CommScope Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CommScope Bundle

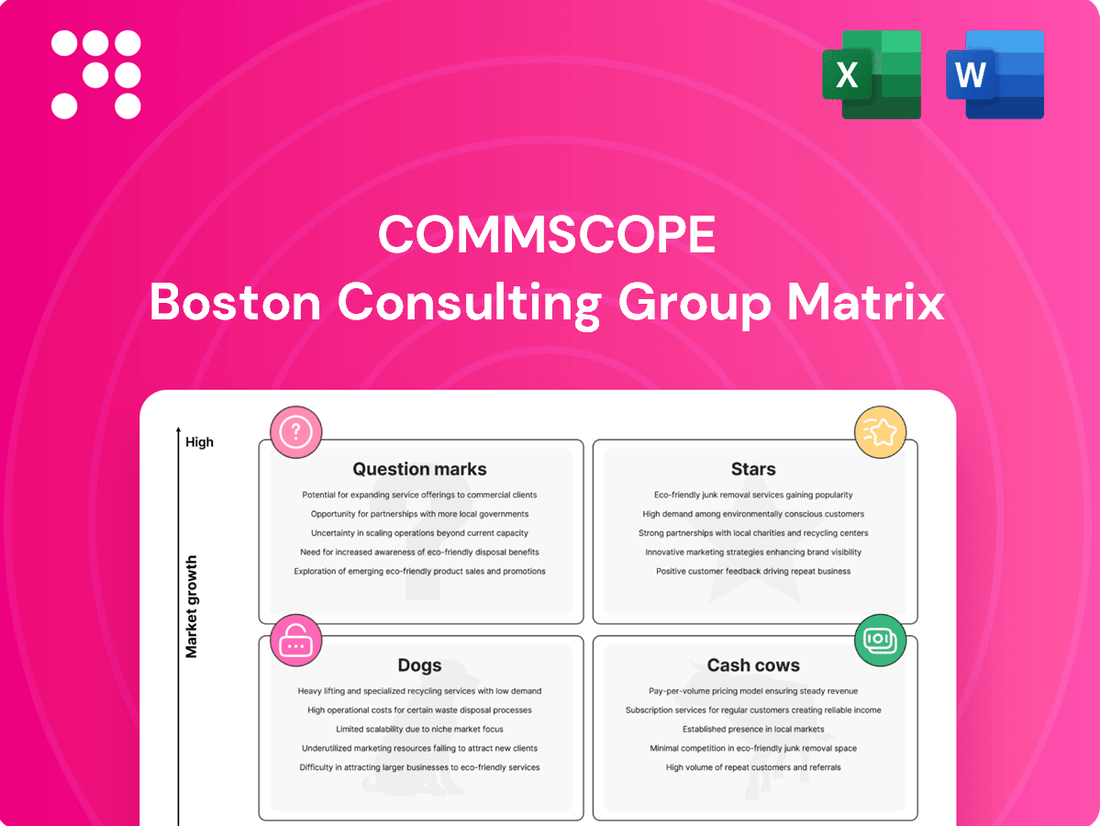

Uncover the strategic positioning of CommScope's product portfolio with this insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and begin to visualize their market dynamics.

This glimpse is designed to highlight the power of strategic analysis. Purchase the full CommScope BCG Matrix to unlock detailed quadrant breakdowns, actionable insights, and a clear roadmap for optimizing your investments and product development.

Stars

CommScope's Connectivity and Cable Solutions (CCS) segment is experiencing robust expansion, fueled by the burgeoning demand for AI-driven data centers. In Q1 2025, this segment's revenue skyrocketed by 88%, a clear indicator of the market's embrace of their fiber optic solutions.

This impressive growth is intrinsically linked to the global proliferation of AI and GenAI initiatives, which necessitate advanced, high-bandwidth fiber connectivity. CommScope's strategic investments in production capacity underscore their commitment to capitalizing on this projected strong market trajectory.

CommScope's RUCKUS Networks, a key player in the Networking, Intelligent Cellular and Security Solutions (NICS) segment, has been named a Visionary by Gartner for its enterprise wired and wireless LAN infrastructure. This recognition highlights their strong position in a market poised for significant expansion.

RUCKUS is actively driving innovation with its early adoption of Wi-Fi 7 technology and the development of its AI-powered RUCKUS One platform. These advancements are crucial as the enterprise networking market is projected to experience double-digit growth through 2025, indicating substantial demand for cutting-edge solutions.

CommScope is a frontrunner in the DOCSIS 4.0 upgrade cycle, offering a complete suite of products essential for this industry shift. Their commitment is underscored by a significant 2025 deployment with Comcast, featuring 1.2 GHz Full Duplex DOCSIS (FDX) amplifiers. This collaboration highlights CommScope's pivotal role in advancing broadband capabilities.

The adoption of DOCSIS 4.0, particularly with FDX technology, is critical for unlocking next-generation broadband speeds, a key factor driving growth within CommScope's Access Network Solutions (ANS) segment. This technological leap is expected to fuel substantial revenue increases as service providers invest in network modernization.

Enterprise Fiber Business

CommScope's enterprise fiber business, a key component of its Connectivity and Cable Solutions (CCS) segment, experienced remarkable growth. In 2024, this sector saw its revenue surge by an impressive 73%, significantly bolstering the CCS segment's overall expansion. This substantial increase underscores CommScope's strong market position within the enterprise fiber market, a segment fueled by the persistent demand for advanced connectivity solutions in business environments and data centers.

The company's strategic focus on high-performance connectivity has paid off, with its well-established brands playing a crucial role. Brands like SYSTIMAX, NETCONNECT, and UNIPRISE are globally recognized as leaders, further solidifying CommScope's competitive edge.

- 2024 Revenue Growth: 73% increase within the enterprise fiber business.

- Segment Contribution: Significant driver of the overall CCS segment's growth.

- Market Position: Strong market share in a rapidly expanding connectivity sector.

- Key Brands: SYSTIMAX, NETCONNECT, and UNIPRISE are global leaders.

Small Cell Solutions

Small cell solutions represent a key growth area for CommScope, aligning with the increasing demand for network densification driven by 5G deployment. These solutions are crucial for enhancing wireless capacity and coverage in urban environments and indoor spaces.

CommScope's strategic focus on high-growth segments is evident in its Networking, Intelligent Cellular and Security Solutions (NICS) segment. This segment, which includes small cell offerings, demonstrated robust performance.

- NICS Segment Growth: The NICS segment experienced a significant 50.7% increase in net sales during the first quarter of 2025.

- Market Position: This substantial growth underscores CommScope's strong standing in the expanding small cell market.

- 5G Enablement: Small cells are fundamental to the successful rollout and optimization of 5G networks, providing the necessary capacity and coverage.

CommScope's Connectivity and Cable Solutions (CCS) segment, particularly its enterprise fiber business, has shown exceptional performance. In 2024, this sector alone saw a 73% revenue surge, significantly contributing to the CCS segment's overall expansion and highlighting CommScope's strong market position. This growth is driven by the persistent demand for advanced connectivity solutions in business environments and data centers, further bolstered by globally recognized brands like SYSTIMAX, NETCONNECT, and UNIPRISE.

| Business Area | 2024 Revenue Growth | Key Driver | Supporting Brands |

|---|---|---|---|

| Enterprise Fiber (CCS) | 73% | Demand for advanced connectivity in businesses and data centers | SYSTIMAX, NETCONNECT, UNIPRISE |

| RUCKUS Networks (NICS) | Double-digit (projected through 2025) | Wi-Fi 7 adoption, AI-powered platforms | RUCKUS |

| Small Cells (NICS) | 50.7% (Q1 2025) | 5G deployment and network densification | CommScope |

What is included in the product

The CommScope BCG Matrix analyzes product portfolios to identify Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

Clear visualization of CommScope's business units, easing strategic decision-making.

Cash Cows

CommScope's core fiber optic and copper cabling infrastructure, primarily within the Connectivity and Cable Solutions (CCS) segment, embodies a classic Cash Cow. This segment holds a significant market share in essential networking components, generating reliable and substantial cash flow with relatively low reinvestment needs. The stability of this business is underscored by its widespread adoption and mature market position.

The CCS segment demonstrated robust performance, with Q4 2024 and Q1 2025 results highlighting its continued strength and profitability. This consistent financial health allows CommScope to leverage the cash generated from these foundational products to fund investments in other, more dynamic areas of its business, such as innovation in 5G and data center solutions. The steady demand for high-quality cabling ensures ongoing revenue streams.

CommScope's established broadband network solutions represent a significant part of its business, even beyond the newer DOCSIS 4.0 technologies. These are the foundational elements that keep existing networks running smoothly, ensuring connectivity for millions. Think of them as the reliable backbone that supports the entire system.

While these solutions might not be in a high-growth phase, their importance is undeniable. They hold a substantial market share because they are essential for the day-to-day operations of countless service providers. This widespread adoption translates into consistent revenue and healthy profit margins for CommScope, making them a true cash cow.

For instance, CommScope's cable and connector products are critical components in virtually all broadband networks. In 2023, the global broadband access market was valued at approximately $20 billion and is projected to grow steadily. CommScope's established products are a major contributor to this market, demonstrating their enduring value and revenue generation capabilities.

CommScope's mature enterprise wired connectivity solutions, including brands like SYSTIMAX and NETCONNECT, represent significant cash cows. These offerings are deeply embedded in traditional enterprise networks, benefiting from stable demand and high market penetration within the CCS segment. For example, in 2023, CommScope reported that its Enterprise segment, which includes these wired solutions, generated substantial revenue, underscoring their consistent cash-generating ability.

Legacy Network Equipment and Components

Legacy network equipment and components represent CommScope's cash cows. These established product lines, found across various segments, hold a commanding position in mature markets. The high barriers to entry for new competitors allow CommScope to enjoy robust profit margins and consistent cash generation from these offerings.

These essential products are critical for the ongoing operation of extensive communication infrastructures worldwide. For instance, CommScope's fiber optic solutions, a key part of their legacy, continue to be indispensable for expanding broadband access and supporting data-intensive applications.

- Dominant Market Presence: Long-standing equipment lines have secured a leading position in their respective markets.

- High Profitability: Mature markets with significant entry barriers translate into strong profit margins for these products.

- Steady Cash Flow: The consistent demand for these essential components provides a reliable stream of income.

- Global Infrastructure Support: These legacy products are vital for maintaining and expanding global communication networks.

Maintenance and Support Services for Core Products

Maintenance and Support Services for Core Products represent CommScope's Cash Cows. These services generate a consistent and profitable revenue stream by catering to the ongoing needs of their extensive installed base of network infrastructure. This segment benefits from high customer retention due to the critical nature of maintaining existing, widely deployed hardware.

The mature market for these services, coupled with strong customer loyalty, ensures predictable income. CommScope's ability to leverage existing relationships and hardware makes this a highly efficient operation. For instance, in 2024, CommScope's focus on customer retention and service excellence continued to be a cornerstone of their financial stability, contributing significantly to their overall profitability through recurring revenue models.

- Predictable Revenue: Ongoing maintenance and support services provide a stable and recurring income for CommScope.

- High Margins: Leveraging existing infrastructure and customer relationships allows for high-profit margins.

- Customer Retention: The essential nature of support for core products ensures strong customer loyalty and repeat business.

- Mature Market Dominance: CommScope's established presence in the mature market for these services solidifies its position.

CommScope's legacy fiber and copper cabling solutions, particularly within its Connectivity and Cable Solutions segment, are prime examples of Cash Cows. These products, vital for established broadband and enterprise networks, benefit from a dominant market share and mature industry status. Their consistent demand, even as newer technologies emerge, ensures a steady and significant cash flow with minimal need for extensive reinvestment, supporting CommScope's overall financial health.

The company's established broadband network infrastructure, encompassing foundational cabling and connectivity components, continues to be a robust revenue generator. These are the reliable backbone systems that millions depend on daily, maintaining their essential role. CommScope's commitment to these core offerings, evident in their sustained market presence, highlights their enduring value and profitability.

CommScope's enterprise wired connectivity solutions, such as SYSTIMAX and NETCONNECT, are firmly established Cash Cows. These offerings are deeply integrated into existing enterprise networks, enjoying stable demand and high market penetration. For instance, CommScope's 2023 financial reports indicated substantial revenue from its Enterprise segment, underscoring the consistent cash-generating capabilities of these mature product lines.

CommScope's maintenance and support services for its core network infrastructure also function as significant Cash Cows. These services leverage a large installed base, generating predictable and profitable recurring revenue. The critical nature of maintaining these essential networks fosters high customer retention, ensuring a stable income stream and high-profit margins for CommScope.

| Product/Service Category | BCG Matrix Quadrant | Key Characteristics | Financial Performance Indicator (Example) |

|---|---|---|---|

| Fiber Optic & Copper Cabling (CCS) | Cash Cow | High market share, mature market, low reinvestment needs, stable cash flow. | Consistent revenue generation, contributing significantly to overall profitability. |

| Established Broadband Network Solutions | Cash Cow | Essential for existing networks, widespread adoption, reliable revenue streams. | Demonstrates steady demand and healthy profit margins. |

| Enterprise Wired Connectivity (SYSTIMAX, NETCONNECT) | Cash Cow | Deep integration, stable demand, high market penetration. | Reported substantial revenue in 2023, highlighting consistent cash generation. |

| Maintenance & Support Services | Cash Cow | Recurring revenue, high customer retention, critical infrastructure support. | Provides predictable income and high-profit margins due to leveraging existing base. |

What You’re Viewing Is Included

CommScope BCG Matrix

The CommScope BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, professionally formatted strategic analysis ready for your immediate use. You're essentially getting a direct look at the final, actionable report that will empower your business planning and decision-making processes. This comprehensive analysis is designed to be directly applicable, allowing you to seamlessly integrate its insights into your strategic initiatives.

Dogs

CommScope's Home Networks business, a provider of broadband and video solutions, was divested to Vantiva in January 2024. This move aligns with CommScope's strategy to optimize its portfolio by shedding non-core assets. The sale strongly suggests this segment operated with low market share and experienced limited growth, making it a typical candidate for divestiture within a BCG matrix framework.

CommScope's Outdoor Wireless Networks (OWN) segment, a provider of essential infrastructure for mobile networks, was divested to Amphenol Corporation in January 2025. This segment faced headwinds, with sales showing a decline throughout 2024, reflecting broader market shifts and competitive pressures within the wireless infrastructure space.

The decision to sell the OWN segment was a strategic maneuver by CommScope. It aimed to sharpen the company's focus on its core, higher-margin business areas, thereby improving overall operational efficiency and profitability. This divestiture underscores a trend of portfolio optimization among telecommunications infrastructure providers.

The Distributed Antenna Systems (DAS) business unit, a former component of CommScope's NICS segment, experienced a significant downturn. In 2024, this unit, crucial for providing cellular infrastructure within indoor venues, saw its sales decline, prompting its classification as a 'Dog' within the BCG Matrix. This underperformance ultimately led to its divestment.

The sale of the DAS business unit to Amphenol, which occurred in January 2025 alongside the OWN segment, underscores its challenging market position. This strategic move reflects CommScope's efforts to streamline its portfolio and focus on more promising growth areas, acknowledging the unit's struggles in the competitive cellular infrastructure landscape.

Older, Non-Strategic Product Lines

CommScope's 'CommScope NEXT' initiative focuses on optimizing its product portfolio by identifying and managing older, non-strategic product lines. These are products that may have once been important but no longer fit the company's current growth strategies or face declining market relevance. For instance, in 2024, the company continued its efforts to streamline offerings, potentially impacting legacy copper cabling solutions that face increasing competition from fiber optics in high-growth sectors.

These underperforming product lines often represent a drain on resources, consuming capital and personnel without contributing substantially to revenue or profit. CommScope's approach involves a critical evaluation to determine if these products warrant continued investment, a managed decline, or outright discontinuation. This strategic pruning allows the company to reallocate resources to more promising areas, such as its 5G infrastructure and broadband access solutions, which are key drivers of future growth.

- De-emphasis of Legacy Products: CommScope actively reduces focus on product lines with low market share and limited growth potential.

- Resource Reallocation: Capital and R&D efforts are shifted from non-strategic products to areas like fiber optics and 5G.

- Portfolio Optimization: The goal is to create a more focused and profitable product catalog aligned with market trends.

- Impact on Older Technologies: Products like older coaxial cable systems may see reduced investment as newer technologies gain traction.

Products Affected by Customer Inventory Destocking in Early 2024

Certain CommScope product lines experienced considerable revenue dips and reduced demand in late 2023 and early 2024. This was largely due to customers adjusting their inventory levels and a broader economic slowdown affecting global markets.

During this destocking phase, these products functioned as Question Marks in the BCG Matrix. They tied up valuable capital without yielding the anticipated returns, indicating a need for strategic evaluation.

CommScope anticipates a rebound in the second half of 2024 for these affected product segments. For instance, their Broadband segment, which includes products like fiber optic cable and connectivity solutions, saw a revenue decline in early 2024 as customers worked through existing stock.

- Broadband Products: Experienced revenue pressure due to customer inventory overhang.

- Network Cable and Connectivity: Faced reduced demand as clients scaled back on new deployments.

- Data Center Solutions: Certain components saw slower sales as data center build-outs were re-evaluated.

- Wireless Infrastructure Components: Experienced temporary slowdowns linked to network upgrade cycles.

CommScope's divestiture of its Home Networks business to Vantiva in January 2024 and its Outdoor Wireless Networks (OWN) segment to Amphenol in January 2025 strongly indicates these were classified as 'Dogs'. These segments likely exhibited low market share and minimal growth, making them prime candidates for strategic exit to optimize the company's portfolio. The company's 'CommScope NEXT' initiative further targets underperforming legacy products, such as older copper cabling solutions, for reduced investment or discontinuation due to declining market relevance and competition from newer technologies like fiber optics.

| Segment/Product Line | BCG Classification Indication | Rationale | Key Financial Indicator (2024 Trend) |

| Home Networks | Dog | Divested due to low market share/growth | N/A (Divested) |

| Outdoor Wireless Networks (OWN) | Dog | Divested due to declining sales and market shifts | Sales Decline in 2024 |

| Distributed Antenna Systems (DAS) | Dog | Sales decline led to divestment | Sales Decline in 2024 |

| Legacy Copper Cabling | Dog (Potential) | Faces competition from fiber optics, reduced investment | N/A (Ongoing evaluation) |

Question Marks

CommScope is investing heavily in AI-powered network automation and management, with new generative AI capabilities for zero-touch provisioning and edge AI for network optimization slated for a 2025 launch. This positions them in the burgeoning intelligent enterprise network market, a sector projected for substantial growth.

While these advanced solutions are still in early adoption, CommScope is actively working to capture market share. The company's commitment to this space reflects a strategic move to capitalize on the high-growth potential, though it necessitates significant ongoing investment to fully realize the capabilities of these emerging technologies.

CommScope's collaboration with Nokia to deliver integrated Wi-Fi 7 and Optical LAN solutions positions them to tap into the rapidly expanding enterprise wireless local area network (WLAN) market. This partnership, slated for a 2025 launch, focuses on creating robust, fiber-based campus networks designed for future demands.

This new offering is considered a question mark in the BCG matrix. While the WLAN market is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of around 10-15% through 2028, CommScope's combined solution is still in its nascent stages. Its current market share is minimal, but the high growth potential hinges on successful market adoption and the ability to capture a significant portion of this expanding sector.

RUCKUS Networks is sharpening its focus on specialized vertical market solutions, aiming to deepen its penetration in sectors like hospitality, multi-dwelling units (MDUs), and higher education. This strategic move involves building out tailored offerings that address the unique connectivity demands of these high-growth industries.

CommScope's investment in these niche areas for RUCKUS is designed to capitalize on specific market opportunities. For instance, the hospitality sector continues to see demand for robust Wi-Fi to support guest devices and operational needs, with the global hospitality Wi-Fi market projected to reach over $7 billion by 2028, growing at a CAGR of approximately 10%.

New Capacity Investments for Future Growth in CCS

CommScope's Connectivity and Cable Solutions (CCS) segment is making substantial new capacity investments, targeting an additional $300 million in revenue. This strategic move is designed to capture anticipated growth in key markets.

- Focus on High-Growth Markets: The investments are primarily directed towards hyperscale and cloud data centers, areas expected to see significant demand for CommScope's solutions.

- Revenue Generation Target: The company aims to unlock an additional $300 million in revenue through these capacity expansions.

- Capital Intensity: Expanding production capabilities in these advanced sectors requires considerable upfront capital expenditure.

- Market Position Enhancement: These investments are intended to solidify and grow CommScope's market share in the burgeoning data center infrastructure space.

Advanced Fiber Optic Technologies for Future Network Architectures

CommScope is actively developing advanced fiber optic technologies, such as smaller diameter fibers and solutions for increased network density. These innovations are essential for the next generation of data centers and broadband networks, anticipating future growth. While these technologies are poised for high-growth trends, their market share is still developing, necessitating ongoing research and development investment.

These advanced fiber solutions are key to enabling higher bandwidth and more efficient space utilization in critical infrastructure. For instance, the demand for higher speeds in data centers is driving the adoption of technologies that can support more fibers within the same conduit space. By 2024, the global fiber optics market was projected to reach over $12 billion, with a significant portion driven by these advanced solutions.

- Innovation Focus: Smaller diameter fiber and high-density solutions for evolving network architectures.

- Market Position: Targeting future high-growth trends, but current market share is nascent.

- Investment Strategy: Continued R&D investment is crucial for market penetration.

- Industry Impact: Enabling higher bandwidth and improved space utilization in data centers and broadband networks.

CommScope's integrated Wi-Fi 7 and Optical LAN solutions represent a question mark. While the enterprise WLAN market is growing robustly, with an estimated CAGR of 10-15% through 2028, this specific offering is in its early stages. CommScope's market share for this combined solution is currently minimal, but its future success hinges on capturing a significant portion of this expanding sector.

The RUCKUS Networks strategy to focus on specialized vertical markets like hospitality and MDUs also falls into the question mark category. While these sectors show strong growth potential, with the hospitality Wi-Fi market alone projected to exceed $7 billion by 2028 at a 10% CAGR, CommScope's tailored solutions are still building traction.

CommScope's investments in advanced fiber optic technologies, such as smaller diameter fibers, are also question marks. These innovations are critical for future high-growth trends in data centers and broadband networks, but their market share is still developing. Significant ongoing R&D is required to establish a strong market position in this evolving space.

BCG Matrix Data Sources

Our CommScope BCG Matrix is built on a foundation of robust market data, incorporating financial disclosures, industry growth rates, and competitive landscape analysis for strategic clarity.