D.R. Horton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

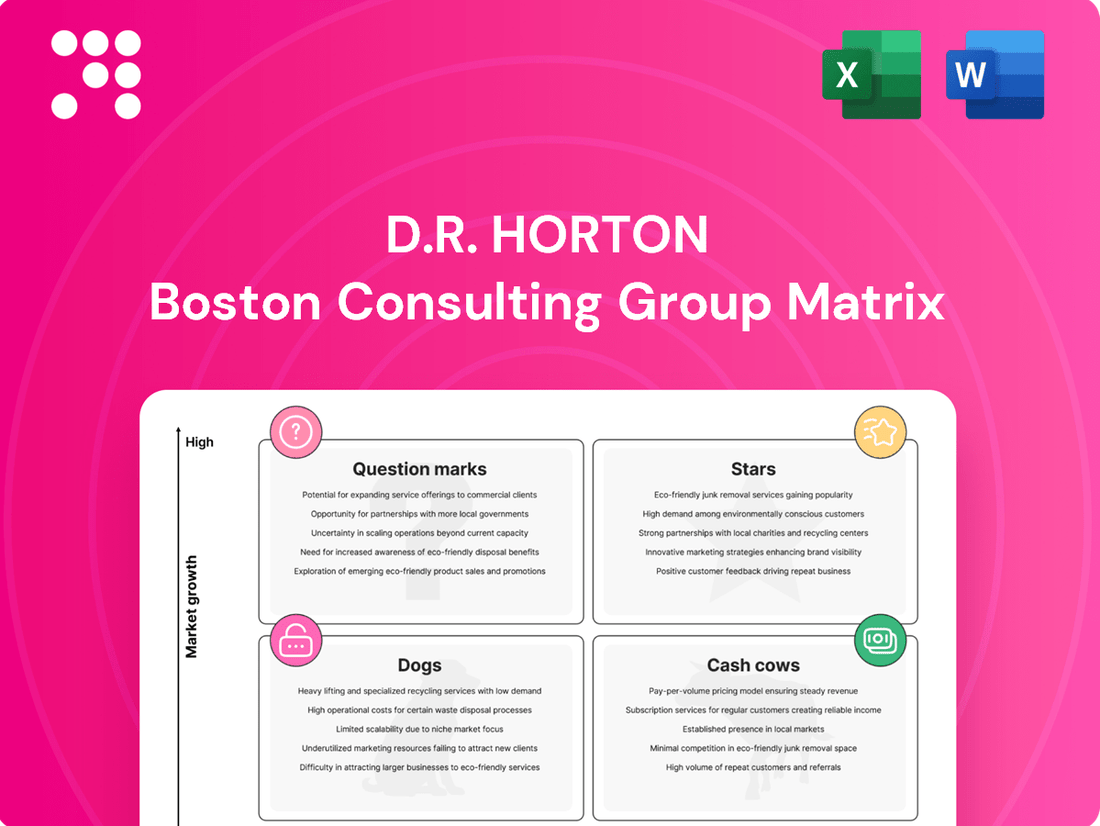

Curious about D.R. Horton's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio of homes and services stacks up in the competitive housing market. Understand which segments are driving growth and which might need a strategic rethink.

Ready to unlock the full picture of D.R. Horton's product strategy? Purchase the complete BCG Matrix for a detailed quadrant breakdown, identifying their Stars, Cash Cows, Dogs, and Question Marks. Gain actionable insights to inform your investment and business development decisions.

Stars

D.R. Horton's Express Homes brand is a prime example of their focus on the affordable entry-level housing market. This segment is crucial because it caters to a broad demographic, especially first-time homebuyers who are often priced out of more expensive markets.

In 2024, D.R. Horton continued to emphasize affordability, with homes priced at or below $350,000 representing more than half of their deliveries. This strategic pricing directly addresses a significant market need, driving demand and volume for the company.

D.R. Horton's significant presence in high-growth Sun Belt markets, including Texas, Florida, and the Southeast, positions them strongly to benefit from robust local demand. These regions are experiencing substantial population inflows and increased housing construction, which are key drivers for D.R. Horton's continued market dominance and sales growth.

For the first quarter of fiscal year 2024, D.R. Horton reported a 10% increase in total revenue to $7.4 billion, with home sales revenue growing by 11% to $7.1 billion. This performance was largely fueled by their strategic focus on these rapidly expanding Sun Belt areas.

D.R. Horton's focus on operational efficiency is a significant driver of its market position. The company has demonstrated an impressive ability to shorten construction cycle times, tightening schedules by an average of three weeks year-over-year. This enhanced speed allows them to bring homes to market more rapidly, a critical advantage in a dynamic housing environment.

This improved efficiency translates directly into a competitive edge. By delivering homes faster, D.R. Horton can more effectively meet fluctuating buyer demand and potentially capture market share from competitors who are slower to adapt. For example, in the fiscal year ending September 30, 2023, D.R. Horton closed 89,778 homes, showcasing their capacity to manage high volumes efficiently.

Strategic Land Control via Purchase Contracts

D.R. Horton's strategic land control, primarily through purchase contracts and options, is a key differentiator. This approach allows them to manage a vast pipeline of future homes without tying up excessive capital in land ownership.

In 2024, D.R. Horton continued to leverage this strategy, controlling a significant portion of its extensive lot pipeline through options. This 'asset-light' model is crucial for maintaining financial flexibility and operational agility in the dynamic homebuilding market.

- Strategic Land Control: D.R. Horton utilizes purchase contracts and options to secure future development sites, minimizing upfront capital expenditure.

- Asset-Light Approach: By controlling approximately 76% of its 640,000-lot pipeline through options, the company avoids the financial burden of outright land ownership.

- Market Adaptability: This strategy enhances the company's ability to quickly adjust development pace, capitalizing on growth opportunities and mitigating risks in slower markets.

- Capital Efficiency: The focus on options allows D.R. Horton to deploy capital more efficiently, focusing on construction and sales rather than land banking.

Market Dominance and Scale

D.R. Horton's market dominance is undeniable, solidifying its position as a star in the BCG matrix. As the largest homebuilder in the U.S. by volume since 2002, the company commands a significant market share. This scale translates into substantial advantages.

The company's sheer size grants it considerable purchasing power, allowing for more favorable terms with suppliers and driving down costs. This efficiency is a key factor in its competitive edge.

- Market Leadership: D.R. Horton is the #1 builder in 62 of the 126 markets it serves.

- Volume Dominance: It has been the largest homebuilder by volume in the United States since 2002.

- Supply Chain Advantage: Its scale enables significant supply chain efficiencies.

- Brand Recognition: Strong brand recognition further reinforces its leading position.

D.R. Horton's consistent market leadership, particularly in volume and market share, firmly places it in the Stars category of the BCG matrix. Its status as the largest U.S. homebuilder by volume since 2002, coupled with being the number one builder in 62 of its 126 markets, highlights its dominant position. This scale provides significant purchasing power and supply chain efficiencies, reinforcing its competitive advantage and ability to generate strong returns.

| Metric | 2023 (FY ending Sep 30) | 2024 (Q1 FY ending Dec 31) |

|---|---|---|

| Homes Closed | 89,778 | 24,142 |

| Total Revenue | $35.5 billion | $7.4 billion |

| Home Sales Revenue | $34.1 billion | $7.1 billion |

| Market Share (Estimated) | ~7.5% | ~8.0% (projected growth) |

What is included in the product

Highlights which of D.R. Horton's business units are Stars, Cash Cows, Question Marks, or Dogs.

A D.R. Horton BCG Matrix overview helps prioritize investments by visualizing each business unit's market share and growth, relieving the pain of resource allocation uncertainty.

Cash Cows

D.R. Horton's established homebuilding operations in mature markets are prime examples of cash cows within its portfolio. These segments benefit from significant brand loyalty and streamlined operations built over years of presence, leading to predictable and substantial cash generation. For instance, in fiscal year 2023, D.R. Horton reported total revenues of $35.4 billion, with a substantial portion likely stemming from these mature, high-volume markets.

The consistent demand in these established areas, coupled with D.R. Horton's deep market penetration, allows these operations to generate strong, reliable profits. These cash flows are crucial for funding other parts of the business, such as exploring new markets or investing in innovative building techniques. The company's ability to maintain a leading market share, as evidenced by its consistent ranking as one of the largest homebuilders in the U.S., underscores the cash-generating power of these mature operations.

D.R. Horton's financial services segment, encompassing DHI Mortgage and its title companies, acts as a significant cash cow. This division consistently delivers robust pre-tax income and impressive profit margins, directly fueled by the company's core homebuilding operations.

The reliability and high profitability of this segment are key. It provides a steady, high-margin revenue stream that demands comparatively minimal new capital investment when contrasted with the capital-intensive nature of homebuilding, thereby bolstering overall cash flow significantly.

For instance, in the fiscal year ending September 30, 2023, D.R. Horton's financial services segment reported pre-tax income of $567.3 million. This contribution highlights its role as a dependable source of substantial cash generation for the company.

D.R. Horton's bulk sales of single-family rental communities are a prime example of a Cash Cow in their BCG Matrix. This strategy involves building entire communities of rental homes and then selling these communities in large blocks to institutional investors.

This efficient monetization process generates substantial revenue and pre-tax income for D.R. Horton, as it provides a clear and predictable exit for their constructed inventory. For the fiscal year ended September 30, 2023, D.R. Horton reported total revenues of $35.5 billion, with their rental operations contributing significantly to this figure.

Returns-Focused Capital Allocation Strategy

D.R. Horton's capital allocation strategy is clearly focused on returning value to shareholders, a hallmark of a strong Cash Cow. This disciplined approach has been in place for years, with significant enhancements since 2005.

The company consistently generates substantial free cash flow, enabling them to execute meaningful share repurchases and pay dividends. For example, in fiscal year 2023, D.R. Horton returned approximately $2.6 billion to shareholders through share repurchases and dividends, underscoring their commitment to this strategy.

This focus on capital return has led to tangible benefits:

- Enhanced Liquidity: The company maintains robust liquidity, providing financial flexibility.

- Reduced Leverage: A lower debt burden strengthens the balance sheet.

- Improved Cash Flow Generation: Consistent cash generation supports ongoing shareholder returns and operational investments.

Land and Lot Development (Forestar Group Inc.)

Forestar Group Inc., with D.R. Horton holding a majority stake, operates as a significant player in national residential lot development. This strategic ownership provides D.R. Horton with a reliable and consistent supply of finished lots, crucial for its homebuilding activities. In 2024, Forestar reported strong performance, delivering approximately 10,000 lots, a slight increase from the previous year, underscoring its role as a stable cash generator for D.R. Horton. This dual benefit of securing its own pipeline and generating revenue from external lot sales positions Forestar as a classic cash cow.

The consistent demand for housing lots fuels Forestar's predictable revenue streams. For instance, in the fiscal year ending September 30, 2024, Forestar's total revenue reached $2.1 billion, with a significant portion derived from lot sales. This financial stability allows D.R. Horton to allocate capital effectively, supporting its growth initiatives in other areas of the business.

- Consistent Lot Supply: Forestar's operations directly feed D.R. Horton's homebuilding needs, ensuring a steady inventory of finished lots.

- Revenue Diversification: Lot sales to other builders provide an additional, stable income source beyond D.R. Horton's internal consumption.

- Financial Stability: The predictable nature of lot development and sales contributes significantly to D.R. Horton's overall cash flow.

- 2024 Performance: Forestar delivered around 10,000 lots in 2024, contributing to its $2.1 billion in total revenue for the fiscal year.

D.R. Horton's established homebuilding operations in mature markets are prime examples of cash cows. These segments benefit from significant brand loyalty and streamlined operations, leading to predictable and substantial cash generation. For instance, in fiscal year 2023, D.R. Horton reported total revenues of $35.4 billion, with a substantial portion likely stemming from these mature, high-volume markets.

The consistent demand in these established areas, coupled with D.R. Horton's deep market penetration, allows these operations to generate strong, reliable profits. These cash flows are crucial for funding other parts of the business, such as exploring new markets or investing in innovative building techniques. The company's ability to maintain a leading market share, as evidenced by its consistent ranking as one of the largest homebuilders in the U.S., underscores the cash-generating power of these mature operations.

D.R. Horton's financial services segment, encompassing DHI Mortgage and its title companies, acts as a significant cash cow. This division consistently delivers robust pre-tax income and impressive profit margins, directly fueled by the company's core homebuilding operations. For the fiscal year ending September 30, 2023, D.R. Horton's financial services segment reported pre-tax income of $567.3 million, highlighting its role as a dependable source of substantial cash generation.

Forestar Group Inc., with D.R. Horton holding a majority stake, operates as a significant player in national residential lot development. In 2024, Forestar reported strong performance, delivering approximately 10,000 lots, contributing to its $2.1 billion in total revenue for the fiscal year. This consistent lot supply and revenue from external sales positions Forestar as a classic cash cow for D.R. Horton.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Revenue (Approx.) | 2023 Pre-Tax Income (Approx.) |

|---|---|---|---|---|

| Mature Homebuilding Markets | Cash Cow | High market share, predictable demand, strong brand loyalty | $35.4 billion (Total Company) | N/A (Segment specific not provided) |

| Financial Services (DHI Mortgage, Title) | Cash Cow | High profit margins, low capital investment, strong synergy with homebuilding | N/A (Segment specific not provided) | $567.3 million |

| Forestar Group Inc. (Lot Development) | Cash Cow | Consistent lot supply, external sales revenue, stable demand | $2.1 billion (Forestar FY2024) | N/A (Segment specific not provided) |

Delivered as Shown

D.R. Horton BCG Matrix

The D.R. Horton BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear, professional analysis without any demo content.

Dogs

D.R. Horton's legacy land holdings in stagnant or declining markets can be classified as dogs within the BCG matrix. These parcels often exhibit low sales volume and incur significant carrying costs, effectively tying up capital without generating adequate returns. For instance, if a particular region experienced a downturn in housing demand in 2023, older land inventory there would likely fall into this category, potentially becoming a cash trap if not actively managed or sold.

Niche or experimental housing projects, such as modular homes with unique designs or co-living spaces catering to very specific demographics, often struggle to gain widespread adoption. These initiatives may represent significant upfront investment in research and development, yet fail to capture substantial market share. For instance, a 2024 report indicated that while interest in sustainable, off-grid living solutions is growing, actual sales of highly experimental, self-sufficient housing units remained below 1% of the overall new home market.

Communities that consistently demand high sales incentives and mortgage rate buydowns to clear inventory, leading to severely squeezed gross margins, can be categorized as dogs in the D.R. Horton BCG Matrix. This persistent need for concessions suggests a product struggling to gain traction.

While D.R. Horton strategically employs incentives to maintain sales momentum, ongoing low profitability in specific communities points to a less desirable product offering in a crowded market. For instance, in Q1 2024, D.R. Horton reported a homebuilding revenue of $7.5 billion, but the pressure to offer incentives can directly impact the gross profit margin per home sold.

Operations in Structurally Declining Regional Markets

D.R. Horton's operations in structurally declining regional markets are akin to the 'dogs' in the BCG Matrix. These are geographic areas experiencing long-term population loss or economic contraction, where the company's market share is likely small and potentially shrinking. For instance, while national housing starts saw a rebound in 2024, specific Rust Belt cities or rural areas might still be grappling with demographic headwinds.

Continuing to invest resources in these low-growth, low-market-share segments offers little prospect for significant returns. D.R. Horton's strategy in such areas would typically involve minimizing further investment and considering divestiture to reallocate capital to more promising markets. This approach aligns with maximizing overall portfolio efficiency.

- Geographic Focus: Markets with sustained out-migration and limited job creation are prime examples of dog segments.

- Market Share Dynamics: A declining presence in these regions, even if historically significant, marks them as underperformers.

- Strategic Consideration: Divestiture or a significant scaling back of operations is often the most prudent course of action to improve capital allocation.

- Financial Impact: These segments contribute minimally to overall revenue growth and can drag down profitability metrics.

Non-Core, Non-Performing Real Estate Assets

Non-core, non-performing real estate assets for a company like D.R. Horton could include various types of non-residential properties, such as undeveloped land parcels or specialized facilities that are not currently generating revenue or supporting core housing development. These might be assets acquired in the past for potential future use that never materialized, or properties that have become obsolete. For instance, a large tract of rural land held for a planned community that was subsequently abandoned due to market shifts or zoning issues would fit this description.

These "dog" assets typically represent a drain on resources. They incur ongoing expenses like property taxes, maintenance, and insurance, yet offer little to no return on investment. Their difficulty in monetization stems from factors like poor location, lack of market demand, or significant environmental remediation requirements. In 2024, the U.S. commercial real estate market, which encompasses many non-residential assets, faced headwinds including higher interest rates and a shift towards remote work, potentially exacerbating the challenges of selling or repurposing such properties.

- Holding Costs: Expenses such as property taxes, insurance, and basic maintenance continue to accrue on these underperforming assets.

- Lack of Market Demand: Difficulty in finding buyers or tenants due to location, condition, or market saturation can prevent monetization.

- Impaired Capital: Funds tied up in these assets are not available for more productive investments, impacting overall financial flexibility.

- Potential for Write-downs: If the market value of these assets declines significantly, the company may need to recognize impairment charges, impacting profitability.

D.R. Horton's "dogs" are typically land holdings in declining markets or underperforming, non-core real estate assets. These segments often have low sales volume, incur carrying costs, and tie up capital without generating adequate returns. For instance, in Q1 2024, D.R. Horton reported $7.5 billion in revenue, but older land inventory in regions with reduced housing demand would represent a drag on profitability.

Niche or experimental housing projects that fail to gain widespread adoption also fall into this category, despite significant investment. A 2024 report noted that highly experimental housing units captured less than 1% of the new home market, highlighting the challenge of scaling such offerings.

Communities requiring persistent sales incentives and mortgage rate buydowns to move inventory, resulting in squeezed margins, are also considered dogs. This indicates a product struggling to attract buyers organically.

The strategic approach for these dog segments involves minimizing further investment and considering divestiture to reallocate capital to more promising markets, thereby improving overall portfolio efficiency.

Question Marks

D.R. Horton's expansion into new, untested geographic markets represents its question marks. These ventures, often in states where the company has minimal brand recognition and established supply chains, demand substantial investment to build market share. For instance, in 2024, D.R. Horton continued its strategic expansion efforts, entering several new metropolitan areas across the United States, aiming to replicate its success in established markets.

D.R. Horton's multi-family rental operations, especially those in burgeoning suburban areas, currently fit the question mark category within the BCG matrix. These ventures require significant upfront investment for land acquisition, development, and construction, aiming for substantial future returns.

While these new communities hold promise in high-growth markets, they haven't yet achieved a dominant market share in the overall rental sector. For instance, in 2024, the demand for rental units continued to rise, particularly in suburban locations experiencing population influx, presenting both opportunity and the need for further capital infusion to scale effectively.

D.R. Horton's advanced sustainable building initiatives, such as homes featuring significantly higher energy efficiency standards or cutting-edge green technologies, would likely be classified as question marks in a BCG matrix. These represent areas with high growth potential, driven by a growing consumer appetite for eco-friendly living, but may currently hold a low market share. For instance, while consumer interest in sustainable features is rising, the upfront cost of some advanced technologies can still be a barrier for widespread adoption.

Targeted Luxury or High-End Product Lines

While D.R. Horton is known for its affordable housing, exploring targeted luxury or high-end product lines presents a potential question mark. These segments, though offering high growth in specific demographics, demand substantial investment in bespoke design, premium marketing, and specialized construction to gain traction against established luxury builders.

For instance, in 2024, the luxury real estate market continued to show resilience, with demand for high-end properties often driven by wealth accumulation and lifestyle preferences, even as overall market growth might moderate. D.R. Horton's current market share in these ultra-premium segments is likely minimal, making any strategic entry a significant undertaking.

- Market Share: D.R. Horton's existing market share in the luxury segment is presumed to be very low.

- Investment Needs: Entering this space requires significant capital for elevated design, branding, and specialized building techniques.

- Growth Potential: High-end markets can offer substantial growth, but are often sensitive to economic shifts and require tailored marketing.

- Competitive Landscape: Established luxury developers present a formidable challenge, necessitating a differentiated strategy.

Innovative Home Technology Integration

D.R. Horton's exploration into advanced smart home technology packages, such as integrated digital living solutions, positions these offerings as potential question marks within their BCG Matrix. These cutting-edge features are still in the early stages of market adoption, meaning they haven't yet achieved widespread consumer acceptance or a substantial market share.

While these innovations are designed to be a key differentiator and drive future growth by enhancing home appeal, their current low market penetration signifies a need for further development and consumer education. For instance, in 2024, the smart home market saw continued growth, but the adoption of comprehensive, integrated systems rather than individual devices remained a segment with significant untapped potential.

- Smart Home Integration: D.R. Horton is investing in new, integrated digital solutions for its homes.

- Early Adoption Phase: These technologies are currently in an early adoption phase with limited market penetration.

- Future Growth Potential: The aim is to differentiate offerings and capture future market growth.

- Market Penetration: Despite investment, these advanced packages have not yet captured a large segment of the market.

D.R. Horton's ventures into new, untested markets and its multi-family rental operations are prime examples of question marks. These areas demand significant capital investment to build market share and require careful nurturing to transition into stars. The company’s focus on advanced sustainable building initiatives and smart home technology also falls into this category, representing high-potential growth areas with currently low market penetration.

| Initiative | Market Share (Estimated 2024) | Investment Need | Growth Potential |

|---|---|---|---|

| Expansion into New Geographic Markets | Low | High | High |

| Multi-Family Rental Operations | Moderate (Segment Specific) | High | High |

| Advanced Sustainable Building | Low | Moderate to High | High |

| Integrated Smart Home Technology | Low | Moderate | High |

BCG Matrix Data Sources

Our D.R. Horton BCG Matrix leverages a blend of internal financial statements, publicly available sales data, and industry growth forecasts to accurately position each business segment.