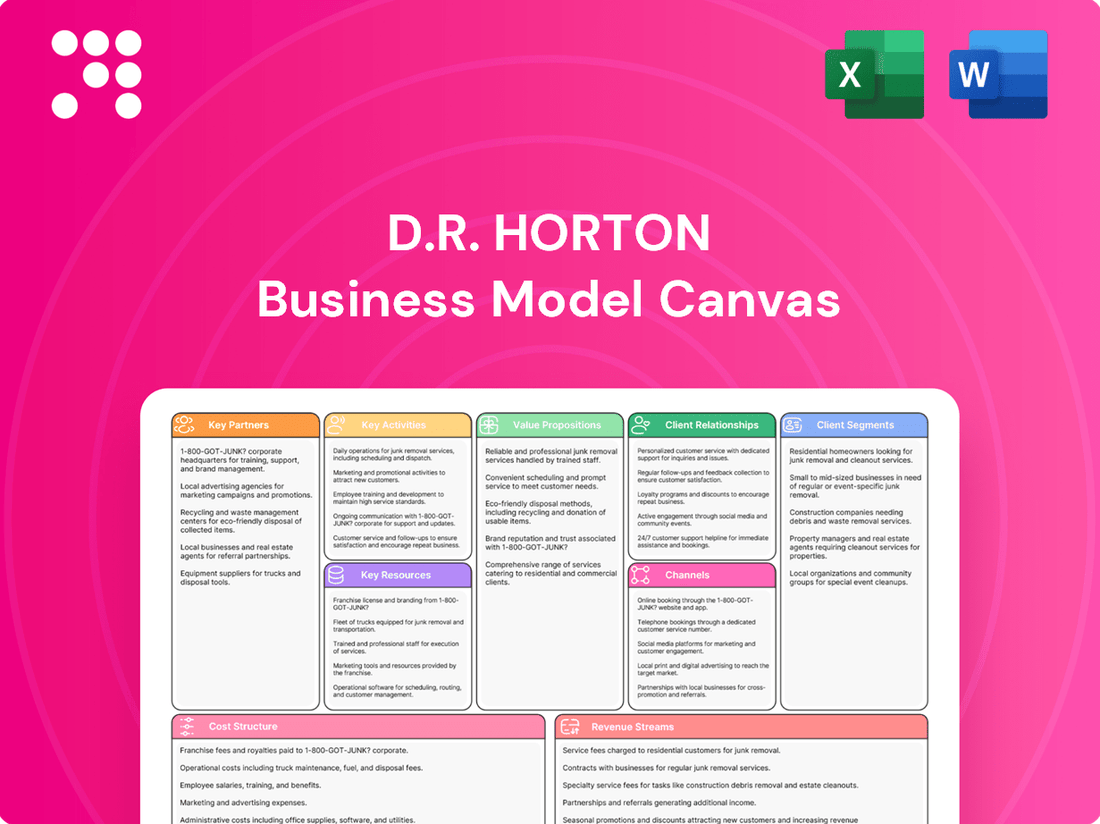

D.R. Horton Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

Unlock the core components of D.R. Horton's dominant market position with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and revenue streams, offering a strategic roadmap for understanding their success. Ideal for anyone seeking to dissect a thriving business model.

Partnerships

D.R. Horton's key partnerships with land developers, especially its majority-owned Forestar Group Inc., are crucial for securing a substantial land and lot pipeline. This strategic alliance ensures a consistent and flexible supply of future development opportunities.

By prioritizing the acquisition of finished lots through these partnerships, D.R. Horton enhances its capital efficiency. In 2023, Forestar Group Inc. reported revenues of $1.1 billion, underscoring the significant contribution of this relationship to D.R. Horton's operational capacity and strategic land acquisition.

D.R. Horton’s success hinges on its extensive network of subcontractors and suppliers, crucial for executing land development and home construction. These partnerships allow for cost management and efficient construction timelines, vital for their high-volume business model.

In 2023, D.R. Horton reported total construction costs of $22.7 billion, a significant portion of which is paid to these subcontractors and suppliers. Maintaining strong relationships ensures access to labor and materials, especially during periods of high demand, contributing to their ability to close over 100,000 homes annually.

D.R. Horton leverages partnerships with various financial institutions and mortgage lenders to broaden financing options for its customers. While DHI Mortgage is a significant internal resource, these external relationships ensure a wider array of loan products and competitive rates are accessible, thereby smoothing the path to homeownership and boosting sales volume.

Title and Insurance Service Providers

D.R. Horton partners with title and insurance service providers to create a seamless homebuying journey. These collaborations are crucial for managing the complexities of property transactions, ensuring that all legal and financial aspects are handled efficiently.

By integrating these services, D.R. Horton simplifies the closing process for its customers. This approach not only enhances customer satisfaction but also helps to expedite sales cycles, a key driver for a high-volume builder.

- Title Companies: Facilitate title searches, examination, and insurance, ensuring clear ownership of the property.

- Insurance Agencies: Offer homeowners insurance and other necessary coverage, protecting the buyer's investment.

- Streamlined Closings: These partnerships contribute to a smoother, faster closing experience for buyers.

- Customer Experience: Enhancing the overall homebuying process by providing essential, integrated services.

Local Governments and Regulatory Bodies

D.R. Horton actively engages with local governments and regulatory bodies to navigate the complex landscape of land development and home construction. These relationships are vital for obtaining the necessary permits, securing zoning approvals, and ensuring strict adherence to all applicable building codes and environmental regulations. For instance, in 2024, D.R. Horton continued to work with municipalities across its 100+ markets to advance its development pipeline, which is essential for its operational efficiency and ability to deliver new homes.

These partnerships are not merely transactional; they are foundational to D.R. Horton's ability to operate smoothly and expand its footprint. By maintaining open communication and demonstrating compliance, the company facilitates the timely progression of its projects, from initial land acquisition through to final home delivery. This collaborative approach helps mitigate potential delays and ensures that D.R. Horton can meet the demand for housing in diverse geographic areas.

- Permitting and Approvals: Securing building permits and zoning changes is a continuous process, with thousands of individual approvals required annually across D.R. Horton's operations.

- Compliance with Building Codes: Adherence to local building codes ensures safety and quality, a non-negotiable aspect of construction that requires constant dialogue with regulatory agencies.

- Land Use and Zoning: Partnerships are critical for favorable land use designations and zoning ordinances that allow for residential development, impacting the availability of buildable lots.

- Environmental Regulations: Compliance with environmental standards, often overseen by state and local agencies, is managed through these key relationships to ensure sustainable development practices.

D.R. Horton's strategic alliances with land developers and its majority-owned Forestar Group Inc. are paramount for securing a consistent and extensive land and lot inventory, directly fueling its high-volume construction model. These partnerships are essential for maintaining a robust pipeline of future development opportunities, as evidenced by Forestar's reported revenues of $1.1 billion in 2023, highlighting the significant impact of these land acquisition relationships.

What is included in the product

A comprehensive, pre-written business model tailored to D.R. Horton's strategy of building affordable homes, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

D.R. Horton's Business Model Canvas acts as a pain point reliever by offering a clear, structured overview of their operations, enabling swift identification of inefficiencies and opportunities for streamlined homebuilding processes.

Activities

D.R. Horton's primary business activity revolves around the strategic acquisition and development of land for new residential communities. This is a crucial step in their operational model, ensuring a pipeline of future homes. They focus on securing land through purchase contracts, which allows them to manage their inventory effectively and minimize financial exposure on their balance sheet.

For the fiscal year ending September 30, 2023, D.R. Horton reported total revenue of $35.5 billion. A significant portion of this revenue is directly tied to their ability to acquire and develop land efficiently, as it forms the foundation for their homebuilding operations. Their controlled lot position as of September 30, 2023, stood at 236,000 lots, highlighting their commitment to long-term land development.

D.R. Horton's core activity is building single-family homes, offering everything from starter houses to more upscale residences. In 2024, the company continued to be a dominant force in this sector, responding to ongoing demand for housing.

Beyond traditional homeownership, D.R. Horton also engages in constructing single-family and multi-family rental properties. This diversification allows them to capture a broader range of housing needs within the market.

D.R. Horton actively engages in sales and marketing across 126 markets in 36 states, tailoring pricing and incentives to optimize sales velocity in response to prevailing market conditions. This extensive reach ensures broad consumer access to their housing inventory.

The company's sales and marketing efforts are fundamental to its operational success, directly impacting the conversion of available homes into completed sales. This focus on efficient sales processes is key to managing inventory and generating revenue.

For the fiscal year 2023, D.R. Horton reported total revenues of $35.4 billion, with a significant portion attributable to its home sales operations, underscoring the critical role of its sales and marketing functions.

Mortgage and Title Services Provision

D.R. Horton's financial services segment, primarily DHI Mortgage, offers integrated mortgage financing and title agency services. This synergy directly supports their homebuilding operations by simplifying the transaction for homebuyers.

This integrated model not only enhances customer experience but also creates a significant revenue stream for the company. In the fiscal year 2023, DHI Mortgage generated approximately $1.7 billion in revenue, showcasing the substantial contribution of these services.

- Mortgage Financing: DHI Mortgage provides a range of mortgage products to D.R. Horton's customers, facilitating the purchase of new homes.

- Title Agency Services: The company offers title insurance and settlement services, ensuring a smooth closing process for homebuyers.

- Revenue Generation: These financial services are a crucial component of D.R. Horton's overall financial performance, contributing directly to profitability.

- Customer Convenience: By bundling these services, D.R. Horton streamlines the homebuying journey, offering a one-stop solution for its clients.

Rental Property Management

D.R. Horton actively engages in managing single-family and multi-family rental properties, extending its business beyond traditional home sales. This strategic move diversifies revenue streams and taps into the consistent demand for rental housing.

The company's rental operations contribute to more predictable cash flows, offering a hedge against the cyclical nature of the homebuilding market. In 2023, D.R. Horton reported significant rental revenue, underscoring the growing importance of this segment.

- Diversification Strategy D.R. Horton’s rental property management provides an alternative income source beyond home sales.

- Stable Cash Flows The leasing segment offers more consistent revenue compared to the volatility of new home construction.

- Market Capitalization This segment allows D.R. Horton to benefit from strong rental demand in various U.S. markets.

- Operational Scale The company leverages its construction expertise to efficiently manage a growing portfolio of rental units.

D.R. Horton's key activities center on land acquisition and development, creating a robust pipeline for future home construction. They are a major builder of single-family homes, catering to a wide range of buyers. Additionally, the company offers integrated financial services through DHI Mortgage, simplifying the homebuying process and generating additional revenue.

| Key Activity | Description | Financial Impact (FY 2023) |

| Land Acquisition & Development | Securing and preparing land for residential communities. | Controlled lot position of 236,000 lots. |

| Homebuilding | Constructing single-family and multi-family homes. | Total revenue of $35.5 billion. |

| Financial Services (DHI Mortgage) | Providing mortgage financing and title services. | Generated approximately $1.7 billion in revenue. |

Preview Before You Purchase

Business Model Canvas

The D.R. Horton Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the precise structure, content, and formatting that will be delivered to you, ensuring complete transparency and no unexpected changes. Once your order is processed, you will gain full access to this same comprehensive business model canvas, ready for your immediate use and customization.

Resources

D.R. Horton maintains a significant advantage through its extensive land and lot inventory, which numbered over 600,000 lots as of late 2023. This vast portfolio includes both directly owned land and lots secured via purchase agreements, ensuring a consistent supply for future construction projects.

This substantial land bank acts as a crucial competitive differentiator, allowing D.R. Horton to maintain a stable and predictable homebuilding pipeline. It mitigates the risk of land acquisition challenges and price volatility, underpinning the company's operational resilience.

D.R. Horton's strong financial capital and liquidity are cornerstones of its business model, enabling strategic land acquisition and development. The company consistently maintains substantial cash reserves and access to significant credit facilities, offering considerable flexibility.

As of the first quarter of 2024, D.R. Horton reported total cash and cash equivalents of $4.7 billion. This robust liquidity allows the company to navigate market fluctuations and pursue growth opportunities without undue reliance on external financing.

This financial strength directly supports D.R. Horton's ability to invest in land inventory, fund ongoing construction projects, and return capital to shareholders through dividends and share repurchases, reinforcing its operational capacity and market position.

D.R. Horton's established brand and market leadership are cornerstones of its business model. As the largest homebuilder in the U.S. by volume since 2002, the company commands significant brand recognition and market sway.

This consistent leadership, demonstrated by closing approximately 89,000 homes in fiscal year 2023, translates into substantial economies of scale. These efficiencies allow D.R. Horton to negotiate more favorable terms with suppliers and subcontractors, a key competitive advantage.

Integrated Financial Services Operations

D.R. Horton's wholly-owned DHI Mortgage and title services are crucial internal resources. These integrated operations offer a complete package for homebuyers, simplifying the entire process from financing to closing. This synergy not only boosts revenue streams but also enhances customer satisfaction by providing a seamless experience.

The strategic integration of these financial services is a significant competitive advantage. It allows D.R. Horton to control more of the transaction, potentially improving margins and offering more competitive pricing to buyers. This vertical integration is a core component of their operational efficiency and customer-centric approach.

For instance, DHI Mortgage reported a significant volume of mortgage originations. In the fiscal year 2023, DHI Mortgage originated approximately $21.8 billion in loans, supporting over 35,000 home closings. This demonstrates the substantial contribution of these integrated services to the overall business model.

- DHI Mortgage: Provides integrated financing solutions, streamlining the homebuying process and generating additional revenue.

- Title Services: Ensures smooth title transfer and closing procedures, enhancing operational efficiency and customer experience.

- Revenue Generation: These wholly-owned subsidiaries contribute directly to D.R. Horton's top-line growth and profitability.

- Customer Convenience: Offering a one-stop shop for financing and closing significantly improves the buyer's journey.

Skilled Workforce and Operational Expertise

D.R. Horton's success hinges on its extensive and skilled workforce, encompassing experienced management, dedicated construction crews, and adept sales teams. This human capital is fundamental to their operational capabilities.

The company's operational expertise, particularly its focus on enhancing construction cycle times, directly translates into efficient home delivery and robust profitability. For instance, in fiscal year 2023, D.R. Horton reported closing 87,456 homes, a testament to their streamlined processes.

- Skilled Management: Guides strategic direction and resource allocation.

- Experienced Construction Personnel: Ensures quality and efficiency in building processes.

- Proficient Sales Professionals: Drive revenue through effective market engagement.

- Operational Excellence: Focus on reducing construction cycle times to improve delivery speed and cost-effectiveness.

D.R. Horton's key resources include its substantial land inventory, robust financial capital, strong brand recognition, integrated financial services, and a skilled workforce. These elements collectively enable the company to operate efficiently and maintain its market leadership.

The company's land bank, exceeding 600,000 lots as of late 2023, provides a stable supply for future construction. Financial strength, evidenced by $4.7 billion in cash and equivalents in Q1 2024, supports strategic growth and operational flexibility.

D.R. Horton's brand, the largest in the U.S. by volume, translates into economies of scale, benefiting from closing nearly 89,000 homes in fiscal year 2023. Its wholly-owned DHI Mortgage and title services, which originated $21.8 billion in loans in FY2023, enhance customer experience and profitability.

The skilled workforce, from management to construction crews, drives operational excellence, as seen in the efficient delivery of 87,456 homes in FY2023.

| Key Resource | Description | Impact | Relevant Data (as of late 2023/early 2024) |

|---|---|---|---|

| Land Inventory | Extensive owned and optioned land parcels. | Ensures consistent supply, mitigates acquisition risk. | Over 600,000 lots. |

| Financial Capital | Strong liquidity and access to credit. | Funds operations, land acquisition, and shareholder returns. | $4.7 billion in cash and cash equivalents (Q1 2024). |

| Brand & Market Leadership | Largest U.S. homebuilder by volume since 2002. | Economies of scale, supplier negotiation power. | Closed 87,456 homes in FY2023. |

| Integrated Financial Services (DHI Mortgage, Title) | Wholly-owned mortgage and title operations. | Streamlines homebuying, enhances customer experience, drives revenue. | $21.8 billion in mortgage originations (FY2023). |

| Skilled Workforce | Experienced management, construction, and sales teams. | Operational efficiency, quality construction, effective sales. | Efficient construction cycle times. |

Value Propositions

D.R. Horton's value proposition centers on providing a wide spectrum of housing options, with a particular emphasis on making homeownership accessible. They cater to diverse buyer needs by offering various home sizes and price points, frequently adjusting these alongside incentives to boost affordability for a broad customer base.

For instance, in fiscal year 2023, D.R. Horton reported closing 87,562 homes, with a significant portion likely falling into the entry-level and first-time buyer categories, underscoring their commitment to this market segment.

D.R. Horton's comprehensive homebuying solution offers a significant advantage by integrating home construction with crucial financial services. This means buyers can secure their mortgage and title through D.R. Horton, simplifying what is often a complex and fragmented process. For instance, in 2023, D.R. Horton's financial services segment, D.R. Horton Mortgage Company, facilitated financing for a substantial portion of their home sales, highlighting the integration's impact.

D.R. Horton emphasizes building homes with superior quality and thoughtful design, aiming to provide a consistently positive customer experience. This commitment extends beyond the initial purchase, focusing on long-term satisfaction and home durability.

Their vertically integrated business model is a key driver of this quality assurance. By controlling various stages of the construction process, from land acquisition to financing and title services, D.R. Horton can maintain rigorous quality standards and ensure consistency across their developments.

For instance, in the fiscal year 2023, D.R. Horton reported revenues of $35.4 billion, a testament to the scale and demand for their homes. This financial performance underscores the market's confidence in their ability to deliver quality construction and design.

Geographic Accessibility and Market Presence

D.R. Horton's expansive operational footprint, spanning 126 markets across 36 states, ensures widespread geographic accessibility for homebuyers. This extensive market presence allows the company to cater to a diverse range of customer preferences regarding location and community lifestyle.

This broad reach translates into a significant advantage for customers, offering them a vast selection of homes in various regions and community settings. By operating in so many markets, D.R. Horton can tap into different housing demands and economic conditions.

- Market Reach: Operates in 126 markets across 36 states.

- Customer Choice: Provides customers with a wide selection of locations and community types.

- Accessibility: Ensures broad geographic accessibility for potential homebuyers.

Reliability and Trust

D.R. Horton's long-standing presence as a leading homebuilder cultivates reliability and trust among its customers. This established market leadership offers buyers confidence, knowing they are dealing with a stable and experienced company.

The company's consistent financial performance, evidenced by its substantial revenue figures, further solidifies this trust. For instance, D.R. Horton reported revenues of $35.5 billion in 2023, demonstrating its continued market strength and ability to deliver.

- Market Leadership: D.R. Horton has consistently been one of the largest homebuilders in the United States by volume.

- Financial Stability: The company's robust financial health provides a sense of security for homebuyers.

- Brand Recognition: Years of operation have built strong brand recognition, synonymous with dependable homeownership.

- Consistent Performance: D.R. Horton's track record of delivering homes across various market conditions reinforces buyer confidence.

D.R. Horton's value proposition is built on making homeownership attainable and simplifying the buying process. They achieve this by offering a wide range of homes at competitive price points, often with incentives to lower upfront costs. Their integrated financial services, including mortgage and title, streamline transactions, as evidenced by their significant mortgage origination volume in 2023. This focus on affordability and a seamless experience resonates with a broad customer base.

Quality and customer satisfaction are paramount, supported by a vertically integrated model that ensures control over the construction process from land acquisition to completion. This allows for consistent quality and design across their extensive portfolio. In fiscal year 2023, D.R. Horton's revenue reached $35.4 billion, reflecting strong market demand for their well-built homes.

Their extensive market presence, operating in 126 markets across 36 states, provides unparalleled choice and accessibility for homebuyers. This broad geographic reach allows them to cater to diverse regional preferences and economic conditions, ensuring a home is available where and how buyers want it.

D.R. Horton's established reputation as a leading homebuilder instills confidence and reliability. Their consistent financial performance, with 2023 revenues of $35.5 billion, underscores their stability and ability to deliver on their promises, making them a trusted name in homeownership.

| Value Proposition Element | Description | Supporting Data (FY 2023) |

|---|---|---|

| Affordability & Accessibility | Wide range of home options and price points, with incentives. | Closed 87,562 homes. |

| Integrated Homebuying Solution | In-house mortgage and title services for a streamlined process. | Significant portion of home sales financed through D.R. Horton Mortgage Company. |

| Quality & Customer Experience | Emphasis on superior quality construction and thoughtful design. | $35.4 billion in revenue, indicating strong market acceptance of quality. |

| Market Reach & Choice | Presence in 126 markets across 36 states, offering diverse locations. | Extensive geographic footprint provides broad customer choice. |

| Reliability & Trust | Long-standing market leadership and consistent financial performance. | $35.5 billion in revenue, demonstrating financial stability and market confidence. |

Customer Relationships

D.R. Horton cultivates customer relationships through its extensive network of sales centers and model homes. This direct engagement allows their sales professionals to personally connect with potential buyers, offering tailored assistance and in-depth product details. This approach was a key factor in their strong performance, with D.R. Horton reporting a record $37.1 billion in revenue for fiscal year 2023.

D.R. Horton cultivates strong customer bonds by offering integrated financial services via DHI Mortgage. This in-house support system streamlines the homebuying process, handling financing for a substantial portion of their clientele, thereby enhancing convenience and customer satisfaction.

D.R. Horton prioritizes a strong post-sale customer experience, offering comprehensive warranty programs and dedicated customer service to address homeowner needs. This commitment is crucial for fostering satisfaction and building lasting relationships, which can translate into repeat business and positive referrals.

In 2023, D.R. Horton's focus on customer satisfaction contributed to their strong financial performance, with revenues reaching $32.1 billion. Their warranty services are designed to provide peace of mind, a key factor in the home-buying journey, and are a significant component of their customer relationship strategy.

Incentive-Based Engagement

D.R. Horton actively engages buyers through incentive-based strategies, especially when the market presents challenges. These can include price reductions, financing assistance, or upgrades to make homes more appealing and affordable.

In 2024, D.R. Horton reported a significant increase in its incentive offerings to drive sales. For instance, in the first quarter of fiscal year 2024, the company noted that incentives, primarily in the form of mortgage rate buydowns and price adjustments, were a key component of their sales strategy.

- Incentives Drive Sales: D.R. Horton uses incentives like rate buydowns and price concessions to attract and retain buyers, particularly in fluctuating housing markets.

- Market Responsiveness: These strategies are adjusted based on consumer demand and current affordability concerns, aiming to boost sales volume.

- 2024 Performance: The company's first-quarter 2024 results highlighted the effectiveness of these incentive programs in a competitive environment.

Digital and Online Interaction

D.R. Horton leverages its digital and online presence to connect with potential homebuyers. The company website serves as a primary hub, offering detailed information about communities, floor plans, and available homes. Online listings and virtual tours further enhance accessibility, allowing customers to explore properties remotely and initiate their buying journey. This digital approach significantly broadens D.R. Horton's reach, catering to a wide audience seeking convenient and informative engagement.

In 2024, D.R. Horton continued to emphasize its digital customer experience. The company's website and online platforms are crucial for lead generation and customer interaction. For instance, in the first quarter of fiscal year 2024, D.R. Horton reported a significant increase in online traffic and digital inquiries, underscoring the importance of these channels in their sales funnel. This digital engagement facilitates an initial research phase, allowing buyers to gather essential details before physical site visits.

- Website as a Primary Information Source: D.R. Horton's website provides comprehensive details on new homes, communities, and financing options, serving as a key digital touchpoint.

- Virtual Tours and Online Listings: The availability of virtual tours and extensive online listings offers potential buyers a convenient way to explore properties from anywhere.

- Broadened Reach and Accessibility: The digital strategy enhances D.R. Horton's market reach, making it easier for a diverse range of customers to discover and engage with their offerings.

- Digital Engagement in 2024: In Q1 FY24, D.R. Horton saw a notable rise in digital inquiries, highlighting the growing reliance on online platforms for initial customer contact and research.

D.R. Horton fosters customer relationships through a multi-faceted approach, combining direct sales engagement with integrated financial services and a strong post-sale support system. Their digital presence, including informative websites and virtual tours, further enhances accessibility and broadens their market reach. Incentive programs, particularly in 2024, demonstrate a commitment to adapting to market conditions and buyer needs, aiming to drive sales and maintain customer satisfaction.

| Customer Relationship Strategy | Description | Impact/Data Point |

|---|---|---|

| Direct Sales Engagement | Utilizes sales centers and model homes for personalized buyer assistance. | Key to connecting with buyers and providing product details. |

| Integrated Financial Services | Offers DHI Mortgage to streamline the homebuying and financing process. | Enhances convenience and customer satisfaction by handling a substantial portion of financing. |

| Post-Sale Support | Provides comprehensive warranty programs and dedicated customer service. | Aims to build lasting relationships through ongoing homeowner support. |

| Digital Presence | Leverages websites, online listings, and virtual tours for broad accessibility. | Facilitates remote property exploration and initiates the buying journey. In Q1 FY24, D.R. Horton saw a significant increase in online traffic and digital inquiries. |

| Incentive Programs | Offers incentives like rate buydowns and price adjustments to boost sales. | Demonstrated effectiveness in Q1 FY24, with incentives being a key sales strategy component. |

Channels

D.R. Horton’s primary sales channel relies heavily on its extensive network of on-site sales centers and model homes. These physical locations are crucial for prospective buyers to experience the quality and design of D.R. Horton homes directly. In 2023, the company reported significant revenue, with these centers playing a vital role in facilitating those sales.

D.R. Horton prominently utilizes its corporate website, drhorton.com, as a primary digital storefront. This platform allows prospective buyers to explore available homes, view community details, and learn about the company's offerings. In 2024, the company continued to invest in its online presence to facilitate customer engagement and provide comprehensive information.

D.R. Horton leverages a network of external real estate agents and brokers to expand its reach and connect with potential homebuyers. These professionals play a crucial role in bringing buyers to D.R. Horton's various communities.

Commissions paid to these agents are a significant and standard operational cost within D.R. Horton's sales strategy. In 2023, D.R. Horton reported total selling, general and administrative expenses of $4.8 billion, a portion of which is allocated to these sales commissions.

Digital Marketing and Advertising

D.R. Horton leverages a diverse digital marketing strategy to connect with potential buyers. This includes active engagement on social media platforms, targeted search engine marketing (SEM) to capture active home seekers, and various online advertising placements. These digital efforts are crucial for driving traffic to both their online resources and their physical sales centers.

In 2024, D.R. Horton continued to invest in digital channels. The company's focus on online presence aims to make the home-buying process more accessible and informative. This digital push is designed to broaden their reach and efficiently convert interest into sales leads.

- Social Media Engagement: D.R. Horton uses platforms like Facebook, Instagram, and YouTube to showcase properties, share customer testimonials, and run targeted ad campaigns.

- Search Engine Marketing (SEM): Paid search ads on Google and Bing target users actively searching for new homes in specific geographic areas.

- Online Advertising: Display ads, retargeting campaigns, and partnerships with real estate listing sites ensure visibility across the digital landscape.

- Website Traffic Generation: These digital marketing activities are directly responsible for driving significant traffic to D.R. Horton's official website, a key hub for information and lead capture.

Financial Services Branches

D.R. Horton's internal financial services, specifically DHI Mortgage and its title operations, function as direct channels to streamline the homebuying process. These branches provide integrated mortgage financing and title services, offering a one-stop shop for customers.

For instance, in the first quarter of fiscal year 2024, DHI Mortgage generated $1.3 billion in mortgage originations. This demonstrates the significant volume and direct impact these channels have on D.R. Horton's overall business model by capturing ancillary revenue and enhancing customer experience.

- DHI Mortgage: Offers direct mortgage financing to D.R. Horton homebuyers, enhancing convenience and potentially reducing closing times.

- Title Services: D.R. Horton's in-house title operations ensure a seamless title search and insurance process, directly supporting the home closing.

- Integrated Solution: These branches work in tandem to provide a comprehensive and efficient experience for customers purchasing a D.R. Horton home.

- Revenue Diversification: The financial services segment contributes to D.R. Horton's revenue streams beyond just home sales, improving profitability.

D.R. Horton's channel strategy is multifaceted, combining direct sales through on-site centers and a robust online presence with indirect sales via real estate agents. The company also leverages its integrated financial services, DHI Mortgage and title operations, as direct channels to capture additional revenue and enhance customer convenience.

These channels work in concert to drive sales and customer engagement. For example, in the first quarter of fiscal year 2024, DHI Mortgage originated $1.3 billion in loans, directly supporting home sales and contributing to overall revenue. This integrated approach aims to provide a seamless homebuying experience.

The company's digital marketing efforts, including social media and SEM, are crucial for directing potential buyers to both its website and physical locations. In 2024, D.R. Horton continued to invest in these digital avenues to broaden its reach and capture a larger share of the market.

| Channel | Description | Key Activities | 2023/2024 Impact/Data |

|---|---|---|---|

| On-site Sales Centers | Physical locations where buyers can view model homes and interact with sales representatives. | Direct sales, home tours, personalized consultations. | Crucial for facilitating significant sales revenue in 2023. |

| Corporate Website (drhorton.com) | Primary digital storefront for exploring communities, available homes, and company information. | Online listings, virtual tours, lead generation, information hub. | Continued investment in 2024 to enhance customer engagement and accessibility. |

| External Real Estate Agents | Partnerships with real estate professionals who bring buyers to D.R. Horton communities. | Broker outreach, commission payments, expanded market reach. | Significant portion of $4.8 billion in SG&A expenses in 2023 included sales commissions. |

| Digital Marketing | Online strategies including social media, SEM, and display advertising. | Targeted ads, search engine optimization, retargeting campaigns. | Drives traffic to website and sales centers; continued investment in 2024. |

| DHI Mortgage & Title Operations | In-house financial services providing mortgage financing and title services. | Integrated financing, streamlined closing process, ancillary revenue generation. | $1.3 billion in mortgage originations in Q1 FY2024. |

Customer Segments

Entry-level homebuyers are a core demographic for D.R. Horton, with brands like Express Homes specifically designed to meet their needs for more affordable housing. This segment often includes first-time buyers or individuals prioritizing cost-effectiveness in their housing choices. In 2024, D.R. Horton continued to emphasize this segment, with a significant portion of their sales volume coming from entry-level and first-time buyers.

D.R. Horton recognizes the move-up homebuyer segment, those seeking to upgrade from their current residence. This group prioritizes increased living space, enhanced features, and often, more sought-after neighborhoods to accommodate growing families or changing lifestyle preferences.

In 2024, the demand for larger homes remained robust. For instance, data from the National Association of Realtors indicated that the median size of new homes sold continued to trend upwards, reflecting this move-up buyer interest. These buyers are often trading up from starter homes, seeking the equity built in their previous property to finance their next purchase.

D.R. Horton actively targets active adult and lifestyle buyers, recognizing their distinct needs and preferences. These customers often seek communities designed with specific amenities, such as walking trails, fitness centers, and social gathering spaces, to support their desired lifestyle.

The company’s product offerings for this segment include homes within specialized developments that cater to this demographic. For example, D.R. Horton’s Express Homes brand often features accessible designs and community layouts appealing to this buyer group. In 2024, the company continued to expand its presence in active adult communities, reflecting a strategic focus on this growing market segment.

Luxury Homebuyers

D.R. Horton targets luxury homebuyers through its Emerald Homes brand, offering premium residences with extensive features in exclusive locations. This segment seeks higher-priced, well-appointed properties.

These homes often include:

- High-end finishes and upgraded materials

- Larger floor plans and sophisticated architectural designs

- Prime locations in sought-after neighborhoods or communities

In 2024, D.R. Horton reported that its move-up and luxury segments continued to perform well, contributing to a solid revenue base. The company’s strategy acknowledges the demand for premium housing, even amidst broader market fluctuations.

Rental Property Tenants

D.R. Horton's rental property tenants represent a significant customer segment, comprising individuals and families who prioritize the convenience and flexibility of renting. This group is actively seeking single-family and multi-family housing solutions, reflecting a broader market trend toward rental living.

The demand for rental properties, particularly single-family homes, has seen robust growth. In 2024, the U.S. Census Bureau reported that approximately 36.1% of all housing units were renter-occupied. This statistic underscores the substantial market opportunity for D.R. Horton's rental offerings.

- Demand for Rental Housing: A growing number of individuals and families prefer renting due to lifestyle flexibility, lower upfront costs, and a desire to avoid homeownership responsibilities.

- Single-Family Rentals: This segment specifically targets those who desire the space and privacy of a single-family home but opt for a rental arrangement.

- Multi-Family Rentals: D.R. Horton also caters to renters seeking apartments or townhouses within larger communities, often valuing shared amenities and convenient locations.

- Market Trends: The increasing preference for renting, especially among younger demographics and in urban/suburban areas, solidifies this segment's importance to D.R. Horton's business model.

D.R. Horton's customer base is diverse, encompassing entry-level buyers seeking affordability, move-up buyers desiring more space, and active adults prioritizing lifestyle amenities. The company also caters to the luxury market through its Emerald Homes brand and serves a growing segment of rental property tenants.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Entry-Level Buyers | First-time buyers, cost-conscious | Core demographic, significant sales volume |

| Move-Up Buyers | Seeking larger homes, enhanced features | Robust demand, driven by equity in existing homes |

| Active Adult/Lifestyle Buyers | Desire specific amenities and community features | Strategic focus, expanding presence in specialized communities |

| Luxury Buyers | High-end residences, exclusive locations | Continued strong performance, contributing to revenue |

| Rental Property Tenants | Value flexibility and convenience of renting | Significant opportunity, 36.1% of US housing units were renter-occupied in 2024 |

Cost Structure

A significant portion of D.R. Horton's expenses is tied to acquiring land, both raw acreage and pre-developed lots. This is a critical input for their homebuilding operations.

In 2024, D.R. Horton continued to manage these acquisition costs, which are fundamental to their ability to build and sell homes across various markets. These costs can fluctuate based on market demand and regional land availability.

Construction costs are the backbone of D.R. Horton's operations, encompassing everything from lumber and concrete to the skilled labor of subcontractors. In 2023, D.R. Horton reported total cost of sales, which includes construction costs, of $24.5 billion. Efficiently managing these expenses directly impacts the company's ability to maintain healthy profit margins in a dynamic market.

D.R. Horton, a major homebuilder, faces significant land development costs, a crucial element in their business model. These expenses involve preparing raw land for construction, encompassing essential infrastructure like roads, water, sewer, and electricity. This upfront investment is substantial, occurring before any homes are actually built.

In 2024, the homebuilding industry, including D.R. Horton, continued to grapple with rising land and development costs. While specific figures for D.R. Horton's land development spending aren't publicly itemized in detail, the company's overall cost of sales, which includes land and development, represents a major portion of their expenses. For instance, in their fiscal year 2023, D.R. Horton reported total revenues of $32.1 billion, with cost of sales accounting for a significant $26.2 billion.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for D.R. Horton are crucial for maintaining operations and driving sales. These costs include everything from marketing campaigns and sales commissions to executive salaries and general office expenses, none of which are directly tied to building homes.

Efficiently managing these SG&A costs is vital for D.R. Horton's profitability. For the fiscal year ended September 30, 2023, D.R. Horton reported SG&A expenses of $3,403 million, which represented 10.9% of its total revenue.

- Sales and Marketing: Costs associated with advertising, sales force compensation, and promotional activities to attract buyers.

- General and Administrative: Includes executive salaries, corporate overhead, legal fees, and accounting services.

- Operational Efficiency: D.R. Horton's focus on streamlined processes aims to keep SG&A as a percentage of revenue in check.

- Profitability Impact: Lowering SG&A as a percentage of revenue directly enhances the company's net profit margin.

Mortgage and Financing Costs

Mortgage and financing costs are a significant part of D.R. Horton's expenses. This includes the operational costs of DHI Mortgage, the company's in-house mortgage subsidiary, and the interest paid on its corporate debt. These financial outlays directly affect the company's bottom line, influencing overall profitability.

In 2023, D.R. Horton's interest expense on its debt totaled $1.1 billion. This figure highlights the substantial cost of capital for the homebuilder, a key consideration in its financial strategy and operational planning.

- DHI Mortgage Operations: Costs related to running the mortgage origination and servicing business.

- Interest Expense on Corporate Debt: Payments made on loans and other forms of borrowed capital.

- Impact on Profitability: Higher financing costs reduce net income and can affect earnings per share.

- 2023 Interest Expense: D.R. Horton reported $1.1 billion in interest expense for the fiscal year 2023.

D.R. Horton's cost structure is dominated by land acquisition, construction, and selling, general, and administrative (SG&A) expenses. In fiscal year 2023, cost of sales, which includes land and construction, was $26.2 billion out of $32.1 billion in total revenues. SG&A expenses for the same period were $3,403 million, or 10.9% of revenue, indicating a significant operational cost beyond direct building activities.

| Cost Category | Fiscal Year 2023 (Millions USD) | Percentage of Revenue |

|---|---|---|

| Cost of Sales (incl. Land & Construction) | 26,200 | 81.6% |

| Selling, General & Administrative (SG&A) | 3,403 | 10.9% |

| Interest Expense | 1,100 | 3.4% |

Revenue Streams

D.R. Horton's core revenue generation hinges on the direct sale of newly built single-family homes. This segment forms the bedrock of its financial performance, representing the overwhelming majority of its consolidated revenues.

In the fiscal year 2023, D.R. Horton reported total revenues of $35.5 billion, with home sales accounting for the lion's share of this figure. This demonstrates the company's primary focus and success in the residential construction market.

D.R. Horton's financial services segment is a key revenue driver, primarily through mortgage financing and title agency services offered to its homebuyers. This integrated approach not only streamlines the purchasing process for customers but also captures additional revenue streams for the company.

In 2023, D.R. Horton reported that its financial services segment, primarily DHI Mortgage, generated approximately $1.1 billion in revenue, representing a substantial portion of the company's overall financial performance and contributing significantly to profitability.

D.R. Horton generates revenue from its rental properties, which include both single-family homes and multi-family units that the company itself develops. This segment of their business offers a steady, recurring income stream, contributing to the overall stability of their financial performance.

In the fiscal year ending September 30, 2023, D.R. Horton's rental revenue, primarily from its single-family rental portfolio, was approximately $160 million. This demonstrates a growing diversification beyond traditional home sales, providing a consistent revenue base.

Lot Sales to Other Builders

While Forestar's core business involves supplying lots to its parent company, D.R. Horton, it strategically diversifies its revenue by selling developed lots to unaffiliated third-party homebuilders. This dual approach leverages Forestar's extensive land development expertise across a wider market, enhancing its overall revenue generation. In 2024, this segment of lot sales to other builders contributed to Forestar's robust financial performance, showcasing the flexibility and demand for its developed land inventory.

This strategy allows Forestar to capitalize on opportunities in various housing markets and with different builder segments, not solely reliant on D.R. Horton's demand. It demonstrates a sophisticated land management approach, maximizing the value of its land assets by serving multiple customer bases. This practice is crucial for maintaining strong sales volumes and profitability, especially in dynamic real estate environments.

- Diversified Revenue: Selling lots to external builders provides an additional income stream beyond D.R. Horton.

- Market Reach: This practice expands Forestar's customer base and market penetration.

- Asset Utilization: Maximizes the value of developed land by catering to a broader builder demand.

Other Ancillary Services

D.R. Horton's revenue streams extend beyond home sales to include various ancillary services that enhance the homeownership experience and create additional income. These services are designed to capture value throughout the customer journey.

The company operates an insurance agency, offering homeowners insurance and other related products. This provides a convenient, one-stop-shop solution for buyers and generates commission income for D.R. Horton. For instance, in fiscal year 2023, D.R. Horton reported significant revenue from its financial services segment, which includes title, mortgage, and insurance operations, underscoring the importance of these ancillary services to its overall financial performance.

- Insurance Agency Services: D.R. Horton offers homeowners insurance through its own agency, generating commission revenue and providing a bundled service for homebuyers.

- Mortgage Services: The company's mortgage operations facilitate financing for its buyers, creating a revenue stream from loan origination and servicing fees.

- Title Services: D.R. Horton also provides title insurance and closing services, capturing revenue related to the legal transfer of property ownership.

D.R. Horton's revenue streams are primarily driven by the sale of new homes, but also include significant contributions from financial services and rental properties. The company's strategic diversification into mortgage, title, and insurance services, alongside its growing rental portfolio, bolsters its overall financial performance and stability.

In fiscal year 2023, D.R. Horton achieved total revenues of $35.5 billion. The financial services segment, encompassing mortgage, title, and insurance, generated approximately $1.1 billion in revenue, highlighting its importance. Rental revenues, primarily from single-family rentals, added around $160 million for the same period.

| Revenue Stream | FY 2023 Revenue (Approx.) | Significance |

|---|---|---|

| Home Sales | $34.3 billion | Core business, largest revenue contributor |

| Financial Services (Mortgage, Title, Insurance) | $1.1 billion | Ancillary services, enhances customer experience, profitability driver |

| Rental Properties | $160 million | Recurring income, diversification, stability |

| Lot Sales (Forestar) | Not separately disclosed, but significant contribution to Forestar's revenue | Leverages land assets, expands market reach |

Business Model Canvas Data Sources

The D.R. Horton Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports on housing trends, and analysis of competitor strategies. These sources provide a comprehensive view of the company's operational landscape and strategic positioning.