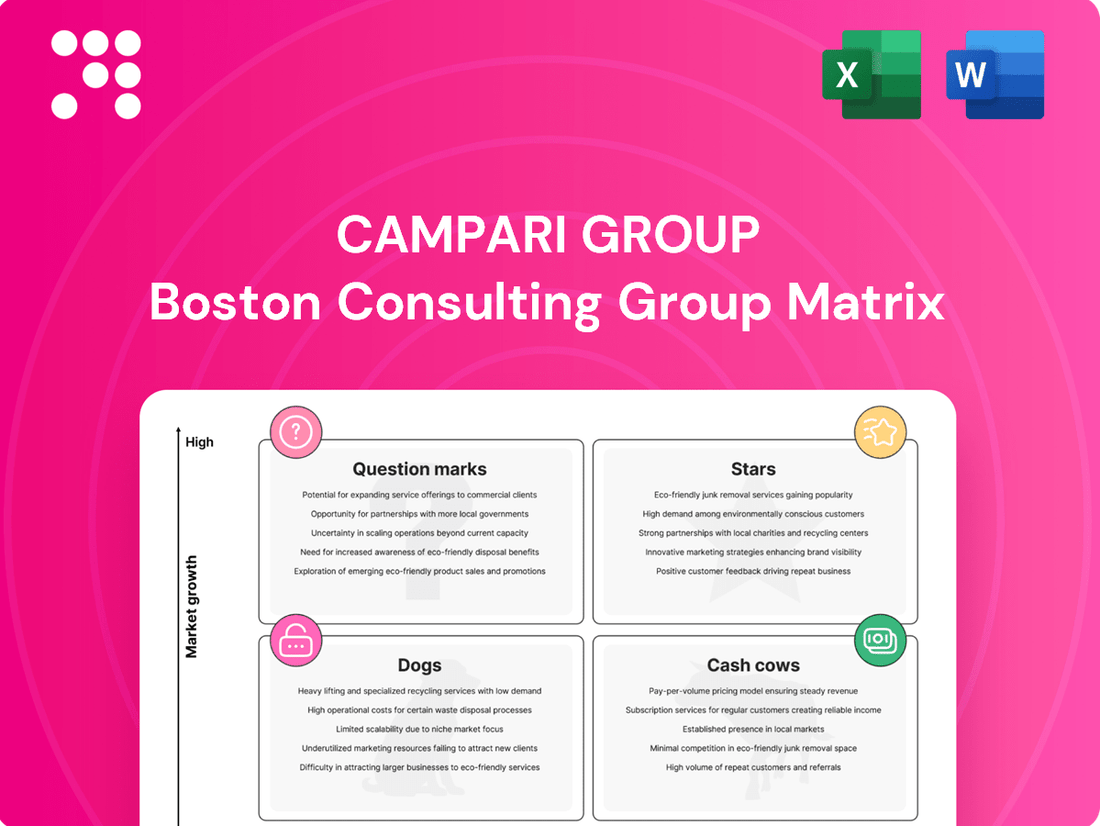

Campari Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Campari Group's diverse portfolio presents a fascinating case study for the BCG Matrix, with established brands likely acting as Cash Cows while newer ventures explore their potential as Stars or Question Marks. Understanding these placements is crucial for strategic resource allocation and future growth.

Dive deeper into Campari Group's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Aperol firmly holds its position as a 'Star' within Campari Group's portfolio, showcasing impressive resilience. In Q1 2024, it achieved a solid organic growth of 6.3%, and projections for the full year 2024 indicate a 5% increase, even when measured against a strong prior performance. This sustained momentum is a testament to its broad appeal and effective market strategies.

The brand's success is notably fueled by its performance in established markets like Germany and the United States. Furthermore, Aperol is experiencing significant traction in emerging markets, with Brazil and Mexico showing particularly strong growth. This dual-market strength highlights Aperol's ability to capture both mature and developing consumer bases.

Aperol's dominance in the aperitif category is undeniable. It consistently ranks as the best-selling aperitif globally, a status reinforced by the enduring popularity of the Aperol Spritz. The fact that the Aperol Spritz remains a top trending search on Google underscores its cultural relevance and continued high consumer demand in a steadily expanding market segment.

Espolòn Tequila is a shining Star within the Campari Group's portfolio, demonstrating robust momentum and impressive double-digit growth, especially within the United States.

In 2024, Espolòn achieved remarkable success, increasing its sales by 15% to reach nearly 1.6 million cases in the US, solidifying its position as Campari's leading brand in that key market.

This strong performance, fueled by gains in market share through both volume increases and favorable pricing, underscores Espolòn's competitive edge in the rapidly expanding tequila sector and its promising outlook for international market penetration.

The namesake Campari brand is a shining 'Star' in the Campari Group's portfolio, demonstrating robust and consistent organic growth. In Q1 2024, it delivered a healthy +6.8% increase, and projections for the full year 2024 indicate a strong +9% growth.

This stellar performance is fueled by key markets such as Brazil, Global Travel Retail, Italy, and France. The brand benefits from sustained momentum and high consumption in on-premise settings, particularly within popular cocktails like the Negroni.

Remarkably, Campari has maintained double-digit growth even with price adjustments, a testament to its powerful market standing and enduring consumer appeal.

Wild Turkey Bourbon

Wild Turkey Bourbon is positioned as a Star within the Campari Group's BCG Matrix. The brand saw an impressive 8.8% growth in 2023, driven by robust sales in key markets including the United States, Australia, Japan, and South Korea, alongside strong performance in global travel retail.

Despite some minor softening in the US market during early 2024, Wild Turkey's premium expressions, notably Russell's Reserve, continue to deliver double-digit growth. This sustained performance highlights the brand's strong standing in the expanding bourbon sector and its potential to maintain a leading position.

- Market Growth: Bourbon category continues to see strong demand.

- Key Markets: US, Australia, Japan, South Korea, and global travel retail are significant drivers.

- Premium Segment Strength: Russell's Reserve demonstrates consistent double-digit growth.

- Strategic Importance: Wild Turkey is a key growth asset for Campari Group.

The Glen Grant Scotch Whisky

The Glen Grant Scotch Whisky is a shining example of a 'Star' within the Campari Group's BCG Matrix. In 2023, it experienced robust double-digit growth, a testament to its rising popularity, especially in the crucial Asian market.

As a premium product in the expanding global whiskey market, particularly for aged expressions, The Glen Grant is capturing a larger share in a segment that continues to see significant expansion. This positions it as a key growth driver for Campari.

- Double-digit growth in 2023.

- Strong performance driven by the Asian market.

- Premium positioning in a high-growth global whiskey category.

- Increasing market share in aged whiskey segments.

Aperol, Campari, Espolòn Tequila, Wild Turkey Bourbon, and The Glen Grant Scotch Whisky are all strong 'Stars' in Campari Group's portfolio. These brands are experiencing significant growth, driven by both established and emerging markets, and their premium positioning within expanding spirits categories. Their consistent performance, often in double digits, highlights their strategic importance and strong consumer appeal.

| Brand | Category | 2023 Growth | 2024 Projection | Key Markets |

| Aperol | Aperitif | N/A | +5% | Germany, US, Brazil, Mexico |

| Campari | Liqueur | N/A | +9% | Brazil, GTR, Italy, France |

| Espolòn Tequila | Tequila | N/A | +15% (US 2024) | United States |

| Wild Turkey Bourbon | Bourbon | +8.8% | Double-digit (Premium Expressions) | US, Australia, Japan, South Korea, GTR |

| The Glen Grant Scotch | Scotch Whisky | Double-digit | N/A | Asia |

What is included in the product

The Campari Group BCG Matrix analyzes its brands' market share and growth potential to guide investment.

It strategically classifies brands as Stars, Cash Cows, Question Marks, or Dogs for portfolio management.

A clear Campari Group BCG Matrix provides a visual roadmap, alleviating the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

Aperol, while a global star, functions as a Cash Cow in its core Italian and established European markets like Germany and France. Its dominant market share in these regions translates into consistent, high-margin cash flow. For instance, in 2023, Campari Group reported that Aperol's net sales grew by 17.1% in Europe, highlighting its continued strength and profitability in these mature territories, requiring less marketing spend to maintain its leading position.

SKYY Vodka operates as a Cash Cow within Campari Group's portfolio, boasting strong global brand recognition and a well-established market footprint. Despite facing a modest growth rate of 1.5% in 2023 and some challenges in the U.S. market during 2024, it reliably generates significant and consistent cash flow from its mature market segment.

The brand's strategic emphasis on brand building and sustainability efforts is designed to preserve its market standing without necessitating substantial investments aimed at aggressive expansion. This approach allows Campari to leverage SKYY's established position for ongoing profitability.

Appleton Estate, a cornerstone of Campari's Jamaican rum offerings, firmly occupies the Cash Cow quadrant of the BCG Matrix. This established brand delivered a solid 7% growth in 2023, reflecting its enduring appeal and consistent market presence.

While the UK faced some supply challenges in 2024, Appleton Estate's premium positioning and rich heritage continue to guarantee robust and predictable cash flow for the Campari Group. Its mature market status means it requires minimal investment to maintain its strong market share.

Cinzano Vermouth and Sparkling Wines

Cinzano vermouth and sparkling wines were a 'Cash Cow' for Campari Group before its planned sale in June 2025. This brand likely maintained a steady market share in established categories, consistently producing reliable cash flow for the company.

The strategic decision to sell Cinzano for €100 million suggests Campari aimed to maximize its value and reallocate capital towards premium brands with higher growth potential. This move aligns with a common strategy of divesting mature assets to fund expansion in more dynamic market segments.

- Cash Cow Status: Cinzano represented a stable, mature product line within Campari's portfolio.

- Financial Contribution: It generated consistent cash flow due to its established market presence.

- Divestment Rationale: The €100 million sale in June 2025 signals a strategic reallocation of resources towards higher-growth premium brands.

Established Local Priority Brands (selected)

Established local priority brands within Campari's portfolio, while not leading global growth engines, likely function as cash cows. These brands possess significant, though geographically concentrated, market shares and consistently deliver reliable profits within their established, mature markets. Campari's strategic efforts to streamline its brand portfolio underscore a focus on operational efficiency, indicating these brands contribute stable earnings without requiring substantial new capital infusions.

For instance, in 2023, Campari Group reported that its portfolio optimization strategy continued, with a focus on key brands. While specific cash cow brand performance isn't always broken out individually, the consistent profitability of its established aperitif and spirit brands in regions like Italy and France underpins this category. The company's commitment to investing in premiumization and brand building for its global priorities allows these local stalwarts to continue generating strong, predictable cash flow.

- Cash Cows: Stable profit generators in mature, localized markets.

- Market Share: Strong, albeit regional, presence.

- Investment: Require minimal new investment due to maturity.

- Contribution: Provide consistent, reliable cash flow to the group.

Campari Group's Cash Cows are brands with strong market positions in mature segments, generating consistent profits with limited investment needs. These brands are crucial for funding growth in other portfolio areas. For example, Aperol's significant sales growth in Europe in 2023 demonstrates its Cash Cow status in established markets.

SKYY Vodka, despite some market challenges, continues to be a reliable Cash Cow due to its global recognition and established presence, providing stable cash flow. Similarly, Appleton Estate, a premium Jamaican rum, maintains its Cash Cow position through consistent sales and minimal investment requirements, ensuring predictable earnings for Campari.

| Brand | Category | Market Status | 2023 Net Sales Growth (Europe) | Key Contribution |

| Aperol | Aperitif | Mature (Europe) | 17.1% | High-margin cash flow |

| SKYY Vodka | Vodka | Mature (Global) | N/A (US market challenges in 2024) | Consistent cash generation |

| Appleton Estate | Rum | Mature (Global) | 7% | Robust, predictable cash flow |

Full Transparency, Always

Campari Group BCG Matrix

The Campari Group BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase, containing no watermarks or demo content. This comprehensive analysis is designed to provide strategic clarity and is ready for immediate professional use. You can confidently expect the complete, unedited document to be delivered directly to you, enabling instant application in your business planning and competitive analysis.

Dogs

Ramazzotti is positioned as a Dog in the Campari Group's BCG Matrix, reflecting a challenging market performance. The brand saw a significant 15.1% decrease in sales volumes during 2023, signaling a weak position in a stagnant or shrinking market.

This classification suggests that Ramazzotti likely commands a low market share and operates within a segment that offers little growth potential. Such brands typically require substantial investment to attempt a turnaround, often with uncertain outcomes, and may be candidates for divestment if revitalization efforts prove unsuccessful.

Lillet, a product within the Campari Group, is positioned as a 'Dog' in the BCG Matrix. This classification stems from its performance in 2023, which saw a 4.8% decline in sales volume.

This negative growth indicates that Lillet is likely operating in a market with limited expansion potential and currently holds a modest position within that market. The brand is not demonstrating the strong growth needed to justify its resource allocation.

Campari Group's strategic move to streamline its portfolio and divest non-core brands highlights a focus on brands that fall into the Dogs quadrant of the BCG Matrix. These are typically regional or local brands with low market share and low growth potential, not fitting Campari's premiumization strategy.

For instance, in 2024, Campari has been actively evaluating its brand portfolio, aiming to concentrate resources on its core, high-performing brands. This often involves shedding smaller, less profitable regional spirits that don't contribute significantly to overall growth or brand equity.

The divestment of these "Dogs" allows Campari to reallocate capital towards brands with higher growth prospects and stronger market positions, thereby enhancing profitability and operational efficiency. This strategic pruning is crucial for maintaining a competitive edge in the dynamic global spirits market.

Brands in Declining Categories (e.g., some herbal or cream liqueurs)

Brands in declining categories, such as certain herbal or cream liqueurs, are often categorized as Dogs in the BCG Matrix. This is particularly true if Campari Group holds brands within these segments that also have a low market share. For instance, in Germany during 2024, the herbal liqueur category saw a decline of 9%, and cream liqueurs experienced a 5% drop.

These categories are facing reduced consumer interest, which makes it difficult for any brand, especially those with a smaller presence, to achieve significant growth or profitability. The overall market contraction creates a challenging environment, limiting the potential for these brands to improve their standing.

- Category Decline: Herbal liqueurs (-9%) and cream liqueurs (-5%) in Germany in 2024 illustrate shrinking markets.

- Low Market Share Impact: Brands with low market share in these declining categories are prime candidates for the Dog quadrant.

- Growth Challenges: Reduced consumer interest in these segments hinders brand growth and profitability.

- Strategic Consideration: Campari Group must assess these brands for potential divestment or restructuring.

Underperforming brands impacted by persistent supply issues

Brands facing persistent supply chain disruptions, like the rum shortages in the UK during 2024 following a hurricane in Jamaica, risk falling into the 'Dogs' category within Campari Group's BCG Matrix. These issues can severely hamper a brand's ability to maintain market presence and competitive pricing. For example, if a key ingredient or production facility is impacted, leading to sustained out-of-stock situations, consumer loyalty can erode quickly.

When a brand consistently loses market share due to these operational challenges, its growth potential diminishes significantly. This makes it difficult to justify continued investment compared to more robust offerings. The impact is amplified if competitors can capitalize on the availability gaps, further entrenching the underperforming brand's position.

- Supply Chain Vulnerabilities: Events like the 2024 Jamaican hurricane highlight the fragility of supply chains for certain spirits, potentially impacting specific Campari brands.

- Market Share Erosion: Prolonged unavailability can lead to a permanent loss of customers, especially if competitors offer readily available alternatives.

- Reduced Investment Appeal: Brands stuck in a cycle of supply issues and declining market share become less attractive for further capital allocation, fitting the 'Dog' profile.

- Profitability Concerns: The inability to meet demand and increased costs associated with supply chain recovery can severely impact a brand's profitability.

Brands classified as 'Dogs' in Campari Group's BCG Matrix represent products with low market share in slow-growing or declining industries. These brands often require significant investment to improve their standing, with uncertain returns, making them candidates for divestment. For example, brands in shrinking categories like certain herbal liqueurs, which saw a 9% decline in Germany in 2024, are particularly susceptible to this classification if they also hold a low market share.

Campari Group's strategic focus on premiumization and portfolio streamlining means that brands fitting the 'Dog' profile, especially those with low growth potential and limited contribution to brand equity, are under constant evaluation. This proactive approach allows for the reallocation of resources to more promising brands, enhancing overall profitability and market competitiveness. The divestment of these underperforming assets is a key tactic in maintaining a robust and growth-oriented brand portfolio.

Question Marks

Courvoisier Cognac is positioned as a 'Question Mark' within the Campari Group's BCG Matrix following its acquisition in 2024. This strategic move bolsters Campari's standing in the premium spirits sector, especially in the burgeoning US and Asian markets, which are key growth areas for cognac.

Currently, Courvoisier represents a smaller portion of Campari's total revenue, but its high growth potential necessitates significant investment. This investment is crucial for effective integration and expanding its market reach, with the ultimate goal of elevating it to 'Star' status within the portfolio.

Espolòn Tequila, while a star performer in the United States, is positioned as a question mark for Campari Group in its international expansion efforts. This means it has a low market share in new, high-growth tequila markets but operates within a category that is expanding rapidly.

Campari recognizes strong international growth potential for Espolòn, necessitating significant investment in marketing and distribution to achieve the same success seen in its core US market. For instance, the global tequila market was valued at approximately $13.1 billion in 2023 and is projected to reach $32.2 billion by 2030, indicating a substantial opportunity for brands willing to invest.

Campari is strategically expanding its portfolio with new ready-to-drink (RTD) cocktails, tapping into a market segment experiencing robust growth. This category is fueled by consumer demand for convenience and novel beverage experiences, with the global RTD market projected to reach $1.85 trillion by 2029, growing at a CAGR of 10.8% from 2022. These new RTD offerings are classic examples of ‘Question Marks’ in the BCG matrix, characterized by their initial low market share within a high-growth industry.

These innovative RTD products require substantial investment in marketing and distribution to build brand awareness and encourage consumer trial. The goal is to capture significant market share, transforming them from nascent products into ‘Stars’ within Campari's product lineup. For instance, Campari's recent launches in the premium RTD space, like the Aperol Spritz RTD, aim to replicate the success of their popular aperitif brands in a convenient format.

X-Rated Liqueur

X-Rated Fusion Liqueur, identified as a 'local priority' brand showing growth in 2023, fits the profile of a Question Mark in the BCG Matrix. This suggests it operates within a market segment experiencing expansion but currently commands a modest market share within Campari Group's broader offerings.

The brand's trajectory presents a strategic opportunity for Campari. By channeling increased investment, X-Rated Fusion Liqueur could be positioned to capitalize on its growing niche, aiming to secure a more dominant presence within that segment. This strategic push could facilitate its evolution into a Star, a category characterized by high growth and high market share.

- Brand Performance: X-Rated Fusion Liqueur was noted for growth among 'local priority' brands in 2023.

- BCG Classification: Its characteristics align with a 'Question Mark' due to its presence in a growing niche with a relatively low overall market share.

- Strategic Opportunity: Increased investment is recommended to capture a larger share of its expanding market segment.

- Potential Evolution: Successful investment could see X-Rated Fusion Liqueur transition into a 'Star' category.

Brands in Emerging Markets with High Growth Potential

Brands in emerging markets with high growth potential, currently holding a low market share within Campari Group's portfolio, would be classified as Stars in the BCG Matrix. These brands represent significant future opportunities, especially as Campari actively pursues expansion in regions like Asia and Latin America, where premiumization trends are notably robust. For instance, in 2023, Campari reported strong double-digit growth in its Asia-Pacific region, driven by increasing disposable incomes and a growing taste for premium spirits, underscoring the potential for these nascent brands.

These 'Stars' are brands that Campari should heavily invest in, focusing on marketing and distribution to capture market share in these rapidly expanding territories. The group's strategic focus on emerging markets is a key driver for identifying and nurturing such brands. In 2024, Campari continued to emphasize this strategy, aiming to leverage the increasing demand for its products in these high-potential geographies.

- Star Brands: Brands with low market share in high-growth emerging markets.

- Investment Focus: Significant investment in marketing and distribution to capture market share.

- Market Trends: Capitalizing on strong spirits consumption and premiumization trends in Asia and Latin America.

- Growth Drivers: Campari's strategic expansion in emerging markets is key to unlocking the potential of these brands.

Question Marks in Campari Group's BCG Matrix represent brands with high potential in growing markets but currently low market share. These require substantial investment to capture market share and evolve into Stars. Examples include Courvoisier Cognac and new ready-to-drink (RTD) offerings, both benefiting from strong market growth trends.

Courvoisier's acquisition in 2024 positions it as a Question Mark, with significant investment planned to boost its presence in key growth markets like the US and Asia. Espolòn Tequila, while strong in the US, is also a Question Mark internationally, needing investment to capitalize on the global tequila market's projected growth to $32.2 billion by 2030.

Campari's new RTD cocktails are prime examples of Question Marks, tapping into a market expected to reach $1.85 trillion by 2029. X-Rated Fusion Liqueur, showing growth as a local priority, also fits this category, with strategic investment aimed at elevating its market position.

| Brand | BCG Classification | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Courvoisier Cognac | Question Mark | High (Premium Spirits) | Low (Post-acquisition) | Investment for market penetration |

| Espolòn Tequila | Question Mark (International) | High (Global Tequila Market) | Low (Outside US) | Marketing and distribution expansion |

| New RTD Cocktails | Question Mark | Very High (RTD Market) | Low (Emerging) | Brand building and consumer trial |

| X-Rated Fusion Liqueur | Question Mark | Moderate (Growing Niche) | Low | Increased investment for share capture |

BCG Matrix Data Sources

Our Campari Group BCG Matrix leverages robust data from financial reports, market research, and industry analysis to accurately position each business unit.