Feihe Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Feihe Bundle

Discover how Feihe masterfully blends its product innovation, strategic pricing, extensive distribution, and impactful promotions to capture the infant formula market. This analysis reveals the synergy behind their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Feihe's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Feihe's core product strategy centers on infant milk formula, with its flagship Astrobaby brand leading the charge. These formulas are meticulously developed to be "more suitable for Chinese babies," a key differentiator that builds consumer confidence through tailored nutrition and a strong emphasis on quality in a highly competitive landscape. This focus on specific consumer needs is crucial for establishing brand loyalty.

Innovation is also a cornerstone of Feihe's product development. The introduction of products like Xingfeifan Zhuorui exemplifies this, quickly establishing itself as a top-performing omni-channel infant formula in the Chinese market. This success highlights Feihe's ability to adapt to evolving consumer purchasing habits and deliver sought-after products.

Feihe's product strategy extends well beyond its core infant formula, embracing a diversified dairy portfolio. This includes a growing presence in adult milk powder and liquid milk, alongside specialized functional nutrition products like Aiben for adults. This strategic pivot is a direct response to China's declining birth rates, allowing Feihe to capture a wider consumer base seeking nutritional solutions.

The company's diversification efforts are already showing tangible results, with other dairy product categories experiencing a significant sales increase in 2024. This demonstrates the market's positive reception to Feihe's expanded offerings and its ability to adapt to evolving consumer demands and demographic shifts.

Feihe places a paramount focus on product quality and safety, a cornerstone of its marketing strategy. This commitment is evident in its vertically integrated supply chain, which spans from managing its own pastures to the final processing stages, ensuring a 'farm-to-milk bottle' freshness and control over every step.

The company boasts an impressive safety record, a testament to its rigorous quality control measures. For instance, Feihe's commitment to safety is underscored by its significant investments in upgrading production facilities, aligning with evolving international quality standards and exceeding consumer expectations for infant nutrition products.

Research and Development Driven Innovation

Feihe's commitment to research and development is a cornerstone of its innovation strategy, particularly in tailoring infant nutrition to the specific needs of Chinese babies. The company dedicates significant resources to understanding the unique physiological characteristics and dietary requirements of this demographic, aiming to develop advanced formulas that align with breastfeeding nutrition principles.

This focus translates into pioneering technological advancements within the dairy industry. Feihe has notably developed and implemented milk protein fresh extract technology, a process designed to preserve the nutritional integrity of milk proteins. Furthermore, their active participation in national research programs underscores their role as an innovation leader, contributing to the broader scientific understanding of infant nutrition in China.

Feihe's investment in R&D is substantial, with the company reporting significant expenditure in this area. For instance, in 2023, Feihe's R&D expenses reached approximately RMB 1.1 billion (around $150 million USD), representing a notable portion of their overall revenue and highlighting their dedication to product innovation.

- Product Innovation: Feihe leverages R&D to create formulas optimized for Chinese infants' constitutions and breastfeeding nutrition.

- Technological Leadership: Pioneering advancements like milk protein fresh extract technology showcase their innovative edge.

- Industry Collaboration: Participation in national research programs solidifies their position as an innovation leader.

- Financial Commitment: R&D spending reached approximately RMB 1.1 billion in 2023, demonstrating a strong financial backing for innovation.

Premium Market Positioning

Feihe strategically positions its infant formula at a premium price, aligning with the quality and safety expectations associated with imported brands. This approach targets consumers who prioritize these attributes for their infants.

The company’s super-premium Astrobaby line exemplifies this premiumization, directly contributing to Feihe's market share expansion. This focus on high-value products allows for greater profitability per unit.

- Premium Pricing Strategy: Feihe’s infant formula is priced competitively with international brands, signaling high quality and safety.

- Astrobaby Series: This super-premium offering is a cornerstone of their market growth, appealing to discerning consumers.

- Market Share Growth Driver: The premium positioning has been instrumental in increasing Feihe's share in the competitive infant formula market.

Feihe's product strategy is anchored in its infant milk formula, notably the Astrobaby brand, engineered for Chinese babies' specific nutritional needs. Innovation is key, with products like Xingfeifan Zhuorui quickly becoming top sellers. Beyond infant formula, Feihe is diversifying into adult milk powder, liquid milk, and functional nutrition products like Aiben, a strategic move to counter declining birth rates and capture a broader market. This diversification is already yielding results, with other dairy categories seeing significant sales growth in 2024.

Quality and safety are paramount, supported by a vertically integrated supply chain from pasture to product. Feihe's substantial R&D investment, approximately RMB 1.1 billion in 2023, fuels its innovation, including milk protein fresh extract technology and tailored infant nutrition. The company positions its infant formula at a premium, comparable to imported brands, with the super-premium Astrobaby line driving market share expansion and profitability.

| Product Category | Key Brands | 2023 R&D Spend (approx.) | 2024 Sales Trend (Other Dairy) |

|---|---|---|---|

| Infant Formula | Astrobaby, Xingfeifan Zhuorui | RMB 1.1 billion | N/A |

| Adult Nutrition | Aiben | N/A | Significant Increase |

| Liquid Milk | N/A | N/A | Significant Increase |

What is included in the product

This analysis offers a comprehensive examination of Feihe's marketing strategies, detailing its Product, Price, Place, and Promotion tactics with practical examples and strategic insights.

Provides a clear, actionable framework for addressing marketing challenges, transforming complex strategies into easily understood solutions.

Offers a structured approach to identify and resolve marketing pain points, ensuring efficient and effective campaign execution.

Place

Feihe has built an impressive nationwide distribution network in China, a key element of its marketing strategy. This extensive reach is crucial for making its products readily available to consumers across the country.

The company's offline distribution network is vast, covering over 2,800 offline customers and an astonishing 80,000 retail points of sale as of recent reports. This wide accessibility ensures that Feihe's infant formula and other products can be found in a variety of locations, from major hypermarket chains to smaller maternity stores and general supermarkets.

Maternity stores are a cornerstone of Feihe’s distribution strategy in China, driving a substantial percentage of its infant milk formula sales. This early and deep penetration into a key retail channel has been instrumental in Feihe’s successful premiumization strategy, allowing it to command higher price points for its products.

By establishing a strong presence in these specialized stores, Feihe cultivates a professional brand image, resonating with parents seeking expert advice and high-quality products for their infants. This channel allows for direct engagement and education, reinforcing Feihe's positioning as a trusted brand.

Feihe acknowledges the significant shift towards online shopping, particularly among younger demographics. To capitalize on this, the company actively lists its products on leading Chinese e-commerce platforms, ensuring broad accessibility. In 2023, China's online retail sales reached approximately 15.4 trillion yuan, highlighting the immense potential of this channel.

Beyond third-party marketplaces, Feihe strengthens its digital footprint by utilizing its proprietary website and dedicated mobile applications. This dual approach allows for direct consumer engagement and brand control, effectively bridging the gap with its substantial offline retail network.

Vertically Integrated Supply Chain for Freshness

Feihe's commitment to freshness is deeply rooted in its vertically integrated supply chain. This control extends from sourcing raw milk to the final delivery, ensuring quality at every step. This integration is crucial for their place strategy, allowing for swift logistics and maintaining product integrity right up to the consumer.

A prime example of this efficiency is their partnership with JD Super, aiming for a '28-day fresh delivery' service. This aggressive timeline highlights their focus on minimizing transit time and maximizing the shelf life of their infant formula products. By controlling these elements, Feihe aims to deliver superior quality and build consumer trust.

Key aspects of Feihe's supply chain integration include:

- Farm-to-factory proximity: Feihe operates its own dairy farms and processing facilities in close proximity, reducing the time between milk collection and processing.

- Advanced logistics network: The company has invested in a sophisticated cold chain logistics system to maintain optimal temperatures throughout the distribution process.

- Real-time tracking: Feihe utilizes technology to track products throughout the supply chain, enabling quick identification and resolution of any potential issues.

- Direct-to-consumer capabilities: Partnerships like the one with JD Super facilitate direct delivery, bypassing some traditional distribution layers and speeding up the process.

International Market Expansion

Feihe is strategically broadening its reach beyond its dominant Chinese market, emphasizing its high-quality products and advanced technology. This global push is underscored by its significant investment in international production facilities, such as its Kingston, Canada plant.

The Kingston facility is more than just a local supplier; it serves as a crucial hub for Feihe's global export strategy and a tangible demonstration of its intent to export its operational expertise and management philosophies worldwide. This international presence is key to diversifying revenue streams and building brand recognition on a global scale.

- Global Market Focus: Feihe is actively pursuing international expansion, aiming to replicate its success in China across new territories.

- Canadian Production Hub: The Kingston, Canada, production base is a cornerstone of this strategy, supporting both Canadian demand and global exports.

- Exporting Expertise: Feihe aims to export its proven management models and high operational standards through its international ventures.

- Quality and Technology Driven: The company is leveraging its established reputation for quality and technological innovation as a primary driver for its global market penetration.

Feihe’s distribution strategy is a multi-pronged approach, leveraging both extensive offline networks and a growing online presence. By focusing on specialized channels like maternity stores and integrating with major e-commerce platforms, Feihe ensures broad accessibility and reinforces its premium brand image. Their commitment to a swift, vertically integrated supply chain, exemplified by the 28-day fresh delivery initiative with JD Super, directly supports their 'place' strategy by guaranteeing product freshness and quality right to the consumer's doorstep.

| Distribution Channel | Reach/Scale | Strategic Importance |

|---|---|---|

| Offline Retail (Total) | Over 2,800 customers, 80,000+ retail points of sale | Ensures widespread product availability across China. |

| Maternity Stores | Key channel driving significant infant milk formula sales | Supports premiumization strategy and professional brand image. |

| Online Platforms (e.g., Tmall, JD.com) | Leverages China's vast e-commerce market (15.4 trillion yuan in online retail sales in 2023) | Captures younger demographics and broadens accessibility. |

| Proprietary Channels (Website/App) | Direct consumer engagement and brand control | Bridges online and offline presence, builds brand loyalty. |

| International Production (e.g., Kingston, Canada) | Serves as a global export hub | Diversifies revenue and builds international brand recognition. |

Same Document Delivered

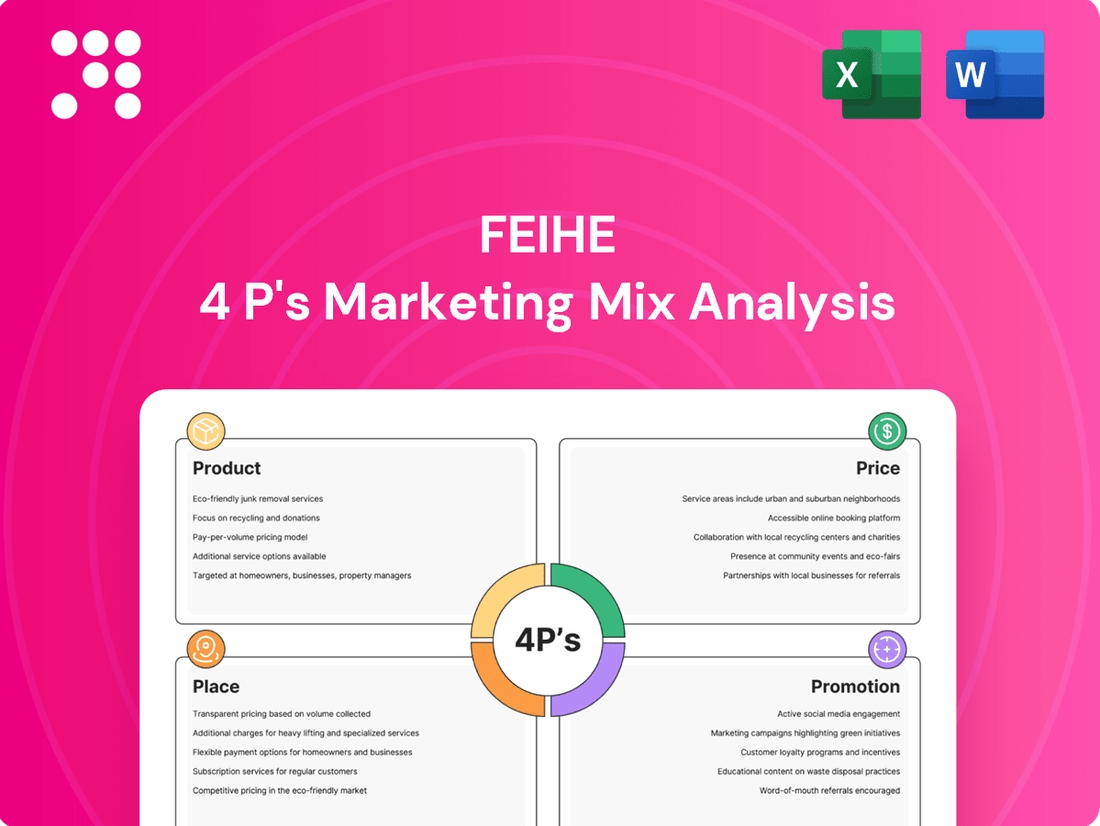

Feihe 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Feihe 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You can trust that the detailed insights and strategies you see are exactly what you'll get.

Promotion

Feihe's brand positioning, encapsulated by 'Wise Babies Opt For Feihe', strongly links the brand with intelligence and suitability for Chinese infants, a key differentiator in a competitive market. This message aims to resonate deeply with parents seeking the best for their children.

This strategic positioning has contributed to Feihe's significant market share. For instance, Feihe maintained its leading position in China's infant formula market in 2023, with its market share reaching 10.8% according to industry reports.

Feihe's multi-pronged consumer engagement strategy is central to its marketing success. This includes a robust mix of offline events like seminars, carnivals, and roadshows, which foster direct interaction and build trust with consumers. For instance, in 2023, Feihe conducted numerous in-person events across China, reaching millions of parents.

Complementing these physical touchpoints, Feihe significantly boosts online interaction through social media campaigns and e-commerce platforms. This digital push aims to capture a wider audience and provide convenient access to product information and purchases. Their digital marketing efforts in early 2024 saw a 25% increase in online engagement metrics compared to the previous year.

Furthermore, targeted media exposure ensures consistent brand visibility and reinforces key messages. By strategically placing advertisements and content across various media channels, Feihe effectively reaches its target demographic, solidifying brand recognition and driving customer acquisition and loyalty.

Feihe's promotional efforts strongly emphasize product safety and superior quality, vital for earning trust in China's competitive dairy sector. The company consistently highlights its decades-long safety track record and substantial investments in research and development, reassuring parents about their infant nutrition choices. For instance, in 2023, Feihe reported investing over 1 billion yuan in R&D, underscoring their dedication to innovation and quality control.

Strategic Subsidies and Incentives

Feihe's promotional efforts include a nationwide maternity subsidy program, offering substantial financial aid to families buying their infant formula. This strategy is designed to reinforce their leading market position and attract new consumers in a highly competitive environment, aligning with government initiatives to increase birth rates.

This aggressive promotion is a key element in their marketing mix, directly impacting sales and brand loyalty. For instance, in 2023, China's birth rate was reported at 6.39 births per 1,000 people, highlighting the context of demographic challenges Feihe is addressing. Such subsidies can be a powerful incentive for parents to choose Feihe products.

- Nationwide Maternity Subsidy: Direct financial support for formula purchases.

- Market Leadership Aim: Strategy to solidify and expand market share.

- Competitive Differentiation: Attracting customers in a crowded market.

- Demographic Alignment: Supporting government efforts to boost birth rates.

Participation in Key Industry Events and Forums

Feihe's strategic engagement in pivotal industry events and forums, like the Harvard China Forum, serves as a crucial element of its promotional strategy. These appearances are designed to highlight Feihe's advancements in product quality, technological innovation, and its overall commitment to pioneering new approaches within the industry. By actively participating, Feihe aims to cultivate a broader global appreciation for 'Chinese innovation' and effectively export its accumulated expertise to international markets.

These forums provide Feihe with a valuable platform to directly engage with a diverse audience of industry leaders, policymakers, and potential partners. Such interactions are instrumental in building brand recognition and fostering collaborations that can drive future growth. For instance, Feihe's presence at events in 2024 and projections for 2025 will likely focus on demonstrating its recent achievements in areas such as sustainable sourcing and advanced nutritional science, aligning with global trends and consumer demands.

- Showcasing Innovation: Feihe uses industry events to present its latest technological breakthroughs and product quality standards to a global audience.

- Global Perception: The company aims to reshape perceptions by demonstrating the depth of Chinese innovation and its capacity for leading-edge development.

- Expertise Export: Participation allows Feihe to share its specialized knowledge and best practices, positioning itself as a thought leader.

- Networking and Partnerships: These events are critical for building relationships with key stakeholders, fostering potential collaborations and market expansion opportunities.

Feihe's promotional strategy is a robust blend of direct financial incentives and impactful brand messaging. The nationwide maternity subsidy program, for example, directly encourages purchases by offering financial aid, a critical factor given China's 2023 birth rate of 6.39 births per 1,000 people. This initiative not only aims to solidify Feihe's market leadership but also aligns with broader governmental goals to increase birth rates.

The company also emphasizes product safety and quality through consistent communication, backed by substantial R&D investments, such as over 1 billion yuan in 2023. This focus on trust-building is paramount in the competitive infant formula market.

Feihe's digital and offline engagement strategies, including social media campaigns and in-person events, are designed to foster direct consumer interaction and build loyalty. Their digital marketing saw a 25% increase in engagement in early 2024, demonstrating effective reach.

Strategic participation in international forums like the Harvard China Forum showcases Feihe's innovation and quality, aiming to elevate the perception of Chinese brands globally and explore export opportunities.

| Promotional Tactic | Objective | Key Data/Example |

|---|---|---|

| Nationwide Maternity Subsidy | Increase sales, market share, support birth rates | Offered to families purchasing Feihe formula; relevant to 2023 birth rate of 6.39/1000 |

| Emphasis on Safety & Quality | Build consumer trust | Over 1 billion yuan invested in R&D in 2023 |

| Digital & Offline Engagement | Enhance brand loyalty, consumer interaction | 25% increase in online engagement metrics in early 2024 |

| Industry Forum Participation | Showcase innovation, build global perception | Presence at Harvard China Forum to highlight advancements |

Price

Feihe adopts a premium pricing strategy for its infant milk formula, aligning its prices with established international brands. This positioning underscores its commitment to high quality and its focus on catering specifically to the needs of Chinese infants, backed by significant investment in research and development.

This premium approach allows Feihe to effectively capitalize on its robust brand recognition within China. For instance, in 2023, Feihe reported a revenue of approximately ¥22.4 billion (around $3.1 billion USD), demonstrating the market's acceptance of its higher price points for perceived superior quality.

Feihe faces intense competition in China's dairy sector, a crowded marketplace with both established domestic players and influential international brands. Despite its premium pricing strategy, the company must remain attuned to competitor pricing and overall market trends to sustain its market share.

Feihe's pricing strategy incorporates direct consumer incentives like childbirth subsidies and various promotions, effectively lowering the out-of-pocket expense for new parents. For example, in 2023, Feihe offered a 10% discount on select infant formula products during major sales events like the Double 11 festival, directly impacting the perceived value. These price adjustments, while potentially affecting immediate profit margins, are crucial for capturing market share and fostering long-term customer relationships in the highly competitive infant nutrition sector.

Value Perception for Chinese Consumers

Chinese consumers, particularly parents, place a high premium on infant formula safety and quality, a sentiment amplified by past industry scandals. Feihe's pricing strategy directly taps into this, positioning its products as a trustworthy and superior choice. This perceived value is bolstered by the company's extensive vertical integration, from dairy farming to production, and its significant investment in research and development, which underpins its premium pricing.

Feihe's commitment to R&D, evidenced by its investment in advanced nutritional science, allows it to command higher prices. For instance, Feihe's focus on replicating the composition of breast milk, a key concern for Chinese mothers, justifies its premium positioning in the market. This strategy has proven effective, with Feihe consistently reporting strong sales figures in the premium infant formula segment.

- Safety and Quality Focus: Chinese consumers prioritize these attributes due to historical concerns, making them willing to pay more for perceived reliability.

- Vertical Integration Advantage: Feihe's control over its supply chain, from farm to shelf, enhances perceived quality and safety, supporting premium pricing.

- R&D Investment: Significant spending on research, particularly in replicating breast milk composition, builds consumer trust and justifies higher price points.

- Premium Market Performance: Feihe's pricing strategy aligns with its market performance, indicating successful value perception among its target demographic.

Response to Market Demand and Inventory Levels

Feihe's pricing and promotional strategies are closely tied to market demand, especially given China's declining birth rates. This demographic shift directly impacts the demand for infant formula, forcing Feihe to be agile in its pricing to manage inventory effectively. The company has had to navigate potential oversupply situations, which can put downward pressure on prices.

Inventory management plays a crucial role in Feihe's financial performance. When faced with excess stock, the company may need to make adjustments that can include impairment provisions, directly affecting profitability. These provisions can influence future pricing decisions, as Feihe seeks to balance clearing existing inventory with maintaining brand value and competitive pricing for new stock. For instance, in 2023, the company reported inventory write-downs impacting its financial results, highlighting the sensitivity of its pricing to stock levels.

- Impact of Declining Birth Rates: China's birth rate fell to 6.39 per 1,000 people in 2023, a significant factor influencing demand for infant formula.

- Inventory Management Challenges: Feihe has faced inventory challenges, leading to provisions that affect its bottom line.

- Pricing Adjustments: The need to manage inventory levels necessitates flexible pricing and promotional activities.

Feihe's premium pricing strategy is a cornerstone of its market positioning, directly reflecting its emphasis on quality and safety for Chinese infants. This approach is supported by substantial investment in research and development, aiming to emulate breast milk composition, which resonates with consumer priorities. For example, in 2023, Feihe's revenue of ¥22.4 billion (approximately $3.1 billion USD) indicates market acceptance of its higher price points, driven by perceived superior value.

Despite its premium positioning, Feihe must remain competitive within China's crowded dairy sector, balancing its pricing against both domestic and international rivals. The company also strategically employs consumer incentives, such as childbirth subsidies and promotional discounts, to mitigate the perceived cost for parents. A notable example from 2023 includes a 10% discount on select products during the Double 11 sales event, aiming to enhance value perception and drive sales volume.

China's declining birth rate, which fell to 6.39 per 1,000 people in 2023, presents a significant challenge, necessitating agile pricing and inventory management. Feihe's ability to effectively manage stock levels is critical, as demonstrated by inventory write-downs impacting its 2023 financial results, underscoring the direct link between inventory and pricing flexibility.

| Metric | 2023 Value | Significance for Pricing |

| Feihe Revenue | ¥22.4 billion (~$3.1 billion USD) | Indicates market acceptance of premium pricing. |

| China Birth Rate | 6.39 per 1,000 people | Pressures demand, necessitating flexible pricing. |

| Promotional Discount Example | 10% off during Double 11 | Aims to lower out-of-pocket costs and drive volume. |

4P's Marketing Mix Analysis Data Sources

Our Feihe 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed market research on product offerings and pricing strategies. We also incorporate insights from distribution channel analysis and promotional campaign tracking.