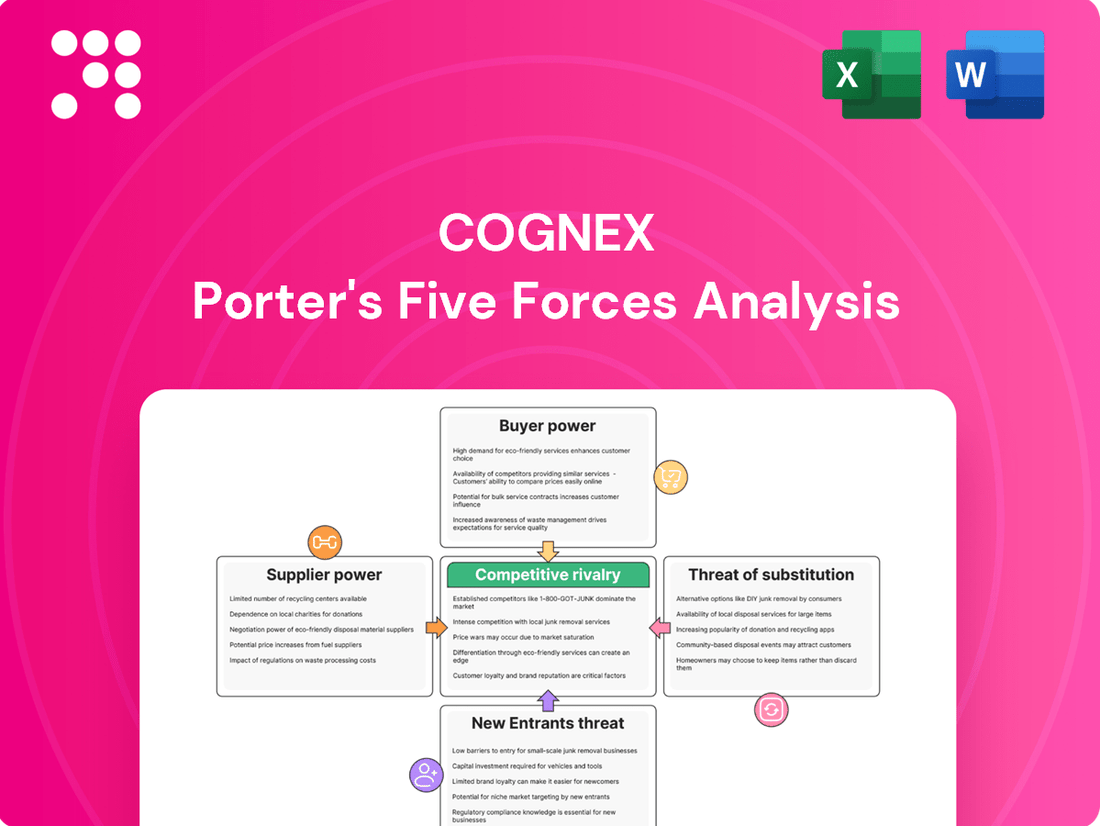

Cognex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

Cognex operates in a dynamic market shaped by intense competition, the threat of new entrants, and the bargaining power of buyers. Understanding these forces is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping Cognex’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the machine vision industry, where Cognex operates, can significantly influence bargaining power. The reliance on specialized components like high-resolution cameras, advanced sensors, and sophisticated optics means that a few key suppliers often dominate the market for these critical parts.

If these specialized component suppliers are few in number and possess unique or proprietary technology, they can wield considerable influence over pricing and availability. For Cognex, securing a consistent supply of these high-quality, often custom-made components at competitive terms is paramount to maintaining its product development and manufacturing efficiency.

For instance, in 2024, the global machine vision market was valued at approximately $10.5 billion, with a projected compound annual growth rate of over 8% through 2030, indicating robust demand. This growth, however, can intensify pressure on specialized component suppliers if demand outstrips supply, potentially increasing their bargaining power.

Cognex's reliance on unique AI inputs, such as specialized chips for advanced processing and proprietary software libraries, significantly influences supplier bargaining power. The increasing sophistication of AI in machine vision means that access to cutting-edge hardware, like high-performance GPUs, from a limited number of providers can give those suppliers considerable leverage. This is especially true if these components are critical for Cognex's product differentiation and performance.

Switching suppliers for Cognex's core components, such as specialized image sensors or advanced vision processors, can be a costly endeavor. These changes often necessitate substantial redesign work, rigorous re-testing, and lengthy re-qualification procedures, significantly increasing the cost and time involved for Cognex.

These substantial switching costs, which can encompass considerable R&D investments, modifications to manufacturing lines, and the risk of delayed product introductions, effectively bolster the bargaining power of Cognex's current suppliers. For instance, in 2023, Cognex reported research and development expenses of $195.8 million, highlighting the significant investment in product innovation and component integration.

Threat of Forward Integration by Suppliers

While less common, a significant threat to Cognex arises if a crucial component supplier were to integrate forward and develop its own complete machine vision systems. This would effectively turn a supplier into a direct competitor, potentially disrupting Cognex's supply chain and increasing input costs. The intricate nature of machine vision system integration typically serves as a substantial barrier, making such forward integration by suppliers a relatively infrequent occurrence in the industry.

For instance, if a supplier of specialized image sensors or advanced optics were to build out their own software and hardware integration capabilities, they could directly challenge Cognex's market position. This would shift the power dynamic considerably, as Cognex would then be competing with entities that control essential inputs. The high capital expenditure and specialized expertise required for developing and marketing comprehensive machine vision solutions often deter suppliers from undertaking this strategic move.

- Supplier Forward Integration: A key supplier could develop complete machine vision systems, becoming a direct competitor.

- Impact on Cognex: This could lead to supply limitations or increased component costs for Cognex.

- Barrier to Entry: The complexity of system integration generally acts as a significant deterrent for suppliers pursuing this strategy.

Importance of Supplier's Input to Cognex's Cost Structure

The cost of critical components directly impacts Cognex's gross margins and overall profitability. As hardware remains a dominant segment in the machine vision market, the pricing power of suppliers for high-performance cameras, lenses, and processing units can significantly influence Cognex's cost of goods sold.

In 2024, hardware accounted for a substantial portion of the machine vision market revenue, estimated to be around 60%. This reliance on specialized hardware means Cognex faces potential pressure from suppliers of these essential components.

- Component Costs: Suppliers of advanced image sensors, specialized optics, and high-speed processors hold significant leverage due to the proprietary nature and high R&D investment required for these parts.

- Market Concentration: If the supply chain for key components is concentrated among a few manufacturers, these suppliers gain increased bargaining power.

- Impact on Margins: Fluctuations in component prices, driven by supplier decisions, can directly compress Cognex's gross profit margins, especially in a competitive market where passing on all cost increases to customers may not be feasible.

- Strategic Sourcing: Cognex's ability to mitigate supplier bargaining power relies on strategic sourcing, building strong supplier relationships, and exploring alternative component technologies.

The bargaining power of suppliers for Cognex is amplified by the concentration of manufacturers for specialized machine vision components. These suppliers often possess proprietary technology, making it difficult for Cognex to find readily available alternatives. For instance, the demand for high-performance image sensors, crucial for advanced machine vision applications, is met by a limited number of specialized producers.

Switching costs for Cognex are substantial, involving significant R&D, re-tooling, and re-qualification processes. This inertia strengthens the position of existing suppliers, as the expense and time associated with changing providers are considerable deterrents. Cognex's 2023 R&D expenditure of $195.8 million underscores the deep integration of specific components into its product development.

The potential for a key supplier to integrate forward into offering complete machine vision solutions poses a threat, though the high capital and expertise required often limit this. However, if a supplier of critical hardware, like advanced processors, were to develop its own software and integration capabilities, it could directly challenge Cognex. This scenario would significantly alter the supplier-customer dynamic.

| Factor | Description | Impact on Cognex |

|---|---|---|

| Supplier Concentration | Few manufacturers dominate specialized component markets (e.g., advanced image sensors). | Increases supplier pricing and negotiation leverage. |

| Switching Costs | High costs for R&D, re-tooling, and re-qualification for component changes. | Bolsters power of incumbent suppliers, limiting Cognex's flexibility. |

| Proprietary Technology | Suppliers possess unique or patented technologies for critical components. | Reduces availability of alternatives, enhancing supplier control. |

| Forward Integration Risk | Potential for suppliers to become direct competitors by offering complete solutions. | Could lead to supply disruptions or increased input costs if realized. |

What is included in the product

A comprehensive examination of the competitive forces impacting Cognex, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the machine vision industry.

Quickly assess competitive intensity with a visual breakdown of each force, enabling faster strategic adjustments.

Customers Bargaining Power

Customer concentration is a key factor in assessing the bargaining power of customers. Cognex's revenue streams are diversified across various sectors, with logistics, automotive, and consumer electronics accounting for roughly 60% of its total sales in 2024. This broad industry reach generally dilutes the power of any single customer or small group of customers.

Customer switching costs for machine vision systems are significant, directly impacting bargaining power. Integrating Cognex's solutions into factory automation or distribution centers often requires substantial investment in new hardware, specialized training for staff, and potentially re-engineering existing operational processes. For example, a manufacturer deeply reliant on Cognex's defect detection for quality control might face considerable downtime and retraining expenses if they were to switch to a different vendor.

These embedded costs create a strong incentive for customers to remain with Cognex once a system is implemented. The disruption and expense associated with migrating data, recalibrating equipment, and retraining personnel mean that switching is not a simple plug-and-play operation. This 'stickiness' effectively limits customers' ability to demand lower prices or more favorable terms, thereby reducing their overall bargaining power and solidifying Cognex's market position.

Customers in manufacturing and logistics are typically very sensitive to price, always looking for ways to boost efficiency and cut down on operational costs. This means Cognex often faces pressure to keep its prices competitive, especially as more companies enter the automation market.

The broader industrial automation market experienced a slowdown in 2024, which further intensified price competition. This environment makes it crucial for Cognex to balance its pricing strategies with the value its advanced machine vision and identification solutions provide.

Availability of Substitute Products/Solutions for Customers

The availability of substitute products significantly impacts customers' bargaining power against Cognex. Customers can opt for manual inspection processes, which are often less efficient but can be perceived as a lower-cost alternative, especially for simpler tasks.

Furthermore, less sophisticated machine vision systems exist that may meet basic requirements at a lower price point than Cognex's advanced offerings. For instance, in 2024, the industrial automation market saw a rise in demand for modular and scalable vision solutions that could be adapted for less complex applications, potentially drawing customers away from premium providers for certain use cases.

- Manual Inspection: While labor-intensive, it remains an alternative for very basic quality checks.

- Less Sophisticated Vision Systems: Competitors offer simpler, lower-cost vision solutions for less demanding applications.

- Emerging AI/IoT Platforms: Broader platforms are integrating vision capabilities, providing alternative, albeit potentially less specialized, solutions.

Customer's Ability to Backward Integrate

Large industrial clients, especially those with strong engineering teams, might explore creating their own internal vision systems for unique, tailored applications. This possibility, although not widespread, gives advanced customers leverage in price discussions.

The high degree of specialized knowledge needed for sophisticated machine vision, particularly AI-driven systems, presents a significant obstacle to backward integration. For instance, developing a custom AI vision solution could require millions in R&D and specialized talent, making it prohibitive for most.

- High R&D Costs: Developing proprietary AI vision technology can cost millions, deterring many customers.

- Specialized Expertise: The need for highly skilled AI engineers and vision system developers is a major barrier.

- Time to Market: In-house development is often slower than purchasing off-the-shelf or customized solutions from established vendors.

The bargaining power of Cognex's customers is moderated by several factors, including customer concentration and switching costs. While Cognex serves diverse industries like logistics and automotive, which accounted for approximately 60% of its sales in 2024, the high cost and complexity of integrating its advanced machine vision systems create significant switching barriers for its clients.

Customers are sensitive to price, especially in a competitive market. However, the substantial investment required for implementation, including hardware, training, and process re-engineering, makes it difficult for customers to switch away from Cognex, thus limiting their leverage.

The availability of substitutes like manual inspection or less sophisticated vision systems exists, but Cognex's technological edge in advanced AI-driven solutions often outweighs these alternatives for demanding applications. Developing in-house solutions is also deterred by high R&D costs and the need for specialized expertise.

Same Document Delivered

Cognex Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written Cognex Porter's Five Forces Analysis, complete with detailed insights into industry rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

The machine vision market is characterized by significant competitive rivalry, featuring a multitude of players with varying strengths and market positions. In 2024, Keyence emerged as the market leader, capturing an impressive 14.2% market share, while Cognex followed closely with 11.4%.

Beyond these leaders, the landscape includes other substantial competitors such as TKH Vision, Teledyne Solutions, Hikrobot, Basler, Omron Automation, and Zebra Technologies. This diverse array of participants highlights a fragmented market where companies offer a broad spectrum of solutions, ranging from specialized component suppliers to comprehensive, integrated system providers.

The global machine vision market is experiencing robust expansion, with a projected 8.6% compound annual growth rate (CAGR) from $19.59 billion in 2024 to $21.27 billion in 2025. This strong growth trajectory, expected to accelerate to an 11.3% CAGR by 2029, is a double-edged sword for competitive rivalry.

This significant market expansion acts as a magnet, drawing in new entrants and encouraging existing players to increase their investments. Consequently, the heightened interest in this sector naturally intensifies competition as companies battle to capture a larger share of the growing pie.

While increased competition can pressure margins, the substantial growth also presents considerable opportunities for established companies like Cognex. This dynamic environment means that while rivalry is high, the expanding market size allows for potential expansion and increased revenue even amidst fiercer competition.

Cognex stands out by specializing in AI-driven machine vision for automated inspection, identification, and guidance. This focus on making complex machine vision accessible, coupled with deep AI integration, aims to deliver enhanced performance and simpler implementation for customers.

Their strategy hinges on continuous innovation, particularly in AI and 3D vision technologies, which is vital for staying ahead of competitors. For instance, in 2023, Cognex reported a revenue of $826.4 million, demonstrating their market presence and ability to invest in these differentiating technologies.

Switching Costs for Customers

High switching costs for customers significantly dampen competitive rivalry in the machine vision market, benefiting companies like Cognex. Once a business integrates a Cognex machine vision system, the effort and expense involved in switching to a competitor's offering are substantial. This integration often involves not just the hardware and software but also the training of personnel and the recalibration of production lines.

This embedded nature of the technology creates a powerful customer lock-in effect. While the initial acquisition of a Cognex system might involve intense competition, the long-term retention of that customer becomes considerably easier. The disruption and cost associated with replacing an established, functional system are often prohibitive for businesses.

For instance, in 2024, many manufacturers have deeply embedded Cognex vision systems into their automated production processes. The cost of retraining staff on new interfaces, revalidating new systems for quality control, and the potential downtime during the transition can easily run into tens or even hundreds of thousands of dollars, depending on the scale of operations. This financial and operational barrier makes switching away from Cognex a difficult decision for many.

- Reduced Rivalry: High switching costs limit the frequency with which customers can easily change vendors.

- Customer Loyalty: Integration complexity fosters long-term customer relationships for Cognex.

- Cost of Change: Significant financial and operational burdens deter customers from switching systems.

- Market Stability: Embedded technology contributes to a more stable competitive landscape for established players.

Strategic Stakes and Exit Barriers

Competitive rivalry within the machine vision sector, where Cognex operates, is intensified by substantial strategic stakes and high exit barriers. Companies like Cognex typically maintain significant investments in research and development, specialized manufacturing capabilities, and a robust portfolio of intellectual property. These considerable fixed costs and the unique nature of their assets mean that exiting the market is exceptionally difficult and costly.

These high exit barriers compel companies to remain competitive even when market conditions are unfavorable, thus perpetuating intense rivalry. For instance, Cognex demonstrated its commitment to innovation by investing 15% of its revenue into research, development, and engineering (R&D&E) in 2024, underscoring the significant capital commitment required to stay relevant in this field.

- High R&D Investment: Companies in machine vision, including Cognex, invest heavily in R&D, which creates specialized knowledge and assets.

- Specialized Assets: Manufacturing facilities and intellectual property are often highly specific to the industry, making them difficult to repurpose or sell.

- Sustained Rivalry: High exit barriers encourage existing players to compete fiercely rather than withdraw, even during economic slowdowns.

- Cognex's 2024 R&D: Cognex's 15% R&D&E investment in 2024 highlights the ongoing capital expenditure necessary to maintain a competitive edge.

The machine vision market is highly competitive, with numerous players vying for market share. Keyence led in 2024 with 14.2%, followed by Cognex at 11.4%, indicating a concentrated top tier within a broader, fragmented market.

This intense rivalry is fueled by significant market growth, projected to reach $21.27 billion in 2025, encouraging both new entrants and existing firms to invest heavily. While growth offers opportunities, it also means companies like Cognex must continuously innovate, as seen in their 2024 R&D investment of 15% of revenue, to maintain their position.

High switching costs for customers, stemming from deep system integration and training, create a powerful lock-in effect for Cognex, mitigating some of the direct competitive pressure. However, substantial strategic stakes and high exit barriers for companies in this sector ensure that rivalry remains a persistent challenge.

| Competitor | 2024 Market Share | Key Focus Area |

| Keyence | 14.2% | Integrated automation solutions |

| Cognex | 11.4% | AI-driven machine vision for inspection & guidance |

| TKH Vision | N/A | Industrial imaging components & systems |

| Teledyne Solutions | N/A | Digital imaging technologies |

| Hikrobot | N/A | Machine vision & mobile robots |

SSubstitutes Threaten

For certain niche applications, especially in smaller businesses or when dealing with highly unique or unpredictable products, manual inspection still presents itself as a viable alternative to automated systems. This human-driven approach can offer flexibility where machine vision might struggle with extreme variability.

However, the landscape is rapidly shifting. Machine vision systems, particularly those enhanced with artificial intelligence, deliver unparalleled speed, precision, and consistency for high-volume production lines and critical quality control. For instance, by 2024, the global machine vision market was projected to reach over $15 billion, a testament to its growing adoption over manual methods.

The increasing global emphasis on product quality and the relentless drive towards operational efficiency are powerful catalysts pushing manufacturers away from manual inspection. This trend is particularly evident in sectors like automotive and electronics, where even minor defects can have significant consequences, making automated, data-driven inspection the preferred choice.

Less sophisticated automation technologies, such as basic sensors or traditional barcode scanners, can act as substitutes for Cognex's more advanced vision systems in simpler applications. These alternatives might be sufficient for tasks requiring straightforward identification or counting, offering a lower initial cost. For instance, a simple proximity sensor can replace a vision system for detecting the presence of an object, though it lacks Cognex's ability to analyze object characteristics.

RFID technology presents a significant substitute for traditional barcode scanning, particularly in identification tasks. While RFID can read multiple items without direct line-of-sight, offering speed and efficiency, barcode readers like those from Cognex's DataMan line remain competitive due to their lower cost and widespread adoption in existing industrial infrastructure. For instance, the global RFID market was projected to reach over $30 billion by 2023, highlighting its growing influence, yet barcode scanner shipments continue to be robust in many sectors.

Emerging Technologies with Overlapping Capabilities

Emerging technologies, like advanced robotics incorporating basic sensing or expansive IoT platforms with nascent visual analytics, are beginning to exhibit capabilities that could eventually overlap with certain machine vision functions. While not yet direct replacements for Cognex's highly specialized solutions, their ongoing development suggests a potential future threat as these technologies mature.

For instance, the industrial robotics market, which often integrates vision systems, saw significant growth. In 2023, global industrial robot installations reached approximately 550,000 units, a figure projected to continue its upward trajectory. As these robots gain more sophisticated built-in sensing and analytical abilities, they might reduce the need for standalone, high-end machine vision systems in some applications.

- Robotics Integration: Advanced robotics are increasingly incorporating visual sensing, potentially reducing reliance on dedicated machine vision systems for basic tasks.

- IoT Expansion: The proliferation of IoT devices with developing analytical capabilities could offer alternative solutions for less complex data interpretation.

- Technological Convergence: The trend of converging technologies means that functionalities previously exclusive to specialized machine vision may become embedded in broader automation platforms.

- Future Threat Evolution: While current substitutes are limited, the rapid pace of technological advancement necessitates monitoring these emerging capabilities as they mature and gain sophistication.

Software-Only Vision Solutions

The rise of software-only vision solutions presents a significant threat of substitution for Cognex. As artificial intelligence and cloud computing mature, these software-centric approaches can perform vision tasks using readily available hardware, potentially bypassing the need for specialized Cognex systems in less complex applications. This trend is particularly concerning for industries looking for cost-effective and flexible solutions.

For instance, in 2024, the market for AI-powered computer vision software continued its rapid expansion, with many startups offering cloud-based platforms that can integrate with standard cameras. These solutions can handle tasks like object detection and quality inspection, directly competing with Cognex's integrated hardware and software offerings. The accessibility and scalability of these software-only options can make them an attractive alternative, especially for businesses with fluctuating demands or those prioritizing lower upfront investment.

- Software-only solutions leverage AI and cloud computing for vision tasks.

- These can reduce reliance on specialized hardware, offering a substitute for Cognex.

- Emerging software-driven approaches are particularly competitive for less demanding applications.

- The trend allows for the use of generic cameras, potentially lowering costs for end-users.

While Cognex offers advanced machine vision, simpler automation like basic sensors or barcode scanners can substitute for less complex identification or presence detection tasks. These alternatives often come with a lower initial cost, making them appealing for straightforward applications where intricate analysis isn't required. For example, a proximity sensor can fulfill a basic presence detection need that might otherwise use a vision system, albeit without the analytical depth.

Entrants Threaten

Entering the machine vision market, particularly at the level Cognex operates, demands substantial upfront capital. This includes significant investment in research and development for cutting-edge AI algorithms and hardware, alongside the establishment of specialized manufacturing facilities and a robust global sales and support network. For instance, Cognex's own R&D spending in 2023 was approximately $200 million, highlighting the scale of investment needed to remain competitive and innovate.

Cognex's robust intellectual property, particularly its patents covering machine vision algorithms, AI applications, and unique hardware, acts as a significant barrier to entry. Developing comparable technology requires substantial investment in research and development, making it difficult for newcomers to replicate Cognex's offerings. For instance, in 2023, Cognex continued to strengthen its patent portfolio, a key aspect of its competitive moat.

Cognex's established brand loyalty, forged over 40 years as a machine vision leader, presents a significant barrier to new entrants. This deep customer trust and recognition, built through consistent performance and support, makes it difficult for newcomers to gain traction. For instance, in 2023, Cognex reported strong customer retention rates, underscoring the stickiness of their solutions.

Access to Distribution Channels

The threat of new entrants to Cognex's market is significantly mitigated by the substantial cost and complexity involved in establishing a global sales and distribution network for sophisticated industrial products like machine vision systems. Building such infrastructure requires extensive investment in physical presence, trained personnel, and logistical capabilities across numerous regions. Newcomers face the daunting task of replicating Cognex's established worldwide network of offices and distributors, a process that represents a considerable barrier to entry.

Cognex's existing global footprint is a key differentiator. As of early 2024, the company operates in over 20 countries, with a robust network of direct sales, support offices, and authorized distributors. This extensive reach allows Cognex to effectively serve a diverse customer base and provide localized support, a critical factor in the industrial automation sector. For potential competitors, the capital expenditure and time required to develop a comparable distribution and sales infrastructure are immense, making it difficult to compete effectively against Cognex's established market presence.

- High Capital Investment: New entrants must invest heavily in setting up global sales offices, training sales and technical support staff, and establishing relationships with distributors worldwide.

- Established Relationships: Cognex benefits from long-standing relationships with its distributors and key customers, which are difficult for new entrants to quickly replicate.

- Technical Expertise and Support: A global distribution network for machine vision requires significant technical expertise to provide pre-sales consultation, installation, and post-sales support, a capability that takes years to build.

- Brand Recognition and Trust: Cognex has cultivated strong brand recognition and trust over decades, which new entrants would struggle to achieve in the short to medium term.

Technological Expertise and R&D Intensity

The machine vision sector, especially with AI's growing role, requires deep knowledge in optics, image processing, software, and deep learning. This high level of technical skill acts as a barrier.

Cognex’s commitment to innovation is evident in its substantial R&D spending. In 2024, the company allocated 15% of its revenue to R&D&E, underscoring the continuous investment needed to stay ahead.

- High R&D Investment: Cognex's 15% R&D spend in 2024 highlights the significant capital required to develop and maintain cutting-edge machine vision technology.

- Talent Acquisition: New entrants must recruit or cultivate top-tier engineers and researchers specializing in AI, optics, and software, a costly and time-consuming endeavor.

- Intellectual Property: The industry's reliance on proprietary algorithms and patented technologies further complicates market entry for those without established IP portfolios.

The threat of new entrants in the machine vision market, where Cognex operates, is considerably low due to several formidable barriers. These include the immense capital required for research and development, establishing a global sales and support network, and the need for specialized technical expertise. Cognex's substantial R&D investment, for example, continues to push the boundaries of AI and hardware innovation, making it challenging for newcomers to match their technological advancements. Furthermore, the company's established brand reputation and extensive patent portfolio create significant hurdles for any potential competitor seeking to enter the market.

| Barrier Factor | Description | Cognex's Position (as of early 2024/2023 data) |

|---|---|---|

| Capital Investment | High costs for R&D, manufacturing, and global sales/support infrastructure. | Cognex's 2023 R&D spending was approx. $200 million, indicating significant investment. |

| Intellectual Property | Proprietary algorithms, AI applications, and hardware patents. | Cognex actively strengthened its patent portfolio in 2023. |

| Brand Recognition & Trust | Established reputation built over 40+ years. | Demonstrated by strong customer retention rates in 2023. |

| Distribution Network | Global presence with offices, support, and distributors in over 20 countries. | Requires immense capital and time for newcomers to replicate. |

| Technical Expertise | Deep knowledge in optics, image processing, software, and AI. | Cognex allocated 15% of revenue to R&D&E in 2024 to maintain this. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, financial statements from key players, and publicly available company filings. This ensures a comprehensive understanding of competitive dynamics.