Campari Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Campari Group navigates a competitive landscape shaped by intense rivalry, moderate buyer power, and the constant threat of substitutes in the alcoholic beverage sector. Understanding these forces is crucial for grasping their strategic positioning.

The complete report reveals the real forces shaping Campari Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability and uniqueness of certain botanicals, fruits, or aged spirits crucial for Campari's premium brands, like its flagship Campari or Aperol, can grant suppliers considerable leverage. For instance, sourcing specific heritage citrus varieties or rare herbs requires specialized cultivation and long-term relationships, potentially limiting alternative suppliers. This uniqueness can translate into stronger pricing power for those suppliers.

However, for more common ingredients such as bulk alcohol, sugar, or basic grain spirits, the bargaining power of suppliers is generally much lower. Campari, as a large global purchaser, benefits from the widespread availability of these commodities and the presence of numerous potential suppliers. This competitive supplier landscape allows Campari to negotiate more favorable terms and prices for these essential, yet less differentiated, inputs.

The bargaining power of packaging suppliers for Campari Group is a significant consideration. Fluctuations in the global supply chain for materials like glass, labels, and other packaging components can impact costs and availability, particularly in the current economic climate. For instance, the price of glass bottles, a key component for spirits, saw increases in 2023 and early 2024 due to energy costs and demand.

While Campari's substantial order volumes likely provide some leverage, the influence of suppliers can grow when specialized or premium packaging is required. For example, unique bottle designs or advanced labeling technologies might necessitate sourcing from fewer, more specialized suppliers, thereby increasing their bargaining power and potentially leading to higher costs or longer lead times for Campari.

Campari's reliance on unique, proprietary ingredients could grant suppliers considerable leverage. For instance, the distinct flavor profiles of flagship products like Campari or Aperol are often tied to specific, potentially scarce botanical blends or production methods. If these specialized inputs are controlled by a few suppliers, Campari faces a greater risk of price increases or supply disruptions.

Logistics and Distribution Services

Campari's reliance on external logistics and warehousing, particularly for specialized needs like cold chain management in certain international markets, can give suppliers significant bargaining power. The concentration of efficient logistics providers in these regions, coupled with the complexity of Campari's global supply chain, means these partners can exert influence over pricing and service terms.

For instance, in 2023, the global third-party logistics market was valued at over $1.1 trillion, indicating a substantial industry where select providers can command leverage. Campari's need for these specialized services means they may face higher costs if a limited number of providers dominate specific geographic areas requiring unique handling capabilities.

- Concentration of Providers: In regions demanding specialized logistics (e.g., temperature-controlled transport for certain spirits), a few dominant service providers can increase their bargaining leverage.

- Service Specialization: The need for expertise in areas like customs clearance or cold chain logistics for premium products strengthens the position of suppliers offering these niche capabilities.

- Cost Sensitivity: Fluctuations in fuel prices and labor costs within the logistics sector directly impact Campari, giving efficient logistics partners more power to pass on these increases.

Labor and Talent

The availability of skilled labor in production, distillation, or flavor development can indirectly influence supplier power for Campari Group. A tight labor market for specialized roles, such as master distillers or experienced flavor chemists, could increase the overall cost of operations. This is akin to higher supplier costs for essential human capital, impacting Campari's operational expenses.

In 2024, the global demand for skilled labor in the beverage industry, particularly for specialized roles, remained robust. For instance, reports from industry recruitment firms indicated a shortage of experienced distillers in key spirits-producing regions, leading to competitive salary offers. This scarcity directly translates to increased labor costs, which can be viewed as a form of supplier power, as human capital becomes a critical, and at times, costly input.

- Skilled Labor Shortages: Persistent gaps in specialized roles like master distillers and flavor scientists can drive up wages.

- Increased Operational Costs: Higher labor expenses directly impact Campari's cost of goods sold, similar to increased raw material prices.

- Talent Acquisition Challenges: Competition for top talent in the premium spirits sector can necessitate higher compensation packages, affecting profitability.

Campari's bargaining power with suppliers is influenced by the uniqueness of its ingredients and packaging. While common inputs like bulk alcohol have many suppliers, specialized botanicals or heritage citrus for brands like Aperol can concentrate power with a few providers, leading to higher prices. For example, the premium nature of certain flavor components can limit Campari's ability to switch suppliers easily, increasing their leverage.

The packaging sector also presents a mixed picture. While Campari's large order volumes for standard bottles and labels offer some negotiation strength, the need for specialized or premium packaging, such as unique bottle designs, can shift power to fewer, more specialized suppliers. This was evident in 2023 and early 2024 with increased glass bottle costs due to energy prices, impacting Campari's input expenses.

Campari's reliance on specialized logistics providers, especially for temperature-controlled transport in certain international markets, grants these suppliers significant bargaining power. The global third-party logistics market, valued over $1.1 trillion in 2023, shows the scale of this industry, where concentrated, specialized providers can dictate terms, particularly when Campari requires niche handling capabilities.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Campari Group's premium spirits and beverage portfolio.

Instantly identify and address competitive threats with a visual representation of Campari Group's Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of customers, particularly large retail chains and global distributors, significantly influences Campari Group. These entities command substantial purchasing power due to the sheer volume of products they handle and their critical control over prime shelf space and valuable promotional opportunities within their stores. For instance, major retailers can leverage their market presence to negotiate better pricing, demand extensive promotional support, and secure extended payment terms, all of which directly impact Campari's profitability and operational flexibility.

In the on-premise sector, individual bars and restaurants typically wield less direct bargaining power over Campari Group. However, large hospitality chains, with their significant volume commitments, can exert considerable influence on pricing and promotional terms. This collective demand can shape Campari's strategies for this segment.

Conversely, off-premise customers like major supermarket chains and large liquor retailers often possess greater bargaining power. Their extensive reach and direct access to a broad consumer base allow them to negotiate more favorable pricing, demand prominent product placement, and influence marketing support, impacting Campari's sales volume and profitability.

Campari's portfolio boasts deeply ingrained, iconic brands such as Aperol and Campari, fostering significant consumer loyalty. This strong brand equity acts as a buffer against direct customer price sensitivity, allowing Campari to maintain premium pricing strategies. For instance, in 2023, Campari's net sales grew by 7.9% to €2,958.7 million, demonstrating the market's continued demand for its established brands despite potential price increases.

Distribution Network Influence

Campari's extensive global distribution network, while a significant asset, also presents a dynamic where customer bargaining power can manifest through its intermediaries. In markets where Campari relies on third-party distributors, these partners gain leverage. Their control over market access, promotional activities, and even pricing strategies can directly influence Campari's sales terms and the speed of market penetration. This reliance means that the effectiveness and reach of Campari's products are, to an extent, in the hands of these distributors.

The bargaining power of customers, as influenced by distribution networks, can be seen in several key areas:

- Market Access Control: Distributors decide which retailers and on-premise establishments receive Campari products, impacting overall sales volume and brand visibility.

- Promotional Influence: Intermediaries can negotiate favorable terms for promotional support, potentially increasing costs for Campari or limiting the scope of marketing efforts.

- Pricing Negotiation: Distributors, especially those with significant market share, can exert pressure on Campari's pricing, impacting profit margins. For instance, in 2024, the spirits market saw increased price sensitivity in certain regions due to economic factors, giving powerful distributors more room to negotiate.

Consumer Price Sensitivity

While the spirits industry, including Campari Group's portfolio, sees a growing demand for premium products, consumer price sensitivity is still a significant consideration. This is particularly true for brands not positioned at the very top tier or when economic conditions become challenging. For instance, in 2024, many markets experienced persistent inflation, which could lead consumers to re-evaluate discretionary spending on beverages.

Customers possess the ability to shift to less expensive alternatives if they don't perceive sufficient value in Campari's offerings relative to their price. This is especially relevant in crowded market segments where numerous brands compete.

- Price Sensitivity in Spirits: Despite premiumization trends, economic pressures in 2024, such as elevated inflation rates in key markets, maintained consumer focus on value.

- Brand Switching: Consumers can easily switch to competitor brands or private label options if Campari's pricing is not perceived as justified by brand equity or product quality.

- Competitive Landscape: The presence of numerous accessible alternatives in segments like aperitifs or liqueurs amplifies customer bargaining power due to the ease of substitution.

- Economic Impact: During periods of economic uncertainty, consumers often become more price-conscious, increasing the likelihood of trading down, which directly affects Campari's pricing power.

The bargaining power of Campari's customers, particularly large retailers and distributors, is a significant factor. These entities can leverage their volume and market access to negotiate better pricing and promotional terms, impacting Campari's profitability. For example, in 2024, increased price sensitivity in certain regions due to economic factors gave powerful distributors more leverage to negotiate with suppliers like Campari.

While strong brand loyalty to iconic brands like Aperol provides some buffer, consumers can still switch to alternatives if they perceive Campari's pricing as unjustified. This is especially true in competitive market segments. The persistent inflation observed in 2024 further heightened consumer focus on value, potentially increasing brand switching behavior.

Campari's reliance on a global distribution network means that intermediaries often hold considerable sway. Distributors control market access and can influence pricing and promotional strategies, directly affecting Campari's sales terms and market penetration speed. This dynamic was evident in 2024 as economic conditions allowed distributors greater negotiation power.

| Factor | Impact on Campari | 2024 Context |

| Customer Volume & Market Access | Negotiating power for pricing and promotions | High due to retailer concentration |

| Brand Loyalty vs. Price Sensitivity | Ability to maintain premium pricing vs. risk of switching | Inflation in 2024 increased price sensitivity |

| Distribution Network Control | Influence on market access, pricing, and promotions | Distributors gained leverage in price-sensitive markets |

What You See Is What You Get

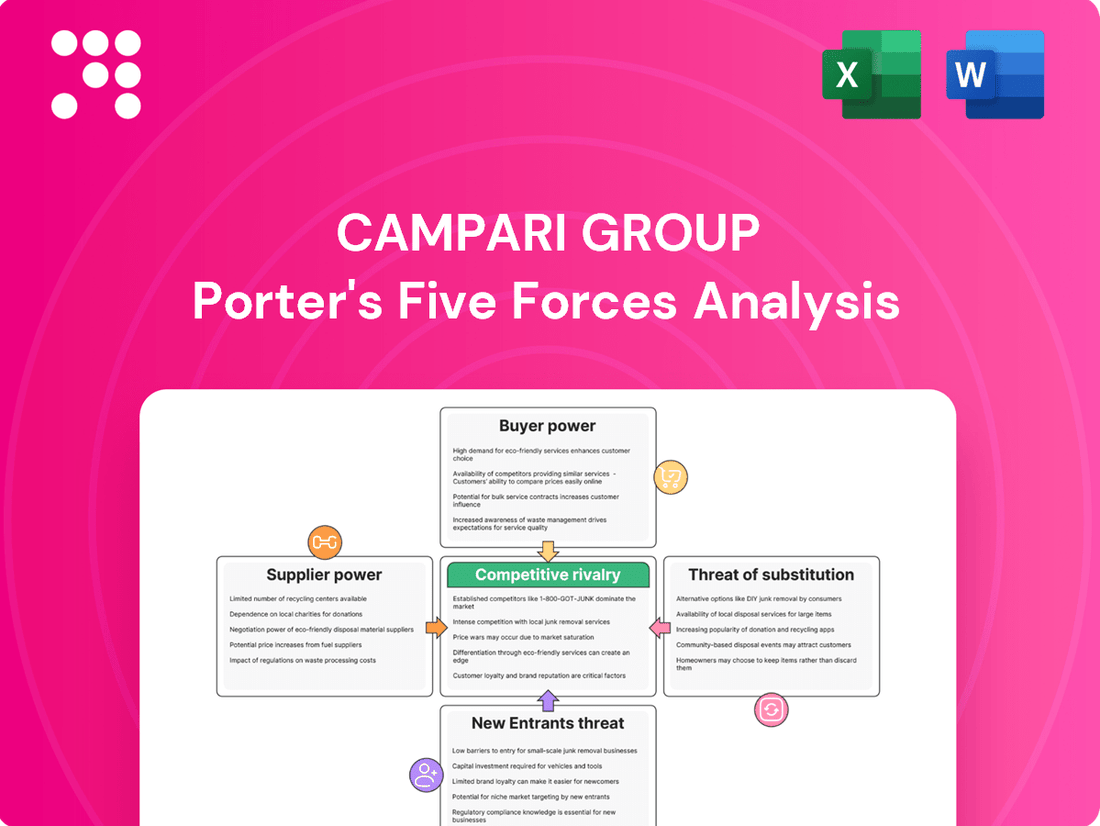

Campari Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Campari Group, detailing the competitive landscape and strategic implications. You're viewing the exact, professionally written document that will be available for immediate download upon purchase, offering a comprehensive understanding of the industry's dynamics. This analysis meticulously covers the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

Campari Group operates in a highly competitive landscape, contending with global spirits titans like Diageo and Pernod Ricard. These rivals boast expansive product ranges, deeply entrenched distribution channels, and significant marketing war chests, creating a challenging environment for market share and prime retail placement.

The competitive rivalry is further intensified by the sheer scale and global reach of these major players. For instance, in 2023, Diageo reported net sales of approximately €17.15 billion, showcasing its immense market presence and financial clout, which Campari must actively counter.

Competitive rivalry within the spirits industry is intense, and Campari Group faces this head-on across a diverse brand portfolio. This rivalry spans key categories like aperitifs, whiskies, rum, gin, and wines, meaning Campari is often competing with the same companies in multiple product segments.

Competitors are not standing still; they are continuously innovating and expanding their own offerings. This constant evolution means direct competition is a daily reality, necessitating significant and ongoing investment in building strong brand identities and making their products stand out from the crowd.

For instance, in the aperitif market, Campari competes with brands like Aperol and Campari itself against rivals such as Pernod Ricard's Suze and various smaller, artisanal producers. In 2023, the global spirits market was valued at over $1.5 trillion, highlighting the scale of investment required to maintain market share.

Competitive rivalry in the spirits industry, particularly for a company like Campari Group, is intense and fueled by aggressive marketing. Companies pour significant resources into advertising, sponsorships, and digital platforms to stand out. For instance, in 2023, the global advertising and marketing spending for the beverage alcohol sector was estimated to be in the tens of billions of dollars, with major players like Campari consistently investing to build brand equity and capture market share.

Product innovation is another key battleground. Companies constantly introduce new flavors, premium offerings, and ready-to-drink (RTD) options to appeal to evolving consumer tastes and trends. This drive for novelty means that brands must continually invest in research and development to stay relevant. The RTD segment, in particular, has seen explosive growth, with many established brands launching new products to capitalize on this demand.

Celebrity endorsements and influencer marketing play a crucial role in capturing consumer attention and building brand loyalty. Collaborations with well-known personalities can significantly boost a brand's visibility and desirability. In 2024, we continue to see major spirits brands partnering with global celebrities, leveraging their reach to drive sales and create cultural relevance in a highly saturated market.

Distribution Network Strength

Campari Group's competitive rivalry is significantly shaped by the strength and efficiency of its distribution networks. These networks are paramount for ensuring products reach consumers widely and on time, directly impacting market share and sales. Rivalry intensifies as companies vie for the best shelf space in retail environments and cultivate robust relationships with bars and restaurants, often referred to as on-premise accounts. These relationships are vital for driving volume and establishing brand presence.

Campari's robust distribution capabilities are a key differentiator. For instance, in 2023, the company reported a strong performance in its key markets, driven by effective route-to-market strategies. This allows Campari to maintain a competitive edge by ensuring its diverse portfolio, from aperitifs to spirits, is readily available to a broad customer base. The ability to efficiently manage inventory and logistics across various channels, including e-commerce and traditional retail, is a critical component of this strength.

- Widespread Availability: Campari's extensive distribution network ensures its products are accessible across numerous retail and on-premise locations globally.

- Prime Retail Placement: Securing prominent shelf space in supermarkets and liquor stores is a constant battleground for market share.

- On-Premise Relationships: Strong ties with bars and restaurants are crucial for driving sales volume and brand visibility, especially for aperitifs and spirits.

- Efficiency in Logistics: Timely delivery and effective inventory management are critical competitive advantages in the fast-moving consumer goods sector.

Pricing Strategies

Competitors in the spirits industry utilize a broad spectrum of pricing tactics. This includes premium pricing for luxury brands, reflecting perceived quality and exclusivity, alongside more aggressive, competitive pricing for widely accessible, mainstream products. This varied approach creates a complex pricing landscape for Campari.

Campari must therefore navigate this dynamic environment by meticulously managing its own pricing structures. The goal is to ensure sustained profitability while simultaneously remaining attractive to a diverse range of consumer demographics and preferences. This requires a keen understanding of market positioning and value perception.

- Premium Pricing: Competitors often leverage premium pricing for brands associated with heritage, craftsmanship, and premium ingredients, targeting affluent consumers.

- Competitive Pricing: For mass-market products, competitors focus on price competitiveness to capture market share, often through promotional activities and larger volume sales.

- Value-Based Pricing: Some brands employ value-based pricing, aligning price with the perceived benefits and emotional connection consumers have with the product.

The competitive rivalry within the spirits sector is fierce, with Campari Group facing off against global giants like Diageo and Pernod Ricard. These competitors possess extensive product portfolios, deeply established distribution networks, and substantial marketing budgets, creating a demanding environment for market share and prominent retail placement.

The sheer scale and global reach of these major players significantly intensify this rivalry. For example, in 2023, Diageo reported net sales of approximately €17.15 billion, underscoring its vast market presence and financial strength, which Campari must actively contend with.

Campari Group's competitive landscape is characterized by intense rivalry across various spirit categories, including aperitifs, whiskies, rum, gin, and wines. This means Campari frequently competes with the same companies across multiple product segments, demanding continuous innovation and investment to differentiate its brands.

In 2023, the global spirits market was valued at over $1.5 trillion, illustrating the significant investment required to maintain or grow market share. Competitors are constantly innovating, launching new flavors and premium offerings, particularly in the rapidly expanding ready-to-drink (RTD) segment, forcing Campari to invest heavily in research and development to remain competitive.

| Competitor | Approx. 2023 Net Sales (EUR Billions) | Key Competitive Areas |

| Diageo | 17.15 | Global Spirits, Premium Brands, Distribution |

| Pernod Ricard | 10.78 | Whiskey, Aperitifs, Wine, Global Reach |

| Campari Group | 2.86 | Aperitifs, Italian Spirits, Premiumization |

SSubstitutes Threaten

The growing health and wellness movement significantly amplifies the threat of substitutes for Campari Group, particularly from the non-alcoholic beverage sector. Consumers are increasingly seeking healthier lifestyle choices, leading them to explore sophisticated alternatives to traditional alcoholic drinks. This trend is evident in the booming market for premium mocktails, craft non-alcoholic spirits, and enhanced soft drinks, which offer appealing taste profiles and social acceptance without the alcohol content.

In 2024, the global non-alcoholic beverage market is projected to continue its robust growth, with some reports indicating a compound annual growth rate (CAGR) of over 5%. This expansion is fueled by a demographic shift towards mindful consumption and a desire for inclusivity in social gatherings. Campari, while a leader in spirits, faces the challenge of retaining consumers who might choose these increasingly sophisticated non-alcoholic options for health, social, or personal preference reasons.

Consumers frequently switch between different alcoholic beverage categories, viewing spirits as interchangeable with beer, cider, or wine. This cross-category substitution is a significant threat, as a consumer choosing a beer over a Campari-based cocktail for a social gathering directly impacts sales. For instance, in 2024, the global beer market is projected to reach over $700 billion, indicating a substantial alternative for consumers.

In markets where cannabis has been legalized and is subject to regulation, cannabis-infused beverages and other cannabis-based products present a growing threat of substitution for Campari Group's alcoholic offerings. These products cater to consumers, particularly younger demographics, seeking alternative methods for relaxation and social engagement, potentially diverting demand from traditional spirits.

This threat is amplified as the cannabis industry matures and product innovation continues. For instance, in Canada, a significant market for legal cannabis, the beverage sector saw substantial growth. By late 2023, cannabis beverages were a notable category, with sales contributing to the overall expansion of the legal cannabis market, indicating a tangible shift in consumer preferences that could impact beverage alcohol sales.

Leisure Activities

Consumers have a wide array of leisure activities competing for their disposable income, which can divert spending away from alcoholic beverages like those offered by Campari Group. For instance, in 2024, global spending on experiences such as travel and dining out is projected to continue its strong growth trajectory, potentially impacting discretionary spending on premium spirits. The perceived value of socialising without alcohol, perhaps through fitness classes or other wellness-focused pursuits, also presents a substitute, influencing where consumers allocate their leisure budgets.

The threat of substitutes for Campari's products is significant as consumers increasingly prioritize experiences and wellness. Consider these points:

- Alternative Leisure Spending: Consumers may opt for non-alcoholic dining experiences, cultural events, or travel, directly competing for leisure funds that could otherwise be spent on alcoholic drinks.

- Shift in Social Norms: A growing emphasis on health and wellness can lead to a preference for alcohol-free socialising, reducing demand for spirits and liqueurs.

- Economic Factors: In 2024, persistent inflation in many regions means consumers are more carefully evaluating discretionary spending, potentially favouring less expensive leisure alternatives over premium beverages.

Home Consumption Alternatives

The growing popularity of home entertainment and streaming services presents a significant threat of substitutes for Campari Group. Consumers are increasingly choosing to socialize and entertain at home, often opting for more casual and cost-effective beverage options or even non-alcoholic alternatives.

This shift directly impacts traditional sales channels, particularly premium on-premise venues like bars and restaurants, as home-based consumption rises. For instance, the global at-home alcohol consumption market saw substantial growth, with reports indicating a significant increase in off-premise sales during recent years, driven by convenience and cost savings.

- Home Entertainment Growth: Increased spending on home entertainment systems and subscription services diverts consumer leisure time and budget away from out-of-home experiences.

- Rise of Non-Alcoholic Options: The expanding market for premium non-alcoholic beverages offers a direct substitute for alcoholic drinks, catering to health-conscious consumers and designated drivers.

- Cost-Consciousness: In an environment of economic uncertainty, consumers may prioritize less expensive drink choices for home consumption over premium spirits and cocktails purchased at bars or events.

The threat of substitutes for Campari Group is multifaceted, encompassing both alcoholic and non-alcoholic alternatives, as well as shifts in consumer leisure spending. The burgeoning non-alcoholic beverage market, projected to grow at over 5% CAGR in 2024, directly competes with spirits for health-conscious consumers. Furthermore, consumers often view beer, wine, and spirits as interchangeable, with the global beer market exceeding $700 billion in 2024, highlighting a substantial alternative for social occasions.

The increasing legalization and innovation within the cannabis beverage sector, particularly noted in markets like Canada by late 2023, presents another avenue for substitution, offering alternative relaxation and social engagement methods. Consumers are also diverting discretionary income towards experiences like travel and dining out, which grew significantly in 2024, potentially reducing spending on premium spirits. The rise of home entertainment and cost-consciousness further fuels the preference for less expensive or non-alcoholic options for at-home consumption.

| Substitute Category | 2024 Market Projection/Trend | Impact on Campari Group |

|---|---|---|

| Non-Alcoholic Beverages | Global market CAGR > 5% | Direct competition for health-conscious consumers |

| Other Alcoholic Beverages (Beer, Wine) | Global Beer Market > $700 billion | Interchangeable choice for social occasions |

| Cannabis Beverages | Growing sector, notable in regulated markets (e.g., Canada late 2023) | Alternative for relaxation and social engagement |

| Experiences (Travel, Dining) | Strong growth trajectory in 2024 | Diversion of discretionary spending |

| Home Entertainment/At-Home Consumption | Increased off-premise sales | Shift from premium on-premise to cost-effective home options |

Entrants Threaten

The spirits industry demands significant capital for distilleries, aging infrastructure, and bottling operations. For instance, building a new craft distillery can cost anywhere from $500,000 to several million dollars, depending on scale and equipment. Establishing robust global distribution networks further amplifies these upfront financial commitments, creating a substantial barrier for aspiring competitors.

The spirits industry is a minefield of regulations, with new entrants facing a daunting array of licensing requirements, taxes, and health and safety standards across different nations. For instance, obtaining a federal basic permit to operate a distillery in the United States can take several months and involves extensive paperwork. These diverse and often stringent rules demand substantial investment in legal and administrative expertise, acting as a significant barrier.

Campari Group's established brands, such as Campari and Aperol, benefit from decades of focused marketing and consistent quality, fostering deep consumer loyalty. This strong brand equity makes it incredibly difficult and expensive for new entrants to gain traction, as they must invest heavily in advertising and cultivate trust over a significant period to even approach Campari's market presence.

Distribution Network Access

New companies entering the spirits market face significant hurdles in accessing established distribution networks. Securing shelf space in major retail chains and building relationships with bars and restaurants, known as on-premise accounts, are incredibly difficult for newcomers. For instance, in 2024, acquiring prime placement in a large supermarket chain could involve substantial slotting fees, often running into tens of thousands of dollars per product, a cost prohibitive for many startups.

Existing players like Campari benefit from decades of investment in their distribution infrastructure and strong ties with wholesalers and retailers. These long-standing relationships translate into preferential treatment and greater bargaining power. Campari's 2023 annual report highlighted its extensive global distribution reach, covering over 190 markets, a scale that new entrants cannot easily replicate. This established network allows them to achieve economies of scale in logistics and marketing, further widening the gap.

- Distribution Network Barriers: New entrants struggle to gain access to established distribution channels.

- Retail Shelf Space: Securing prominent shelf space in major retailers is a significant challenge, often requiring substantial slotting fees.

- On-Premise Relationships: Building relationships with bars and restaurants is crucial but difficult for new brands.

- Economies of Scale: Existing players like Campari leverage their scale to make market penetration harder for newcomers.

Access to Raw Materials and Expertise

Newcomers face significant hurdles in securing consistent access to premium raw materials and specialized ingredients, a challenge amplified by the need for unique flavor profiles. For instance, obtaining the specific botanicals for gin or the aged oak for whiskey often requires long-term contracts or direct ownership of resources. In 2024, global supply chain disruptions continued to impact the availability and cost of many agricultural inputs, making it harder for new entrants to establish reliable sourcing.

Attracting and retaining highly skilled master distillers and blenders presents another substantial barrier. These individuals possess invaluable, often proprietary, knowledge and experience crucial for product quality and innovation. The Campari Group, like other established spirits companies, benefits from a deep bench of talent cultivated over decades, a resource not easily replicated by startups.

Established companies often leverage deep supply chain relationships and proprietary sourcing agreements, giving them preferential access and pricing. This can create a significant cost disadvantage for new entrants. For example, preferential access to specific grape varietals for brandy or unique yeast strains for rum can be locked up by incumbents.

- Securing High-Quality Ingredients: New entrants struggle to gain consistent access to premium raw materials and specialized ingredients needed for distinctive spirits.

- Talent Acquisition: Attracting and retaining experienced master distillers and blenders, who hold critical knowledge, is a major challenge for new companies.

- Proprietary Relationships: Established players often have exclusive sourcing agreements and strong supply chain connections that new entrants cannot easily access.

The threat of new entrants in the spirits industry is generally considered low to moderate for Campari Group. Significant capital requirements for production facilities and global distribution networks, coupled with stringent regulatory landscapes across various markets, create substantial upfront barriers. Furthermore, the strong brand loyalty cultivated by established players like Campari, built over decades of marketing and consistent quality, makes it difficult and costly for newcomers to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|---|

| Capital Requirements | High costs for distilleries, aging, bottling, and distribution. | Significant financial hurdle. | Craft distillery startup costs can range from $500,000 to millions. |

| Regulatory Hurdles | Complex licensing, taxes, and health/safety standards. | Time-consuming and resource-intensive compliance. | US federal permit process can take months and requires extensive documentation. |

| Brand Loyalty | Established brands like Campari and Aperol benefit from decades of marketing. | Difficult to gain traction against trusted names. | New entrants need substantial investment in advertising to build trust. |

| Distribution Access | Securing shelf space and on-premise accounts is challenging. | Limited market reach for new products. | Prime retail placement can involve slotting fees in the tens of thousands of dollars. |

Porter's Five Forces Analysis Data Sources

Our Campari Group Porter's Five Forces analysis is built upon a robust foundation of data, including Campari's annual reports and investor presentations, alongside industry-specific market research from firms like Euromonitor and Statista. We also incorporate insights from financial news outlets and competitor disclosures to provide a comprehensive view of the competitive landscape.