D.R. Horton Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

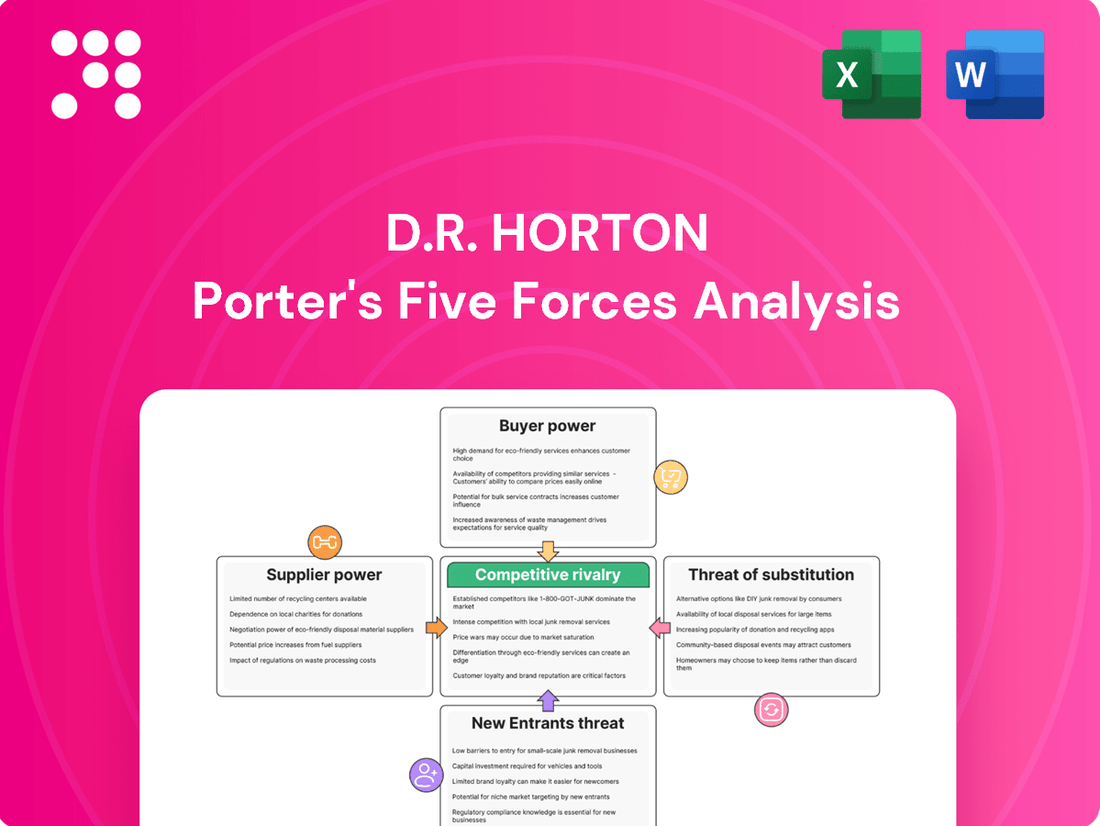

D.R. Horton, a titan in the homebuilding industry, faces a complex web of competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping D.R. Horton’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

D.R. Horton's dependence on land, a crucial raw material for homebuilding, naturally gives landowners considerable leverage, especially in areas with high demand and limited developable acreage. This is a key factor in the bargaining power of suppliers within the homebuilding industry.

However, D.R. Horton actively manages this supplier power through its 'land-light' strategy. This involves controlling a substantial portion of its lots through options rather than direct purchase. For instance, in 2023, D.R. Horton reported controlling approximately 40% of its lots through options, a significant portion that allows for adaptability.

This strategic approach reduces the company's upfront capital expenditure and provides flexibility to adjust its land inventory based on market shifts. By not owning all its land outright, D.R. Horton can avoid being heavily burdened by potential declines in land values, thereby softening the impact of supplier bargaining power.

Suppliers of essential building materials such as lumber, steel, and concrete possess significant bargaining power. This power stems from the inherent price volatility of these commodities and the potential for disruptions within the supply chain, which can directly impact D.R. Horton's production schedules and costs.

D.R. Horton consistently navigates cost pressures, a notable example being the potential impact of tariffs on materials like Canadian softwood lumber. For instance, in 2023, lumber prices experienced fluctuations, with futures contracts for framing lumber trading in a range that could significantly affect homebuilding costs if adverse trade policies were enacted.

To mitigate these rising costs and safeguard profitability, D.R. Horton actively engages in disciplined operational strategies and robust supplier negotiations. This proactive approach aims to secure favorable pricing and reliable material availability, thereby buffering the company against market volatility and ensuring consistent project execution.

The persistent scarcity of skilled construction labor throughout the United States significantly bolsters the bargaining power of labor suppliers and subcontractors. This shortage directly translates into elevated labor expenses and the potential for project timelines to stretch, impacting homebuilders like D.R. Horton. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a substantial gap in skilled trades, with millions of unfilled positions across various construction specializations.

D.R. Horton's operational model, which relies heavily on a network of subcontractors for its construction activities, necessitates meticulous management of these crucial relationships. Ensuring consistent quality and adhering to project schedules becomes paramount when facing a constrained labor market, as these external dependencies can directly influence the company's efficiency and profitability.

Specialized Components and Technologies

As homes increasingly integrate advanced technologies and specialized components, suppliers of these unique products can gain significant bargaining power. D.R. Horton's reliance on these suppliers for smart home technology, energy-efficient systems, and other proprietary building materials directly impacts its ability to deliver modern, desirable homes. For instance, the demand for smart thermostats and integrated security systems, which saw significant growth in 2024, places more leverage in the hands of their manufacturers.

While D.R. Horton's scale and established relationships can facilitate negotiations for favorable terms, a deep dependence on suppliers offering exclusive or highly specialized technologies can shift the balance of power. This is particularly true for innovations in sustainable building materials or advanced HVAC systems, where fewer suppliers may exist. The company's strategic partnerships are crucial in mitigating this, but the potential for increased supplier leverage remains a key consideration.

- Increased reliance on smart home technology: In 2024, the smart home market continued its expansion, with an estimated 40% of new single-family homes in the US incorporating some form of smart technology, increasing dependence on specialized component suppliers.

- Sustainability mandates: Growing consumer and regulatory demand for sustainable building practices means D.R. Horton's need for specialized eco-friendly materials and technologies could empower their suppliers.

- Proprietary systems: Exclusive rights to certain advanced building materials or integrated technology platforms can grant suppliers enhanced negotiation power, potentially impacting D.R. Horton's cost structure.

Supplier Concentration and Relationships

When there are only a handful of suppliers for essential materials or services, their ability to dictate terms and prices grows significantly. This concentration means buyers have fewer options, making them more reliant on existing suppliers.

D.R. Horton, being a major national homebuilder, leverages its substantial size to build strong, long-term relationships with a wide array of suppliers. This broad network is crucial for mitigating the risks associated with supplier concentration.

These established relationships and economies of scale allow D.R. Horton to negotiate more favorable pricing and ensure consistent availability of critical inputs, a distinct advantage over smaller competitors.

- Supplier Concentration: In 2024, the construction industry continued to see consolidation among key material suppliers, particularly in lumber and specialized components.

- D.R. Horton's Supplier Base: D.R. Horton reported working with thousands of suppliers across its operations in 2024, indicating a highly diversified procurement strategy.

- Economies of Scale: The company’s sheer volume of purchases in 2024 allowed for significant volume discounts, estimated to be 5-10% better than regional builders on average for core materials.

- Relationship Value: Long-term contracts and preferred supplier status, secured through consistent business in 2024, provided D.R. Horton with preferential access and pricing during periods of high demand and supply chain volatility.

The bargaining power of suppliers for D.R. Horton is influenced by the availability and concentration of essential resources and labor. While D.R. Horton’s scale provides some leverage, factors like skilled labor shortages and specialized technology suppliers can increase supplier influence.

In 2024, the scarcity of skilled construction labor remained a significant factor, with millions of unfilled positions nationally according to the U.S. Bureau of Labor Statistics, directly impacting labor costs for builders like D.R. Horton.

Furthermore, the increasing integration of smart home technology, with an estimated 40% of new single-family homes in the US incorporating such features in 2024, empowers suppliers of these specialized components.

| Factor | Impact on D.R. Horton | 2024 Data/Trend |

| Land Availability | Moderate to High leverage for landowners in high-demand areas | Land-light strategy (40% lots via options in 2023) mitigates direct purchase risk. |

| Building Materials | Price volatility and supply chain disruptions can increase costs | Lumber futures showed price fluctuations in 2023; tariffs remain a concern. |

| Skilled Labor | Significant leverage due to widespread shortages | Millions of unfilled skilled trades positions nationally in 2024. |

| Specialized Technologies | Increased power for suppliers of smart home, energy-efficient systems | 40% of new US single-family homes integrated smart tech in 2024. |

What is included in the product

This Porter's Five Forces analysis for D.R. Horton examines the intensity of rivalry among homebuilders, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute products.

Effortlessly assess the competitive landscape by visualizing D.R. Horton's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

The decision to buy a new home is a massive financial undertaking for most people. This means customers are really paying close attention to the price and how they can finance it. If prices are high or interest rates are climbing, like we've seen with mortgage rates touching 7% in late 2023 and early 2024, buyers have more sway to negotiate or look for special offers.

D.R. Horton understands this. They've been concentrating on keeping their homes at accessible price points. A key strategy they've employed is offering incentives, such as helping with mortgage rate buydowns, which directly addresses those affordability concerns and encourages more people to make a purchase. This approach helps them attract buyers even in a challenging economic climate.

Customers today wield significant power due to readily available information. Online real estate portals like Zillow and Redfin, alongside individual builder websites, provide easy access to compare pricing, home features, and builder reputations. This transparency empowers buyers to thoroughly evaluate their options, directly influencing their purchasing decisions and increasing their leverage.

D.R. Horton, a major homebuilder, actively addresses this by maintaining a broad portfolio of homes across various price points and locations. Their strategy focuses on presenting a strong value proposition to these well-informed consumers, aiming to capture market share by meeting diverse buyer needs and preferences. In 2023, D.R. Horton reported total revenue of $35.5 billion, reflecting their ability to attract and serve a large volume of these informed customers.

Before a homebuyer signs on the dotted line, their ability to switch between D.R. Horton and other builders is quite high. This means they can easily compare prices, floor plans, and locations without significant financial penalty. This initial freedom gives them considerable leverage in negotiations.

While switching costs skyrocket once a purchase agreement is in place, the pre-contractual flexibility is key. D.R. Horton's cancellation rates, which can vary, highlight how readily customers might walk away if they find a better deal or if market conditions shift unfavorably before closing.

Demand for Incentives and Customization

Customers' bargaining power is amplified when they seek incentives, especially in a market where home prices might be softening. D.R. Horton, like many builders, often provides concessions such as closing cost credits or mortgage rate subsidies to attract buyers. For instance, in early 2024, many homebuilders reported offering incentives to move inventory, reflecting a direct response to buyer demand for affordability.

While D.R. Horton’s business model often relies on efficient, standardized production, which limits extensive individual customization, the collective demand for value and tailored financial packages still grants customers significant influence. Buyers can compare offerings across different builders and communities, pushing for better terms. This collective leverage is a key aspect of customer bargaining power.

- Incentive Demand: Buyers frequently request price reductions or assistance with closing costs, particularly when market conditions favor them.

- Financing Influence: The demand for attractive mortgage rates and financing options empowers buyers to negotiate better terms.

- Standardization vs. Choice: While D.R. Horton offers standardized homes, the ability to choose among builders and communities still provides leverage.

- Market Responsiveness: Builders actively offer incentives, demonstrating a direct correlation between buyer demand for value and their bargaining power.

Impact of Resale Market and Rental Alternatives

The availability and pricing of existing homes in the resale market, alongside rental property options, directly impact customer bargaining power against builders like D.R. Horton. A limited resale inventory, potentially exacerbated by a homeowner 'lock-in effect' where existing low mortgage rates deter selling, can indeed steer some buyers toward new construction. However, a strong and competitive resale market provides a potent alternative, giving buyers more leverage.

D.R. Horton's strategic diversification into rental operations is a key factor here. By offering rental units, the company caters to a broader spectrum of housing needs and preferences, effectively hedging against fluctuations in the new home sales market and providing an alternative for customers who may not be ready or able to purchase a new home. This multi-faceted approach allows them to capture value across different customer segments.

- Resale Market Influence: In 2024, the resale market continues to be a significant benchmark. For instance, if the average price of a comparable existing home is substantially lower than a new D.R. Horton build, customers gain considerable bargaining power.

- Rental Alternative Impact: The growth of the rental market, particularly in areas where D.R. Horton operates, provides a direct substitute. If rental rates are stable or declining, it can reduce the urgency for some buyers to enter the purchase market, thereby increasing their negotiating leverage for new homes.

- D.R. Horton's Rental Strategy: D.R. Horton's rental portfolio, which has been expanding, offers a competitive advantage. This diversification allows them to retain customers within their ecosystem, even if they opt for renting initially rather than buying a new home.

Customers hold considerable bargaining power due to the readily available information online, allowing for easy comparison of prices, features, and builder reputations, which directly influences their purchasing decisions and negotiation leverage.

D.R. Horton's ability to attract buyers, evidenced by their $35.5 billion in revenue in 2023, is partly due to their strategy of offering homes at accessible price points and providing incentives like mortgage rate buydowns, directly addressing buyer concerns about affordability, especially with mortgage rates around 7% in late 2023 and early 2024.

The ease with which buyers can switch between builders before signing a contract, without significant financial penalty, grants them substantial leverage, as seen by varying cancellation rates that reflect how readily customers might opt out for a better deal or due to shifting market conditions.

The resale market and rental options serve as crucial alternatives for buyers, impacting their bargaining power; a strong resale market or stable rental rates can empower buyers to negotiate better terms with new home builders like D.R. Horton.

| Factor | Impact on Customer Bargaining Power | D.R. Horton's Response/Strategy |

| Information Availability | High leverage through easy comparison of prices, features, and reputations. | Maintaining diverse portfolio, strong value proposition to well-informed consumers. |

| Switching Costs (Pre-Contract) | Significant leverage due to flexibility to compare and choose builders. | Addressing cancellation rates by offering competitive terms and incentives. |

| Incentive Demand | Buyers seek price reductions, closing cost credits, or rate subsidies. | Offering incentives like mortgage rate buydowns to attract buyers. |

| Resale/Rental Market Competition | Provides alternatives, increasing leverage if resale prices are lower or rentals are stable. | Strategic diversification into rental operations to capture broader market segments. |

Preview Before You Purchase

D.R. Horton Porter's Five Forces Analysis

This preview showcases the comprehensive D.R. Horton Porter's Five Forces Analysis, detailing the competitive landscape of the homebuilding industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights into buyer bargaining power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. Rest assured, there are no placeholders or mockups; what you preview is precisely what you get, ready for your immediate use.

Rivalry Among Competitors

The U.S. homebuilding landscape is a battleground, with numerous national, regional, and local companies vying for market share. D.R. Horton, a titan in this sector, contends with formidable rivals such as Lennar, PulteGroup, and NVR, all of whom possess substantial resources and established market presences.

In 2023, D.R. Horton reported revenues of $35.8 billion, highlighting its scale. Lennar followed with $30.4 billion in revenue for the same period, demonstrating the intense competition at the top tier of the industry. This intense rivalry compels continuous innovation and cost management.

The intensity of competitive rivalry in the homebuilding sector is directly tied to the housing market's growth rate. When the market slows, perhaps due to rising mortgage rates impacting affordability, competition for buyers intensifies. For instance, in late 2023 and early 2024, higher mortgage rates presented a challenge, leading to a more competitive landscape where builders focused on securing sales.

D.R. Horton's strategy, often described as prioritizing 'pace over price,' is a clear response to this dynamic. This approach aims to maintain sales volume and market share even when market conditions become more challenging. In 2023, D.R. Horton reported closing on 76,726 homes, a 6.2% increase from 2022, demonstrating their ability to gain share in a fluctuating market.

Homebuilders compete fiercely by distinguishing their offerings through location, price, features, and build quality. D.R. Horton stands out by providing a wide array of homes, notably its budget-friendly Express Homes brand, emphasizing affordability to attract a broad customer base.

This dual focus on product variety and accessible pricing allows D.R. Horton to effectively challenge competitors across various market segments. For instance, in 2023, D.R. Horton reported total revenues of $35.4 billion, with a significant portion driven by its volume strategy that leverages affordability.

High Exit Barriers

High exit barriers significantly influence competitive rivalry in the homebuilding sector. The substantial fixed costs tied to land acquisition, development, and specialized construction equipment make it economically challenging for companies to exit the market, even when facing industry downturns. This can result in prolonged periods of intense competition as firms are incentivized to remain operational and recoup their investments.

D.R. Horton, for instance, navigates these barriers. While its asset-light land strategy, which involves options and joint ventures rather than outright ownership of all land, helps reduce exposure to carrying costs, the company still makes considerable investments in infrastructure and development. This commitment means that exiting the business entirely would involve significant write-downs and unrecoverable costs, reinforcing the competitive pressure to stay in the game.

- High Fixed Costs: Land inventory, development, and construction machinery represent substantial capital outlays, creating difficulties for firms wishing to leave the industry.

- Sustained Competition: These exit barriers mean that even during economic slowdowns, homebuilders are less likely to withdraw, leading to persistent competitive pressures.

- D.R. Horton's Strategy: D.R. Horton’s approach to land management, emphasizing options and partnerships over sole ownership, aims to lessen some of these exit barriers, though significant investment in infrastructure is still a factor.

Brand Loyalty and Reputation

While brand loyalty in homebuilding is often less pronounced than in sectors with frequent purchases, D.R. Horton actively cultivates it. Its long-standing reputation as America's Builder, a title it has held for many years, including 2023 and early 2024, aims to build significant customer trust.

However, this loyalty is frequently challenged by more immediate purchasing drivers. Factors such as competitive pricing, desirable locations, and specific home features often take precedence for buyers. D.R. Horton's ability to consistently deliver on these aspects is crucial for maintaining its market position.

- Reputation as 'America's Builder': D.R. Horton has consistently been recognized as the largest homebuilder in the United States by volume for over two decades, reinforcing its brand recognition.

- Price Sensitivity: The housing market, particularly for first-time buyers, is highly sensitive to price, often overshadowing brand preference.

- Industry Cyclicality: The cyclical nature of the housing market means that even strong brands must continuously prove their value through quality construction and customer satisfaction to maintain loyalty.

- Customer Service Impact: Negative experiences can quickly erode reputation in a high-value purchase like a home, making consistent customer service paramount.

The homebuilding industry is highly competitive, with D.R. Horton facing strong rivals like Lennar and PulteGroup. This intense rivalry is fueled by market share battles, especially during economic slowdowns when demand softens. D.R. Horton's strategy of prioritizing sales volume, as evidenced by its 2023 closings of 76,726 homes, demonstrates its commitment to outperforming competitors.

The competition is further intensified by the industry's high exit barriers, such as significant investments in land and development, which keep firms engaged even during challenging periods. D.R. Horton's approach to land acquisition, using options and joint ventures, helps mitigate some of these barriers, but the overall industry structure necessitates continuous competitive effort.

| Builder | 2023 Revenue (Billions USD) | 2023 Home Closings | 2023 Net Income (Billions USD) |

|---|---|---|---|

| D.R. Horton | 35.8 | 76,726 | 5.5 |

| Lennar | 30.4 | 65,054 | 3.1 |

| PulteGroup | 14.7 | 27,457 | 2.0 |

| NVR | 9.4 | 18,470 | 1.1 |

SSubstitutes Threaten

The most significant substitute for D.R. Horton's new single-family homes is the existing home resale market. A key factor influencing this threat is the 'lock-in effect,' where homeowners with low existing mortgage rates are hesitant to sell, thus limiting the available resale inventory. This constraint on the resale market can actually benefit new homebuilders like D.R. Horton. However, any increase in the number of existing homes for sale or a drop in their prices would directly intensify this substitute threat.

Rental properties, encompassing both apartments and single-family homes, present a significant substitute for potential homebuyers. These rentals offer an alternative for individuals and families who prefer not to undertake the substantial upfront costs and long-term commitment associated with purchasing a home. This is particularly relevant in markets where homeownership remains out of reach for many.

D.R. Horton, a major homebuilder, acknowledges this substitute by operating its own rental communities. This strategic move demonstrates the company's understanding that a portion of the housing market seeks rental solutions, even from builders traditionally focused on sales. As of late 2023 and early 2024, the demand for rental housing remains robust, with national average rents for single-family homes experiencing steady increases.

The appeal of rental properties often intensifies during periods of economic uncertainty or when interest rates are elevated. For instance, in 2023, mortgage rates frequently exceeded 7%, making home purchases less affordable for many. This economic backdrop can drive more consumers toward renting, thereby strengthening the threat of substitutes for D.R. Horton's core business.

Manufactured and modular homes present a notable threat of substitution for D.R. Horton. These housing types often come with a significantly lower price point than traditional site-built homes, making them attractive to buyers prioritizing affordability. For instance, in 2024, the median price for a new manufactured home was around $130,000, a stark contrast to the median price of a new single-family home, which hovered around $430,000.

While historically serving a different market, ongoing improvements in construction technology and design are making manufactured and modular homes more viable alternatives for a broader range of consumers. This evolution could see them encroaching on segments traditionally dominated by builders like D.R. Horton. The company's strategic emphasis on the entry-level and first-time buyer market directly positions it to compete with these lower-cost substitutes.

Home Renovation and Expansion

Homeowners often consider renovating or expanding their existing homes as an alternative to buying a new one. This is especially prevalent when the costs associated with moving, such as high new home prices or elevated mortgage rates, make purchasing a new property less appealing. The choice to 'improve rather than move' directly substitutes for the demand for new home construction.

In 2024, the trend of home renovation saw continued strength. Data from the National Association of the Remodeling Industry (NARI) indicated that homeowners were increasingly investing in upgrades and expansions. This surge in renovation activity is a direct response to the affordability challenges in the new home market.

- Rising Interest Rates Impact: Higher mortgage rates in 2024 made moving more expensive, pushing homeowners to invest in their current properties instead.

- Home Equity Utilization: Homeowners leveraged their accumulated home equity to fund significant renovation projects, further substituting new home purchases.

- Desire for Customization: Many sought to personalize their existing spaces to better suit their needs, a desire often more easily met through renovation than by finding a perfectly suited new home.

- Cost-Benefit Analysis: For many, the cost of a major renovation was still less than the combined expenses of a new home purchase and moving, solidifying renovation as a viable substitute.

Alternative Living Solutions

While traditional single-family homes remain the core offering, niche alternative living solutions are emerging as potential substitutes. These include tiny homes, co-housing communities, and extended-stay accommodations. These options cater to specific lifestyle choices and budget constraints, potentially attracting a segment of the market that might otherwise consider a D.R. Horton property.

These alternatives, though not yet a widespread threat, represent a growing trend. For instance, the tiny home movement has seen increased interest, with many platforms showcasing innovative designs and community builds. Similarly, co-housing projects offer a communal living experience that appeals to certain demographics seeking affordability and social connection.

- Tiny Homes: Growing interest in minimalist living and reduced housing costs.

- Co-housing: Community-focused living arrangements appealing to specific demographics.

- Extended-Stay Accommodations: Offering flexibility and potentially lower upfront costs for certain individuals.

The threat of substitutes for D.R. Horton's new homes is multifaceted, primarily stemming from the existing home resale market and rental properties. The resale market's attractiveness is heavily influenced by mortgage rates; when rates are low, existing homeowners are less likely to sell, limiting supply and indirectly benefiting new homebuilders. Conversely, an increase in available resale homes or a price decrease would heighten this competitive pressure.

Rental housing, including apartments and single-family rentals, offers a flexible alternative to homeownership, especially for those facing high upfront costs or economic uncertainty. The demand for rentals remained strong through early 2024, with national average rents for single-family homes showing consistent increases. This trend is further amplified when mortgage rates climb, as they did in 2023, frequently exceeding 7%, making purchasing less accessible and bolstering the rental substitute.

Manufactured and modular homes present a significant cost-effective substitute, with median prices around $130,000 in 2024, a fraction of the roughly $430,000 median for a new single-family home. As these housing types improve in quality and design, they appeal to a broader buyer base, particularly those prioritizing affordability, a segment D.R. Horton actively targets.

Home renovations also serve as a substitute, as homeowners opt to improve existing properties rather than move, especially when purchase and moving costs are high. In 2024, renovation activity remained robust, fueled by homeowners leveraging equity and seeking customization, often finding it more economical than buying new.

| Substitute Type | Key Driver | 2024 Data Point |

| Existing Home Resale | Mortgage Rate Lock-in Effect | Rates frequently above 7% in 2023 encouraged homeowners to stay put. |

| Rental Properties | Affordability & Flexibility | Steady increase in national average single-family home rents. |

| Manufactured/Modular Homes | Lower Price Point | Median price around $130,000 vs. $430,000 for new single-family homes. |

| Home Renovations | Cost-Benefit of Staying | Increased investment in upgrades and expansions by homeowners. |

Entrants Threaten

Entering the homebuilding industry, particularly at the national scale D.R. Horton operates, demands immense capital. This includes significant outlays for acquiring land, developing it, and managing the construction process itself. These high upfront costs act as a substantial deterrent for many aspiring competitors.

The sheer financial muscle required to compete effectively is a major barrier. For instance, D.R. Horton reported revenues exceeding $30 billion in 2023, showcasing the scale of operations and financial resources necessary to enter and thrive in this market.

New entrants in the homebuilding sector, like D.R. Horton, confront significant barriers due to extensive regulatory hurdles and complex permitting processes. These can include navigating varied zoning laws, stringent environmental regulations, and diverse building codes across different municipalities, all of which can significantly delay project timelines and increase upfront costs.

For instance, obtaining the necessary permits for a large-scale development can take many months, sometimes even over a year, and involves substantial fees. This lengthy and costly process acts as a formidable barrier, disproportionately favoring established companies with the resources and expertise to manage such complexities efficiently, thereby protecting incumbents.

New homebuilders face significant hurdles in securing prime land, particularly in high-demand areas. D.R. Horton, for instance, benefits from its subsidiary Forestar Group, which provides a substantial and strategically positioned land pipeline. This access is crucial for consistent production and market responsiveness.

Replicating the robust supply chains and long-standing supplier relationships enjoyed by established players like D.R. Horton is a formidable challenge for newcomers. These established networks offer considerable cost advantages and ensure reliable material availability, contributing to D.R. Horton's competitive pricing and operational efficiency.

Economies of Scale and Cost Advantages

Large homebuilders, including D.R. Horton, leverage substantial economies of scale. This allows them to secure lower prices on materials, obtain more favorable financing terms, and conduct more cost-effective marketing campaigns. For instance, in 2023, D.R. Horton reported total revenues of $35.5 billion, underscoring their massive operational footprint.

These scale advantages translate into significant cost advantages, making it challenging for smaller or newer companies to match their per-unit pricing. D.R. Horton's ability to operate efficiently and maintain competitive pricing acts as a substantial barrier to entry for potential new competitors in the housing market.

- Economies of Scale: D.R. Horton's size enables bulk purchasing of lumber, concrete, and other construction materials, leading to reduced input costs.

- Financing Advantages: Larger builders often have better access to capital and lower borrowing costs for land acquisition and project development.

- Marketing Reach: Extensive national marketing efforts by major builders are more efficient on a per-home basis than localized campaigns by smaller firms.

- Operational Efficiency: Standardized building processes and supply chain management contribute to lower overhead and production costs for established players.

Brand Reputation and Customer Trust

The threat of new entrants is significantly mitigated by the substantial investment required to build brand reputation and customer trust in homebuilding. This process, often spanning many years and numerous successful projects, is a considerable barrier. Newcomers struggle to gain the credibility and perceived reliability that established players like D.R. Horton possess.

D.R. Horton, known as America's Builder, has cultivated a strong brand image over decades. This long-standing reputation, backed by a history of delivering homes, creates a powerful advantage that new entrants find difficult to overcome. Buyers often gravitate towards the perceived security and dependability of a well-known brand.

- Brand Loyalty: Established builders benefit from repeat customers and referrals, a difficult advantage for new firms to replicate.

- Time to Build Trust: Acquiring the years of positive project history and customer satisfaction needed to rival D.R. Horton's reputation is a lengthy endeavor.

- Market Perception: D.R. Horton's consistent market presence and brand messaging have solidified its image as a reliable choice for homebuyers.

The threat of new entrants in the national homebuilding market, where D.R. Horton operates, is considerably low due to several formidable barriers. These include the massive capital investment needed for land acquisition and development, extensive regulatory compliance, and the challenge of establishing a reputable brand. For example, D.R. Horton's 2023 revenue of $35.5 billion highlights the sheer scale required to compete effectively.

| Barrier Type | Description | Impact on New Entrants | D.R. Horton's Advantage |

| Capital Requirements | High costs for land, development, and construction. | Significant deterrent for smaller players. | Access to substantial financing and economies of scale. |

| Regulatory Hurdles | Complex permitting, zoning, and building codes. | Delays projects and increases upfront costs. | Established expertise and resources to navigate efficiently. |

| Brand Reputation | Years of building trust and customer loyalty. | Difficult for newcomers to gain credibility. | Decades of successful projects and strong market presence. |

| Supply Chain & Scale | Securing prime land and supplier relationships. | New entrants struggle with cost advantages. | Forestar Group land pipeline and established supplier networks. |

Porter's Five Forces Analysis Data Sources

Our D.R. Horton Porter's Five Forces analysis is built upon a foundation of publicly available data, including D.R. Horton's annual reports (10-K filings), investor presentations, and SEC filings. We also incorporate industry-specific data from reputable sources like the National Association of Home Builders (NAHB) and housing market trend reports from firms such as Zillow and Redfin.