Cognex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

Navigate the complex external forces shaping Cognex's trajectory with our meticulously researched PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with the strategic foresight needed to thrive in this dynamic market. Download the full PESTLE analysis now and unlock actionable intelligence for your business.

Political factors

Governments worldwide are actively encouraging industrial automation and smart factory adoption through financial incentives, grants, and supportive policies. For instance, the United States' CHIPS and Science Act of 2022, while focused on semiconductor manufacturing, also bolsters automation investments in related industries. This governmental push directly benefits Cognex by increasing demand for its machine vision systems as businesses upgrade their operations.

Fluctuating international trade policies, including tariffs and trade agreements, significantly impact Cognex's global supply chain and market access. For example, new tariffs can increase the cost of components or finished goods, affecting profitability and pricing strategies.

Cognex has noted efforts to mitigate the direct cost impact of tariffs currently in effect in 2025, suggesting a proactive approach to these political challenges. This highlights the company's focus on adapting to a dynamic trade landscape.

Geopolitical tensions, such as ongoing conflicts and trade disputes, pose a significant risk to Cognex's global operations. These instabilities can disrupt the flow of goods, impacting manufacturing and delivery schedules, particularly as supply chain disruptions were a notable concern throughout 2024 and are projected to persist into 2025.

For a company like Cognex, which relies on a worldwide network for production and sales, regional instabilities directly translate to increased operational risks and can dampen investor confidence in key manufacturing regions. A stable geopolitical climate is therefore essential for predictable production, efficient distribution, and encouraging the long-term capital investments needed for automation advancements.

AI and Data Regulation Development

The global push for AI and data regulation, exemplified by the EU AI Act slated for enforcement in 2025 and emerging US state-level legislation, presents a significant factor for Cognex. These evolving rules directly shape how Cognex designs, develops, and deploys its AI-driven machine vision solutions, demanding adherence to principles of transparency, accountability, and robust data privacy. Navigating this complex regulatory environment is crucial for maintaining compliance and mitigating potential penalties, impacting product development timelines and market access.

The implications for Cognex are multifaceted:

- Compliance Costs: Implementing necessary changes to meet AI and data privacy standards, such as GDPR and the upcoming EU AI Act, can lead to increased research and development expenses.

- Market Access: Non-compliance with regional AI regulations could restrict Cognex's ability to sell its products in key markets, potentially impacting revenue streams.

- Product Design: Future product iterations will likely need to incorporate built-in ethical AI frameworks and enhanced data security measures from the outset.

- Competitive Landscape: Companies that proactively adapt to these regulations may gain a competitive advantage by building trust and demonstrating responsible AI practices.

Industrial Policy Revival and Reshoring

The global push for industrial policy revival and reshoring is a significant political factor influencing Cognex. Concerns around national security and economic resilience are driving manufacturing back to developed nations, creating fertile ground for automation solutions like those Cognex provides. This trend is particularly relevant as companies seek to offset increased labor costs associated with domestic production.

This reshoring movement is projected to gain momentum through 2025, fueled by ongoing trade volatility and geopolitical uncertainties. For instance, the U.S. Department of Commerce's initiatives aimed at strengthening domestic supply chains, particularly in critical sectors like semiconductors, directly encourage the adoption of advanced manufacturing technologies. Cognex's machine vision systems are essential for enabling the high-precision, automated processes required for these reshoring efforts.

- Reshoring Trend: A significant portion of companies surveyed in late 2024 indicated plans to increase domestic manufacturing presence over the next two years.

- Automation Demand: The need to maintain cost competitiveness in reshoring efforts is driving a projected 15% year-over-year increase in demand for automation solutions in North America by 2025.

- Government Incentives: Policies offering tax credits or subsidies for domestic manufacturing investment directly support the adoption of technologies like machine vision.

Governmental support for automation, exemplified by initiatives like the US CHIPS Act, directly boosts demand for Cognex's machine vision systems as industries modernize.

Evolving AI and data regulations, such as the EU AI Act effective in 2025, necessitate compliance adjustments in Cognex's product development and deployment, impacting costs and market access.

Geopolitical instability and supply chain disruptions, a persistent concern through 2024 and into 2025, increase operational risks for Cognex's global network.

The reshoring trend, driven by national security and economic resilience, is projected to increase automation demand, with North America anticipating a 15% year-over-year rise in automation solutions by 2025.

| Political Factor | Impact on Cognex | Supporting Data/Trend (2024-2025) |

| Government Incentives for Automation | Increased demand for machine vision systems | US CHIPS Act supporting automation investment; Projected 15% YoY automation demand increase in North America by 2025 |

| AI & Data Regulation | Compliance costs, market access considerations, product design changes | EU AI Act enforcement in 2025; Need for transparency and data privacy in AI solutions |

| Geopolitical Instability & Trade Policies | Supply chain disruption, increased operational risks, tariff impacts | Persistent supply chain concerns through 2024-2025; Mitigation efforts for tariff costs noted |

| Reshoring & Industrial Policy | Growth in demand for automation in domestic manufacturing | Companies planning increased domestic manufacturing presence (late 2024); Need for automation to maintain cost competitiveness |

What is included in the product

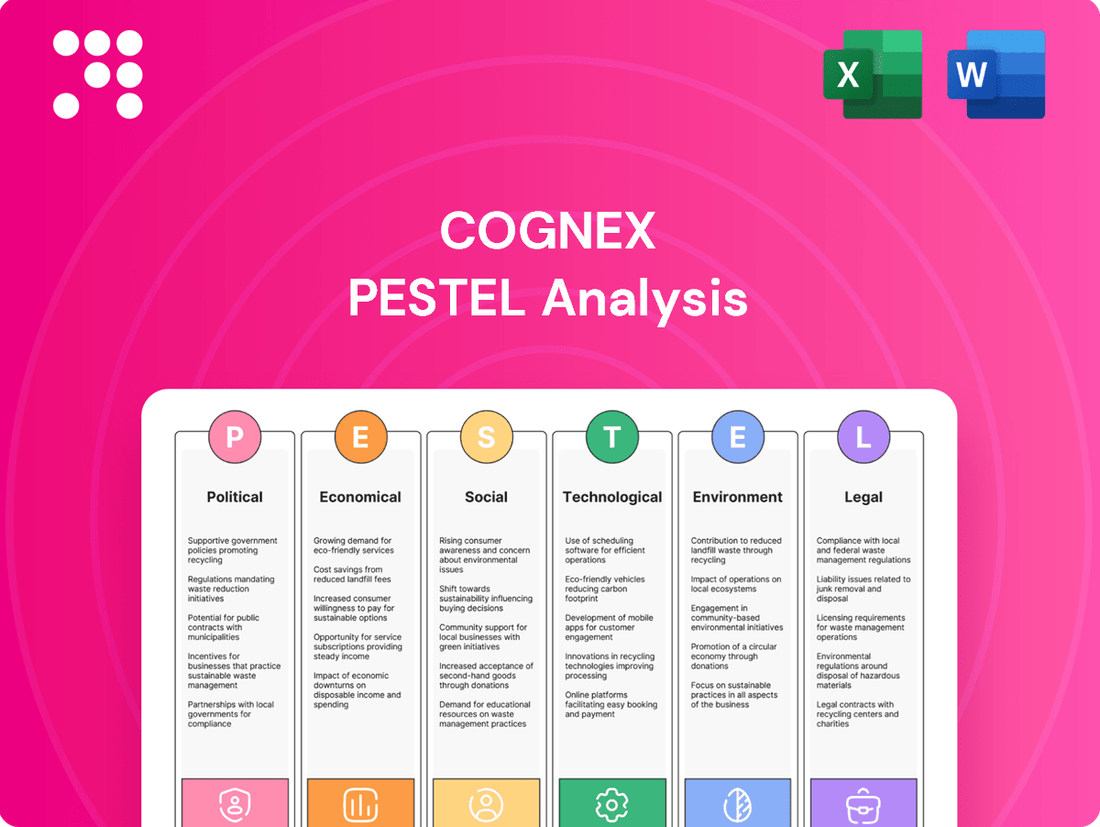

This Cognex PESTLE analysis meticulously examines the six macro-environmental forces—Political, Economic, Social, Technological, Environmental, and Legal—that impact the company's operations and strategic direction.

Provides a clear, actionable breakdown of external factors, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

The global economic climate is a significant driver for Cognex, as manufacturers, their core clientele, tend to increase capital expenditure when the economy is robust. A healthy global economy directly translates to higher demand for industrial automation and machine vision solutions.

While the machine vision market saw a dip in 2024, projections indicate a rebound into growth territory for 2025. This aligns with broader trends in industrial automation, which is expected to exhibit strong growth in the coming years, with some forecasts suggesting a compound annual growth rate (CAGR) of over 10% for the industrial automation market through 2030.

When businesses feel confident about future economic conditions, they are more inclined to invest in technologies that boost efficiency and productivity, such as Cognex's machine vision systems. This positive economic outlook is crucial for driving adoption of automation solutions.

Persistent inflation and rising material and labor costs continue to impact Cognex's operational expenses and influence customer spending on capital equipment. While inflation has shown signs of moderating by mid-2025, underlying cost pressures persist, potentially increasing the appeal of Cognex's efficiency-driving machine vision solutions for manufacturers looking to optimize operations.

Cognex's financial performance in Q4 2024 reflected these cost pressures, with the company reporting an increase in operating expenses. This highlights the direct impact of higher input costs on the company's profitability and operational efficiency.

Interest rate shifts directly impact the cost of capital for companies like Cognex, influencing their decisions on investing in advanced automation. When interest rates are low, borrowing becomes cheaper, making substantial capital expenditures on new technologies more attractive.

Conversely, rising interest rates can make financing automation projects more expensive, potentially leading companies to postpone or scale back such investments. For instance, if the Federal Reserve maintains its hawkish stance through 2024 and into 2025, this could dampen enthusiasm for large-scale tech upgrades.

The anticipation of falling interest rates in 2025, however, could serve as a catalyst, encouraging manufacturers to accelerate their adoption of digital and automation solutions, thereby boosting demand for Cognex's offerings.

Supply Chain Disruptions and Costs

Ongoing global supply chain vulnerabilities, including rising freight prices and persistent material shortages, continue to present significant challenges for manufacturers worldwide. For instance, the Drewry World Container Index saw a notable increase in early 2024, reflecting elevated shipping costs. Cognex, as a provider of machine vision and barcode reading technology essential for manufacturing processes, is directly impacted by these disruptions, experiencing potential delays in component sourcing.

However, Cognex's solutions are also instrumental in helping its customers navigate these very issues. By enabling greater automation and quality control on production lines, Cognex’s technology can reduce reliance on manual labor, which is often subject to availability issues, and improve overall operational efficiency. This dual impact highlights Cognex's position within the evolving manufacturing landscape.

The undeniable need for enhanced supply chain visibility and resilience is a key driver for increased adoption of automation technologies. As businesses strive to better track inventory, monitor production, and ensure product quality in the face of disruptions, demand for Cognex's advanced sensing and identification systems is expected to grow. Reports from 2024 indicate a strong upward trend in industrial automation investments as companies prioritize supply chain robustness.

- Rising Freight Costs: Global shipping rates, particularly for containerized freight, remained elevated throughout much of 2023 and into early 2024, impacting the cost of components and finished goods.

- Material Shortages: Key electronic components and raw materials continued to experience sporadic shortages in 2024, affecting production schedules for many industries.

- Automation as a Solution: The drive for supply chain resilience is fueling increased investment in automation, with Cognex's products directly addressing this demand by improving efficiency and visibility.

Labor Cost Increases and Shortages

Rising labor costs and persistent skilled labor shortages are compelling businesses, particularly in manufacturing, to accelerate automation adoption. In 2024, the U.S. Bureau of Labor Statistics reported average hourly earnings for production and non-supervisory employees in manufacturing rose by 4.5% year-over-year, a significant factor driving this shift. Companies like Cognex are seeing increased demand for their machine vision and barcode reading systems as they help bridge workforce gaps and enhance operational efficiency.

The trend of seeking automation solutions to mitigate labor challenges is projected to intensify through 2025. Manufacturers are actively investing in technologies that can perform tasks previously done by human workers, thereby reducing their dependency on manual labor and boosting overall productivity. This strategic pivot is crucial for maintaining competitiveness in a dynamic global market.

- Increased Wage Pressures: Average hourly earnings for production and non-supervisory employees in manufacturing saw a 4.5% increase in 2024, impacting operational budgets.

- Skilled Labor Gaps: Persistent shortages of skilled workers across industries necessitate the implementation of automated solutions to maintain production levels.

- Automation as a Solution: Machine vision and robotics are increasingly viewed as essential tools to address workforce deficits and improve operational throughput.

- Future Investment: Continued economic pressures and labor market dynamics are expected to fuel further investment in automation technologies through 2025.

The economic outlook significantly influences manufacturing investment, with robust economies driving demand for Cognex's automation solutions. While the machine vision market experienced a dip in 2024, forecasts point to a rebound and strong growth through 2025, mirroring the broader industrial automation sector's projected CAGR exceeding 10% by 2030.

Persistent inflation and rising costs in 2024 impacted Cognex's operational expenses and customer spending, though moderating inflation by mid-2025 may increase the appeal of efficiency-boosting solutions. Interest rate hikes in 2024 could temper automation investments, but anticipated rate decreases in 2025 may spur adoption.

Supply chain disruptions, including elevated freight costs seen in early 2024 and material shortages, continue to challenge manufacturers. Cognex's technology aids customers in mitigating these issues by enhancing automation and quality control, reducing reliance on manual labor.

Labor shortages and rising wages, with manufacturing wages up 4.5% year-over-year in 2024, are accelerating automation adoption. Cognex's solutions are in demand to address workforce gaps and boost productivity, a trend expected to intensify through 2025.

| Economic Factor | 2024 Impact/Trend | 2025 Outlook | Cognex Relevance |

| Global Economic Growth | Mixed, with some regions showing resilience | Projected moderate growth, boosting manufacturing capex | Higher demand for automation solutions |

| Inflation & Costs | Persistent, impacting operational expenses and customer budgets | Moderating but underlying cost pressures remain | Increased demand for efficiency-driving tech |

| Interest Rates | Potential for continued higher rates impacting borrowing costs | Anticipation of rate decreases stimulating investment | Lower rates encourage capital expenditure on automation |

| Supply Chain Stability | Vulnerabilities persist, with elevated freight costs and shortages | Gradual improvement expected, but resilience remains key | Demand for visibility and control solutions |

| Labor Market | Tight labor market and rising wages driving automation needs | Continued pressure for automation to offset shortages | Solutions to bridge workforce gaps and improve productivity |

Preview the Actual Deliverable

Cognex PESTLE Analysis

The preview you see here is the exact Cognex PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cognex.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The manufacturing sector is rapidly evolving, with automation and AI becoming standard. This shift demands a workforce equipped with advanced skills, driving a need for continuous upskilling. For instance, a 2024 report indicated that 85% of manufacturing jobs will require new skills by 2030 due to technological advancements.

While automation raises concerns about job displacement, it also creates opportunities for more secure, higher-skilled roles. By embracing new technologies, workers can become more productive and address persistent labor shortages. This trend positions companies like Cognex to play a crucial role in customer workforce development by providing the necessary training and tools.

Public perception of AI and automation is a critical factor for Cognex. As of early 2024, surveys indicate a growing, albeit cautious, acceptance of automation in manufacturing, with many consumers recognizing its potential for increased efficiency and product quality. However, concerns about job displacement and data privacy remain significant, influencing how regulators and the public view companies like Cognex.

Cognex's strategy must address these societal views head-on. By highlighting how its machine vision and AI solutions enhance worker safety and create new, higher-skilled roles, the company can build trust. For instance, Cognex's systems are often implemented to take over repetitive or dangerous tasks, thereby improving the overall work environment, a point that resonates well with a public increasingly focused on ethical business practices.

Aging populations in developed economies, such as Japan where the median age was 48.6 years in 2023, are leading to significant skilled labor shortages in manufacturing sectors. This demographic trend directly fuels the demand for automation solutions like Cognex's machine vision systems, which can undertake repetitive or physically taxing jobs. These technologies are crucial for extending the productive lifespan of the current workforce and mitigating the impact of fewer younger workers entering these fields.

Demand for Product Quality and Traceability

Consumers and businesses are increasingly focused on product quality and want to know where their goods come from. This means companies need to ensure their products are consistent and can be tracked from start to finish. For example, in 2024, the global food traceability market was valued at approximately $2.5 billion and is expected to grow significantly as consumers demand more transparency.

Machine vision systems, like those offered by Cognex, are essential tools for meeting these demands. They can perform highly accurate inspections and identify products with great precision, ensuring that quality standards are met at every stage. Cognex's solutions are vital for quality assurance and inspection, helping manufacturers verify product integrity and compliance.

This societal push for better quality directly fuels the market for Cognex's technologies. As more industries prioritize defect detection and supply chain visibility:

- Increased consumer awareness of product safety and origin is driving demand for traceable goods.

- Industries like automotive and electronics are implementing stricter quality control measures, requiring advanced inspection capabilities.

- The global market for industrial machine vision is projected to reach over $16 billion by 2027, with quality inspection being a primary driver.

- Cognex's expertise in automated inspection and identification directly addresses these growing needs for reliable product quality and supply chain accountability.

Safety and Ergonomics in the Workplace

The increasing emphasis on workplace safety and ergonomics, particularly in manufacturing, is a significant driver for automation adoption. This trend directly benefits companies like Cognex, whose machine vision systems are integral to creating safer industrial settings. For instance, in 2024, reports indicated a 7% decrease in manufacturing workplace injuries in the US compared to the previous year, partly due to increased automation and safety protocols.

Cognex's solutions contribute to this by enabling automated hazard identification and real-time process monitoring. They also facilitate the safe integration of robots working alongside human operators. This collaborative robotics trend is expected to grow substantially, with the global market for cobots projected to reach $10.5 billion by 2027, up from an estimated $2.1 billion in 2022.

- Worker Safety Focus: Growing regulatory and societal pressure for safer workplaces is a key sociological factor.

- Ergonomic Improvements: Enhancing worker comfort and reducing strain through automation directly addresses ergonomic concerns.

- Automation as a Solution: Machine vision and robotics are increasingly seen as tools to achieve higher safety standards.

- Human-Robot Collaboration: Enabling robots to work safely with people is a direct response to the need for both productivity and human well-being.

Societal expectations for ethical business practices and corporate responsibility are growing. Consumers and employees alike are increasingly scrutinizing companies for their impact on communities and the environment. This means businesses like Cognex must demonstrate a commitment to social good, fair labor practices, and sustainable operations to maintain a positive public image and attract talent.

The demand for transparency in supply chains is also a significant sociological factor. Customers want to know where their products come from and how they are made, pushing manufacturers to adopt more robust tracking and quality control systems. For example, by early 2024, over 70% of consumers reported that transparency about product origins influenced their purchasing decisions.

Cognex's machine vision technology directly supports these societal trends by enabling precise product identification and quality inspection. This ensures that manufacturers can meet consumer demands for high-quality, traceable goods, thereby enhancing brand trust and loyalty.

Technological factors

The rapid evolution of AI and deep learning is a significant technological factor for Cognex, powering more sophisticated and user-friendly machine vision solutions. By integrating these advancements, Cognex is enhancing its product capabilities, making them more adaptable to complex industrial challenges and improving overall customer satisfaction.

Cognex has already demonstrated this by launching products that utilize next-generation AI Transformer models. This strategic move allows them to tackle more intricate use cases, such as defect detection in challenging lighting conditions or complex assembly verification, thereby expanding their market reach and competitive edge.

Looking ahead, these ongoing AI advancements are expected to continue driving innovation within Cognex's product portfolio. For instance, the company's investment in AI research and development is crucial for maintaining leadership in the burgeoning machine vision market, which is projected to grow substantially in the coming years.

The accelerating adoption of Industry 4.0 and the Internet of Things (IoT) is fundamentally reshaping manufacturing, demanding intelligent, interconnected operations. Cognex's machine vision systems are central to this transformation, acting as sophisticated sensors that capture critical visual data. This data fuels real-time analytics, enables predictive maintenance, and drives significant improvements in overall factory efficiency.

Cognex's ability to seamlessly integrate with cloud and edge computing platforms is paramount for realizing the full potential of Industry 4.0. For instance, in 2024, the global IoT market was projected to reach over $1.5 trillion, with manufacturing being a key growth driver. Cognex's solutions facilitate the ingestion and processing of vast amounts of visual data at the edge, allowing for immediate decision-making and enhanced operational agility.

The expanding use of collaborative robots, or cobots, and sophisticated robotics in manufacturing facilities directly benefits machine vision companies like Cognex. These intelligent machines require precise guidance for tasks such as picking items, assembling components, and performing quality checks, and Cognex's vision systems are critical for this.

By integrating Cognex's technology, cobots can operate with greater accuracy and enhanced safety, even when working alongside human employees. The cobot market is anticipated to see substantial expansion, with projections indicating continued strong growth through 2025, creating a robust demand for the vision solutions that enable their advanced capabilities.

Miniaturization and Cost Reduction of Components

The relentless progress in miniaturizing and reducing the cost of essential components like cameras, sensors, and processors is a significant technological driver. This makes sophisticated machine vision systems more affordable and easier to implement across various industries. For instance, the cost of image sensors has seen a consistent decline, with CMOS sensor prices dropping by an estimated 10-15% annually in recent years, making them accessible for a broader array of devices.

This trend directly benefits companies like Cognex by lowering the barrier to entry for businesses of all sizes. Smaller enterprises can now adopt advanced automation solutions that were previously cost-prohibitive. This expanded accessibility significantly broadens the potential market for Cognex's offerings, particularly in the growing area of embedded vision systems where compact and cost-effective solutions are paramount.

Key impacts include:

- Increased Adoption: Lower component costs accelerate the adoption of machine vision in sectors like small-scale manufacturing, logistics, and even consumer electronics.

- Expanded Addressable Market: Cognex can now target a wider customer base, including small and medium-sized businesses (SMBs) that previously found machine vision solutions too expensive.

- Innovation in Embedded Vision: The availability of smaller, cheaper, and more powerful components fuels innovation in embedded vision, allowing for integration into a greater variety of products and machinery.

Cybersecurity of Connected Systems

As manufacturing systems increasingly integrate AI and IoT, the need for strong cybersecurity for industrial control systems and data integrity becomes paramount. Cognex must prioritize securing its products against cyber threats, as breaches in connected supply chains can result in substantial financial and reputational harm.

The global cybersecurity market is projected to reach $300 billion by 2025, underscoring the critical nature of this challenge. For Cognex, this means ensuring its machine vision and barcode reading solutions, often deployed in critical infrastructure and production lines, are resilient to attacks.

- Increased Attack Surface: The proliferation of connected devices in manufacturing environments expands the potential entry points for cyberattacks.

- Data Integrity Risks: Compromised systems can lead to inaccurate data, impacting production quality, supply chain visibility, and AI-driven decision-making.

- Operational Disruption: Cyberattacks on industrial control systems can halt production, causing significant downtime and financial losses.

- Reputational Damage: A security breach can erode customer trust and damage Cognex's reputation as a reliable technology provider.

The continuous advancement in Artificial Intelligence and deep learning is a core technological factor for Cognex, enabling more sophisticated machine vision capabilities. These advancements allow Cognex to offer solutions that are more adaptable to complex industrial environments, enhancing product performance and customer value.

Cognex's integration of AI, particularly in areas like Transformer models, allows for improved defect detection and intricate assembly verification, expanding their market appeal. The company's commitment to AI research is vital for maintaining its leadership in the growing machine vision sector, which is expected to see significant expansion through 2025.

The increasing prevalence of Industry 4.0 and the Internet of Things (IoT) necessitates intelligent, connected manufacturing processes. Cognex's vision systems are integral to this, acting as data-gathering sensors that support real-time analytics and operational improvements. The global IoT market, with manufacturing as a key driver, was projected to exceed $1.5 trillion in 2024, highlighting the demand for such integrated solutions.

The growth of collaborative robots (cobots) in manufacturing creates a strong demand for precise guidance systems, which Cognex's machine vision provides. These systems enhance cobot accuracy and safety, particularly in human-robot collaboration. The cobot market is forecast for substantial growth through 2025, further boosting demand for enabling vision technologies.

Declining costs and miniaturization of components like cameras and sensors make advanced machine vision more accessible. For example, CMOS sensor prices have seen annual declines of 10-15% in recent years, lowering the barrier for smaller businesses to adopt automation. This trend broadens Cognex's market reach, especially for embedded vision applications.

The increasing connectivity in manufacturing environments, driven by Industry 4.0, heightens the importance of cybersecurity. Cognex must ensure its products are secure against cyber threats, as breaches could lead to significant financial and reputational damage. The global cybersecurity market is expected to reach $300 billion by 2025, emphasizing the critical need for robust security measures.

| Technological Factor | Impact on Cognex | Supporting Data/Trends (2024-2025) |

|---|---|---|

| AI & Deep Learning Advancements | Enhanced product capabilities, new use cases, competitive edge. | Integration of Transformer models; AI R&D crucial for market leadership. |

| Industry 4.0 & IoT Adoption | Vision systems as key data sensors for analytics and efficiency. | Global IoT market projected over $1.5 trillion in 2024; manufacturing is a key growth area. |

| Cobot & Robotics Growth | Enabling precise guidance for automated tasks, increasing demand. | Cobot market expected strong growth through 2025. |

| Component Miniaturization & Cost Reduction | Increased accessibility, broader market reach, innovation in embedded vision. | CMOS sensor prices declining 10-15% annually; benefits SMBs. |

| Cybersecurity Needs | Requirement for secure products to prevent data integrity and operational risks. | Global cybersecurity market projected to reach $300 billion by 2025. |

Legal factors

Strict data privacy and security regulations, like the EU Data Act effective September 2025 and evolving US state laws, directly influence Cognex's operations and customer data handling. These laws mandate strong data protection measures, clear communication about data usage, and adherence to consent protocols, particularly for AI-powered systems. For instance, the California Consumer Privacy Act (CCPA) grants consumers rights over their personal data, impacting how visual data containing personal information can be collected and processed.

Intellectual property (IP) protection is paramount for Cognex, a company heavily reliant on its proprietary machine vision algorithms, AI models, and hardware innovations. Strong patent laws are vital to shield its competitive edge from infringement, encouraging ongoing investment in research and development. For instance, in 2023, Cognex reported significant R&D expenditures, underscoring the importance of safeguarding these investments.

Product liability and safety standards are critical for Cognex, especially as its machine vision systems become more embedded in automated manufacturing. Failure to meet stringent safety requirements could lead to accidents and significant legal repercussions. For instance, in 2024, the global industrial automation market, where Cognex operates, was valued at over $80 billion, highlighting the scale of potential liability.

As AI capabilities within machine vision advance, ensuring these systems adhere to evolving industrial safety standards is paramount. This includes rigorous testing and validation to prevent malfunctions that could cause harm. The increasing complexity of AI-driven automation means that regulatory bodies are scrutinizing these technologies more closely, impacting compliance costs and product development timelines.

International Trade Compliance and Export Controls

Cognex's global reach means it must meticulously navigate international trade compliance and export controls. These regulations, particularly for advanced technologies like AI-powered vision systems, determine market access and sales channels. Failure to comply can result in significant penalties and restricted business opportunities.

The evolving landscape of export controls, especially concerning dual-use technologies and artificial intelligence, presents ongoing challenges. For example, the United States Department of Commerce's Bureau of Industry and Security (BIS) continually updates its Export Administration Regulations (EAR), impacting the sale of sophisticated automation and AI components to various countries. In 2023, the BIS continued to focus on strengthening export controls for emerging technologies, which directly affects companies like Cognex that develop cutting-edge vision systems.

- Export Administration Regulations (EAR): Cognex must ensure its products, especially those with AI capabilities, comply with the EAR, which governs the export and re-export of commercial items that could be used for military or proliferation purposes.

- Sanctions and Embargoes: Adherence to sanctions imposed by governments and international bodies is critical, preventing sales to restricted entities or countries.

- End-User and End-Use Controls: Cognex needs to verify that its advanced vision systems are not being diverted for unauthorized military or sensitive applications, a key component of export control compliance.

- Customs and Import/Export Declarations: Accurate declarations are essential for smooth cross-border movement of goods, avoiding delays and legal issues.

Antitrust and Competition Laws

Cognex, as a significant entity in the machine vision sector, must meticulously adhere to antitrust and competition regulations. These laws are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2024, regulatory bodies globally continue to scrutinize large technology firms for potential anti-competitive behavior, which could impact Cognex's strategic decisions regarding market share and pricing.

The company’s approach to mergers and acquisitions is also subject to these regulations. Any significant acquisition would likely undergo review to ensure it does not unduly stifle competition. Similarly, pricing strategies must be carefully managed to avoid accusations of predatory pricing or collusion, which could lead to substantial fines and reputational damage. As of early 2025, the focus on fair competition remains a priority for antitrust enforcers worldwide.

- Market Share Scrutiny: Regulatory bodies monitor companies like Cognex to prevent excessive market dominance that could harm smaller competitors.

- Merger and Acquisition Oversight: Any proposed acquisitions by Cognex will be evaluated for their potential impact on market competition.

- Pricing Practices: Cognex must ensure its pricing strategies are competitive and do not engage in anti-competitive behavior.

- Global Regulatory Landscape: Adherence to varying antitrust laws across different international markets is crucial for Cognex's operations.

Data privacy laws, such as the EU Data Act effective September 2025, directly impact how Cognex handles customer data, especially with its AI-powered systems. These regulations necessitate robust data protection measures and transparent data usage policies, a critical consideration given the increasing volume of visual data processed.

Cognex's reliance on proprietary technology makes intellectual property laws essential for protecting its competitive advantage. The company's significant R&D investments, reported in 2023, highlight the need for strong patent protection to safeguard its innovations and encourage further development.

Product liability and safety standards are paramount for Cognex, particularly as its machine vision systems integrate into automated manufacturing. Ensuring compliance with stringent safety requirements is vital to prevent accidents and mitigate legal risks in a market valued at over $80 billion in 2024.

Navigating international trade and export controls is crucial for Cognex's global operations. Regulations like the Bureau of Industry and Security's (BIS) updated Export Administration Regulations (EAR) in 2023 directly affect the sale of advanced AI components, requiring careful adherence to prevent penalties and market access restrictions.

Environmental factors

Governments worldwide are tightening environmental regulations, pushing manufacturers to reduce their carbon footprint and energy usage. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting manufacturing processes significantly. This trend directly influences how Cognex's clients allocate capital, prioritizing investments that enhance sustainability.

Cognex's machine vision technology plays a crucial role in helping manufacturers meet these new environmental standards. By enabling precise quality control, these systems minimize material defects and scrap, thereby reducing waste. Furthermore, optimized production lines facilitated by vision systems can lead to lower energy consumption per unit produced. In 2024, companies are increasingly seeking solutions that offer both operational efficiency and environmental benefits, a demand Cognex is well-positioned to meet.

Cognex's operations are significantly influenced by evolving e-waste management and product lifecycle regulations. These rules often mandate extended producer responsibility, meaning Cognex must consider the environmental impact of its products from design through disposal. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, which was updated in recent years, places stringent requirements on manufacturers for collection and recycling.

Compliance necessitates designing products for easier disassembly and material recovery, a challenge given the complexity of Cognex's vision systems and industrial automation hardware. The company must invest in developing more sustainable materials and processes, ensuring that its products can be efficiently recycled or safely disposed of at the end of their useful life to meet global environmental standards.

Cognex is facing increasing pressure from investors, consumers, and regulators to showcase robust Environmental, Social, and Governance (ESG) practices. This means a growing emphasis on sustainable operations, ethical sourcing within their supply chain, and clear reporting on environmental impact. For instance, in 2024, many institutional investors are actively screening companies based on their ESG scores, with a significant portion of assets under management now tied to ESG criteria, influencing capital allocation towards more responsible businesses.

Resource Scarcity and Supply Chain Resilience

Growing concerns over resource scarcity, particularly for critical materials like semiconductors, are pushing manufacturers to seek greater efficiency. This trend directly benefits companies like Cognex, whose machine vision and AI-powered solutions are designed to optimize production processes. For instance, by enabling precise component placement and defect detection, Cognex's technology can significantly reduce material waste.

Cognex's vision systems play a crucial role in enhancing the environmental resilience of supply chains. By improving accuracy and reducing errors on the factory floor, these systems help minimize scrap rates. For example, in the electronics manufacturing sector, where miniaturization is key, even small improvements in yield can translate to substantial savings in raw materials and reduced environmental impact. This focus on efficiency aligns with broader industry goals to lessen reliance on potentially strained natural resources.

The increasing emphasis on sustainability and circular economy principles further amplifies the value proposition of Cognex's offerings. Manufacturers are actively looking for ways to reduce their environmental footprint, and technologies that enable better resource management are in high demand. Cognex's ability to provide real-time quality control and process optimization directly supports these efforts, making their solutions integral to building more resilient and environmentally responsible operations.

Consider these points regarding resource scarcity and supply chain resilience:

- Reduced Waste: Cognex's vision systems can decrease scrap rates in manufacturing by up to 30%, conserving valuable raw materials.

- Optimized Material Usage: By ensuring precise component placement and quality checks, Cognex solutions minimize the need for rework and material reprocessing.

- Supply Chain Security: Enhancing operational efficiency and reducing reliance on virgin materials contributes to greater supply chain stability in the face of resource volatility.

- Sustainability Goals: Cognex technology directly supports corporate sustainability targets by enabling more efficient use of energy and materials throughout the production lifecycle.

Climate Change Adaptation in Industrial Operations

Climate change presents significant challenges for industrial operations, with extreme weather events and shifting resource availability directly impacting manufacturing and supply chains. For instance, the World Meteorological Organization reported that in 2023, global average temperatures were approximately 1.45°C above pre-industrial levels, highlighting the increasing frequency of disruptive weather. These shifts necessitate greater operational resilience and adaptability.

Cognex's vision systems and automation solutions play a crucial role in helping factories navigate these environmental pressures. By enhancing efficiency and enabling more flexible production lines, these technologies empower manufacturers to adapt to changing conditions. For example, improved quality control through machine vision can reduce waste, a key factor in resource conservation. The company's focus on smart manufacturing directly supports the transition to more sustainable industrial practices.

The broader implications extend to supply chain robustness. Disruptions from climate-related events, such as floods or droughts affecting raw material sourcing, can halt production. Cognex's ability to optimize logistics and inventory management through automated tracking and data analysis contributes to building more resilient supply networks. This adaptability is increasingly vital as businesses prepare for a future marked by climate volatility.

Cognex's contribution to climate adaptation in industry can be seen through:

- Enhanced efficiency: Reducing energy consumption and material waste in manufacturing processes.

- Supply chain visibility: Improving tracking and management to mitigate disruptions caused by extreme weather.

- Process optimization: Enabling factories to adapt production more quickly to changing resource availability or environmental regulations.

- Waste reduction: Minimizing defects through precise automated inspection, leading to less scrap and more sustainable output.

Environmental regulations are increasingly shaping manufacturing, pushing for reduced waste and energy consumption. Cognex's machine vision technology directly addresses this by minimizing defects and optimizing production, leading to lower scrap rates and energy usage per unit.

Resource scarcity, particularly for critical components, is driving demand for efficiency. Cognex's solutions, by improving precision and reducing rework, conserve valuable materials and enhance supply chain stability.

Climate change necessitates greater operational resilience. Cognex's automation and vision systems boost factory efficiency and adaptability, helping businesses navigate disruptions from extreme weather and shifting resource availability.

The company's commitment to sustainability is also reflected in its product lifecycle management, adhering to e-waste regulations like the WEEE directive by designing for easier disassembly and material recovery.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of public and proprietary data, ensuring comprehensive coverage of real-world business conditions. We integrate insights from leading market research firms, government statistical agencies, and reputable industry publications to provide a robust understanding of the macro-environment.