Eni Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

Uncover the strategic positioning of key products within the Eni BCG Matrix, identifying potential Stars, Cash Cows, Dogs, and Question Marks. This glimpse offers a foundational understanding of their market performance. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize Eni's product portfolio and drive future growth.

Stars

Plenitude, Eni's integrated energy unit focusing on renewables and retail, is a prime example of a Star in the BCG matrix. Its installed renewable capacity saw a substantial 37% surge in 2024, reaching 4.1 GW, and continued its upward trajectory to 4.5 GW by early 2025. This rapid expansion highlights its strong market presence in the burgeoning renewable energy sector.

The company's ambitious growth strategy projects an increase to over 8 GW of installed capacity by 2027. Furthermore, Plenitude anticipates its EBITDA to nearly triple between 2024 and 2030, underscoring its robust financial outlook and dominance in a high-growth, high-share market segment.

Enilive is a strong contender in the Star category due to its significant advancements in Hydrogenated Vegetable Oil (HVO) biofuels. The company aims to boost its biorefining capacity to over 5 million tons annually by 2030, with a particular focus on increasing Sustainable Aviation Fuel (SAF) production.

The market's confidence in Enilive's sustainable mobility initiatives is further solidified by KKR's increased investment, raising their stake to 30%. This substantial backing highlights the perceived high growth trajectory and market demand for environmentally friendly fuel alternatives.

Eni's Carbon Capture and Storage (CCS) business, exemplified by its operational Ravenna CCS project in Italy and UK ventures, positions it as an early leader in a burgeoning decarbonization sector. This strategic focus is highlighted by ongoing discussions to divest a substantial stake to Global Infrastructure Partners (BlackRock) for $1.2 billion, underscoring the segment's significant valuation and growth potential.

The company's commitment is further solidified by its plan to establish a new CCUS satellite company in 2025, reinforcing its leadership in this critical environmental technology.

Major New Oil & Gas Developments

Eni's strategic investments in major upstream developments, exemplified by the Congo LNG project, position it strongly in high-growth segments. The first cargo from Congo LNG shipped in February 2024, marking a significant milestone. This project is on track to enhance liquefaction capacity, contributing substantially to Eni's portfolio.

These developments are crucial for bolstering Eni's supply to international markets, with a particular emphasis on Europe. The company is leveraging its expertise to secure a significant market share in expanding gas export markets, reinforcing its competitive edge.

- Congo LNG Project: Launched first cargo in February 2024, with ongoing capacity expansion.

- Market Focus: Supplying new gas volumes to international markets, especially Europe.

- Market Share: Aiming for high market share in growing gas export regions.

- Strategic Importance: Critical for Eni's upstream growth and energy security contributions.

Strategic Acquisitions for Upstream Growth

Eni's strategic acquisitions, notably the Neptune Energy deal and the merger with Ithaca Energy, are prime examples of Stars in the BCG matrix, driving significant upstream growth. These moves bolster Eni's presence in crucial regions like the UK Continental Shelf, enhancing its gas production capacity and widening its geographical reach.

The integration of Neptune Energy, a transaction valued at approximately $4.9 billion in 2023, immediately amplified Eni's production volumes. This acquisition is projected to contribute around 130,000 boe/d (barrels of oil equivalent per day) in net production, with a substantial portion coming from the UK. It also brings substantial reserves and a portfolio of high-quality, low-emission assets.

Similarly, the merger with Ithaca Energy, which closed in early 2023, created a leading independent exploration and production company in the UK North Sea. This consolidation is expected to yield significant synergies and strengthen Eni's competitive position in a key operating area. The combined entity is well-positioned for organic growth and further value creation.

- Neptune Energy Acquisition: Added approximately 130,000 boe/d net production and significant reserves, primarily from the UK Continental Shelf.

- Ithaca Energy Merger: Created a dominant player in the UK North Sea, enhancing Eni's production and growth potential in the region.

- Strategic Rationale: Focus on strengthening gas production capabilities and expanding geographic footprint in key markets.

- Growth Outlook: Immediate boost to production with strong underlying organic growth potential and establishment of dominant positions in targeted areas.

Stars in the BCG matrix represent business units with high market share in high-growth industries. Eni's Plenitude, Enilive, Carbon Capture and Storage (CCS), Congo LNG project, and strategic acquisitions like Neptune Energy and Ithaca Energy all exhibit characteristics of Stars. These segments are experiencing significant growth and Eni holds a strong position within them.

Plenitude's renewable capacity grew to 4.5 GW by early 2025, with ambitious plans to exceed 8 GW by 2027, demonstrating its Star status in the renewable energy sector. Enilive's focus on HVO biofuels and increasing SAF production, backed by KKR's investment, also points to a high-growth, high-share market. Eni's CCS business, with projects like Ravenna CCS and planned new ventures, is positioned to lead in the expanding decarbonization market.

The Congo LNG project, which shipped its first cargo in February 2024, is a key Star, bolstering Eni's position in growing gas export markets, particularly for Europe. Strategic acquisitions, such as Neptune Energy for approximately $4.9 billion in 2023, added around 130,000 boe/d net production, solidifying Eni's presence in high-growth upstream segments and creating dominant positions in key regions like the UK North Sea.

| Business Unit | Market Growth | Market Share | Key Developments (2024-Early 2025) |

|---|---|---|---|

| Plenitude | High (Renewables) | High | Installed capacity reached 4.5 GW by early 2025; 37% surge in 2024. |

| Enilive | High (Biofuels/SAF) | High | Aiming for over 5 million tons annual biorefining capacity by 2030; KKR increased stake to 30%. |

| CCS | High (Decarbonization) | High (Early Leader) | Operational Ravenna CCS project; planning new CCUS satellite company in 2025. |

| Congo LNG | High (LNG Exports) | High | First cargo shipped Feb 2024; capacity expansion underway for European supply. |

| Neptune Energy / Ithaca Energy Acquisitions | High (Upstream Gas) | High | Added ~130,000 boe/d net production; strengthened UK North Sea presence. |

What is included in the product

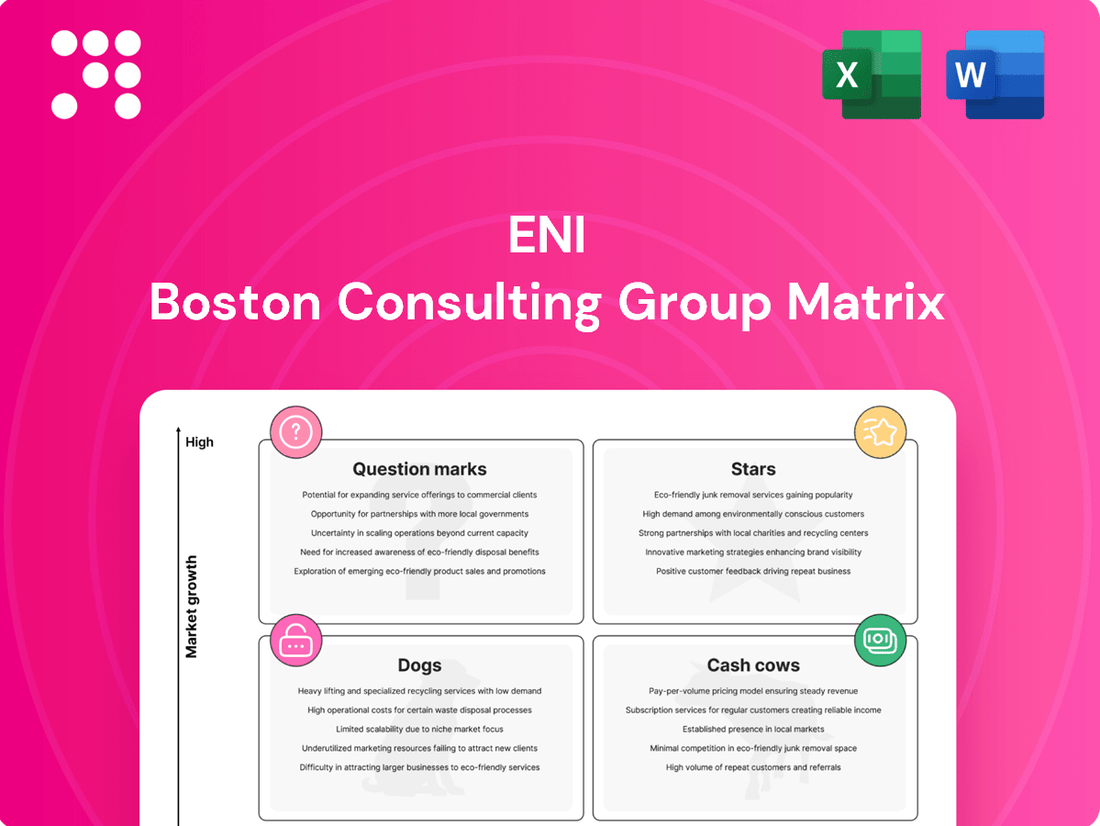

The Eni BCG Matrix provides a strategic overview of a company's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

The Eni BCG Matrix offers a clear, quadrant-based overview, simplifying complex business unit analysis to relieve strategic decision-making pain.

Cash Cows

Eni's mature upstream oil and gas production acts as a classic cash cow, reliably producing significant operating cash flow. This segment is the bedrock of Eni's financial stability.

In 2024, despite fluctuating market conditions, Eni's exploration and production activities saw a 3% rise in oil and gas output. This growth directly bolstered the company's proforma adjusted EBIT, underscoring the segment's importance.

The consistent earnings from these established fields provide the crucial financial muscle needed for Eni to fund strategic investments in emerging, higher-growth business ventures and technologies.

The Global Gas & LNG Portfolio (GGP) is a cornerstone of Eni's business, firmly positioned as a Cash Cow within the BCG Matrix. Its established trading operations consistently generate robust economic results, evidenced by a proforma adjusted EBIT of €1.1 billion in 2024.

This segment, responsible for the supply, trading, and marketing of gas and LNG, acts as a dependable engine for cash flow generation. Eni's strategic optimization of this portfolio, coupled with its extensive infrastructure and deep market relationships, allows GGP to maintain strong profit margins and unwavering resilience.

Eni's refining and marketing segment, including its over 5,000 Enilive stations across Europe, remains a significant cash generator. Despite facing some market pressures in 2024, this segment boasts a substantial market share, ensuring a steady, albeit variable, flow of income.

The company's strategic pivot towards biorefining is designed to bolster future earnings and environmental credentials. This move leverages Eni's existing infrastructure, positioning it to capitalize on evolving market demands for more sustainable fuel options.

Retail Gas and Power Sales (Plenitude's core customer base)

Plenitude's retail gas and power sales represent a significant cash cow within its business portfolio. The company boasts an established customer base exceeding 10 million individuals in the retail energy market, providing a consistent and substantial inflow of revenue from electricity and gas sales.

This extensive retail network, primarily operating in mature markets, generates stable cash flow. Despite Plenitude's investments in high-growth renewable energy assets, the predictable earnings from its widespread retail operations anchor this segment as a reliable cash cow.

- Established Customer Base: Over 10 million retail energy customers.

- Steady Cash Flow: Consistent revenue from electricity and gas sales.

- Mature Market Presence: Low promotional investment required due to established market position.

Dividend and Shareholder Returns

Eni's commitment to robust shareholder returns, including a 5% dividend increase to €1.05 per share and a buy-back program of at least €1.5 billion planned for 2025, highlights its position as a cash cow. This strategy is underpinned by a strong cash-generating business model and a disciplined financial approach.

The company's financial strength is further evidenced by its plan to return over €5 billion to shareholders in 2024. This substantial figure demonstrates consistent cash generation that exceeds operational requirements, a hallmark of a mature and highly profitable business.

- Dividend Increase: Eni raised its dividend by 5% to €1.05 per share.

- Share Buy-back Program: A buy-back program of at least €1.5 billion is planned for 2025.

- Total Shareholder Returns (2024): Over €5 billion is expected to be returned to shareholders in 2024.

- Financial Strategy: Disciplined financial management supports these substantial returns.

Eni's mature upstream oil and gas operations are prime examples of cash cows, consistently generating substantial operating cash flow. This segment, which saw a 3% rise in oil and gas output in 2024, is fundamental to Eni's financial stability.

The Global Gas & LNG Portfolio (GGP) is another key cash cow, delivering robust economic results with a proforma adjusted EBIT of €1.1 billion in 2024. Its established trading operations and extensive infrastructure ensure stable cash generation.

Plenitude's retail gas and power sales, serving over 10 million customers, also function as a cash cow. The predictable earnings from this mature market presence provide a reliable income stream, underpinning Eni's overall financial strength.

| Segment | BCG Classification | Key Financial Indicator (2024) | Supporting Data |

|---|---|---|---|

| Upstream Oil & Gas | Cash Cow | Increased Output | 3% rise in oil and gas output |

| Global Gas & LNG Portfolio (GGP) | Cash Cow | Proforma Adjusted EBIT | €1.1 billion |

| Plenitude Retail Energy | Cash Cow | Customer Base | Over 10 million retail energy customers |

Delivered as Shown

Eni BCG Matrix

The BCG Matrix document you are previewing is the identical, fully completed report you will receive immediately after your purchase. This means you'll get the complete analysis, without any watermarks or placeholder text, ready for your strategic decision-making. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the final product.

Dogs

Eni's basic chemicals segment, operated by Versalis, has been a considerable financial burden. Over the past 15 years, this division has accumulated nearly €7 billion in losses, with a substantial €3 billion of that occurring in the last five years alone.

Operating within a contracting European market, Eni is strategically reducing its involvement in basic chemicals. This includes plans to phase out specific cracking and polyethylene plants, aiming to mitigate ongoing financial strain.

The current performance of Versalis's basic chemicals operations is significantly under par, with the segment not projected to achieve positive EBIT until 2027, underscoring the challenges it faces.

Eni's traditional refining assets, while undergoing a strategic shift towards biorefining, are currently experiencing headwinds. The refining and chemicals division posted a proforma adjusted EBIT loss in the fourth quarter of 2024, highlighting the challenges these units face.

Factors such as weak crack spreads, reduced throughput volumes, and elevated energy costs have significantly impacted the profitability of these specific refining operations. These underperforming assets are therefore being considered for strategic repositioning, which could involve transformation or divestment as Eni prioritizes its biorefining initiatives.

Eni's divestment of non-core upstream assets, including its sale of permits in Congo to Perenco in March 2024 for an undisclosed sum, exemplifies a strategic shift. This move, alongside disposals in Nigeria and Alaska, signals a focus on optimizing its portfolio by shedding lower-performing or less strategically aligned assets.

Legacy Petroleum Marketing Infrastructure in Declining Markets

Eni's legacy petroleum marketing infrastructure, particularly those segments not being repurposed for sustainable mobility, face significant headwinds in markets with declining fossil fuel demand. These assets could be categorized as having low growth potential and a shrinking market share as the global energy transition accelerates.

The company's strategic emphasis on Enilive's sustainable mobility solutions signals a clear pivot away from traditional, solely conventional fuel station models. This suggests a proactive approach to managing and potentially divesting or reconfiguring these legacy assets to align with future energy landscapes.

- Declining Demand: Infrastructure tied to traditional gasoline and diesel sales is experiencing a structural decline in demand as electric vehicles and alternative fuels gain traction.

- Low Market Share Potential: Without adaptation, these legacy petroleum assets are unlikely to capture significant market share in a transitioning energy sector.

- Strategic Shift: Eni's investment in Enilive indicates a deliberate move towards sustainable mobility, reducing reliance on conventional fuel marketing.

- 2024 Context: By 2024, many regions are seeing accelerated adoption of EVs, further pressuring the profitability and relevance of purely petroleum-focused marketing infrastructure.

Older, Less Efficient Exploration Blocks

Older, less efficient exploration blocks are those where past drilling efforts have resulted in only marginal discoveries or have proven to be geologically difficult, leading to high development expenses and limited potential for profitable returns. These areas often represent mature fields with declining production or complex geological structures that make further extraction economically unviable.

While specific details on Eni's divestment or abandonment of such blocks aren't always highlighted in public disclosures, the company's overarching strategy to concentrate upstream investments on significant, high-potential projects implicitly involves a pruning of less promising exploration ventures. This approach ensures capital is allocated to areas with a greater likelihood of generating substantial future growth and enhancing market position.

By rationalizing these less efficient exploration efforts, Eni can redirect resources toward more promising opportunities, thereby improving overall operational efficiency and maximizing the return on its exploration and production portfolio. This strategic focus is crucial for maintaining competitiveness in a dynamic energy market.

- Focus on High-Potential Projects: Eni's upstream strategy prioritizes major developments, implying a de-emphasis on marginal exploration areas.

- Resource Allocation: Shifting resources from inefficient blocks to promising ones enhances capital efficiency.

- Geological Challenges: Older blocks often present increased geological complexity, driving up development costs.

- Return on Investment: Low potential returns from these mature or difficult blocks make them less attractive for continued investment.

Eni's basic chemicals segment, primarily operated by Versalis, represents a significant challenge within the company's portfolio, fitting the description of a 'Dog' in the BCG Matrix. This division has accumulated substantial losses, with nearly €7 billion lost over the past 15 years, including €3 billion in the last five years alone. Operating in a shrinking European market, Eni is actively reducing its exposure to basic chemicals, planning to phase out certain plants to curb ongoing financial drains.

The refining and chemicals division, including traditional refining assets, is also under pressure. In the fourth quarter of 2024, this segment reported a proforma adjusted EBIT loss, impacted by weak crack spreads, lower throughput, and high energy costs. This underperformance suggests these assets may require strategic repositioning, transformation, or divestment as Eni focuses on its biorefining initiatives.

Legacy petroleum marketing infrastructure, particularly those not adapted for sustainable mobility, also falls into the 'Dog' category. With declining demand for fossil fuels and increasing electric vehicle adoption, these assets have low growth potential and a shrinking market share. Eni's strategic pivot towards Enilive's sustainable mobility solutions underscores a move away from these conventional fuel station models.

Older, less efficient exploration blocks with marginal discoveries or high development costs also represent 'Dogs'. These areas, often mature fields with declining production or complex geology, offer limited potential for profitable returns. Eni's strategy to focus upstream investments on significant, high-potential projects implicitly involves pruning these less promising ventures to improve capital efficiency and overall portfolio performance.

| Eni Business Segment | BCG Matrix Category | Key Challenges & Rationale |

|---|---|---|

| Basic Chemicals (Versalis) | Dog | Significant accumulated losses (€7bn over 15 years), contracting market, low projected EBIT positive until 2027. |

| Traditional Refining Assets | Dog | Q4 2024 proforma adjusted EBIT loss, weak crack spreads, reduced throughput, high energy costs, requiring strategic repositioning. |

| Legacy Petroleum Marketing Infrastructure | Dog | Declining demand for fossil fuels, increasing EV adoption, low growth potential, shrinking market share without adaptation. |

| Older, Less Efficient Exploration Blocks | Dog | Marginal discoveries, high development costs, declining production, complex geology, limited profitable return potential. |

Question Marks

Eni's new frontier oil and gas exploration projects, like its planned offshore ventures in Libya and ongoing work in Namibia and Angola, are classic examples of Stars or Question Marks in the BCG Matrix. These are high-risk, high-reward plays in underexplored regions, demanding substantial capital investment with uncertain outcomes.

For instance, Eni's 2024 exploration activities in Namibia are focused on unlocking significant deepwater potential, aiming to replicate the successes seen in other African nations. These ventures are characterized by a low current market share but possess the potential for substantial future resource discovery, making them critical for Eni's long-term upstream growth strategy.

Eni's expansion into advanced bio-jet fuel (SAF) positions it as a key player in a rapidly growing, high-potential market. With a target of over 2 million tons by 2030, Eni is actively investing in new production facilities and robust supply chains to secure a significant share of this crucial sector for aviation decarbonization.

This strategic move into SAF production, while requiring substantial capital outlay for scaling, represents a forward-looking investment. It aligns with global efforts to reduce aviation's carbon footprint and taps into a market driven by increasing environmental regulations and demand for sustainable travel solutions.

Eni is actively developing agri-feedstock supply chains to support its biorefining operations, with a target of over 35% of Italian biorefining throughputs by 2027. This initiative places Eni within a rapidly expanding market for sustainable raw materials, driven by increasing demand for biofuels and bio-based products.

While Eni's strategic focus on agri-feedstocks is clear, its direct market share and operational footprint within the agricultural production segment itself are likely in early stages. Building a substantial and reliable supply requires significant investment in cultivation, logistics, and potentially partnerships with agricultural producers.

Emerging Energy Technologies (e.g., Hydrogen, Advanced Batteries)

Eni's exploration into emerging energy technologies like hydrogen and advanced batteries positions them in high-growth, transformative markets where their current market share is minimal. These initiatives, such as evaluating a stationary networked battery factory in Brindisi or pursuing hydrogen projects, represent early-stage ventures.

These ventures require substantial cash outlays for research and development, alongside pilot projects, carrying inherent risks but also offering the potential for significant future returns. For instance, the global green hydrogen market is projected to reach approximately $150 billion by 2030, indicating substantial growth potential.

- Hydrogen: Eni is exploring various hydrogen projects, including potential production facilities and infrastructure development, aiming to capitalize on the growing demand for cleaner fuels.

- Advanced Batteries: The company is evaluating investments in advanced battery technologies, such as stationary networked batteries, to support grid stability and renewable energy integration.

- Market Position: These emerging technologies represent new frontiers for Eni, where they are currently building their market presence and technological capabilities.

- Investment Profile: These are typically cash-consuming, R&D-intensive projects with long-term payoff horizons, characteristic of 'Question Marks' in the BCG matrix.

Global Expansion of Plenitude's Customer Base through Acquisitions

Plenitude's ambitious acquisition strategy, exemplified by its binding offer to acquire Acea Energia, aims to significantly boost its customer base, projecting a growth of over 10%. This aggressive expansion into new customer segments, especially within competitive retail energy markets, positions these acquired entities as Question Marks within the BCG Matrix.

While Plenitude as a whole is considered a Star due to its strong market position and growth potential, integrating these newly acquired customer bases demands considerable investment. Resources are channeled into marketing, upgrading infrastructure, and streamlining integration processes to solidify market share and ensure these acquisitions become long-term contributors.

- Acquisition of Acea Energia: A key move to expand Plenitude's customer base by over 10%.

- Strategic Importance: These acquisitions represent efforts to capture new market segments.

- Investment Needs: Significant capital required for marketing, infrastructure, and integration.

- BCG Classification: New customer bases are categorized as Question Marks, requiring careful management.

Question Marks in Eni's portfolio represent areas with low current market share but high growth potential, demanding significant investment. These are ventures where Eni is establishing a foothold in nascent or rapidly evolving sectors, requiring careful strategic decisions to convert them into future Stars or Stars. Failure to invest adequately or a misjudgment of market dynamics could see them become Dogs.

Eni's exploration in new frontiers like Namibia, its push into advanced bio-jet fuel (SAF), and its investments in hydrogen and battery technologies all fit the Question Mark profile. These are high-risk, high-reward propositions that are crucial for Eni's long-term growth and diversification strategy, reflecting the company's commitment to future energy landscapes.

The strategic acquisitions by Plenitude, such as Acea Energia, also fall into the Question Mark category. While aiming to expand market presence, these new customer bases require substantial investment for integration and development, representing potential future growth engines for the company.

The success of these Question Marks hinges on Eni's ability to allocate capital effectively, manage technological risks, and adapt to evolving market conditions. For instance, the global green hydrogen market's projected growth to approximately $150 billion by 2030 underscores the potential upside for Eni's hydrogen ventures.

| Business Unit/Project | BCG Category | Market Growth | Eni's Market Share | Investment Need |

|---|---|---|---|---|

| Namibia Exploration | Question Mark | High (Deepwater Potential) | Low | High (CAPEX) |

| Bio-Jet Fuel (SAF) | Question Mark | High (Aviation Decarbonization) | Low | High (Production Scale-up) |

| Hydrogen Technology | Question Mark | Very High (Energy Transition) | Very Low | High (R&D, Infrastructure) |

| Advanced Batteries | Question Mark | High (Grid Modernization) | Very Low | High (R&D, Pilot Projects) |

| Plenitude Acquisitions (e.g., Acea Energia customer base) | Question Mark | Moderate to High (Retail Energy Market) | Low (for new segments) | Moderate (Integration, Marketing) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.