CommScope PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

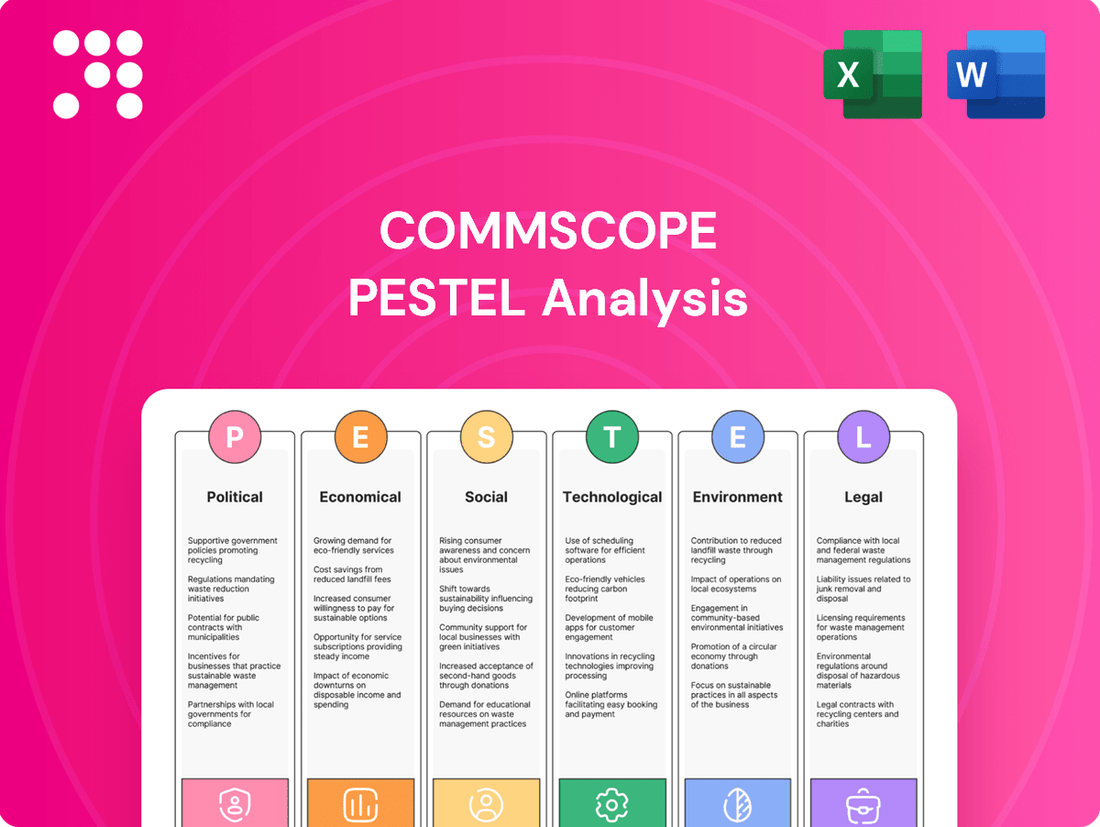

Navigate the complex external forces shaping CommScope's future with our expert PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Arm yourself with actionable intelligence to refine your strategy and gain a significant competitive advantage. Download the full analysis now and unlock critical insights.

Political factors

Governments worldwide are heavily investing in digital infrastructure, with a particular focus on expanding broadband access, rolling out 5G networks, and improving connectivity in rural areas. For instance, the United States' Broadband Equity, Access, and Deployment (BEAD) program alone allocated $42.45 billion in 2024 to fund broadband infrastructure deployment in unserved and underserved communities.

These substantial public funding initiatives and subsidies create a direct boost in demand for CommScope's extensive portfolio of fiber optic cables, wireless network components, and other critical infrastructure solutions. The sheer magnitude of these government outlays directly influences the pace at which the market for these technologies expands or contracts.

Telecommunications policies, including spectrum allocation and network neutrality, directly influence CommScope's market. For instance, in 2024, many countries continued to auction 5G spectrum, with the US alone generating billions, impacting the demand for CommScope's infrastructure solutions.

Infrastructure sharing mandates and universal service obligations also play a key role. As of early 2025, initiatives to expand broadband access in rural areas are gaining momentum globally, creating opportunities for CommScope's deployment technologies, but also potentially increasing competition.

Favorable regulatory environments can significantly reduce barriers to entry and deployment. Conversely, stringent regulations or unexpected policy shifts, such as changes in net neutrality rules in major markets during 2024, can increase compliance costs and affect revenue streams for companies like CommScope.

CommScope's global operations are significantly influenced by international trade policies. For instance, the evolving landscape of trade agreements, such as potential shifts in agreements impacting the flow of goods between major economic blocs, directly affects CommScope's ability to source components and distribute its networking solutions worldwide. Tariffs imposed on electronic components or finished goods could increase manufacturing costs, potentially impacting pricing strategies and market competitiveness. In 2023, global trade growth slowed to an estimated 0.9%, down from 5.2% in 2022, highlighting the sensitivity of companies like CommScope to these policy shifts.

Geopolitical tensions present another critical factor. Disruptions stemming from regional conflicts or strained international relations can impact CommScope's supply chain by affecting logistics or leading to increased raw material costs. For example, restrictions on technology sales to specific countries, driven by national security concerns, could limit market access for CommScope's advanced communication infrastructure products. The ongoing geopolitical realignments in 2024 continue to create an environment where supply chain resilience and strategic market positioning are paramount for sustained growth.

National Security and Data Sovereignty

National security concerns are increasingly shaping government procurement for telecommunications infrastructure. Many nations are enacting stricter regulations, prioritizing domestic or allied suppliers to safeguard critical networks. This focus on data sovereignty means companies like CommScope must demonstrate robust security protocols and potentially localize manufacturing or R&D to meet these demands.

The geopolitical landscape directly impacts CommScope's market access and operational strategies. For instance, in 2024, several countries continued to review and update their cybersecurity standards for network equipment. This trend could lead to increased demand for CommScope’s secure solutions in some regions, while potentially creating barriers in others where compliance with stringent national security frameworks is paramount.

- Government Mandates: Increasing adoption of ‘buy national’ policies for critical infrastructure.

- Supply Chain Scrutiny: Heightened governmental review of foreign-sourced telecommunications components.

- Data Protection Laws: Evolving regulations on data residency and cross-border data flows impacting network design.

- Cybersecurity Standards: More rigorous security certifications and compliance requirements for network vendors.

Political Stability and Investment Climate

CommScope's operations are significantly influenced by political stability and the investment climate in its core markets. For instance, the company's substantial presence in North America and Europe means that geopolitical events and policy shifts in these regions, such as infrastructure spending bills or trade disputes, directly affect its revenue streams and operational costs. A stable political landscape fosters confidence for the large-scale, long-term investments required in telecommunications infrastructure, which is CommScope's primary market.

Conversely, political instability can pose considerable risks. Unpredictable regulatory changes or social unrest in key customer regions can delay or halt critical network build-outs, impacting demand for CommScope's products. For example, disruptions in the Middle East or parts of Asia, where CommScope also has a market presence, can affect supply chain logistics and project timelines. The company's 2023 annual report highlighted the importance of navigating diverse political environments to ensure consistent growth.

- Geopolitical Stability: CommScope's reliance on global supply chains and international customer bases makes it sensitive to political stability in regions like North America, Europe, and Asia.

- Regulatory Environment: Favorable government policies supporting broadband expansion and 5G deployment in major markets, such as the US and Germany, are crucial for driving demand for CommScope's network infrastructure solutions.

- Investment Climate: A positive investment climate, often driven by political certainty and economic growth, encourages telecommunications companies to invest in network upgrades, directly benefiting CommScope's sales.

- Trade Policies: Changes in international trade agreements and tariffs can impact the cost of raw materials and finished goods, affecting CommScope's profitability and pricing strategies.

Government investments in digital infrastructure, like the US Broadband Equity, Access, and Deployment program's $42.45 billion allocation in 2024, directly fuel demand for CommScope's network solutions. Telecommunications policies, including 2024 5G spectrum auctions that generated billions globally, also shape market dynamics for the company's offerings.

Stringent cybersecurity standards and data protection laws are increasingly influencing network equipment procurement, a trend evident in 2024 reviews of national standards. This necessitates robust security protocols and potentially localized operations for companies like CommScope to meet national security and data sovereignty demands.

Geopolitical stability is critical for CommScope's global supply chains and customer base, with regions like North America and Europe being key markets. Favorable policies supporting broadband and 5G expansion, as seen in major markets, are vital for sustained demand, while trade policies and tariffs can impact costs and competitiveness.

| Political Factor | Impact on CommScope | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Government Infrastructure Spending | Increased demand for network components | US BEAD program: $42.45 billion (2024) for broadband deployment. |

| Spectrum Allocation Policies | Drives demand for 5G infrastructure | Global 5G spectrum auctions generated billions in 2024. |

| Cybersecurity & Data Protection | Requirement for enhanced security solutions, potential market access barriers | Ongoing review and update of national cybersecurity standards for network equipment. |

| Trade Policies & Tariffs | Affects component costs and pricing strategies | Global trade growth slowed to 0.9% in 2023, indicating sensitivity to policy shifts. |

What is included in the product

This CommScope PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of external forces, offering actionable insights for strategic decision-making and risk mitigation.

The CommScope PESTLE Analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain point of information overload.

Economic factors

Global economic growth significantly impacts CommScope's revenue streams. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable rate from 2023, indicating continued, albeit moderate, demand for telecommunications infrastructure. This steady economic environment generally supports capital expenditure by CommScope's core customer segments: telecom operators, enterprises, and data centers, who are more likely to invest in network expansion and upgrades when the economy is expanding.

However, economic slowdowns present a direct challenge. Should global growth falter, as seen in periods of recession, these customers tend to defer or reduce their spending on new equipment and network enhancements. For instance, a projected dip in global GDP growth in 2025, if it materializes, could lead to delayed projects and softened demand for CommScope's connectivity solutions, impacting their order books and financial performance.

Rising inflation presents a significant challenge for CommScope, directly impacting its operational costs. The prices of key raw materials, such as copper and fiber optic components, have seen notable increases. For instance, copper prices, a crucial input for many of CommScope's connectivity solutions, experienced significant volatility throughout 2023 and into early 2024, with spot prices fluctuating around the $3.50 to $4.00 per pound range.

Supply chain disruptions, coupled with the inherent volatility in commodity markets, can put considerable pressure on CommScope's profit margins. If the company cannot effectively pass these increased costs onto its customers through strategic pricing adjustments, its profitability will likely be eroded. For example, disruptions in the semiconductor supply chain in 2022 and 2023 led to extended lead times and higher component costs across the telecommunications equipment sector.

Therefore, diligent monitoring of global commodity markets is essential for CommScope's cost control strategies. Understanding trends in the prices of aluminum, plastics, and precious metals, in addition to copper and fiber, allows for more informed procurement decisions and hedging strategies to mitigate financial risks.

Higher interest rates, such as those seen with the Federal Reserve's monetary tightening cycles, directly increase borrowing costs for companies like CommScope and their customers. This can put a damper on significant infrastructure investments that often depend on debt financing, potentially impacting demand for CommScope's network solutions. For instance, if benchmark rates rise by 1%, the cost of debt for a large project could increase substantially.

The ease and expense of obtaining capital for network operators are critical. When capital is readily available and cheap, operators are more likely to invest in upgrading their networks and purchasing new equipment, benefiting CommScope. Conversely, tighter credit conditions can lead to delayed or scaled-back capital expenditures by these key customers.

CommScope's financial health is also tied to global monetary policies. Central bank decisions on interest rates and quantitative easing or tightening influence the overall economic environment, affecting consumer spending, business investment, and ultimately, the demand for telecommunications infrastructure.

Competition and Pricing Pressure

The telecommunications infrastructure sector is fiercely competitive, featuring a multitude of global and regional companies vying for market share. This intense rivalry often translates into significant pricing pressure on CommScope's offerings, directly affecting its revenue streams and profit margins. For instance, in 2023, the average selling price for fiber optic cables, a key CommScope product, saw continued downward trends in certain segments due to oversupply from some competitors.

To navigate this challenging environment, CommScope must prioritize differentiation. This involves not only technological innovation in its product lines but also a strong focus on customer service and operational cost efficiency. Companies that successfully blend these elements are better positioned to retain their market standing and ensure sustained profitability amidst aggressive competition.

- Market Saturation: High competition can lead to market saturation, forcing companies to compete more aggressively on price.

- Innovation as a Differentiator: Investing in R&D to offer unique solutions is critical for standing out.

- Cost Management: Efficient operations and supply chain management are vital to offer competitive pricing without sacrificing profitability.

- Service Excellence: Superior customer support and integration services can command premium pricing and build customer loyalty.

Currency Exchange Rate Fluctuations

CommScope, operating globally, faces significant risks from currency exchange rate fluctuations. As of the first quarter of 2024, the company reported that a 1% unfavorable change in foreign currency exchange rates could have a $10 million impact on its operating income. These shifts directly affect the translation of international revenues and expenses into its reporting currency, impacting reported financial results and overall profitability.

For instance, a stronger US dollar can make CommScope's products more expensive for international buyers, potentially dampening sales volumes. Conversely, a weaker dollar can boost reported earnings when foreign currency profits are repatriated. The company actively manages this exposure through hedging strategies, but considerable volatility remains a key consideration for its financial performance.

- Impact on Revenue: Fluctuations can alter the US dollar value of sales made in foreign currencies, affecting top-line growth reported in the company's primary financial statements.

- Cost of Goods Sold: Similarly, the cost of raw materials or components sourced internationally is subject to exchange rate changes, influencing gross margins.

- Profitability: The net effect of these revenue and cost translations directly impacts CommScope's operating income and net profit.

- Competitive Positioning: Exchange rates can also influence the relative pricing of CommScope's products compared to local competitors in various markets.

Global economic growth directly influences CommScope's revenue, with the IMF projecting 3.2% growth for 2024, indicating stable demand for telecom infrastructure. However, economic downturns can lead customers to delay investments, impacting CommScope's order books.

Inflation raises operational costs for CommScope, particularly for raw materials like copper, which saw price volatility through early 2024. Supply chain issues can further pressure profit margins if cost increases cannot be passed on to customers.

Rising interest rates increase borrowing costs for CommScope and its clients, potentially slowing network infrastructure investments. Monetary policies from central banks significantly shape the economic environment, affecting overall demand for telecommunications solutions.

Currency exchange rate fluctuations pose a risk, with a 1% unfavorable shift potentially impacting CommScope's operating income by $10 million as of Q1 2024. These shifts affect reported earnings and competitive positioning in international markets.

Preview the Actual Deliverable

CommScope PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CommScope delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain actionable insights into the external forces shaping CommScope's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of the opportunities and threats CommScope faces in its market.

Sociological factors

The world's growing dependence on fast and dependable internet for everything from work and school to entertainment and everyday tasks is pushing up the need for better communication networks. This constant demand for connectivity is a major driver for investments in fiber optics, 5G technology, and business networks, which directly helps companies like CommScope.

By the end of 2024, it's estimated that over 5.5 billion people globally will be using the internet, a number projected to climb even higher. This widespread digital adoption means more people are relying on robust infrastructure for their daily lives, creating a sustained market for CommScope's solutions.

The ongoing digital transformation across all sectors of society is the bedrock of this increasing demand for connectivity. As more services and interactions move online, the necessity for high-performance networks becomes paramount, directly benefiting CommScope's product and service offerings.

The global push towards urbanization is accelerating, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This demographic shift fuels the demand for robust digital infrastructure, making smart city initiatives a key driver for communication technology providers like CommScope.

Smart cities rely heavily on interconnected systems and the Internet of Things (IoT), requiring high-capacity networks. CommScope's expertise in fiber optics, essential for 5G backhaul and data transmission, and its solutions for small cells and in-building wireless are vital for building the dense, reliable networks these urban environments need. For instance, in 2024, investments in smart city projects globally were estimated to reach over $100 billion, highlighting the significant market potential.

Societal and governmental efforts to bridge the digital divide are creating significant new market opportunities. Initiatives focused on bringing broadband to underserved rural and remote areas, often through public-private partnerships and dedicated funding, directly align with CommScope's mission to connect more people. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, is a prime example of such investment, aiming to expand access to high-speed internet nationwide.

Evolution of Work and Education Models

The way we work and learn has fundamentally changed, with remote and hybrid models becoming the norm. This evolution significantly boosts the demand for robust network infrastructure, directly benefiting companies like CommScope. Reliable connectivity is no longer a luxury; it's a necessity for both businesses and individuals.

This ongoing shift translates into increased spending on upgrading corporate networks, data centers, and residential broadband services. CommScope's solutions in fiber optics and networking are crucial for meeting this heightened demand. For instance, global internet traffic saw a significant surge, with mobile data traffic alone expected to reach 1,600 exabytes by 2029, up from 77.7 exabytes in 2022, underscoring the need for advanced infrastructure.

- Increased Network Demand: The pandemic accelerated the adoption of remote work, leading to a sustained higher demand for reliable internet access at home and in offices.

- Infrastructure Upgrades: Businesses are investing in upgrading their internal networks and data centers to support hybrid workforces and increased data flow.

- Residential Broadband Growth: Consumers are demanding faster and more stable internet for work, education, and entertainment, driving upgrades in residential broadband.

- CommScope's Role: The company's products, such as fiber optic cables and network solutions, are essential for building and maintaining this critical infrastructure.

Changing Consumer Behavior and Data Consumption

Consumers are increasingly reliant on data-heavy applications like 4K/8K streaming and immersive gaming, significantly increasing demand for robust network infrastructure. This trend directly fuels the need for CommScope's advanced cabling and connectivity solutions, as service providers invest heavily to meet this bandwidth appetite. For instance, global mobile data traffic is projected to reach 304 exabytes per month by 2026, up from 77 exabytes per month in 2021, highlighting the escalating consumption.

The shift towards cloud-based services and remote work further amplifies the need for reliable, high-speed internet access. This behavioral change necessitates network upgrades and densification, creating a sustained market for CommScope's products designed to support these evolving digital lifestyles.

- Increased Demand for Bandwidth: Global mobile data traffic is expected to grow at a CAGR of 20% between 2021 and 2026.

- Adoption of Data-Intensive Applications: 4K/8K video streaming and online gaming are becoming mainstream, requiring superior network performance.

- Cloud Service Penetration: The global cloud computing market is anticipated to reach over $1 trillion by 2027, driving demand for high-capacity networks.

Societal shifts towards remote work and digital learning continue to drive demand for robust connectivity solutions. This trend means businesses and individuals alike require dependable, high-speed internet, directly benefiting companies like CommScope that provide the necessary infrastructure.

The increasing reliance on data-intensive applications, such as high-definition streaming and cloud services, is pushing network capacity limits. Consumers' growing adoption of these services necessitates upgrades in both residential and enterprise networks, creating a consistent market for advanced networking components.

The global push for digital inclusion, aiming to connect underserved populations, opens new avenues for growth. Government initiatives and private investments focused on expanding broadband access, particularly in rural areas, align with CommScope's offerings in fiber optics and network deployment.

Urbanization trends and the development of smart cities further amplify the need for sophisticated communication networks. These initiatives require dense, high-capacity infrastructure to support interconnected systems and the Internet of Things, areas where CommScope's expertise is crucial.

| Societal Factor | Impact on CommScope | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Remote Work/Learning | Increased demand for reliable home and office connectivity. | Global internet traffic continues to grow; mobile data traffic projected to reach 1,600 exabytes by 2029. |

| Data-Intensive Applications | Higher need for bandwidth and advanced network solutions. | Global mobile data traffic expected to grow at a 20% CAGR (2021-2026); cloud market over $1 trillion by 2027. |

| Digital Inclusion Efforts | Opportunities in expanding broadband to underserved areas. | US BEAD program allocates $42.45 billion for broadband expansion. |

| Urbanization & Smart Cities | Demand for dense, high-capacity networks for IoT and smart infrastructure. | Global smart city project investments estimated over $100 billion in 2024. |

Technological factors

The ongoing global deployment of 5G technology, alongside advancements toward 6G, directly fuels demand for CommScope's core offerings like antennas, small cells, and fiber optic solutions. By mid-2024, over 3.6 billion 5G connections were projected globally, underscoring the massive infrastructure build-out required.

This relentless technological progression necessitates substantial capital expenditure in network densification and upgrades, ensuring a consistent market for CommScope's comprehensive wireless infrastructure portfolio. For instance, operators are investing billions in expanding their 5G coverage and capacity, directly benefiting suppliers like CommScope.

Maintaining a leading position in this rapidly evolving mobile network landscape is paramount for CommScope's continued success and market share. The race to develop and deploy next-generation networks demands continuous innovation and strategic investment in research and development.

Ongoing innovations in fiber optic cables, connectivity, and optical networking equipment are essential for handling the growing demand for bandwidth and enabling future network designs. CommScope's strength in fiber solutions, offering greater capacity and reduced latency, allows it to meet the widespread need for fiber extending further into networks.

Companies like CommScope are investing heavily in research and development. For instance, the global fiber optic market was valued at approximately USD 11.5 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over USD 25 billion by 2030, driven by 5G deployment and data center expansion.

The explosion of Internet of Things (IoT) devices, projected to reach over 29 billion by 2030, is fundamentally shifting computing needs. This massive device proliferation necessitates processing data closer to its source to reduce latency, a key driver for edge computing.

CommScope is well-positioned to capitalize on this trend by supplying the specialized infrastructure required for edge data centers and robust, localized connectivity. The demand for faster data processing and real-time analytics in sectors like manufacturing and smart cities directly fuels the need for CommScope's networking solutions.

Network Virtualization and Software-Defined Networking (SDN)

The ongoing transition to software-defined networking (SDN) and network function virtualization (NFV) is reshaping the telecommunications landscape. This shift diminishes the reliance on traditional, hardware-focused network components, compelling companies like CommScope to evolve. By 2024, the global SDN market was projected to reach over $20 billion, highlighting this significant industry trend.

CommScope needs to pivot towards offering more software-centric products and solutions that seamlessly integrate with these virtualized environments. This strategic adjustment is crucial for meeting the growing demand for adaptable and automated network infrastructures. The company's success will hinge on its ability to blend deep hardware knowledge with robust software development capabilities.

- Market Shift: Industry move towards SDN/NFV reduces demand for traditional hardware.

- CommScope's Adaptation: Focus on software-enabled products and virtualized environment integration.

- Key Requirement: Blending hardware expertise with software development is essential.

- Market Growth: SDN market expected to exceed $20 billion by 2024, indicating strong adoption.

Cybersecurity and Network Resilience

The ever-growing complexity of cyber threats and the non-negotiable need for continuous network availability are significantly boosting the market for secure and robust physical and logical network infrastructure. CommScope's product portfolio must integrate advanced security measures and guarantee unwavering reliability to shield clients from operational disruptions.

Customers are increasingly prioritizing the integrity and security of their networks. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, with a significant portion allocated to network security solutions. This trend highlights the crucial role CommScope plays in providing dependable infrastructure that can withstand evolving digital risks.

- Growing Cyber Threats: The increasing frequency and sophistication of cyberattacks necessitate stronger network defenses.

- Network Uptime Demand: Businesses across all sectors require uninterrupted connectivity, making network resilience a key purchasing criterion.

- CommScope's Role: Providing secure and reliable infrastructure is paramount for CommScope to meet customer needs in this evolving technological landscape.

The continued global rollout of 5G and the progression towards 6G directly increase demand for CommScope's foundational products, such as antennas, small cells, and fiber optic systems. By mid-2024, global 5G connections were expected to surpass 3.6 billion, signaling a substantial infrastructure build-out.

This technological advancement requires significant investment in network upgrades and densification, ensuring sustained market opportunities for CommScope's comprehensive wireless infrastructure. For example, telecom operators are investing billions to enhance 5G coverage and capacity, directly benefiting suppliers like CommScope.

Innovations in fiber optic cables, connectivity solutions, and optical networking equipment are vital for managing escalating bandwidth needs and enabling future network architectures. CommScope's expertise in fiber solutions, offering higher capacity and reduced latency, positions it to address the widespread demand for fiber to extend deeper into networks.

| Technology Trend | Impact on CommScope | Market Data/Projections (2024/2025) |

|---|---|---|

| 5G/6G Deployment | Increased demand for antennas, small cells, fiber optics. | Global 5G connections projected over 3.6 billion by mid-2024. |

| Fiber Optic Growth | Essential for bandwidth and future network designs. | Global fiber optic market valued at ~$11.5 billion in 2023, projected growth to over $25 billion by 2030. |

| IoT Expansion | Need for edge computing infrastructure. | IoT devices projected to exceed 29 billion by 2030. |

| SDN/NFV Transition | Shift from hardware to software-centric solutions. | Global SDN market projected to exceed $20 billion by 2024. |

| Cybersecurity Focus | Demand for secure and reliable network infrastructure. | Global cybersecurity market projected to exceed $200 billion in 2024. |

Legal factors

CommScope navigates a stringent telecommunications regulatory landscape, impacting everything from spectrum allocation to equipment certification. Failure to comply with these rules, which vary significantly by nation, can lead to substantial fines and restricted market access. For instance, in 2024, regulatory bodies worldwide continued to refine 5G deployment guidelines and spectrum sharing protocols, directly influencing CommScope’s product roadmap and go-to-market strategies for its network infrastructure solutions.

Strict global data privacy laws like GDPR and CCPA significantly shape network design and security. CommScope's offerings must facilitate customer compliance with these evolving data protection mandates, impacting everything from data collection to storage and transmission protocols.

In 2024, the global data privacy management market was valued at approximately $2.5 billion, highlighting the increasing regulatory and market focus on data security. CommScope's ability to embed privacy-by-design principles into its network infrastructure solutions is therefore not just a legal necessity but a key competitive advantage, influencing customer purchasing decisions.

Antitrust and competition laws significantly impact CommScope's strategic moves. For instance, the company's 2020 acquisition of ARRIS Group, a substantial deal valued at $7.4 billion, faced rigorous review from regulatory bodies worldwide to ensure it wouldn't stifle competition in the broadband and cable network sectors. Navigating these regulations is paramount to avoid hefty penalties, such as the potential fines levied by the European Commission for non-compliance, and to maintain the freedom to pursue future growth through mergers, acquisitions, or strategic alliances.

Intellectual Property Rights and Patents

Protecting CommScope's vast intellectual property, encompassing patents, trademarks, and trade secrets, is paramount to sustaining its edge in innovation and market position. This legal framework safeguards their technological advancements and brand identity.

Navigating the intellectual property landscape of competitors is equally crucial to prevent potential infringement issues. CommScope must diligently monitor and understand the IP rights of others in the telecommunications and infrastructure sectors.

- Patent Portfolio Strength: As of early 2024, CommScope held thousands of patents globally, a testament to its ongoing investment in research and development. For instance, their patent filings often relate to advancements in fiber optic technology, wireless network infrastructure, and intelligent building solutions.

- IP Litigation Landscape: While specific ongoing IP litigation details are often confidential, the broader industry sees significant patent disputes. In 2023, the telecommunications equipment sector experienced numerous patent-related legal challenges, underscoring the importance of robust IP defense for companies like CommScope.

- Trade Secret Protection: Beyond patents, CommScope relies on trade secrets for proprietary manufacturing processes and customer data management. The legal enforcement of these secrets is a continuous effort, especially with a global workforce and supply chain.

Product Safety and Environmental Compliance

CommScope navigates a complex web of product safety and environmental compliance, crucial for market access and avoiding penalties. Regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) dictate the materials used in their network infrastructure solutions, directly influencing product design and manufacturing costs. For instance, the EU's RoHS directive, updated in 2023 with new exemptions, continues to shape component sourcing and product lifecycle management.

These global and regional standards, including those for e-waste disposal, necessitate rigorous adherence throughout the supply chain. Failure to comply can lead to significant fines, product recalls, and reputational damage. CommScope's commitment to these standards, such as their participation in industry initiatives for responsible electronics manufacturing, ensures their products meet the stringent requirements of diverse markets, thereby safeguarding their marketability and legal standing.

- RoHS and REACH Compliance: Strict adherence to material restrictions for hazardous substances impacts component selection and sourcing strategies.

- E-Waste Regulations: CommScope must manage the end-of-life disposal of its products in compliance with varying international e-waste directives.

- Regional Variations: Navigating different regulatory landscapes across North America, Europe, and Asia Pacific adds complexity to global operations.

- Impact on Costs: Compliance efforts can influence research and development, manufacturing processes, and overall product pricing.

CommScope operates within a dynamic legal framework, where adherence to telecommunications regulations, data privacy laws, and intellectual property rights is critical for market access and competitive advantage. The company's 2020 acquisition of ARRIS, valued at $7.4 billion, highlights the intense antitrust scrutiny it faces, impacting strategic growth initiatives. As of early 2024, CommScope's robust patent portfolio, encompassing thousands of global patents, underscores its commitment to innovation and the need for diligent IP protection amidst a litigious industry landscape.

Environmental factors

CommScope faces growing demands from investors, customers, and regulators to showcase robust Environmental, Social, and Governance (ESG) performance. This translates into expectations for sustainable practices across its entire value chain, from product development to sourcing.

For instance, in 2024, a significant portion of institutional investors, estimated to be over 70% by various financial surveys, are actively integrating ESG factors into their investment decisions, impacting capital availability for companies like CommScope.

CommScope’s commitment to ESG reporting and demonstrable progress directly influences investor sentiment and its overall brand image. Companies with strong ESG credentials often see improved access to capital and a more favorable market valuation, as seen in the outperformance of ESG-focused indices in recent years.

Stricter global regulations on e-waste, such as the EU’s updated Ecodesign for Sustainable Products Regulation (ESPR) and various national extended producer responsibility (EPR) schemes, are compelling companies like CommScope to rethink product lifecycles. These rules, increasingly enforced through 2024 and into 2025, push for greater durability, repairability, and recyclability in electronic goods, directly influencing CommScope's design and manufacturing processes.

The drive towards a circular economy means CommScope must invest in robust take-back and recycling programs. For instance, the global e-waste generated reached an estimated 62 million metric tons in 2020, projected to climb to 74 million metric tons by 2030, according to the Global E-waste Monitor 2020. This escalating volume underscores the urgency for effective management strategies that can mitigate environmental impact and comply with evolving legal frameworks.

CommScope's commitment to responsible e-waste management is not just a compliance matter but a critical component of its brand reputation. Consumers and business partners alike are increasingly scrutinizing companies’ environmental, social, and governance (ESG) performance, making transparent and effective e-waste handling a key differentiator and a driver of customer loyalty in the competitive telecommunications infrastructure market.

The escalating energy demands of global communication networks present a significant environmental challenge, fueling a market push for more energy-efficient technologies. CommScope has an opportunity to differentiate itself by innovating and marketing network infrastructure components that reduce power consumption, including advanced antennas, smarter power management systems, and optimized fiber optic solutions.

In 2024, the telecommunications industry's energy consumption is projected to account for a notable percentage of global electricity usage, underscoring the urgency for efficiency. CommScope's commitment to making energy efficiency a core element in product design for its 2025 portfolio can translate into substantial cost savings for operators and a reduced environmental impact, positioning the company as a leader in sustainable network solutions.

Climate Change Impact on Infrastructure

Climate change is increasingly impacting physical infrastructure, including the communication networks CommScope supports. The rising frequency and intensity of extreme weather events, such as hurricanes and severe storms, directly threaten the durability of cell towers, fiber optic cables, and data centers. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a significant increase from previous years, highlighting the growing vulnerability of essential infrastructure.

This environmental shift necessitates that CommScope's solutions are engineered for enhanced resilience and longevity. Products must be capable of withstanding harsher conditions, driving innovation in materials and design to ensure network uptime even in adverse weather. This creates a market opportunity for more robust, weather-resistant components and adaptable network architectures that can better endure environmental stressors.

- Increased Demand for Durable Products: Growing awareness of climate risks fuels demand for products with enhanced weatherproofing and structural integrity.

- Network Resilience as a Differentiator: Companies are prioritizing network infrastructure that can maintain connectivity during extreme weather events.

- Adaptable Network Designs: Future network planning must incorporate flexibility to accommodate changing environmental conditions and potential disruptions.

Supply Chain Environmental Standards

The environmental performance of CommScope's entire supply chain is facing heightened scrutiny. This includes how raw materials are sourced and the manufacturing practices of its suppliers. For instance, in 2024, a significant portion of global companies reported increased pressure from investors and regulators regarding Scope 3 emissions, which encompass supply chain activities.

CommScope is therefore compelled to ensure its suppliers meet stringent environmental benchmarks. This involves responsible mineral sourcing and efforts to reduce carbon emissions throughout the value chain. By 2025, many industry leaders are aiming for at least 75% of their key suppliers to have publicly stated environmental goals.

Growing expectations for supply chain transparency and accountability are a critical environmental consideration. This means CommScope needs to demonstrate clear visibility into its suppliers' environmental impact and their commitment to improvement.

- Increased Investor Demand: By Q3 2024, ESG (Environmental, Social, and Governance) funds saw continued inflows, pushing portfolio companies like CommScope to address supply chain sustainability.

- Regulatory Focus: Emerging regulations in 2024 and 2025 are increasingly targeting Scope 3 emissions, directly impacting supply chain environmental standards.

- Supplier Audits: CommScope's commitment to responsible sourcing, particularly for conflict minerals, requires robust supplier auditing processes to ensure compliance with evolving standards.

- Carbon Footprint Reduction: Industry-wide targets by 2025 often include a 10-15% reduction in supply chain carbon intensity for leading technology firms.

The increasing global focus on sustainability is driving demand for CommScope's energy-efficient network solutions. By 2025, telecommunications networks are expected to consume a significant portion of global electricity, making energy efficiency a key competitive advantage and a critical factor for operators aiming to reduce operational costs and their environmental footprint.

Climate change poses direct risks to CommScope's infrastructure, with extreme weather events becoming more frequent. In 2023 alone, the U.S. experienced 28 billion-dollar weather disasters, according to NOAA, underscoring the need for more resilient and durable network components to ensure service continuity.

CommScope faces growing pressure to manage its supply chain's environmental impact, with a focus on Scope 3 emissions. By 2025, many industry leaders aim for substantial reductions in supply chain carbon intensity, necessitating robust supplier environmental standards and transparency.

PESTLE Analysis Data Sources

Our CommScope PESTLE Analysis is built on comprehensive data from leading market research firms, government economic reports, and technology trend analysis platforms. We integrate insights from industry-specific publications and regulatory updates to ensure a thorough understanding of the macro-environment.