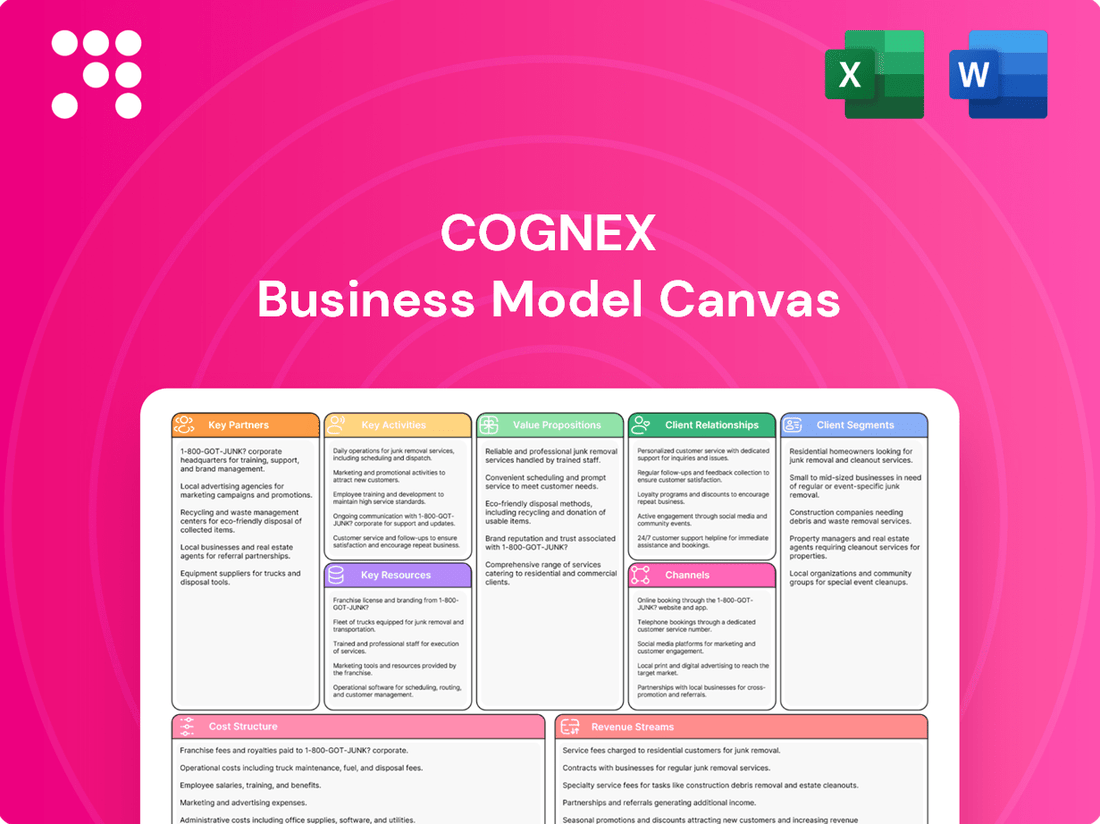

Cognex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

Curious about the engine driving Cognex's success in machine vision? Our Business Model Canvas breaks down their core customer segments, unique value propositions, and key revenue streams. Discover how they build strong customer relationships and leverage essential partnerships to maintain their competitive edge.

Unlock the full strategic blueprint behind Cognex's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cognex partners with system integrators and automation solution providers worldwide to embed its machine vision technology into larger automation projects. These collaborations are vital for reaching diverse markets and providing end-to-end solutions, particularly in intricate manufacturing and logistics settings.

These partnerships enable Cognex to offer specialized integration expertise, ensuring their vision systems seamlessly function within complex automated workflows. For instance, in 2023, Cognex reported that a significant portion of its revenue was driven by projects involving these integration partners, highlighting their critical role in market penetration and customer success.

Cognex heavily relies on its partnerships with manufacturers of cameras, optics, and other essential hardware components. These alliances are critical for guaranteeing the seamless compatibility, top-tier performance, and dependable supply chain of Cognex's advanced machine vision systems. For instance, in 2023, Cognex's revenue was $827.9 million, highlighting the scale of operations supported by these supplier relationships.

Cognex actively pursues research and development collaborations with leading academic institutions and specialized research firms. These partnerships are crucial for exploring and integrating cutting-edge AI and machine vision technologies, thereby accelerating the company's innovation pipeline. For instance, in 2024, Cognex continued to invest in university research programs focused on advanced deep learning algorithms and novel image processing techniques, aiming to enhance the core capabilities of its product offerings.

Strategic Acquisition Targets

Cognex views strategic acquisitions as crucial for bolstering its capabilities and market reach, rather than traditional ongoing partnerships. These targeted acquisitions are designed to integrate complementary technologies and expand its presence in key industrial automation sectors.

A prime example of this strategy is Cognex's acquisition of Moritex Corporation, a leader in optical solutions for machine vision. This move, completed in early 2024, significantly enhances Cognex's ability to offer integrated hardware and software solutions, particularly in high-growth areas like semiconductor inspection.

By acquiring companies like Moritex, Cognex aims to accelerate its product development cycles and gain immediate access to new technologies and customer bases. This approach directly supports its long-term growth objectives by diversifying its revenue streams and strengthening its competitive advantage.

The company's financial reports often highlight the strategic rationale behind such acquisitions, emphasizing their potential to drive future profitability and market share expansion. For instance, the Moritex acquisition was expected to contribute to revenue growth in the mid-single-digit percentage range in the initial years post-acquisition.

- Acquisition of Moritex Corporation: Completed in early 2024, this acquisition integrated advanced optical solutions into Cognex's machine vision portfolio.

- Synergistic Growth: The strategy focuses on acquiring businesses that enhance existing product lines and expand market penetration, particularly in semiconductor and electronics manufacturing.

- Technology Integration: Acquisitions aim to bring in cutting-edge technologies that complement Cognex's core machine vision expertise, enabling more comprehensive solutions.

- Long-Term Profitability: Cognex strategically targets acquisitions that are expected to contribute positively to its financial performance and market leadership over the long term.

Industry-Specific Solution Partners

Cognex collaborates with industry-specific solution partners to tailor its vision technology for unique market needs. For instance, partnerships in the logistics sector, such as with IMA E-COMMERCE, enable the co-development of specialized solutions. These collaborations directly address critical industry challenges, like optimizing sustainable order fulfillment processes, showcasing the practical impact of Cognex's innovations.

These strategic alliances are crucial for demonstrating the tangible benefits of Cognex's machine vision systems. By working with companies deeply embedded in specific industries, Cognex can refine its offerings to meet precise operational demands. This approach allows for the creation of highly effective, industry-tailored solutions that drive efficiency and address complex automation requirements.

The value of these partnerships is evident in their ability to solve real-world problems. For example, in 2024, the e-commerce boom continued to drive demand for faster, more accurate sorting and picking systems, areas where Cognex's vision solutions, enhanced by partner expertise, proved invaluable. These collaborations ensure that Cognex remains at the forefront of providing practical, high-impact automation technology across diverse industrial landscapes.

Key aspects of these industry-specific partnerships include:

- Co-development of specialized vision solutions

- Addressing unique industry challenges like sustainable logistics

- Demonstrating practical applications of Cognex technology

- Enhancing market reach through combined expertise

Cognex's key partnerships extend to system integrators and automation solution providers worldwide, crucial for embedding its machine vision technology into broader automation projects. These collaborations are vital for market penetration and delivering end-to-end solutions, especially in complex manufacturing and logistics environments.

The company also relies on strategic alliances with manufacturers of essential hardware components like cameras and optics. These relationships ensure the compatibility, performance, and supply chain reliability of Cognex's advanced systems. Furthermore, Cognex actively engages in R&D collaborations with academic institutions and research firms to integrate cutting-edge AI and machine vision technologies, accelerating innovation.

Cognex strategically utilizes acquisitions to bolster capabilities and market reach, rather than relying solely on ongoing partnerships. A prime example is the early 2024 acquisition of Moritex Corporation, a leader in optical solutions, which significantly enhances Cognex's integrated hardware and software offerings, particularly for semiconductor inspection.

These partnerships and acquisitions are critical for Cognex's growth. In 2023, Cognex reported revenue of $827.9 million, underscoring the scale of its operations and the importance of its partner ecosystem. The Moritex acquisition, for instance, was projected to contribute to mid-single-digit revenue growth in its initial years.

| Partnership Type | Key Activities | Strategic Importance | Example | Impact (Illustrative) |

|---|---|---|---|---|

| System Integrators | Embedding vision tech into automation projects | Market reach, end-to-end solutions | Worldwide automation solution providers | Drove significant revenue in 2023 projects |

| Hardware Component Suppliers | Ensuring compatibility and performance | Reliable supply chain, system dependability | Camera and optics manufacturers | Supports large-scale operations |

| R&D Collaborators | Integrating AI and advanced vision tech | Accelerating innovation pipeline | Academic institutions, research firms | Focus on deep learning algorithms in 2024 |

| Acquisitions | Integrating complementary technologies | Expanding market presence, new capabilities | Moritex Corporation (early 2024) | Expected mid-single-digit revenue growth |

| Industry-Specific Partners | Tailoring vision tech for unique needs | Solving real-world industry challenges | IMA E-COMMERCE (logistics) | Optimizing sustainable order fulfillment |

What is included in the product

A detailed breakdown of Cognex's strategy, outlining its customer segments, value propositions, and revenue streams. It provides a clear visual representation of how Cognex creates, delivers, and captures value in the machine vision market.

The Cognex Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to map out complex strategies, simplifying the identification of inefficiencies and areas for improvement.

It alleviates the pain of scattered information and unclear objectives by offering a single, visual document that aligns all key business aspects for focused problem-solving.

Activities

Cognex's commitment to Research, Development, and Engineering (RD&E) is a cornerstone of its business model. In 2023, the company strategically invested around 15% of its revenue back into RD&E, a substantial allocation aimed at fostering continuous innovation. This investment fuels the creation of cutting-edge AI and advanced rule-based technologies essential for defect detection, identification, and guidance systems.

This significant RD&E spend directly translates into product leadership and a faster pace of bringing new solutions to market. By focusing on developing next-generation platforms and enhancing existing product lines, Cognex ensures it remains at the forefront of machine vision technology, addressing evolving customer needs in areas like advanced robotics and automated quality control.

Cognex's key activities heavily revolve around designing, developing, and manufacturing high-quality machine vision systems, sensors, and barcode readers. This intricate process merges robust hardware with advanced software, enabling these products to capture and interpret visual data for automation. In 2023, Cognex reported $829.7 million in revenue, underscoring the market demand for their specialized hardware and software solutions.

The company's manufacturing focus is on precision and reliability, ensuring their equipment can withstand demanding industrial settings. This commitment to quality is crucial for machine vision components that often operate in harsh factory environments. Their investment in advanced manufacturing capabilities supports the production of these sophisticated, yet durable, industrial automation tools.

Cognex actively pursues sales and marketing to broaden its customer reach worldwide, aiming for deeper market penetration. This involves direct sales teams and targeted programs like the emerging customer initiative, designed to tap into less-served market segments. Their marketing focuses on showcasing the advantages of automation and artificial intelligence in manufacturing and logistics sectors.

Technical Support and Customer Service

Cognex's technical support and customer service are vital for the successful implementation and continued operation of its advanced machine vision systems. This involves offering comprehensive training, expert troubleshooting, and proactive maintenance to ensure clients achieve optimal performance and uptime. For instance, in 2023, Cognex reported that over 90% of its revenue was recurring, a testament to the value and reliability customers find in their ongoing support and service offerings, fostering strong, long-term relationships.

Key activities in this area focus on:

- Providing expert installation and setup assistance to ensure seamless integration of vision solutions into customer operations.

- Offering responsive troubleshooting and repair services to minimize downtime and maintain productivity.

- Delivering ongoing training and educational resources to empower users and maximize the utility of Cognex products.

- Cultivating strong customer relationships through dedicated account management and proactive communication.

Intellectual Property Management and Protection

Cognex actively manages and protects its substantial intellectual property portfolio, which is crucial for maintaining its leadership in the machine vision market. This focus on patents and proprietary technology, especially in AI-driven solutions, safeguards its competitive advantage.

By securing a robust IP position, Cognex differentiates its products and prevents others from replicating its innovations. This strategic activity is fundamental to its business model, ensuring continued market relevance and profitability.

- Patent Portfolio Strength: Cognex holds a significant number of patents, with over 1,000 granted globally by early 2024, covering core machine vision and AI technologies.

- R&D Investment: The company consistently invests heavily in research and development, with R&D expenses often exceeding 15% of revenue annually, fueling the creation of new IP.

- Competitive Differentiation: Protecting its innovations through patents allows Cognex to offer unique, high-performance solutions that are difficult for competitors to replicate, supporting premium pricing.

- Licensing and Enforcement: Cognex actively monitors the market for potential IP infringements and takes appropriate action to protect its rights, including licensing agreements where beneficial.

Cognex's key activities center on the design, development, and manufacturing of sophisticated machine vision systems, sensors, and barcode readers. These systems integrate advanced hardware with intelligent software to interpret visual data for industrial automation. The company's commitment to research and development, often exceeding 15% of revenue, fuels innovation in AI and rule-based technologies, ensuring product leadership. In 2023, Cognex generated $829.7 million in revenue, demonstrating strong market demand for these specialized solutions.

What You See Is What You Get

Business Model Canvas

The Cognex Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this professionally prepared Business Model Canvas, ready for immediate use and customization.

Resources

Cognex's proprietary AI and machine vision technologies, including its VisionPro Deep Learning software and advanced imaging techniques, form the bedrock of its intellectual property. These innovations are crucial for enabling highly precise automated inspection, identification, and guidance tasks across various industries.

The company's commitment to innovation is evident in its continuous development and patenting of new AI-powered systems, ensuring a competitive edge in the rapidly evolving machine vision market. For instance, Cognex reported that its revenue from AI-powered products grew significantly in 2023, highlighting the market's adoption of these advanced solutions.

Cognex's most critical resources are its people, especially its engineers, researchers, and sales teams. Their deep knowledge in machine vision, AI, software, and automation is the engine behind the company's innovation and customer satisfaction.

As of the close of 2024, Cognex proudly had 2,914 employees, affectionately known as 'Cognoids,' working across the globe. This talent pool is essential for developing cutting-edge automation solutions.

Cognex's global sales and distribution network, featuring direct sales offices and numerous distribution partners, is a cornerstone of its business model. This expansive reach across the Americas, Europe, and Asia ensures efficient product delivery and localized customer support, crucial for penetrating diverse international markets.

In 2023, Cognex reported a significant portion of its revenue, approximately 35%, came from the Americas, with Europe and Asia accounting for around 30% and 35% respectively, highlighting the importance of this geographically diverse network in serving its global customer base.

Manufacturing and Supply Chain Capabilities

Cognex relies on efficient manufacturing and a strong supply chain to deliver its advanced machine vision products. This involves carefully managed relationships with contract manufacturers, ensuring they meet Cognex's stringent quality standards.

Managing these external manufacturing partners and securing critical components are essential operational resources. This proactive approach guarantees that Cognex can meet customer demand with reliable, high-quality products, a crucial aspect of their business model.

- Contract Manufacturers: Cognex partners with specialized contract manufacturers to produce its hardware, allowing for scalability and focus on core competencies.

- Component Sourcing: A robust strategy for sourcing and managing the availability of key electronic components is vital to prevent production delays.

- Quality Assurance: Rigorous quality control processes are implemented throughout the manufacturing and supply chain to maintain the high performance expected of Cognex products.

- Inventory Management: Effective inventory management, both at Cognex and its manufacturing partners, ensures timely product availability for customers.

Financial Capital and Investments

Cognex's financial capital is a cornerstone of its business model, enabling robust investment in innovation and growth. As of March 30, 2025, the company reported $513 million in cash and investments. This substantial financial backing fuels critical areas such as research and development, allowing Cognex to stay at the forefront of machine vision technology.

This financial strength is not just about maintaining operations; it's a strategic asset that underpins Cognex's ability to pursue market expansion and make strategic acquisitions. The company's reserves provide the necessary capital to invest in new technologies and enter emerging markets, ensuring continued competitiveness.

- Research & Development: Funds ongoing innovation in machine vision and AI.

- Strategic Acquisitions: Enables the integration of complementary technologies and market access.

- Market Expansion: Supports entry into new geographic regions and industry verticals.

- Operational Stability: Provides a buffer for consistent performance and investment.

Cognex's intellectual property, particularly its proprietary AI and machine vision technologies, is a paramount resource. These innovations, including its VisionPro Deep Learning software, are the engine driving precise automated inspection and guidance systems across industries.

The company’s human capital, comprising skilled engineers, researchers, and sales professionals, is indispensable. Their deep expertise in AI, software, and automation fuels Cognex’s innovation and ensures customer success.

Cognex’s extensive global sales and distribution network, encompassing direct sales offices and numerous partners, is critical for market penetration and localized customer support. This network ensures efficient delivery and service worldwide.

The company’s financial resources, including substantial cash and investments, are vital for fueling research and development, strategic acquisitions, and market expansion, thereby securing its competitive position.

| Resource Category | Key Elements | Significance |

|---|---|---|

| Intellectual Property | Proprietary AI & Machine Vision Tech, VisionPro Deep Learning | Enables precise automated inspection and guidance. |

| Human Capital | Engineers, Researchers, Sales Teams | Drives innovation and customer satisfaction. |

| Distribution Network | Global Sales Offices, Distribution Partners | Facilitates market access and customer support. |

| Financial Capital | Cash & Investments (e.g., $513M as of March 30, 2025) | Funds R&D, acquisitions, and market expansion. |

Value Propositions

Cognex's vision systems and barcode readers automate critical inspection, identification, and guidance processes in factories and distribution centers. This automation directly translates to significantly faster and more efficient operations, allowing businesses to streamline their production lines. For instance, the company's solutions are instrumental in reducing manual labor, which in turn boosts overall throughput.

By automating tasks that were traditionally performed by humans, Cognex helps companies achieve substantial operational cost savings. In 2023, Cognex reported revenue of $827 million, reflecting the strong demand for automation solutions that drive productivity and efficiency across various industries.

Cognex machine vision systems deliver unparalleled inspection accuracy, spotting microscopic flaws that human eyes miss. This leads to a significant reduction in production errors and waste, directly impacting a company's bottom line. For instance, in 2024, manufacturers leveraging advanced vision systems reported an average decrease in product defects by 15%, saving millions in rework and warranty claims.

Cognex's AI-powered intelligence and adaptability transform industrial automation. Their vision systems, enhanced by deep learning, can now tackle intricate tasks and variations previously impossible for traditional machine vision. This means improved defect detection accuracy, even on challenging surfaces or with subtle anomalies. For instance, in 2024, Cognex reported strong demand for its AI-enabled solutions, highlighting their role in boosting manufacturing efficiency and quality control.

Comprehensive Data Capture and Traceability

Cognex's barcode readers and vision systems are instrumental in capturing detailed data for individual items, offering unparalleled traceability across manufacturing and distribution. This capability is vital for ensuring the integrity of supply chains, as demonstrated by the increasing demand for such solutions in industries combating product counterfeiting and diversion. For instance, the pharmaceutical sector relies heavily on this for regulatory compliance and patient safety.

This end-to-end supply chain visibility is a cornerstone for effective logistics and inventory management. By accurately tracking each item, businesses can significantly reduce errors, minimize losses, and optimize stock levels. The speed at which Cognex systems can capture and process visual information is a key differentiator, allowing for high-throughput operations without compromising accuracy.

The value proposition is further amplified by the ability to collect and analyze vast amounts of visual data in real-time. This data can be used for quality control, process optimization, and even predictive maintenance. In 2024, the global market for machine vision systems, a core component of Cognex's offerings, is projected to reach over $15 billion, underscoring the critical need for advanced data capture and traceability solutions.

- Enhanced Supply Chain Visibility: Cognex technology provides granular tracking of individual products, crucial for modern logistics and inventory control.

- Counterfeit and Loss Prevention: Robust data capture helps identify and deter counterfeit goods and prevent product loss throughout the supply chain.

- High-Speed Data Acquisition: The systems process visual information at rapid speeds, essential for high-volume manufacturing and distribution environments.

- Data-Driven Optimization: Captured visual data supports quality assurance, process improvements, and operational efficiency.

Cost Savings and Maximized Throughput

Cognex’s value proposition centers on significant cost savings and maximized throughput for its clients. By automating tasks that were previously manual and prone to human error, companies drastically reduce labor costs and scrap rates. For instance, in 2024, manufacturing sectors continued to face labor shortages and rising wages, making automation a critical factor in maintaining profitability.

Their advanced machine vision and barcode reading systems are engineered for high-speed operation. This allows businesses to process more items or perform more inspections per unit of time, effectively boosting production output without requiring additional capital investment in machinery or personnel. This efficiency gain directly translates to a healthier bottom line by optimizing operational expenses.

- Reduced Labor Costs: Automation of inspection and identification tasks lowers reliance on manual labor.

- Minimized Scrap and Rework: Improved accuracy in defect detection and part identification prevents costly errors.

- Increased Production Speed: High-speed processing capabilities enable higher throughput for assembly lines.

- Optimized Resource Utilization: Maximizing output with existing infrastructure enhances overall operational efficiency.

Cognex's value proposition is built on delivering substantial operational efficiencies and cost reductions for its clients. By automating critical inspection, identification, and guidance tasks, businesses can significantly cut down on labor expenses and reduce errors that lead to scrap or rework. This focus on automation directly enhances productivity, allowing companies to achieve higher output with their existing resources.

The company's advanced vision systems and barcode readers ensure a high degree of accuracy, often surpassing human capabilities in detecting subtle defects. This precision minimizes production errors, leading to fewer rejected products and lower warranty claims. For instance, Cognex’s solutions are vital for industries where quality control is paramount, such as automotive and electronics manufacturing.

Cognex's AI-powered systems offer adaptability, enabling them to handle complex and varied inspection tasks that traditional automation struggles with. This enhanced intelligence means improved defect detection, even on challenging surfaces or with slight variations in product appearance. In 2024, the demand for these intelligent automation solutions has surged as manufacturers seek to boost both quality and efficiency.

The core of Cognex's offering lies in its ability to provide granular, item-level data capture and traceability. This is crucial for supply chain integrity, helping to combat counterfeiting and product diversion. The pharmaceutical and electronics sectors, for example, rely heavily on this for regulatory compliance and brand protection.

| Value Proposition | Key Benefit | Impact |

|---|---|---|

| Enhanced Operational Efficiency | Automation of manual tasks | Increased throughput, reduced cycle times |

| Improved Quality Control | High-accuracy defect detection | Reduced scrap, lower warranty costs |

| Cost Reduction | Minimized labor dependency, less rework | Significant savings in operational expenses |

| Supply Chain Visibility | Item-level tracking and data capture | Improved inventory management, loss prevention |

Customer Relationships

Cognex prioritizes direct sales and technical engagement with its industrial clientele, fostering robust relationships through dedicated sales and engineering teams. This approach ensures expert consultation and the development of customized solutions, understanding intricate customer requirements for complex automation challenges.

In 2024, Cognex continued to emphasize this direct model, with its sales and support personnel actively engaging with manufacturers across various sectors. This direct interaction is crucial for addressing the evolving needs in areas like quality control and logistics, where precise vision system integration is paramount.

The company's commitment to technical expertise builds trust, enabling them to provide specialized support that drives the adoption of advanced machine vision technologies. This hands-on approach is a cornerstone of their customer relationship strategy.

Cognex cultivates enduring customer bonds through consistent technical assistance, crucial product enhancements, and a dedication to ongoing improvement. This commitment ensures clients fully leverage their Cognex automation investments and remain agile amidst shifting manufacturing landscapes.

The company positions itself as a steadfast ally across the entire lifespan of its automation solutions, fostering loyalty and repeat business. In 2023, Cognex reported that over 80% of its revenue came from existing customers, highlighting the success of its long-term partnership strategy.

Cognex offers extensive training and educational resources designed to ensure customers can maximize the value of their machine vision solutions. This focus on customer enablement means users can more easily set up and deploy Cognex systems, significantly cutting down on implementation time and associated costs.

By providing clear guidance and accessible learning materials, Cognex empowers its clients to leverage the full potential of their investments. This is particularly crucial with advanced technologies like AI-powered vision, where education plays a key role in simplifying adoption and driving successful integration into production lines.

Dedicated Customer Experience Initiatives

Cognex is deeply invested in providing an exceptional customer experience, aiming to simplify the adoption and implementation of advanced machine vision technologies. Their commitment is evident in initiatives like the OneVision cloud platform, which streamlines the creation, training, and scaling of AI-driven vision applications for manufacturers.

- OneVision Platform: Designed to democratize AI vision development, making it accessible to a wider range of users.

- Customer Support: Cognex emphasizes comprehensive support to ensure successful deployment and ongoing operation of their solutions.

- Ease of Use: A core tenet is making complex machine vision easy to integrate and manage, reducing the technical barrier for customers.

- Industry Leadership: By focusing on customer experience, Cognex aims to solidify its position as a leader in the machine vision market.

Feedback Integration and Product Co-development

Cognex actively solicits customer feedback, a crucial element in their product development cycle. This engagement helps them understand evolving industry needs and pain points. For instance, in 2024, Cognex continued to leverage user forums and direct customer consultations to inform their roadmap for vision systems.

Through co-development initiatives, Cognex partners with key clients to create tailored solutions. This collaborative process ensures that new technologies directly address specific manufacturing or logistics challenges. A notable example from 2024 involved working with a major automotive manufacturer to refine an inspection system for critical components, leading to improved defect detection rates.

This focus on customer-centric innovation allows Cognex to stay ahead of market demands. By integrating feedback and co-developing products, they ensure their offerings are not just advanced but also directly applicable and valuable in real-world scenarios. This approach directly contributes to their market relevance and customer loyalty.

- Customer Feedback Loops: Cognex utilizes surveys, user groups, and direct client interactions to gather insights on product performance and desired features.

- Co-development Projects: Strategic partnerships with select customers in 2024 focused on creating specialized vision solutions for emerging applications.

- Market Responsiveness: Feedback integration directly influences product updates and new feature releases, ensuring alignment with industry requirements.

- Enhanced Customer Satisfaction: Collaborative development and responsive product refinement lead to higher adoption rates and stronger client relationships.

Cognex's customer relationships are built on a foundation of direct engagement, technical expertise, and a commitment to long-term partnership. This strategy, evident in 2024, involves dedicated sales and engineering teams working closely with clients to develop customized automation solutions. The company also prioritizes customer enablement through extensive training and educational resources, exemplified by their OneVision platform, which simplifies AI vision development.

This customer-centric approach fosters strong loyalty, with over 80% of Cognex's revenue in 2023 stemming from existing customers. Their proactive solicitation of feedback and co-development projects, such as a 2024 collaboration with an automotive manufacturer, ensure their products remain relevant and address specific industry challenges, reinforcing their market leadership.

| Key Customer Relationship Aspect | Description | 2024 Focus/Example |

| Direct Sales & Technical Support | Expert consultation and customized solutions | Active engagement by sales and engineering teams |

| Customer Enablement | Training and educational resources | OneVision platform for AI vision development |

| Customer Loyalty | Long-term partnerships and repeat business | Over 80% of 2023 revenue from existing customers |

| Feedback Integration & Co-development | Incorporating client input into product development | Automotive manufacturer collaboration for inspection system refinement |

Channels

Cognex leverages a global direct sales force to connect with major industrial customers. This team excels at offering tailored solutions and overseeing intricate project rollouts.

This direct channel fosters immediate customer engagement, enabling thorough product demonstrations and detailed technical conversations. It proves especially valuable for high-ticket, customized offerings.

In 2023, Cognex reported that its direct sales channel was instrumental in securing significant deals, contributing to its overall revenue growth. The company's investment in its direct sales force underscores its commitment to providing expert support for complex automation challenges.

Cognex's extensive global network of authorized distributors and system integrators is a cornerstone of its market strategy. This network effectively extends Cognex's reach, allowing them to serve a broader customer base, especially smaller and regional businesses that might otherwise be difficult to access directly. These partners are vital for providing localized sales, technical support, and crucial on-site services, ensuring customers receive timely and expert assistance.

These partners are instrumental in the successful deployment of Cognex's advanced machine vision solutions. They handle the intricate installation, precise configuration, and ongoing maintenance of Cognex products, integrating them seamlessly into larger industrial automation systems. This deep integration capability is key to delivering complete solutions that meet diverse customer needs and drive wider market penetration for Cognex's technologies.

Cognex leverages its corporate website and dedicated product pages as a cornerstone of its online presence, acting as a vital informational hub for potential customers. This digital platform is meticulously designed to educate visitors, offering in-depth product details, comprehensive technical specifications, and compelling case studies that showcase the practical applications of their solutions. In 2023, Cognex reported that its website traffic saw a significant increase, with a substantial portion of leads originating from digital channels, underscoring the effectiveness of their online strategy.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for Cognex to exhibit its cutting-edge machine vision and barcode reading solutions. These events provide a direct avenue to demonstrate product capabilities and engage with a broad spectrum of potential clients and collaborators. For instance, participation in major events like Automate 2024 allows for significant visibility and direct customer interaction.

These platforms are crucial for unveiling new technologies and fostering relationships within the automation sector. Cognex leverages these gatherings to solidify its market presence and gather valuable market intelligence.

- Showcase Innovations: Cognex uses trade shows to present its latest advancements in machine vision and barcode reading technology.

- Customer Engagement: Events offer direct interaction opportunities with potential customers, allowing for product demonstrations and feedback collection.

- Market Visibility: Participation in key industry events, such as Automate 2024, enhances brand recognition and market penetration.

- Partnership Development: Conferences facilitate networking with potential channel partners and technology collaborators.

Partner Portals and Collaboration Platforms

Cognex leverages dedicated online partner portals and collaboration platforms to foster seamless integration and sales of its automation solutions. These digital hubs offer partners access to crucial resources, including product documentation, marketing collateral, and technical training modules. This structured approach ensures partners are proficient in demonstrating and implementing Cognex technologies.

These platforms are designed to streamline the entire partnership lifecycle, from onboarding to ongoing support. By providing a centralized repository for information and communication, Cognex empowers its channel partners to effectively represent its brand and deliver high-quality customer experiences. This focus on partner enablement is critical for expanding market reach and driving sales growth.

The effectiveness of these platforms is underscored by the increasing reliance on digital tools for business operations. For instance, in 2024, the global partner relationship management (PRM) market was projected to reach over $1.5 billion, indicating a strong trend towards digital collaboration and resource management within partner ecosystems.

- Resource Hub: Provides partners with up-to-date product information, sales enablement materials, and marketing assets.

- Training & Certification: Offers online courses and certification programs to enhance partner expertise in Cognex solutions.

- Collaboration Tools: Facilitates communication and project management between Cognex and its partners.

- Performance Tracking: Enables partners to monitor their sales performance and access support for deal registration.

Cognex's channels are multifaceted, combining direct sales for major accounts with a robust network of distributors and system integrators to reach a broader market. Online platforms and industry events further amplify their reach and engagement.

The direct sales force is crucial for high-value, complex solutions, while the partner network ensures accessibility for smaller businesses and provides localized support. Digital channels and trade shows serve to educate, engage, and build brand presence.

This integrated approach allows Cognex to effectively serve diverse customer segments and maintain a strong position in the industrial automation market.

| Channel | Description | Key Role | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Global team for major industrial clients | Tailored solutions, complex project oversight | Secured significant deals; investment in expert support |

| Distributors & System Integrators | Extensive global network | Market reach expansion, localized sales & support | Vital for deploying advanced solutions, integration capabilities |

| Corporate Website | Online informational hub | Product education, technical details, case studies | Significant website traffic increase; leads originating from digital channels |

| Industry Trade Shows & Conferences | Exhibition of solutions, networking | Product demonstrations, relationship building, market intelligence | Key events like Automate 2024 provide visibility and interaction |

| Online Partner Portals | Digital collaboration platforms | Resource access, training, streamlined partnership lifecycle | Growing reliance on PRM market (projected >$1.5B in 2024) |

Customer Segments

The logistics and e-commerce sector, encompassing distribution centers, parcel warehouses, and online marketplaces, relies heavily on Cognex's automated solutions for high-speed, efficient operations and comprehensive supply chain visibility. These businesses leverage Cognex for automated tracking, precise sorting, and robust package integrity checks. In 2024, logistics represented Cognex's most significant market, with projections indicating it will also be the fastest-growing segment.

The automotive industry represents a substantial and enduring customer base for Cognex. Machine vision is integral across the entire vehicle production process, from precise component measurement and robotic arm guidance to meticulous quality checks. This deep integration underscores the critical role Cognex's technology plays in modern automotive manufacturing.

Despite a current softening in certain areas, notably within electric vehicle (EV) battery production investments, the automotive sector continues to be a cornerstone market for Cognex. In 2024, the automotive industry's reliance on automation and quality control remains high, driving demand for advanced vision solutions.

Consumer electronics manufacturers, such as those producing smartphones and tablets, are a key customer segment for Cognex. These companies require highly precise vision systems for inspecting small, intricate components and ensuring defect-free assembly during high-volume production runs. For instance, the global smartphone market shipped approximately 1.17 billion units in 2023, highlighting the immense scale and need for efficient quality control.

The demand for Cognex's solutions in this sector is driven by the need for speed and accuracy to maintain product quality and minimize scrap rates. Manufacturers often face seasonal peaks in production, particularly around holiday seasons, which can influence revenue patterns for their suppliers. In 2024, the consumer electronics industry is expected to see continued growth, with a particular focus on advancements in mobile technology, further emphasizing the need for sophisticated inspection capabilities.

Semiconductor Industry

The semiconductor industry relies heavily on Cognex's machine vision systems for essential operations. These systems are crucial for tasks like identifying individual wafers, inspecting for defects, and precisely guiding the assembly of microelectronic components. The industry's stringent requirements for accuracy and reliability make Cognex's advanced machine vision and AI solutions particularly sought after.

This vital sector demonstrated robust growth for Cognex. For instance, in 2024, Cognex reported significant revenue increases driven by demand from semiconductor manufacturers. This trend continued into Q1 2025, with the company highlighting the ongoing strength of its semiconductor segment in its financial reports.

- Wafer Identification and Tracking: Ensuring each wafer is correctly identified and its process history is maintained.

- Defect Inspection: Detecting microscopic flaws on wafers and chips that could impact performance.

- Precision Assembly Guidance: Assisting robotic systems in the accurate placement of tiny components.

- Semiconductor Market Growth: Cognex's semiconductor revenue saw a notable year-over-year increase in 2024, continuing into early 2025.

General Factory Automation (Diverse Manufacturing)

This segment covers a wide array of manufacturers producing discrete items, from everyday consumer goods and critical medical devices to food and beverages. Virtually any factory can leverage Cognex's machine vision to enhance both product quality and operational efficiency. For instance, in 2024, the global market for industrial vision systems was projected to reach approximately $10 billion, with factory automation being a primary driver.

- Diverse Industries: Encompasses consumer products, medical devices, and food & beverage manufacturing.

- Efficiency Gains: Machine vision offers significant improvements in production line speed and accuracy.

- Quality Assurance: Essential for detecting defects and ensuring product consistency across diverse manufacturing.

- Broad Applicability: Cognex's solutions are adaptable to nearly any discrete manufacturing process.

Cognex's customer segments are diverse, spanning key industrial and technological sectors. The logistics and e-commerce industry, representing Cognex's largest market in 2024, relies on its solutions for high-speed tracking and sorting. The automotive sector, a consistent major customer, utilizes Cognex for quality control and robotic guidance throughout production. Consumer electronics manufacturers, driven by the massive global smartphone market, depend on Cognex for precise inspection of intricate components. The semiconductor industry, a significant growth area for Cognex in 2024, uses its vision systems for wafer identification and defect detection.

The discrete manufacturing segment, covering everything from consumer goods to medical devices, also benefits greatly from Cognex's technology, with the industrial vision systems market projected to reach $10 billion in 2024.

| Customer Segment | Key Applications | 2024 Market Significance |

|---|---|---|

| Logistics & E-commerce | Automated tracking, high-speed sorting, package integrity | Largest market, fastest growing |

| Automotive | Component measurement, robotic guidance, quality checks | Substantial and enduring base |

| Consumer Electronics | Inspection of small components, defect detection | Driven by high-volume production (e.g., 1.17 billion smartphones shipped in 2023) |

| Semiconductor | Wafer identification, defect inspection, precision assembly | Robust growth, significant revenue increases reported in 2024 |

| Discrete Manufacturing (General) | Product quality enhancement, operational efficiency | Broad applicability across industries (e.g., medical, food & beverage) |

Cost Structure

Cognex dedicates a substantial portion of its resources to Research, Development, and Engineering (RD&E), underscoring its focus on innovation and technological advancement. In 2024, these costs amounted to roughly $140 million, which was 15% of the company's revenue. This significant investment is vital for creating new products and improving current offerings.

Cognex's cost structure heavily relies on its Sales, Marketing, and Service Expenses. These are critical for driving growth and maintaining customer loyalty in the competitive automation technology market.

The company incurs significant costs related to its global sales force, extensive marketing campaigns, and ongoing customer acquisition efforts. Furthermore, providing robust technical support is a substantial investment, essential for customer satisfaction and retention.

These expenditures are fundamental to expanding Cognex's market reach, attracting new clients, and nurturing existing customer relationships. In 2024, Cognex employed 1,586 individuals dedicated to these vital sales, marketing, and service functions.

Cognex's cost of revenue for manufacturing and supply chain encompasses the direct expenses tied to creating their machine vision systems. This includes essential components like raw materials, the labor involved in production, and factory overhead. For 2024, Cognex reported a gross margin of 68.4%, which directly reflects the efficiency of managing these production and supply chain costs relative to their sales revenue.

General and Administrative Expenses

General and Administrative Expenses are the essential overhead costs that keep Cognex running smoothly. These include vital corporate functions like finance, human resources, legal support, and information technology. While Cognex is committed to managing its costs carefully, these expenses are fundamental for the company's overall operation and governance.

These overhead costs are crucial for maintaining the structure and compliance of the business. In 2024, Cognex saw its operating expenses rise by 9%. This increase was driven by strategic investments in expanding sales coverage, integrating recent acquisitions, and enhancing incentive compensation programs to motivate its workforce.

- Corporate Functions: Finance, HR, Legal, IT are covered.

- Cost Management: Cognex prioritizes disciplined cost control.

- 2024 Increase: Operating expenses grew 9%.

- Drivers of Growth: Sales coverage, acquisitions, and incentives fueled the rise.

Acquisition-Related Costs and Amortization

Strategic acquisitions, like the purchase of Moritex Corporation, bring substantial upfront expenses and require the ongoing amortization of intangible assets. These financial commitments directly influence Cognex's overall cost structure and its profitability metrics.

These acquisition-related costs are a key component of Cognex's cost structure, impacting the bottom line through amortization. For example, in the third quarter of 2024, Cognex recorded $2 million in amortization of intangible assets specifically linked to the Moritex acquisition.

- Strategic Acquisitions: Significant upfront investments are made for acquiring companies, impacting cash flow and balance sheets.

- Amortization of Intangible Assets: Costs associated with acquired goodwill and intellectual property are expensed over their useful lives, affecting net income.

- Impact on Profitability: These expenses reduce reported profits, necessitating careful financial planning and analysis of acquisition ROI.

- Q3 2024 Moritex Impact: The $2 million amortization charge highlights the immediate financial consequence of strategic growth through acquisition.

Cognex's cost structure is built around significant investments in innovation, sales, and operations. RD&E spending in 2024 was approximately $140 million, representing 15% of revenue, to fuel product development. The cost of revenue, reflecting manufacturing and supply chain efficiency, contributed to a 68.4% gross margin in 2024.

Sales, Marketing, and Service expenses are crucial for market expansion and customer retention, with 1,586 employees dedicated to these functions in 2024. General and Administrative costs, including essential corporate operations, saw a 9% increase in operating expenses in 2024 due to strategic investments.

Strategic acquisitions, such as Moritex, introduce additional costs like amortization of intangible assets, with $2 million recorded in Q3 2024 for this purpose.

| Cost Category | 2024 Data Point | Significance |

| RD&E Expenses | ~$140 million (15% of revenue) | Drives innovation and new product development. |

| Gross Margin | 68.4% | Reflects efficiency in manufacturing and supply chain costs. |

| Sales, Marketing, & Service Personnel | 1,586 employees | Supports market reach, customer acquisition, and retention. |

| Operating Expense Growth | 9% increase | Fueled by sales expansion, acquisitions, and incentives. |

| Amortization of Intangible Assets (Moritex) | $2 million (Q3 2024) | Impacts profitability from strategic acquisitions. |

Revenue Streams

Cognex's main income source is selling complete machine vision systems. These systems blend hardware and software, designed for intricate inspection and guidance jobs in factories. For instance, in 2023, Cognex reported revenue of $827.5 million, with a significant portion stemming from these integrated solutions.

These sophisticated systems are implemented across many sectors to boost automation and ensure product quality. Industries like automotive, electronics, and consumer goods rely on them for tasks ranging from defect detection to robot guidance, contributing to Cognex's overall financial performance.

Cognex generates revenue by selling machine vision sensors, particularly those that are straightforward to implement for tasks like error-proofing or confirming the presence or absence of components. These sensors are crucial for manufacturers seeking to automate quality control and assembly processes.

Products such as the In-Sight SnAPP Vision Sensor exemplify this revenue stream, offering an accessible entry point into machine vision for many businesses. For instance, in 2023, Cognex reported that its Machine Vision Systems segment, which includes these sensors, saw significant demand, contributing substantially to its overall financial performance.

Cognex's sales of industrial barcode readers represent a foundational revenue stream, critical for automation in manufacturing and logistics. These devices are the backbone of identification and tracking systems within warehouses and production lines.

The introduction of advanced AI-powered readers, such as the DataMan 290 and 390 series, is designed to bolster this segment. These newer models offer improved performance and versatility, catering to increasingly complex automated identification needs.

In 2024, Cognex reported strong performance in its Machine Vision Systems segment, which includes barcode readers, highlighting the continued demand for these essential automation tools. This segment is a primary driver of the company's overall financial results.

Software Licenses and Upgrades

Cognex generates revenue by licensing its sophisticated proprietary vision software, such as VisionPro and OneVision. These licenses are crucial for customers seeking to leverage advanced functionalities and cutting-edge AI-powered tools within their operations.

Beyond initial licensing, the company also earns income through providing regular software upgrades. These upgrades ensure customers have access to the latest features and performance enhancements, maintaining the value proposition of Cognex's software solutions.

- Software Licenses: Provides access to Cognex's core vision processing and analysis capabilities.

- Software Upgrades: Offers continuous improvement and new feature sets for existing software installations.

- AI-Powered Tools: Licenses include access to advanced artificial intelligence and machine learning functionalities for enhanced vision tasks.

Service and Support Contracts

Cognex generates recurring revenue through ongoing service and support contracts. These agreements, which cover essential maintenance, prompt technical assistance, and specialized training, are crucial for ensuring customers achieve the best possible performance and extended lifespan from their Cognex solutions.

In 2023, Cognex reported approximately $147 million in revenue from its service and support segments, highlighting the significance of this revenue stream. This ongoing commitment to customer success not only fosters loyalty but also provides a predictable income base.

- Recurring Revenue: Service and support contracts provide a stable, predictable revenue stream.

- Customer Success: These services ensure optimal performance and longevity of deployed solutions.

- 2023 Performance: Service and support contributed around $147 million to Cognex's revenue in 2023.

- Customer Retention: Strong support enhances customer satisfaction and encourages long-term relationships.

Cognex's revenue is primarily driven by the sale of integrated machine vision systems, which combine hardware and software for complex factory automation tasks. The company also generates income from selling individual machine vision sensors, often used for simpler applications like error-proofing. In 2023, Cognex reported total revenue of $827.5 million, with these hardware and software solutions forming the core of their sales.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

| Machine Vision Systems | Complete integrated hardware and software solutions. | Significant portion of $827.5M total revenue. |

| Machine Vision Sensors | Individual sensors for simpler automation tasks. | Contributes to Machine Vision Systems segment. |

| Software Licenses & Upgrades | Proprietary vision software and ongoing updates. | Key for advanced AI and AI-powered tools. |

| Service & Support Contracts | Maintenance, technical assistance, and training. | Approximately $147 million in 2023. |

Business Model Canvas Data Sources

The Cognex Business Model Canvas is built upon a foundation of internal sales data, customer feedback, and product development roadmaps. These sources provide a comprehensive view of our current operations and future strategic direction.