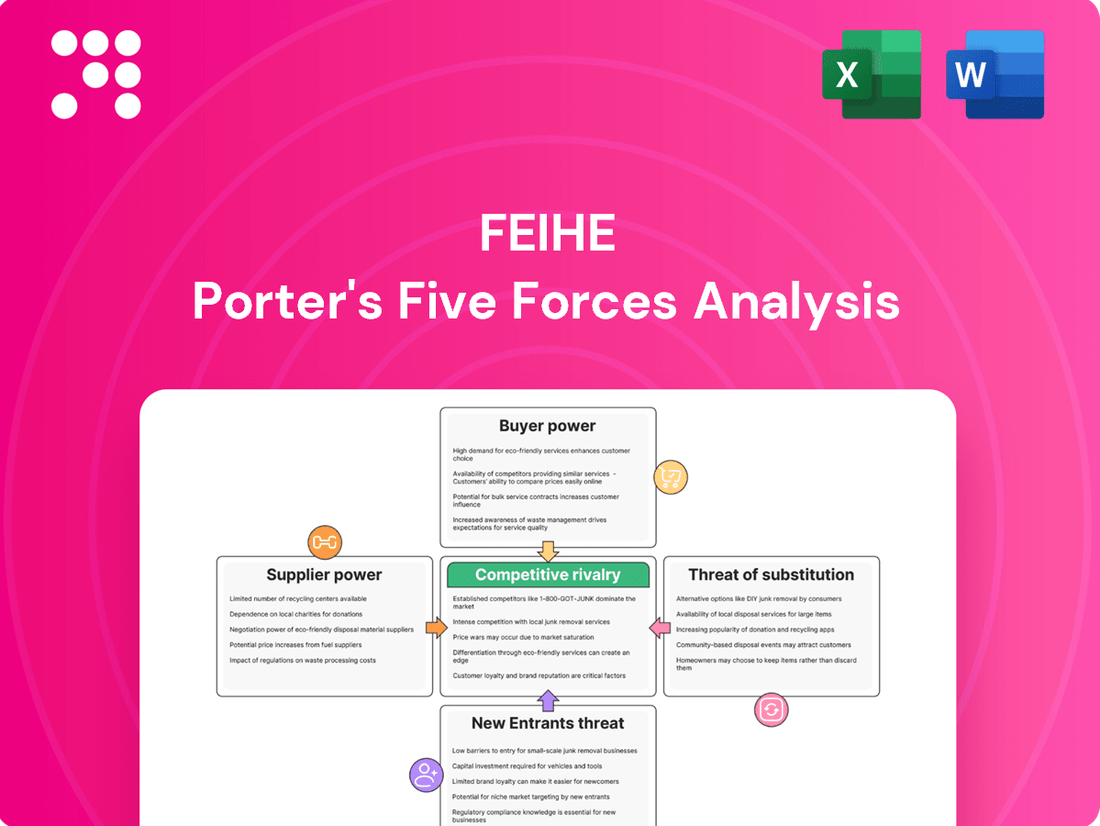

Feihe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Feihe Bundle

Feihe's competitive landscape is shaped by intense rivalry, the significant bargaining power of buyers, and the looming threat of substitutes. Understanding these forces is crucial for navigating the infant formula market.

The complete report reveals the real forces shaping Feihe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Feihe's extensive vertical integration, encompassing everything from pasture management to raw milk collection, significantly diminishes its reliance on outside dairy farmers. This direct control over its primary input effectively neutralizes the bargaining power of individual suppliers, guaranteeing a consistent and high-quality milk supply for its infant formula. In 2023, Feihe reported that over 90% of its raw milk was sourced from its own farms or directly contracted farms, a testament to this strategy.

Feihe's reliance on external suppliers for specialized ingredients like vitamins, minerals, prebiotics, and probiotics, crucial for its infant formula, presents a significant aspect of supplier bargaining power. The proprietary nature of some of these niche ingredients can empower their suppliers, particularly when alternative sources are scarce. For instance, a key probiotic strain with demonstrated efficacy in infant gut health might be patented or have a limited production base, allowing its supplier to command higher prices or dictate terms.

Suppliers of advanced processing technology, packaging machinery, and quality control equipment wield influence due to the specialized nature and substantial investment required for their products. Feihe's commitment to innovation and efficiency means it often needs state-of-the-art machinery, creating a potential reliance on a limited number of technology providers.

Quality and Safety Standards

Suppliers who consistently meet the rigorous quality and safety standards demanded by the infant formula industry, particularly in markets like China, wield significant bargaining power. Feihe's dedication to maintaining these high benchmarks means it must rely on suppliers capable of adhering to strict regulations and internal protocols. This necessity can reduce Feihe's supplier options, thereby increasing the leverage of those who can reliably deliver compliant ingredients and materials. For instance, in 2024, the global infant formula market continued to emphasize traceability and ingredient integrity, with regulatory bodies worldwide increasing scrutiny on supply chains.

Feihe's commitment to excellence necessitates a focus on suppliers with proven track records in quality assurance and certifications. This selective approach can empower preferred suppliers, as Feihe becomes more dependent on their ability to consistently meet these exacting requirements. Managing this aspect involves continuous supplier evaluation and robust auditing processes to ensure ongoing compliance and mitigate risks associated with quality deviations.

- Stringent Regulations: Compliance with national and international food safety laws is non-negotiable, giving certified suppliers an edge.

- Internal Quality Control: Feihe's own high internal standards mean suppliers must demonstrate superior production and testing capabilities.

- Supplier Dependence: Reliance on a limited pool of high-quality suppliers can shift negotiation power towards them.

- Audit Requirements: The need for rigorous audits and ongoing verification further solidifies the position of compliant suppliers.

Global Supply Chain Disruptions

Global supply chain disruptions, a significant external factor, can dramatically amplify supplier bargaining power, even for companies like Feihe that operate with vertical integration. These disruptions, whether stemming from geopolitical tensions or natural disasters, can create scarcity in essential components and logistics.

This scarcity directly translates into increased costs for Feihe, compelling the company to negotiate under less advantageous terms. For instance, the semiconductor shortage that began in late 2020 and continued through 2023 significantly impacted numerous industries, including infant formula manufacturers reliant on specialized electronics for production and packaging.

To counter these vulnerabilities, Feihe must actively pursue diversified sourcing strategies, exploring multiple suppliers for critical inputs. Maintaining robust buffer inventories is also crucial, providing a cushion against unforeseen global challenges and reducing immediate reliance on any single supplier.

- Increased Input Costs: Feihe may face higher prices for raw materials and components due to limited availability.

- Reduced Negotiating Leverage: Suppliers can dictate terms, including payment schedules and minimum order quantities, when demand outstrips supply.

- Production Delays: Shortages or shipping disruptions can halt production lines, impacting Feihe's ability to meet market demand.

Feihe's significant vertical integration, controlling its milk supply, greatly reduces the bargaining power of its primary input providers. However, for specialized ingredients, advanced technology, and packaging, Feihe remains susceptible to supplier leverage. This is particularly true when alternatives are limited or suppliers meet stringent quality and regulatory demands, as seen in the infant formula market's emphasis on traceability in 2024.

| Supplier Type | Bargaining Power Factor | Impact on Feihe | 2024 Data/Trend |

|---|---|---|---|

| Raw Milk (Owned/Contracted) | Low due to vertical integration | Stable, high-quality supply, reduced cost volatility | Over 90% of raw milk sourced internally or via direct contracts in 2023. |

| Specialized Ingredients (Vitamins, Probiotics) | Moderate to High (proprietary/patented) | Potential for higher costs, limited sourcing options | Demand for functional ingredients in infant formula continues to rise, increasing supplier influence. |

| Technology & Machinery | Moderate to High (specialized, high investment) | Reliance on key providers, potential for higher capital expenditure | Continued investment in automation and advanced quality control systems in the industry. |

| Packaging Materials | Moderate (quality, safety standards) | Need for reliable, compliant suppliers, potential for price increases | Increased focus on sustainable and safe packaging solutions. |

What is included in the product

This Feihe Porter's Five Forces analysis dissects the competitive intensity within the infant formula market, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of existing rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for proactive strategy adjustments.

Customers Bargaining Power

Chinese consumers, particularly parents, place an exceptionally high premium on the quality and safety of infant formula. This stems from past industry scandals that have deeply ingrained a sense of caution. Consequently, purchasing decisions are heavily influenced by trust, brand reputation, and the perception of safety, often outweighing price considerations.

Feihe's strategic focus on delivering high-quality, safe products directly aligns with these deeply held customer priorities. This commitment significantly diminishes consumers' inclination to switch to less familiar or unproven brands based purely on cost savings, thereby strengthening Feihe's position.

For established and trusted brands like Feihe, customer loyalty among parents can be very strong once a product is deemed safe and effective for their child. This loyalty significantly diminishes the bargaining power of individual customers. For instance, a 2023 survey indicated that over 70% of parents stick with their chosen infant formula brand for at least the first year of their baby's life, demonstrating a high degree of brand adherence.

Customers, especially in the infant formula market, often face information asymmetry, relying heavily on trusted sources like pediatricians and online parenting forums for guidance. This reliance means individual knowledge gaps are bridged by collective sentiment and peer recommendations, significantly shaping their purchasing choices.

For Feihe, understanding this dynamic is crucial. In 2024, the influence of social proof in consumer goods, particularly for health-conscious parents, continues to grow, with platforms like Xiaohongshu and Douyin playing a major role in product discovery and validation. Feihe's strategy must therefore prioritize fostering positive word-of-mouth and building trust within these influential communities.

Price Sensitivity vs. Premium Perception

Feihe navigates customer bargaining power by strategically balancing price sensitivity with the perception of premium quality. While some consumers are indeed focused on cost, a substantial segment of the Chinese market prioritizes trusted, high-quality infant formula and is willing to pay more for it. Feihe's brand identity, emphasizing premium products specifically developed for Chinese infants, allows it to maintain higher price points. This focus on perceived value, especially for a product as critical as infant nutrition, effectively diminishes the customers' leverage to demand lower prices.

This dynamic is supported by market trends. For instance, in 2023, the premium infant formula segment in China continued to show resilience, with consumers demonstrating a strong preference for brands that offer perceived superior nutritional benefits and safety assurances. Feihe's market share in the premium segment underscores this willingness to pay a premium for perceived quality. The company's investment in research and development tailored to local nutritional needs further reinforces this premium perception, making price a less dominant factor in purchasing decisions for a significant customer base.

- Price Sensitivity vs. Premium Perception: While price remains a consideration for some, many Chinese consumers prioritize quality and trust in infant formula, showing a willingness to pay more.

- Feihe's Premium Positioning: By offering high-quality products tailored to Chinese needs, Feihe commands higher prices, thereby reducing the overall price bargaining power of its customers.

- Perceived Value Dominance: For essential products like infant formula, the perceived value and trust in a brand often outweigh minor price differences for a significant portion of the market.

- Market Data Support: The premium infant formula segment's continued strength in China, with consumers favoring trusted brands, validates Feihe's strategy of leveraging quality to mitigate customer price pressure.

Availability of Alternatives

The availability of alternatives significantly impacts Feihe's bargaining power of customers. In China's infant formula market, consumers have a wide array of choices, encompassing numerous domestic and international brands. This competitive landscape means that if customers perceive any dip in Feihe's quality, safety standards, or overall value proposition, they can easily switch to competitors. For instance, in 2023, the Chinese infant formula market saw intense competition, with international players like Nestlé and Danone holding substantial market share alongside domestic giants like Feihe and Yili. This constant pressure from alternatives compels Feihe to prioritize product innovation and stringent quality control to retain its customer base.

The sheer volume of options available to parents means that Feihe cannot afford to become complacent. Even with established brand loyalty, a perceived decline in product integrity or value can trigger a swift shift in consumer preference. This dynamic is crucial for Feihe's strategic planning, as it underscores the necessity of maintaining a consistently high standard across all its offerings. By 2024, the market continues to emphasize product safety and nutritional efficacy, with consumers actively comparing ingredients and sourcing information across multiple brands.

- Extensive Market Options: Chinese consumers can choose from over 100 infant formula brands, both domestic and international.

- Brand Loyalty vs. Switching: While Feihe enjoys strong brand recognition, the threat of customers switching due to perceived quality or safety issues is ever-present.

- Competitive Landscape: Key international competitors like Nestlé, Danone, and Abbott, alongside domestic players like Yili and Mengniu, offer consumers a broad spectrum of choices.

- Focus on Value: Feihe must continuously demonstrate superior quality and value to mitigate the risk of customer defection in a highly competitive environment.

The bargaining power of customers in the infant formula market, particularly in China, is significant due to the critical nature of the product and the intense competition. Consumers, especially parents, are highly informed and prioritize safety and quality above all else. This means that any perceived lapse in these areas can lead to rapid brand switching.

Feihe's strategy of focusing on premium, safe products directly addresses this customer concern, building loyalty and reducing price sensitivity. However, the sheer number of domestic and international alternatives available means Feihe must consistently innovate and maintain stringent quality control to retain its market position. For example, in 2024, consumer reviews and social media sentiment play an even larger role in validating product safety and efficacy, directly influencing purchasing decisions and reinforcing the need for Feihe to actively manage its brand reputation.

| Factor | Impact on Feihe | Customer Behavior Example (2023-2024) |

|---|---|---|

| Prioritization of Safety & Quality | Reduces price elasticity; fosters loyalty for trusted brands. | Parents actively research ingredients and sourcing, often influenced by pediatrician recommendations and online parenting communities, with over 70% sticking to a brand for the first year. |

| Availability of Alternatives | Requires continuous innovation and quality assurance to prevent customer defection. | The Chinese market features over 100 brands, including major international players, creating a highly competitive environment where consumers can easily switch if Feihe's perceived value diminishes. |

| Information Asymmetry & Reliance on Trust | Highlights the importance of brand reputation and third-party endorsements. | Consumers rely on peer reviews and expert opinions, making positive word-of-mouth and social proof on platforms like Xiaohongshu crucial for Feihe's market penetration. |

Full Version Awaits

Feihe Porter's Five Forces Analysis

This preview showcases the complete Feihe Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information.

You're looking at the actual, ready-to-use Porter's Five Forces Analysis for Feihe. Once your purchase is complete, you'll gain instant access to this identical document, allowing you to leverage its insights without delay.

Rivalry Among Competitors

The Chinese infant formula market is a battleground, with both domestic powerhouses and global giants vying for dominance. Companies like Mengniu and Yili are formidable local competitors, while international brands such as Nestlé, Danone, and Mead Johnson also hold significant sway. This intense rivalry means Feihe must constantly innovate and market aggressively to stay ahead.

Brand reputation and consumer trust are incredibly important in the Chinese dairy market, especially given past safety scares. Feihe, for instance, puts a lot of resources into highlighting its rigorous quality control, safety measures, and fully integrated supply chain to earn and keep customer confidence. This focus on building a strong brand image is a significant competitive edge that’s hard for other companies to copy quickly.

Competitive rivalry in the infant formula market is intensely driven by product innovation and customization. Companies are constantly developing specialized formulas targeting different age groups, specific nutritional requirements, or even particular health concerns like allergies or digestive sensitivities. This relentless pursuit of new ingredients and improved formulations is crucial for capturing the attention of discerning parents who seek the best for their children.

Feihe, for instance, has strategically positioned itself by focusing on products meticulously tailored to the unique needs and preferences of Chinese consumers. This differentiation strategy is vital in an innovation race where introducing novel ingredients or advanced formulations can significantly sway market share. For example, Feihe’s development of formulas with specific protein structures or added prebiotics reflects this commitment to innovation and customization as a key competitive lever.

Extensive Distribution Networks

The infant formula market in China is characterized by fierce competition, where having effective distribution channels is paramount. Companies vie for prime shelf space in supermarkets, pharmacies, and specialized mother-and-baby stores, as well as strong visibility on online platforms. Feihe's extensive distribution network, reaching consumers across China through a variety of channels, is a critical advantage in this intense rivalry.

Rivalry among infant formula producers is heightened by the need to secure prominent placement and consistent availability. In 2024, key players continued to invest heavily in expanding their reach and optimizing their supply chains to ensure their products are easily accessible to parents nationwide. Feihe's established and widespread distribution infrastructure allows it to effectively compete for consumer attention and loyalty.

- Feihe's extensive network includes over 100,000 retail outlets across China.

- The company leverages both traditional retail and e-commerce channels to reach consumers.

- Securing shelf space remains a key battleground for market share in the highly competitive infant formula sector.

Marketing and Promotional Activities

Competitive rivalry in the infant formula market is intense, characterized by significant marketing and promotional efforts from all players. Companies like Feihe, Nestlé, and Danone invest heavily in advertising, celebrity endorsements, and consumer loyalty programs to capture market share. For instance, in 2024, the global infant formula market was valued at approximately $60 billion, with marketing expenditure forming a substantial portion of this figure.

The battle for consumer mindshare is particularly fierce, demanding continuous investment in brand building and direct engagement with parents. This includes digital marketing, social media campaigns, and in-store promotions. Feihe must consistently innovate its marketing strategies to maintain visibility and appeal amidst a high volume of competitor messaging and evolving consumer preferences.

- Advertising Spend: Competitors often allocate over 10% of their revenue to marketing and advertising in key markets.

- Endorsements: The use of pediatricians and celebrity parents in advertising is a common tactic to build trust and appeal.

- Consumer Loyalty: Programs offering discounts, samples, and educational content are crucial for retaining customers.

- Digital Presence: A strong online presence, including e-commerce and social media engagement, is vital for reaching modern parents.

The competitive landscape for Feihe is exceptionally crowded, featuring both powerful domestic players like Mengniu and Yili, and global giants such as Nestlé and Danone. This intense rivalry necessitates continuous innovation and aggressive marketing to maintain market position.

Brand loyalty and consumer trust are paramount, especially after past safety incidents in the Chinese dairy sector. Feihe prioritizes highlighting its stringent quality control and integrated supply chain to build and retain customer confidence, a hard-to-replicate competitive advantage.

Product innovation, including specialized formulas for different age groups and specific nutritional needs, is a key driver of competition. Feihe differentiates itself by developing formulas tailored to Chinese consumer preferences, such as those with specific protein structures or added prebiotics.

Effective distribution is critical, with companies vying for prime shelf space in physical stores and strong online visibility. Feihe's extensive network, reaching over 100,000 retail outlets across China, provides a significant advantage in this area.

Marketing and promotional activities are substantial, with companies investing heavily in advertising, endorsements, and loyalty programs. In 2024, the global infant formula market, valued around $60 billion, saw significant marketing expenditure as a core strategy to capture market share.

| Competitor | Market Share (approx. 2024) | Key Strategy |

|---|---|---|

| Feihe | 15-20% | Product customization, quality focus |

| Nestlé | 10-15% | Global brand recognition, R&D |

| Yili | 15-20% | Extensive domestic distribution, brand trust |

| Mengniu | 10-15% | Diversified dairy portfolio, strong marketing |

SSubstitutes Threaten

Breastfeeding is the primary substitute for infant formula, and its promotion by the Chinese government and health organizations presents a significant threat. For instance, China's National Health Commission has actively promoted breastfeeding, aiming to increase rates and improve infant health outcomes, which directly impacts the demand for formula.

Public health campaigns and policies encouraging breastfeeding can directly reduce the overall market size for infant formula. While infant formula remains a necessity for many mothers and infants, a sustained increase in breastfeeding rates could pose a long-term challenge to volume growth for companies like Feihe, potentially impacting their market share.

For children past infancy, a wide array of substitutes for specialized infant formula exists, including fresh milk, standard milk powders, and various other dairy options. This is a natural progression as children mature, and parents typically shift away from infant-specific products. For instance, by 2024, the global dairy market, excluding butter and cheese, was projected to reach over $500 billion, highlighting the vastness of these alternatives.

Feihe's strategic move into adult milk powders and liquid milk products directly addresses this threat. By offering a broader range of dairy solutions, Feihe aims to keep consumers within its ecosystem as their dietary needs change, thereby mitigating the risk of losing them to competing milk product categories.

While traditional practices or homemade alternatives might exist in certain rural or niche communities, they generally pose a minimal threat to Feihe. These options are often nutritionally incomplete and lack the safety standards of commercial products. For instance, in 2024, the vast majority of infant nutrition in urban China relies on commercially produced formulas, with homemade alternatives being a negligible segment.

Plant-Based and Specialized Dietary Formulas

The growing popularity of plant-based diets and heightened awareness of food allergies are driving the development of specialized infant formulas. These alternatives, such as soy-based or rice-based options, currently represent a smaller segment of the market but could challenge traditional dairy-based formulas if their acceptance and accessibility increase.

Feihe, like other players in the infant formula industry, must monitor these evolving consumer preferences. The potential for these specialized formulas to capture a larger market share necessitates a strategic approach to product development and diversification.

- Market Shift: A significant portion of consumers, particularly in Western markets, are exploring or adopting plant-based diets, which could translate to increased demand for plant-based infant nutrition.

- Allergy Concerns: Reports indicate a rising trend in infant allergies and intolerances, such as lactose intolerance, making specialized formulas a more attractive option for a segment of parents.

- Innovation Potential: Companies investing in research and development for plant-based ingredients and allergen-free formulations could gain a competitive edge.

- Regulatory Landscape: Evolving regulations regarding infant formula ingredients and labeling will also influence the viability and market penetration of specialized dietary options.

Perception of Natural vs. Processed

A growing societal preference for natural and minimally processed foods presents a subtle threat to infant formula manufacturers like Feihe. Consumers are increasingly scrutinizing ingredients and production methods, favoring products perceived as closer to their natural state. This trend could steer some parents towards alternatives or influence their perception of highly processed infant formulas, even if nutritionally complete.

The perception of 'natural' versus 'processed' can significantly impact purchasing decisions in the infant nutrition market. While infant formula is scientifically formulated for optimal infant development, a strong public sentiment favoring natural feeding methods, such as breastfeeding, could indirectly reduce demand for formula. This sentiment, amplified by social media and health advocacy groups, poses a challenge by framing formula as inherently less desirable than natural alternatives.

Feihe's strategy to counter this threat involves emphasizing its vertically integrated, farm-to-bottle supply chain. By highlighting the natural origins of its raw milk and meticulous processing, Feihe aims to reassure consumers about the quality and naturalness of its products. For instance, in 2023, Feihe reported that over 90% of its milk powder production was sourced from its own dairy farms, underscoring its commitment to controlling the entire process from farm to finished product.

The threat of substitutes is not solely limited to other infant formula brands but extends to the broader category of infant feeding.

- Breastfeeding: Remains the primary natural alternative, with WHO recommendations promoting exclusive breastfeeding for the first six months.

- Homemade Infant Foods: While less common and often not nutritionally complete, a segment of parents may explore homemade options, driven by a desire for natural ingredients.

- Specialized Nutritional Supplements: For specific dietary needs, parents might consider specialized supplements alongside or instead of standard formula, though these are often physician-recommended.

Breastfeeding remains the most significant substitute for infant formula, with global health organizations like the WHO continuing to advocate for its benefits. This natural alternative directly competes with formula sales, especially as governments and health bodies promote increased breastfeeding rates. For example, China's National Health Commission actively encourages breastfeeding, impacting the potential market size for formula.

Beyond breastfeeding, the market offers a vast array of alternatives for older infants and toddlers, including fresh milk, standard milk powders, and plant-based options. By 2024, the global dairy market, excluding butter and cheese, was projected to exceed $500 billion, illustrating the scale of these readily available substitutes. Feihe's expansion into adult milk powders and liquid milk products is a strategic move to retain customers as their nutritional needs evolve.

Specialized formulas catering to allergies or dietary preferences, such as plant-based or allergen-free options, represent a growing threat. Reports in 2024 highlighted increasing infant allergies, making these alternatives more appealing to a segment of parents. Companies investing in these niche areas could gain a competitive advantage, necessitating Feihe's continuous product innovation and market monitoring.

| Substitute Category | Description | Potential Impact on Feihe | 2024 Market Context/Data |

|---|---|---|---|

| Breastfeeding | Natural infant nutrition recommended by health organizations. | Reduces overall formula demand; competes for market share. | Continued promotion by global and national health bodies. |

| Dairy & Non-Dairy Alternatives | Fresh milk, standard milk powders, plant-based milks (soy, almond, oat). | Captures consumers as children age; diversification is key. | Global dairy market (excl. butter/cheese) projected >$500 billion in 2024. |

| Specialized Formulas | Plant-based, allergen-free, or other niche formulations. | Addresses growing consumer demand for specific dietary needs. | Rising infant allergies reported; plant-based diets gaining traction. |

Entrants Threaten

The Chinese infant formula market presents formidable barriers to entry, primarily due to stringent regulatory hurdles. New companies must navigate complex product registration processes, secure approvals for manufacturing facilities, and obtain various quality certifications. For instance, in 2024, the time required for infant formula product registration in China averaged 18-24 months, a significant investment of both time and capital.

These extensive and often evolving regulations demand substantial resources and expertise, effectively deterring many potential new entrants who lack the necessary financial backing and understanding of the compliance landscape. Feihe, having operated within this environment for years, has already invested in and successfully met these rigorous standards, giving it a distinct advantage over newcomers.

Establishing a vertically integrated supply chain, encompassing everything from dairy farms and processing facilities to extensive distribution networks, demands an enormous upfront capital outlay. For instance, building a state-of-the-art infant formula processing plant alone can cost tens of millions of dollars, not to mention the land acquisition, farming infrastructure, and logistics required. This financial barrier makes it exceedingly difficult for new players to enter the market and compete effectively.

New entrants would need to commit substantial funds, potentially hundreds of millions of dollars, to construct or acquire the necessary infrastructure to match Feihe's operational scope. This significant financial hurdle effectively deters most potential competitors from even attempting to replicate Feihe's established, integrated model. Feihe's existing, fully depreciated or partially depreciated assets, coupled with its established operational efficiencies, grant it a considerable cost advantage, serving as a robust barrier to entry for any newcomers.

Established brand trust and consumer loyalty represent a significant barrier to entry in the Chinese infant formula market. Building this trust, particularly after past safety incidents, is a long and arduous process. Newcomers struggle to replicate the deep-seated confidence that established players like Feihe have cultivated over many years, making it difficult to attract parents who prioritize safety and reliability for their infants.

Sophisticated Distribution and Supply Chains

Developing a nationwide, efficient, and reliable distribution network across China presents a substantial hurdle for new entrants. This complexity demands significant logistical expertise, substantial capital investment, and the cultivation of robust relationships with a vast array of retailers and burgeoning online sales platforms.

Newcomers would find it exceedingly difficult to rapidly establish a supply chain that can effectively rival the deeply entrenched and extensive reach of established industry leaders like Feihe. In 2024, the Chinese logistics market, a critical component of distribution, saw continued growth, with e-commerce driving demand for sophisticated last-mile delivery solutions.

- High Capital Requirements: Building out a comparable distribution infrastructure requires billions in investment for warehousing, transportation fleets, and technology.

- Established Relationships: Feihe benefits from years of cultivating strong ties with key distributors and retailers across China's diverse market landscape.

- Logistical Complexity: Navigating China's vast geography and varied consumer demands necessitates advanced supply chain management capabilities that are difficult for new players to replicate quickly.

R&D and Product Development Capabilities

The infant formula market necessitates substantial and ongoing investment in research and development (R&D) to innovate and create formulas that meet evolving nutritional science and consumer demands for specialized products. New companies entering this arena must commit significant capital to R&D infrastructure, employ top-tier scientific talent, and conduct rigorous clinical trials to prove product efficacy and safety, a substantial barrier to entry.

Feihe's robust R&D capabilities, including its dedicated research centers and a strong pipeline of scientifically backed products, represent a formidable competitive advantage. For instance, Feihe has consistently invested in advanced infant nutrition research, aiming to replicate the complex composition of breast milk. In 2023, Feihe reported significant R&D expenditure, underscoring its commitment to innovation in a market where such investments are crucial for differentiation and market share growth.

- High R&D Costs: New entrants face substantial upfront costs for research, product formulation, and clinical testing, potentially running into tens of millions of dollars.

- Scientific Expertise: Access to specialized nutritionists, pediatricians, and food scientists is critical, and building such teams takes time and resources.

- Regulatory Hurdles: Obtaining approvals for new infant formulas requires extensive safety and nutritional data, often necessitating years of research and validation.

- Feihe's Advantage: Feihe's established track record and ongoing investment in R&D, including collaborations with research institutions, provide a significant moat against potential new competitors.

The threat of new entrants into the Chinese infant formula market is significantly mitigated by high capital requirements, particularly for establishing vertically integrated supply chains and state-of-the-art manufacturing facilities. These extensive investments, often in the tens of millions of dollars for a single plant, coupled with the need for nationwide distribution networks, create a substantial financial barrier.

Stringent regulatory compliance, including lengthy product registration processes averaging 18-24 months in 2024, demands considerable time and financial resources, effectively deterring many potential new players. Furthermore, building brand trust and loyalty in a market sensitive to safety concerns requires years of consistent quality and marketing, a difficult feat for newcomers to replicate quickly.

Feihe's established infrastructure, robust R&D capabilities, and deep-seated brand trust, cultivated over years of operation and significant investment in innovation, present a formidable competitive moat. For instance, Feihe's consistent investment in advanced infant nutrition research, aiming to replicate breast milk's complexity, underscores its commitment to staying ahead in a market where R&D is paramount.

| Barrier to Entry | Estimated Cost/Timeframe | Feihe's Position |

| Regulatory Compliance (Product Registration) | 18-24 months (2024 average) | Established, fully compliant |

| Vertical Integration (Manufacturing Plant) | Tens of millions of dollars | Fully operational, optimized |

| Distribution Network Development | Billions in investment (logistics, warehousing) | Extensive, deeply entrenched nationwide reach |

| R&D and Clinical Trials | Tens of millions of dollars | Significant ongoing investment, strong product pipeline |

Porter's Five Forces Analysis Data Sources

Our Feihe Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic statistics to provide a comprehensive view of the competitive landscape.