Eni Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

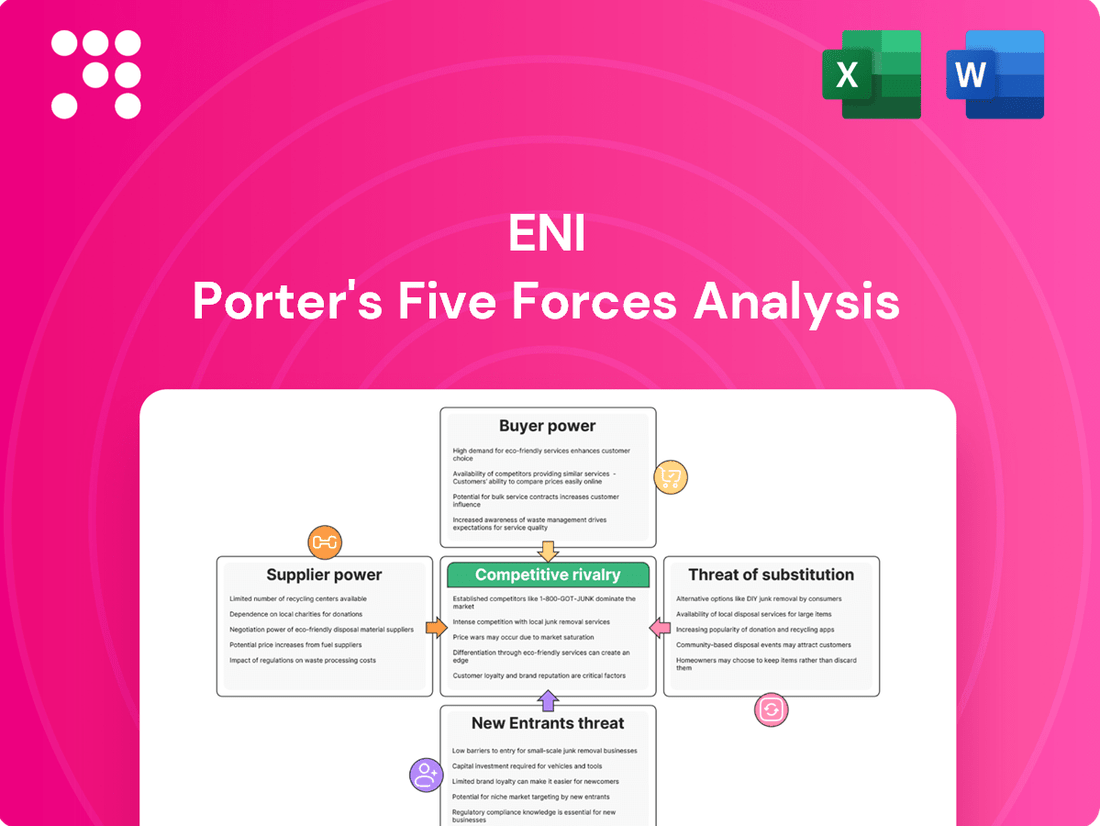

Porter's Five Forces offers a powerful lens to understand the competitive landscape of any industry, including Eni's. By examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry, businesses can uncover critical strategic insights.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eni’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Eni's reliance on a concentrated group of specialized suppliers for critical oil and gas exploration and production components, like advanced IoT sensors, significantly amplifies supplier bargaining power. For instance, in 2024, the market for highly specialized subsea drilling equipment saw a notable consolidation, with only a handful of manufacturers offering cutting-edge solutions. This limited supplier base means Eni has fewer viable alternatives for essential, high-quality equipment, potentially leading to increased costs and reduced negotiation flexibility.

The reliability and quality of inputs are paramount for Eni's intricate operations, especially in the demanding upstream oil and gas sector. Disruptions or quality lapses from critical suppliers can directly affect Eni's production levels, operational safety, and overall financial results. For instance, in 2023, Eni's capital expenditures for exploration and production amounted to approximately €7.1 billion, underscoring the significant investment in securing necessary resources and technologies.

Eni's reliance on specialized suppliers for essential components, such as advanced sensors and drilling equipment, amplifies the bargaining power of these suppliers. The specialized nature of these inputs means Eni has fewer readily available alternatives, making supplier relationships particularly influential in cost and availability negotiations.

Switching suppliers in the energy sector, particularly for Eni, often entails substantial expenses. These can include the costs associated with retooling existing infrastructure, retraining personnel on new systems, and the potential for significant operational disruptions during the transition period. For instance, in 2024, the energy industry saw continued investment in specialized digital platforms for exploration and production, making integration with new vendors a complex undertaking.

These high switching costs effectively limit Eni's flexibility in negotiating terms and consequently bolster the bargaining power of its existing suppliers. When it's difficult and expensive to change, suppliers can often command better prices or more favorable contract terms, impacting Eni's operational costs and profitability.

Furthermore, Eni's ongoing integration of advanced technologies and new operational systems adds another layer of complexity when considering changing suppliers. The need for seamless compatibility and the risk of interoperability issues mean that even if a new supplier offers lower prices, the cost and effort to switch might outweigh the immediate financial benefits.

Differentiation of Supplier Offerings

When suppliers offer highly differentiated or proprietary technologies, their bargaining power significantly increases. For instance, if a supplier provides unique drilling technologies or specialized refining catalysts that are difficult for competitors to replicate, Eni may find itself with limited alternatives. This scarcity of substitutes directly translates to greater leverage for the supplier in negotiating prices and contract terms.

Eni's strategic focus on technological advancement and integrated value chains, as highlighted in their 2024 operational reviews, inherently increases their reliance on such specialized suppliers. This dependence can amplify the supplier's ability to dictate terms, especially if the proprietary technology offers a critical competitive edge for Eni's operations.

For example, in 2024, Eni's investment in advanced deep-water exploration projects necessitated partnerships with providers of highly specialized subsea equipment. The limited number of companies capable of supplying this cutting-edge technology meant these suppliers commanded premium pricing, impacting Eni's project cost structures.

- Proprietary Technology: Suppliers with unique, hard-to-replicate technologies gain substantial leverage.

- Limited Alternatives: When few other suppliers can offer comparable products or services, the supplier's power grows.

- Eni's Strategy: Eni's emphasis on technology and integration increases its dependence on specialized suppliers.

- Impact on Costs: Differentiated offerings can lead to higher input costs for Eni, affecting profitability.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Eni's operations, while not a dominant concern in the capital-intensive energy sector, could nonetheless shift bargaining power. Imagine a major equipment provider deciding to offer maintenance or even exploration services that Eni currently handles. This would directly challenge Eni's existing business model.

However, the sheer scale and intricate nature of Eni's integrated operations present substantial hurdles for most suppliers considering such a move. The industry’s established players as suppliers generally possess strong bargaining power, but forward integration by these entities remains a less probable scenario given the significant investment and expertise required to replicate Eni's complex value chain.

For instance, in 2024, the global oil and gas services market, where many of Eni's key suppliers operate, is characterized by a few dominant, specialized firms. These companies, while powerful in their own right, typically focus on their core competencies rather than undertaking the massive capital expenditures needed to compete directly with integrated energy giants like Eni across the entire upstream, midstream, and downstream spectrum.

- Supplier Forward Integration Risk: While theoretically possible, suppliers integrating forward into Eni's core activities is a low probability due to the immense capital and operational complexity involved.

- Industry Structure: The oil and gas sector features established, specialized suppliers, whose primary strength lies in their specific service offerings rather than broad integration.

- Barriers to Entry for Suppliers: Eni's integrated model creates significant barriers, making it economically unfeasible for most suppliers to replicate its diverse operational capabilities.

Eni's bargaining power with suppliers is influenced by the concentration of its supplier base and the uniqueness of the products or services offered. When suppliers provide highly specialized or proprietary components, such as advanced subsea drilling equipment, Eni faces limited alternatives, thereby increasing supplier leverage. For example, in 2024, the market for these specialized items saw consolidation, with few manufacturers providing cutting-edge solutions, directly impacting Eni's negotiation flexibility and potentially increasing costs.

High switching costs further empower suppliers. These costs can include retooling infrastructure, retraining personnel, and the risk of operational disruptions. Eni's 2024 investments in specialized digital platforms for exploration and production highlight the complexity of integrating new vendors, making supplier changes a costly endeavor.

The threat of suppliers integrating forward into Eni's operations is minimal due to the significant capital and expertise required to replicate Eni's complex, integrated value chain in the oil and gas sector. Suppliers in this industry typically focus on their core competencies rather than competing with integrated energy giants.

| Factor | Description | Impact on Eni | 2024 Relevance |

|---|---|---|---|

| Supplier Concentration | Few suppliers offer critical, specialized components. | Increased supplier pricing power. | Consolidation in subsea equipment market. |

| Switching Costs | High expenses and operational risks associated with changing suppliers. | Reduced Eni's negotiation flexibility. | Investment in specialized digital platforms. |

| Product Differentiation | Suppliers offering unique or proprietary technologies. | Supplier ability to dictate terms and pricing. | Eni's reliance on advanced deep-water exploration tech. |

| Forward Integration Risk | Suppliers moving into Eni's business areas. | Low probability due to high barriers to entry. | Focus of suppliers on core competencies. |

What is included in the product

Eni Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and profitability potential within Eni's operating environment, examining threats from new entrants, bargaining power of buyers and suppliers, threat of substitutes, and the intensity of rivalry among existing competitors.

Uncover hidden threats and opportunities across your industry, transforming uncertainty into actionable strategies.

Customers Bargaining Power

Eni interacts with a wide array of customers, from massive industrial operations and utility providers to everyday individual consumers across its energy product lines. This broad customer base generally limits the bargaining power of any single customer segment.

While major industrial clients or national distributors can wield influence due to their significant purchase volumes, Eni's diverse customer portfolio typically diffuses this concentrated power. For instance, Eni's 2024 financial reports indicate a balanced revenue stream across its various business segments, suggesting no single customer group dominates its sales.

However, in particular geographical areas or for specific energy products, a handful of large buyers might still possess notable leverage. This localized concentration can create situations where these key customers can negotiate more favorable terms, impacting Eni's pricing and profitability in those niche markets.

For many of Eni's customers, especially those using existing infrastructure for gas, electricity, or refined products, changing suppliers can come with significant expenses and logistical hurdles. These can involve updating infrastructure, renegotiating contracts, or altering supply chains, all of which tend to make it harder for customers to switch easily.

In 2024, the energy market saw continued investment in grid modernization and smart meter rollouts, which, while improving efficiency, also embed customers further into existing provider networks. For instance, the European Union's energy market reports indicate that the average household's switching time for electricity can still range from 2 to 6 weeks, often involving administrative fees and potential service disruptions, thereby increasing the perceived switching cost.

The growing availability of substitute energy sources significantly bolsters customer bargaining power. For instance, the global renewable energy market, valued at approximately $1,050 billion in 2023, is projected to reach $2,500 billion by 2030, offering consumers more choices beyond traditional fossil fuels. This trend pressures companies like Eni to adapt and compete on price and sustainability.

Customer Price Sensitivity

In markets like oil and gas, where products are largely undifferentiated, customers often exhibit high price sensitivity. This means that changes in global energy prices can significantly sway their purchasing decisions and their willingness to negotiate for more favorable terms.

For Eni, this price sensitivity directly impacts its profitability. The company's pricing strategies must constantly adapt to market volatility, affecting its ability to maintain margins.

- Customer Price Sensitivity in Energy Markets: In 2024, global oil prices experienced significant fluctuations, with Brent crude averaging around $83 per barrel in the first half of the year, impacting consumer and industrial demand.

- Impact on Negotiation: High price sensitivity empowers customers to demand better pricing, potentially squeezing Eni's profit margins, especially when supply outstrips demand.

- Eni's Strategic Response: Eni's focus on cost optimization and diversification into lower-carbon energy sources in 2024 aims to mitigate the direct impact of commodity price volatility on its core business.

Customer Information and Transparency

The bargaining power of customers in the energy sector is significantly influenced by increased information access. For instance, by mid-2024, many energy comparison websites in Europe provided real-time pricing data, allowing consumers to switch providers with greater ease. This transparency directly impacts how customers can negotiate, especially for those with substantial energy needs.

Large industrial and commercial clients, in particular, leverage this information advantage. Their dedicated procurement teams actively seek out the best rates and contract terms. In 2024, major industrial consumers were often able to secure discounted energy rates through bulk purchasing agreements, demonstrating their heightened bargaining power due to readily available market intelligence.

- Increased Price Transparency: Energy comparison platforms in 2024 offered consumers unprecedented visibility into pricing structures and available tariffs.

- Informed Negotiation: Access to this data empowers customers, especially large buyers, to negotiate more favorable terms and rates.

- Impact on Suppliers: This customer leverage can pressure energy suppliers to offer more competitive pricing and service packages to retain business.

The bargaining power of Eni's customers is a significant factor in its operational strategy. While Eni's broad customer base generally dilutes individual customer power, large industrial clients and distributors can exert considerable influence due to their purchase volumes. The increasing availability of substitute energy sources, like renewables, further empowers customers by offering alternatives and increasing price sensitivity.

| Factor | Impact on Eni | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | Limited by diverse portfolio, but localized concentration can increase leverage. | Eni's 2024 reports show balanced revenue, no single segment dominates. |

| Switching Costs | High switching costs for infrastructure-bound customers limit power. | EU energy market reports indicate 2-6 week switching times with fees. |

| Availability of Substitutes | Bolsters customer power, forcing competition on price and sustainability. | Global renewable energy market valued at ~$1,050 billion in 2023. |

| Price Sensitivity | Customers can demand better pricing, impacting margins. | Brent crude averaged ~$83/barrel in H1 2024, influencing demand. |

Preview the Actual Deliverable

Eni Porter's Five Forces Analysis

This preview showcases the precise Porter's Five Forces Analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You are viewing the complete, professionally formatted document, ready for immediate application to your strategic planning needs. This is the exact file you'll download, offering a comprehensive understanding of competitive forces within your industry.

Rivalry Among Competitors

Eni faces intense competition from a vast array of global energy players. This includes established supermajors like ExxonMobil and Shell, whose sheer scale and integrated operations present a formidable challenge. In 2024, these companies continue to invest billions in exploration, production, and refining, directly vying for market share and resources.

The landscape is further complicated by national oil companies (NOCs) such as Saudi Aramco and PetroChina, which often benefit from state backing and privileged access to reserves. These NOCs are increasingly sophisticated, expanding their global reach and technological capabilities, directly competing with Eni in key geographic regions and product markets.

Adding another layer of competition are the rapidly growing renewable energy companies. In 2024, the transition to cleaner energy sources means Eni must also contend with specialized firms focused on solar, wind, and other green technologies, who are capturing market share and influencing energy policy and investment trends.

While global energy demand continues to climb, especially in developing economies, Eni's traditional oil and gas operations are navigating a more challenging landscape. The ongoing energy transition is dampening growth prospects in these core areas, intensifying the competition for existing market share.

The International Energy Agency (IEA) projects that while global energy demand will increase by roughly 25% by 2040, the share of oil in the energy mix is expected to decline. This means companies like Eni must contend with slower growth in established segments, leading to heightened rivalry.

In the traditional oil and gas sectors, where products are largely commoditized, Eni faces intense rivalry driven by price and operational efficiency. However, the company is actively cultivating differentiation through its strategic investments in renewable energy sources and sustainable fuels.

Eni's push into areas like sustainable aviation fuel (SAF) and advanced biorefining offers a pathway to create distinct offerings. This strategy aims to foster customer loyalty by appealing to a growing demand for environmentally conscious energy solutions, setting them apart from competitors focused solely on conventional products.

Exit Barriers for Competitors

The energy sector, especially upstream oil and gas and refining operations, is characterized by immense capital investment in fixed assets. These long-term, specialized assets, such as offshore platforms, pipelines, and refineries, represent significant sunk costs. This makes it incredibly difficult and financially prohibitive for companies to simply walk away from these investments, even when market conditions are unfavorable.

Consequently, companies often continue to operate in the market despite low profitability. This persistence, driven by high exit barriers, can intensify competitive rivalry. Competitors may be reluctant to cut production or capacity, leading to prolonged periods of oversupply and depressed margins across the industry. For example, in 2024, the global oil and gas industry continues to grapple with the challenge of stranded assets, where the value of existing infrastructure is threatened by the energy transition, further complicating exit strategies.

- High Capital Intensity: The energy industry requires massive upfront investments in exploration, drilling, production facilities, and refining infrastructure.

- Specialized Assets: Much of the infrastructure is highly specialized and cannot be easily repurposed or sold, increasing the cost of exiting.

- Long-Term Commitments: Contracts for resource extraction, transportation, and refining often involve long-term obligations, binding companies to continued operations.

- Regulatory and Environmental Obligations: Decommissioning assets requires significant financial and environmental compliance, adding to exit costs.

Strategic Objectives and Integration of Rivals

Many of Eni's competitors, like Shell and TotalEnergies, are also integrated energy giants. They share Eni's strategic goal of expanding into renewable energy sources while simultaneously refining their existing oil and gas operations. This creates a dynamic where rivals are often vying for the same limited resources, aiming to capture market share in emerging green energy sectors, and pushing for advancements in technologies like Carbon Capture and Storage (CCS) and Liquefied Natural Gas (LNG).

This strategic overlap intensifies rivalry. For instance, in 2024, major oil and gas companies collectively announced trillions of dollars in planned investments across both traditional and new energy ventures. This shared ambition means competition is fierce not just for customers, but for the talent and capital needed to develop and deploy next-generation energy solutions.

- Diversification Race: Rivals are all pursuing a dual strategy of maintaining hydrocarbon revenue streams while aggressively investing in renewables, leading to direct competition for market share in solar, wind, and hydrogen projects.

- Resource Competition: The race for critical minerals essential for renewable technologies and the acquisition of prime locations for new energy infrastructure creates significant competitive pressure.

- Technological Innovation: Companies are locked in a battle to develop and commercialize advanced technologies such as CCS, advanced biofuels, and more efficient LNG production and transport.

Eni operates in a highly competitive arena, facing rivals like ExxonMobil, Shell, and national oil companies such as Saudi Aramco. In 2024, these players are investing heavily in both traditional oil and gas and the burgeoning renewable energy sector, intensifying the battle for market share and resources.

The energy transition further fuels competition, with specialized renewable energy firms capturing attention and investment. This means Eni must contend with a diverse set of competitors, from established giants to agile green tech innovators, all vying for dominance in a rapidly evolving market.

The commoditized nature of oil and gas products means rivalry often centers on price and operational efficiency. However, Eni is differentiating itself through strategic investments in sustainable aviation fuel and advanced biorefining, aiming to attract customers seeking eco-friendly energy solutions.

High capital intensity and specialized assets create significant exit barriers in the energy sector, compelling companies to remain competitive even during downturns. This persistence, exemplified by the ongoing challenge of stranded assets in 2024, can lead to prolonged periods of oversupply and squeezed profit margins.

Rivals are actively pursuing similar diversification strategies, investing in renewables and technologies like Carbon Capture and Storage (CCS) and Liquefied Natural Gas (LNG). This strategic overlap intensifies competition for critical minerals, prime locations for new energy infrastructure, and technological leadership.

| Competitor | 2024 Estimated Revenue (USD Billions) | Renewable Energy Investment (2024, USD Billions) | Key Focus Areas |

|---|---|---|---|

| ExxonMobil | ~350 | 5-7 | Oil & Gas, Lower-emission solutions, CCS |

| Shell | ~300 | 6-8 | Integrated Energy, Renewables, EV Charging |

| Saudi Aramco | ~400 | 2-3 | Oil & Gas, Petrochemicals, Hydrogen |

| TotalEnergies | ~230 | 4-6 | Integrated Energy, Renewables, Biofuels |

SSubstitutes Threaten

The threat of substitutes for Eni's traditional oil and gas products is escalating, driven by the expanding availability and enhanced performance of renewable energy sources like solar, wind, and hydropower. These alternatives are becoming increasingly cost-competitive, a trend bolstered by robust policy initiatives aimed at decarbonization.

For instance, global renewable energy capacity additions reached approximately 510 gigawatts (GW) in 2023, a significant jump from previous years, making these options more viable replacements for fossil fuels. This growing accessibility and efficiency directly challenge Eni's core business segments.

The declining cost and increasing efficiency of renewable energy technologies significantly enhance their price-performance ratio, making them increasingly competitive against traditional fossil fuels. For instance, the global average cost of electricity from solar photovoltaics (PV) fell by 89% between 2010 and 2022, reaching $0.150 per kilowatt-hour (kWh) in 2022, according to the International Renewable Energy Agency (IRENA). This trend directly pressures fossil fuel prices and profit margins as consumers and industries find cleaner, more cost-effective alternatives.

Customers are increasingly open to alternatives, especially in the energy sector. This shift is fueled by environmental awareness and new technologies. For instance, electric vehicle adoption is accelerating, with global EV sales projected to reach over 13 million units in 2024, a significant jump from previous years.

Government Policies and Regulations Favoring Substitutes

Government policies and regulations can dramatically increase the threat of substitutes, particularly in sectors like energy. For instance, strong incentives for renewable energy adoption, such as tax credits and subsidies, make solar and wind power more competitive against traditional fossil fuels. By 2024, many nations have strengthened their commitments to decarbonization, directly impacting industries reliant on carbon-intensive energy sources.

Regulations aimed at reducing carbon emissions and promoting energy efficiency further bolster the viability of substitutes. The European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024, mandates detailed reporting on environmental, social, and governance (ESG) factors, pushing companies to adopt cleaner energy solutions. This regulatory push makes it harder for incumbent energy providers to ignore the growing appeal and cost-effectiveness of alternatives.

- Government incentives for renewables: Many countries offer tax credits and subsidies, making solar and wind power more competitive. For example, the US Inflation Reduction Act of 2022 provides significant incentives for clean energy deployment through 2032.

- Carbon emission reduction targets: Stricter emission standards, like those implemented by the EPA in 2024 for vehicles, encourage the adoption of electric vehicles, a substitute for gasoline-powered cars.

- Energy efficiency mandates: Building codes and appliance standards that promote energy efficiency reduce demand for conventional energy sources, favoring substitutes like smart home technology and improved insulation.

- Corporate sustainability reporting: Directives like the CSRD push companies to report on their environmental impact, driving investment in and adoption of cleaner energy alternatives.

Technological Advancements in Substitutes

Technological advancements are significantly bolstering the threat of substitutes, particularly in the energy sector. Innovations in energy storage, such as improved battery chemistries and grid-scale solutions, are making intermittent renewable sources like solar and wind more reliable and competitive. For instance, by late 2023, global battery storage capacity was projected to reach over 150 GW, a substantial increase from previous years, directly challenging the role of traditional fossil fuels.

Smart grid technologies are further enabling the integration and efficient management of diverse energy sources, including decentralized renewables and electric vehicles, which can act as distributed energy resources. This sophisticated infrastructure allows for greater flexibility and resilience, reducing reliance on centralized fossil fuel power plants. By 2024, investments in smart grid technologies were anticipated to exceed $30 billion globally, highlighting the rapid development in this area.

The progress in advanced biofuels and synthetic fuels also presents a growing substitute threat. Research and development are yielding more efficient and sustainable production methods, making these alternatives increasingly viable for sectors traditionally dominated by fossil fuels, such as aviation and heavy transport. Eni, recognizing this evolving landscape, is actively investing in these alternative energy technologies, including biofuels and hydrogen production, to adapt to long-term market shifts.

These technological leaps collectively enhance the attractiveness and scalability of substitute energy solutions, directly impacting the competitive position of established fossil fuel providers. The increasing efficiency and decreasing costs of these alternatives mean that consumers and industries have more viable options than ever before.

The threat of substitutes for Eni's traditional oil and gas products is intensifying due to the growing availability and improving performance of renewable energy sources. These alternatives, like solar and wind power, are becoming more cost-competitive, supported by global decarbonization efforts. For instance, global renewable energy capacity additions reached approximately 510 GW in 2023, a significant increase that makes these options more viable replacements for fossil fuels.

The declining cost and increasing efficiency of renewable energy technologies, such as solar photovoltaics, directly pressure fossil fuel prices. The global average cost of solar PV electricity fell by 89% between 2010 and 2022, reaching $0.150 per kWh in 2022. This trend, coupled with accelerating electric vehicle adoption, with over 13 million units projected for 2024, highlights the increasing viability of alternatives.

Government policies and technological advancements are key drivers in this shift. For example, the US Inflation Reduction Act of 2022 offers substantial incentives for clean energy, while innovations in energy storage, with global capacity projected to exceed 150 GW by late 2023, enhance the reliability of renewables. These factors collectively bolster the attractiveness and scalability of substitute energy solutions.

| Substitute Type | Key Driver | 2023/2024 Data Point | Impact on Eni |

|---|---|---|---|

| Renewable Energy (Solar, Wind) | Cost Reduction, Policy Support | ~510 GW capacity additions in 2023 | Direct competition for electricity generation |

| Electric Vehicles (EVs) | Technological Improvement, Consumer Demand | Over 13 million units projected sales in 2024 | Reduced demand for gasoline/diesel |

| Energy Storage (Batteries) | Innovation, Grid Integration | >150 GW global capacity projected by late 2023 | Enables greater penetration of intermittent renewables |

| Advanced Biofuels/Synthetic Fuels | R&D, Sustainability Focus | Growing investment and pilot projects | Potential alternative in hard-to-abate sectors (aviation, transport) |

Entrants Threaten

The energy sector, particularly oil and gas exploration and production, demands staggering capital outlays for essential infrastructure, cutting-edge technology, and achieving operational efficiency. For instance, a single offshore oil platform can cost billions of dollars to construct and operate. These substantial financial barriers significantly discourage new companies from entering the market.

Established energy giants like Eni leverage substantial economies of scale across their operations, from exploration and production to refining and global distribution. This scale allows them to spread fixed costs over a larger output, resulting in significantly lower per-unit production costs compared to potential newcomers. For instance, in 2024, Eni's integrated business model, encompassing upstream, midstream, and downstream activities, provides a cost advantage that is incredibly difficult for new entrants to replicate without massive upfront capital expenditure and years of operational learning.

New entrants face a formidable barrier in matching Eni's cost efficiencies. To achieve comparable per-unit costs, they would require enormous initial investments to build out similar infrastructure and reach a comparable scale of operations. Furthermore, the experience curve effect, where costs decrease with accumulated production volume, means Eni has already optimized its processes over decades. A new player would need to invest heavily not only in physical assets but also in acquiring the necessary operational expertise to compete on cost, making the threat of new entrants relatively low in this regard.

Eni's formidable global distribution networks for oil, gas, LNG, and refined products present a significant barrier. Newcomers would need to invest billions to replicate Eni's established infrastructure and relationships, making market entry exceedingly difficult.

Government Policy and Regulations

Government policy and regulations act as a significant deterrent to new entrants in the energy sector. The industry is subject to extensive oversight, covering environmental protection, operational safety, and market conduct. For instance, in 2024, the European Union continued to implement its Fit for 55 package, introducing stricter emissions standards for power generation and industrial facilities, which require substantial upfront investment and technological adaptation from any new player. Obtaining the necessary permits and licenses to operate, especially for large-scale projects like new power plants or offshore wind farms, can be a lengthy and costly process, often involving multiple governmental bodies and public consultations. This regulatory complexity creates a substantial barrier, favoring established companies with existing infrastructure and expertise in navigating these requirements.

The financial implications of these regulations are considerable. New entrants must factor in the cost of compliance, which can include investments in advanced pollution control technologies, adherence to stringent safety protocols, and potential carbon pricing mechanisms. By the end of 2023, the global average cost of carbon emissions allowances in major trading schemes had risen, impacting operational expenses for all energy producers. This financial burden, coupled with the uncertainty of evolving regulatory frameworks, makes it challenging for new companies to compete with incumbents who have already amortized these compliance costs. The need for specialized legal and technical expertise to manage regulatory affairs further adds to the barriers.

Furthermore, government incentives and subsidies can also influence the threat of new entrants. While some policies aim to encourage competition and innovation, others might inadvertently favor existing, larger players who are better positioned to access or leverage these programs. For example, in 2024, many governments continued to offer tax credits and grants for renewable energy projects, but the eligibility criteria often favored projects of a certain scale or those utilizing specific, proven technologies, potentially excluding smaller, novel ventures.

- Stringent Environmental Standards: Regulations like the EU's emissions trading system (ETS) create significant compliance costs for new energy ventures.

- Complex Permitting Processes: Obtaining licenses for energy projects can take years and involve substantial legal and administrative expenses.

- Safety and Operational Mandates: Adherence to rigorous safety protocols requires significant investment in training and equipment.

- Evolving Policy Landscape: The constant change in energy policy creates uncertainty and increases the risk for new market participants.

Brand Identity and Customer Loyalty

Eni's brand identity and deep-seated customer loyalty present a significant barrier to new entrants. While loyalty might be less intense in pure commodity markets, Eni's decades of operation have fostered strong relationships, particularly with industrial clients and governmental bodies, built on reliability and consistent supply. This established trust is a substantial hurdle for newcomers to overcome.

Furthermore, Eni's strategic pivot towards renewable energy, including significant investments in solar and wind power, is cultivating a new layer of brand affinity. By 2024, Eni had committed billions to its energy transition strategy, aiming to achieve net-zero emissions by 2050. This proactive approach not only diversifies its portfolio but also positions the brand favorably with environmentally conscious stakeholders, making it challenging for new, less established entities to compete on brand perception alone.

- Brand Recognition: Eni's long history and global presence cultivate significant brand recognition.

- Customer Loyalty: Established relationships with industrial clients and governments create a loyal customer base.

- Renewable Energy Focus: Investments in green energy enhance brand image and attract new customer segments.

- Trust and Reliability: Decades of operation build a reputation for dependability, difficult for new entrants to match.

The threat of new entrants in the energy sector, particularly for companies like Eni, is generally low due to substantial barriers. High capital requirements for infrastructure and technology, economies of scale enjoyed by incumbents, and strong brand loyalty make it difficult for newcomers to compete effectively. Regulatory hurdles and complex permitting processes further solidify the position of established players.

New entrants face immense financial hurdles, needing billions to replicate existing infrastructure and achieve cost efficiencies. For example, building a new offshore platform can cost billions. Eni's integrated model in 2024, spanning upstream to downstream, offers cost advantages that are nearly impossible for new players to match without similar massive upfront investments and years of operational experience.

Government regulations, such as the EU's Fit for 55 package in 2024, impose strict environmental and safety standards. Navigating these, including obtaining permits, is a lengthy and costly process that favors established companies. Compliance costs, like investing in pollution control and adhering to safety protocols, add significant financial burdens for new entrants, especially with rising carbon costs by the end of 2023.

Eni's established brand recognition and customer loyalty, built over decades, create a significant barrier. Their strategic investments in renewable energy by 2024, backed by billions in funding for their energy transition strategy, are also enhancing brand appeal. This makes it challenging for new entities to compete on brand perception and trust alone.

| Barrier Type | Description | Impact on New Entrants | Example Data (as of 2024) |

| Capital Requirements | High upfront investment for infrastructure and technology. | Major deterrent due to massive financial outlay. | Offshore platform construction can exceed billions of dollars. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to match cost efficiencies. | Eni's integrated model provides significant cost advantages. |

| Brand Loyalty & Reputation | Established trust and relationships with customers. | Difficult for newcomers to build comparable market presence. | Eni's decades of operation foster strong client relationships. |

| Government Regulation | Complex permitting, safety, and environmental standards. | Lengthy and costly compliance processes create barriers. | EU's Fit for 55 package mandates significant technological adaptation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and government economic indicators. This blend ensures a comprehensive understanding of competitive dynamics.