Campari Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Campari Group boasts a powerful global brand portfolio and a strong presence in the booming aperitivo market, showcasing significant strengths. However, potential weaknesses in supply chain management and reliance on key markets could pose challenges.

Want the full story behind Campari's impressive brand equity, its potential vulnerabilities, and the opportunities in emerging markets? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Campari Group's strength lies in its extensive and premium brand portfolio, featuring over 50 well-recognized names such as Campari, Aperol, and Grand Marnier. This broad selection allows the company to appeal to a wide array of consumer tastes and market niches, mitigating risks associated with over-dependence on any single product. The strategic acquisition of Courvoisier in 2024 significantly bolstered their standing in the high-end spirits market.

Campari Group's robust global distribution network is a significant strength, allowing them to effectively reach consumers across diverse international markets. This established infrastructure is key to building strong brand recognition and solidifying their market presence in various regions.

The company's international market penetration is further evidenced by the double-digit growth observed in their global travel retail (GTR) sales during 2024. This performance highlights the effectiveness of their strategies in engaging international consumers and expanding their global footprint.

Campari Group demonstrated remarkable resilience throughout 2024, navigating a landscape marked by significant macroeconomic and geopolitical instability. Despite these headwinds, the company achieved positive financial results, notably outperforming many of its industry peers.

This ability to maintain solid top-line growth in a demanding environment underscores the strength of Campari's business fundamentals and the efficacy of its management strategies. For instance, the company reported a 7.4% organic net sales growth in the first nine months of 2024, a testament to its operational agility.

Such resilience is a critical strength, suggesting that Campari is well-positioned to weather future market fluctuations and capitalize on emerging opportunities, even when the broader economic climate is challenging.

Focus on High-Growth Categories

Campari Group strategically focuses on high-growth beverage categories, notably aperitifs and tequila. This focus is a significant strength, aligning the company with evolving consumer tastes and market trends. For instance, Aperol continues its upward trajectory, and Espolòn Tequila has become a powerhouse, achieving the status of Campari's largest brand in the United States by the end of 2024.

This alignment with trending preferences is a key driver of sales and market share expansion. The company's commitment to these dynamic segments positions it for sustained growth and increased profitability in the coming years.

- Aperitif Dominance: Brands like Aperol are at the forefront of the booming aperitif trend.

- Tequila Strength: Espolòn Tequila's rapid ascent highlights success in the high-demand tequila market.

- U.S. Market Leadership: Espolòn's 2024 performance made it Campari's top U.S. brand, demonstrating strong market penetration.

- Consumer Alignment: Portfolio choices directly tap into consumer desires for premium and trending spirits.

Strategic Acquisitions for Market Expansion

Campari Group has a proven track record of successful strategic acquisitions, significantly bolstering its market presence and brand portfolio. The 2024 acquisition of Courvoisier, a premium cognac brand, and the 2022 purchase of Wilderness Trail Distillery, a burgeoning bourbon producer, exemplify this strategy. These moves have not only broadened Campari's offerings but also solidified its position in crucial, high-growth spirits categories, particularly within the United States market.

These acquisitions are designed to unlock substantial synergies, allowing for cross-selling opportunities and operational efficiencies across the expanded group. By diversifying its product range, Campari mitigates risks associated with over-reliance on specific categories or markets. This strategic expansion enhances the company's overall leverage and competitive standing in the global spirits industry.

- Strategic Acquisitions: Courvoisier (2024), Wilderness Trail Distillery (2022).

- Market Expansion: Strengthened presence in key markets, notably the U.S.

- Portfolio Diversification: Broadened offerings in premium spirits segments.

- Synergy Creation: Aimed at cross-selling and operational efficiencies.

Campari Group's robust global distribution network is a significant strength, enabling effective reach across diverse international markets and solidifying brand recognition. This infrastructure was key to their double-digit growth in global travel retail (GTR) sales during 2024, underscoring their international market penetration.

The company's strategic focus on high-growth categories like aperitifs and tequila is a major advantage. Aperol continues its strong performance, and Espolòn Tequila became Campari's largest brand in the U.S. by the end of 2024, demonstrating excellent alignment with evolving consumer preferences and driving market share expansion.

Campari's resilience was evident in 2024, with positive financial results despite macroeconomic instability. The company reported 7.4% organic net sales growth in the first nine months of 2024, showcasing operational agility and a strong ability to outperform peers in challenging environments.

Successful strategic acquisitions, such as Courvoisier in 2024 and Wilderness Trail Distillery in 2022, have significantly enhanced Campari's market presence and brand portfolio, particularly in the U.S. These moves diversify offerings and strengthen their position in premium spirits segments.

| Key Strength | Supporting Data (2024/Early 2025) | Impact |

| Brand Portfolio | Over 50 premium brands including Aperol, Grand Marnier, Courvoisier. | Broad consumer appeal, reduced single-product risk. |

| Global Distribution | Double-digit growth in GTR sales. | Effective international market penetration and brand building. |

| Category Focus | Espolòn Tequila became largest U.S. brand. Aperol continues strong growth. | Alignment with trending consumer preferences, driving sales. |

| Financial Resilience | 7.4% organic net sales growth (first 9 months 2024). | Outperformance amidst economic headwinds, operational strength. |

| Acquisition Strategy | Courvoisier acquisition (2024). | Strengthened premium portfolio and U.S. market position. |

What is included in the product

Analyzes Campari Group’s competitive position through key internal and external factors, highlighting its strong brand portfolio and global reach while acknowledging potential market saturation and economic sensitivities.

Highlights Campari's competitive advantages and potential threats, enabling targeted strategies to mitigate risks and capitalize on opportunities.

Weaknesses

Campari Group faced a notable profitability challenge in 2024, reporting a 39% decrease in net profit. This downturn was exacerbated by a substantial charge related to a cost containment initiative spanning three years, which also contributed to a 3.7% dip in adjusted profit.

Increased selling, general, and administrative expenses are also putting pressure on the company's financial performance. These rising costs are directly impacting Campari's EBIT margin, signaling a need for careful cost management and operational efficiency improvements moving forward.

Campari faces considerable risk from potential US tariffs, especially a 25% import duty on goods originating from Mexico, Canada, and Europe. This could significantly impact its bottom line.

The company has projected a negative financial impact ranging from €90 million to €100 million due to these tariffs. The immediate effect is anticipated to be around €35 million in 2025, highlighting the near-term pressure.

This tariff uncertainty creates a challenging environment for Campari’s future profitability, making strategic planning and cost management crucial.

Campari faced headwinds in specific markets during 2024, with the Asia-Pacific region experiencing a revenue decline. This downturn was particularly pronounced in key markets like India, South Korea, and Australia, indicating localized challenges impacting overall performance.

The company's rum portfolio also encountered difficulties, largely attributed to supply constraints. This issue directly affected the House of Whiskeys and Rum segment, which saw a 6% decrease in performance, with the Wild Turkey brand notably under pressure.

Impact of Acquisition-Related Financial Strain

The significant US$1.32 billion acquisition of Courvoisier in late 2023 has undeniably placed a strain on Campari Group's financial resources. This large outlay, coupled with the potential for overpayment, creates a considerable debt burden that needs careful management.

Adding to these pressures, recent market dynamics have proven challenging. A reported slowdown in Cognac sales within the crucial US market, a key revenue driver, directly impacts the profitability of the acquired asset. Furthermore, existing Chinese trade barriers present an ongoing obstacle to robust international sales performance for brands like Courvoisier.

- Financial Strain: The US$1.32 billion Courvoisier acquisition increases Campari's debt load.

- Market Headwinds: A slowdown in US Cognac sales is impacting profitability.

- Trade Barriers: Chinese trade restrictions continue to hinder sales growth for key brands.

Dependence on Aperitifs for Growth

Campari Group's significant reliance on its House of Aperitifs, spearheaded by Aperol, presents a notable weakness. While this segment has been a powerful engine for growth, contributing substantially to overall sales, an overdependence creates vulnerability. Should consumer preferences evolve away from aperitifs or if competitive pressures within this niche intensify, Campari could face challenges if its other product categories do not exhibit comparable growth trajectories.

This concentration risk is underscored by recent performance trends. For instance, in the first half of 2024, the aperitifs category continued to be a primary growth driver for the group. However, this success also highlights the potential impact of any slowdown in this specific market segment on the company's broader financial health.

- Over-reliance on Aperol: Aperol's strong performance, while positive, concentrates growth drivers.

- Vulnerability to trend shifts: A decline in aperitif popularity could disproportionately impact Campari.

- Diversification challenge: Growth in other categories needs to offset potential aperitif market saturation or decline.

Campari's profitability faced a significant hit in 2024, with net profit dropping by 39% and adjusted profit declining by 3.7%, partly due to a three-year cost containment initiative. Rising selling, general, and administrative expenses are also squeezing EBIT margins, necessitating a sharp focus on cost control.

The company is exposed to substantial risk from potential US tariffs, with a projected negative financial impact of €90 million to €100 million, including an estimated €35 million in 2025. This tariff uncertainty creates a challenging outlook for future profitability.

Campari experienced revenue declines in the Asia-Pacific region during 2024, particularly in India, South Korea, and Australia. Additionally, supply constraints impacted its rum portfolio, leading to a 6% decrease in the House of Whiskeys and Rum segment, with Wild Turkey brands facing pressure.

The acquisition of Courvoisier for US$1.32 billion in late 2023 has increased Campari's debt burden, coupled with concerns about overpayment. This is compounded by a slowdown in US Cognac sales and existing Chinese trade barriers, which hinder international sales for brands like Courvoisier.

Campari's significant reliance on its House of Aperitifs, particularly Aperol, represents a key weakness. While this segment has been a strong growth driver, over-dependence makes the company vulnerable to shifts in consumer preferences or increased competition within the aperitif market.

Same Document Delivered

Campari Group SWOT Analysis

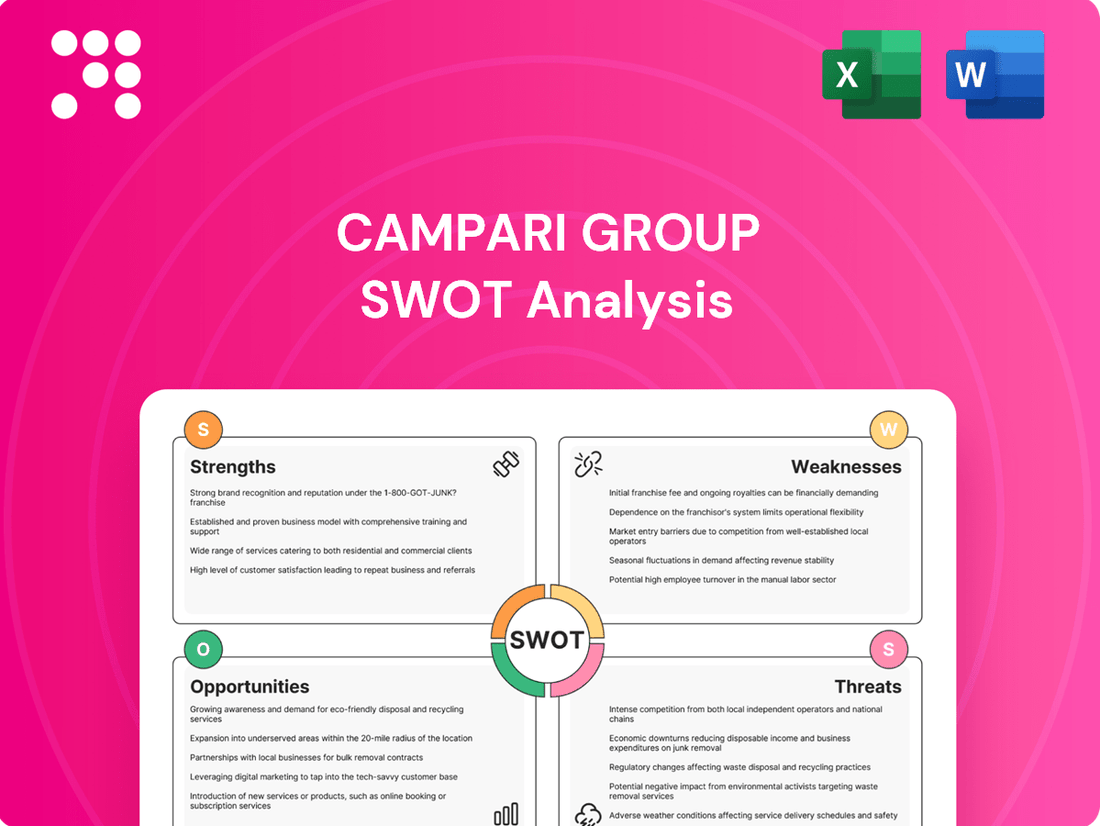

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing Campari Group's key strengths, weaknesses, opportunities, and threats.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, offering a comprehensive understanding of Campari Group's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, detailing all aspects of Campari Group's strategic landscape.

Opportunities

The global spirits market is increasingly seeing consumers opt for premium and super-premium offerings, a trend known as premiumization. This shift means people are more inclined to spend on higher-quality, craft, and distinctive spirits. For instance, Euromonitor International projected the premium spirits segment to grow at a compound annual growth rate (CAGR) of 4.5% globally between 2023 and 2028, reaching an estimated value of over $250 billion.

Campari Group is strategically positioned to benefit from this movement, given its strong portfolio of established premium and super-premium brands. The company's focus aligns with the consumer desire for 'less but better' experiences, particularly in high-growth categories such as tequila and whiskey. Campari's recent performance, with its premium brands driving significant revenue growth in 2024, underscores its ability to leverage this evolving consumer preference.

The ready-to-drink (RTD) cocktail market is booming, with consumers increasingly seeking convenient, high-quality options. This surge in demand, particularly for pre-mixed beverages, offers Campari Group a prime opportunity to expand its footprint in this dynamic segment. For instance, the global RTD market was valued at approximately $27.5 billion in 2023 and is projected to grow significantly, reaching an estimated $75 billion by 2032, according to some market analyses.

Campari can capitalize on this trend by leveraging its strong portfolio of established brands to develop innovative RTD products. This expansion allows for broader market reach, especially through convenient retail channels like convenience stores, catering to the modern consumer's lifestyle and preference for on-the-go enjoyment.

Emerging economies like India, China, Brazil, and Mexico are poised to be significant growth engines for the beverage alcohol sector. These regions are experiencing a demographic shift with a growing young adult population and an expanding middle class, creating a fertile ground for increased consumption.

Campari Group can capitalize on this trend by tailoring its premium and innovative product offerings to the evolving tastes of consumers in these burgeoning markets. For instance, the premiumization trend in India's spirits market, which saw a notable uptick in 2023, presents a direct opportunity for Campari's portfolio.

Leveraging E-commerce and Digital Platforms

The alcohol e-commerce market is booming, presenting a prime opportunity for Campari Group to boost sales and connect with consumers. This digital channel allows for direct engagement and expanded reach, especially as online purchasing habits continue to solidify. In 2024, the global online alcohol sales were projected to reach over $160 billion, a figure expected to climb further in 2025.

Campari can amplify its digital marketing and direct-to-consumer (DTC) efforts. This includes tailoring packaging for the rigors of e-commerce shipping and developing immersive virtual tasting events. These initiatives are crucial for building brand loyalty and capturing market share in an increasingly digital landscape.

- Digital Sales Growth: The global e-commerce alcohol market is a rapidly expanding sector, demonstrating strong consumer adoption of online purchasing.

- DTC Expansion: Enhancing direct-to-consumer models allows Campari to control the customer experience and gather valuable data.

- Virtual Engagement: Virtual tasting experiences offer innovative ways to engage consumers, particularly those geographically distant from traditional retail.

- E-commerce Packaging: Optimizing product packaging for online sales ensures product integrity and enhances the unboxing experience.

Rise of Low- and No-Alcohol Options

The increasing consumer demand for low- and no-alcohol beverages presents a significant opportunity for Campari Group. This trend is fueled by a growing emphasis on health and wellness, as well as a broader shift towards mindful consumption. For instance, the global low- and no-alcohol market was valued at approximately $11 billion in 2023 and is projected to reach over $25 billion by 2030, indicating substantial growth potential.

Campari can capitalize on this by either developing its own innovative low- and no-alcohol products or by acquiring existing brands within this burgeoning segment. This strategic move would not only cater to evolving consumer preferences but also diversify Campari's portfolio, reducing reliance on traditional alcoholic offerings and tapping into a new revenue stream.

- Growing Market: The global low- and no-alcohol market is experiencing rapid expansion, offering a fertile ground for new product introductions and brand acquisitions.

- Consumer Trends: Health consciousness and mindful drinking are key drivers, aligning with a demographic seeking alternatives to traditional alcoholic beverages.

- Portfolio Diversification: Expanding into this category allows Campari to broaden its product range and appeal to a wider consumer base.

- Strategic Acquisitions: Acquiring established low- and no-alcohol brands could provide immediate market access and brand recognition.

Campari Group is well-positioned to leverage the ongoing premiumization trend in the spirits market, with consumers increasingly seeking higher-quality, craft offerings. The company's robust portfolio of premium and super-premium brands directly aligns with this demand, as evidenced by the significant revenue growth driven by these segments in 2024.

The burgeoning ready-to-drink (RTD) cocktail market presents a substantial growth avenue, with consumers favoring convenient, high-quality options. Campari can capitalize on this by developing innovative RTD products from its established brands, expanding its reach, particularly through accessible retail channels.

Emerging economies, such as India and Brazil, offer significant untapped potential due to a growing young adult population and expanding middle class. Campari can tailor its premium and innovative products to meet the evolving tastes in these dynamic markets, mirroring the premiumization trend already observed in places like India in 2023.

The expanding alcohol e-commerce sector, projected to exceed $160 billion in global sales in 2024, provides Campari with a vital channel for direct consumer engagement and sales growth. Enhancing digital marketing and direct-to-consumer (DTC) strategies, including optimized packaging for online delivery, will be crucial for capturing market share.

Threats

The alcohol beverage sector is grappling with heightened regulatory scrutiny, encompassing more stringent social media marketing rules and increased penalties for illicit sales. Environmental compliance also presents evolving challenges for companies like Campari Group.

A significant concern is the potential for new US import tariffs, specifically a 25% levy on goods from Mexico, Canada, and Europe. Such tariffs could substantially disrupt Campari's global supply chain and negatively affect its financial performance, impacting profitability and overall trade operations.

A growing trend of consumers reducing or abstaining from alcohol, often termed 'mindful drinking,' poses a significant threat. This shift is fueled by increasing health consciousness and economic pressures, potentially dampening demand for alcoholic beverages.

The rise of alternative adult beverages, including functional drinks, non-alcoholic spirits, and even hemp-derived products, further intensifies competition. This diversification of the beverage market could siphon off consumers who might otherwise purchase Campari's core offerings, impacting sales volumes.

For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2024 and is projected to grow, indicating a substantial consumer base seeking alternatives to traditional alcohol.

Persistent inflation and macroeconomic volatility are significantly impacting consumer purchasing power in key markets like the US and Europe. This economic uncertainty can make consumers more price-sensitive, potentially affecting demand for Campari's premium and super-premium offerings as they might seek more affordable alternatives.

Intense Competition in the Global Spirits Market

The global spirits market is a crowded arena, with Campari Group navigating a landscape populated by both legacy behemoths and nimble craft producers. This intense rivalry exerts significant pressure on pricing strategies and necessitates substantial investments in marketing to capture consumer attention. For instance, in 2023, the global spirits market was valued at approximately $1.3 trillion, with projections indicating continued growth, underscoring the high stakes for market share.

Campari faces formidable competition from major players like Diageo, Pernod Ricard, and Beam Suntory, each with extensive portfolios and global reach. Simultaneously, the rise of artisanal and craft distilleries, particularly in North America and Europe, offers consumers more niche and specialized options, fragmenting the market further. This dynamic environment can erode profit margins and complicate efforts to expand or defend market positions, especially in mature product categories.

- Market Saturation: Key spirit categories, such as premium vodka and gin, exhibit high levels of saturation, making differentiation and market penetration increasingly challenging.

- Pricing Pressure: Intense competition often forces brands to engage in promotional activities and price adjustments, impacting overall profitability.

- Innovation Race: Competitors are continuously launching new products and flavors, requiring Campari to maintain a robust innovation pipeline to stay relevant.

- Distribution Battles: Securing prime shelf space and favorable distribution agreements with retailers and on-premise establishments is a constant struggle against well-resourced rivals.

Supply Chain Disruptions and Geopolitical Tensions

Campari Group's global reach means its operations are inherently susceptible to supply chain disruptions. For instance, a hurricane impacting rum production in Jamaica in 2024 highlighted these vulnerabilities, potentially affecting key product availability and costs. This reliance on specific regions for raw materials creates a tangible risk.

Furthermore, persistent geopolitical tensions contribute significantly to macroeconomic volatility. This uncertain environment directly impacts Campari's ability to forecast and manage its business, influencing everything from raw material sourcing costs to consumer demand patterns across different markets. The ongoing conflict in Eastern Europe, for example, continues to create ripple effects in energy prices and global trade.

- Supply Chain Vulnerability: Hurricane impact on Jamaican rum production in 2024 demonstrated potential disruptions to key raw material sourcing.

- Geopolitical Impact: Ongoing global tensions create macroeconomic volatility, affecting production, distribution, and consumer spending.

- Economic Uncertainty: Volatility in energy prices and trade routes, influenced by geopolitical events, poses a direct threat to operational costs and market stability.

The increasing consumer shift towards mindful drinking and the growing popularity of non-alcoholic alternatives, with the global non-alcoholic beverage market projected to grow from its 2024 valuation of around $1.1 trillion, present a significant threat by potentially reducing demand for Campari's core alcoholic products. Intense market competition from established giants like Diageo and Pernod Ricard, alongside a surge in craft producers, intensifies pricing pressure and necessitates continuous innovation to maintain market share, especially in saturated categories like premium vodka and gin. Furthermore, Campari's global operations are vulnerable to supply chain disruptions, as exemplified by the 2024 hurricane impacting Jamaican rum production, and macroeconomic volatility fueled by geopolitical tensions, which can escalate operational costs and dampen consumer spending power.

| Threat Category | Specific Threat | Impact on Campari | Relevant Data/Example |

|---|---|---|---|

| Consumer Trends | Mindful Drinking & Non-Alcoholic Alternatives | Reduced demand for alcoholic beverages, market share erosion. | Global non-alcoholic beverage market valued at ~$1.1 trillion in 2024, with growth projected. |

| Competitive Landscape | Intense Competition & Market Saturation | Pricing pressure, increased marketing costs, challenges in differentiation. | Saturated premium vodka/gin markets; competition from Diageo, Pernod Ricard, craft distillers. |

| Operational Risks | Supply Chain Disruptions & Geopolitical Volatility | Product availability issues, increased costs, unpredictable market conditions. | 2024 hurricane impacting Jamaican rum production; ongoing geopolitical tensions affecting energy prices and trade. |

SWOT Analysis Data Sources

This Campari Group SWOT analysis is built upon a robust foundation of financial reports, comprehensive market research, and expert industry commentary, ensuring a data-driven and insightful strategic evaluation.