Cognex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

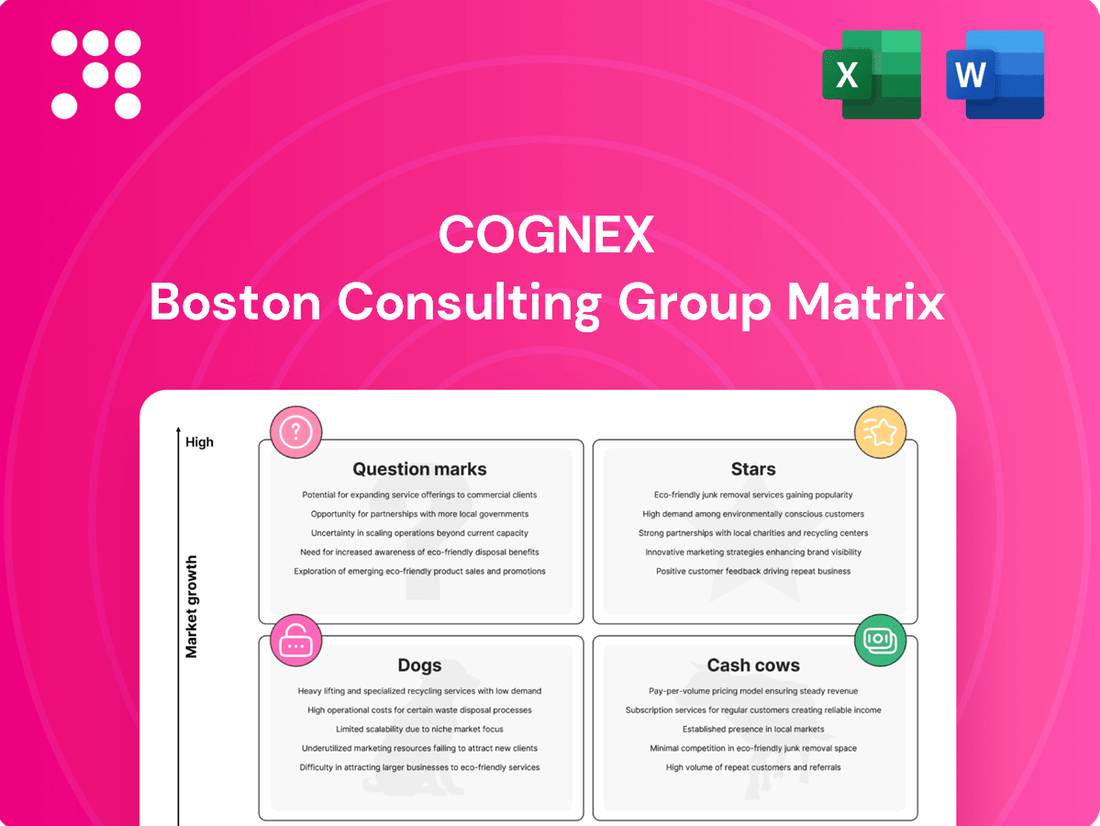

Unlock the strategic potential of your product portfolio with the Cognex BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual representation of their market performance and growth prospects. Don't just guess where to invest; know exactly where your resources will yield the greatest returns.

Gain a comprehensive understanding of your company's competitive landscape and make informed decisions that drive profitability. The full BCG Matrix report offers in-depth analysis and actionable insights to optimize your product strategy and maximize market share.

Ready to transform your product management? Purchase the complete Cognex BCG Matrix today and equip yourself with the data-driven clarity needed to navigate complex markets and achieve sustainable growth.

Stars

Cognex's AI-powered machine vision systems, like the In-Sight L38 and In-Sight 8900, are a key growth driver, tapping into the expanding smart factory market. These systems utilize advanced AI, including Transformer models and deep learning, to tackle intricate inspection and measurement tasks, simplifying complex automation for businesses.

The company's commitment to AI is evident, with all new product launches incorporating AI capabilities. This strategic focus positions Cognex at the forefront of a rapidly growing sector, offering sophisticated solutions for modern industrial automation needs.

Logistics automation solutions, encompassing advanced barcode readers and vision systems for automated tracking and inspection in distribution centers, represent a key growth area for Cognex. This segment has demonstrated robust momentum, with significant year-over-year revenue increases. For instance, Cognex reported strong performance in its logistics business in early 2024, reflecting continued demand for its automated identification and inspection technologies.

Cognex's semiconductor business solutions are a significant growth driver, fueled by substantial industry investments. The demand for advanced chip manufacturing, especially for high-bandwidth memory and hyperscaler capital expenditures, is boosting this segment. This unit holds a strong market position in a fast-growing sector.

New Generation AI Barcode Readers

Cognex's new generation AI barcode readers, the DataMan 290 and 390, are positioned as Stars in the BCG matrix. Their advanced AI technology ensures reliable decoding of challenging barcodes, a critical factor in manufacturing and logistics where traceability is paramount.

These readers bolster Cognex's dominance in the industrial barcode reading sector, a market anticipated to expand significantly. For instance, the global barcode scanner market was valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, according to various market research reports.

- Innovation: Leverages AI for superior decoding of difficult and damaged codes.

- Market Position: Strengthens Cognex's leadership in a growing industrial automation segment.

- Customer Needs: Addresses key industry demands for enhanced traceability and operational efficiency.

VisionPro Deep Learning Software

Cognex's VisionPro Deep Learning software, particularly its latest 4.0 iteration leveraging advanced AI Transformer models, is positioned as a Star within the BCG Matrix. This designation stems from its commanding market share in the rapidly expanding deep learning segment of machine vision. The software's ability to enhance inspection accuracy for parts with high variability is a key driver of its success, opening new market opportunities and significantly boosting software revenue. For instance, Cognex reported strong growth in its software and services segment in 2023, a trend expected to continue with VisionPro Deep Learning leading the charge. This product is central to Cognex's strategic focus on artificial intelligence.

The VisionPro Deep Learning software's impact is evident in its contribution to Cognex's overall performance. By enabling more robust and adaptable inspection solutions, it addresses complex manufacturing challenges that traditional machine vision systems struggle with. This innovation not only solidifies Cognex's market leadership but also sets a new benchmark for AI-powered quality control. The company's commitment to advancing its AI capabilities through software like VisionPro underscores its strategy to capture growth in high-tech industrial automation markets.

Key factors contributing to VisionPro Deep Learning's Star status include:

- High market penetration in the growing AI-driven machine vision sector.

- Enhanced inspection capabilities for complex and variable parts.

- Significant contribution to Cognex's software and services revenue growth.

- Alignment with Cognex's core AI and automation strategy.

Cognex's DataMan 290 and 390 barcode readers are classified as Stars due to their advanced AI capabilities and strong market reception. These readers excel at decoding difficult and damaged barcodes, a crucial need in manufacturing and logistics for improved traceability. The industrial barcode scanner market, valued at approximately $12.5 billion in 2023, is projected for significant growth, with Cognex's innovative readers well-positioned to capture a larger share.

VisionPro Deep Learning software, particularly its latest iteration, is also a Star. It holds a substantial market share in the expanding deep learning segment of machine vision. This software enhances inspection accuracy for parts with high variability, driving significant revenue growth in Cognex's software and services segment, which saw strong performance in 2023 and is expected to continue this trend.

| Product Category | BCG Classification | Key Growth Drivers | Market Data Point | Strategic Importance |

| AI Barcode Readers (DataMan 290/390) | Star | Advanced AI decoding, demand for traceability | Global barcode scanner market ~$12.5B (2023), >6% CAGR | Strengthens leadership in industrial automation |

| VisionPro Deep Learning Software | Star | High market share in AI vision, complex part inspection | Strong growth in software/services revenue (2023) | Central to AI strategy, drives software revenue |

What is included in the product

The Cognex BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment decisions.

Visualize your business portfolio with a clear BCG Matrix, identifying strategic opportunities and resource allocation needs.

Cash Cows

Cognex's established 2D machine vision systems are undeniably Cash Cows within their Business Growth Matrix. These systems, a cornerstone of Cognex's offerings for years, enjoy a dominant market share in mature factory automation environments.

While the growth rate for these mature technologies might not match emerging AI-powered solutions, their consistent performance translates into substantial and reliable cash flow for Cognex. This strong cash generation is supported by their widespread adoption and the relatively low need for ongoing, significant investment for further development.

Standard industrial barcode readers, the foundational models within Cognex's portfolio, function as cash cows. These reliable workhorses, excluding the newest AI-driven units, boast a significant installed base, particularly in established manufacturing and logistics sectors. Their widespread adoption and proven dependability translate into consistent revenue and healthy profit margins, minimizing the need for extensive marketing spend.

Cognex's broad factory automation solutions, encompassing machine vision systems for quality inspection and guidance, operate in a mature but stable market. These offerings are foundational to many manufacturing processes, ensuring consistent product quality and operational efficiency across diverse industries like automotive and consumer goods.

The widespread adoption of these automation tools has led to high market penetration, with revenue streams remaining consistent. For instance, Cognex reported that its traditional machine vision business, which includes many of these broad solutions, continued to be a significant contributor to its overall financial performance in 2023, even as newer segments experienced faster growth.

These solutions act as cash cows because they serve an established customer base with ongoing needs for automation in existing production lines. The reliability of these revenue streams, bolstered by the essential nature of quality control and automation in manufacturing, provides Cognex with stable cash flow to reinvest in higher-growth areas.

In-Sight Vision Sensors (Core Models)

Cognex's In-Sight vision sensors, particularly the core models, represent a significant cash cow. These integrated smart cameras are designed for straightforward implementation in various inspection and guidance tasks, making them accessible to a broad user base.

Their long-standing presence has allowed them to secure a substantial portion of the market for standard automation applications. This maturity, coupled with their proven reliability, ensures steady revenue streams and robust cash flow for Cognex.

- Market Share: In-Sight core models hold a dominant position in the vision sensor market for general-purpose automation.

- Revenue Contribution: These products consistently contribute a significant portion of Cognex's overall revenue due to their widespread adoption.

- Profitability: Mature product lines like In-Sight sensors typically exhibit high profit margins, further solidifying their cash cow status.

- Sales Volume: Demand remains strong for these reliable, established solutions in manufacturing and logistics sectors.

Legacy VisionPro Software (Rule-Based)

The legacy VisionPro software, a staple in rule-based machine vision, continues to be a significant cash cow for Cognex. Despite the rise of newer AI-driven solutions, this established software holds a substantial market share in traditional machine vision applications, ensuring a steady stream of revenue from licensing and ongoing support agreements.

These older versions, while not requiring extensive new R&D, deliver robust cash flow. For example, in 2024, Cognex reported that its Machine Vision segment, which includes VisionPro, continued to be a primary revenue driver. The company's focus on maintaining and supporting its existing VisionPro customer base means these products are essentially self-sustaining, minimizing incremental investment while maximizing profitability.

- Established Customer Base: VisionPro's rule-based versions cater to a vast existing clientele with deeply integrated applications.

- Consistent Revenue Streams: Licensing fees, maintenance contracts, and upgrade sales provide predictable and reliable income.

- Low Investment Needs: Reduced need for new development allows for significant cash generation with minimal capital outlay.

- Profitability Driver: The mature nature of this product line makes it a key contributor to Cognex's overall cash flow and profitability.

Cognex's established 2D machine vision systems, including foundational In-Sight sensors and the legacy VisionPro software, are prime examples of cash cows. These mature products benefit from a dominant market share in stable factory automation sectors, generating consistent and reliable cash flow with minimal reinvestment needs. For instance, Cognex's Machine Vision segment, which encompasses many of these established offerings, remained a significant revenue contributor in 2023 and 2024, demonstrating their enduring financial strength.

| Product Category | Market Position | Revenue Contribution (Indicative) | Investment Requirement | Cash Flow Generation |

|---|---|---|---|---|

| 2D Machine Vision Systems (Core Models) | Dominant in mature automation | High, consistent | Low | Strong |

| In-Sight Vision Sensors (Core) | Market leader for general automation | Significant | Minimal | Robust |

| VisionPro Software (Legacy Rule-Based) | Substantial share in traditional applications | Steady (licensing/support) | Very Low | High |

What You See Is What You Get

Cognex BCG Matrix

The Cognex BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional and ready-to-use strategic tool. You can trust that this preview accurately represents the comprehensive analysis and presentation quality of the complete BCG Matrix report. Once purchased, this document will be immediately available for your business planning needs, offering clear insights into your product portfolio.

Dogs

Discontinued or obsolete product lines within Cognex's portfolio would fall into the Dogs category of the BCG Matrix. These are products, perhaps older vision systems or specific software versions, that Cognex no longer actively promotes or develops. Their market share is likely minimal, and future growth is virtually nonexistent.

For instance, if Cognex phased out a particular industrial camera model from the early 2010s due to the advent of higher-resolution sensors and faster processing speeds, that model would be a prime example of a Dog. Such products typically generate very little revenue, if any, and are often only maintained for existing customer support obligations, consuming minimal resources.

Certain highly specialized machine vision solutions from Cognex, perhaps those targeting very specific industrial processes with limited adoption, might fall into the Dogs category. These products often struggle to gain significant market traction, resulting in a low market share and minimal anticipated growth. For instance, a solution developed for a single, obscure manufacturing step might have seen only a handful of sales in 2024, failing to recoup its development costs.

Products without AI upgrade paths represent a significant challenge for Cognex. These are typically older hardware or software offerings that lack the architecture to seamlessly integrate with the company's cutting-edge AI technologies. As the market increasingly demands AI-powered solutions, these legacy products are finding it harder to compete.

The consequence for Cognex is a potential decline in market share for these specific offerings. Without the ability to leverage AI, their growth prospects become stagnant. This situation can lead to a scenario where these products become cash traps, consuming resources without generating substantial returns in a rapidly evolving, AI-centric landscape.

Underperforming Regional Offerings

Underperforming regional offerings within Cognex's product portfolio represent specific configurations or solutions designed for particular geographic markets that have struggled to gain significant traction. Despite initial investments, these products have not achieved the desired market share or profitability, indicating a need for strategic re-evaluation. For instance, a specialized vision system tailored for a niche manufacturing sector in Southeast Asia might be facing intense local competition or a slower-than-anticipated adoption rate.

These offerings often encounter unique competitive pressures or market conditions that hinder their growth. Factors such as differing regulatory environments, varying customer preferences, or the presence of strong local competitors can limit the success of even well-designed products. In 2024, Cognex continued to navigate these complexities, with certain regional solutions experiencing sales that fell short of internal projections, impacting overall growth in those specific markets.

- Limited Market Penetration: Some regional product variants have struggled to capture substantial market share, indicating a disconnect with local demand or effective competitor strategies.

- Profitability Challenges: Despite initial development costs, these underperforming offerings have not generated sufficient revenue to cover their expenses or contribute positively to profit margins.

- Competitive Landscape: Intense competition from both global players and local manufacturers in specific regions has created significant hurdles for these specialized Cognex solutions.

Non-Strategic, Acquired Technologies

Non-Strategic, Acquired Technologies within Cognex's BCG Matrix would likely be categorized as Dogs. These are typically technologies or product lines, often stemming from smaller acquisitions, that haven't successfully meshed with Cognex's core business strategy or delivered expected synergies. For instance, if an acquired company specialized in a niche automation solution that proved difficult to integrate or market broadly, it might fall into this category. These represent investments that have struggled to gain significant market share and generate substantial growth, consequently draining resources without commensurate returns.

These "Dog" assets can be characterized by several factors:

- Low Market Share: The acquired technology struggles to capture a meaningful portion of its target market, indicating limited customer adoption or competitive disadvantage.

- Low Growth Prospects: The market for the acquired technology is stagnant or declining, offering little potential for future expansion or increased profitability.

- Integration Challenges: Difficulties in merging the acquired technology's operations, software, or sales channels with Cognex's existing infrastructure hinder its success.

- Resource Drain: Continued investment in research, development, marketing, or support for these underperforming assets diverts capital and attention from more promising opportunities.

Products in the Dogs category for Cognex represent discontinued or underperforming offerings with minimal market share and little to no growth potential. These could include older hardware models or specialized software solutions that have been superseded by newer technologies or failed to gain significant traction. For instance, a legacy industrial camera from the early 2010s, lacking modern resolution and processing capabilities, would likely be a Dog. These products often require continued support for existing customers but generate negligible new revenue and are not strategic growth drivers.

Cognex's "Dogs" are essentially products that consume resources without contributing significantly to the company's future. This might encompass acquired technologies that proved difficult to integrate or market effectively, leading to low adoption rates and stagnant growth. For example, a niche automation solution from a past acquisition might have seen very limited sales in 2024, failing to justify ongoing investment. Such products represent a drain on resources that could be better allocated to more promising areas of the business.

The consequence of having "Dogs" in the portfolio is a drag on overall profitability and a diversion of management focus. These products often lack the ability to adapt to market shifts, such as the increasing demand for AI-powered solutions, further limiting their viability. Cognex must actively manage these "Dogs," either by divesting them or by minimizing the resources allocated to their support, to ensure capital is directed towards its Stars and Question Marks.

Question Marks

Cognex's OneVision cloud platform, a new AI-powered machine vision solution, fits squarely into the Question Mark quadrant of the BCG matrix. Its potential for high growth is evident, given the increasing demand for AI in industrial automation.

However, its current market share is still developing, meaning it requires substantial investment to gain traction and prove its value proposition to customers. This strategic positioning highlights the need for careful resource allocation to nurture its growth.

Cognex's strategy to capture smaller and mid-sized businesses is a classic question mark play. While the total addressable market is vast, their current penetration is minimal, indicating low relative market share in a segment with high growth potential. For instance, in 2023, Cognex reported that its revenue from small and medium-sized businesses was a growing but still relatively small portion of its overall sales, highlighting the opportunity.

This initiative demands significant investment in expanding their sales teams and developing tailored marketing approaches to reach these new customer segments. The company’s 2024 capital expenditure plans reflect this increased focus on market penetration, with a notable allocation towards sales and marketing infrastructure. The outcome of this push will be crucial in determining whether these emerging customer bases mature into future Stars for Cognex.

The electric vehicle (EV) battery market represents a significant growth opportunity for machine vision, with substantial potential for applications in quality control and inspection. Cognex's own observations point to this high growth trajectory, suggesting a fertile ground for their solutions.

Despite the promising market outlook, Cognex did not meet its revenue expectations in the EV battery sector last year. This indicates that while the demand exists, the company is still in the process of establishing a stronger market presence and capturing a larger share of this burgeoning industry.

Consequently, EV battery inspection solutions fall into the Question Mark category within the BCG Matrix. This classification underscores the need for strategic and focused investment to overcome current market penetration challenges and capitalize on the substantial latent demand for advanced inspection technologies in this critical sector.

Advanced Vision for Collaborative Robotics

Cognex's advanced vision systems are crucial for the burgeoning collaborative robotics (cobot) sector. While current integration is strong, a more specialized vision approach for cobots, especially those handling intricate human-robot tasks or adaptable automation, presents a significant growth opportunity. This requires dedicated research and development to capture a larger share of this expanding market.

The cobot market is experiencing rapid expansion, with projections indicating continued robust growth. For instance, the global cobot market was valued at approximately $1.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 30% through 2030, reaching an estimated $8.2 billion by then. This presents a fertile ground for Cognex to deepen its penetration.

- Cobot Market Growth: Expected to reach $8.2 billion by 2030, with a CAGR exceeding 30% as of 2023.

- Human-Robot Interaction: Specialized vision for safer, more intuitive human-cobot collaboration is a key development area.

- Flexible Automation: Vision solutions enabling cobots to adapt to diverse and changing tasks are in high demand.

- Cognex's Opportunity: Focused R&D and market strategies can solidify Cognex's leadership in this high-growth segment.

AI-Driven Solutions for New Vertical Markets

Cognex is actively expanding into new vertical markets with its AI-powered machine vision solutions, targeting industries where automation adoption is still nascent. These new frontiers, while holding significant growth potential, represent areas where Cognex's current market penetration is minimal, demanding substantial investment in market development and customized product offerings to demonstrate value and scalability.

The company's strategy involves identifying industries ripe for automation, where their advanced AI capabilities can offer a competitive edge. For instance, in the burgeoning life sciences sector, Cognex's vision systems can be adapted for complex tasks like cell counting and pharmaceutical quality control, areas that have historically relied on manual inspection.

- Life Sciences: AI vision for quality control and process automation in drug manufacturing and medical device production.

- Food & Beverage: Enhanced inspection for product integrity, packaging defects, and fill level verification.

- Packaging: Advanced code reading and defect detection for a wider range of packaging materials and formats.

Cognex's commitment to these new verticals is underscored by their ongoing research and development, focusing on AI algorithms that can learn and adapt to the unique challenges of each industry. This approach is crucial for overcoming the initial hurdles of market acceptance and proving the return on investment for automation in these less-established sectors.

Question Marks represent areas with high growth potential but low market share, requiring significant investment to capture market opportunities. Cognex's focus on emerging sectors like electric vehicle battery inspection and collaborative robotics exemplifies this strategic positioning.

These segments, while experiencing rapid expansion, demand substantial R&D and market development efforts to establish a strong foothold. Cognex's 2024 financial outlook indicates continued investment in these high-potential but unproven markets.

The success of these ventures hinges on Cognex's ability to innovate and effectively penetrate new customer bases, transforming these Question Marks into future market leaders.

| Segment | Market Growth Potential | Cognex's Current Market Share | Strategic Focus | Investment Required |

|---|---|---|---|---|

| EV Battery Inspection | High | Low | Market penetration, tailored solutions | Significant R&D and sales expansion |

| Collaborative Robotics (Cobots) | Very High (projected $8.2B by 2030) | Developing | Specialized vision for human-robot interaction | Targeted product development |

| New Vertical Markets (e.g., Life Sciences) | High | Minimal | AI adaptation for industry-specific needs | Market development and proof-of-concept |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.