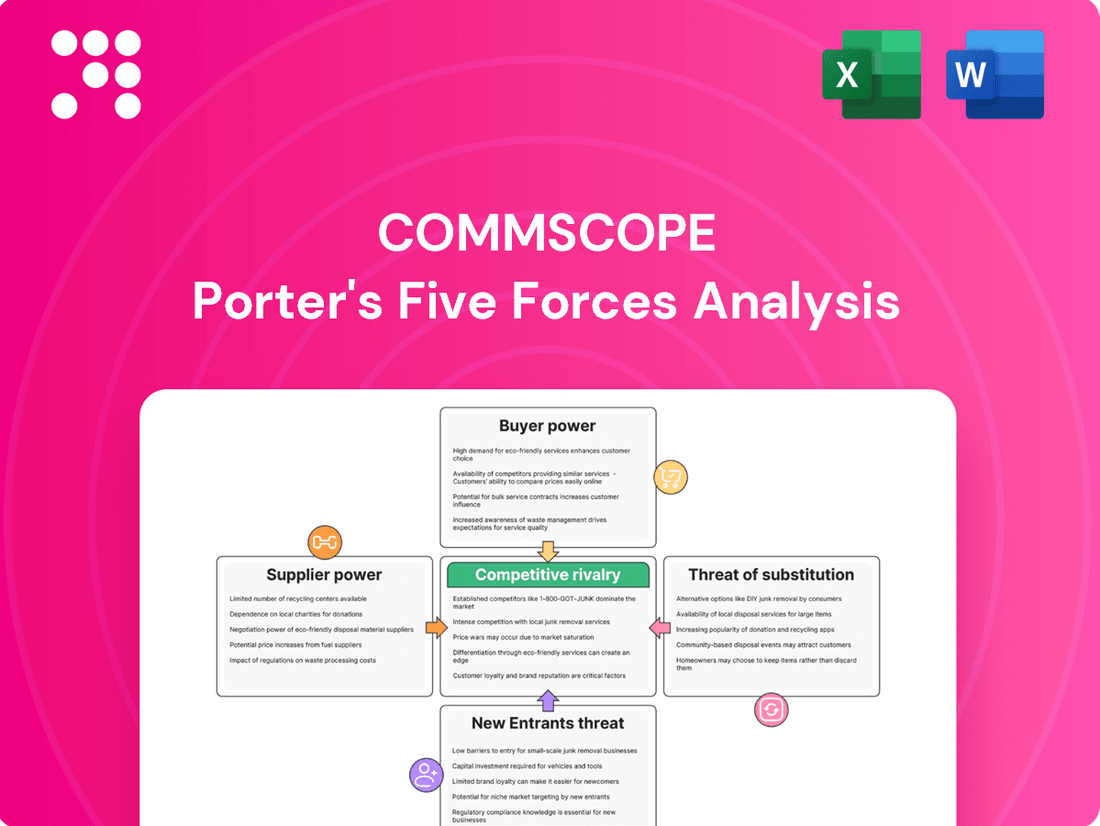

CommScope Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

CommScope operates within a dynamic telecommunications infrastructure market, facing significant pressures from powerful buyers and intense rivalry. Understanding the nuances of these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping CommScope’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CommScope's reliance on a concentrated supplier base for critical components, such as specialized fiber optic cables and advanced network equipment, significantly amplifies supplier bargaining power. For instance, in 2024, CommScope's acquisition of certain advanced materials was heavily dependent on a handful of global manufacturers, allowing these suppliers to dictate terms and pricing due to limited alternatives.

This concentration means that if these few dominant suppliers decide to increase prices or alter supply agreements, CommScope faces limited options for sourcing, directly impacting its cost of goods sold and overall profitability. In 2023, CommScope reported that its top five suppliers accounted for approximately 35% of its total procurement costs, highlighting the substantial leverage these concentrated suppliers hold.

The specialized nature of communication infrastructure components, like fiber optic and copper cabling, means some suppliers offer unique technologies. If these inputs are hard to substitute, suppliers gain leverage, as CommScope would struggle to find alternatives without compromising quality.

Switching suppliers presents CommScope with substantial hurdles, often translating into significant financial and operational burdens. These costs can encompass everything from re-tooling manufacturing equipment to accommodate new components, to the rigorous process of re-certifying parts to meet quality and performance standards. Furthermore, establishing entirely new logistical networks and supply chains adds another layer of complexity and expense.

The presence of these high switching costs inherently strengthens the bargaining power of CommScope's current suppliers. Knowing that CommScope faces considerable difficulty and expense in finding and onboarding alternative providers, suppliers may feel more empowered to dictate terms, potentially including price increases or less favorable contract conditions. This dynamic can limit CommScope's flexibility in negotiating better deals or responding to market shifts by diversifying its supplier base.

Threat of Forward Integration by Suppliers

If CommScope's suppliers possess the capability or motivation to move into producing their own finished communication infrastructure solutions, they could directly challenge CommScope in the market. This looming possibility grants suppliers greater negotiation strength, as CommScope would naturally seek to avoid nurturing a future rival.

- Supplier Forward Integration Risk: Suppliers might leverage their expertise and existing infrastructure to manufacture end-products, directly competing with CommScope.

- Increased Negotiation Leverage: The threat of suppliers becoming competitors enhances their bargaining power, allowing them to potentially dictate terms or prices.

- Strategic Implications for CommScope: CommScope must carefully manage supplier relationships to mitigate the risk of creating future rivals, potentially impacting its supply chain costs and market position.

Importance of CommScope to Supplier Revenue

CommScope's reliance on specific suppliers significantly shapes the bargaining power dynamic. If a supplier's revenue is heavily dependent on CommScope, it's likely to be more accommodating with pricing and terms to secure continued business. For example, if a key component supplier derives over 20% of its annual sales from CommScope, that supplier might be less inclined to exert strong price increases.

Conversely, if CommScope represents a minor portion of a supplier's customer base, perhaps less than 5% of their total revenue, the supplier holds considerably more leverage. This asymmetry means the supplier has less incentive to negotiate favorable terms, as losing CommScope's business would have a minimal impact on their overall financial performance.

- Supplier Dependence: The percentage of a supplier's total revenue derived from CommScope is a critical factor.

- Favorable Terms: High dependence can lead suppliers to offer better pricing and more flexible contract conditions.

- Increased Leverage: Low dependence grants suppliers greater power to dictate terms and potentially increase prices.

- Strategic Importance: CommScope's ability to influence a supplier's revenue stream directly correlates with the supplier's bargaining power.

The bargaining power of suppliers for CommScope is significantly influenced by the concentration of its supplier base and the specialized nature of the components it requires. In 2024, CommScope's dependence on a few manufacturers for advanced materials underscores this leverage, allowing suppliers to command favorable terms due to limited alternatives.

This concentration means that price hikes or altered supply agreements from these key suppliers directly impact CommScope's costs. In 2023, CommScope's top five suppliers represented about 35% of its procurement costs, highlighting their substantial influence on profitability.

| Factor | Impact on CommScope | 2023 Data Point |

| Supplier Concentration | Increases supplier leverage | Top 5 suppliers = 35% of procurement costs |

| Component Specialization | Limits substitution options | N/A (Qualitative factor) |

| Switching Costs | Reinforces existing supplier power | N/A (Qualitative factor) |

What is included in the product

This analysis dissects the competitive forces impacting CommScope, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications infrastructure market.

Easily assess competitive intensity by visualizing the impact of each force on CommScope's profitability.

Customers Bargaining Power

CommScope's bargaining power of customers is significantly influenced by the concentration of its customer base. A substantial portion of its revenue often comes from a select group of major telecommunications companies, broadband providers, and large enterprise clients. For instance, in 2023, CommScope's top ten customers accounted for approximately 35% of its net sales, highlighting the significant reliance on a few key accounts.

Customers in the communication infrastructure market are often highly price-sensitive due to tight budgets, frequently seeking the most cost-effective solutions available. This directly translates into increased bargaining power for them.

For CommScope, this means a constant need to offer competitive pricing, particularly for its more standardized product lines. For instance, in 2024, many enterprise clients were observed scrutinizing capital expenditures closely, prioritizing vendors offering clear cost savings without compromising essential performance.

The availability of numerous substitute products significantly bolsters customer bargaining power in the communication infrastructure sector. Companies like Cisco Systems, Corning, and Amphenol offer comparable solutions, providing customers with a wide array of choices. This abundance of alternatives means customers can easily switch if CommScope's pricing or product satisfaction doesn't meet their expectations, directly increasing their leverage.

Customer's Ability to Backward Integrate

Large customers, such as major telecom operators and data center providers, hold significant bargaining power due to their potential to backward integrate. These entities often possess the technical expertise and financial resources to manufacture certain communication infrastructure components themselves, thereby reducing their dependence on suppliers like CommScope.

This capability directly influences their leverage in negotiations. For instance, a major hyperscale data center operator might explore in-house production of fiber optic cabling if they perceive CommScope's pricing or terms as unfavorable.

The threat of backward integration is a constant consideration for suppliers. In 2024, the increasing modularity and standardization of certain network components make in-house production more feasible for large tech companies, further amplifying customer bargaining power.

- Customer's Ability to Backward Integrate: Major clients like AT&T or Amazon Web Services could potentially develop their own specialized connectivity solutions.

- Reduced Reliance: This in-house capability allows them to decrease their reliance on external vendors, strengthening their negotiating position.

- Feasibility in 2024: Advances in manufacturing and the availability of skilled labor make it more practical for large customers to consider producing components internally.

- Impact on Suppliers: For companies like CommScope, this means a constant need to offer competitive pricing and innovative solutions to retain these key accounts.

Information Availability to Customers

Customers in the telecommunications infrastructure sector, where CommScope operates, benefit from readily available information. This includes detailed product specifications, competitive pricing structures, and performance data from various suppliers. This transparency significantly reduces information asymmetry.

With easy access to comparative data, customers are empowered to make well-informed purchasing decisions. They can effectively assess value propositions and engage in more assertive negotiations, directly enhancing their bargaining power.

For instance, in 2024, major telecom operators often leverage detailed technical reviews and publicly available pricing benchmarks to secure favorable terms. This widespread availability of data means suppliers must compete not just on product but also on price and perceived value.

- Informed Decision-Making: Customers can easily compare specifications and pricing across multiple vendors.

- Reduced Information Asymmetry: Transparency levels the playing field between buyers and sellers.

- Enhanced Negotiation Leverage: Access to data allows customers to negotiate more effectively on price and terms.

- Supplier Accountability: Performance data holds suppliers accountable, driving better service and product quality.

The bargaining power of CommScope's customers is substantial due to the industry's fragmented nature and the availability of numerous alternatives. Customers can readily switch suppliers if CommScope's offerings are not competitive on price, quality, or innovation. This dynamic forces CommScope to maintain rigorous cost management and continuous product development to retain its market position.

The concentration of CommScope's customer base, with a significant portion of revenue derived from a few large telecommunications and broadband providers, further amplifies customer bargaining power. These major clients often have the scale to demand customized solutions and preferential pricing. In 2023, CommScope's top ten customers represented about 35% of its net sales, underscoring this dependency.

The ease with which customers can access detailed product specifications, pricing benchmarks, and performance data from various competitors significantly reduces information asymmetry. This transparency empowers customers to negotiate more assertively, ensuring they secure the best possible value. For instance, in 2024, major telecom operators frequently utilized detailed technical reviews and publicly available pricing benchmarks to secure favorable terms.

The potential for large customers to backward integrate, producing certain components in-house, also serves as a powerful lever in negotiations. Advances in manufacturing and component standardization in 2024 have made this option more feasible for large tech companies, increasing their leverage over suppliers like CommScope.

| Factor | Impact on Customer Bargaining Power | CommScope's Response/Consideration |

|---|---|---|

| Customer Concentration | High; reliance on a few large accounts | Need for competitive pricing and strong customer relationships |

| Price Sensitivity | High; customers seek cost-effective solutions | Focus on cost efficiency and value proposition |

| Availability of Substitutes | High; numerous competitors exist | Emphasis on product differentiation and innovation |

| Backward Integration Threat | Moderate to High; large clients can produce components internally | Maintaining competitive pricing and offering superior value |

| Information Availability | High; transparency in pricing and performance | Need for clear communication and demonstrable value |

Same Document Delivered

CommScope Porter's Five Forces Analysis

This preview showcases the identical CommScope Porter's Five Forces Analysis you will receive immediately after purchase, ensuring complete transparency and no hidden surprises. The document displayed here is the actual, fully formatted analysis, ready for your immediate download and application. You are viewing the complete, professionally crafted analysis, meaning what you see is precisely what you will get, enabling you to leverage this strategic insight without delay.

Rivalry Among Competitors

The communication infrastructure market is a crowded space with many players, from giants like Cisco and Huawei to smaller, specialized firms. This sheer number and variety of competitors means companies are constantly battling for customers and market share across different product lines and regions.

In 2024, the global telecommunications equipment market was valued at approximately $190 billion, showcasing the scale of the industry and the intensity of competition within it. This robust market size attracts a wide array of companies, each trying to carve out its niche and gain an advantage.

The communication infrastructure market's growth rate directly fuels competitive rivalry. While sectors like fiber broadband and data centers show robust expansion, the overall industry can experience shifts due to demand fluctuations and technology upgrade cycles. For instance, in 2023, the global telecommunications infrastructure market was valued at approximately $220 billion, with projections indicating a compound annual growth rate of around 6-7% through 2028, driven by 5G and IoT adoption.

When growth slows or market volatility arises, the intensity of competition escalates. Companies then vie more aggressively for market share within a less expansive environment. This dynamic can lead to price wars and increased marketing efforts as players strive to capture existing demand rather than capitalizing on new market expansion.

CommScope's competitive edge hinges on its innovation in areas like high-speed fiber optic connectivity for data centers and advanced DOCSIS 4.0 solutions. These technological advancements allow the company to stand out in a crowded marketplace. For instance, CommScope's commitment to developing next-generation solutions positions it favorably against rivals seeking to capture market share in rapidly evolving telecommunications infrastructure.

High Fixed Costs and Capacity

The communication infrastructure sector is characterized by significant upfront investments. These include building and maintaining advanced manufacturing plants, funding extensive research and development for new technologies, and establishing robust global supply chains. For instance, CommScope's significant capital expenditures in its fiber optic and connectivity solutions highlight these industry realities.

Companies facing high fixed costs often feel pressure to maximize production output to spread these expenses over a larger volume. This can lead to a tendency to engage in aggressive pricing, especially when demand fluctuates, intensifying the competition among players in the market. This dynamic can erode profit margins for all involved.

- High Capital Intensity: The need for substantial investment in manufacturing, R&D, and distribution creates a barrier to entry and forces existing players to utilize capacity efficiently.

- Capacity Utilization Pressure: Companies must operate near full capacity to cover fixed costs, which can drive price competition as firms seek to fill production lines.

- Pricing Strategies: The imperative to cover high fixed costs often results in competitive pricing, impacting overall industry profitability.

Exit Barriers

CommScope, like many in the telecommunications infrastructure sector, faces significant exit barriers. These can include highly specialized manufacturing equipment, such as advanced fiber optic cable extrusion lines, which have limited resale value outside the industry. Additionally, long-term supply agreements and customer contracts can make it financially punitive to cease operations or divest certain business units. For instance, if a company has invested heavily in dedicated production facilities for a specific type of connector, repurposing that plant for a different product line might be prohibitively expensive, forcing continued operation even in a down market.

These high exit barriers mean companies are often compelled to stay in the game, even when profitability is scarce. This can perpetuate overcapacity within the industry, intensifying competitive pressures as players fight for market share with existing, often aging, infrastructure. In 2024, the global telecommunications equipment market, while growing, still experiences periods of intense price competition, partly due to the sunk costs and specialized nature of assets that make exiting difficult.

- Specialized Assets: CommScope's manufacturing facilities often house highly specialized machinery for producing fiber optic cables and connectivity solutions, which are difficult and costly to repurpose or sell.

- Contractual Obligations: Long-term supply contracts with major telecommunications providers can create significant financial penalties for early termination, locking companies into ongoing operations.

- Sustained Competition: The inability to easily exit the market due to these barriers can lead to prolonged periods of overcapacity, driving down prices and increasing rivalry among remaining players.

CommScope operates in a highly competitive landscape, characterized by numerous players ranging from global giants to niche specialists. This intense rivalry, fueled by a market valued at approximately $190 billion in 2024 for telecommunications equipment, forces companies to constantly innovate and compete on price and performance.

The industry's high capital intensity, with significant investments in R&D and specialized manufacturing, pressures companies to maintain high capacity utilization. This often leads to aggressive pricing strategies to cover fixed costs, especially when demand fluctuates, as seen in the telecommunications infrastructure market's growth projections of 6-7% through 2028.

High exit barriers, such as specialized machinery and long-term contracts, compel companies to remain active even in challenging market conditions. This perpetuates overcapacity and intensifies competition, impacting profitability across the sector.

| Key Competitive Factors | Impact on Rivalry | Example for CommScope |

| Number and Diversity of Competitors | High rivalry across product lines and regions | Competition from Cisco, Huawei, Nokia, Ericsson |

| Market Growth Rate | Intensifies during slower growth periods | 5G and IoT drive growth, but upgrade cycles create volatility |

| Capital Intensity & Fixed Costs | Pressure for capacity utilization and competitive pricing | High investment in fiber optic manufacturing |

| Exit Barriers | Perpetuates overcapacity and sustained competition | Specialized fiber optic extrusion lines, long-term customer contracts |

SSubstitutes Threaten

The communication industry's rapid evolution presents a significant threat of substitutes. For instance, while CommScope heavily relies on wired infrastructure like fiber optics, the burgeoning capabilities of wireless technologies, such as 5G for last-mile connectivity and the expansion of satellite broadband, offer alternative solutions for data transmission. These advancements can potentially diminish the demand for traditional wired solutions in specific market segments, impacting CommScope's core business.

Customers constantly weigh the price against the performance of available alternatives. If a substitute technology delivers similar or even better results for less money, it becomes a very attractive option for CommScope's clients.

For example, in 2024, the market saw increased adoption of open-source networking solutions, which often provide robust functionality at a fraction of the cost of proprietary systems. This trend directly challenges traditional vendors by offering a compelling price-performance trade-off.

Specifically, for broadband deployment, service providers are actively seeking simpler and more cost-effective methods. The emergence of new, less complex technologies that can achieve comparable speeds and reliability at a lower capital and operational expenditure poses a significant threat to CommScope's existing product lines.

The threat of substitutes for CommScope's networking and connectivity solutions is largely determined by customer switching costs. If a customer needs to invest heavily in new infrastructure, retraining personnel, or undertaking complex network reconfigurations to adopt an alternative, CommScope faces a lower threat from those substitutes.

Conversely, if emerging technologies offer seamless integration with existing systems and present a clear advantage in long-term operational expenses or performance, the incentive for customers to switch away from CommScope increases significantly. For instance, the transition to fiber optics from copper cabling, while requiring upfront investment, has offered long-term cost savings and performance gains, influencing switching decisions.

In 2024, the ongoing advancements in passive optical network (PON) technologies and the increasing adoption of Wi-Fi 7 are examples of substitutes that could lower switching costs for certain segments of CommScope's customer base, particularly those looking for higher bandwidth and reduced latency without extensive proprietary hardware dependencies.

Evolution of Network Architectures

The increasing trend towards converged network architectures, integrating voice, video, and data onto a single platform, presents a significant threat of substitutes for CommScope. This evolution can lead to infrastructure requirements that differ substantially from traditional, siloed network components.

Solutions offering unified connectivity and management, often based on software-defined networking (SDN) or cloud-native approaches, can bypass the need for specialized physical infrastructure that CommScope traditionally supplies. For instance, the growth in 5G network deployments, while also an opportunity, necessitates new types of distributed antenna systems and small cell solutions that might be offered by competitors with more agile, integrated architectures.

- Converged Networks: The move to single networks for voice, video, and data reduces demand for separate, specialized cabling and hardware.

- SDN and Cloud Solutions: Software-defined networking and cloud-based services can abstract away the need for physical network hardware, diminishing reliance on traditional providers.

- 5G Infrastructure: The build-out of 5G requires new, often integrated, small cell and distributed antenna systems, creating opportunities for alternative providers.

Emergence of Software-Defined Solutions

The rise of software-defined solutions like Software-Defined Networking (SDN) and Network Function Virtualization (NFV) presents a significant threat of substitution for CommScope. These technologies allow network functions, traditionally requiring dedicated hardware, to be handled by software. This shift could lessen the demand for physical infrastructure components that CommScope specializes in.

For instance, as more network management and services are virtualized, the need for specific, often proprietary, hardware devices decreases. This trend could lead to customers opting for more flexible, software-based alternatives, thereby reducing their reliance on CommScope's physical product portfolio. By 2024, the global SDN market was projected to reach over $20 billion, indicating substantial growth and adoption of these software-centric approaches.

- Reduced Hardware Dependency: SDN and NFV enable network operators to consolidate and manage network functions through software, diminishing the necessity for specialized, single-purpose hardware.

- Cost Efficiency and Flexibility: Software-defined solutions often offer greater cost savings and agility compared to traditional hardware-centric networks, making them an attractive alternative for businesses.

- Market Growth of Virtualization: The increasing adoption of cloud computing and virtualization technologies fuels the demand for software-based network solutions, directly impacting the market for physical network infrastructure.

The threat of substitutes for CommScope is amplified by the growing availability of wireless and software-defined networking solutions. For example, the expanding reach of 5G and satellite internet offers alternatives to wired infrastructure, potentially impacting demand for CommScope's fiber optic solutions. Furthermore, the increasing adoption of open-source networking in 2024, providing robust functionality at a lower cost, directly challenges traditional hardware vendors by offering a compelling price-performance trade-off.

Customers are increasingly evaluating alternatives based on cost and performance. If a substitute technology, such as simpler broadband deployment methods, offers comparable speeds and reliability at a lower capital and operational expenditure, it poses a significant threat to CommScope's existing product lines.

The shift towards converged network architectures and software-defined networking (SDN) further intensifies this threat. These solutions can bypass the need for specialized physical infrastructure, with the global SDN market projected to exceed $20 billion by 2024, highlighting the growing preference for software-centric approaches over traditional hardware.

| Threat of Substitutes | Description | Impact on CommScope | Examples | 2024 Market Trend/Data |

| Wireless Technologies | Alternative data transmission methods like 5G and satellite broadband. | Reduces demand for wired infrastructure. | 5G for last-mile connectivity, satellite internet. | Continued 5G rollout and satellite broadband expansion. |

| Software-Defined Networking (SDN) & Virtualization | Network functions handled by software rather than dedicated hardware. | Lessens demand for physical infrastructure components. | Network Function Virtualization (NFV), cloud-native architectures. | Global SDN market projected to exceed $20 billion. |

| Open-Source Solutions | Cost-effective alternatives to proprietary systems. | Challenges traditional vendors with price-performance trade-offs. | Open-source networking solutions. | Increased adoption in 2024. |

Entrants Threaten

The communication infrastructure sector, where CommScope operates, demands immense upfront capital. Think about the costs for cutting-edge research and development, building state-of-the-art manufacturing plants, and establishing extensive global supply chains. These aren't small investments; they can easily run into billions of dollars.

This significant financial hurdle effectively deters many potential new companies from entering the market. For instance, establishing the necessary R&D capabilities and production facilities to compete with established players like CommScope requires a financial commitment that few newcomers can realistically meet. This high barrier significantly lowers the threat of new entrants.

Established players like CommScope leverage significant economies of scale in manufacturing and procurement. For instance, in 2023, CommScope's substantial production volumes allowed for optimized material sourcing, leading to lower per-unit costs compared to smaller, emerging competitors.

These cost advantages in production and research and development create a substantial barrier for new entrants. A new company would find it incredibly challenging to match CommScope's efficiency and pricing power, thereby diminishing the immediate threat of new market participants entering the fiber optic cable industry.

CommScope's extensive portfolio of patents, particularly in fiber optic connectivity and wireless solutions, significantly deters new entrants. Developing comparable, non-infringing technology requires substantial research and development investment, creating a high barrier to entry.

Brand Identity and Customer Loyalty

Building a strong brand identity and fostering customer loyalty in the telecommunications infrastructure market is a lengthy and capital-intensive endeavor. New entrants would struggle to gain credibility with major clients who prioritize unwavering reliability and demonstrated performance.

CommScope has cultivated deep relationships with established network operators, often built over decades of consistent service delivery and product innovation. This ingrained loyalty creates a significant barrier, as switching costs, both tangible and intangible, can be substantial for these critical infrastructure providers.

For instance, in 2024, major telecommunications companies continued to invest heavily in network upgrades, favoring vendors with proven track records. CommScope’s extensive portfolio of fiber optic cables and connectivity solutions, backed by a reputation for quality, positions it favorably against newcomers who lack this historical performance data.

- Brand Equity: CommScope's long-standing presence has built significant brand equity, making it a trusted name in the industry.

- Customer Relationships: Decades of partnership with major telecom operators create strong customer loyalty and high switching costs.

- Reliability Focus: The critical nature of network infrastructure means customers prioritize proven reliability, a hurdle for new entrants.

- Investment Barrier: Establishing a comparable level of trust and performance requires substantial time and financial investment for new players.

Access to Distribution Channels

CommScope’s deeply entrenched relationships with key telecommunications operators and enterprise clients present a formidable barrier. For instance, in 2024, CommScope continued to leverage its long-standing partnerships, securing significant contracts that solidify its market presence. New entrants would struggle to replicate this level of access, as these distribution channels are often exclusive or require substantial investment and proven reliability.

Gaining access to established distribution networks is a major hurdle for potential competitors. CommScope benefits from a global network of distributors and resellers, built over years of operation. In 2024, the company reported that its channel partners contributed to a substantial portion of its revenue, underscoring the importance of these relationships. Newcomers would face considerable difficulty in establishing similar reach, as these channels are critical for customer acquisition and product deployment.

- Established Relationships: CommScope boasts deep ties with major telecom providers and enterprises, making it hard for new players to penetrate these markets.

- Channel Partner Network: The company's extensive network of distributors and resellers is a key asset, difficult for new entrants to replicate.

- Market Access: Access to these critical distribution channels is essential for reaching customers, and new entrants face significant challenges in securing this.

The threat of new entrants in the communication infrastructure sector, where CommScope operates, is significantly mitigated by substantial capital requirements and established brand loyalty. The need for massive upfront investment in R&D, manufacturing, and global supply chains, often in the billions of dollars, acts as a powerful deterrent. For instance, in 2024, the ongoing demand for 5G network buildouts meant new entrants needed to demonstrate immediate capacity and reliability, which is difficult without prior operational history.

Porter's Five Forces Analysis Data Sources

Our CommScope Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from CommScope's annual reports and SEC filings, alongside industry-specific market research reports and competitive landscape assessments.