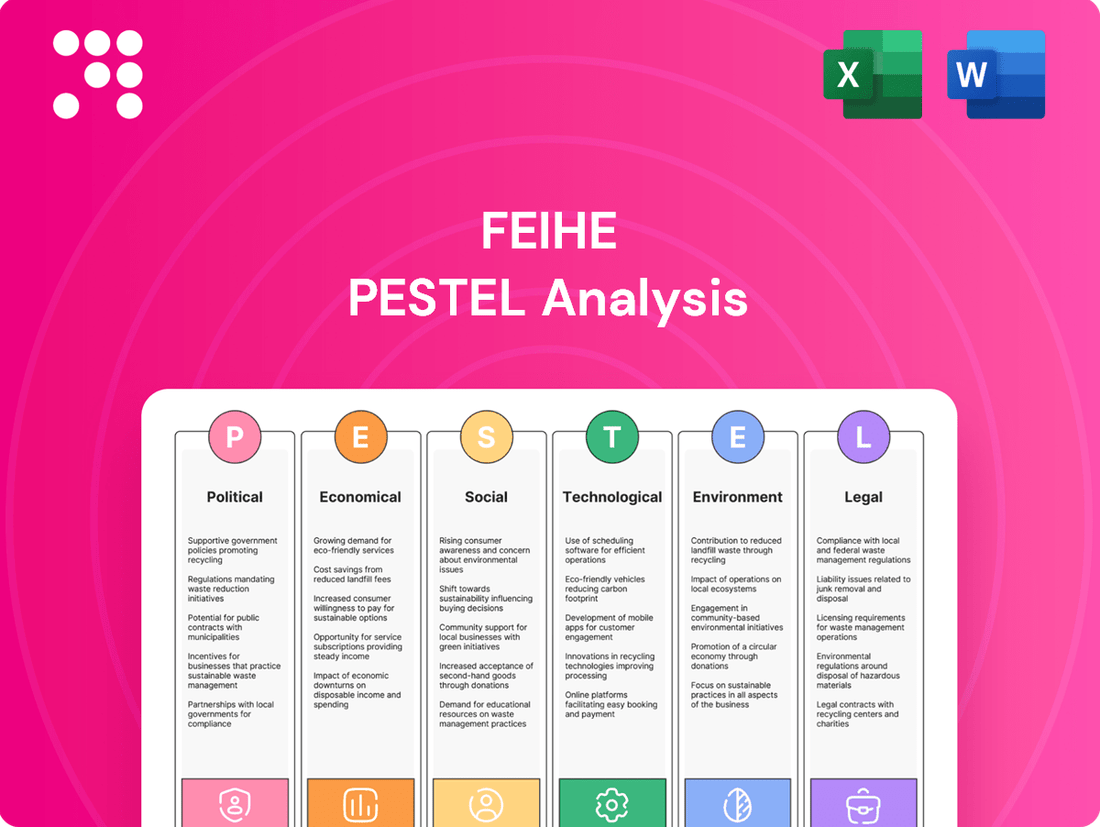

This Feihe PESTLE analysis meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides a comprehensive overview of the external landscape, highlighting key opportunities and challenges for Feihe's growth and sustainability.

A concise Feihe PESTLE analysis simplifies complex external factors, acting as a pain point reliver by providing a clear, actionable overview for strategic decision-making.

Economic factors

China's birth rate has fallen sharply in recent years, with official data showing a rate of 6.39 births per 1,000 people in 2023, down from 6.77 in 2022. This demographic trend directly shrinks the market for infant formula, Feihe's core product. The infant formula market in China was valued at approximately $25 billion in 2023 and is projected to contract as fewer babies are born.

Despite economic headwinds, China's burgeoning middle class is exhibiting a strong propensity for premiumization in infant formula. Disposable incomes are on the rise, with average per capita disposable income in China projected to reach approximately RMB 50,000 by the end of 2024, a notable increase from previous years. This financial uplift enables consumers to prioritize quality and safety, translating into a willingness to invest more in high-nutrition, trusted brands.

This consumer behavior directly benefits companies like Feihe, whose focus on premium and ultra-premium segments aligns perfectly with evolving purchasing habits. The demand for superior infant nutrition is not merely a trend but a sustained shift, as parents increasingly associate higher price points with enhanced safety standards and more sophisticated nutritional profiles for their children.

The Chinese infant formula market is a battlefield, with domestic giants like Feihe facing fierce competition from both established international players and emerging local brands. This crowded landscape forces companies to engage in aggressive pricing strategies and promotional activities to capture even a small slice of the market.

For instance, in 2023, the market saw continuous promotional efforts, with brands offering discounts and bundled deals, directly impacting profitability. Feihe, like its peers, has actively participated in these promotions, which can lead to a squeeze on profit margins as the cost of customer acquisition rises.

Supply Chain and Raw Material Costs

Feihe's robust, vertically integrated supply chain, encompassing raw milk collection and processing, provides a degree of control over production costs. However, the company remains susceptible to the volatility of global and domestic raw milk prices. For instance, a significant factor impacting the sector is the projected decline in Chinese milk production for 2025, largely attributed to persistently low farmgate prices. This trend could directly influence both the cost and the consistent availability of essential domestic raw materials for Feihe.

The impact of these supply chain dynamics is multifaceted:

- Raw Material Price Volatility: Fluctuations in global dairy commodity prices, influenced by factors like weather patterns and international demand, can directly increase Feihe's cost of goods sold.

- Domestic Production Challenges: The anticipated drop in Chinese milk output for 2025, driven by farmer profitability concerns, presents a risk to Feihe's sourcing of local raw milk, potentially leading to higher procurement costs or the need to increase reliance on imported milk powder.

- Logistics and Transportation: While not explicitly detailed for Feihe, broader economic trends in 2024-2025 indicate that global shipping costs and domestic logistics efficiency continue to be critical factors affecting the overall cost of bringing raw materials to processing facilities and finished goods to market.

E-commerce Growth and Distribution Channels

China's e-commerce landscape is booming, with social e-commerce platforms playing an increasingly vital role in how consumers, particularly those focused on maternal and baby products, make purchasing decisions. This trend necessitates that Feihe strategically enhance its presence and offerings across these digital avenues.

The shift in consumer behavior towards online purchasing is undeniable. For instance, in 2023, China's online retail sales of physical goods reached approximately 9.8 trillion yuan, highlighting the immense potential of the digital marketplace. Feihe's ability to effectively integrate and utilize these channels will be crucial for sustained growth and market penetration.

- E-commerce Dominance: Online channels are becoming the primary purchasing point for many consumers, especially in the maternal and baby sector.

- Social Commerce Integration: Platforms like Douyin (TikTok) and Kuaishou are not just for entertainment but are powerful sales engines, driving impulse buys and brand discovery.

- Feihe's Adaptation: The company must invest in digital marketing, influencer collaborations, and seamless online shopping experiences to capture this growing market share.

- Data-Driven Strategies: Leveraging e-commerce data allows Feihe to understand consumer preferences and tailor product offerings and promotions more effectively.

China's declining birth rate, falling to 6.39 births per 1,000 people in 2023, presents a significant economic challenge for Feihe by shrinking its core infant formula market, which was valued at about $25 billion in 2023. However, a growing middle class with increasing disposable incomes, projected to reach approximately RMB 50,000 per capita by the end of 2024, is driving demand for premium, high-quality infant nutrition, aligning with Feihe's strategy.

The competitive landscape remains intense, forcing companies like Feihe into aggressive promotional activities that can impact profit margins. Feihe's vertical integration offers some cost control, but it's still vulnerable to raw material price volatility, particularly with a projected decline in Chinese milk production for 2025 potentially increasing procurement costs for domestic milk.

The booming e-commerce sector, with online retail sales of physical goods reaching about 9.8 trillion yuan in 2023, is crucial for Feihe, especially with the rise of social commerce platforms driving brand discovery and purchases in the maternal and baby product category.

Preview the Actual Deliverable

Feihe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Feihe PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You can be confident that the insights and structure you see in this preview are precisely what you will obtain.

Sociological factors

Chinese parents are increasingly prioritizing health and safety in infant formula, driving demand for organic, non-GMO, and natural ingredients. This trend is evident as the organic baby food market in China experienced significant growth, with projections indicating continued expansion through 2025. Companies like Feihe are responding by enhancing product formulations and ensuring transparent sourcing to meet these evolving consumer expectations.

Following significant food safety incidents in the past, Chinese consumers have shown a marked resurgence in trust towards domestically produced infant formula. This shift is largely attributed to stringent quality control measures and the growing competitiveness of local brands, with Feihe being a prime beneficiary as a leading domestic manufacturer.

Westernization is significantly reshaping Chinese parenting, with trends like urbanization and more dual-income families becoming common. This shift directly impacts how parents approach child-rearing, creating a greater need for products that offer convenience and assured quality for their children.

Consequently, there's a rising demand for convenient and high-quality baby food options. Think infant formula, pre-packaged snacks, and ready-to-eat meals designed for babies and toddlers. For instance, the Chinese infant formula market was valued at approximately $25 billion in 2023 and is projected to grow, reflecting this demand for convenient, trusted nutrition solutions.

Demographic Shifts and Aging Population

China's demographic landscape is undergoing significant shifts, with an aging population becoming increasingly prominent. This trend extends beyond the declining birth rate, impacting the overall structure of society and potentially redirecting market focus towards products catering to older adults, such as adult nutrition. For instance, by the end of 2023, China's population aged 60 and above reached 296.97 million, representing 21.1% of the total population.

Feihe, a company primarily known for its infant formula, is strategically adapting to these demographic changes. Recognizing the growing demand for products that support healthy aging, Feihe has begun diversifying its portfolio to include adult milk powder. This move signifies a proactive response to evolving consumer needs and a broadening market opportunity beyond its traditional infant nutrition segment.

This diversification is crucial for Feihe's long-term growth strategy. As the proportion of older adults in China continues to rise, the market for adult nutritional supplements and dairy products is expected to expand significantly. Feihe's expansion into this area positions it to capitalize on this demographic dividend, ensuring continued relevance and revenue streams in a changing consumer environment.

- Aging Population Growth: China's elderly population (60+) reached 296.97 million by end-2023, a 21.1% share of the total.

- Market Shift: Demographic trends suggest a growing demand for adult nutrition products.

- Feihe's Diversification: The company is expanding into adult milk powder to meet evolving consumer needs.

- Strategic Adaptation: This diversification aims to leverage the opportunities presented by an aging demographic.

Social Media and Influencer Marketing

Social media platforms are incredibly influential in China, particularly for new parents seeking information on infant nutrition. In 2024, platforms like Douyin and Xiaohongshu are key battlegrounds for brands. Feihe's success hinges on leveraging these channels effectively, with a strong emphasis on building trust through credible voices.

The rise of healthcare professionals and Key Opinion Leaders (KOLs) as trusted sources is paramount. These influencers, often sharing educational content and personal experiences, significantly shape parental purchasing decisions. For instance, a positive endorsement from a pediatrician on Douyin can drive substantial sales, highlighting the need for strategic partnerships.

Effective influencer marketing campaigns are crucial for brand perception and sales growth. By 2025, it's projected that influencer marketing spend in China will continue its upward trajectory, with a significant portion dedicated to categories like baby care. Feihe's ability to secure authentic partnerships with respected KOLs will be a key differentiator.

- Douyin and Xiaohongshu dominate social media engagement for parents.

- KOLs and healthcare professionals are critical trust-builders for infant formula brands.

- Influencer marketing spend in China's baby care sector is expected to grow significantly through 2025.

- Authentic endorsements from credible sources drive brand perception and sales.

Chinese parents are increasingly prioritizing health and safety, driving demand for organic and natural infant formula ingredients. This trend is amplified by the significant influence of social media platforms like Douyin and Xiaohongshu, where Key Opinion Leaders (KOLs) and healthcare professionals shape purchasing decisions. Feihe's strategic engagement with these platforms and credible influencers is vital for building trust and driving sales in a competitive market.

Technological factors

Feihe's commitment to vertical integration, spanning from its own pastures to final distribution, is a significant technological advantage. This control over the entire process, from sourcing raw materials to delivering finished goods, allows for enhanced quality assurance and traceability. For instance, in 2023, Feihe reported that its self-owned dairy farms supplied over 50% of its raw milk needs, a testament to its integrated model.

The company has heavily invested in digital and intelligent upgrades across its operations. This includes fully automated and aseptic production lines, which minimize human intervention and potential contamination. By the end of 2024, Feihe aims to have 100% of its key production facilities operating with advanced automation systems, ensuring product safety and consistent quality.

Feihe's commitment to R&D in nutritional science is a significant technological driver, focusing on understanding the unique needs of Chinese infants and their nutritional requirements. This dedication has positioned them as an industry leader in creating specialized infant formulas and advanced manufacturing processes.

The company's innovation pipeline includes groundbreaking products such as customized brain nutrition solutions for infants, reflecting a deep dive into specific developmental needs. Furthermore, Feihe is strategically expanding its functional nutrition offerings to cater to consumers across their entire life stages, not just infancy.

Feihe leverages advanced food safety technologies, including rapid pathogen detection and real-time supply chain monitoring, to ensure product integrity. This commitment is crucial for meeting China's increasingly stringent food safety regulations, which have seen significant updates in recent years to bolster consumer confidence.

The company emphasizes its comprehensive milk quality inspection, which involves multiple checkpoints from farm to finished product. This rigorous approach has contributed to Feihe's sustained reputation for a strong safety record, a key differentiator in the competitive infant formula market.

Data Analytics and Consumer Insights

Feihe's ability to harness data analytics is paramount for staying ahead in understanding shifting consumer desires and emerging market patterns. This data-driven approach directly fuels product innovation and enables more precise marketing campaigns. For instance, Feihe can analyze sales data and social media sentiment to pinpoint demand for novel ingredients or product ideas, such as infant formulas fortified with Human Milk Oligosaccharides (HMOs).

In 2024, the global market for infant formula was valued at approximately $57.1 billion, with a projected compound annual growth rate (CAGR) of 5.2% through 2030. Within this, the segment for specialized formulas, including those with added prebiotics and probiotics like HMOs, is experiencing even faster growth. Feihe's strategic use of analytics can identify specific regional preferences for these advanced formulations, allowing for tailored product development and more effective market penetration.

- Data-driven insights enable Feihe to anticipate demand for specialized infant nutrition products, such as HMO-enhanced formulas.

- The global infant formula market reached an estimated $57.1 billion in 2024, with a significant growth trajectory.

- Analyzing consumer data allows for targeted marketing, optimizing promotional efforts for new and existing product lines.

- Early identification of trends through analytics can provide a competitive advantage in product development and market positioning.

E-commerce and Digital Sales Platforms

Technological advancements are revolutionizing how Feihe reaches its customers. E-commerce platforms, particularly in China, are crucial for direct-to-consumer sales, expanding market reach significantly. For instance, Tmall and JD.com remain dominant, with Tmall Global reporting a 30% year-over-year growth in GMV for Q1 2024, showcasing the ongoing digital shift. Feihe must continually refine its strategy on these comprehensive platforms.

The burgeoning trend of content e-commerce, where product discovery and purchasing are integrated within engaging content like live streams and short videos, presents both an opportunity and a challenge. By the end of 2024, it's projected that live-streaming e-commerce sales in China could exceed $300 billion, a substantial increase from previous years. Feihe's ability to adapt and leverage these dynamic sales channels will be key to its continued success.

- E-commerce Growth: China's e-commerce market is expected to grow by 10% in 2024, reaching over $3.5 trillion.

- Live-Streaming Impact: Over 60% of Chinese consumers reported making purchases after watching live streams in 2023.

- Platform Optimization: Feihe's investment in user experience and data analytics on platforms like Douyin (TikTok China) and Kuaishou is essential for capturing this audience.

- Digital Marketing: Increased spending on digital advertising by competitors highlights the need for Feihe to innovate its online marketing strategies.

Feihe's technological edge is amplified by its deep investment in R&D, focusing on advanced nutritional science tailored for Chinese infants. This includes developing specialized formulas, such as those incorporating Human Milk Oligosaccharides (HMOs), to meet specific developmental needs. By 2025, Feihe plans to allocate over 5% of its revenue to R&D, aiming to solidify its leadership in innovative infant nutrition solutions.

Legal factors

China's National Food Safety Standards, known as GB Standards, are rigorous and apply to all infant formula and dairy products, including those imported. These standards are not suggestions; they are mandatory requirements covering everything from the quality of raw ingredients to the precise nutritional content and even the clarity of product labeling. For a company like Feihe, this means constant vigilance and investment to ensure every product batch meets these exacting specifications, including regular re-certification processes.

New regulations, especially for Foods for Special Medical Purposes (FSMP) infant formula, require each product to be registered individually and have specific labeling. This means companies like Feihe need to carefully manage these detailed filings and update their packaging to gain market access. For instance, China's stringent FSMP regulations, implemented in recent years, demand extensive scientific substantiation and detailed ingredient disclosure on labels, impacting product development timelines and costs.

Feihe, as a dominant player in China's infant formula market, must navigate the nation's increasingly stringent anti-monopoly and fair competition laws. These regulations, enforced by bodies like the State Administration for Market Regulation (SAMR), are designed to prevent market abuse and foster a competitive environment. For instance, in 2023, SAMR continued its focus on various sectors, including e-commerce and digital platforms, signaling an ongoing commitment to fair play that extends to consumer goods industries like dairy.

Any strategic move by Feihe, whether it involves pricing, distribution agreements, or potential mergers and acquisitions, is scrutinized under this legal umbrella. Failure to comply can result in significant fines, as seen in other industries where companies have faced penalties for monopolistic practices. For example, in 2021, several tech companies were fined substantial amounts for anti-competitive behavior, setting a precedent for rigorous enforcement across the Chinese economy.

The evolving legal landscape in China means Feihe must maintain proactive compliance. This includes ensuring its market share does not stifle innovation or unfairly disadvantage smaller competitors. The company's commitment to transparency and adherence to these laws is crucial for sustained growth and maintaining consumer trust, especially given the sensitive nature of the infant nutrition sector.

Advertising and Marketing Regulations

Advertising and marketing regulations in China for infant formula are particularly stringent, often prioritizing the promotion of breastfeeding over direct public advertising of formula products. Feihe, as a major player, must navigate these rules carefully, ensuring all marketing efforts adhere to guidelines that restrict direct consumer promotion and emphasize appropriate channels and messaging. This focus on compliance is critical for maintaining market access and brand reputation.

For instance, China's Food Safety Law and related regulations impose limitations on how infant formula can be advertised. Feihe's marketing strategies need to be mindful of these restrictions, which can include prohibitions on claims that might discourage breastfeeding or imply superiority over breast milk. The company's 2024 marketing expenditures will undoubtedly reflect the need to operate within these carefully defined parameters.

Feihe's approach to marketing must therefore be strategic and compliant, potentially focusing on:

- Educating healthcare professionals: Engaging with pediatricians and nutritionists to provide accurate information about Feihe products for situations where breastfeeding is not possible or sufficient.

- Digital content and platforms: Utilizing online channels that are permitted for information dissemination, rather than overt advertising, to reach parents.

- Product quality and safety messaging: Highlighting the company's commitment to quality and safety standards, which are always permissible and important for consumer trust.

Labor Laws and Employee Welfare

Feihe's operations in China necessitate strict adherence to the nation's labor laws, covering employee rights, fair wages, and safe working conditions. For instance, China's Labor Contract Law and its subsequent amendments set clear guidelines for employment agreements, working hours, and social insurance contributions, all of which Feihe must navigate. Failure to comply can lead to significant penalties and reputational damage.

The company's proactive approach to employee welfare, such as its program to financially support employees with children, aligns with broader trends in corporate social responsibility and can be seen as a forward-thinking interpretation of labor welfare policies. This initiative, launched in recent years, reflects a growing expectation for companies to contribute positively to their employees' lives beyond basic statutory requirements. This focus on employee well-being can enhance talent retention and attract skilled workers.

- Compliance with China's Labor Contract Law: Ensuring all employment practices meet legal standards for contracts, wages, and working hours.

- Employee Welfare Initiatives: Programs like financial support for employees with children demonstrate a commitment to social responsibility and talent retention.

- Impact of Labor Regulations: Adherence to evolving labor laws is critical for operational stability and avoiding legal repercussions.

Feihe must meticulously adhere to China's stringent food safety regulations, including the GB Standards, which dictate everything from raw ingredient quality to precise nutritional content and labeling clarity. These mandates require continuous investment in compliance and regular re-certification to ensure products meet exacting specifications.

The registration and specific labeling requirements for Foods for Special Medical Purposes (FSMP) infant formula, a recent regulatory focus, necessitate careful management of detailed filings and packaging updates for market access. This includes providing extensive scientific substantiation and detailed ingredient disclosures, impacting development timelines and costs for companies like Feihe.

Navigating China's anti-monopoly and fair competition laws, enforced by bodies like SAMR, is crucial for Feihe's dominant market position. These regulations aim to prevent market abuse and foster a competitive environment, with SAMR continuing its focus on various sectors, including consumer goods, in 2023 and 2024.

Feihe's marketing strategies must comply with strict regulations that often prioritize breastfeeding promotion over direct infant formula advertising. This means focusing on channels and messaging that adhere to guidelines, potentially emphasizing education for healthcare professionals and compliant digital content rather than overt public promotion.

Environmental factors

Feihe's commitment to sustainable pasture management is a key environmental consideration. By optimizing feed, waste, and water usage in their vertically integrated model, they aim to reduce the environmental footprint of raw milk production. For instance, in 2023, Feihe reported a 15% reduction in water consumption across their dairy farms through advanced irrigation techniques.

The dairy sector, including companies like Feihe, faces environmental challenges related to waste generation, such as manure and wastewater. Feihe's engagement in international sustainability forums and their presentation of novel circular economy strategies for cold-region livestock farming highlight a commitment to tackling these issues and improving resource utilization.

Feihe is actively addressing climate change by focusing on reducing its carbon footprint across its entire value chain. This includes efforts to lower greenhouse gas emissions from agricultural sourcing to manufacturing processes.

The company's commitment to investing in sustainability projects and optimizing production methods demonstrates a strategic alignment with global environmental mandates. For instance, by 2024, many dairy producers are aiming for a 15% reduction in methane emissions from their herds.

Feihe's proactive approach to environmental stewardship is crucial as consumers and regulators increasingly demand accountability for climate impact. This focus is essential for long-term operational resilience and market competitiveness in the evolving dairy industry.

Water Resource Management

Water is absolutely vital for dairy operations, from raising cows to processing milk. Feihe's commitment to efficient water use, treating wastewater, and ensuring responsible discharge is a significant environmental focus, particularly in areas experiencing water shortages or facing tighter environmental rules.

In 2023, China's agricultural sector, which includes dairy farming, faced increasing pressure to improve water efficiency. For instance, the Ministry of Water Resources has been pushing for stricter water conservation measures across all industries. Feihe, like other major players, needs to invest in advanced water recycling technologies. A report from the China Dairy Association in early 2024 highlighted that leading dairy companies are aiming to reduce their water footprint by 15-20% by 2025 through improved irrigation and processing techniques.

- Water Scarcity: Many of Feihe's operational regions in China are in areas prone to water stress, requiring careful management.

- Regulatory Compliance: Evolving environmental regulations on water discharge quality necessitate continuous investment in wastewater treatment facilities.

- Operational Efficiency: Implementing water-saving technologies in feed production and milking processes directly impacts operational costs and sustainability.

- Reputational Risk: Poor water management can lead to negative public perception and regulatory penalties, impacting brand image.

Compliance with Environmental Regulations

Feihe, like all companies operating in China, must navigate an increasingly stringent environmental regulatory landscape. This includes adhering to laws concerning air and water pollution, waste management, and carbon emissions. For instance, China's Ministry of Ecology and Environment has been actively enforcing stricter standards, with significant penalties for non-compliance.

Failure to meet these environmental obligations can result in substantial fines, temporary or permanent closure of facilities, and severe damage to Feihe's brand reputation. This was highlighted in 2023 when several companies faced hefty penalties for exceeding emission limits, demonstrating the government's commitment to environmental enforcement.

- Stricter Emission Standards: China's updated air quality standards, implemented progressively, require significant investment in pollution control technologies for manufacturing.

- Waste Management Protocols: New regulations on solid and hazardous waste disposal necessitate advanced treatment and disposal methods, impacting operational costs.

- Carbon Neutrality Goals: The national commitment to carbon peaking by 2030 and carbon neutrality by 2060 will likely lead to further regulations impacting energy consumption and industrial processes.

- Water Resource Protection: Enhanced regulations on industrial wastewater discharge require more sophisticated treatment systems to prevent water pollution.

Feihe's environmental strategy is deeply intertwined with resource management, particularly water. In 2023, the company reported a 15% reduction in water consumption across its dairy farms by implementing advanced irrigation techniques, aligning with China's push for agricultural water efficiency. This focus is critical given that many of Feihe's operational regions face water stress, and stricter regulations on wastewater discharge, as seen in China's Ministry of Water Resources initiatives, demand continuous investment in treatment facilities.

| Environmental Factor | Impact on Feihe | Key Initiatives/Data (2023-2025) |

|---|---|---|

| Water Scarcity & Management | Operational risk in water-stressed regions; increased costs for compliance. | 15% water consumption reduction (2023) via advanced irrigation. Investment in wastewater treatment to meet stricter discharge standards. |

| Climate Change & Emissions | Regulatory pressure for carbon footprint reduction; potential for increased operational costs. | Focus on reducing greenhouse gas emissions across the value chain. Alignment with national carbon neutrality goals (by 2060). |

| Waste Management | Need for advanced treatment and disposal methods; impact on operational costs. | Development of circular economy strategies for livestock farming. Adherence to evolving waste management protocols. |

| Regulatory Compliance | Risk of fines, facility closure, and reputational damage for non-compliance. | Adherence to stringent air and water pollution, waste management, and carbon emission laws. Significant penalties for exceeding emission limits observed in 2023. |

PESTLE Analysis Data Sources

Our Feihe PESTLE analysis is built on a robust foundation of data from reputable sources, including government reports, international economic organizations, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.