D.R. Horton PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

Navigate the complex external forces shaping D.R. Horton's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the housing market, and gain a strategic advantage. Download the full version to unlock actionable intelligence and refine your market approach.

Political factors

Government housing policies, like those promoting affordable housing or offering tax incentives for homebuyers, directly shape D.R. Horton's market. For instance, the Inflation Reduction Act of 2022 included tax credits for energy-efficient home improvements, potentially boosting demand for new, efficient homes. These initiatives can open up new avenues for growth or influence the types of properties D.R. Horton prioritizes.

Changes in federal or state housing mandates, such as zoning reforms or requirements for increased housing supply, significantly impact D.R. Horton's strategic planning. Policies designed to streamline the development process or encourage specific housing types, like multi-family units, can alter the company's project pipeline and operational focus. For example, states like California have enacted legislation to address housing shortages, which could benefit builders like D.R. Horton.

Policies that encourage first-time homeownership, such as down payment assistance programs or favorable mortgage rates, can directly increase demand for D.R. Horton's entry-level homes. As of late 2024, many regional housing authorities continue to offer such programs, aiming to make homeownership more accessible. This trend supports D.R. Horton's core business model, which often targets first-time buyers.

The regulatory landscape, particularly concerning building permits and zoning laws, significantly impacts D.R. Horton's operational agility. Navigating these local regulations can be complex and time-consuming, directly influencing construction schedules and project expenses. For instance, in 2023, the average time to obtain a building permit in many U.S. municipalities could extend for several months, adding to project carrying costs.

Political shifts at the municipal and state levels can either facilitate or hinder D.R. Horton's expansion efforts. Changes in land-use policies or the introduction of new zoning restrictions can alter development feasibility and increase compliance costs. A streamlined permitting process, as seen in some states aiming to boost housing supply, can improve D.R. Horton's ability to meet market demand efficiently.

International trade policies, especially tariffs on imported construction materials like lumber, can significantly affect D.R. Horton's expenses. For example, in early 2024, lumber prices saw volatility, with futures contracts trading around $450-$500 per thousand board feet, a key input cost. Fluctuations in these tariffs, driven by geopolitical shifts or protectionist measures, directly influence the company's profit margins and how it prices new homes.

Political Stability and Elections

The broader political climate, including upcoming elections, can introduce uncertainty or potential opportunities for homebuilders like D.R. Horton. Changes in administrative priorities might affect economic stimulus measures, infrastructure investment, or environmental regulations, all of which can indirectly shape D.R. Horton's operational landscape and investor confidence.

Builder sentiment, as tracked by the National Association of Home Builders (NAHB)/Wells Fargo Housing Index, has shown some optimism for potential regulatory relief following election cycles. For instance, the index saw fluctuations throughout 2024, with periods of improved builder expectations correlating with anticipated shifts in policy. This suggests that political outcomes can directly influence the outlook for the housing market.

- Election Cycles: Upcoming elections can lead to policy shifts impacting housing demand and construction costs.

- Regulatory Environment: Changes in administration may alter building codes, zoning laws, and environmental standards.

- Economic Stimulus: Government spending on infrastructure or housing initiatives can boost the sector.

- Builder Confidence: Political stability and clear policy direction generally foster greater builder optimism.

Labor Policies and Immigration

Government labor policies, particularly those concerning immigration, significantly affect the construction sector. A stricter immigration environment can reduce the pool of available construction workers, driving up labor costs for companies like D.R. Horton. This can lead to project delays and increased expenses, impacting profitability and delivery timelines.

For instance, changes in immigration regulations can directly influence the supply of skilled and unskilled labor essential for homebuilding. The U.S. construction industry, which relies heavily on immigrant labor, could face substantial challenges if policies become more restrictive. This directly impacts D.R. Horton's operational capacity and cost management.

- Labor Shortages: A tightening of immigration policies could worsen existing labor shortages in construction, a sector that has seen a persistent deficit in skilled trades.

- Wage Inflation: Increased competition for a smaller labor pool typically leads to higher wages, directly impacting D.R. Horton's project costs.

- Project Timelines: Labor scarcity can extend construction schedules, affecting D.R. Horton's ability to meet delivery commitments and potentially increasing overhead.

Government housing policies, such as those promoting affordable housing or offering tax credits for energy-efficient homes, directly influence D.R. Horton's market. For example, the Inflation Reduction Act of 2022 included credits for energy-efficient improvements, potentially boosting demand for new, efficient homes. These initiatives can shape the types of properties D.R. Horton prioritizes and create new growth avenues.

What is included in the product

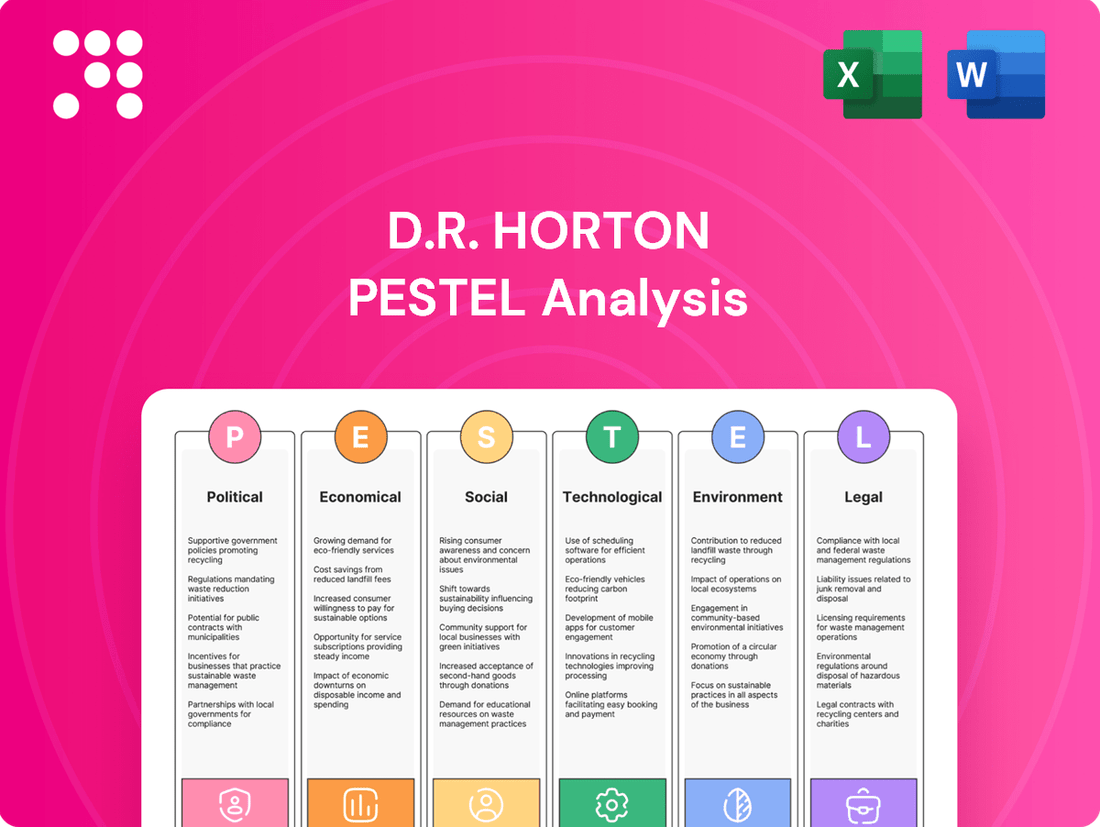

This D.R. Horton PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions present both opportunities and threats to the company's operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of D.R. Horton's external environment to proactively address potential challenges and capitalize on opportunities.

Economic factors

Fluctuations in interest rates, particularly for 30-year fixed mortgages, are a major economic driver for the housing market. These rates directly influence how much potential buyers can afford and, consequently, the overall demand for new homes, a key consideration for builders like D.R. Horton.

With 30-year fixed mortgage rates projected to stay above 6% through much of 2025, the monthly cost of homeownership increases substantially. This elevated cost can discourage many prospective buyers, leading to a potential slowdown in sales volumes for D.R. Horton and other homebuilders.

Inflationary pressures continue to impact D.R. Horton by increasing the cost of essential materials like lumber and concrete, as well as labor and transportation expenses. While the U.S. inflation rate has shown signs of cooling, it remained elevated in early 2024, with the Consumer Price Index (CPI) at 3.4% in April 2024. This persistent cost pressure can affect D.R. Horton's profit margins if they cannot pass these increases onto homebuyers through higher home prices.

Robust economic growth and strong employment rates are fundamental drivers for the housing market, directly impacting D.R. Horton's performance. In the first quarter of 2024, the U.S. economy expanded at an annualized rate of 1.3%, reflecting a moderating but still positive growth trajectory. A healthy job market, with the unemployment rate hovering around 3.9% in April 2024, bolsters consumer confidence and disposable income, encouraging home purchases.

When the economy is expanding and jobs are plentiful, more households are formed, and individuals feel financially secure enough to invest in housing. This scenario directly benefits D.R. Horton by increasing demand for their homes, leading to higher sales volumes and revenue. For example, D.R. Horton reported a significant increase in its fiscal 2023 revenues, reaching $35.5 billion, underscoring the impact of favorable economic conditions.

Conversely, any deceleration in economic activity or a rise in unemployment could negatively affect D.R. Horton. A weakening job market and reduced consumer spending would likely dampen demand for new homes, potentially leading to slower sales and impacting the company's financial results. For instance, if unemployment were to climb to 5% or higher, it could signal a significant downturn impacting housing affordability and demand.

Housing Inventory and Supply

Housing inventory levels are a critical factor for D.R. Horton. While inventory has been gradually improving, it still hasn't reached a point considered balanced for the market. This persistent undersupply, particularly for new homes, supports higher pricing for builders like D.R. Horton, but also highlights the ongoing demand for new construction.

As of early 2024, the U.S. housing market continued to grapple with historically low inventory. For instance, the number of homes for sale remained significantly below pre-pandemic levels. This scarcity directly benefits D.R. Horton by limiting direct competition from the resale market and allowing them to command stronger pricing on their new builds.

- Existing Home Inventory: Remained tight in early 2024, contributing to upward pressure on prices.

- New Home Inventory: While increasing, it was still insufficient to meet demand, creating opportunities for builders.

- Impact on Pricing: Low inventory generally allows D.R. Horton to maintain or increase home prices.

- Market Balance: The market is still not considered balanced, indicating continued demand for new construction.

Consumer Spending and Sentiment

Consumer sentiment plays a crucial role in the housing market, directly influencing demand for new homes. When consumers feel optimistic about the economy and their personal finances, they are more likely to make significant purchases, including buying a house. Conversely, a cautious outlook can dampen this willingness.

D.R. Horton, like other homebuilders, closely monitors consumer sentiment. For instance, in late 2023 and early 2024, persistent inflation and higher interest rates led to some consumer caution. This environment prompted builders to implement strategies such as offering mortgage rate buydowns to make homes more affordable and attractive.

- Consumer Confidence Index: The Conference Board's Consumer Confidence Index, a key indicator of sentiment, showed fluctuations throughout 2023 and into 2024, reflecting ongoing economic uncertainties.

- Affordability Concerns: High housing prices coupled with elevated mortgage rates in 2023 and early 2024 created significant affordability challenges for many potential buyers, impacting demand.

- Sales Incentives: To counteract reduced demand stemming from affordability issues, D.R. Horton and competitors frequently offered incentives like mortgage rate buydowns, price reductions, and closing cost assistance during this period.

- Impact on Demand: Reduced consumer willingness to commit to large purchases due to economic worries can lead to slower sales cycles and increased inventory for homebuilders.

Economic factors significantly shape D.R. Horton's operating environment. Fluctuating interest rates, particularly for mortgages, directly impact affordability and demand for new homes. Inflationary pressures increase construction costs for materials and labor, potentially squeezing profit margins if not passed on to buyers.

A strong economy with low unemployment generally fuels housing demand, benefiting D.R. Horton through increased sales. Conversely, economic slowdowns or rising unemployment can dampen consumer confidence and purchasing power, negatively affecting sales volumes.

Limited housing inventory, a persistent issue in early 2024, provides an advantage to builders like D.R. Horton by reducing competition and supporting higher home prices. However, sustained affordability challenges due to high prices and mortgage rates can temper demand despite low inventory.

Consumer sentiment is a key driver; positive outlooks encourage home purchases, while economic uncertainty can lead to caution. D.R. Horton, like its peers, employs strategies such as rate buydowns to mitigate the impact of affordability concerns on sales.

| Economic Factor | 2024/2025 Outlook/Data | Impact on D.R. Horton |

|---|---|---|

| Mortgage Rates (30-yr Fixed) | Projected above 6% through much of 2025 | Increases cost of ownership, potentially lowering demand. |

| Inflation (CPI) | 3.4% in April 2024; persistent pressure | Raises material, labor, and transportation costs. |

| Economic Growth (GDP) | 1.3% annualized in Q1 2024; moderating | Positive growth supports consumer confidence and home buying. |

| Unemployment Rate | Around 3.9% in April 2024 | Low rates bolster disposable income and housing demand. |

| Housing Inventory | Historically low in early 2024, gradually improving | Limits resale competition, supports higher new home prices. |

What You See Is What You Get

D.R. Horton PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive D.R. Horton PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping D.R. Horton's strategic landscape.

Sociological factors

Demographic shifts are fundamentally reshaping the housing market. The aging population, for instance, may increase demand for smaller, more accessible homes, while the large millennial generation, now entering their prime homebuying years, is a key driver for entry-level and move-up properties. In 2023, millennials accounted for the largest share of homebuyers at 43%, a significant figure for builders like D.R. Horton.

D.R. Horton's strategic focus on affordable, entry-level, and move-up housing directly aligns with these evolving demographic trends. This approach positions the company to capitalize on the substantial demand from millennials seeking to purchase their first homes or upgrade to larger residences as their families grow. The company's commitment to this segment is evident in its consistent market share within this crucial buyer demographic.

Shifting lifestyle trends are significantly influencing homebuyer preferences, with a growing demand for smart home technology and energy-efficient features. For instance, a 2024 survey indicated that 75% of new homebuyers consider smart home capabilities a desirable feature. D.R. Horton must integrate these elements into its designs to capture this market segment.

Furthermore, community amenities are playing a larger role in purchasing decisions. Buyers are increasingly seeking homes in communities offering features like walking trails, community gardens, or co-working spaces. D.R. Horton's ability to adapt its development plans to incorporate these sought-after amenities will be crucial for maintaining its competitive edge in the 2024-2025 housing market.

Urbanization and suburbanization trends significantly shape D.R. Horton's strategic land acquisition. The rise of remote work, for instance, has fueled a demand for larger homes in suburban areas, a segment where D.R. Horton excels. In 2024, many metropolitan areas continued to see population shifts towards outer suburbs, driven by affordability and lifestyle preferences.

D.R. Horton's established strength in suburban markets positions it well to capitalize on this ongoing migration. Suburban growth often translates to sustained demand for single-family homes, a core product offering for the company. As of early 2025, data indicates that suburban housing markets are still experiencing robust activity, benefiting builders with a strong footprint in these regions.

Affordability Crisis and Social Equity

The escalating housing affordability crisis, fueled by persistent high prices and elevated interest rates, is a significant sociological factor. This challenge directly impacts social equity, potentially intensifying calls for government intervention and more accessible housing options. For instance, the median home price in the US remained stubbornly high in early 2024, often exceeding $400,000, while mortgage rates hovered around 6-7%, making homeownership a distant dream for many. D.R. Horton, as a major builder, must adapt by maintaining diverse product offerings across various price points and exploring partnerships or programs that enhance housing accessibility.

Navigating this affordability crunch requires D.R. Horton to be responsive to evolving societal expectations. The company's strategy to offer a spectrum of homes, from starter houses to more premium options, is crucial in addressing the needs of a wider demographic. Recent data suggests that the demand for entry-level homes remains strong, even amidst economic headwinds. By continuing to innovate in construction methods and site selection, D.R. Horton can play a role in mitigating the social equity implications of the housing market.

- Housing Affordability Gap: In Q1 2024, the National Association of Realtors reported that a significant portion of potential homebuyers were priced out of the market due to the combination of high median home prices and mortgage rates.

- Social Equity Concerns: The widening gap between housing costs and household incomes raises concerns about intergenerational wealth transfer and access to stable housing for lower and middle-income families.

- Demand for Affordable Solutions: Surveys indicate a growing public desire for policy interventions and builder initiatives aimed at increasing the supply of affordable housing units.

- Builder Response: D.R. Horton's continued focus on building homes across multiple price segments, including its more affordably priced product lines, positions it to address some of these societal pressures.

Labor Availability and Workforce Diversity

The construction industry, including companies like D.R. Horton, faces ongoing challenges with the availability of skilled labor. This shortage directly impacts project completion times and overall construction costs, a persistent issue throughout 2024 and projected into 2025. For instance, the U.S. Bureau of Labor Statistics reported in early 2024 that there were over 400,000 unfilled construction positions nationwide.

D.R. Horton's success is significantly tied to its capacity to attract and retain a diverse and skilled workforce. A varied team can bring different perspectives and problem-solving approaches, enhancing operational efficiency and better meeting the diverse needs of its customer base. As of late 2023, the construction sector's workforce demographic showed a continued reliance on certain age groups, highlighting the need for D.R. Horton to focus on broader recruitment strategies.

To combat labor shortages, D.R. Horton, like many in the industry, must consider proactive strategies. These could include expanding apprenticeship programs, partnering with trade schools, and investing in training initiatives to upskill existing workers. Such measures are critical for ensuring a steady pipeline of qualified personnel to meet the robust housing demand anticipated through 2025.

- Labor Shortage Impact: Continued skilled labor gaps in construction, as evidenced by hundreds of thousands of open positions nationwide in early 2024, directly affect D.R. Horton's project timelines and cost management.

- Workforce Diversity: Attracting and retaining a diverse workforce is essential for D.R. Horton's operational efficiency and its ability to innovate and meet varied market demands.

- Recruitment Strategies: Proactive recruitment and training initiatives are vital for D.R. Horton to address labor availability challenges and secure a skilled workforce for future projects.

Societal expectations around homeownership are evolving, with a growing emphasis on sustainability and community integration. Buyers in 2024 are increasingly prioritizing energy-efficient homes and community features like green spaces, reflecting a broader societal shift towards environmental consciousness and quality of life. D.R. Horton's ability to incorporate these elements into its developments will be key to meeting these changing consumer desires.

The ongoing housing affordability crisis, exacerbated by high prices and interest rates, continues to be a major sociological concern. This affordability gap, with median home prices often exceeding $400,000 in early 2024, fuels discussions about social equity and the need for more accessible housing solutions. D.R. Horton must continue to offer diverse product lines to cater to a wider range of income levels.

Labor shortages within the construction industry remain a significant challenge, impacting project timelines and costs. With hundreds of thousands of unfilled construction positions nationwide in early 2024, D.R. Horton's focus on recruitment, training, and retention of skilled labor is paramount for sustained growth through 2025.

| Sociological Factor | Impact on D.R. Horton | 2024/2025 Data/Trend |

|---|---|---|

| Evolving Consumer Preferences | Demand for sustainable and community-focused homes | 75% of new homebuyers consider smart home features desirable (2024 survey) |

| Housing Affordability | Need for diverse product offerings across price points | Median home prices remained above $400,000 in early 2024; mortgage rates around 6-7% |

| Skilled Labor Shortage | Impact on project completion and costs | Over 400,000 unfilled construction positions nationwide (early 2024) |

Technological factors

Innovations like modular construction and prefabrication are significantly impacting homebuilding efficiency. For D.R. Horton, these methods can slash build times and reduce material waste, contributing to a more sustainable and cost-effective operation. For instance, the modular construction market is projected to grow substantially, with some estimates suggesting a compound annual growth rate exceeding 6% through 2028, indicating a strong trend towards off-site construction.

The adoption of advanced building materials, such as high-performance insulation and smart home technologies, also offers D.R. Horton a competitive advantage. These materials can improve energy efficiency, enhance durability, and increase the overall appeal of new homes. By integrating these advancements, D.R. Horton can deliver higher quality products and potentially achieve significant cost savings in labor and materials, especially as the demand for sustainable and technologically advanced housing continues to rise.

The growing desire for smart home technology, encompassing AI automation, energy efficiency, and enhanced security, means D.R. Horton must incorporate these advancements into its new constructions. For instance, by 2025, an estimated 60% of new homes are projected to include some form of smart home technology, a significant increase from just 25% in 2020, according to industry reports.

By offering integrated smart home packages, D.R. Horton can appeal to a younger, tech-oriented demographic and potentially boost resale values. The smart home market itself is expected to reach $150 billion globally by 2025, highlighting a substantial opportunity for builders who can deliver these features.

Digital sales and marketing tools are transforming the homebuilding industry. D.R. Horton can capitalize on this by utilizing digital platforms for wider reach and virtual tours to enhance buyer engagement. In 2023, online channels accounted for a significant portion of lead generation for many homebuilders, with virtual tours often leading to higher conversion rates.

Data Analytics and AI in Operations

D.R. Horton is increasingly leveraging data analytics and artificial intelligence (AI) to sharpen its operational edge. These technologies are being deployed across critical functions such as identifying promising land acquisition opportunities, refining demand forecasting for new homes, and streamlining project management. For instance, AI can analyze vast datasets to pinpoint optimal locations and predict market absorption rates more accurately.

The integration of AI-driven tools promises to enhance D.R. Horton's financial planning and execution. Improved budgeting accuracy, real-time site monitoring through advanced analytics, and predictive capabilities for project timelines are key benefits. This allows for more proactive management of resources and potential issues, ultimately contributing to smoother and more efficient project delivery.

- Enhanced Land Acquisition: AI algorithms can process demographic, economic, and zoning data to identify undervalued land parcels, potentially reducing acquisition costs.

- Improved Demand Forecasting: Predictive analytics help D.R. Horton anticipate buyer preferences and regional housing demand, optimizing inventory levels and reducing carrying costs.

- Streamlined Project Management: AI can monitor construction progress, predict potential delays, and optimize resource allocation, leading to faster project completion and cost savings.

- Optimized Budgeting: Machine learning models can analyze historical project data to create more accurate budgets, minimizing cost overruns.

Sustainable Building Materials and Methods

Technological progress is significantly shaping the construction industry, presenting D.R. Horton with avenues to innovate. Advancements in sustainable and carbon-negative building materials, like those derived from perennial grasses, are emerging. These innovations allow homebuilders to lessen their ecological footprint and attract buyers prioritizing environmental responsibility.

The adoption of these advanced materials can also lead to tangible performance improvements in new homes. For instance, certain sustainable options offer enhanced resistance to moisture and fire, contributing to greater durability and safety. This aligns with D.R. Horton's goal of delivering quality housing while adapting to evolving consumer preferences and regulatory landscapes.

- Material Innovation: Development of carbon-negative materials from sources like perennial grasses offers a pathway to reduce embodied carbon in construction.

- Performance Enhancement: Integration of these materials can improve home resilience, specifically in areas like moisture management and fire resistance.

- Market Appeal: Growing consumer demand for eco-friendly and sustainable housing provides a competitive advantage for builders adopting these technologies.

Technological advancements are revolutionizing home construction, with D.R. Horton benefiting from innovations like modular building and prefabrication, which are projected to boost efficiency. The increasing integration of smart home technology, with an estimated 60% of new homes featuring it by 2025, presents a significant market opportunity.

D.R. Horton is also leveraging AI and data analytics for land acquisition, demand forecasting, and project management, aiming for greater precision and cost savings. For example, AI can optimize resource allocation in real-time, leading to smoother project delivery and potentially reducing construction timelines.

The adoption of advanced and sustainable building materials, such as those offering enhanced moisture and fire resistance, further strengthens D.R. Horton's product offering. These materials not only improve home performance but also cater to the growing consumer demand for eco-friendly housing options.

| Technology Area | Impact on D.R. Horton | Market Data/Projections |

|---|---|---|

| Modular/Prefab Construction | Increased build efficiency, reduced waste, cost savings | Modular construction market projected to grow at over 6% CAGR through 2028 |

| Smart Home Technology | Enhanced home appeal, appeal to tech-savvy buyers, potential for higher resale values | Estimated 60% of new homes to include smart tech by 2025; global smart home market to reach $150 billion by 2025 |

| AI & Data Analytics | Improved land acquisition, demand forecasting, project management, budgeting accuracy | AI-driven insights can pinpoint optimal locations and predict market absorption rates |

| Sustainable Materials | Reduced ecological footprint, improved home performance (moisture/fire resistance), market differentiation | Growing consumer demand for eco-friendly housing |

Legal factors

D.R. Horton must comply with a complex web of national and local building codes and construction standards. This includes staying current with updates to influential frameworks like the International Building Code (IBC) and the International Energy Conservation Code (IECC). These evolving regulations often mandate enhanced safety features, improved energy efficiency, and greater structural resilience, directly impacting D.R. Horton's design and construction methodologies.

Meeting these increasingly stringent requirements can lead to higher material and labor costs for D.R. Horton. For instance, the 2021 IECC introduced more rigorous insulation and fenestration requirements, potentially adding 2-5% to construction costs for new homes, depending on climate zone and specific design. Failure to adhere to these codes can result in significant fines, project delays, and reputational damage, underscoring the critical nature of compliance for the company's operations and profitability.

D.R. Horton, like all homebuilders, must navigate a complex web of environmental regulations. Key among these are laws like the Clean Water Act, which govern stormwater discharges and impact land development. This means careful management of construction sites to prevent pollution runoff is essential.

Failure to comply can result in substantial financial penalties. For instance, D.R. Horton has faced settlements related to stormwater management practices, underscoring the significant costs associated with non-compliance. These settlements often mandate the implementation of robust stormwater management programs, adding to operational expenses.

Zoning and land-use laws are critical for D.R. Horton, as they directly control where and how the company can build homes. These local regulations, often influenced by community desires and environmental considerations, can significantly affect the cost and availability of land. For instance, shifts towards stricter zoning or increased open-space requirements can limit the density of new developments, potentially impacting D.R. Horton's ability to scale its operations efficiently in certain markets.

Consumer Protection and Warranty Laws

Consumer protection and warranty laws significantly impact D.R. Horton's operations. These regulations safeguard homebuyers against issues like construction defects and ensure builders honor warranties. Failure to comply can lead to costly litigation and reputational damage.

D.R. Horton has faced numerous lawsuits concerning construction quality. For instance, in 2023, the company settled a class-action lawsuit in Florida alleging widespread construction defects, underscoring the need for stringent quality control and adherence to consumer protection statutes to minimize legal exposure.

- Legal Risk Mitigation: Robust quality assurance programs and proactive defect resolution are essential to avoid costly lawsuits and maintain consumer trust.

- Warranty Compliance: Adhering to all warranty obligations is critical to prevent legal disputes and protect the company's financial standing.

- Regulatory Scrutiny: Ongoing compliance with evolving consumer protection laws, such as those related to disclosure and construction standards, is paramount.

Labor Laws and Workforce Regulations

D.R. Horton must navigate a complex web of federal and state labor laws. This includes adhering to regulations on minimum wage, overtime pay, workplace safety standards like OSHA, and anti-discrimination statutes. For example, in 2024, the U.S. Department of Labor continued its focus on wage and hour compliance, with significant penalties for violations impacting construction companies. Staying compliant is crucial for managing labor costs and ensuring smooth operations.

Evolving labor regulations can directly influence D.R. Horton's expenses and how it manages its workforce. For instance, potential increases in minimum wage or new mandates for employee benefits, such as paid sick leave, could raise operational costs. The company's ability to adapt its human capital management strategies to these changes is vital for maintaining profitability and competitive advantage in the housing market.

- Wage and Hour Laws: Adherence to Fair Labor Standards Act (FLSA) provisions for minimum wage and overtime.

- Workplace Safety: Compliance with Occupational Safety and Health Administration (OSHA) standards, critical in the construction sector.

- Worker Classification: Navigating regulations regarding employee vs. independent contractor status, which impacts tax liabilities and benefits.

- Anti-Discrimination: Ensuring fair employment practices in line with Title VII of the Civil Rights Act and other relevant legislation.

D.R. Horton's operations are heavily influenced by building codes and land-use regulations, which dictate construction standards and development locations. These legal frameworks, including the International Building Code, are constantly updated, demanding adherence to enhanced safety and energy efficiency measures. For example, the 2021 IECC’s stricter insulation requirements can increase home construction costs by 2-5%.

Environmental laws, such as the Clean Water Act, necessitate careful site management to prevent pollution, with non-compliance leading to significant fines and mandated program improvements. Consumer protection laws and warranty obligations are also critical, as failures in construction quality can result in costly litigation, as seen in a 2023 Florida class-action settlement for D.R. Horton. Furthermore, adherence to federal and state labor laws, including wage and hour regulations and OSHA safety standards, is vital for managing operational costs and avoiding penalties, with the Department of Labor actively pursuing violations in 2024.

Environmental factors

Climate change is increasingly impacting the construction industry, forcing companies like D.R. Horton to adapt. The rising frequency and intensity of extreme weather events, such as hurricanes and heavy rainfall, demand more robust building materials and designs. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling $177.6 billion in damages, according to NOAA. This trend directly affects construction costs and insurance premiums for homebuilders.

Adapting to these environmental shifts means D.R. Horton must invest in more resilient building practices. This could involve utilizing stronger roofing materials, improved flood mitigation techniques, and designs engineered to withstand higher wind speeds. Such adaptations, while increasing upfront costs, are crucial for long-term property durability and reducing future repair expenses and liability for the company.

The increasing focus on sustainability is reshaping the housing market, pushing builders like D.R. Horton to integrate eco-friendly features. Consumers are more aware of energy efficiency, and regulations are tightening, directly influencing home designs and materials. For instance, the U.S. Department of Energy's ENERGY STAR program continues to set benchmarks for energy-efficient homes, a trend D.R. Horton is actively participating in.

D.R. Horton is responding by incorporating more energy-efficient options, such as improved insulation, high-performance windows, and efficient HVAC systems. The company is also tracking its environmental impact, a crucial step for aligning with the growing green building movement. This proactive approach could lead to advantages like enhanced brand reputation and potential eligibility for green building certifications or tax incentives, which are becoming more prevalent in various states.

D.R. Horton's reliance on timber and water for home construction means resource availability is a key concern. For instance, in 2024, lumber prices saw volatility, impacting D.R. Horton's cost of goods sold. The company actively monitors these trends and explores sustainable sourcing options to mitigate risks associated with scarcity and evolving environmental regulations.

Waste Management and Pollution Control

D.R. Horton, like other homebuilders, faces significant environmental responsibilities, particularly concerning waste management and pollution control. Effectively managing construction debris and preventing pollution, especially from stormwater runoff at its building sites, are crucial operational and ethical considerations. Failure to comply with environmental regulations can result in substantial fines and damage to the company's reputation.

The company must actively implement strategies for waste reduction, recycling, and proper disposal of construction materials. Furthermore, controlling sediment and pollutant runoff from its sites is paramount to protecting local waterways and ecosystems. As of 2024, the Environmental Protection Agency (EPA) continues to emphasize stringent stormwater management regulations, requiring builders to obtain permits and implement best management practices.

- Waste Diversion: D.R. Horton aims to divert a significant portion of construction and demolition waste from landfills through recycling and reuse programs.

- Stormwater Management: Implementing best management practices (BMPs) to control erosion and sediment runoff, thereby protecting water quality.

- Regulatory Compliance: Adhering to federal, state, and local environmental laws, including those related to hazardous materials and air quality.

- Sustainability Initiatives: Exploring and adopting more sustainable building practices that minimize environmental impact throughout the construction lifecycle.

Land Development and Biodiversity

The environmental footprint of land acquisition and development is a critical consideration for homebuilders like D.R. Horton. This includes the impact on biodiversity and the preservation of natural habitats. In 2023, D.R. Horton reported a net sales revenue of $35.5 billion, underscoring the scale of their land development activities and the associated environmental responsibilities.

Responsible land use necessitates careful site selection and development practices. This often involves conducting environmental impact assessments and implementing mitigation strategies to minimize harm to ecosystems. For instance, developers might set aside portions of land for conservation or employ techniques to reduce soil erosion and water runoff.

D.R. Horton's approach to environmental stewardship is increasingly scrutinized by investors and regulators. The company's commitment to sustainability is becoming a key factor in its long-term valuation and social license to operate. As of the first quarter of 2024, the company's stock price reflected market confidence, but continued environmental performance will be crucial for sustained investor support.

- Ecological Impact: Land development can lead to habitat fragmentation and loss, affecting local wildlife populations.

- Mitigation Efforts: Companies may invest in environmental studies and conservation plans to offset development impacts.

- Regulatory Landscape: Stricter environmental regulations can influence site acquisition costs and development timelines.

- Stakeholder Expectations: Growing demand for sustainable housing puts pressure on builders to adopt greener practices.

Environmental factors significantly shape D.R. Horton's operations, from the increasing costs of adapting to extreme weather events, which caused $177.6 billion in damages across 28 U.S. billion-dollar disasters in 2023, to the demand for sustainable building practices. The company must balance these challenges with its reliance on resources like timber, which experienced price volatility in 2024, and manage its environmental footprint, including waste and stormwater runoff, to comply with stringent EPA regulations as of 2024.

D.R. Horton's land development activities, generating $35.5 billion in net sales revenue in 2023, also face scrutiny regarding ecological impact and biodiversity. Stakeholder expectations for greener practices and stricter regulations on land use are pushing the company towards more responsible development, influencing site acquisition and potentially affecting long-term valuation and investor confidence.

| Environmental Factor | Impact on D.R. Horton | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Extreme Weather Events | Increased construction costs, demand for resilient designs | $177.6 billion in damages from 28 billion-dollar weather/climate disasters in the U.S. (2023) |

| Sustainability Demand | Integration of energy-efficient features, enhanced brand reputation | Continued growth of ENERGY STAR certified homes; increasing consumer preference for green building |

| Resource Availability | Supply chain management, cost of goods sold | Lumber price volatility observed in 2024 |

| Waste & Pollution Control | Operational costs, regulatory compliance, reputational risk | Stricter EPA stormwater management regulations (ongoing as of 2024) |

| Land Use & Biodiversity | Site acquisition costs, development timelines, stakeholder expectations | $35.5 billion in net sales revenue (2023) indicates significant land development scale |

PESTLE Analysis Data Sources

Our D.R. Horton PESTLE analysis is grounded in comprehensive data from leading housing market research firms, government economic indicators, and regulatory updates. We meticulously gather insights on political stability, economic forecasts, technological advancements, and environmental policies impacting the construction sector.