CommScope SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

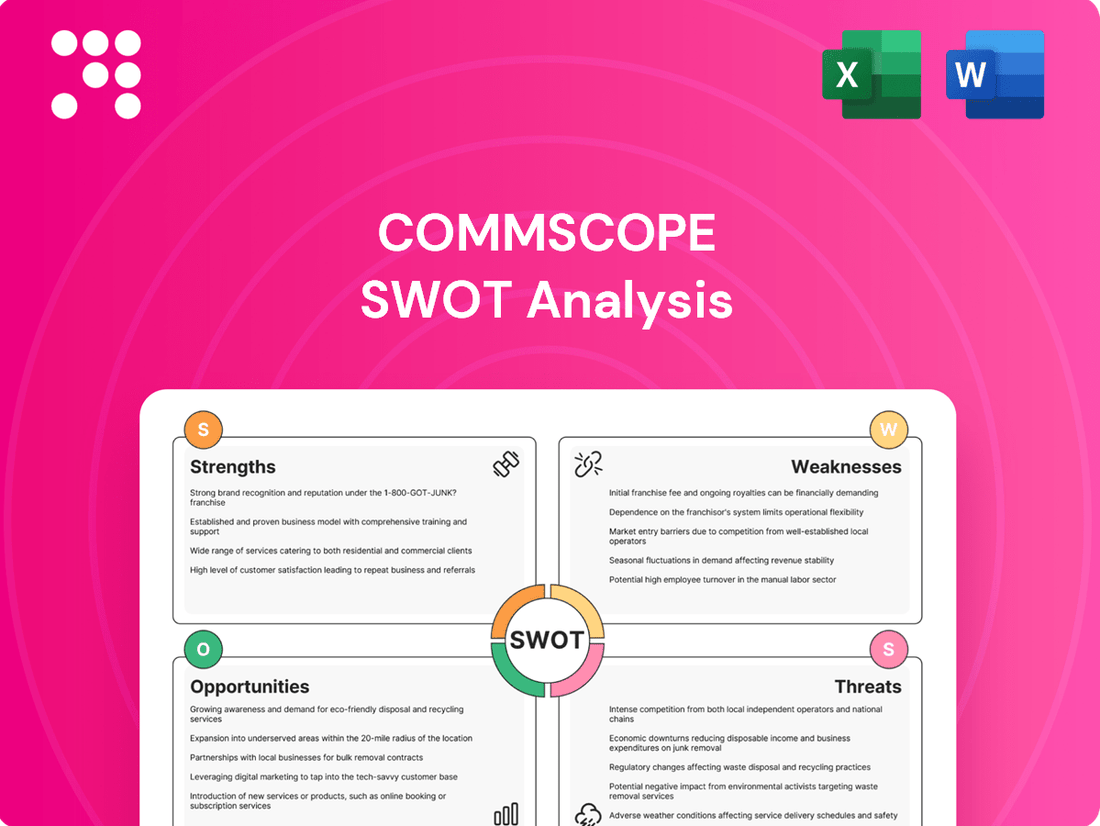

CommScope leverages its strong brand and extensive product portfolio as key strengths, but faces challenges from intense competition and evolving technological landscapes. Understanding these dynamics is crucial for navigating the connectivity market.

Want the full story behind CommScope's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CommScope boasts a significant global leadership position, underpinned by its extensive and diversified portfolio of communication infrastructure solutions. This broad offering, encompassing everything from fiber optic and copper cabling to advanced antennas and network equipment, serves a wide array of customers across broadband, enterprise, and wireless sectors. For instance, in 2023, CommScope reported net sales of $7.4 billion, demonstrating its substantial market reach and the demand for its comprehensive product lines.

CommScope is showing impressive financial muscle, with a notable 23.5% year-over-year increase in net sales for Q1 2025, reaching $1.11 billion. This surge is a clear indicator of their operational effectiveness and smart strategic moves.

The company's core adjusted EBITDA saw a remarkable 159% boost, climbing to $245 million in the same quarter. This significant jump highlights CommScope's enhanced efficiency and successful execution of its business plans.

A key driver of this financial strength is the performance within their Connectivity and Cable Solutions (CCS) segment, where enterprise fiber revenue alone experienced an outstanding 88% growth. This demonstrates CommScope's ability to capitalize on market opportunities and deliver strong results.

CommScope has strategically streamlined its operations by divesting non-core assets. The sale of its Home Networks business in January 2024 and the Outdoor Wireless Networks (OWN) and Distributed Antenna Systems (DAS) businesses in Q1 2025 are prime examples of this portfolio optimization. These moves generated significant capital, allowing for a more focused business strategy.

These divestitures, coupled with proactive debt management, have substantially improved CommScope's financial health. The company successfully addressed upcoming debt maturities through comprehensive refinancing efforts, leading to a notable reduction in overall leverage. This strengthened capital structure provides greater financial flexibility for future investments and operations.

Innovation and R&D Investment

CommScope's dedication to innovation is a significant strength, underscored by its substantial investment in research and development. In 2024, the company allocated $316.2 million to R&D, a clear indicator of its commitment to staying at the forefront of technological advancements.

This investment fuels the development of cutting-edge solutions designed to meet the dynamic needs of their customer base. CommScope is actively pushing boundaries with its new AI-driven networking solutions, which promise to revolutionize network management and efficiency.

Furthermore, their focus extends to emerging technologies like Wi-Fi 7, offering enhanced speed and capacity. They are also developing advanced fiber optic solutions specifically tailored for the growing demands of data centers and the critical expansion of rural broadband infrastructure.

- R&D Investment: $316.2 million in 2024.

- Key Innovations: AI-driven networking, Wi-Fi 7 products.

- Market Focus: Advanced fiber optics for data centers and rural broadband.

Commitment to Sustainability

CommScope's dedication to sustainability is a significant strength. They've achieved an impressive 44% reduction in market-based Scope 1 and 2 greenhouse gas emissions since 2019, showcasing tangible progress in environmental responsibility. This commitment is further validated by their eighth consecutive EcoVadis Gold Sustainability Rating, a testament to their ongoing efforts in eco-friendly practices.

The company actively designs products that are smaller, simpler, and more sustainable. This approach directly addresses the growing market preference for environmentally conscious solutions. By offering these eco-friendly options, CommScope empowers its customers to meet their own sustainability targets, creating a mutually beneficial relationship.

- Reduced Emissions: Achieved a 44% reduction in market-based Scope 1 and 2 greenhouse gas emissions (vs. 2019).

- Sustainability Recognition: Earned an 8th consecutive EcoVadis Gold Sustainability Rating.

- Product Innovation: Focus on developing smaller, simpler, and more sustainable product designs.

- Customer Alignment: Helps customers achieve their own sustainability goals through eco-conscious offerings.

CommScope holds a strong global leadership position with a diverse portfolio of communication infrastructure solutions, serving broadband, enterprise, and wireless sectors. Its financial performance shows significant growth, with a 23.5% year-over-year increase in net sales to $1.11 billion in Q1 2025, and a remarkable 159% boost in core adjusted EBITDA to $245 million in the same period. The company's strategic divestitures and debt management have improved its financial health and flexibility.

CommScope's commitment to innovation is evident in its substantial R&D investment of $316.2 million in 2024, driving advancements in AI-driven networking and Wi-Fi 7. The company is also focused on developing advanced fiber optic solutions for data centers and rural broadband expansion. Furthermore, CommScope demonstrates a strong dedication to sustainability, achieving a 44% reduction in market-based Scope 1 and 2 greenhouse gas emissions since 2019 and earning its eighth consecutive EcoVadis Gold Sustainability Rating.

| Metric | 2024/2025 Data | Significance |

|---|---|---|

| Net Sales (Q1 2025) | $1.11 billion | 23.5% YoY increase, indicating strong market demand and operational effectiveness. |

| Core Adjusted EBITDA (Q1 2025) | $245 million | 159% increase, highlighting enhanced efficiency and successful business execution. |

| R&D Investment (2024) | $316.2 million | Demonstrates commitment to technological advancement and future solutions. |

| GHG Emissions Reduction (Scope 1 & 2) | 44% reduction (vs. 2019) | Tangible progress in environmental responsibility and sustainability initiatives. |

| EcoVadis Rating | 8th consecutive Gold | Consistent recognition for strong sustainability practices. |

What is included in the product

Analyzes CommScope’s competitive position through key internal and external factors, detailing its strengths in product innovation and market presence, while addressing weaknesses in debt and integration challenges, and exploring opportunities in 5G and broadband expansion alongside threats from intense competition and supply chain disruptions.

Offers a clear, actionable framework to identify and address CommScope's strategic challenges and opportunities.

Weaknesses

CommScope has grappled with cash flow management, experiencing negative cash flow from operations in the first quarter of 2025. This dip was primarily driven by increased working capital requirements, the timing of annual incentive payouts, and significant interest expenses.

While the company projects reaching breakeven free cash flow for the full year 2025, the initial quarter's performance highlights the ongoing need for robust cash flow strategies to navigate operational demands and financial obligations.

CommScope's substantial indebtedness remains a significant concern. Although the company successfully executed strategic refinancing in late 2024 and early 2025, extending debt maturities, the high leverage ratio continues to present a risk to its financial flexibility.

Despite these efforts, CommScope's debt levels are considerable. The company projects a reduction in its total debt to Adjusted EBITDA ratio, aiming to bring it below 6.00:1.00 by the close of 2026, indicating a long-term strategy to manage this weakness.

CommScope faces a significant weakness in its dependence on a few large clients. In 2024, the company reported that its top two direct customers accounted for roughly 19% of its total net sales. This concentration means that losing even one of these major clients could have a substantial negative impact on the company's financial performance.

Furthermore, the markets CommScope serves are prone to considerable volatility. This instability, coupled with a tendency for customers to reduce capital expenditures during uncertain economic periods, has previously led to revenue declines in certain business segments. This sensitivity to broader economic trends and customer spending habits poses an ongoing challenge.

Impact of Tariffs and Supply Chain Risks

CommScope faces challenges from escalating tariffs, with an anticipated $10 million to $15 million negative impact in the second quarter of 2025, primarily affecting its Ruckus offerings. While the company is leveraging its global manufacturing and pricing strategies to offset these costs, the concentration of key suppliers for critical components introduces significant supply chain vulnerabilities.

These supply chain risks are amplified by the potential for disruptions, which could further strain CommScope's operational efficiency and financial performance. The company's reliance on a select few suppliers for essential raw materials and components makes it susceptible to price fluctuations and availability issues.

- Tariff Impact: Anticipated $10-$15 million headwind in Q2 2025, impacting Ruckus products.

- Mitigation Efforts: Utilizing global manufacturing and pricing adjustments.

- Supply Chain Vulnerability: Dependence on a limited number of key suppliers for critical raw materials and components.

- Risk Exposure: Susceptibility to disruptions, price volatility, and availability constraints from concentrated suppliers.

Mixed Performance in Certain Segments

CommScope's performance in the first half of 2024 revealed a mixed bag across its various business segments. While the Connectivity and Cable Solutions (CCS) segment demonstrated robust growth, other areas faced headwinds. For instance, the Access Network Solutions (ANS) and Networking, Intelligent Cellular and Security Solutions (NICS) divisions encountered difficulties, largely attributed to the lingering effects of excess inventory and a slowdown in customer upgrade cycles. This unevenness across its product lines highlights a key weakness.

The challenges in ANS and NICS are particularly notable. These segments experienced a dip in performance during the initial months of 2024, impacting overall company results. Although CommScope anticipates improvements in the latter half of the year, the first-half performance underscores the vulnerability of these specific areas to market dynamics such as inventory build-up and customer spending patterns. This disparity in segment performance is a critical consideration for stakeholders.

- Uneven Segment Growth: While CCS showed strength, ANS and NICS faced challenges in H1 2024.

- Inventory and Upgrade Cycles: Excess inventory and delayed customer upgrades negatively impacted ANS and NICS.

- Anticipated Improvements: CommScope expects a rebound in these challenged segments, but the initial performance indicates underlying issues.

- Portfolio Vulnerability: The mixed performance highlights potential vulnerabilities in specific parts of CommScope's product portfolio.

CommScope's financial health is burdened by significant debt. Despite refinancing efforts in late 2024 and early 2025 to extend maturities, the company's high leverage ratio, projected to be below 6.00:1.00 by the end of 2026, limits its financial flexibility. This substantial indebtedness remains a core weakness that requires careful management.

The company's operational performance is also impacted by uneven segment growth. While the Connectivity and Cable Solutions (CCS) segment showed strength in the first half of 2024, the Access Network Solutions (ANS) and Networking, Intelligent Cellular and Security Solutions (NICS) divisions faced headwinds due to excess inventory and slower customer upgrade cycles. This disparity highlights vulnerabilities within specific product lines.

CommScope's reliance on a few major clients presents a notable risk, with its top two direct customers accounting for approximately 19% of total net sales in 2024. Losing even one of these significant clients could severely impact the company's revenue and overall financial performance.

Additionally, the company faces ongoing challenges from escalating tariffs, with an estimated $10 million to $15 million negative impact anticipated in the second quarter of 2025, particularly affecting its Ruckus offerings. This is compounded by supply chain vulnerabilities stemming from dependence on a limited number of key suppliers for critical components, exposing CommScope to potential disruptions and price volatility.

| Financial Weakness | 2024/2025 Data/Projection | Impact |

|---|---|---|

| High Indebtedness | Target Debt to Adjusted EBITDA < 6.00:1.00 by end of 2026 | Limited financial flexibility, increased financial risk |

| Uneven Segment Performance (H1 2024) | ANS & NICS faced challenges; CCS showed growth | Vulnerability in specific product lines, inconsistent revenue streams |

| Customer Concentration | Top 2 customers = ~19% of 2024 net sales | Significant revenue risk if major clients are lost |

| Tariff Impact (Q2 2025 Projection) | $10-$15 million negative impact, primarily on Ruckus | Reduced profitability, potential price increases for customers |

| Supply Chain Vulnerability | Dependence on limited key suppliers for critical components | Risk of disruptions, price fluctuations, and availability issues |

Same Document Delivered

CommScope SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual CommScope SWOT analysis, giving you a clear understanding of its content. The full, detailed report will be available immediately after your purchase.

Opportunities

The accelerating global deployment of 5G networks is a significant growth driver for CommScope. The company is well-positioned to supply the critical fiber optic cabling, connectivity components, and antenna solutions necessary for this expansion, potentially capturing increased market share as carriers invest heavily in infrastructure upgrades. The total global spending on 5G infrastructure was projected to reach over $200 billion in 2024.

Furthermore, the continuous evolution towards next-generation networks, including the demand for enhanced mobile broadband and low-latency applications, creates ongoing opportunities. CommScope's commitment to research and development allows it to introduce innovative products that meet these escalating performance requirements, solidifying its role as a key enabler of advanced communication technologies.

CommScope's Connectivity and Cable Solutions (CCS) segment is experiencing robust growth, particularly within the data center sector. Enterprise fiber revenue saw a notable increase, reflecting strong market demand.

The burgeoning need for AI-driven data center designs presents a substantial opportunity. These advanced architectures are inherently fiber-intensive, requiring massive amounts of high-speed cabling, a core area of CommScope's expertise.

CommScope is well-positioned to benefit from the expansion of telecommunications infrastructure in emerging markets. As these economies grow, their demand for advanced connectivity solutions, like fiber optics and 5G-enabled networks, is expected to rise significantly. CommScope's established global presence allows it to serve these burgeoning markets effectively.

The company can also leverage significant opportunities presented by rural broadband initiatives. For instance, the Broadband Equity, Access, and Deployment (BEAD) program in the United States alone allocates $42.45 billion to expand high-speed internet access in unserved and underserved areas. CommScope's broad portfolio of broadband network infrastructure solutions is a direct fit for these government-backed deployment projects, which are projected to drive substantial demand through 2025 and beyond.

Leveraging AI and Advanced Technologies for Solutions

The swift advancement of Artificial Intelligence (AI) offers CommScope significant avenues to develop and deliver infrastructure solutions tailored for both iterative and generative AI applications. This includes supporting the massive data processing and connectivity demands inherent in AI model training and deployment.

CommScope is actively embedding AI within its network monitoring tools. This integration aims to elevate capabilities in areas such as advanced issue triage, predictive analytics for network performance, and sophisticated network optimization, ensuring more resilient and efficient operations for its clients.

- AI-Driven Network Optimization: CommScope's focus on AI in network monitoring can lead to reduced downtime and improved bandwidth allocation, crucial for AI workloads.

- Infrastructure for Generative AI: The company can capitalize on the need for high-density fiber and advanced cabling solutions to support the data-intensive nature of generative AI.

- Enhanced Predictive Maintenance: By leveraging AI for network analytics, CommScope can offer clients proactive solutions, minimizing disruptions and enhancing service reliability.

Strategic Acquisitions and Partnerships

CommScope has a proven track record of using strategic acquisitions to bolster its offerings and tap into new market demands. A prime example is their acquisition of certain assets from Casa Systems, which aimed to strengthen their broadband network solutions. This approach allows them to quickly integrate new technologies and expand their market presence.

Continuing this strategy of targeted acquisitions and forging strategic partnerships presents a significant opportunity for CommScope. By doing so, they can further diversify their product portfolio and solidify their standing in an industry that is constantly evolving. For instance, in early 2024, CommScope announced a partnership with Nokia to accelerate the deployment of fiber-to-the-home (FTTH) solutions, demonstrating their commitment to collaborative growth.

These moves are crucial for staying ahead of competitors and addressing the ever-increasing demand for advanced networking infrastructure. The company's ability to identify and integrate synergistic businesses will be key to its future success.

Key opportunities include:

- Expanding into new technology segments: Acquisitions can provide access to cutting-edge technologies like 5G infrastructure components or advanced fiber optics.

- Gaining market share: Partnering with or acquiring companies that have a strong presence in specific geographic regions or customer segments can rapidly increase market penetration.

- Enhancing vertical integration: Acquiring suppliers or complementary service providers can lead to greater control over the supply chain and improved cost efficiencies.

- Accessing new customer bases: Strategic alliances can open doors to new industries or customer types that CommScope may not currently serve effectively.

The ongoing global 5G rollout presents a substantial opportunity for CommScope, with worldwide 5G infrastructure spending projected to exceed $200 billion in 2024. The company is strategically positioned to supply essential components like fiber optic cabling and antennas, capitalizing on this massive investment. Furthermore, the increasing demand for high-performance networks driven by AI applications, particularly in data centers, creates a significant need for CommScope's fiber-intensive solutions. The Broadband Equity, Access, and Deployment (BEAD) program in the US, with its $42.45 billion allocation for rural broadband, directly benefits CommScope's portfolio of network infrastructure solutions.

CommScope's strategic acquisitions and partnerships, such as its collaboration with Nokia to accelerate fiber-to-the-home (FTTH) deployments in early 2024, are key to expanding its market reach and technological capabilities. These moves allow the company to integrate new technologies and access new customer bases, reinforcing its competitive position in the evolving telecommunications landscape.

Threats

The telecommunications infrastructure sector is a battlefield, with giants like Cisco Systems, Ubiquiti, and Fortinet aggressively competing for dominance. Newcomers are also constantly emerging, intensifying the fight for market share. This environment forces CommScope to continuously innovate and develop unique solutions to stay ahead and protect its position.

Global economic uncertainty continues to cast a shadow over telecommunications infrastructure spending. For CommScope, this translates to a heightened risk of reduced capital expenditures from carriers, potentially impacting order volumes. For instance, in the first quarter of 2024, many telecom operators reported cautious consumer spending, leading to a slowdown in network upgrade projects.

This market volatility can also force CommScope to make inventory adjustments, potentially leading to write-downs or increased carrying costs. The ongoing inflationary pressures and fluctuating interest rates observed throughout 2024 further exacerbate this uncertainty, making long-term investment planning for customers more challenging and, by extension, for CommScope's sales pipeline.

CommScope navigates a complex regulatory landscape where evolving rules can significantly affect operations and expenses. For instance, changes in data privacy or environmental regulations could necessitate costly adjustments to business practices.

Geopolitical tensions and trade policies present another significant threat. Anticipated tariff impacts in Q2 2025, for example, highlight the vulnerability of CommScope's supply chain and potential increases in the cost of goods, directly impacting profitability.

Rapid Technological Change and Obsolescence

The telecommunications sector is a hotbed of innovation, meaning companies like CommScope must constantly invest in research and development to stay ahead. Failure to adapt quickly to new technologies risks making their current products outdated, which could significantly hurt their market position. For instance, the rapid evolution from 5G to early discussions of 6G demands substantial R&D expenditure to remain competitive.

CommScope's ability to successfully bring new technologies to market is crucial. If they lag behind competitors in commercializing next-generation solutions, their competitive advantage could diminish. The company's commitment to innovation is reflected in its R&D spending, which, while not always publicly itemized for specific technology shifts, is a core component of its strategy to navigate this dynamic landscape.

- Technological Pace: The telecom industry sees product lifecycles shrinking due to rapid advancements.

- R&D Imperative: Continuous investment in R&D is essential to prevent product obsolescence and maintain market relevance.

- Commercialization Risk: Delays or failures in bringing new technologies to market can erode competitive standing.

Operational and Supply Chain Disruptions

CommScope faces significant threats from operational and supply chain disruptions. Challenges in adjusting global manufacturing capacity and capabilities, or problems with contract manufacturers, could hinder their ability to fulfill customer orders. For instance, a significant portion of the electronics industry experienced extended lead times in 2023 and early 2024 due to component shortages, impacting production schedules.

Furthermore, ongoing supply chain volatility, including fluctuations in the cost and availability of essential raw materials and components, directly threatens CommScope's production efficiency and overall profitability. In 2024, the telecommunications equipment sector, where CommScope operates, continued to grapple with the aftermath of global logistics bottlenecks and geopolitical events affecting material sourcing.

- Manufacturing Capacity Issues: Potential difficulties in realigning global manufacturing capacity and capabilities, or issues with contract manufacturers, could affect CommScope's ability to meet customer demands.

- Supply Chain Volatility: Supply chain disruptions and changes in the cost and availability of raw materials or components pose ongoing threats to production and profitability.

- Component Shortages: The electronics industry, including CommScope's sector, faced persistent component shortages through 2023 and into 2024, leading to extended lead times and increased costs.

- Geopolitical Impact: Geopolitical events in 2024 continued to exert pressure on global supply chains, impacting the cost and availability of key materials for manufacturers like CommScope.

CommScope faces intense competition from established players and emerging innovators, demanding continuous R&D and rapid commercialization of new technologies like 6G to maintain market share. Global economic uncertainty, as seen in cautious carrier spending in Q1 2024, along with inflationary pressures and fluctuating interest rates throughout 2024, directly impacts CommScope's sales pipeline and can lead to inventory write-downs.

Navigating evolving regulatory landscapes and geopolitical tensions, including potential tariff impacts in Q2 2025, poses significant operational and cost challenges. Furthermore, persistent supply chain volatility, component shortages experienced through 2023-2024, and manufacturing capacity issues threaten production efficiency and profitability.

SWOT Analysis Data Sources

This CommScope SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research from leading industry analysts, and insights from expert commentary and industry publications.