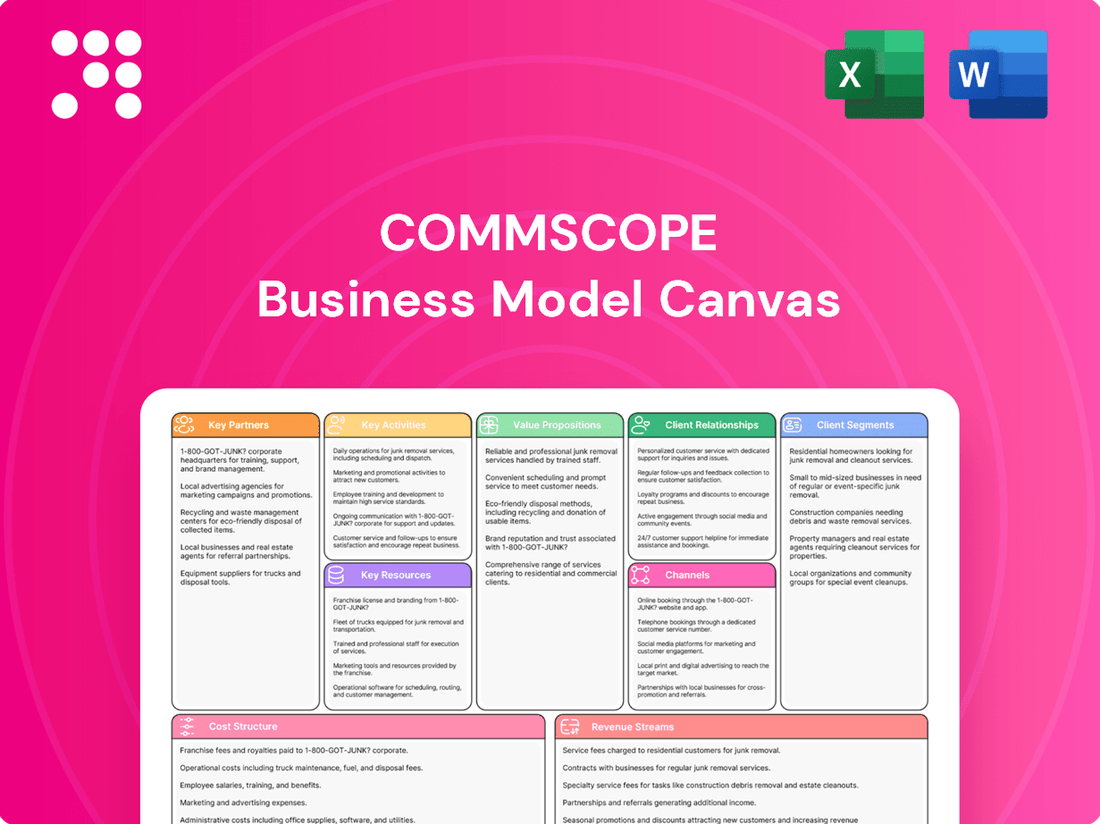

CommScope Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

Curious about CommScope's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap to their success. Dive into the details and discover how they connect the world.

Partnerships

CommScope actively cultivates strategic technology alliances to bolster its product portfolio and broaden its market presence.

A prime example is the recent collaboration with DvSum, focusing on embedding AI-driven analytics into CommScope's ServAssure NXT network monitoring solution. This integration is designed to deliver immediate insights and significantly decrease the time service providers spend on initial call center assessments.

This partnership aims to equip service providers with advanced capabilities for proactive network management and improved customer support, a critical factor in the evolving telecommunications landscape.

CommScope's key partnerships with telecommunications service providers are fundamental to its strategy for deploying cutting-edge network infrastructure. These collaborations enable the widespread adoption of advanced technologies.

A prime example is CommScope's work with Liberty Global, a major operator that chose CommScope to bolster its DOCSIS 4.0 Distributed Access Architecture (DAA) rollout across Europe. This partnership highlights CommScope's role in enabling next-generation broadband capabilities.

Furthermore, significant progress has been made with Comcast in the United States, with both companies achieving key milestones in deploying advanced connectivity solutions. These joint efforts underscore the importance of these relationships in driving innovation and expanding network reach.

CommScope's manufacturing and supply chain partners are crucial for delivering its physical infrastructure products efficiently. These collaborations ensure product availability and foster innovation in a dynamic market. For instance, partnerships with manufacturers are fundamental to maintaining a resilient supply chain, a critical factor in the telecommunications industry.

A prime example of such a partnership is CommScope's collaboration with Emtelle. This alliance focuses on manufacturing hardened connectivity solutions specifically for fiber optic drop cables. This strategic relationship not only bolsters product availability but also drives advancements in fiber optic technology, a key growth area for CommScope.

Industry Alliances and Standards Bodies

CommScope's engagement with industry alliances and standards bodies is crucial for shaping the future of connectivity and ensuring seamless interoperability. By actively participating in organizations like the Wireless Broadband Alliance, CommScope influences the development of Wi-Fi standards and enterprise connectivity solutions. In 2024, CommScope's commitment to these groups was evident through its representatives holding key board positions, directly contributing to the technological roadmap.

These partnerships are not just about influence; they are about ensuring CommScope's offerings remain relevant and compatible with evolving industry needs. This strategic involvement allows them to:

- Drive innovation: Directly contribute to the creation of new industry standards and best practices.

- Ensure interoperability: Guarantee that CommScope's products work seamlessly with other vendors' solutions.

- Gain market insights: Stay ahead of emerging trends and anticipate future customer demands.

- Enhance credibility: Position CommScope as a thought leader and reliable partner in the connectivity space.

Channel Partners and System Integrators

CommScope heavily relies on a robust network of channel partners and system integrators. These entities, including independent distributors and specialized resellers, are crucial for accessing a wide array of customer segments. In 2024, this network was instrumental in extending CommScope's reach, enabling them to effectively deploy their networking solutions across various industries.

These partnerships are not just about sales; they significantly bolster CommScope's support infrastructure. System integrators, in particular, are key to delivering and implementing CommScope's complex product portfolios, ensuring successful project outcomes for end-users. This collaborative approach allows for deeper market penetration and more efficient service delivery.

- Extensive Market Reach: Channel partners provide access to markets CommScope might not directly serve, amplifying sales efforts.

- Specialized Expertise: System integrators offer technical know-how crucial for deploying intricate CommScope solutions.

- Enhanced Customer Support: Partners act as an extension of CommScope's support teams, improving customer satisfaction.

- Solution Deployment Efficiency: The combined capabilities ensure faster and more effective installation and integration of CommScope products.

CommScope's Key Partnerships are multifaceted, encompassing technology providers, telecommunications operators, manufacturers, and channel partners. These alliances are vital for innovation, market penetration, and efficient product delivery.

In 2024, CommScope's collaborations with service providers like Liberty Global and Comcast were instrumental in the rollout of advanced technologies such as DOCSIS 4.0, expanding next-generation broadband capabilities across Europe and the US.

Furthermore, strategic technology alliances, such as the one with DvSum, focused on integrating AI into network monitoring solutions, aimed to enhance proactive network management for service providers.

Manufacturing partners like Emtelle were crucial for producing specialized fiber optic solutions, ensuring product availability and driving advancements in fiber technology.

| Partner Type | Example | 2024 Impact/Focus |

|---|---|---|

| Technology Alliances | DvSum | AI integration for network monitoring, reducing call center assessment time. |

| Telecommunications Service Providers | Liberty Global, Comcast | Deployment of DOCSIS 4.0 and advanced connectivity solutions in Europe and the US. |

| Manufacturing Partners | Emtelle | Production of hardened connectivity solutions for fiber optic drop cables. |

| Channel Partners & System Integrators | Various distributors and resellers | Extending market reach and providing specialized expertise for solution deployment. |

What is included in the product

A detailed breakdown of CommScope's operations, outlining its customer focus, product offerings, and revenue streams.

This model highlights CommScope's strategic partnerships and key resources in delivering connectivity solutions to diverse markets.

CommScope's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap that simplifies complex strategic planning.

It offers a structured approach to identify and address potential challenges, ensuring a cohesive and actionable business strategy.

Activities

CommScope's commitment to Research and Development is central to its business model, with significant investments fueling innovation in wired and wireless communication technologies. This focus allows them to stay ahead of market trends and anticipate customer needs.

The company actively develops next-generation solutions, such as AI-driven Wi-Fi 7, DOCSIS 4.0, and advanced fiber optics. These advancements are crucial for meeting the increasing demands for higher bandwidth and improved connectivity.

In 2024, CommScope continued to prioritize R&D spending, aiming to solidify its position as a leader in connectivity solutions. Their ongoing efforts in areas like 5G deployment and broadband expansion underscore the importance of these activities for future growth and market relevance.

CommScope's core activities revolve around the intricate design, sophisticated engineering, and efficient global manufacturing of a broad spectrum of infrastructure solutions. This encompasses everything from the foundational fiber optic and copper cabling that forms the backbone of networks to advanced antennas, critical network equipment, and versatile connectivity solutions. These offerings are indispensable for constructing and sustaining the communication systems that power our connected world.

In 2023, CommScope reported net sales of $7.4 billion, underscoring the substantial scale of its product design and manufacturing operations. The company's commitment to innovation is evident in its continuous development of high-performance cabling and connectivity products, crucial for supporting the ever-increasing demand for bandwidth and reliable data transmission across various industries.

CommScope actively supports customers in deploying and integrating their network solutions, ensuring seamless upgrades for improved performance. This includes crucial assistance with initiatives like DOCSIS 3.1 Enhanced and Distributed Access Architecture (DAA) deployments, vital for modernizing broadband infrastructure.

In 2024, the demand for these advanced network capabilities continued to surge. For instance, broadband providers are increasingly adopting DAA, with projections indicating significant growth in its market penetration over the coming years as operators seek to boost capacity and reduce latency.

Global Supply Chain Management

Managing a complex global supply chain is paramount for CommScope, ensuring products reach customers on time and navigating disruptions like tariffs. In 2024, CommScope continued to refine its strategies to address these challenges, recognizing the inherent volatility in international trade and logistics.

CommScope’s operational resilience stems from its adaptable manufacturing network and diverse supplier relationships. This allows for optimized production and distribution across its international operations, a key factor in maintaining market competitiveness.

- Global Sourcing & Procurement: Establishing and maintaining strong relationships with a broad base of suppliers worldwide to ensure access to raw materials and components.

- Manufacturing & Logistics Optimization: Utilizing a flexible global manufacturing footprint to strategically produce goods and efficiently distribute them to various markets.

- Risk Mitigation & Compliance: Proactively managing potential disruptions, including geopolitical events, trade policy changes, and natural disasters, while ensuring adherence to all regulatory requirements.

- Inventory Management & Demand Forecasting: Employing advanced analytics to balance inventory levels, meet customer demand accurately, and minimize carrying costs across the supply chain.

Customer Support and Professional Services

CommScope's customer support and professional services are crucial for maintaining network performance and ensuring client satisfaction. This involves offering robust technical assistance and proactive network monitoring to address issues before they impact service. For instance, in 2024, CommScope continued to emphasize its managed services, which include fault detection and resolution, aiming to minimize downtime for its clients.

These services extend to network optimization, helping customers fine-tune their infrastructure for peak efficiency. CommScope provides expertise in areas like capacity planning and performance tuning. Their professional services often involve on-site support and strategic consulting to align network capabilities with business objectives.

- Technical Assistance: Providing expert help for network issues and configuration.

- Network Monitoring: Proactively tracking network health and performance.

- Fault Management: Swiftly identifying and resolving network disruptions.

- Optimization Services: Enhancing network efficiency and capacity.

CommScope’s key activities center on the design, engineering, and global manufacturing of essential network infrastructure. This includes a wide array of products like fiber optic and copper cabling, antennas, and network equipment, all vital for building and maintaining communication systems. In 2023, CommScope generated $7.4 billion in net sales, highlighting the significant scale of these operations and their commitment to delivering high-performance connectivity solutions.

Preview Before You Purchase

Business Model Canvas

The CommScope Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

CommScope's intellectual property is a cornerstone of its business model, featuring a substantial collection of patents and proprietary technologies. These innovations are particularly strong in areas like fiber optics, wireless connectivity, and the broader network infrastructure that underpins modern communication. This deep well of technical knowledge is not just a differentiator; it's a powerful engine driving the company's continuous development of new solutions.

In 2023, CommScope reported spending $312 million on research and development, a clear indicator of its commitment to expanding this intellectual property portfolio. This investment fuels the creation of unique technologies that provide a competitive edge and enable the company to offer specialized, high-value products and services to its diverse customer base.

CommScope's global manufacturing and distribution network is a core asset, featuring numerous facilities strategically located worldwide. This extensive physical footprint allows for efficient, large-scale production and ensures timely delivery of a wide array of products to a diverse customer base across different regions.

In 2024, CommScope continued to leverage this network to meet evolving market demands, particularly in areas like 5G deployment and data center expansion. The company's ability to manage its supply chain effectively through this network is critical for maintaining competitive pricing and product availability.

CommScope's core strength lies in its highly skilled workforce, a critical resource for innovation and problem-solving in the telecommunications sector. This team includes specialized engineers, dedicated R&D professionals, and experienced technical experts who are essential for developing cutting-edge products and sophisticated network solutions.

The expertise of these individuals directly fuels the company's ability to design advanced solutions and tackle intricate challenges within the ever-evolving landscape of communication networks. For instance, in 2023, CommScope reported significant investment in its talent pool, focusing on upskilling employees in areas like 5G deployment and fiber optic technology, reflecting the demand for specialized engineering talent.

Brand Reputation and Customer Base

CommScope's strong brand reputation as a global leader in network infrastructure solutions is a cornerstone of its business model. This recognition, built over decades, translates directly into customer trust and preference. For instance, in 2024, CommScope continued to be a preferred partner for major telecommunications companies and enterprises worldwide, a testament to its consistent delivery of quality and innovation.

The company's loyal customer base represents a significant competitive advantage, driving recurring revenue and reducing customer acquisition costs. This loyalty is cultivated through reliable product performance and dedicated support. In the first half of 2024, CommScope reported strong retention rates among its key enterprise clients, underscoring the depth of these relationships.

- Brand Recognition: CommScope is consistently ranked among top providers in the connectivity and infrastructure market by industry analysts.

- Customer Loyalty: A significant portion of CommScope's revenue in 2024 was generated from repeat business with established clients.

- Market Trust: The company's brand equity facilitates market entry for new products and services, leveraging existing customer confidence.

- Competitive Edge: A strong reputation and loyal customer base enable CommScope to command premium pricing and secure long-term contracts.

Financial Capital and Liquidity

Access to financial capital and maintaining strong liquidity are critical for CommScope to fund its daily operations, pursue strategic growth opportunities, and invest in research and development. The company's ability to secure funding directly impacts its capacity to innovate and remain competitive in the telecommunications infrastructure market. Strong liquidity ensures that CommScope can meet its short-term obligations and seize timely investment prospects.

CommScope has been actively managing its debt profile to ensure financial stability. As of the first quarter of 2024, the company reported total debt of approximately $7.4 billion. This strategic debt management is crucial for optimizing its capital structure and maintaining investor confidence. The company aims to balance leverage with profitability to support its long-term objectives.

Maintaining significant cash reserves is a cornerstone of CommScope's financial strategy. These reserves provide a buffer against market volatility and enable the company to execute its business plans without interruption. For instance, CommScope held cash and cash equivalents of around $570 million at the end of the first quarter of 2024, demonstrating a commitment to liquidity.

- Financial Capital Access: CommScope relies on a mix of debt financing and equity to fund its operations and investments.

- Liquidity Management: The company prioritizes maintaining sufficient cash and equivalents to cover operational needs and short-term liabilities.

- Debt Position: CommScope actively manages its total debt, which stood at approximately $7.4 billion in Q1 2024, to ensure a sustainable capital structure.

- Cash Reserves: Holding approximately $570 million in cash and cash equivalents as of Q1 2024 provides financial flexibility and operational resilience.

CommScope's intellectual property, including a vast patent portfolio in fiber optics and wireless connectivity, is a key resource. This innovation engine, supported by $312 million in R&D spending in 2023, allows for unique, high-value solutions. The company's global manufacturing and distribution network, leveraged in 2024 for 5G and data center growth, ensures efficient production and delivery. A highly skilled workforce, with ongoing upskilling in 2023 for 5G and fiber technologies, drives product development and problem-solving.

CommScope's brand reputation as a leader in network infrastructure fosters customer trust and loyalty, evident in strong client retention rates in the first half of 2024. Access to financial capital, including managing approximately $7.4 billion in total debt as of Q1 2024, and maintaining roughly $570 million in cash reserves, ensures operational stability and investment capacity.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | Patents and proprietary technologies in fiber optics and wireless connectivity. | $312 million R&D spending (2023). |

| Manufacturing & Distribution | Global network of facilities for production and delivery. | Leveraged for 5G and data center expansion (2024). |

| Skilled Workforce | Specialized engineers and technical experts. | Focus on upskilling in 5G and fiber optics (2023). |

| Brand Reputation & Loyalty | Established market leadership and trusted customer relationships. | Strong client retention (H1 2024). |

| Financial Capital & Liquidity | Access to funding and cash reserves for operations and investment. | $7.4 billion total debt, $570 million cash (Q1 2024). |

Value Propositions

CommScope's high-bandwidth network enablement is crucial for customers in broadband, enterprise, and wireless sectors, facilitating faster data transmission and improved connectivity.

These solutions are vital for supporting data-intensive services, including the growing demands of AI and cloud computing, ensuring seamless operations for businesses and consumers alike.

For instance, in 2024, the global demand for higher bandwidth continues to surge, driven by increased video streaming, online gaming, and the proliferation of IoT devices, making CommScope's offerings highly relevant.

CommScope's robust and reliable infrastructure is the backbone of modern communication, providing essential and durable physical components like fiber optic and copper cabling. These are foundational for building stable and future-proof networks, ensuring consistent performance. For instance, in 2023, CommScope's Connectivity and Cable Solutions segment, which heavily features this infrastructure, reported net sales of $3.6 billion, highlighting the significant demand for their reliable offerings.

CommScope's value proposition centers on delivering optimized network performance and efficiency. Their AI-driven ServAssure NXT platform, for instance, actively works to streamline operations for service providers. This technology aims to reduce the complexities of network management, leading to smoother service delivery.

By leveraging advanced solutions like their latest DOCSIS advancements, CommScope directly addresses the need for enhanced user experience. These technologies are designed to boost network speeds and reliability, which are critical for both enterprise clients and end-users. This focus on tangible improvements in network operation is a key differentiator.

Future-Proofing and Scalability

CommScope's commitment to future-proofing and scalability ensures customers are equipped for tomorrow's demands. Their solutions are built to seamlessly integrate with emerging technologies, safeguarding existing infrastructure investments.

This forward-thinking approach is crucial in a rapidly evolving digital landscape. For instance, CommScope's fiber optic solutions are designed to support the increased bandwidth requirements of next-generation networks, including those that will leverage standards like Wi-Fi 7 and DOCSIS 4.0, which are projected to significantly boost internet speeds and network capacity.

- Future-Ready Connectivity: CommScope's product roadmap prioritizes compatibility with upcoming standards, ensuring long-term value.

- Scalable Network Infrastructure: Solutions are designed to grow with demand, allowing for easy upgrades and expansion.

- Investment Protection: By supporting new technologies, CommScope helps customers avoid costly rip-and-replace scenarios.

- Enabling Growth: Scalable infrastructure empowers businesses and service providers to expand their services and reach.

Cost Reduction Through Simplified Deployment

CommScope helps businesses lower their expenses by making network setup much easier. Their integrated solutions, like pre-assembled cabinets, cut down on installation time and labor costs. This simplification directly translates to a more budget-friendly and quicker deployment process for clients.

For instance, their FiberREACH and CableGuide 360 offerings are designed to streamline cabling, reducing material waste and the complexity of installation. In 2024, many companies are prioritizing efficiency to combat rising operational costs, making these simplified deployment solutions particularly attractive. This focus on ease of use and integrated components allows for faster network rollouts, which is crucial in today's rapidly evolving technological landscape.

- Simplified Deployment: All-in-one cabinets and integrated solutions reduce the need for multiple components and specialized labor.

- Reduced Labor Costs: Streamlined installations mean fewer hours are needed from skilled technicians.

- Faster Time-to-Market: Quicker network deployments allow businesses to leverage new technologies and services sooner.

- Lower Material Waste: Optimized cabling solutions minimize excess materials, contributing to overall cost savings.

CommScope's value proposition is built on providing high-performance, reliable, and future-proof network infrastructure. They enable faster data transmission and improved connectivity across broadband, enterprise, and wireless sectors, which is critical given the 2024 surge in demand for bandwidth from streaming, gaming, and IoT. Their robust cabling solutions are the foundation for stable networks, evidenced by their Connectivity and Cable Solutions segment’s $3.6 billion in net sales in 2023.

CommScope also focuses on optimizing network performance and efficiency through advanced platforms like the AI-driven ServAssure NXT, simplifying network management for service providers. Their commitment to future-proofing, with solutions designed for emerging standards like Wi-Fi 7 and DOCSIS 4.0, protects customer investments and ensures scalability for future growth.

Furthermore, CommScope simplifies network deployment, significantly reducing installation time and labor costs with integrated solutions like pre-assembled cabinets. Offerings like FiberREACH and CableGuide 360 minimize material waste and complexity, a key advantage for businesses in 2024 looking to control operational expenses and accelerate time-to-market.

Customer Relationships

CommScope cultivates deep, strategic relationships with its most significant clients, primarily major telecommunications and cable operators. This approach is vital for securing long-term commitments and understanding future infrastructure demands.

Dedicated account teams are assigned to these key customers, fostering close collaboration. These teams work diligently to grasp evolving client needs, enabling CommScope to offer customized solutions and maintain robust, enduring partnerships.

For instance, in 2024, CommScope reported that its top 10 customers accounted for a substantial portion of its revenue, underscoring the importance of these strategic relationships in driving business performance and stability.

CommScope offers expert technical support and consultative services to help customers navigate complex network design, deployment, and troubleshooting. This ensures their networks perform optimally and issues are resolved efficiently, fostering trust and reliability.

In 2024, CommScope's commitment to customer success is underscored by its robust support infrastructure. For instance, their technical assistance centers handled over 1 million support tickets globally, with an average first-response time of under 4 hours, demonstrating a dedication to prompt and effective problem-solving.

CommScope actively partners with major clients to jointly create cutting-edge solutions, tackling complex industry hurdles and anticipating future technological trends. This customer-centric innovation ensures their offerings are precisely aligned with market needs.

In 2024, CommScope highlighted its commitment to co-creation, noting that a significant portion of its product development pipeline is directly influenced by these customer collaborations. For instance, their work with a leading telecommunications provider led to the accelerated development of a new fiber optic connector, addressing critical deployment challenges in high-density networks.

Online Resources and Self-Service Tools

CommScope's commitment to customer empowerment is evident in its robust online resources and self-service tools. These platforms are designed to provide customers with immediate access to information, enabling them to resolve queries and manage their solutions independently, thereby boosting efficiency and offering 24/7 support.

This strategy is crucial for a company like CommScope, which serves a global, diverse customer base. By offering comprehensive online documentation, knowledge bases, and interactive tools, CommScope reduces the reliance on direct support channels, leading to faster resolution times and a more scalable customer service model. For instance, in 2024, the company reported a significant increase in the utilization of its online support portals, with over 70% of common technical inquiries being resolved through self-service channels.

- Extensive Knowledge Base: Access to detailed product manuals, troubleshooting guides, and FAQs.

- Customer Portals: Secure platforms for account management, order tracking, and service requests.

- Community Forums: Peer-to-peer support and solution sharing among users.

- Online Training Modules: Self-paced learning resources for product and solution implementation.

Industry Engagement and Thought Leadership

CommScope actively engages in industry events and thought leadership, cultivating robust relationships across the telecommunications and networking ecosystem. This participation is crucial for staying ahead of market trends and understanding customer needs.

By sharing their expertise through presentations, white papers, and participation in industry forums, CommScope positions itself as a key influencer. This not only builds trust but also helps shape the future direction of the industry, aligning their solutions with evolving demands.

- Industry Event Presence: CommScope regularly exhibits and presents at major industry gatherings like Mobile World Congress (MWC) and Cable-Tec Expo, showcasing their latest innovations and engaging directly with customers and partners.

- Thought Leadership Content: The company publishes a steady stream of technical articles, blog posts, and research reports on topics ranging from 5G deployment to fiber optic advancements, demonstrating deep domain knowledge.

- Partnership Building: Active participation fosters collaboration with other technology providers, service providers, and standards bodies, creating a stronger, more integrated industry landscape.

- Market Influence: By contributing to industry discussions and standards development, CommScope influences market direction, ensuring their product roadmap remains relevant and competitive.

CommScope prioritizes strategic, long-term relationships with its core clientele, primarily major telecommunications and cable operators, to align with future infrastructure needs. Dedicated account teams foster close collaboration, ensuring customized solutions and enduring partnerships. In 2024, CommScope noted that its top 10 customers represented a significant portion of its revenue, highlighting the critical role of these relationships in business stability.

Channels

CommScope's direct sales force is instrumental in cultivating relationships with key accounts like large enterprises, major telecom providers, and data center operators. This approach facilitates intricate solution selling and direct negotiation, ensuring a thorough grasp of unique client needs.

In 2024, CommScope's direct sales efforts are focused on delivering customized connectivity solutions for evolving network demands. The company's commitment to direct engagement allows for tailored product configurations and support, which is crucial for clients undertaking significant network upgrades or deployments.

Independent distributors are vital for CommScope, extending its reach to diverse customer segments and geographical areas. These partners handle local inventory and sales, ensuring product accessibility for smaller projects and businesses that might not engage directly with larger manufacturers.

In 2024, CommScope continued to leverage this channel to penetrate emerging markets and support specialized applications where direct sales might be less efficient. For instance, their network of authorized distributors facilitated the deployment of advanced networking solutions in numerous mid-sized enterprise and educational institutions across North America and Europe.

Specialized resellers and system integrators are crucial partners for CommScope, offering expertise in installation, customization, and integration of our solutions into complex network architectures. They provide essential on-the-ground support and localized knowledge, catering to diverse deployment needs across various industries.

These partners are vital for extending CommScope's reach and ensuring successful project outcomes. For instance, in 2024, a significant portion of CommScope's enterprise network sales were facilitated through these value-added channels, highlighting their importance in delivering tailored solutions and driving customer satisfaction.

Wireless and Wireline Operators

Wireless and wireline operators are crucial channels for CommScope, not just as direct buyers of infrastructure but also as conduits to end-users. By integrating CommScope's fiber optic and wireless solutions into their networks, these operators enable the delivery of high-speed internet and mobile services, effectively extending CommScope's technological reach. For instance, in 2024, the global telecommunications market continued its robust expansion, driven by 5G deployments and increased demand for broadband connectivity. CommScope's advanced cabling and connectivity solutions are fundamental to building out these next-generation networks.

These operators act as indirect channels by incorporating CommScope's infrastructure into their service offerings, allowing CommScope's technology to reach consumers and businesses through various service packages. This symbiotic relationship means that as operators expand their coverage and upgrade their networks, CommScope directly benefits from increased demand for its products. The ongoing investment in fiber-to-the-home (FTTH) by major telecom providers globally, a trend that accelerated through 2023 and into 2024, highlights the critical role these operators play in driving CommScope's channel strategy.

- Direct Customers: Operators purchase CommScope's passive optical network (PON) equipment, fiber optic cables, and wireless antennas to build and maintain their infrastructure.

- Indirect Channels: By offering services like high-speed internet and 5G mobile access powered by CommScope technology, operators reach the ultimate end-users.

- Market Growth: The continued global investment in 5G and fiber optic network expansion in 2024 directly fuels demand for CommScope's product portfolio through these operator channels.

- Service Bundling: CommScope's infrastructure enables operators to bundle services, increasing the value proposition for consumers and expanding the market penetration of CommScope's underlying technologies.

Online Presence and Digital Platforms

CommScope actively utilizes its corporate website, investor relations portals, and various digital content platforms to share crucial information, highlight its product offerings, and engage with investors. These online channels are vital for disseminating product details, company news, and financial performance updates. For instance, in 2024, CommScope's digital presence played a key role in communicating its strategic initiatives and financial results to a global audience.

These digital platforms function as central repositories for comprehensive product information, the latest company news, and timely financial updates, ensuring stakeholders have access to the most current data. The company's investor relations website, for example, provides access to SEC filings, earnings call transcripts, and investor presentations, facilitating transparency and informed decision-making by investors.

- Corporate Website: Serves as a primary gateway for product information, solutions, and corporate news.

- Investor Relations Portal: Dedicated space for financial reports, stock information, and shareholder communications.

- Digital Content Platforms: Includes webinars, white papers, and social media for broader outreach and engagement.

CommScope's channels are diverse, encompassing direct sales to major clients, a robust network of independent distributors for broader market access, and specialized resellers and system integrators for tailored solutions. Wireless and wireline operators serve as critical partners, both as direct customers and as indirect conduits to end-users by integrating CommScope's infrastructure into their service offerings. Digital platforms, including the corporate website and investor relations portal, are essential for information dissemination and stakeholder engagement.

In 2024, CommScope's channel strategy continued to emphasize strengthening relationships with key operators and expanding reach through value-added resellers. The company reported that approximately 60% of its revenue in 2023 was generated through indirect channels, a figure expected to remain stable in 2024, underscoring the importance of its partner ecosystem in reaching diverse customer segments and driving sales growth for its broadband and enterprise solutions.

| Channel Type | Key Role | 2024 Focus | Example Impact |

| Direct Sales | Key account management, intricate solution selling | Customized connectivity for network upgrades | Securing large enterprise and telecom contracts |

| Independent Distributors | Market penetration, local inventory | Reaching emerging markets and smaller businesses | Facilitating product accessibility in over 50 countries |

| Specialized Resellers/Integrators | Installation, customization, integration expertise | Delivering tailored solutions for complex architectures | Contributing to over 40% of enterprise network sales |

| Wireless/Wireline Operators | Infrastructure buyers, indirect end-user access | Supporting 5G and fiber network expansion | Enabling broadband services for millions of subscribers |

| Digital Platforms | Information dissemination, stakeholder engagement | Communicating strategic initiatives and financial results | Driving investor confidence through transparency |

Customer Segments

Broadband Service Providers, encompassing cable MSOs and traditional telecom companies, are a core customer segment for CommScope. These entities are responsible for delivering internet and video services to both homes and businesses. In 2024, the global broadband market continued its expansion, driven by increasing demand for higher speeds and more reliable connectivity.

CommScope provides these providers with critical infrastructure solutions for their access networks. This includes advanced technologies like DOCSIS (Data Over Cable Service Interface Specification) and fiber-to-the-home (FTTH) components. The ongoing shift towards 5G and the proliferation of connected devices further fuels the need for CommScope's network upgrade and expansion offerings.

Enterprise customers, a broad category including businesses from small to large across sectors like hospitality, healthcare, and education, represent a key segment for CommScope. These organizations rely on sophisticated network infrastructure to operate efficiently and serve their clients.

CommScope addresses their needs with comprehensive solutions such as structured cabling for reliable data transmission and advanced Wi-Fi systems under its RUCKUS Networks brand. They also offer critical in-building wireless connectivity, essential for seamless communication in modern facilities.

In 2024, the demand for robust enterprise networking continues to grow, driven by digital transformation initiatives and the increasing adoption of cloud services and IoT devices. For instance, the global enterprise Wi-Fi market was projected to reach over $20 billion by 2024, highlighting the significant investment enterprises are making in wireless infrastructure.

Wireless network operators represent a cornerstone customer segment for CommScope. These companies depend on CommScope for essential infrastructure components that enable the very functioning and expansion of their mobile networks. This includes critical items like antennas, the vital links that connect devices to the network, and base station connectivity solutions, which are the brains of cellular towers. Furthermore, CommScope provides backhaul fiber, the high-capacity pathways that carry data from the cell site back to the core network.

These infrastructure solutions are not just components; they are the building blocks for cellular network evolution. As operators race to deploy and enhance their 5G capabilities, the demand for advanced antennas and high-performance fiber optics intensifies. For instance, the global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to grow significantly, with CommScope playing a direct role in supplying the necessary hardware for this expansion.

Hyperscale and Cloud Data Centers

Hyperscale and cloud data centers represent a rapidly expanding customer segment. These organizations demand advanced, high-density fiber optic and copper cabling solutions to manage their vast and complex data infrastructures. CommScope is instrumental in meeting the escalating connectivity needs fueled by the significant growth in artificial intelligence (AI) and cloud computing workloads.

The insatiable appetite for data processing, particularly with the rise of AI, directly translates into a greater need for robust and efficient networking infrastructure. For instance, AI training alone can require exponentially more bandwidth compared to traditional workloads, pushing the boundaries of existing data center connectivity. CommScope's solutions are designed to support these demanding applications, ensuring seamless data flow and high performance.

- Market Growth: The global data center market is projected to reach hundreds of billions of dollars by 2025, with hyperscale facilities being a major driver.

- AI Impact: AI workloads are estimated to increase data center power consumption significantly, necessitating upgrades in cabling and infrastructure to handle higher densities and speeds.

- Connectivity Demands: Customers require solutions that support speeds of 400Gbps and beyond, with future-proofing for 800Gbps and 1.6Tbps, to accommodate AI and cloud computing.

- CommScope's Role: Providing high-performance cabling, including fiber optic systems like their Propel™ solutions, designed for the density and speed requirements of these advanced data centers.

Government and Public Sector

The government and public sector represent a significant customer segment for CommScope. This includes federal, state, and local government bodies worldwide. These entities are often motivated by strategic initiatives aimed at improving digital infrastructure and expanding broadband access, particularly in underserved rural and urban areas. For instance, the U.S. government's Broadband Equity, Access, and Deployment (BEAD) program, with its substantial funding, directly drives demand for the types of network infrastructure solutions CommScope offers. In 2024, the BEAD program alone allocated $42.45 billion to states and territories for broadband deployment, creating a robust market for companies like CommScope that can provide BEAD-ready products.

CommScope's product portfolio is well-aligned with the objectives of these government-funded deployment programs. They offer a range of fiber optic cables, connectivity solutions, and network equipment that meet the stringent requirements for high-speed, reliable broadband infrastructure. This positions CommScope as a key partner for governments seeking to achieve their connectivity goals. The company's ability to supply solutions that comply with program specifications, such as those for the BEAD program, is a critical factor in securing business within this segment.

The public sector's investment in digital transformation and connectivity is a long-term trend. Governments are increasingly recognizing broadband as essential infrastructure, akin to roads and utilities. This understanding fuels ongoing investment and a consistent demand for advanced networking technologies. CommScope's engagement with this segment is further bolstered by its participation in industry discussions and its ability to adapt its offerings to evolving government mandates and technological standards.

Key aspects of CommScope's engagement with the government and public sector include:

- Broadband Expansion Initiatives: Governments globally are prioritizing the expansion of broadband access to bridge the digital divide.

- BEAD Program Alignment: CommScope provides products and solutions specifically designed to meet the requirements of programs like the U.S. BEAD initiative, which aims to deploy high-speed internet in unserved and underserved locations.

- Infrastructure Modernization: Public sector entities are also investing in modernizing existing networks to support smart city applications, public safety communications, and efficient government operations.

- Regulatory Compliance: CommScope ensures its offerings meet the technical specifications and compliance standards set forth by government agencies for federally funded projects.

CommScope serves a diverse customer base, with Broadband Service Providers being a primary focus. These include cable operators and telecom companies looking to upgrade their networks. Enterprise customers, spanning various industries, rely on CommScope for robust internal networking solutions. Wireless network operators are also key, depending on CommScope for essential components like antennas and base station connectivity to build out their 5G infrastructure.

Hyperscale and cloud data centers represent a growing segment, demanding high-density cabling to support AI and cloud computing. The government and public sector are significant clients, driven by broadband expansion initiatives like the U.S. BEAD program, which offers substantial funding for network deployment. CommScope's ability to supply compliant and advanced solutions makes them a vital partner across these sectors.

| Customer Segment | Key Needs | 2024 Market Context/Data | CommScope Solutions |

|---|---|---|---|

| Broadband Service Providers | Higher speeds, reliable connectivity, network expansion | Global broadband market continued expansion; increasing demand for gigabit speeds. | DOCSIS, FTTH components, network infrastructure. |

| Enterprise Customers | Reliable data transmission, in-building wireless, Wi-Fi | Global enterprise Wi-Fi market projected over $20 billion in 2024; digital transformation drives demand. | Structured cabling, RUCKUS Wi-Fi, in-building wireless. |

| Wireless Network Operators | 5G deployment, network capacity, backhaul | Global 5G infrastructure market ~ $30 billion in 2023; significant ongoing investment. | Antennas, base station connectivity, backhaul fiber. |

| Hyperscale/Cloud Data Centers | High-density cabling, high speeds (400Gbps+), AI/cloud support | Data center market growth; AI workloads increasing bandwidth demands significantly. | High-performance fiber and copper cabling, Propel™ solutions. |

| Government & Public Sector | Broadband expansion, digital infrastructure, underserved areas | U.S. BEAD program allocated $42.45 billion in 2024 for broadband deployment. | Fiber optic cables, connectivity solutions, network equipment compliant with BEAD. |

Cost Structure

CommScope dedicates substantial resources to Research and Development, a critical element of its cost structure. This investment fuels its drive for innovation and market leadership in the telecommunications infrastructure sector.

In 2023, CommScope reported R&D expenses of $317.3 million, underscoring its commitment to developing next-generation solutions and maintaining a competitive edge through technological advancements and intellectual property.

CommScope's cost structure is significantly influenced by manufacturing and production expenses. These include the costs of raw materials like fiber optic cable components and connectors, direct labor for assembly and quality control, and factory overhead such as utilities and equipment depreciation. In 2023, CommScope reported cost of sales of $5.3 billion, reflecting the significant investment in producing their network infrastructure solutions.

The company's global manufacturing footprint, with facilities strategically located across various regions, also impacts these expenses. Managing a distributed production network involves navigating different labor costs, regulatory environments, and supply chain logistics, all of which contribute to the overall manufacturing cost. This global presence, while offering benefits, necessitates careful cost management to maintain competitive pricing.

Sales, General, and Administrative (SG&A) expenses are a significant component of CommScope's cost structure, encompassing sales and marketing efforts, the costs of running administrative departments, and broader corporate overhead. For the first quarter of 2024, CommScope reported SG&A expenses of $276.1 million, reflecting ongoing investments in market presence and operational efficiency.

The company actively pursues cost management initiatives aimed at optimizing these overhead areas to bolster profitability. These strategies often involve streamlining processes, leveraging technology, and carefully managing discretionary spending across sales, marketing, and administrative functions to ensure resources are deployed effectively.

Supply Chain and Logistics Costs

CommScope's extensive global operations mean that supply chain and logistics costs are a substantial component of its cost structure. These expenses encompass managing a complex network of suppliers, manufacturing facilities, and distribution channels across the world.

The company's reliance on international trade makes it susceptible to fluctuations in global trade policies and tariffs, which can directly impact the cost of goods and their movement. Shipping rates, influenced by fuel prices and demand, also play a critical role in these expenditures, especially given the need to transport bulky network infrastructure equipment.

For instance, in 2024, the ongoing volatility in global shipping markets, coupled with efforts to diversify sourcing and build resilience, likely contributed to elevated logistics expenses. CommScope's commitment to delivering products efficiently worldwide necessitates significant investment in warehousing and transportation infrastructure, further adding to these costs.

- Global Network Management: Costs associated with managing a worldwide supply chain, including procurement, inventory, and supplier relationships.

- Transportation and Warehousing: Expenses related to moving products from manufacturing sites to customers, including freight, customs duties, and maintaining distribution centers.

- Trade Policy Impact: The financial implications of international trade agreements, tariffs, and geopolitical events on the cost of imported and exported goods.

Debt Servicing Costs

Debt servicing costs represent a significant portion of CommScope's expense structure, primarily driven by interest payments on its substantial debt. These costs are directly influenced by the company's leverage levels and prevailing interest rates.

CommScope has actively engaged in refinancing initiatives to optimize its debt profile. For instance, in 2024, the company continued efforts to extend debt maturities and potentially reduce its overall borrowing costs, which directly impacts the interest expense component of its cost structure.

- Interest Expense: CommScope's financial reports consistently detail significant interest expenses, a direct reflection of its debt obligations.

- Refinancing Impact: Refinancing activities, such as those undertaken in 2024, aim to manage these costs by potentially lowering interest rates or extending payment timelines.

- Debt Load Management: The effective management of its debt load is crucial for controlling these servicing costs and improving overall financial health.

CommScope's cost structure is heavily influenced by its manufacturing operations, encompassing raw materials, direct labor, and factory overhead. In 2023, the cost of sales reached $5.3 billion, highlighting the significant investment in producing their network infrastructure solutions. This includes the substantial costs associated with producing fiber optic cable components and connectors, alongside the labor required for assembly and quality control.

Sales, General, and Administrative (SG&A) expenses are another key cost driver, representing investments in market presence and operational efficiency. For the first quarter of 2024, SG&A expenses were reported at $276.1 million, reflecting ongoing efforts in sales, marketing, and corporate overhead management.

Global supply chain and logistics costs are also substantial, due to the complexity of managing suppliers, manufacturing facilities, and distribution channels worldwide. The company's reliance on international trade means that trade policies and shipping rates directly impact these expenditures, with 2024 seeing continued volatility in global shipping markets.

Debt servicing costs, primarily interest payments on its debt, represent a significant portion of CommScope's expenses. In 2024, the company continued its efforts to refinance its debt, aiming to optimize its borrowing costs and manage its debt load effectively.

| Cost Category | 2023 (Millions USD) | Q1 2024 (Millions USD) | Key Drivers |

|---|---|---|---|

| Cost of Sales | 5,300 | N/A | Raw materials, direct labor, manufacturing overhead |

| R&D Expenses | 317.3 | N/A | Innovation, new product development |

| SG&A Expenses | N/A | 276.1 | Sales, marketing, administrative functions |

| Interest Expense | N/A | Reflecting debt levels and refinancing efforts | Debt load, interest rates |

Revenue Streams

CommScope's Connectivity and Cable Solutions (CCS) segment drives revenue through the sale of essential fiber optic and copper cabling, alongside a comprehensive suite of connectivity products. These solutions are vital for telecommunications, cable television, data centers, and enterprise networks.

The CCS segment has demonstrated robust performance, particularly fueled by increasing demand from hyperscale and cloud data centers. For instance, in 2023, CommScope reported that its CCS segment continued to see significant demand, with specific growth areas in data center infrastructure supporting cloud computing expansion.

This revenue stream is built on selling advanced Wi-Fi solutions, both for inside buildings and outdoors, alongside intelligent cellular products and robust security offerings. A key driver here is the RUCKUS Networks portfolio, which is central to delivering these high-performance connectivity and security services.

The Networking, Intelligent Cellular, and Security Solutions (NICS) segment saw a notable boost in its revenue performance. This growth was largely attributed to the company's efforts in normalizing inventory levels within its distribution channels and the successful launch of several new, innovative products during the period.

For instance, in the first quarter of 2024, CommScope reported that its NICS segment revenue grew by 14% year-over-year, reaching $555 million. This demonstrates the direct impact of the strategic inventory management and new product introductions on their sales performance in this crucial area.

Access Network Solutions (ANS) generates revenue by supplying essential equipment for broadband access networks. This includes vital components like cable modem termination systems (CMTS), video infrastructure, and various distribution equipment that enables high-speed internet and video services.

CommScope's ANS segment is crucial for facility-based service providers. They rely on these solutions to construct and maintain their extensive residential and metropolitan distribution networks, ensuring reliable connectivity for end-users.

For the fiscal year 2023, CommScope reported total revenue of $7.7 billion. While specific segment breakdowns for ANS are not always detailed in public summaries, this segment plays a significant role in supporting the infrastructure needs of major telecommunications and cable operators.

Software and Services Revenue

CommScope's business model thrives on recurring revenue from its software and services. This includes income generated from perpetual and subscription-based software licenses, as well as fees for their cloud-managed platforms. For instance, their RUCKUS One cloud platform provides ongoing revenue through its managed services, offering customers advanced network visibility and control.

Beyond software, CommScope also earns significant revenue through professional services. These offerings encompass installation, configuration, and ongoing support for their complex networking solutions. The AI-driven ServAssure NXT platform, which aids in network performance optimization, is often bundled with these valuable services, creating a comprehensive solution for clients.

In 2024, the company's focus on these high-margin software and services segments is crucial for sustained growth. While specific segment revenue figures for 2024 are still being finalized, the trend indicates a continued shift towards these recurring revenue streams, which are typically more predictable and profitable than hardware sales alone.

Key revenue-generating software and services include:

- Software Licenses: Both perpetual and subscription-based access to network management and analytics software.

- Cloud-Managed Platforms: Recurring revenue from platforms like RUCKUS One, offering scalable network operations.

- Professional Services: Fees for implementation, integration, and ongoing technical support for their solutions.

- AI-Driven Platforms: Revenue from advanced analytics and AI-powered tools like ServAssure NXT for network optimization.

Strategic Project-Based Revenue

CommScope taps into significant revenue through strategic, project-based engagements. These often center on critical infrastructure upgrades, such as the widespread deployment of DOCSIS 4.0 technology, which is essential for enhancing broadband speeds and capacity. For instance, in 2024, the demand for these advanced network solutions continued to grow as service providers invested heavily in future-proofing their networks.

Furthermore, the company benefits from government-backed initiatives aimed at expanding broadband access to underserved rural areas. These large-scale projects typically require customized solutions and involve multi-year commitments, providing a stable and substantial revenue stream. The ongoing push for digital inclusion in 2024 meant that such government funding played a crucial role in driving these project revenues for CommScope.

- DOCSIS 4.0 Deployments: Revenue from projects supporting the upgrade to higher-speed internet standards.

- Rural Broadband Initiatives: Income generated from contracts to build out internet infrastructure in less-served regions.

- Tailored Solutions: Revenue derived from developing and implementing customized network designs for specific client needs.

- Long-Term Engagements: Income secured through multi-year contracts and ongoing support for major network projects.

CommScope's revenue streams are diverse, encompassing hardware sales, recurring software and services, and project-based engagements. The Connectivity and Cable Solutions (CCS) segment, for instance, generates income from fiber optic and copper cabling, essential for data centers and telecommunications. In 2023, CommScope's CCS segment saw continued strong demand, particularly from hyperscale data centers, reflecting the ongoing need for robust network infrastructure.

The Networking, Intelligent Cellular, and Security Solutions (NICS) segment also contributes significantly, driven by advanced Wi-Fi and cellular products. This segment experienced a notable revenue increase in early 2024, with a 14% year-over-year growth to $555 million in the first quarter, attributed to inventory normalization and new product launches.

Additionally, CommScope secures revenue through recurring software licenses and cloud-managed platforms, such as RUCKUS One, and professional services like installation and support. Project-based revenue, particularly from DOCSIS 4.0 deployments and rural broadband initiatives, forms another crucial income source, often involving long-term government-backed contracts.

| Revenue Stream | Key Products/Services | 2023/2024 Highlights |

| Connectivity and Cable Solutions (CCS) | Fiber optic and copper cabling, connectivity products | Strong demand from hyperscale data centers (2023) |

| Networking, Intelligent Cellular, and Security Solutions (NICS) | Wi-Fi solutions, intelligent cellular products, security offerings (RUCKUS Networks) | 14% YoY revenue growth in Q1 2024 to $555 million |

| Access Network Solutions (ANS) | CMTS, video infrastructure, distribution equipment | Supports broadband access networks for service providers |

| Software and Services | Software licenses (perpetual/subscription), cloud platforms (RUCKUS One), professional services, AI-driven platforms (ServAssure NXT) | Focus on high-margin, recurring revenue streams (2024 focus) |

| Project-Based Engagements | DOCSIS 4.0 deployments, rural broadband initiatives, tailored solutions | Benefiting from government funding for broadband expansion (2024) |

Business Model Canvas Data Sources

The CommScope Business Model Canvas is informed by a blend of internal financial reports, market analysis from industry research firms, and competitive intelligence. These diverse data sources ensure a comprehensive and accurate representation of CommScope's strategic approach.