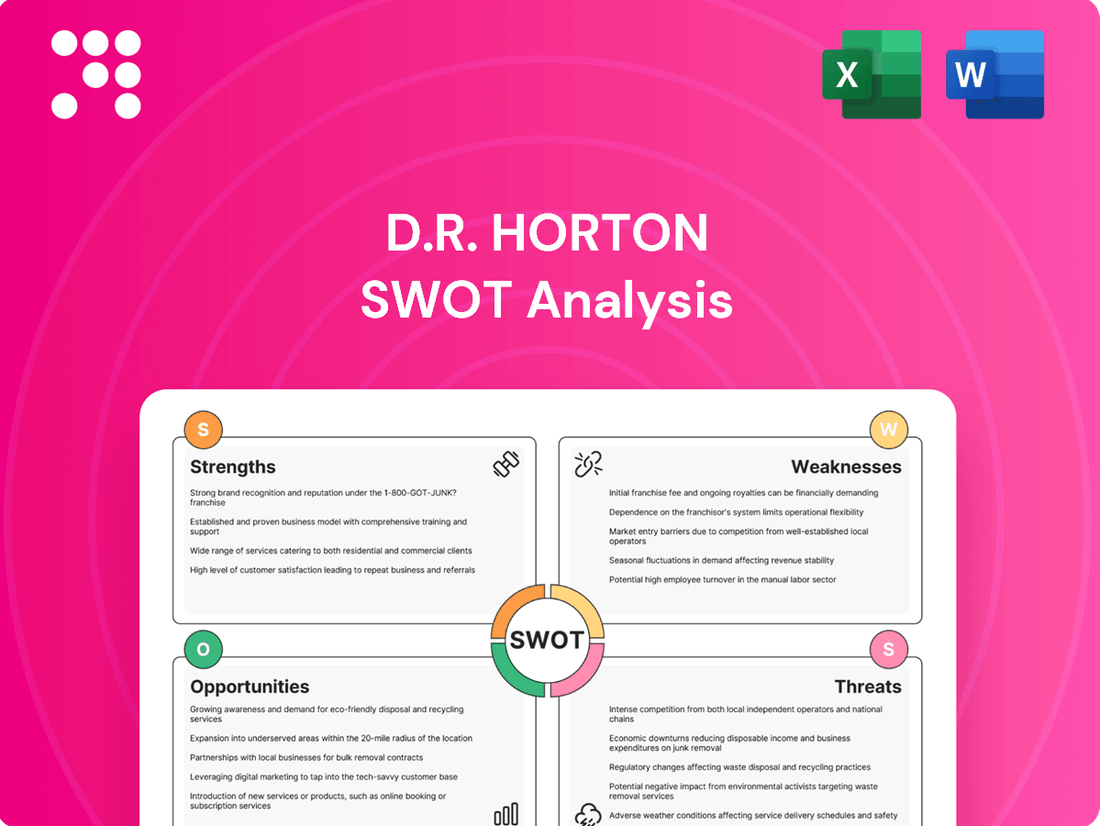

D.R. Horton SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

D.R. Horton, a titan in the homebuilding industry, boasts significant strengths in its scale and diverse product offerings, but also faces challenges from economic shifts and competitive pressures. Understanding these dynamics is crucial for any investor or strategist looking to navigate the housing market.

Want the full story behind D.R. Horton’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

D.R. Horton stands as the undisputed leader in U.S. homebuilding by volume, a position that translates into substantial economies of scale. This scale allows for more favorable pricing on materials and efficient operational management, directly impacting profitability. For instance, in fiscal year 2023, D.R. Horton closed on 87,555 homes, solidifying its top spot and demonstrating its vast operational reach.

D.R. Horton's strength lies in its broad spectrum of homes, from starter houses to more upscale residences, ensuring it appeals to a wide array of buyers. This diverse product line allows the company to capture market share across different economic segments.

A key differentiator is its commitment to affordability, particularly for first-time homebuyers. By offering smaller, more budget-friendly floor plans and employing strategies like mortgage rate buydowns, D.R. Horton effectively navigates economic headwinds and sustains demand. For instance, in the first quarter of fiscal year 2024, the company reported a 16% increase in home closings, demonstrating the success of its affordability focus in a market still influenced by higher interest rates.

D.R. Horton maintains a strong financial position, characterized by low leverage and ample liquidity. This robust balance sheet provides significant flexibility to navigate varying market conditions and pursue growth opportunities.

The company actively returns value to its shareholders. In the first quarter of fiscal year 2024, D.R. Horton repurchased approximately 1.6 million shares of common stock for $189.8 million, demonstrating a consistent commitment to share buybacks.

Extensive Geographic Footprint and Diversification

D.R. Horton's extensive geographic footprint, spanning over 125 markets across 36 states, significantly mitigates risk by reducing reliance on any single region. This broad operational base allows the company to effectively navigate diverse economic conditions and housing market cycles nationwide.

The company's strategic presence in high-growth areas, such as Texas and the Southeast, enables it to capitalize on localized demand surges. For instance, in the first quarter of fiscal year 2024, D.R. Horton reported a 14% increase in total revenue, driven in part by strong performance in these key markets.

- National Reach: Operates in over 125 markets across 36 states, spreading risk and reducing single-market dependency.

- Regional Advantage: Capitalizes on regional demand surges, particularly in high-growth areas like Texas and the Southeast.

- Diversified Revenue Streams: Geographic spread contributes to more stable and diversified revenue generation.

- Market Adaptability: Ability to adjust strategies based on localized market conditions and economic trends.

Integrated Business Model and Operational Efficiency

D.R. Horton's vertically integrated model, covering land acquisition through sales, is a significant strength. This integration allows for greater control over costs and quality throughout the homebuilding process. In 2023, D.R. Horton reported revenues of $32.2 billion, showcasing the scale of its operations and the effectiveness of its integrated approach.

The company's asset-light land strategy, utilizing options for a substantial portion of its land, enhances flexibility and reduces capital tied up in inventory. This approach directly contributes to improved operational efficiency and faster build times, crucial in the dynamic housing market. For example, their ability to manage land efficiently allowed them to close 101,750 homes in fiscal year 2023.

- Vertically Integrated Operations: Controls land, development, construction, and sales for cost and quality management.

- Asset-Light Land Strategy: Utilizes land options to minimize capital intensity and maximize flexibility.

- Operational Efficiency: Streamlined processes contribute to faster build times and improved profitability.

- Scale of Operations: Demonstrated by closing 101,750 homes in fiscal year 2023, reflecting robust operational execution.

D.R. Horton's dominant market share, evidenced by closing 87,555 homes in fiscal year 2023, provides significant economies of scale. This scale translates into better purchasing power for materials and streamlined operational processes, boosting profitability. The company's broad product offering, from starter homes to more premium residences, allows it to capture a diverse customer base, enhancing its market penetration. Furthermore, a strategic focus on affordability, including strategies like mortgage rate buydowns, has proven effective, as seen in a 16% increase in home closings in Q1 FY24.

| Metric | Value (FY23) | Significance |

|---|---|---|

| Homes Closed | 87,555 | Largest U.S. homebuilder by volume, enabling economies of scale. |

| Geographic Markets | 125+ across 36 states | Diversified risk and broad market reach. |

| Total Revenue | $32.2 billion | Demonstrates operational scale and market presence. |

What is included in the product

Analyzes D.R. Horton’s competitive position through key internal and external factors, examining its strengths in market presence and operational efficiency against potential weaknesses in economic sensitivity and opportunities in diverse housing markets, while also considering threats from competition and regulatory changes.

Offers a clear, actionable SWOT analysis for D.R. Horton, addressing the pain point of understanding complex market dynamics and internal capabilities for strategic decision-making.

Weaknesses

D.R. Horton faced margin compression in fiscal 2025, largely driven by increased sales incentives aimed at boosting demand. These incentives, like mortgage rate buy-downs and contributions to closing costs, directly impacted gross profit margins, even as they helped move inventory.

Simultaneously, the company contended with rising input costs across various materials and labor. This dual pressure of higher incentives and increased expenses squeezed profitability, a trend reflected in their financial reports for the period.

D.R. Horton's performance is intrinsically tied to the ebb and flow of the housing market. This means that downturns in the economy, rising interest rates, or a general dip in buyer confidence can significantly impact the company's sales and profitability. For instance, in the first quarter of fiscal year 2024, D.R. Horton reported a 7% decrease in total revenue compared to the same period in the prior year, a clear indicator of this sensitivity.

This cyclical nature means that periods of robust growth can be followed by sharp contractions. The company’s financial results, including net income and revenue, often mirror the broader housing market trends. In the fiscal year ending September 30, 2023, D.R. Horton saw its net income decline by 15.6% year-over-year, highlighting the challenges posed by market volatility and cautious consumer spending in the face of economic uncertainty.

D.R. Horton's reliance on subcontractors for its construction projects, a common practice in the homebuilding industry, can introduce significant risks. A primary concern is maintaining consistent quality control across numerous independent teams. Furthermore, managing this extensive network of subcontractors presents inherent challenges, potentially impacting project timelines and overall efficiency, as seen in the broader construction sector's ongoing labor and material availability issues throughout 2024.

Potential for Inventory Management Challenges

D.R. Horton, like many homebuilders, faces the inherent challenge of managing its inventory effectively, particularly in response to market shifts. While the company strives for optimal turnover, fluctuations in demand and supply chains can create complexities in maintaining ideal inventory levels. This can lead to periods where holding costs might increase or opportunities are missed due to an imbalance between available homes and buyer interest.

Data from recent periods suggests D.R. Horton's inventory turnover, while generally healthy, has shown some variability. For instance, in the fiscal year ending September 30, 2023, D.R. Horton reported total inventory of $17.3 billion. While this represents a significant asset, a comparative analysis against industry peers often highlights areas where operational efficiencies in inventory management could be further enhanced. A slightly lower turnover ratio compared to some competitors might indicate potential for streamlining processes to accelerate sales and reduce carrying costs.

- Inventory Turnover Ratio: While specific comparative ratios fluctuate, D.R. Horton's efficiency in moving inventory is a key performance indicator.

- Market Sensitivity: The housing market's cyclical nature directly impacts inventory management, requiring agile responses to demand changes.

- Operational Efficiency: Opportunities may exist to refine supply chain and construction processes to improve inventory turnover and reduce holding expenses.

Impact of Declining Average Selling Prices

D.R. Horton has experienced a slight dip or stabilization in its average selling price (ASP) for homes. This is partly due to a strategic focus on more budget-friendly housing options and the necessity of offering incentives to buyers. For instance, in the fiscal first quarter of 2024, the company reported an average selling price of $419,100, a modest decrease from $421,300 in the prior year's comparable period.

This trend can put a damper on overall revenue expansion and profit margins if the company cannot compensate with a significant increase in the number of homes sold. The pressure on ASPs can be seen in the following:

- Slight ASP Decrease: Average selling price declined from $421,300 in Q1 2023 to $419,100 in Q1 2024.

- Profit Margin Impact: Lower ASPs can directly reduce per-unit profit, requiring higher sales volumes to maintain profitability.

- Competitive Market: The need for incentives suggests a competitive environment where pricing power may be limited.

D.R. Horton's reliance on subcontractors introduces challenges in maintaining consistent quality and managing project timelines, especially given broader industry issues with labor and material availability observed throughout 2024.

The company's profitability is sensitive to housing market fluctuations; for example, a 7% revenue decrease in Q1 2024 and a 15.6% net income drop in fiscal 2023 highlight this vulnerability to economic downturns and interest rate hikes.

D.R. Horton experienced margin compression in fiscal 2025 due to increased sales incentives like mortgage rate buy-downs, coupled with rising input costs for materials and labor, which squeezed profitability despite efforts to boost demand.

The average selling price (ASP) has seen a slight decrease, with Q1 2024 ASP at $419,100 compared to $421,300 in Q1 2023, potentially limiting revenue growth and impacting profit margins if sales volume doesn't compensate.

Full Version Awaits

D.R. Horton SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for D.R. Horton. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase. This ensures you receive the exact, professional-grade document you see here.

Opportunities

The ongoing need for more budget-friendly homes, especially for those buying for the first time, is a major chance for D.R. Horton to grow. This segment of the market consistently shows strong demand, making it a reliable area for expansion.

Furthermore, the market for building homes specifically to rent out is expected to see considerable growth. This presents D.R. Horton with a prime opportunity to diversify its business and create ongoing income streams through its rental property management.

In 2023, D.R. Horton reported a significant increase in its rental portfolio, with over 2,000 homes completed and another 10,000 in various stages of development, highlighting the company's commitment to this growing sector.

D.R. Horton's asset-light land strategy, heavily utilizing optioned lots over owned parcels, offers significant flexibility. This allows them to efficiently secure land in burgeoning markets and swiftly adjust to evolving market conditions. For instance, in Q1 2024, D.R. Horton reported controlling 252,000 lots, with a substantial portion being optioned, demonstrating their commitment to this agile approach.

This strategic land management ensures a consistent flow of affordable housing inventory. It also positions the company to effectively capitalize on sudden upticks in local demand, a key advantage in the dynamic homebuilding sector. Their ability to scale acquisition based on regional demand, rather than being tied to extensive owned land banks, is a core strength.

D.R. Horton can capitalize on technological advancements to streamline operations. By further integrating technology into construction, like advanced building information modeling (BIM) and prefabrication, the company can reduce build times and material waste. For instance, in 2023, the construction industry saw a growing adoption of AI for project management, leading to an estimated 10-15% improvement in efficiency on some projects.

Optimizing the supply chain through digital platforms and data analytics presents another key opportunity. This can lead to better inventory management, reduced logistics costs, and more reliable material sourcing. Companies utilizing advanced supply chain software have reported up to a 20% reduction in carrying costs.

Innovations in energy-efficient home design are crucial for meeting modern consumer demands. Features like improved insulation, smart thermostats, and solar panel integration appeal to buyers looking for lower utility bills and a smaller environmental footprint. Homes with certified energy efficiency can command a premium, with some studies showing a 5-10% increase in resale value.

Expansion into Underserved or Emerging Markets

D.R. Horton can explore expanding into new or underserved U.S. regions showing robust demographic growth and housing demand. This strategic move would diversify revenue and lessen reliance on specific geographic areas.

For instance, while D.R. Horton is strong in many Sun Belt states, emerging markets in the Midwest or Northeast with favorable economic indicators could present untapped potential. Such expansion could capitalize on lower land acquisition costs and potentially less competition.

- Market Diversification: Entering new regions reduces concentration risk.

- Demographic Tailwinds: Targeting areas with strong population growth.

- Competitive Advantage: Identifying markets with less saturation.

- Revenue Growth: Tapping into new customer bases and demand.

Leveraging Financial Services for Customer Retention

D.R. Horton's integrated financial services, encompassing mortgage and title operations, present a significant opportunity for enhanced customer retention. By offering more personalized solutions and targeted incentives through these channels, the company can elevate the homebuying journey. This focus on a seamless, integrated experience directly contributes to higher customer satisfaction and, consequently, improved retention, solidifying a key competitive edge in the market.

Leveraging these financial services can translate into tangible benefits. For instance, in 2023, D.R. Horton's mortgage origination volume was substantial, and further optimizing these services for customer loyalty could yield even greater returns.

- Tailored Incentives: Offering exclusive mortgage rates or closing cost credits to repeat buyers or those who utilize DHI Mortgage services can foster loyalty.

- Streamlined Process: Integrating title and mortgage services reduces friction for buyers, making the overall experience more positive and memorable.

- Data-Driven Personalization: Utilizing data from DHI Mortgage and title services allows for more precise customer segmentation and the delivery of highly relevant offers.

- Competitive Differentiation: A superior, integrated financial service offering can set D.R. Horton apart from competitors who may not have such robust in-house capabilities.

The increasing demand for affordable housing, particularly among first-time homebuyers, presents a significant growth avenue for D.R. Horton. This market segment consistently demonstrates robust demand, offering a stable platform for expansion.

The rental home construction market is projected for substantial growth, providing D.R. Horton an opportunity to diversify its revenue streams through property management.

D.R. Horton's strategic land acquisition, prioritizing optioned lots over owned parcels, grants considerable operational flexibility. This approach allows for efficient land procurement in high-growth markets and swift adaptation to changing market dynamics. As of Q1 2024, the company controlled 252,000 lots, with a significant portion being optioned, underscoring their commitment to this agile land strategy.

The company can leverage technological advancements to optimize its construction processes. Adopting technologies like Building Information Modeling (BIM) and prefabrication can reduce build times and material waste. For example, the construction industry saw a growing adoption of AI for project management in 2023, leading to estimated efficiency improvements of 10-15% on certain projects.

Furthermore, D.R. Horton can explore expanding into new or underserved U.S. regions characterized by strong demographic expansion and housing demand, thereby diversifying revenue and reducing reliance on specific geographic markets.

| Opportunity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Affordable Housing Demand | Meeting the needs of first-time homebuyers. | D.R. Horton is the largest homebuilder in the U.S. by volume, with a strong focus on entry-level and first-time buyers. |

| Rental Home Market | Developing homes for rental income. | In 2023, D.R. Horton completed over 2,000 rental homes and had 10,000 more in development. |

| Land Strategy Flexibility | Utilizing optioned lots for agile land acquisition. | Controlled 252,000 lots in Q1 2024, with a significant portion optioned. |

| Technology Integration | Streamlining construction with advanced tools. | Industry adoption of AI in project management saw 10-15% efficiency gains in 2023. |

Threats

Rising interest rates, a persistent concern throughout 2024 and into 2025, directly challenge housing affordability. For D.R. Horton, this translates to a significant headwind as higher mortgage rates dampen buyer demand and can slow sales volumes. For instance, the Federal Reserve's continued stance on maintaining elevated interest rates, with projections suggesting rates could remain higher for longer than initially anticipated in early 2024, directly impacts the purchasing power of potential homeowners.

Economic uncertainty, particularly the specter of recession, poses a significant threat to D.R. Horton. Such conditions often dampen consumer confidence, leading to job insecurity and a general hesitancy to commit to major expenditures like home purchases. This can directly translate to reduced demand for new homes, impacting D.R. Horton's sales volumes and overall financial performance.

The homebuilding industry is inherently tied to the broader economic climate. For instance, if the U.S. experiences a downturn, as some economists predict for late 2024 or early 2025, it could lead to higher unemployment rates. Historically, periods of increased unemployment correlate with a slowdown in housing starts and sales, a direct challenge for builders like D.R. Horton.

The homebuilding sector is inherently competitive, with D.R. Horton facing formidable rivals such as Lennar and PulteGroup. This intense rivalry, particularly in the crucial entry-level housing market, often translates into significant pricing pressures and a greater reliance on buyer incentives. These factors directly impact profitability, potentially squeezing margins as companies vie for market share.

Regulatory Changes and Environmental Concerns

Regulatory changes present a significant threat to D.R. Horton. For instance, shifts in zoning laws or stricter environmental regulations, such as those concerning water usage or endangered species protection, can significantly delay projects and increase development costs. In 2024, the ongoing debate around building codes and energy efficiency standards, particularly in states like California, could necessitate costly upgrades and impact the pace of new construction.

Compliance with these evolving governmental policies is a constant challenge. D.R. Horton, like other builders, must navigate a complex web of federal, state, and local rules. For example, changes to building codes related to fire safety or seismic retrofitting can add substantial expenses to projects.

- Increased Construction Costs: New environmental regulations or updated building codes can require more expensive materials or construction techniques, directly impacting D.R. Horton's profit margins.

- Project Delays: Obtaining permits and ensuring compliance with evolving zoning laws can lead to unforeseen delays, pushing back revenue recognition and increasing carrying costs for undeveloped land.

- Limited Land Availability: Stricter environmental protections or changes in land use policies can reduce the amount of available land suitable for development, potentially constraining D.R. Horton's growth.

Supply Chain Disruptions and Material/Labor Cost Inflation

D.R. Horton, like many in the homebuilding sector, faces significant threats from ongoing supply chain volatility. For instance, in early 2024, persistent issues with lumber availability and transportation logistics continued to affect project timelines and material costs. This can directly squeeze profit margins as construction expenses rise unexpectedly.

Inflationary pressures on both building materials and skilled labor are a major concern. Throughout 2024, the cost of key components such as drywall, concrete, and roofing materials saw notable increases. Simultaneously, the demand for skilled tradespeople, from framers to electricians, has kept wage pressures elevated, adding to overall construction expenses.

Specific trade policies can exacerbate these cost challenges. Tariffs imposed on materials, such as those historically seen on Canadian lumber, can directly impact D.R. Horton's cost of goods sold. These tariffs, even if adjusted, create uncertainty and can lead to higher input prices, directly affecting profitability on new home sales.

- Supply Chain Strain: Continued disruptions in 2024 led to an average 8% increase in material lead times for key construction components.

- Material Cost Inflation: Prices for lumber, steel, and concrete experienced an average rise of 12-15% year-over-year through the first half of 2024.

- Labor Cost Increases: The cost of skilled labor, particularly for framing and electrical work, rose by an estimated 7-9% in 2024 due to high demand.

- Tariff Impact: Historical tariffs on imported materials like lumber have demonstrated the potential to add hundreds of dollars per home to construction costs.

Persistent supply chain disruptions, evident throughout 2024, continue to pose a threat by increasing material costs and causing project delays for D.R. Horton. For instance, lumber prices, a key indicator, saw volatility, impacting the overall cost of building a home. This volatility directly affects profit margins and the company's ability to meet construction timelines.

The homebuilding industry is highly sensitive to economic downturns, and predictions of a potential recession in late 2024 or early 2025 represent a significant risk. Reduced consumer confidence and job security during such periods can lead to a sharp decline in housing demand, directly impacting D.R. Horton's sales and revenue streams.

Intense competition within the homebuilding sector, particularly from major players like Lennar and PulteGroup, creates pricing pressures. This rivalry, especially in the affordable housing segment, can force D.R. Horton to offer more incentives, potentially eroding profit margins as they vie for market share.

Evolving regulatory landscapes, including stricter environmental standards and changes in zoning laws, can introduce compliance challenges and increase development costs. For example, new energy efficiency mandates in building codes, which gained traction in 2024, may require D.R. Horton to invest in more expensive materials or construction methods.

SWOT Analysis Data Sources

This D.R. Horton SWOT analysis is constructed from a robust blend of financial statements, comprehensive market research reports, and expert industry commentary, ensuring a well-rounded and data-backed strategic overview.