Eni SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Eni's strengths lie in its integrated energy model and significant upstream assets, but its reliance on fossil fuels presents a clear threat in a rapidly decarbonizing world. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Eni’s opportunities in renewable energy and the challenges posed by regulatory shifts? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Eni's strength lies in its fully integrated energy model, covering everything from upstream exploration and production to downstream refining, marketing, and a significant expansion into renewables and chemicals. This comprehensive approach shields the company from market fluctuations by allowing it to capture value at every stage of the energy supply chain.

The company's strategic blueprint for 2024-2027 is designed to capitalize on its established oil and gas operations while aggressively developing new, high-growth ventures aligned with the global energy transition. This dual focus ensures continued profitability from traditional assets while actively positioning Eni for future energy demands.

Eni has showcased impressive financial resilience, achieving strong adjusted net profits and cash flow from operations even amidst difficult market environments. This financial strength is further bolstered by a historically low leverage ratio, offering significant flexibility for strategic investments and rewarding shareholders.

The company's commitment to shareholder returns is evident, with plans to increase its dividend and continue its share buyback program through 2025. For instance, Eni's 2024 guidance anticipates a dividend of €0.44 per share, and the buyback program is expected to reach €1.5 billion in 2024, with a further €1.6 billion planned for 2025, reflecting robust financial discipline.

Eni is a leader in the energy transition, with a clear strategy for decarbonization. Their goal is carbon neutrality by 2050, backed by significant investments in renewables through Plenitude, which is targeting 7 GW of installed capacity by 2026. This proactive approach positions them well for a lower-carbon future.

Leading Position in Gas and LNG

Eni holds a commanding position in the gas and LNG markets, a sector it's strategically prioritizing for future growth. By 2045, the company intends for natural gas and LNG to represent more than 90% of its total production, underscoring a significant shift in its operational focus.

This strategic pivot is supported by substantial investments in expanding its LNG infrastructure and securing long-term supply contracts. These initiatives are crucial for bolstering Eni's global reach and ensuring a flexible, robust portfolio to meet escalating international demand for cleaner energy sources.

- Strategic Gas and LNG Focus: Eni aims for over 90% of its production to be gas and LNG by 2045.

- Global Expansion: Actively developing major LNG projects and long-term supply agreements to enhance its international presence.

- Meeting Demand: Positioned to capitalize on the increasing global need for cleaner fuels.

Innovative Satellite Model and Strategic Partnerships

Eni's innovative satellite model is a key strength, enabling the separation of growth businesses into distinct entities. This structure is designed to attract external investment, thereby unlocking value and boosting operational efficiency. This approach fosters agile growth and diversification, allowing Eni to adapt quickly to market changes.

Recent successes highlight the effectiveness of this strategy. For instance, Plenitude and Enilive have successfully attracted external partners, demonstrating the model's ability to generate interest and capital. Furthermore, the establishment of new upstream satellite joint ventures showcases Eni's commitment to leveraging this model across its diverse operations.

The financial implications are significant. By attracting external capital, Eni can reduce its own investment burden while still pursuing growth opportunities. This strategic capital allocation is crucial for maintaining financial flexibility and driving shareholder value in a dynamic energy landscape.

Key aspects of this strength include:

- Separation of Growth Businesses: Distinct entities for focused development and investment attraction.

- External Investment Attraction: Successfully drawing capital into subsidiaries like Plenitude and Enilive.

- Enhanced Operational Efficiency: Streamlined management and resource allocation within satellite entities.

- Agile Growth and Diversification: Facilitating quicker expansion and entry into new markets or technologies.

Eni's integrated business model is a significant advantage, allowing it to manage the entire energy value chain from exploration to retail and renewables. This integration provides a buffer against market volatility and ensures consistent value capture. For 2024, Eni is targeting €1.5 billion in share buybacks, with an additional €1.6 billion planned for 2025, underscoring its financial strength and commitment to shareholder returns.

The company's strategic emphasis on gas and LNG is a key strength, with plans to make these segments over 90% of its production by 2045. This focus aligns with current global energy demands for cleaner, more reliable fuels. Eni's renewable arm, Plenitude, is also expanding rapidly, aiming for 7 GW of installed capacity by 2026, demonstrating its commitment to the energy transition.

Eni's innovative satellite model, which creates distinct entities for growth businesses, is a powerful tool for attracting external investment and unlocking value. This approach has already seen success with Plenitude and Enilive attracting partners, reducing Eni's capital burden while fostering agile growth and diversification. This strategy is crucial for navigating the evolving energy landscape and maximizing returns on investment.

| Metric | 2024 Target/Guidance | 2025 Target/Guidance |

|---|---|---|

| Share Buybacks | €1.5 billion | €1.6 billion |

| Plenitude Installed Capacity | N/A (Target 7 GW by 2026) | N/A (Target 7 GW by 2026) |

| Gas/LNG Production Share | N/A (Target >90% by 2045) | N/A (Target >90% by 2045) |

What is included in the product

Delivers a strategic overview of Eni’s internal and external business factors, highlighting its strengths in integrated energy operations and opportunities in the energy transition, while also acknowledging weaknesses in certain legacy assets and threats from market volatility.

Offers a clear, structured view of Eni's strategic landscape, simplifying complex internal and external factors for decisive action.

Weaknesses

Eni's financial results are closely tied to the ups and downs of oil and gas prices. For instance, a drop in Brent crude prices in early 2024 led to a noticeable decrease in the company's earnings. This sensitivity means that even with diversification strategies, Eni's profitability can be significantly affected by market volatility.

Eni has grappled with declining hydrocarbon output, impacting its upstream segment. For instance, in the first quarter of 2024, the company reported a decrease in its average daily production compared to the previous year, reflecting the inherent challenges in maintaining output from mature fields.

Furthermore, the refining and biofuels sectors experienced compressed margins throughout 2023 and into early 2024, driven by volatile feedstock costs and shifts in market demand. This pressure on downstream operations has directly affected Eni's profitability in these areas.

The company's traditional chemicals arm, Versalis, has been a significant drag, posting substantial losses. In response, Eni announced a strategic recalibration for Versalis, involving the divestment of certain assets and a focus on more sustainable chemical production, signaling a move away from legacy, loss-making operations.

Eni's commitment to a significant energy transition, including substantial investments in renewables and decarbonization projects, necessitates high capital expenditures. For instance, the company allocated approximately €7 billion in capital expenditure for its upstream segment in 2023, with a growing portion dedicated to lower-carbon initiatives.

While Eni aims for efficient spending, these large upfront investments can place a considerable strain on its financial resources. This is particularly true when considering the inherent volatility and uncertainties present in global energy markets and the long payback periods often associated with green energy infrastructure.

Geopolitical Risks and Operational Complexities

Eni's extensive global operations, particularly in regions like Africa and the Middle East, present significant geopolitical risks. These areas are often characterized by political instability and evolving regulatory landscapes, which can directly impact exploration and production activities. For instance, in 2024, several African nations where Eni operates experienced heightened political tensions, leading to temporary disruptions in some project timelines.

The operational complexities inherent in these diverse international locations add another layer of challenge. Managing logistics, ensuring security, and navigating local customs and laws require substantial resources and expertise. In 2025, Eni reported increased operational costs in certain Middle Eastern countries due to unforeseen logistical hurdles and the need for enhanced security measures, impacting overall project efficiency.

- Geopolitical Instability: Regions like North Africa and the Middle East, where Eni has substantial assets, are prone to political unrest and conflict, potentially disrupting supply chains and operations.

- Regulatory Changes: Frequent shifts in government policies and energy regulations in host countries can create uncertainty and necessitate costly adjustments to Eni's business model.

- Operational Hurdles: Challenges such as infrastructure limitations, security concerns, and the need for specialized local expertise in diverse operating environments can lead to project delays and increased expenditure.

- Resource Nationalism: Growing trends of resource nationalism in some countries could lead to renegotiation of contracts or increased state participation, impacting Eni's ownership and profit margins.

Need for Continuous Innovation in New Energy Technologies

Eni's success in the energy transition, particularly in areas like carbon capture, utilization, and storage (CCUS), hydrogen production, and advanced biofuels, is heavily reliant on its ability to continuously innovate. The energy sector is rapidly evolving, and staying ahead requires significant and sustained investment in research and development to keep pace with emerging technologies and competitors.

The challenge lies in the sheer speed of technological advancement. For instance, while Eni has made strides in developing its hydrogen capabilities, the global landscape for green hydrogen production is seeing new breakthroughs and cost reductions almost constantly. This dynamic environment means that R&D efforts must be agile and adaptable to avoid obsolescence and maintain a competitive advantage.

- Technological Obsolescence Risk: Failure to innovate at the pace of the market could render Eni's current investments in new energy technologies less competitive or even obsolete.

- Intensified Competition: The new energy sectors are attracting significant investment from both established energy players and new entrants, increasing competitive pressure on Eni.

- Capital Intensity of R&D: Continuous innovation demands substantial and ongoing capital allocation to R&D, which can strain financial resources if not managed effectively.

Eni's profitability remains susceptible to fluctuations in global oil and gas prices, as seen in the earnings dip during early 2024 when Brent crude prices declined. This inherent price volatility, despite diversification efforts, poses a significant risk to the company's financial performance.

The company faces challenges in maintaining hydrocarbon output, with a reported decrease in average daily production in Q1 2024 compared to the prior year, highlighting difficulties with mature fields. Additionally, compressed margins in refining and biofuels throughout 2023 and early 2024, due to volatile feedstock costs and shifting demand, have impacted downstream profitability.

Eni's legacy chemicals business, Versalis, has been a persistent drain, incurring substantial losses, necessitating a strategic realignment including asset divestments and a focus on sustainable chemicals. The significant capital expenditure required for its energy transition initiatives, such as renewables and decarbonization, estimated at around €7 billion for upstream in 2023, can strain financial resources given market uncertainties and long payback periods for green infrastructure.

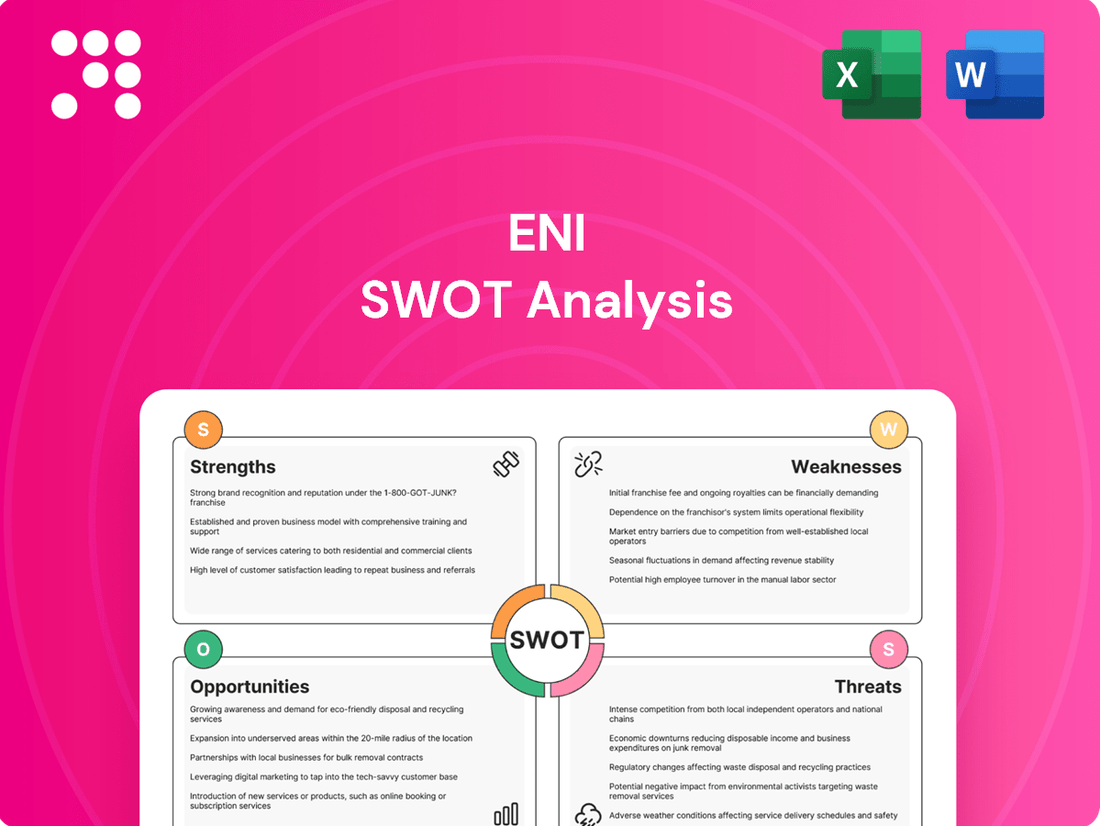

Preview Before You Purchase

Eni SWOT Analysis

The preview you see is the actual Eni SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professional analysis without any surprises.

You're viewing a live preview of the actual Eni SWOT analysis file. The complete, detailed version becomes available immediately after checkout, ready for your strategic planning.

This is a real excerpt from the complete Eni SWOT analysis document. Once purchased, you’ll receive the full, editable version, providing comprehensive insights into Eni's strategic position.

Opportunities

Eni's Plenitude division is strategically expanding its renewable energy capacity, with ambitious targets of 15 GW by 2030 and a substantial 60 GW by 2050. This aggressive growth plan positions Eni to significantly benefit from the escalating worldwide demand for sustainable energy sources, encompassing solar, wind, and crucial energy storage solutions.

The global energy landscape's increasing reliance on natural gas as a cleaner bridge fuel presents a significant growth avenue for Eni's Liquefied Natural Gas (LNG) operations. Eni aims for LNG to represent over 90% of its production by 2045, underscoring its strategic commitment to this expanding market.

Key developments, including the ramp-up of the Coral South floating LNG facility in Mozambique and new long-term supply agreements in regions like the Republic of the Congo and Argentina, are crucial for bolstering Eni's competitive standing in the burgeoning LNG sector.

Eni, through its Enilive division, is significantly boosting its biorefining capacity, targeting over 5 million tonnes annually by 2030. This expansion includes a strategic focus on sustainable aviation fuel (SAF), a key component in decarbonizing air travel.

This move directly addresses the growing global demand for low-carbon transportation fuels, presenting a substantial growth opportunity for Eni in a rapidly evolving energy landscape.

By 2024, Eni's Venice biorefinery is set to become the first in Europe to produce ENI Biojet, a sustainable aviation fuel derived from waste and vegetable oils, marking a concrete step in this direction.

Leveraging Carbon Capture, Utilization, and Storage (CCUS)

Eni is strategically positioning itself in the burgeoning CCUS market by establishing a dedicated satellite company. This move directly targets the decarbonization of industries that are difficult to transition away from fossil fuels, such as cement and steel production. This focus is crucial as global efforts to meet climate targets intensify, creating a significant demand for effective emission reduction solutions.

The CCUS technology presents a dual opportunity: it allows Eni to significantly reduce its own operational emissions and those of its industrial partners, while simultaneously opening up new avenues for revenue generation. These new revenue streams can come from providing CCUS services to other companies, or potentially from the utilization of captured CO2 in products like sustainable fuels or building materials.

The CCUS sector is poised for substantial growth. For instance, the International Energy Agency (IEA) projects that CCUS will need to capture 7.6 billion tonnes of CO2 annually by 2070 to meet net-zero goals, a massive increase from the current capture rate. Eni's investment in this area aligns with this projected demand, aiming to capture a share of this expanding market.

- Strategic Focus: Eni's new CCUS satellite company targets hard-to-abate sectors, a key growth area for decarbonization solutions.

- Dual Opportunity: CCUS offers emission reduction benefits and creates new revenue streams through service provision and CO2 utilization.

- Market Growth: The CCUS sector is projected for significant expansion, with the IEA estimating a need for 7.6 billion tonnes of CO2 capture annually by 2070.

Strategic Partnerships and Portfolio Optimization through Satellite Model

Eni's strategic partnerships, particularly through its satellite model, offer a significant opportunity to attract external capital and foster growth. This approach allows for the creation of financially distinct entities, thereby accelerating development and unlocking inherent value within specific business segments. For instance, Eni's joint venture with Petronas in Asia for liquefied natural gas (LNG) projects, and its collaboration with Global Infrastructure Partners (GIP) for carbon capture, utilization, and storage (CCUS) initiatives, exemplify this strategy. These ventures not only optimize Eni's existing portfolio but also pave the way for further expansion into new markets and technologies.

The satellite model's effectiveness is further underscored by its ability to optimize Eni's diverse portfolio. By bringing in external investors, Eni can reduce its capital burden on high-growth or capital-intensive projects, allowing for more focused resource allocation. This strategy is crucial in the current energy transition landscape, where significant investment is required for decarbonization technologies and new energy sources. The company's ongoing exploration of similar joint ventures signals a commitment to leveraging this model for continued portfolio enhancement and value creation.

- Attracting External Investment: The satellite model enables Eni to bring in third-party capital, de-risking and accelerating projects.

- Portfolio Optimization: Joint ventures allow Eni to refine its asset mix, focusing on core strengths while divesting or partnering on non-core or capital-intensive ventures.

- Accelerated Growth: Financially independent satellite entities can pursue growth strategies more nimbly, unburdened by the parent company's overall financial structure.

- Unlocking Value: By creating distinct legal and financial structures, Eni can better highlight the intrinsic value of specific business units to investors.

Eni's strategic expansion into renewable energy, particularly through its Plenitude division, is a key opportunity, aiming for 15 GW by 2030. The growing global demand for cleaner energy sources, including solar and wind power, directly benefits this expansion. Furthermore, Eni's increased focus on Liquefied Natural Gas (LNG) as a transitional fuel positions it to capitalize on the evolving energy market, with LNG projected to form over 90% of its production by 2045.

The company's investment in biorefining, with a target of over 5 million tonnes annually by 2030, especially in sustainable aviation fuel (SAF), addresses the urgent need for decarbonizing transportation. Eni's proactive establishment of a CCUS satellite company taps into the significant growth potential of carbon capture technologies, crucial for hard-to-abate industries and meeting climate targets. The satellite model, exemplified by partnerships like the one with GIP for CCUS, allows Eni to attract external capital and accelerate the development of its diverse business segments.

| Opportunity Area | Target/Projection | Key Drivers |

|---|---|---|

| Renewable Energy Expansion | 15 GW by 2030 (Plenitude) | Global demand for sustainable energy |

| LNG Market Growth | >90% of production by 2045 | Natural gas as a bridge fuel |

| Biorefining and SAF Production | >5 million tonnes annually by 2030 | Decarbonization of transportation |

| CCUS Market Development | Targeting hard-to-abate sectors | Climate targets and emission reduction needs |

| Strategic Partnerships (Satellite Model) | Attracting external capital | Portfolio optimization and accelerated growth |

Threats

Eni faces growing threats from intensifying regulatory pressure and climate policies worldwide. The European Green Deal, for instance, is a major driver of these changes, aiming for significant carbon emission reductions. This regulatory environment can translate into higher operational expenses for Eni as they adapt to stricter compliance mandates and potentially face limitations on their established hydrocarbon business lines.

Global energy demand is facing significant uncertainty. Economic slowdowns in major economies and ongoing geopolitical tensions, like the conflict in Ukraine, are creating volatility. For instance, the International Energy Agency (IEA) has revised its 2024 global oil demand growth forecast multiple times, reflecting this unpredictability. These shifts directly impact Eni's sales volumes and pricing power.

Fluctuations in oil and gas prices represent a substantial threat. Periods of lower commodity prices, such as those experienced in late 2023 and early 2024, directly compress Eni's profit margins. If prices remain depressed, it could hinder Eni's ability to fund its strategic investments and maintain its dividend payouts, impacting overall financial performance.

The energy sector is experiencing a seismic shift driven by rapid technological advancements. Eni faces a significant threat from nimble, pure-play renewable energy companies that are unburdened by legacy fossil fuel infrastructure. For instance, the global renewable energy market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.1 trillion by 2030, indicating substantial growth and investment in this area.

To counter this, Eni must prioritize continuous innovation and adaptation. Failing to keep pace with the development of more efficient solar panels, advanced battery storage, and green hydrogen production could leave Eni at a competitive disadvantage. The company's strategic investments in renewables, such as its 2024 commitment to increase its renewable power generation capacity by 5 GW, are crucial steps in mitigating this threat.

Geopolitical Instability and Supply Chain Disruptions

Eni's operations are susceptible to geopolitical instability, particularly in regions where it has significant investments. Conflicts and political tensions can disrupt its complex global supply chains, leading to operational delays and increased security costs. For instance, the ongoing war in Ukraine has significantly impacted global energy markets, forcing a reorientation of supply routes and creating price volatility that directly affects companies like Eni.

The company's exposure to these risks is substantial, as evidenced by the challenges faced in securing reliable energy flows and managing fluctuating commodity prices. In 2023, the European Union continued to navigate the complex landscape of diversifying its energy sources away from Russia, a move that underscored the vulnerability of established supply chains and the need for strategic resilience. This ongoing shift presents both challenges and opportunities for Eni to adapt its operational strategies and supply network.

- Supply Chain Vulnerability: Geopolitical events can sever or reroute critical energy supply lines, impacting Eni's ability to source and deliver products efficiently.

- Operational Disruptions: Instability in operating regions can lead to temporary shutdowns, increased security measures, and higher insurance premiums.

- Market Volatility: Conflicts and political crises directly influence global energy prices, creating unpredictable revenue streams and impacting profitability.

Public Perception and ESG Scrutiny

Eni, as a major energy player heavily reliant on fossil fuels, is under intense public and investor scrutiny regarding its Environmental, Social, and Governance (ESG) practices. This heightened awareness means that any perceived missteps in sustainability or ethical conduct can significantly damage its brand and operational capacity. For instance, in 2023, the energy sector as a whole faced increased pressure from stakeholders demanding clearer transition plans, with many investors linking ESG performance directly to long-term value creation.

Negative public perception can directly hinder Eni's ability to secure financing for new projects, especially those related to traditional energy sources, and can also make it harder to attract top talent who increasingly prioritize working for environmentally conscious organizations. By mid-2024, several major financial institutions have strengthened their ESG screening criteria, potentially limiting capital availability for companies not demonstrating robust climate action strategies.

- Investor Pressure: A growing number of institutional investors are divesting from companies with poor ESG ratings, impacting Eni's share price and cost of capital.

- Reputational Risk: Negative media coverage or public campaigns related to environmental incidents or social issues can erode consumer trust and brand loyalty.

- Talent Acquisition: Younger generations of skilled workers often prioritize employers with strong sustainability commitments, posing a challenge for companies with a significant fossil fuel footprint.

- Regulatory Scrutiny: Increased focus on climate disclosures and emissions targets by governments worldwide can lead to stricter regulations and potential penalties for non-compliance.

Eni faces significant threats from evolving global energy policies and the accelerating transition to renewables. Stricter climate regulations, like those within the European Green Deal, can increase operational costs and limit traditional business lines, while the rapid growth of renewable energy companies, projected to reach $2.1 trillion by 2030, presents intense competition. Furthermore, geopolitical instability, as seen with the Ukraine conflict, disrupts supply chains and creates market volatility, impacting Eni's revenue and operational stability.

The company's heavy reliance on fossil fuels also exposes it to considerable ESG scrutiny. Negative public perception and investor pressure regarding sustainability practices can restrict financing and talent acquisition, especially as financial institutions increasingly prioritize climate action. For instance, by mid-2024, many major banks have tightened ESG screening, potentially limiting capital for companies lacking robust climate strategies.

SWOT Analysis Data Sources

This Eni SWOT analysis is built upon a robust foundation of data, drawing from Eni's official financial reports, comprehensive market intelligence from leading industry analysts, and expert opinions from energy sector specialists to ensure a thorough and accurate assessment.