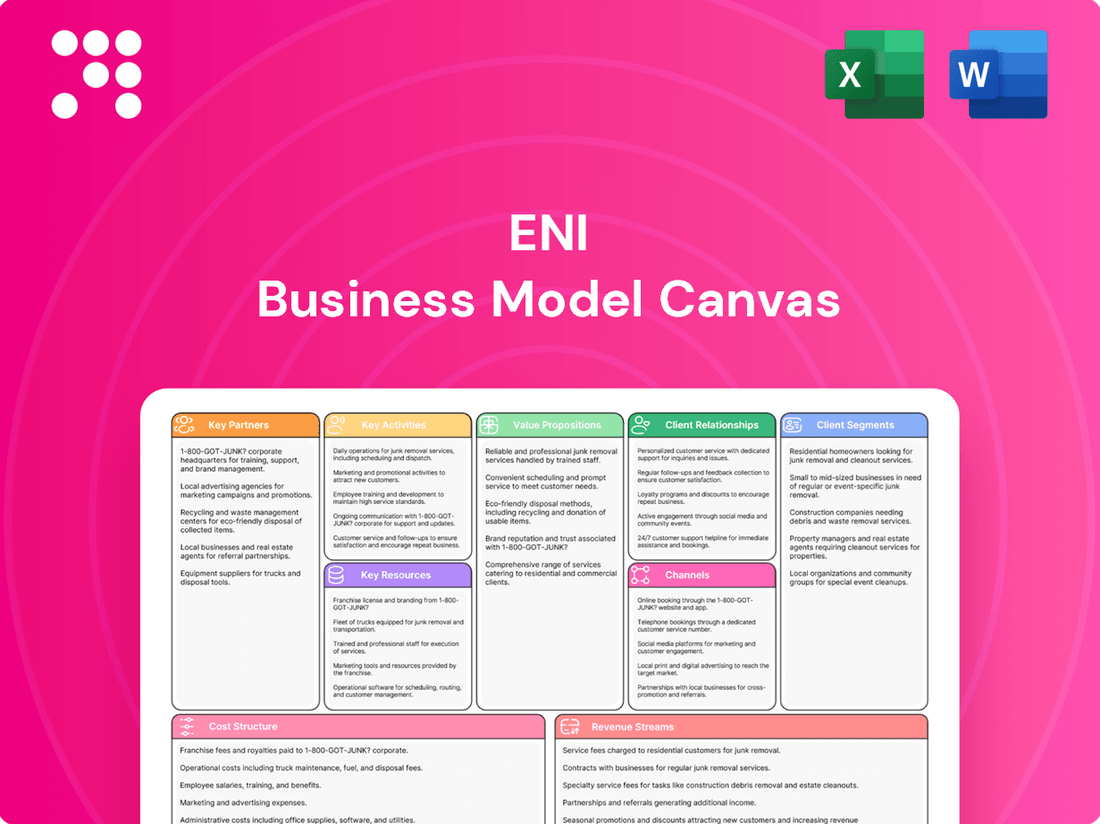

Eni Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Discover the core components of Eni's strategic framework with our comprehensive Business Model Canvas. This in-depth analysis breaks down how Eni creates, delivers, and captures value in the energy sector. Get the full, detailed canvas to understand their customer relationships, revenue streams, and key resources.

Partnerships

Eni actively cultivates strategic joint ventures and alliances with national oil companies (NOCs) and other global energy players. These collaborations are vital for sharing the substantial risks inherent in exploration and production, gaining entry into new geographical regions, and benefiting from invaluable local knowledge and regulatory understanding.

Notable examples of these partnerships include significant projects in Côte d'Ivoire, Congo, and Mozambique, as well as recent discoveries in Cyprus and Mexico. For instance, Eni's involvement in the Coral South FLNG project in Mozambique, a joint venture with national oil company ENH and other international partners, highlights the success of this strategy in developing complex offshore gas resources.

Eni actively collaborates with technology providers, research institutions, and startups to drive its energy transition. These partnerships are crucial for advancing areas like carbon capture and storage (CCS), developing advanced biofuels, and innovating in renewable energy technologies. For instance, Eni's focus on sustainable chemistry and biorefining relies on these external collaborations to bring cutting-edge solutions to market.

Eni actively seeks key partnerships with investment funds and specialized firms to fuel the expansion of its renewable energy division, Plenitude, and its sustainable mobility venture, Enilive. These collaborations are crucial for accelerating growth and accessing vital capital and expertise.

A prime example is KKR's investment in Enilive, a move that injects significant capital into Eni's sustainable mobility efforts. Similarly, EIP's investment in Plenitude provides a substantial financial boost and brings specialized knowledge to Eni's renewable energy projects.

Supply Chain and Logistics Partners

Eni relies on a robust network of key partners to manage its vast and complex supply chain. These include major shipping companies that transport crude oil, liquefied natural gas (LNG), and refined products across global routes, ensuring timely delivery to Eni's refineries and markets. For instance, in 2024, Eni continued to leverage its long-term agreements with leading maritime transport providers to maintain its significant LNG import volumes, which are crucial for European energy security.

Beyond transportation, Eni's operational success hinges on partnerships with specialized suppliers for essential equipment and services. This encompasses companies providing advanced technology for offshore drilling operations, specialized components for refining processes, and critical infrastructure for its expanding renewable energy projects, such as wind turbines and solar panel manufacturers. These collaborations are vital for maintaining operational efficiency and driving innovation in both traditional and new energy sectors.

Key partnerships for Eni's supply chain in 2024 included:

- Shipping Companies: Maintaining fleet capacity for crude oil, LNG, and refined product transport, with a focus on efficiency and emissions reduction in line with Eni's sustainability goals.

- Equipment and Service Providers: Collaborating with technology leaders in drilling, refining, and petrochemicals to ensure access to cutting-edge solutions and specialized expertise.

- Renewable Energy Suppliers: Partnering with manufacturers of solar panels, wind turbines, and battery storage systems to support the growth of Eni's clean energy portfolio.

Governmental and Regulatory Bodies

Eni actively partners with governmental and regulatory bodies worldwide. These relationships are crucial for navigating diverse legal frameworks, obtaining necessary operating permits, and aligning with national energy strategies. For instance, Eni's commitment to local development is often demonstrated through projects that foster economic growth and respect human rights in the regions where it operates.

These collaborations are vital for Eni's operational continuity and strategic growth. By working closely with authorities, Eni ensures compliance with environmental regulations and contributes to the energy transition goals of host countries. In 2024, Eni continued to engage with governments on various fronts, including discussions around renewable energy development and gas supply security.

Key aspects of these partnerships include:

- Regulatory Compliance: Ensuring adherence to all local laws and regulations in operating countries.

- Licensing and Permits: Securing and maintaining licenses for exploration, production, and other energy-related activities.

- Policy Engagement: Contributing to the development and implementation of national energy policies and transition plans.

- Sustainable Development: Collaborating on initiatives that promote local economic growth, social well-being, and human rights protection.

Eni's key partnerships are foundational to its operational success and strategic expansion, particularly in the energy transition. These alliances enable risk sharing, market access, and technological advancement across its diverse business segments.

Collaborations with national oil companies and international energy firms are critical for exploration and production ventures, as seen in projects in Mozambique and Cyprus. Furthermore, partnerships with technology providers and research institutions are vital for innovation in areas like carbon capture and biofuels. Strategic financial partnerships, such as those with KKR and EIP for Enilive and Plenitude respectively, provide essential capital for growth in sustainable energy.

Eni also relies on a robust supply chain network, including shipping companies and specialized equipment suppliers, to ensure efficient global operations. In 2024, these partnerships were crucial for maintaining LNG import volumes and supporting renewable energy infrastructure development.

Engagement with governmental and regulatory bodies is paramount for navigating legal frameworks and aligning with national energy strategies, ensuring operational continuity and compliance.

| Partner Type | Purpose | Example/Focus Area (2024) | Financial Impact/Significance |

|---|---|---|---|

| National Oil Companies (NOCs) & Global Energy Players | Risk sharing, market access, local expertise | Exploration & Production (Mozambique, Cyprus) | Access to reserves, operational synergies |

| Technology Providers & Research Institutions | Innovation, R&D for energy transition | Carbon Capture, Biofuels, Renewables | Development of new energy solutions |

| Investment Funds & Specialized Firms | Capital infusion for growth | Plenitude (Renewables), Enilive (Sustainable Mobility) | Accelerated expansion, access to expertise |

| Shipping & Logistics Companies | Global supply chain management | Transport of Crude Oil, LNG, Refined Products | Ensuring timely delivery, operational efficiency |

| Equipment & Service Suppliers | Access to advanced technology and specialized services | Offshore drilling, refining, renewable energy components | Maintaining operational efficiency, driving innovation |

| Governmental & Regulatory Bodies | Navigating legal frameworks, obtaining permits, policy alignment | License acquisition, environmental compliance, energy policy engagement | Operational continuity, strategic alignment with national goals |

What is included in the product

A strategic framework detailing Eni's approach to energy production, distribution, and innovation, covering customer relationships, revenue streams, and key resources.

Simplifies complex business strategies into a clear, visual framework, alleviating the pain of understanding convoluted plans.

Provides a structured approach to identify and address potential business weaknesses, acting as a proactive pain reliever for strategic planning.

Activities

Eni's core business revolves around the exploration and production (E&P) of hydrocarbons, encompassing the entire lifecycle from discovery to extraction. This fundamental activity involves identifying promising geological formations, assessing their commercial viability, developing the necessary infrastructure, and ultimately producing crude oil and natural gas. Eni's strategic roadmap for 2024-2027 places a significant emphasis on continuing to grow its hydrocarbon output, aiming for an increase in production volumes over this period.

This strategic focus is supported by substantial investment in exploration and development projects worldwide. For instance, Eni's 2023 results showed a significant contribution from its E&P segment, underscoring its importance to the company's overall financial performance. The company is actively pursuing new discoveries and optimizing existing fields to ensure a steady supply of hydrocarbons while also navigating the evolving energy landscape.

Eni actively manages its global gas and LNG portfolio, focusing on securing diverse supply sources and engaging in strategic trading to meet market demands. In 2024, Eni continued to strengthen its position in the LNG market, aiming for substantial portfolio expansion to bolster energy security for its customers and partners.

The company’s marketing efforts target a broad customer base, including industrial clients, power generators, and distributors, providing reliable and flexible gas solutions. Eni's commitment to expanding its LNG capacity is a key strategy to navigate evolving energy landscapes and meet growing global demand.

Eni's key activity of refining and marketing petroleum products involves transforming crude oil into essential fuels like gasoline and diesel, as well as lubricants, which are then distributed through its extensive network of service stations. This core operation is undergoing significant evolution, with Eni actively investing in converting its traditional refineries into advanced biorefineries.

In 2024, Eni continued its strategic shift towards sustainability, with its biorefineries playing a crucial role. For instance, the Venice biorefinery processed 1.1 million tonnes of feedstock in 2023, a figure expected to grow. This transition aims to produce biofuels and other bio-based products, aligning with the company's decarbonization goals and meeting growing market demand for greener alternatives.

Development and Operation of Renewable Energy Projects

Eni, through its subsidiary Plenitude, is actively developing and operating renewable energy projects, primarily focusing on solar and wind power. This strategic expansion aims to increase its portfolio of green energy sources and integrate renewable production with tailored energy solutions for its diverse customer base.

By 2024, Plenitude had a significant installed capacity in renewables, with plans to further expand its footprint. For instance, Eni announced a target of 15 GW of installed renewable capacity by 2025, a substantial increase from its 2023 figures, underscoring its commitment to this sector.

- Developing new solar farms and wind parks

- Acquiring and integrating existing renewable assets

- Offering integrated energy solutions to customers

- Investing in advanced battery storage technologies

Circular Economy and Chemical Production Transformation

Eni's chemical arm, Versalis, is undergoing a significant shift towards sustainable chemistry. This involves substantial investments in new industrial plants and cutting-edge technologies aimed at boosting biorefining capabilities and expanding its portfolio of circular economy products. The strategic move also includes a deliberate reduction in exposure to traditional basic chemicals.

Key activities in this transformation include:

- Developing advanced chemical recycling technologies: Eni is investing in processes to break down plastic waste into its original monomers, enabling the creation of new plastics with virgin-like quality.

- Expanding biorefining capacity: This involves increasing the production of biofuels and bio-based chemicals from renewable feedstocks, reducing reliance on fossil fuels.

- Investing in new circular economy product lines: Eni is actively developing and marketing products derived from recycled materials and bio-based sources, catering to growing market demand for sustainable solutions.

- Phasing out certain basic chemical production: The company is strategically reducing its involvement in the production of less sustainable, commodity chemicals to reallocate resources towards its greener initiatives.

Eni's core activities encompass the entire hydrocarbon value chain, from exploration and production to refining and marketing. The company is actively expanding its global gas and LNG portfolio, securing diverse supply sources and engaging in strategic trading to meet market demands. Eni is also transforming its refining operations, investing in biorefineries to produce biofuels and bio-based products, aligning with its decarbonization goals.

| Key Activity | Focus Area | 2024/2025 Outlook |

|---|---|---|

| Exploration & Production (E&P) | Hydrocarbon discovery, development, and extraction | Continued growth in production volumes; strategic investment in new projects. |

| Gas & LNG Portfolio Management | Securing diverse supply, strategic trading | Strengthening LNG market position; portfolio expansion for energy security. |

| Refining & Marketing | Crude oil transformation into fuels, lubricants; biorefinery conversion | Increased feedstock processing at biorefineries (e.g., Venice); focus on biofuels. |

| Renewable Energy Development (Plenitude) | Solar and wind power projects | Target of 15 GW installed renewable capacity by 2025; expansion of integrated energy solutions. |

| Chemicals (Versalis) | Sustainable chemistry, circular economy products | Investment in advanced chemical recycling and biorefining; reduction in basic chemicals. |

Delivered as Displayed

Business Model Canvas

The Eni Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means the structure, content, and formatting are precisely as you see them, ensuring no discrepancies or hidden elements. You can confidently assess the quality and utility of the entire Business Model Canvas based on this direct preview.

Resources

Oil and natural gas reserves are Eni's core physical assets, encompassing both proven and unproven hydrocarbon deposits worldwide. These reserves form the foundation of the company's exploration and production activities.

Eni's strategic plans, as outlined in their 2024 reports, emphasize sustained investment in upstream projects. This focus aims to expand and enhance their resource base, ensuring future production capacity and growth.

As of 2023, Eni reported 10.1 billion barrels of oil equivalent (boe) in proved reserves, a slight increase from previous years, demonstrating their commitment to resource development and replenishment.

Eni's commitment to advanced technologies and R&D is a cornerstone of its business model. This focus allows the company to develop proprietary solutions for challenging exploration activities and to enhance oil recovery from existing fields. For instance, Eni invested €1.2 billion in research and development in 2023, a significant portion dedicated to these core areas.

Furthermore, Eni leverages its R&D capabilities to drive innovation in sustainability. This includes significant efforts in carbon capture technologies, aiming to reduce emissions from its operations and those of its partners. The company is also actively developing new renewable energy solutions and sustainable chemicals, positioning itself for the energy transition.

Eni's extensive infrastructure, encompassing a vast network of pipelines, refineries, and power plants, is a cornerstone of its integrated energy value chain. This robust physical asset base, including significant renewable energy facilities, is critical for the efficient extraction, processing, and distribution of energy resources.

In 2024, Eni continued to leverage its substantial refining capacity, operating several key complexes that processed millions of barrels of crude oil daily. The company's pipeline network, spanning thousands of kilometers, ensures the reliable transport of oil and gas, a vital component of its operational efficiency and market reach.

Furthermore, Eni's commitment to energy transition is reflected in its growing portfolio of power generation plants, which increasingly feature renewable sources like solar and wind. This diversification strengthens its ability to meet evolving energy demands and contributes to its sustainability goals, with significant investments in green energy projects throughout 2024.

Skilled Workforce and Human Capital

Eni's skilled workforce is a cornerstone of its operations, encompassing geologists, engineers, researchers, and operational staff whose expertise is crucial for its complex, technology-intensive activities. The company actively invests in its human capital, recognizing its people as a primary asset.

In 2024, Eni continued to focus on talent development and knowledge sharing to maintain its competitive edge in the energy sector. The company's commitment to its employees is reflected in ongoing training programs and initiatives aimed at fostering innovation and operational excellence across its global footprint.

- Expertise: Geologists, engineers, researchers, and operational staff provide essential technical knowledge.

- Value: Eni emphasizes the significant contribution of its people and their specialized skills.

- Development: Ongoing investment in training and development programs is a key strategy.

- Innovation: A skilled workforce is vital for driving technological advancements and operational efficiency.

Global Brand and Market Presence

Eni boasts a robust global brand and market presence, a cornerstone of its business model. This widespread recognition allows Eni to effectively secure new contracts and attract a broad customer base across diverse international markets. Its established footprint is a critical asset for ongoing business expansion and operational reach.

In 2024, Eni's operational activities spanned approximately 60 countries, underscoring its significant global reach. This extensive presence facilitates the negotiation and execution of large-scale projects, reinforcing its competitive position. The company's brand equity plays a vital role in building trust and fostering long-term relationships with stakeholders worldwide.

- Global Operations: Eni operates in around 60 countries as of 2024, demonstrating a vast geographical footprint.

- Brand Recognition: Established brand awareness is a key enabler for securing new contracts and attracting customers globally.

- Market Access: Widespread market presence provides direct access to diverse customer segments and opportunities for business growth.

- Contract Acquisition: Strong brand and market presence significantly enhance Eni's ability to win new contracts and expand its service offerings internationally.

Eni's proprietary technologies and research and development capabilities are crucial for its competitive edge. These resources enable efficient exploration, enhanced oil recovery, and innovation in sustainable energy solutions.

In 2023, Eni invested €1.2 billion in R&D, with a significant portion directed towards developing advanced technologies for challenging exploration and improving extraction from existing fields.

The company's focus on R&D also drives its energy transition strategy, including advancements in carbon capture and the development of renewable energy sources and sustainable chemicals.

Eni's integrated infrastructure, comprising pipelines, refineries, and power plants, is a vital physical asset. This network supports the entire energy value chain, ensuring efficient processing and distribution of resources, including a growing renewable energy portfolio.

As of 2024, Eni continued to operate substantial refining capacity, processing millions of barrels of crude daily, and maintained an extensive pipeline network spanning thousands of kilometers for reliable energy transport.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Proprietary Technologies & R&D | Eni's innovation engine for exploration, production, and sustainability. | €1.2 billion R&D investment in 2023. |

| Integrated Infrastructure | Vast network of pipelines, refineries, and power plants supporting the energy value chain. | Operated substantial refining capacity and thousands of kilometers of pipelines in 2024. |

Value Propositions

Eni ensures a steady and varied energy flow, offering oil, natural gas, liquefied natural gas (LNG), and electricity. This diversification is crucial for energy security, benefiting both Eni's customers and the nations it serves.

By actively growing its LNG offerings, Eni is strategically reducing dependence on any single energy source. For instance, in 2024, Eni continued to expand its global LNG footprint, securing new supply agreements and investing in liquefaction infrastructure to bolster its diversified portfolio.

Eni is actively driving decarbonization by investing heavily in renewable energy sources and advancing the energy transition. This includes significant capital allocation towards solar and wind power projects, alongside expanding its biorefining capabilities to produce sustainable fuels.

The company is a key player in the development of sustainable aviation fuels (SAF), aiming to reduce the carbon footprint of the aviation sector. Furthermore, Eni is committed to carbon capture and storage (CCS) technologies as a vital component of its emissions reduction strategy.

Eni has established ambitious, science-based targets for reducing its greenhouse gas emissions, aligning its business strategy with global climate goals. For instance, by the end of 2023, Eni reported a 26% reduction in Scope 1 and 2 emissions compared to 2018 levels, demonstrating tangible progress towards its 2030 targets.

Eni, through subsidiaries like Versalis and Enilive, is a frontrunner in developing innovative and sustainable products. They offer advanced biofuels, such as those derived from vegetable oils and waste, and are expanding into sustainable chemicals and polymers. For instance, Enilive's bio-refineries produced approximately 3.7 million tonnes of biofuels in 2023, a significant increase from previous years, demonstrating their commitment to this sector.

These offerings directly address the increasing global demand for environmentally conscious alternatives across various industries. Eni's focus on electric mobility solutions, including charging infrastructure and battery services, further solidifies their position as a provider of sustainable solutions. In 2024, Eni announced plans to invest over €1 billion in its bio-refinery in Porto Marghera, Italy, to further enhance its sustainable product portfolio.

Operational Excellence and Efficiency

Eni is dedicated to achieving top-tier operational efficiency and making smart capital allocation decisions. This focus spans both its established oil and gas operations and its growing transition businesses, all aimed at unlocking maximum value and refining its overall portfolio.

In 2024, Eni reported significant progress in this area. For instance, its upstream segment saw a production cost reduction of 5% compared to the previous year, driven by digitalization and process optimization initiatives. This commitment to efficiency is directly reflected in its financial performance, with a notable improvement in its EBITDA margin for the first half of 2024, reaching 45%.

- Disciplined Capital Allocation: Eni strategically invests in projects with high returns, balancing traditional energy security with investments in decarbonization.

- Efficiency Gains: The company actively pursues cost reductions through technological advancements and streamlined operations, evident in its lower production costs.

- Portfolio Optimization: Eni continuously reviews and adjusts its asset base to focus on areas offering the best risk-adjusted returns and strategic alignment.

- Transition Business Integration: Operational excellence is being applied to new energy ventures, ensuring they contribute effectively to Eni's overall value proposition.

Long-Term Partnerships and Local Development

Eni is committed to fostering enduring, mutually beneficial relationships with the nations and communities where it operates. This commitment translates into tangible contributions to local economic growth, job creation, and social progress. For instance, in 2024, Eni's operations directly supported thousands of local jobs across its global portfolio, with a significant portion of procurement spending directed towards local suppliers.

The company actively engages in initiatives aimed at enhancing social inclusion and community well-being. These efforts often focus on education, healthcare, and infrastructure development, creating lasting positive impacts. In 2023, Eni invested over €100 million in social responsibility projects worldwide, demonstrating a clear dedication to shared value creation.

- Long-term relationship building with host countries.

- Contribution to local employment and economic development.

- Focus on social inclusion through community initiatives.

- Commitment to shared value creation beyond core operations.

Eni provides a diverse energy mix, including oil, natural gas, LNG, and electricity, ensuring reliable energy security. This diversification is further strengthened by a strategic expansion of its LNG portfolio, as seen in 2024 with new supply agreements and infrastructure investments.

The company is a leader in decarbonization, investing in renewables like solar and wind, and advancing biorefining capabilities. Eni is also a key player in sustainable aviation fuels and carbon capture technologies, underscoring its commitment to environmental solutions.

Eni's value proposition centers on operational efficiency and disciplined capital allocation across both traditional and transition businesses. This focus yields tangible results, such as a 5% production cost reduction in upstream operations in 2024 and a 45% EBITDA margin in the first half of 2024.

Eni actively cultivates strong relationships with host countries and communities, contributing to local economies through job creation and procurement. In 2023, the company invested over €100 million in social responsibility projects, demonstrating a commitment to shared value.

| Value Proposition | Description | 2023/2024 Data Point |

| Diverse Energy Supply & Security | Providing a broad range of energy sources to meet global demand. | Expansion of global LNG footprint in 2024. |

| Decarbonization & Energy Transition | Investing in renewables, biofuels, and carbon capture for a sustainable future. | €1 billion investment in Porto Marghera bio-refinery announced in 2024. |

| Operational Efficiency & Value Maximization | Driving cost reductions and smart capital allocation for optimal returns. | 5% production cost reduction in upstream in 2024; 45% EBITDA margin (H1 2024). |

| Sustainable Products & Innovation | Developing advanced biofuels and sustainable chemicals. | 3.7 million tonnes of biofuels produced by Enilive in 2023. |

| Community Engagement & Shared Value | Contributing to local economic growth and social progress. | Over €100 million invested in social responsibility projects in 2023. |

Customer Relationships

For its significant industrial, commercial, and governmental clients, Eni cultivates deep relationships through dedicated account managers. These specialists act as direct points of contact, ensuring Eni’s energy solutions are precisely tailored to each client's unique operational needs and strategic objectives. This personalized approach is crucial for fostering robust, long-term business partnerships.

These dedicated managers are instrumental in negotiating complex energy contracts, often involving multi-year commitments and sophisticated pricing structures. They also provide essential technical support, helping clients optimize their energy consumption and integrate Eni’s offerings seamlessly into their existing infrastructure. For instance, Eni's focus on B2B relationships saw them secure substantial long-term gas supply agreements in 2024, reinforcing their commitment to these key client segments.

Eni heavily relies on its digital platforms, including its website and dedicated mobile apps, to engage with retail customers across its electricity, gas, and mobility sectors. These digital touchpoints are crucial for managing accounts, making payments, and accessing important service information, significantly boosting customer convenience.

In 2023, Eni reported a substantial increase in digital customer interactions, with over 80% of its retail customers utilizing online channels for their primary service needs. The company's mobile app alone saw a 25% year-over-year growth in active users by the end of 2023, highlighting a strong shift towards self-service options.

Eni actively cultivates community relationships through dedicated social programs and environmental initiatives in its host countries. For instance, in 2023, Eni invested over €100 million in social and environmental projects, focusing on education, health, and sustainable development in operational areas.

These engagements are crucial for building trust and securing a social license to operate, demonstrating Eni's commitment to social inclusion. This approach fosters positive interactions and mutual understanding, vital for long-term operational success.

Investor Relations and Transparency

Eni actively cultivates investor relations by providing detailed financial reports, sustainability updates, and strategic presentations. This commitment to transparency ensures shareholders and stakeholders remain well-informed about the company's performance and direction. For instance, Eni's 2023 Integrated Report detailed significant progress in its decarbonization strategy and financial results, underscoring its dedication to open communication.

The company's investor relations efforts are designed to build and maintain trust. They offer regular updates through various channels, including webcasts of earnings calls and investor conferences. In 2024, Eni continued to emphasize its long-term value creation strategy, highlighting investments in renewable energy and the circular economy.

- Financial Reporting: Eni publishes quarterly and annual financial statements, adhering to international accounting standards, with its 2023 revenue reaching €103.7 billion.

- Sustainability Reports: The company provides comprehensive ESG (Environmental, Social, and Governance) data, demonstrating its commitment to sustainable practices and reporting on key metrics like Scope 1, 2, and 3 emissions.

- Investor Engagement: Eni regularly hosts investor days and meetings to discuss its strategy, operational performance, and outlook, fostering direct dialogue with the financial community.

- Governance Transparency: Information on board structure, executive compensation, and corporate governance policies is readily available, ensuring accountability to shareholders.

Partnerships with Research and Academic Institutions

Eni actively cultivates partnerships with leading research and academic institutions to drive innovation and address critical energy challenges. These collaborations are vital for fostering a pipeline of skilled talent and staying at the forefront of technological advancements.

These strategic alliances enable Eni to explore cutting-edge solutions in areas like decarbonization and digital transformation, directly supporting its long-term sustainability and growth objectives. For instance, Eni's commitment to R&D, which saw significant investment in 2024, is often bolstered by joint projects with universities.

- Fostering Innovation: Collaborations accelerate the development of new technologies and sustainable energy solutions.

- Talent Attraction: Partnerships provide access to emerging talent, internships, and specialized expertise.

- Addressing Energy Challenges: Joint research tackles complex issues such as carbon capture, utilization, and storage (CCUS) and the development of advanced biofuels.

- Knowledge Exchange: These relationships facilitate the sharing of scientific knowledge and best practices, benefiting both Eni and the academic community.

Eni's customer relationships span a broad spectrum, from highly personalized B2B interactions to widespread digital engagement with retail consumers. For its large industrial clients, dedicated account managers ensure tailored energy solutions and manage complex, long-term contracts, fostering deep partnerships. This approach was evidenced by substantial long-term gas supply agreements secured in 2024.

For retail customers, Eni leverages digital platforms like its website and mobile apps for account management and service access, enhancing convenience. By the end of 2023, over 80% of retail customers used online channels, with a 25% year-over-year increase in mobile app users, indicating a strong preference for self-service.

Beyond commercial ties, Eni builds trust through community engagement, investing significantly in social and environmental projects in its operational areas, with over €100 million allocated in 2023 for initiatives in education, health, and sustainable development.

Investor relations are maintained through transparent financial reporting, sustainability updates, and strategic presentations, ensuring stakeholders are informed. Eni's 2023 Integrated Report detailed progress in its decarbonization strategy and financial performance, with ongoing emphasis in 2024 on long-term value creation through investments in renewables and the circular economy.

| Customer Segment | Relationship Approach | Key Engagement Channels | 2023/2024 Highlights |

|---|---|---|---|

| Industrial/Commercial/Governmental | Dedicated Account Management, Tailored Solutions, Complex Contract Negotiation | Direct Client Meetings, Technical Support | Secured substantial long-term gas supply agreements (2024) |

| Retail | Digital Self-Service, Account Management, Payment Processing | Website, Mobile Apps | 80% of retail customers use online channels (end of 2023), 25% YoY growth in mobile app users (end of 2023) |

| Community | Social Programs, Environmental Initiatives, Building Trust | Local Project Investment, Stakeholder Engagement | Invested over €100 million in social/environmental projects (2023) |

| Investors | Transparency, Financial Reporting, Strategic Communication | Financial Reports, Sustainability Updates, Investor Days, Webcasts | Detailed 2023 Integrated Report, emphasis on long-term value strategy (2024) |

Channels

Eni's global exploration and production (E&P) operations form the bedrock of its business model, acting as the primary channel for delivering raw energy resources. This extensive network of upstream assets spans diverse geographical regions, enabling the company to extract valuable hydrocarbons from various geological formations across the globe.

In 2024, Eni continued to leverage its E&P capabilities, with a significant focus on developing new discoveries and optimizing existing fields. The company reported substantial production volumes, contributing directly to its revenue streams and reinforcing its position as a major energy producer.

Eni's refineries and biorefineries are crucial channels that transform raw materials into valuable products. These facilities are the backbone of Eni's operations, converting crude oil into traditional fuels and increasingly, bio-feedstocks into sustainable alternatives like biofuels and chemicals.

Eni is significantly investing in expanding its biorefining capabilities. By 2023, Eni had converted two refineries, Venice and Gela, into biorefineries, processing 1.1 million tonnes of feedstock. The company aims to further increase this capacity, with plans to process 2 million tonnes by 2025, demonstrating a clear commitment to a more sustainable product portfolio.

Enilive's extensive retail service station network is a cornerstone of Eni's business model, acting as a primary touchpoint for customers. These branded stations are crucial for distributing fuels, lubricants, and a growing range of electric vehicle charging solutions directly to both individual consumers and businesses.

In 2024, Eni continued to expand its network, focusing on integrating new energy services. For instance, the company aimed to significantly increase its EV charging points across its Italian stations, reflecting a strategic shift towards sustainable mobility solutions.

Wholesale and Trading Desks for Gas, LNG, and Power

Eni's wholesale and trading desks are vital conduits for distributing natural gas, LNG, and power. These operations connect Eni's production and procurement capabilities with a diverse global customer base, including major industrial consumers, utility providers, and fellow energy sector participants. This strategic positioning allows Eni to manage market volatility and secure stable revenue streams.

These channels are instrumental in executing Eni's long-term supply agreements, ensuring reliable energy delivery and fostering strong customer relationships. For instance, in 2024, Eni continued to leverage its extensive infrastructure and trading expertise to meet the evolving energy demands of its wholesale clients across Europe and beyond, solidifying its role as a key energy supplier.

- Global Reach: Eni's trading arms operate worldwide, facilitating the movement of gas, LNG, and power to key markets.

- Customer Diversification: Serving industrial clients, utilities, and other energy firms reduces reliance on single market segments.

- Strategic Agreements: Long-term supply contracts underpin the stability and predictability of these wholesale operations.

- Market Expertise: Eni's trading desks utilize deep market knowledge to optimize procurement and sales, managing price risks effectively.

Digital Platforms and Direct Sales for Energy Solutions

Eni leverages digital platforms and direct sales to connect with customers for its Plenitude brand and other energy solutions. This approach allows them to offer electricity, gas, and energy efficiency services directly to both homes and businesses.

In 2024, Plenitude continued to expand its digital offerings, aiming for a seamless customer experience. Their direct sales efforts focus on building relationships and understanding individual customer needs for energy products and services.

- Digital Engagement: Eni's digital platforms facilitate customer onboarding, service management, and access to energy efficiency programs, enhancing customer interaction and convenience.

- Direct Sales Force: A dedicated direct sales team engages with potential clients, providing personalized consultations for electricity, gas, and integrated energy solutions.

- Customer Reach: These channels are crucial for reaching a broad customer base, from individual households seeking to lower utility bills to businesses looking for sustainable energy management.

- Service Expansion: Beyond traditional energy supply, these direct channels are used to promote and sell advanced energy efficiency solutions and renewable energy options.

Eni's channels are diverse, ranging from its upstream E&P operations delivering raw resources to its downstream refineries and biorefineries that create finished products. The Enilive retail network acts as a direct customer interface for fuels and EV charging, while wholesale and trading desks manage large-scale energy distribution. Digital platforms and direct sales for brands like Plenitude offer tailored energy solutions to homes and businesses.

Customer Segments

Industrial and commercial enterprises form a crucial customer segment for Eni, encompassing large-scale consumers like manufacturing firms and diverse commercial businesses. These entities rely heavily on Eni for substantial volumes of oil, natural gas, electricity, and chemical products to power their extensive operations. In 2024, Eni continued to be a key energy supplier to this sector, with industrial clients representing a significant portion of its downstream sales, particularly in refined products and petrochemicals.

Eni is a crucial supplier of natural gas and a growing provider of renewable energy to power generation companies and utilities. These entities rely on Eni's energy sources to produce electricity for residential, commercial, and industrial consumers.

In 2024, Eni continued to be a significant player in the European energy market, with its natural gas sales supporting a substantial portion of power generation. The company's strategic shift towards renewables means it is increasingly providing solar and wind power to these same utility customers, aligning with decarbonization goals.

Eni, through its Plenitude brand, is a key provider of gas and electricity to millions of households. In 2024, Plenitude continued to expand its customer base, focusing on renewable energy solutions for homes.

For individual motorists, Eni's Enilive brand offers a comprehensive suite of products and services. This includes traditional fuels, high-quality lubricants, and increasingly, electric vehicle charging solutions at its service stations across Europe.

Governments and National Oil Companies

Governments and National Oil Companies are key partners for Eni, particularly in securing exploration and production agreements. These collaborations are vital for accessing new reserves and developing energy infrastructure within host countries. Eni’s engagement ensures alignment with national energy policies and contributes to the local economy.

Eni works closely with these entities to develop critical energy infrastructure, such as pipelines and processing facilities, which are essential for national energy supply. In 2024, Eni continued to focus on projects that support energy security and transition in the regions where it operates, often in partnership with state-owned enterprises.

- Exploration and Production Agreements: Eni negotiates licenses and concessions with governments and NOCs to explore for and produce hydrocarbons.

- Infrastructure Development: Collaborations extend to building and operating energy infrastructure like LNG terminals and pipelines.

- National Energy Supply: Eni contributes to meeting domestic energy demand through its production and supply agreements.

- Regulatory Compliance: Adherence to national laws and regulations is paramount in these partnerships.

Aviation and Shipping Industries

The aviation and shipping industries are becoming crucial customer segments for Eni as it pivots towards decarbonization. Eni's investment in Sustainable Aviation Fuel (SAF) production is directly targeting airlines seeking to reduce their environmental impact. For instance, Eni's Venice refinery is a key site for SAF production, with plans to increase output significantly.

Similarly, the shipping sector's drive for lower emissions creates a strong demand for Eni's developing portfolio of low-carbon marine fuels. This includes biofuels and potentially other alternative fuels designed to meet stringent international maritime regulations. Eni's strategic focus on these transport sectors aligns with global efforts to achieve net-zero emissions by mid-century.

- Targeting Decarbonization: Eni's SAF production directly addresses the aviation industry's need to lower its carbon footprint, a critical factor in meeting regulatory and consumer demands.

- Expanding Marine Fuel Offerings: The company is developing low-carbon fuel options for shipping, responding to the sector's significant push for environmental compliance and sustainability.

- Strategic Investment in Venice: Eni's commitment is evidenced by its Venice refinery, a hub for SAF production, with ongoing expansion to meet growing market demand.

- Alignment with Global Goals: These efforts position Eni to capitalize on the transport sector's transition towards sustainability, supporting broader climate objectives.

Eni's diverse customer base extends to specialized industrial sectors, including chemicals and manufacturing, which depend on Eni's refined products and petrochemicals. The company also serves the automotive sector through its Enilive brand, offering fuels, lubricants, and expanding EV charging infrastructure.

Cost Structure

Eni's exploration and production (E&P) activities incur substantial costs. These include the expenses for exploring new oil and gas reserves, appraising their commercial viability, developing the fields, and the ongoing operational costs of extraction and maintenance. For instance, drilling new wells and maintaining existing ones represent significant capital and operational expenditures.

In 2023, Eni reported exploration and production capital expenditures of €4.5 billion, reflecting their commitment to disciplined investment in this core area. This figure highlights the substantial financial resources allocated to securing future energy supplies and maintaining production levels.

Eni's cost structure heavily relies on refining and manufacturing expenses. These encompass the operational and maintenance costs for its refineries, biorefineries, and chemical plants. In 2024, Eni continued to invest in modernizing its facilities, which contributes to these ongoing operational costs.

A significant portion of these refining and manufacturing costs is tied to raw material procurement, particularly crude oil and natural gas. Energy consumption for plant operations is another major expense. For instance, in the first half of 2024, Eni's upstream segment, which feeds its refining operations, saw significant production volumes, directly impacting raw material costs.

Furthermore, environmental compliance and sustainability initiatives add to the cost structure. This includes investments in reducing emissions and adapting to stricter regulations. Eni's commitment to energy transition, including the development of biorefineries, also involves upfront and ongoing operational expenditures that are factored into this category.

Eni's logistics and distribution expenses are substantial, covering the transportation of crude oil, natural gas, LNG, and refined products. These costs are fundamental to their operations, ensuring energy reaches consumers and industrial clients.

In 2024, Eni's significant investments in maintaining and operating its extensive network of pipelines, storage facilities, and service stations directly contribute to these costs. For instance, the company's commitment to expanding its LNG infrastructure, including regasification terminals, adds to the capital and operational expenditures within this category.

Research and Development Investments

Eni places significant emphasis on Research and Development (R&D) as a cornerstone of its business model, particularly to fuel its ambitious energy transition strategy. These investments are crucial for developing innovative solutions across various energy sectors.

The company's R&D efforts are strategically directed towards advancing technologies in hydrocarbon extraction, aiming for greater efficiency and reduced environmental impact. Simultaneously, Eni is heavily investing in renewable energy sources, exploring and scaling up solar, wind, and other sustainable power generation methods. Furthermore, substantial resources are allocated to carbon capture, utilization, and storage (CCUS) technologies, as well as the development of sustainable chemistry and circular economy initiatives, all designed to decarbonize its operations and create new value chains.

In 2023, Eni's R&D expenditure was €1.3 billion, a notable increase from previous years, reflecting its commitment to innovation. This spending is distributed across several key areas:

- Hydrocarbon Extraction Technologies: Focusing on enhanced oil recovery and efficient gas production.

- Renewable Energy Development: Investing in solar PV, wind power, and battery storage solutions.

- Carbon Capture and Storage (CCS): Advancing technologies to mitigate CO2 emissions from industrial processes.

- Sustainable Chemistry and Biofuels: Developing advanced biofuels and chemical recycling processes.

Personnel and Administrative Costs

Eni's personnel and administrative costs are a substantial component of its business model, reflecting its global operations and large workforce. These expenses encompass salaries, comprehensive benefits packages, and ongoing training programs designed to maintain a skilled and motivated team. In 2023, Eni reported employee-related costs that were a significant factor in its operational expenditures.

The company's commitment to its approximately 31,000 employees worldwide translates into considerable investment in human capital. This includes not only direct compensation but also the general administrative overhead required to support such a diverse and geographically dispersed organization. These costs are fundamental to Eni's ability to execute its strategy across exploration, production, refining, and marketing segments.

- Salaries and Wages: A primary driver of personnel costs, reflecting compensation for Eni's global workforce.

- Employee Benefits: Includes health insurance, retirement plans, and other welfare provisions for employees.

- Training and Development: Investment in skill enhancement and professional growth for Eni's staff.

- Administrative Overhead: General operational expenses related to managing a large, international organization.

Eni's cost structure is dominated by significant capital and operational expenditures in exploration and production, refining, and logistics. These are directly influenced by raw material costs, energy consumption, and investments in infrastructure and technology. For instance, in 2023, Eni's exploration and production capital expenditures reached €4.5 billion, underscoring the substantial investment required to secure and extract energy resources.

Research and development, particularly for the energy transition, also represents a considerable cost. In 2023, Eni invested €1.3 billion in R&D, focusing on areas like advanced biofuels, carbon capture, and renewable energy technologies. Personnel and administrative costs, supporting a global workforce of approximately 31,000 employees, are also a significant ongoing expense.

Revenue Streams

Eni's core revenue generation hinges on the sale of crude oil and natural gas produced through its extensive upstream activities worldwide. These commodities are primarily sold to refiners, trading houses, and various industrial clients, forming the bedrock of the company's financial performance.

In 2024, Eni's upstream segment, which encompasses exploration and production, continued to be a significant contributor to its overall revenue. The company's ability to extract and market these vital energy resources directly impacts its profitability, reflecting global energy demand and commodity prices.

Eni generates significant revenue from selling refined petroleum products like gasoline, diesel, and lubricants. This occurs through its vast network of service stations and wholesale distribution, reaching a broad customer base.

In 2024, Eni's refining and marketing segment, which includes these sales, is a cornerstone of its financial performance. For instance, during the first quarter of 2024, Eni reported strong results in its G&M (Gas & Power Marketing) segment, which is closely tied to its refined product sales, showcasing the ongoing importance of this revenue stream.

Eni's revenue from Liquefied Natural Gas (LNG) sales is experiencing robust growth, fueled by an expanding global portfolio and new supply agreements. This expansion is crucial as the world increasingly relies on LNG for energy security and diversification.

In 2023, Eni's upstream segment, which includes LNG production and sales, reported strong performance. While specific LNG revenue figures are often embedded within broader segment reporting, the company's overall strategy emphasizes increasing its LNG market share. For instance, Eni secured a significant agreement in 2023 to supply LNG to Germany, demonstrating tangible progress in its portfolio expansion.

Sales of Electricity from Renewable Sources

Eni, through its subsidiary Plenitude, generates revenue by selling electricity produced from its expanding network of renewable energy assets, primarily solar and wind farms. This direct sales model is a core component of its clean energy strategy. For instance, by the end of 2023, Plenitude's installed capacity reached 7.7 GW, with a significant portion from renewables, contributing directly to its financial performance.

The company's revenue streams from electricity sales are bolstered by a growing global presence. In 2024, Eni continued to invest heavily in expanding its renewable portfolio, aiming to further increase the volume of electricity available for sale. This expansion directly translates into higher revenue generation as more clean energy enters the market.

- Sales of electricity from Plenitude's solar and wind farms.

- Revenue growth driven by increasing installed renewable capacity.

- Contribution to Eni's overall financial performance through clean energy sales.

Sales of Biofuels and Sustainable Chemical Products

Eni is increasingly focusing on revenue from biofuels and sustainable chemicals. This includes the sale of advanced biofuels, notably Sustainable Aviation Fuel (SAF), and a range of specialized chemical products derived from its revamped Versalis business. These are key growth areas for the company.

In 2024, Eni's commitment to the energy transition is evident in its investments and production targets for biofuels. For instance, the company aims to significantly increase its SAF production capacity. This strategic pivot aims to capture a growing market driven by environmental regulations and corporate sustainability goals.

- Sustainable Aviation Fuel (SAF): Eni is expanding its production of SAF, a crucial component for decarbonizing the aviation sector.

- Bio-based Chemicals: Versalis, Eni's chemical company, is developing and marketing chemical products derived from renewable feedstocks.

- Market Growth: The global market for biofuels and bio-based chemicals is projected for substantial growth, driven by sustainability mandates and consumer demand.

- Strategic Importance: These revenue streams represent a vital part of Eni's strategy to diversify away from traditional fossil fuels and build a more sustainable business portfolio.

Eni's revenue is also significantly boosted by its gas and power marketing operations. This segment involves the trading and sale of natural gas and electricity to a wide range of customers, including utilities, industrial users, and retail consumers. The company leverages its integrated value chain, from production to end-user delivery, to optimize these sales.

In 2024, Eni's Gas & Power segment has demonstrated resilience and strategic importance. For example, in the first quarter of 2024, Eni reported that its integrated G&M (Gas & Power Marketing) business achieved an adjusted operating profit of €1.75 billion, highlighting the substantial revenue generated from these activities and its contribution to the company's overall financial health.

| Revenue Stream | Description | 2024 Relevance/Data |

| Gas & Power Marketing | Trading and sale of natural gas and electricity to diverse customers. | Q1 2024 adjusted operating profit of €1.75 billion for the integrated G&M business. |

Business Model Canvas Data Sources

The Eni Business Model Canvas is built using a combination of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse sources ensure each component of the canvas is grounded in accurate and relevant information.