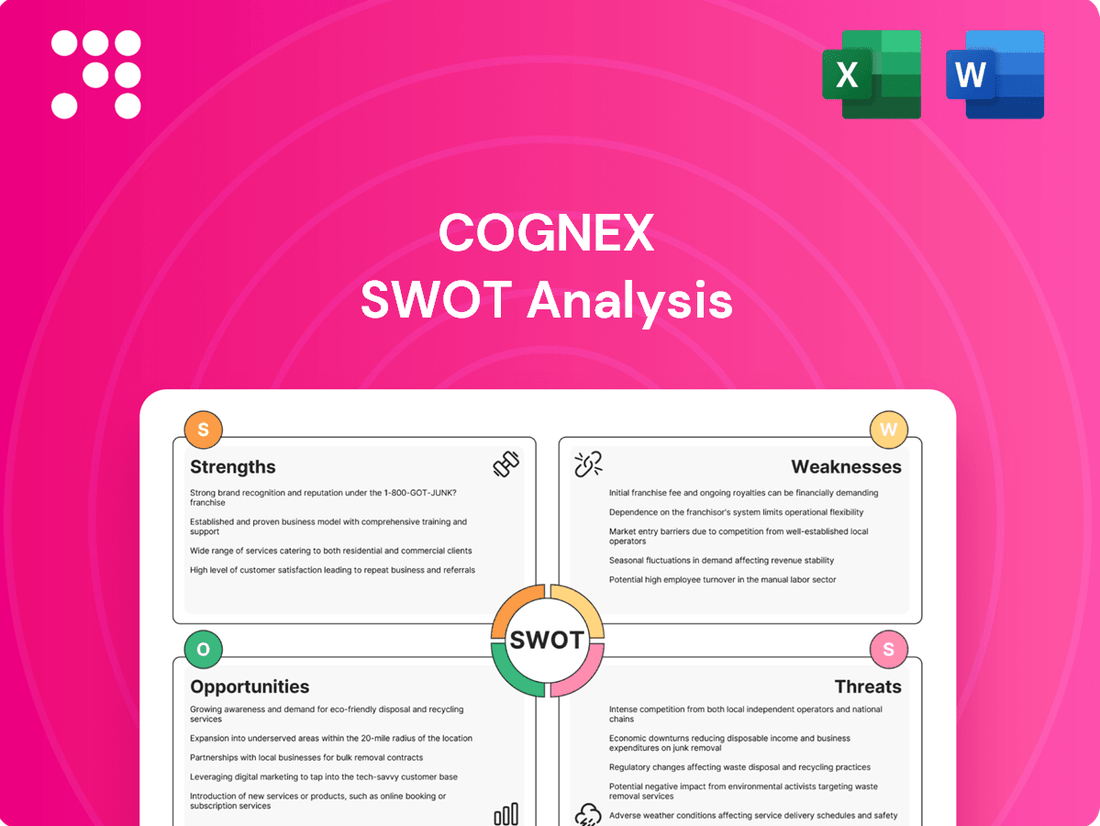

Cognex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

Cognex, a leader in machine vision, boasts strong technological innovation and a loyal customer base, but faces intense competition and evolving market demands.

Want the full story behind Cognex's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cognex commands a dominant position in the machine vision market, holding an estimated 45% global market share as of the fourth quarter of 2023. This leadership is built upon a robust and diverse product range, catering to a wide array of industrial automation needs. Their extensive global sales and support infrastructure further solidifies this advantage.

Cognex is a leader in applying artificial intelligence to machine vision, evident in its early 2025 launches of AI-powered DataMan 290/390 barcode readers and the OneVision cloud platform. These innovations significantly boost inspection accuracy and simplify complex vision tasks, directly addressing evolving customer demands for smarter manufacturing solutions.

Cognex boasts a robust financial position, underscored by its substantial cash and investment reserves and a debt-free status as of December 31, 2024. This financial strength is further evidenced by its impressive cash generation from operating activities and free cash flow in the fourth quarter of 2024.

The company's strong cash flow generation in Q4 2024, amounting to $105 million in operating cash flow and $96 million in free cash flow, directly fuels its ability to return capital to shareholders through share repurchases and dividend payments. This financial discipline enhances shareholder value while maintaining operational flexibility.

This solid financial footing provides Cognex with considerable stability and strategic flexibility, allowing it to pursue new investment opportunities and effectively navigate potential market downturns or economic uncertainties. Its healthy balance sheet is a key enabler of long-term growth and resilience.

Strategic Acquisitions and Product Diversification

Cognex's strategic acquisitions, notably the purchase of Moritex Corporation, have significantly bolstered its position in the premium optical components market. This expansion not only broadens its product portfolio but also solidifies its presence in specialized market segments. The company's commitment to ongoing research and development further fuels product diversification, ensuring a robust and technologically advanced offering.

Cognex is actively pursuing additional mergers and acquisitions within the optics and sensor industries, signaling a clear strategy to consolidate and grow its market share. For instance, in 2023, Cognex reported revenue of $967.1 million, with a significant portion attributed to its expanding product lines driven by such strategic initiatives. This proactive approach to M&A, coupled with organic growth, positions Cognex for continued success in a competitive landscape.

- Moritex Acquisition: Enhanced premium optical component capabilities.

- Product Diversification: Strengthened technological offerings through R&D and M&A.

- Market Expansion: Increased market share in niche optical and sensor segments.

- Future Growth: Active exploration of further M&A opportunities in optics and sensors.

Strong Performance in Key Growth Sectors

Cognex has shown impressive revenue growth in its Logistics and Semiconductor segments, continuing this strong performance through 2024 and into Q1 2025. These areas are crucial for industrial automation and the increasing use of AI, where Cognex's technology is vital for advanced manufacturing processes like producing high-bandwidth memory chips and streamlining e-commerce operations.

The company's strength lies in its ability to capitalize on these high-growth markets, which are experiencing significant demand for automation solutions. For instance, the logistics sector's expansion, driven by e-commerce growth, directly benefits Cognex's vision systems used in sorting, picking, and packing. Similarly, the semiconductor industry's push for greater efficiency and precision in chip manufacturing provides a fertile ground for Cognex's advanced machine vision products.

- Logistics Sector Growth: Cognex's solutions are integral to the booming e-commerce fulfillment centers, enabling faster and more accurate order processing.

- Semiconductor Demand: The increasing complexity and miniaturization in semiconductor manufacturing, particularly for AI-related chips, require sophisticated vision inspection, a core Cognex offering.

- AI Integration: Cognex's machine vision systems are increasingly being integrated with AI and machine learning algorithms, enhancing their capabilities in complex inspection and guidance tasks.

Cognex's market leadership is undeniable, holding approximately 45% of the global machine vision market share as of late 2023. This dominance is supported by a broad product portfolio and a well-established worldwide sales and support network, ensuring strong customer reach and service. The company's strategic acquisitions, like Moritex, have also expanded its capabilities in premium optical components, further solidifying its competitive edge.

What is included in the product

Analyzes Cognex’s competitive position through key internal and external factors, detailing its technological leadership and market expansion potential alongside potential competitive pressures and execution risks.

Offers a clear, actionable framework to identify and leverage Cognex's strengths, mitigating weaknesses and capitalizing on opportunities.

Weaknesses

Cognex's performance is closely tied to the health of the manufacturing sector, which can lead to revenue swings. For instance, in the first quarter of 2024, the company reported a 14% year-over-year decrease in revenue, largely attributed to softness in global manufacturing. This dependency makes Cognex vulnerable to economic slowdowns or shifts in capital expenditure by its manufacturing clients.

The automotive sector, especially the electric vehicle (EV) battery market, presents a significant weakness for Cognex. Declining demand in this area has directly impacted the company's revenue, acting as a substantial drag on its overall financial performance.

This underperformance in the EV battery segment is a persistent headwind for Cognex, counteracting positive growth seen in other business areas. The anticipated surge in EV battery production and related spending has not materialized as projected, creating an imbalance in Cognex's revenue streams.

Cognex faced a notable downturn in its gross and operating margins through 2024 and into the first quarter of 2025. This contraction was significantly influenced by the integration of Moritex, which brought a less favorable revenue mix, alongside persistent pricing pressures in the market.

Furthermore, operating margins felt the squeeze from increased operating expenses. These rises stemmed from investments made during acquisitions and ongoing initiatives to transform its sales operations, indicating a struggle to translate revenue into sustained profitability.

Intense Competitive Landscape and Pricing Pressure

The machine vision market is fiercely competitive, with major players like Keyence, Teledyne FLIR, and Basler constantly innovating. This intense rivalry puts significant pressure on pricing, potentially forcing Cognex to lower its prices to retain market share, particularly in dynamic markets like China.

This competitive environment necessitates continuous investment in research and development to maintain Cognex's technological leadership. For instance, in 2023, Cognex reported R&D expenses of $220 million, a critical investment to stay ahead of rivals who are also pushing the boundaries of machine vision technology.

- Intensifying Competition: Keyence, Teledyne FLIR, and Basler are strong rivals.

- Pricing Pressure: Competition can lead to margin erosion.

- Market Share Defense: Pricing strategies may be needed to compete, especially in China.

- Technological Imperative: Sustaining innovation is key to counter competitive threats.

Reliance on Large E-commerce Players for Logistics Growth

Cognex's significant growth in the logistics sector, while a positive, is largely fueled by a concentrated customer base, primarily major e-commerce giants. This dependence means that any slowdown in investment or strategic shifts by these key players could directly impact Cognex's expansion trajectory in this vital market. For instance, in 2023, e-commerce logistics represented a substantial portion of Cognex's revenue, highlighting this concentration.

This reliance presents a potential weakness, as a significant portion of Cognex's logistics growth is tied to the strategic decisions of a few very large customers. If these dominant e-commerce companies were to reduce their capital expenditures on automation or pivot their logistics strategies, it could disproportionately affect Cognex's performance in this segment. Industry analysts noted that while e-commerce demand was robust through early 2024, the pace of investment by some of the largest players showed signs of moderating by Q2 2024.

To strengthen its position, Cognex would benefit from actively diversifying its customer portfolio within the logistics industry. Expanding its reach to mid-sized retailers, third-party logistics (3PL) providers, and international e-commerce businesses could create a more resilient revenue stream and reduce the impact of any single customer's strategic adjustments. This diversification strategy is crucial for long-term stability and sustained growth in the dynamic logistics automation market.

- Customer Concentration Risk: Cognex's logistics growth is heavily reliant on a few large e-commerce customers, creating vulnerability to their investment cycles and strategic changes.

- Market Volatility Impact: A slowdown in spending by major e-commerce players, as observed in some market reports during early 2024, could significantly hinder Cognex's logistics segment expansion.

- Diversification Imperative: Broadening the customer base beyond top-tier e-commerce firms is essential to mitigate over-reliance and ensure more stable revenue growth in the logistics sector.

Cognex's profitability is under pressure due to increased operating expenses and a less favorable revenue mix, particularly following the Moritex acquisition. These factors, combined with market-wide pricing challenges, have led to a contraction in both gross and operating margins through early 2025. The company's efforts to invest in sales transformation initiatives further contribute to these margin headwinds, impacting its ability to translate revenue into sustained profit.

Preview the Actual Deliverable

Cognex SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cognex SWOT analysis, so you know exactly what you're getting. Purchase unlocks the complete, in-depth report for your strategic planning.

Opportunities

The rapid integration of Artificial Intelligence across manufacturing and logistics sectors is a prime opportunity for Cognex. As businesses worldwide push for enhanced operational efficiency and error reduction, Cognex's vision and inspection systems, which are increasingly AI-powered, are perfectly positioned to meet this demand. This trend is driving significant investment in smart factory solutions.

AI's role in enabling predictive maintenance, sophisticated real-time data analysis, and autonomous decision-making aligns directly with Cognex's core technological strengths. For instance, the global AI in industrial automation market was valued at approximately $10.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 20% through 2030, reaching an estimated $38.6 billion by 2030, according to various market research reports.

Cognex's Emerging Customer Initiative (ECI) is a strategic move to tap into smaller businesses and sectors that have historically been overlooked. By making AI-powered solutions more accessible, the company aims to onboard a vast number of new clients.

This initiative is supported by the deployment of entry-level sales teams and a focus on user-friendly products. The goal is to simplify the adoption of machine vision and AI for a broader customer base, potentially adding thousands of new accounts.

The ECI is projected to be a significant driver of future revenue, with expectations of contributing substantially by 2026. This expansion into new market segments represents a key opportunity for Cognex to diversify its customer portfolio and enhance its long-term growth trajectory.

The global machine vision market is poised for substantial growth, with forecasts suggesting it will expand from an estimated $15.8 billion in 2024 to over $30 billion by 2030. This surge is fueled by the escalating demand for automated quality control and process optimization across various industries, including automotive, electronics, and pharmaceuticals. Such a robust market expansion presents a significant tailwind for Cognex, bolstering demand for its specialized machine vision systems and software.

Reshoring and Supply Chain Recalibration

The global push to strengthen supply chains, often referred to as recalibration, presents a significant opportunity. Many countries, including the United States, are actively encouraging manufacturing to return, a process known as reshoring. This trend is expected to boost investment in automation technologies.

Cognex is well-positioned to benefit from this reshoring movement. As companies build or upgrade factories domestically, they will likely seek advanced solutions to ensure efficiency and maintain high product quality. Cognex's machine vision systems are crucial for these goals.

- Increased Demand: Reshoring initiatives are projected to drive substantial capital expenditure in manufacturing infrastructure, directly benefiting automation solution providers.

- Efficiency Gains: Domestic production often emphasizes higher quality control and faster throughput, areas where Cognex's vision systems excel.

- Supply Chain Resilience: Companies are prioritizing shorter, more reliable supply chains, which can lead to more localized manufacturing and thus, more on-site automation needs.

Technological Advancements in 3D Vision and Software

The machine vision sector is experiencing robust growth, particularly in its software and 3D camera segments. Projections indicate that AI software within this market is set to more than double its value within the next five years, highlighting a significant opportunity for innovation and expansion.

Cognex is well-positioned to leverage these advancements. By continuing to invest in and refine its 3D vision systems and bolstering its AI-powered software offerings, the company can effectively address the increasing sophistication of industrial automation needs. This strategic focus aligns with market trends and customer demands for more intelligent and capable machine vision solutions.

- AI Software Growth: The machine vision AI software market is anticipated to experience a growth rate exceeding 100% over the next five years.

- 3D Vision Demand: The increasing adoption of 3D vision in quality inspection and robotics fuels demand for advanced hardware and software.

- Cognex's Role: Cognex can enhance its competitive edge by integrating more advanced AI algorithms into its existing 3D vision platforms.

The increasing adoption of AI in manufacturing and logistics presents a significant growth avenue for Cognex. As businesses prioritize efficiency and accuracy, Cognex's AI-driven vision systems are well-suited to meet this demand, with the global AI in industrial automation market projected to reach $38.6 billion by 2030.

Cognex's Emerging Customer Initiative (ECI) aims to expand its reach into smaller businesses, simplifying AI adoption with user-friendly products and entry-level sales teams, potentially adding thousands of new accounts and driving future revenue.

The global machine vision market is expected to nearly double from an estimated $15.8 billion in 2024 to over $30 billion by 2030, driven by automation needs in sectors like automotive and electronics, which directly benefits Cognex.

Reshoring initiatives, encouraging domestic manufacturing, are boosting investment in automation technologies, positioning Cognex to supply essential vision systems for upgraded and new factories.

Advancements in machine vision software, particularly AI, and 3D camera technology offer substantial opportunities, with AI software in this market projected to more than double in value within five years, a trend Cognex is poised to capitalize on.

| Opportunity Area | Market Projection (2024-2030) | Cognex Relevance |

|---|---|---|

| AI in Industrial Automation | $10.5B (2023) to $38.6B (2030) | Directly aligns with Cognex's AI-powered vision systems |

| Global Machine Vision Market | $15.8B (2024) to >$30B (2030) | Broad market expansion benefits Cognex's core offerings |

| Machine Vision AI Software | Expected to more than double in value in 5 years | Cognex can enhance its software capabilities and market share |

Threats

Global economic uncertainties, such as ongoing trade tensions and the specter of potential downturns, present a significant threat to Cognex. These macro factors can directly dampen capital expenditure by Cognex's core customer base in manufacturing and logistics, impacting the company's revenue streams.

For instance, a slowdown in global manufacturing output, which saw a contraction in many regions during late 2023 and early 2024, could lead to delayed or canceled automation projects. This would directly translate to reduced demand for Cognex's machine vision and barcode reading solutions, potentially affecting their sales growth projections for 2024 and 2025.

Geopolitical tensions and the imposition of trade tariffs, particularly those involving major economies like the United States and China, present a significant threat to Cognex. These factors can disrupt the global supply chain, affecting the availability of essential components and increasing logistics expenses. For instance, the ongoing trade disputes have led to increased uncertainty in component sourcing and delivery times, impacting manufacturers worldwide.

The volatility in raw material prices, driven by geopolitical instability, can also squeeze Cognex's profit margins. While the company works to absorb some of these direct costs, the indirect consequences, such as delayed customer investment in automation projects due to economic uncertainty, could prove more detrimental to long-term growth. The global economic climate, heavily influenced by these geopolitical risks, directly impacts capital expenditure decisions by Cognex's customer base.

The relentless pace of technological advancement, especially in AI and machine vision, poses a significant threat. Competitors can quickly develop products that match or even surpass Cognex's offerings, potentially eroding market share. This rapid evolution necessitates substantial and ongoing investment in research and development, which can strain financial resources and affect profitability.

Supply Chain Disruptions and Component Shortages

Ongoing supply chain risks, particularly semiconductor chip shortages and global logistics disruptions, remain a significant threat to Cognex. These issues can directly hinder the company's production capacity and delivery timelines, impacting its ability to meet customer demand. For instance, the lingering effects of the 2021-2022 global chip shortage continued to affect various industries, and while easing, the potential for renewed disruptions persists.

These disruptions translate into reduced component availability, forcing Cognex to potentially face higher procurement costs. This escalation in operational expenses can directly squeeze profit margins and negatively affect overall revenue generation. The company's reliance on specialized components makes it particularly vulnerable to these external shocks.

- Semiconductor Shortages: Continued volatility in semiconductor supply chains poses a risk to Cognex's production schedules.

- Logistics Disruptions: Global shipping and transportation bottlenecks can delay component delivery and finished product shipment.

- Increased Costs: Shortages and logistical challenges often lead to higher raw material and transportation expenses, impacting profitability.

- Production Delays: Inability to secure necessary components can result in manufacturing slowdowns and missed sales opportunities.

Integration Complexity and High Implementation Costs for Customers

While Cognex offers cutting-edge machine vision solutions, a significant hurdle for many customers lies in the complexity and expense of integrating these systems into their existing manufacturing environments. A substantial portion of manufacturers report that integration challenges are a primary reason for delaying or foregoing adoption. This can directly impact Cognex's market penetration and the speed at which its advanced technologies are embraced.

Specifically, the upfront investment required for hardware, software, and specialized personnel to implement and maintain these systems can be prohibitive for some businesses. For instance, a survey conducted in late 2023 indicated that over 40% of small to medium-sized manufacturers identified high implementation costs as a major deterrent to adopting advanced automation technologies, including machine vision.

- Integration Complexity: Manufacturers often face difficulties in seamlessly incorporating new machine vision hardware and software with their legacy equipment and existing IT infrastructure.

- High Implementation Costs: The total cost of ownership, encompassing initial purchase, installation, customization, training, and ongoing maintenance, can be a significant barrier for many potential clients.

- Slower Adoption Rates: These integration challenges and cost concerns can lead to slower market adoption for Cognex's advanced solutions, potentially limiting revenue growth and market share expansion.

- Need for Skilled Personnel: Customers may lack the in-house expertise required to effectively deploy and manage complex machine vision systems, necessitating additional investment in training or external support.

Intensifying competition from both established players and emerging technology firms presents a substantial threat. These competitors may offer comparable or even more advanced solutions at lower price points or with more flexible integration options, potentially eroding Cognex's market share. For example, in 2024, several new entrants specializing in AI-powered vision systems have gained traction, particularly in the automotive and electronics sectors, directly challenging Cognex's dominance.

The rapid evolution of artificial intelligence and machine learning algorithms means that Cognex must continuously innovate to maintain its technological edge. Failure to keep pace with these advancements could render its current offerings less competitive, impacting future sales and profitability. The company's R&D spending, which was approximately $200 million in 2023, needs to remain robust to address this challenge.

Economic downturns and reduced capital expenditure by Cognex's core customer base in manufacturing and logistics remain a significant threat. A slowdown in global industrial production, which experienced fluctuations in late 2023 and early 2024, could directly impact demand for automation solutions. For instance, a projected 1.5% contraction in global manufacturing output for 2024 in certain regions could translate to delayed or canceled projects for Cognex.

SWOT Analysis Data Sources

This Cognex SWOT analysis is built upon a comprehensive foundation of data, including publicly available financial reports, in-depth market research from leading industry analysts, and insights from expert commentary and verified industry publications.