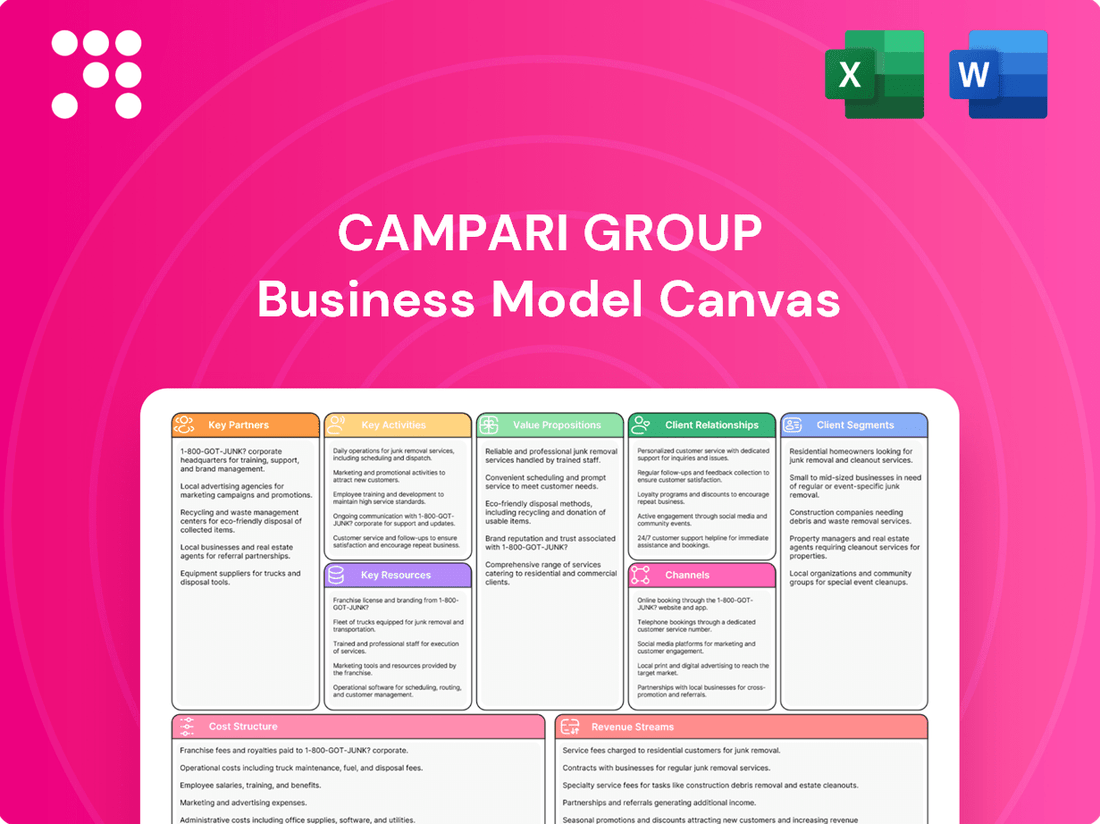

Campari Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Unlock the strategic blueprint behind Campari Group's success with our comprehensive Business Model Canvas. Discover how they build value through premium brands, leverage key partnerships for global distribution, and optimize revenue streams across diverse markets. This detailed analysis is essential for anyone looking to understand the mechanics of a leading spirits company.

Dive deeper into Campari Group's operational excellence with the full Business Model Canvas. This resource breaks down their customer relationships, cost structures, and key resources, offering a clear view of their competitive advantage. Get actionable insights for your own strategic planning.

Ready to dissect Campari Group's winning formula? Our complete Business Model Canvas provides an in-depth look at their value propositions, channels, and revenue streams, revealing the core strategies that drive their market leadership. Download it now to gain a competitive edge.

Partnerships

Campari Group leverages an extensive global distribution network, featuring key national partners such as Southern Glazer's in the United States. This network is vital for getting its diverse portfolio of brands to consumers across more than 190 countries.

These logistics partners are indispensable for the efficient handling of warehousing, transportation, and successful market entry, particularly in varied territories like the Americas and the EMEA region. For instance, in 2023, Campari's net sales in the Americas increased by 1.7% on a reported basis, highlighting the importance of these distribution channels.

The performance of these collaborations directly influences Campari's overall market presence and sales figures. The Group's ability to reach consumers effectively hinges on the operational excellence of its distribution and logistics partners.

Campari Group’s on-premise and retail collaborations are cornerstones of its business model, driving both visibility and consumer access. These partnerships are crucial for showcasing its diverse portfolio, from classic aperitifs to innovative spirits.

The company leverages its relationships with bars and restaurants, recognizing these as key touchpoints for consumer engagement. In 2024, Campari’s strategic brands, such as Aperol and Campari, demonstrated strong performance in these on-premise channels, outperforming the broader sector in sell-out data. This indicates the effectiveness of their on-premise strategies.

Furthermore, Campari actively cultivates partnerships with retailers, encompassing both traditional brick-and-mortar stores and burgeoning online platforms. These off-premise collaborations are essential for expanding the brand’s reach and ensuring products are readily available to a wider consumer base, contributing significantly to overall sales volume.

Campari Group collaborates with specialized marketing and brand activation agencies to amplify its global presence and build robust brand equity. These partnerships are crucial for developing and executing impactful campaigns across various channels.

In 2024, Campari continued to leverage these agencies for innovative digital initiatives and engaging experiential activations, such as their ongoing partnership with the Festival de Cannes. This strategic alliance ensures compelling brand storytelling and effective outreach to target audiences.

These agencies also help Campari navigate emerging platforms, including the strategic use of TikTok for consumer engagement and the exploration of AI-driven chatbots for enhanced customer interaction and brand experience.

Ingredient and Raw Material Suppliers

Campari Group's key partnerships with ingredient and raw material suppliers are vital for maintaining the consistent quality and distinctive flavors of its extensive portfolio, which spans over 50 brands. These relationships ensure access to high-quality botanicals, fruits, and other essential components, directly impacting the premium and super-premium positioning of its products. For instance, the group relies on specialized growers for botanicals crucial to iconic brands like Aperol and Campari itself, ensuring the unique taste profiles that consumers expect. In 2023, the beverage industry, in general, saw continued focus on supply chain resilience, with companies like Campari actively managing supplier relationships to mitigate potential disruptions and cost fluctuations, a trend expected to persist through 2024.

The reliability of these suppliers directly influences Campari's ability to manage production costs and maintain product availability. Building strong, long-term partnerships allows for better negotiation on pricing and terms, which is crucial for profitability in a competitive market. This strategic sourcing also supports Campari's sustainability initiatives, as many suppliers are increasingly vetted for their environmental and social practices. In 2024, the focus on ethical sourcing and supply chain transparency continues to grow, making these supplier relationships even more critical for brand reputation and operational efficiency.

- Supplier Reliability: Ensures consistent availability of core ingredients like herbs and fruits, essential for maintaining brand integrity.

- Quality Control: Partnerships guarantee the high-quality botanicals and raw materials needed for premium and super-premium brand profiles.

- Cost Management: Strong supplier relationships facilitate negotiation and help manage production costs for over 50 diverse brands.

- Supply Chain Resilience: Critical for mitigating disruptions and ensuring product availability in a dynamic global market.

Acquisition Targets and Integration Partners

Campari Group's strategic growth is significantly fueled by targeted acquisitions, exemplified by its January 2024 acquisition of Courvoisier Cognac for €1.2 billion. This move highlights a consistent strategy of acquiring premium brands to bolster its portfolio and market presence.

To execute these complex acquisitions, Campari relies on a network of specialized partners. These include financial advisors who assist in valuation and deal structuring, legal counsel for due diligence and contract negotiation, and integration specialists who ensure smooth operational and brand integration post-acquisition. For instance, the Courvoisier deal involved extensive legal and financial expertise to finalize the transaction.

- Acquisition of Premium Brands: Campari Group has a proven track record of acquiring established and high-potential brands, such as Courvoisier, to enhance its market position.

- Financial Advisory: Expert financial partners are crucial for evaluating acquisition targets, structuring deals, and securing financing, as demonstrated in the €1.2 billion Courvoisier transaction.

- Legal and Due Diligence: Legal teams provide essential support in navigating regulatory approvals, conducting thorough due diligence, and ensuring compliance throughout the acquisition process.

- Integration Expertise: Specialized consultants are vital for the seamless integration of acquired businesses and brands, covering operational, marketing, and distribution aspects to maximize synergy.

Campari Group's key partnerships extend to influential media and advertising agencies, crucial for crafting compelling brand narratives and executing targeted marketing campaigns. These collaborations are instrumental in building brand equity and driving consumer engagement across diverse markets.

In 2024, Campari continued to invest in these agency relationships for innovative digital strategies and experiential activations, such as its ongoing partnership with the Festival de Cannes. This strategic alliance ensures impactful brand storytelling and effective outreach to target demographics.

These agencies also facilitate Campari's exploration of new consumer touchpoints, including leveraging social media platforms like TikTok for enhanced engagement and utilizing AI for improved customer interaction.

What is included in the product

The Campari Group Business Model Canvas outlines its strategy for premium spirit brands, focusing on diverse customer segments and global distribution channels to deliver unique brand experiences.

This model details key partnerships, resource allocation, and cost structures, reflecting Campari's operational excellence and growth ambitions.

Campari Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex global operations, simplifying strategy for stakeholders.

It effectively condenses Campari's intricate value proposition and distribution networks into a digestible format, easing the burden of understanding their multifaceted business.

Activities

Campari Group invests significantly in brand building and marketing to cultivate robust brand equity. This involves strategic campaigns, digital engagement, and aligning with cultural trends. For instance, Aperol's success is partly attributed to its experiential marketing, creating vibrant social occasions.

The group actively works to premiumize its diverse portfolio, a strategy that resonated well in 2024. This premiumization effort is crucial for maintaining competitive advantage and driving higher margins. Campari's consistent presence at high-profile events further reinforces its premium image.

In 2024, Campari Group continued to adapt to evolving market dynamics through innovative marketing. Their digital strategies saw increased investment, aiming to connect with consumers on a more personal level. This focus on digital presence is essential for reaching younger demographics and fostering long-term brand loyalty.

Campari Group's core activity revolves around the meticulous production and manufacturing of its extensive portfolio, encompassing over 50 brands. This commitment is realized through a global network of 25 production sites, ensuring consistent quality and availability of products ranging from premium spirits to popular aperitifs.

A prime example of this operational strength is the Novi Ligure plant, which recently underwent significant expansion, effectively doubling its production capacity for Aperol. This strategic investment underscores Campari's dedication to meeting growing global demand and maintaining its competitive edge in the market.

Campari Group actively manages its extensive global distribution network, reaching over 190 countries. This involves a blend of direct operations in key markets and strategic alliances with third-party distributors to ensure efficient product availability.

The company focuses on optimizing its route-to-market strategies, with a particular emphasis on expanding its footprint in high-growth regions such as the Americas and EMEA. This strategic focus aims to enhance market penetration and drive sales volume.

In 2023, Campari Group reported a net sales increase of 10.1% to €2,959.8 million, demonstrating the effectiveness of its global distribution and sales efforts. The Americas region saw particularly strong growth, up 15.1%.

Portfolio Management and Acquisitions

Campari Group's key activities center on actively managing its extensive portfolio of over 50 brands. The core strategy involves a dual approach: premiumization of existing brands and growth through targeted acquisitions. This dynamic management ensures the portfolio remains aligned with evolving market demands and consumer preferences, particularly in the premium spirits segment.

Strategic acquisitions are a significant driver of Campari's growth. A prime example is the acquisition of Courvoisier, a renowned cognac brand. This move not only expands Campari's premium offerings but also strengthens its presence in key global markets. The process involves rigorous identification of acquisition targets, meticulous negotiation of terms, and seamless integration of new brands into Campari's operational framework.

Beyond acquisitions, Campari also engages in portfolio streamlining by divesting non-core or underperforming brands. This strategic pruning allows the company to concentrate resources on its most promising and profitable assets, thereby enhancing overall portfolio value and operational efficiency. This active portfolio management is crucial for maintaining competitive advantage and driving long-term shareholder value.

In 2023, Campari Group reported net sales of €2,850.6 million, a significant increase driven by its strategic portfolio management and acquisitions. The company's focus on premium and super premium brands continues to yield strong results, with these categories representing a growing share of total sales.

- Portfolio Focus: Over 50 brands managed with emphasis on premiumization.

- Acquisition Strategy: Growth driven by strategic acquisitions, exemplified by Courvoisier.

- Brand Integration: Seamlessly integrating acquired brands into the existing structure.

- Portfolio Optimization: Streamlining non-core labels to enhance focus and efficiency.

Innovation and Product Development

Campari Group actively pursues innovation to stay relevant, even with its strong portfolio of heritage brands. This focus ensures they capture evolving consumer tastes and market opportunities.

- New Product Introductions: Campari Group consistently launches new variants and extensions of its existing brands, catering to diverse consumer preferences and occasions.

- Ready-to-Drink (RTD) Expansion: The company is investing in and expanding its ready-to-drink offerings, recognizing the growing consumer demand for convenient, pre-mixed cocktails.

- Trend Adaptation: They adapt established brands to new consumption trends, such as the resurgence of bitter-forward cocktails, by developing specific products or marketing campaigns.

- Investment in R&D: While specific figures for 2024 are still emerging, Campari historically allocates resources to research and development to drive these innovation efforts. In 2023, marketing and advertising expenses, which often support new product launches, were €437.7 million.

Campari Group's key activities revolve around managing a vast portfolio of over 50 brands, with a strong emphasis on premiumization and strategic acquisitions. This dual approach ensures the portfolio remains attractive to consumers and drives growth, particularly in the premium spirits sector. The acquisition of Courvoisier is a notable example, bolstering their premium offerings and global market presence.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Campari Group you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis, with all sections and insights intact, ready for your immediate use. Once your order is complete, you'll gain full access to this exact file, ensuring no surprises and complete transparency in your acquisition.

Resources

Campari Group's core strength lies in its extensive portfolio of over 50 premium and super-premium brands. This collection includes globally recognized names such as Campari, Aperol, and Grand Marnier, which are vital for its market presence.

The intellectual property underpinning these brands, encompassing trademarks and proprietary recipes, serves as a significant differentiator. This IP is fundamental to maintaining Campari Group's competitive edge and ensuring brand equity.

In 2023, Campari Group's net sales reached €2.95 billion, with its key brands like Aperol and Campari showing robust growth, underscoring the value of this brand portfolio and its associated intellectual property.

Campari Group's global production facilities are a cornerstone of its business model, with 25 strategically located sites. These facilities are crucial for manufacturing the company's diverse portfolio of alcoholic and non-alcoholic beverages, ensuring consistent quality and efficient distribution worldwide. For instance, the significant investment in expanding the Novi Ligure plant underscores Campari's commitment to enhancing its production capacity and maintaining stringent quality control.

Campari's extensive global distribution network is a cornerstone of its business, featuring in-market companies across 26 countries. This robust infrastructure, complemented by strategic partnerships with major distributors, ensures its products reach consumers in over 190 nations.

This vast reach allows Campari to maintain strong market positions and effectively introduce new products, a critical advantage in the competitive spirits industry. For instance, in 2023, Campari continued to leverage this network to drive growth in key markets, with net sales increasing by 10.7% organically.

Human Capital and Expertise

Campari Group's approximately 4,900 employees, known as 'Camparistas,' are a cornerstone of its business model, bringing diverse expertise across critical areas. This human capital is essential for developing and executing strategies in brand management, production, sales, and marketing.

The collective talent and commitment of these individuals directly fuel Campari's ability to build strong brands, maintain efficient operations, and achieve sustained strategic growth in the competitive spirits market.

- Brand Stewardship: Camparistas are instrumental in nurturing and expanding iconic brands like Aperol and Campari through insightful marketing and sales initiatives.

- Operational Excellence: Their expertise in production ensures the quality and consistency of Campari's diverse portfolio, from sourcing raw materials to final distribution.

- Market Insight: Employees in sales and marketing functions provide crucial understanding of consumer preferences and market trends, driving product innovation and market penetration.

Financial Capital and Market Access

Campari Group's access to financial capital is a cornerstone of its business model, significantly bolstered by its listing on the Italian Stock Exchange. This public status provides a vital platform for raising funds. In 2023, Campari Group reported a net profit of €367.5 million, a 17.9% increase compared to 2022, demonstrating its robust financial health and ability to attract investment.

This strong financial performance directly fuels its ambitious growth strategy. The company leverages its market access to fund organic expansion, invest in key brands, and upgrade its infrastructure. Furthermore, it enables strategic acquisitions, allowing Campari to broaden its portfolio and geographic reach.

Key resources in this category include:

- Access to Public Markets: Listing on the Italian Stock Exchange (Borsa Italiana) provides a continuous avenue for equity and debt financing.

- Strong Financial Performance: Consistent profitability, as evidenced by a 17.9% net profit increase in 2023, enhances creditworthiness and investor confidence.

- Credit Facilities and Debt Management: Established relationships with financial institutions and prudent debt management practices ensure liquidity for operations and investments.

- Investor Relations and Capital Allocation: Effective communication with shareholders and a clear strategy for capital deployment attract and retain investment.

Campari Group's key resources are its strong brand portfolio, intellectual property, global production facilities, extensive distribution network, dedicated employees, and access to financial capital. These elements collectively enable the company to maintain its market leadership and drive growth.

The company's brand portfolio, featuring over 50 premium and super-premium brands like Aperol and Campari, is a significant asset. This is complemented by intellectual property, including trademarks and recipes, which differentiate its offerings. In 2023, Campari Group achieved net sales of €2.95 billion, showcasing the commercial power of these brands.

Operational capabilities are supported by 25 global production facilities, ensuring quality and efficiency, while a distribution network spanning 190 countries guarantees market reach. The approximately 4,900 employees, or 'Camparistas,' contribute diverse expertise crucial for brand management and operational excellence.

Financial strength, evidenced by a 17.9% net profit increase in 2023 to €367.5 million, and access to public markets via the Italian Stock Exchange, underpins strategic investments and growth initiatives.

| Key Resource | Description | 2023 Data/Impact |

| Brand Portfolio | Over 50 premium/super-premium brands | Net sales of €2.95 billion |

| Intellectual Property | Trademarks, proprietary recipes | Brand equity and competitive edge |

| Production Facilities | 25 global sites | Quality control and efficient distribution |

| Distribution Network | Presence in 190+ countries | Market reach and new product introduction |

| Human Capital | Approx. 4,900 employees (Camparistas) | Expertise in brand management, operations, sales |

| Financial Capital | Listing on Italian Stock Exchange | Net profit of €367.5 million (17.9% increase) |

Value Propositions

Campari Group boasts a premium and diverse brand portfolio, offering consumers more than 50 premium and super-premium spirits, wines, and aperitifs. This extensive selection caters to a wide array of tastes and occasions, ensuring there's a high-quality choice for nearly every preference.

The group's portfolio includes globally recognized icons such as Campari, Aperol, and Grand Marnier, underscoring their commitment to delivering exceptional products. In 2023, Campari Group's net sales reached €2,969.4 million, with a significant portion driven by the strong performance of these premium brands.

Campari Group's value proposition is deeply rooted in authenticity and heritage, resonating with consumers seeking tradition and craftsmanship. Many of its brands, like Campari itself, which traces its origins to 1860, offer a tangible connection to the past.

This commitment to legacy is further exemplified by Courvoisier's recent Maison Courvoisier restoration, a significant investment reinforcing its historical significance and craftsmanship. This focus on heritage not only differentiates Campari Group in the market but also builds strong emotional connections with its consumer base.

Campari Group's brands, like Aperol and Campari, are central to fostering social connections and memorable experiences. The iconic Aperol Spritz ritual, for instance, has become synonymous with shared moments of conviviality.

This value proposition goes beyond just selling beverages; it's about enabling a lifestyle and creating opportunities for people to connect and enjoy time together. Campari's deep roots in cultural events further solidify its role in facilitating these shared experiences.

Global Availability and Accessibility

Campari Group's extensive global distribution network is a cornerstone of its business model, ensuring its premium spirits are readily available to consumers in over 190 countries. This vast reach means that whether you're in Milan, New York, or Sydney, you're likely to find your favorite Campari brands. In 2023, net sales reached €2,935.7 million, highlighting the scale of their international operations.

This widespread accessibility empowers consumers by allowing them to enjoy consistent quality and familiar tastes, regardless of their location. It fosters brand loyalty and provides a reliable experience for travelers and international residents alike. The group's strategic focus on expanding its presence in key emerging markets further solidifies this value proposition.

- Global Reach: Availability in over 190 nations.

- Consumer Convenience: Easy access to preferred premium spirits worldwide.

- Brand Consistency: Delivering a familiar and high-quality experience across markets.

- Market Penetration: Strong presence in both mature and developing economies.

Innovation and Trend Relevance

Campari Group actively monitors and integrates emerging consumer preferences, such as the growing demand for bitter-forward and low-alcohol beverages. This forward-thinking approach ensures their portfolio stays aligned with market shifts.

The company leverages digital marketing and social media to connect with consumers on new platforms, amplifying brand relevance. For instance, in 2024, Campari continued its investment in digital channels to reach younger demographics.

Product innovation is a cornerstone, with Campari Group introducing new offerings that cater to evolving tastes. This includes expanding their range of aperitifs and ready-to-drink options, reflecting a dynamic market response.

- Adapting to Trends: Campari Group's agility in responding to consumer shifts, like the resurgence of bitter flavors and the growth of low-ABV drinks, keeps its brands competitive.

- Digital Engagement: Strategic marketing on evolving digital platforms is crucial for maintaining brand visibility and consumer connection in the contemporary market.

- Product Innovation: The introduction of new products, such as expanded aperitif lines and ready-to-drink formats, directly addresses changing consumer habits and preferences.

Campari Group's value proposition centers on offering a premium and diverse portfolio of over 50 spirits, wines, and aperitifs, appealing to a broad spectrum of consumer tastes. Their commitment to authenticity and heritage, exemplified by brands with deep historical roots like Campari (established 1860), builds strong emotional connections.

The group facilitates social connections and memorable experiences through its brands, such as the iconic Aperol Spritz ritual, positioning itself as an enabler of shared moments. This is supported by a robust global distribution network reaching over 190 countries, ensuring consistent quality and accessibility.

Campari Group demonstrates agility by adapting to emerging consumer preferences, like the demand for bitter-forward and low-alcohol options, and by investing in digital engagement and product innovation. In 2023, the company achieved net sales of €2,935.7 million, reflecting the strength of its global presence and brand appeal.

| Value Proposition | Key Features | Supporting Data/Facts |

| Premium & Diverse Portfolio | Over 50 premium and super-premium spirits, wines, and aperitifs. | Brands include Campari, Aperol, Grand Marnier. 2023 Net Sales: €2,935.7 million. |

| Authenticity & Heritage | Brands with deep historical roots and craftsmanship. | Campari brand origins trace back to 1860. Recent investment in Courvoisier's Maison Courvoisier restoration. |

| Social Connection & Experiences | Brands that foster conviviality and shared moments. | Aperol Spritz ritual is a key example. Campari's involvement in cultural events. |

| Global Reach & Accessibility | Availability in over 190 countries. | Ensures consistent quality and familiarity for consumers worldwide. |

| Adaptability & Innovation | Responding to consumer trends and introducing new products. | Focus on bitter-forward and low-ABV beverages. Investment in digital marketing in 2024. |

Customer Relationships

Campari Group cultivates brand loyalty by nurturing active communities, especially on social media platforms and through engaging experiential events. This strategy transforms customers into passionate advocates for their favorite brands.

By fostering these connections, Campari aims to create 'super-fan brand advocates' who actively promote the brands. For instance, in 2023, Campari saw a significant rise in social media engagement across its key brands, demonstrating the growing strength of these communities.

Campari Group leverages event-based engagement, notably through its sponsorship of the Festival de Cannes. This strategy allows for direct customer interaction and brand immersion, creating memorable experiences that foster deeper connections.

Campari Group enhances customer relationships through digital channels, utilizing AI-powered chatbots and dedicated brand websites for personalized interactions. This approach facilitates tailored marketing messages and seamless online purchasing experiences.

In 2024, Campari Group continued to invest in digital transformation, aiming to deepen consumer engagement. Their strategy focuses on leveraging data analytics from these platforms to understand purchasing behavior and preferences, thereby refining future outreach and product development.

On-Premise Advocacy and Bartender Relationships

Campari Group places immense value on cultivating deep connections with bartenders and the broader on-premise sector. These individuals are not just servers; they are brand ambassadors who directly influence consumer choices. By fostering these relationships, Campari Group ensures its brands are not only present but also championed at the point of sale.

The company actively invests in programs designed to educate and engage bartenders. This includes providing training on product knowledge, mixology, and the importance of responsible drinking. For instance, Campari Academy offers extensive resources and certifications, empowering bartenders with the skills and confidence to promote the brands effectively. In 2023, Campari Group reported a significant increase in engagement with its on-premise partners, with over 5,000 bartenders participating in training sessions across key markets.

- Bartender Training Programs: Campari Academy provides comprehensive education on brand heritage, product characteristics, and responsible service.

- On-Premise Partnerships: Collaborations with bars and restaurants focus on creating unique brand experiences and driving sales through dedicated activations.

- Advocacy and Influence: Bartenders act as key influencers, shaping consumer preferences and driving trial of Campari Group's portfolio.

- Responsible Consumption Initiatives: Training emphasizes promoting safe and enjoyable drinking experiences, aligning with Campari Group's commitment to sustainability.

Responsible Drinking Initiatives

Campari Group actively fosters positive customer relationships through its dedicated responsible drinking initiatives. A prime example is the 'Take Time to Taste' campaign, which educates consumers on moderation and mindful enjoyment of alcoholic beverages. This commitment not only safeguards public health but also cultivates a sense of trust and brand loyalty among its diverse customer base.

These efforts directly contribute to a stronger brand image, positioning Campari Group as a socially responsible entity. By promoting responsible consumption, the company aligns its business practices with societal well-being, enhancing its reputation. For instance, in 2023, Campari Group continued to invest in programs that reached millions of consumers globally, reinforcing its dedication to this cause.

- 'Take Time to Taste' campaign promotes moderation and responsible consumption.

- Builds trust and a positive brand image within society.

- Global reach of responsible drinking programs in 2023.

- Enhances customer loyalty through demonstrated social responsibility.

Campari Group actively engages consumers through vibrant digital communities and immersive experiential events, transforming patrons into brand advocates. In 2023, this strategy saw a marked increase in social media interaction across its portfolio, underscoring the growing power of these connected consumer groups.

The company's commitment extends to fostering deep relationships with bartenders, recognizing them as crucial influencers in shaping consumer choices. Through initiatives like Campari Academy, which provided training to over 5,000 bartenders globally in 2023, Campari empowers these professionals to champion its brands at the point of sale.

Furthermore, Campari Group prioritizes responsible consumption, exemplified by campaigns like 'Take Time to Taste,' which reached millions of consumers worldwide in 2023. This dedication to social responsibility not only builds trust but also enhances brand loyalty by aligning business practices with societal well-being.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (2023/2024 Focus) |

|---|---|---|

| Community Building | Social Media Engagement, Experiential Events | Increased social media interaction; Festival de Cannes sponsorship driving brand immersion. |

| On-Premise Partnerships | Bartender Training (Campari Academy), Bar Activations | Over 5,000 bartenders trained globally in 2023; Focus on digital transformation for deeper consumer engagement in 2024. |

| Responsible Consumption | 'Take Time to Taste' Campaign, Moderation Education | Global reach of responsible drinking programs; Enhanced brand image and trust through social responsibility. |

Channels

Campari Group relies heavily on a robust global distribution network, leveraging third-party distributors like Southern Glazer's in the United States to ensure its brands reach consumers across numerous international markets. These strategic alliances are crucial for effective market penetration and maintaining consistent product availability in diverse geographical regions.

In 2023, Campari Group's net sales reached €2,946.8 million, a testament to the effectiveness of its extensive distribution partnerships in driving global reach and sales volume. This network allows Campari to navigate complex local regulations and consumer preferences, solidifying its presence in key markets.

Campari Group maintains a direct market presence through its own distribution networks in 26 countries. This allows for granular control over how its brands are presented and sold in crucial regions.

This direct operational model, exemplified by its in-market companies, is a cornerstone of Campari's strategy to deeply embed its brands. It also contributes to more efficient management of working capital by streamlining inventory and receivables.

For instance, in 2023, Campari reported that its own distribution channels contributed significantly to its global sales performance, with a strong emphasis on key European and American markets where this direct approach is most prevalent.

Bars, restaurants, and hotels are fundamental to Campari Group's strategy, serving as prime locations for consumers to experience its aperitif portfolio, including iconic brands like Aperol and Campari. These on-premise environments foster social consumption, directly influencing brand preference and trial.

Campari Group actively engages with the on-premise sector through targeted marketing initiatives and partnerships to boost brand visibility and drive sales. This focus is crucial for brands that are often discovered and enjoyed in a social, out-of-home setting.

In 2024, the on-premise channel continued to be a significant revenue driver for Campari Group, demonstrating resilience and recovery post-pandemic. The company's investment in supporting these venues directly translates to increased sell-out and brand equity, especially for its premium aperitif offerings.

Off-Premise (Retailers, Supermarkets, Liquor Stores)

Retailers, supermarkets, and liquor stores are crucial for Campari's off-premise strategy, ensuring broad consumer access for at-home consumption. These channels are vital for driving sales volume and brand visibility. Campari actively works to secure prominent shelf placement and execute targeted promotions within these diverse retail environments.

Campari's success in off-premise channels is supported by data showing the continued strength of these outlets. For instance, the global off-premise beverage alcohol market is substantial, with traditional retail channels forming its backbone. In 2024, these channels are expected to continue their dominance in consumer purchasing habits for spirits and aperitifs.

- Extensive Reach: Supermarkets and liquor stores provide unparalleled access to a vast consumer base, facilitating impulse purchases and routine grocery shopping integration.

- Brand Visibility: Strategic shelf placement and in-store displays are key to capturing consumer attention and differentiating Campari's portfolio amidst a crowded market.

- Promotional Effectiveness: Targeted discounts, bundled offers, and sampling events within these channels directly influence purchase decisions and drive trial.

- Market Share Contribution: Off-premise sales through these retailers significantly contribute to Campari's overall revenue, underscoring their strategic importance.

E-commerce and Digital Platforms

Campari Group is actively expanding its presence on e-commerce and digital platforms. This includes both their own branded websites and partnerships with major online retailers, aiming to offer a seamless shopping journey for consumers. This strategic focus allows for direct consumer engagement and broadens the sales footprint, particularly beneficial for brands like Espolòn, which saw significant growth in online channels.

The digital channel is instrumental in reinforcing brand narratives and reaching new demographics. In 2024, Campari Group reported a continued upward trend in e-commerce sales, contributing a notable percentage to their overall revenue growth. This channel not only drives sales but also provides valuable data insights into consumer preferences and purchasing behavior, informing future marketing and product development strategies.

- Direct-to-Consumer (DTC) Growth: Campari Group's investment in branded e-commerce sites allows for direct interaction with consumers, fostering brand loyalty and capturing higher margins.

- Online Retailer Partnerships: Collaborations with key online liquor retailers and general e-commerce platforms expand product availability and reach a wider audience.

- Brand Building Online: Digital platforms are utilized to tell brand stories, share product information, and engage consumers through targeted content, enhancing brand equity.

- Data-Driven Insights: E-commerce activities generate valuable data on consumer behavior, informing inventory management, marketing campaigns, and new product introductions.

Campari Group utilizes a multi-channel approach, blending third-party distributors for broad market access with its own 26 direct distribution networks for greater control. This dual strategy ensures both extensive reach and deep market penetration, as evidenced by its €2,946.8 million net sales in 2023. The company also prioritizes on-premise channels like bars and restaurants, crucial for brand discovery and social consumption, with these venues remaining significant revenue drivers in 2024. Furthermore, Campari actively engages in off-premise retail, leveraging supermarkets and liquor stores for volume sales, and is increasingly focused on e-commerce and digital platforms to enhance direct consumer engagement and gather valuable data.

| Channel Type | Key Characteristics | Strategic Importance | 2023/2024 Relevance |

|---|---|---|---|

| Third-Party Distribution | Leverages established networks for broad global reach. | Market penetration, product availability. | Crucial for entering and maintaining presence in diverse markets. |

| Direct Distribution (26 countries) | In-market companies offering granular control. | Brand presentation, sales management, working capital efficiency. | Key for deep market embedding in strategic regions. |

| On-Premise (Bars, Restaurants, Hotels) | Environments for brand trial and social consumption. | Brand discovery, preference, driving sales. | Significant revenue driver, focus for premium aperitifs. |

| Off-Premise (Retail, Supermarkets) | Broad consumer access for at-home consumption. | Sales volume, brand visibility, impulse purchases. | Dominant channel for spirits and aperitifs, vital for market share. |

| E-commerce & Digital Platforms | Branded websites and online retailer partnerships. | Direct consumer engagement, data insights, expanded footprint. | Continued upward trend in sales, informing strategy. |

Customer Segments

Premium Spirit Enthusiasts are consumers who actively seek out high-quality, often artisanal, spirits, valuing unique flavor profiles and sophisticated consumption rituals. They are drawn to brands with a rich heritage and a story to tell, willing to pay a premium for exceptional taste and experience. In 2024, the premium spirits market continued its robust growth, with categories like single malt Scotch and premium gin showing particularly strong demand.

Campari Group effectively targets this segment through its diverse portfolio, featuring iconic brands such as Campari, Aperol, and Grand Marnier, all recognized for their premium positioning and distinctive character. These brands are often featured in high-end bars and restaurants, reinforcing their association with sophisticated drinking occasions. The company's investment in brand storytelling and premium activations further resonates with these discerning consumers.

Cocktail Culture Participants are individuals who actively engage with the world of mixed drinks, whether they are crafting sophisticated beverages at home or patronizing specialized cocktail bars. This segment is deeply invested in the experience and artistry of cocktails.

Campari's portfolio directly caters to these enthusiasts, as its brands are foundational to globally recognized and beloved cocktails. For instance, Campari is the namesake ingredient in the iconic Negroni, and Aperol is the star of the immensely popular Aperol Spritz.

The resurgence and continued growth of cocktail culture, particularly evident in the 2024 market, underscore the significance of this customer segment. This trend is fueled by a desire for premium experiences and authentic flavors, areas where Campari excels.

Social drinkers and conviviality seekers view beverages as catalysts for shared experiences and enhancing social gatherings. They actively seek out drinks that facilitate conversation and create memorable moments, often associating brands like Aperol and Campari with leisure and celebration.

This segment’s preference for aperitifs stems from their ability to stimulate appetite and encourage lingering social interactions. For instance, Aperol Spritz, a signature drink for this group, saw significant growth, contributing to Campari Group's net sales increase of 16.1% in 2023, reaching €2,963.6 million.

Geographically Diverse Consumers

Campari Group actively engages a geographically diverse consumer base, holding strong market shares in Europe and the Americas, while strategically growing its footprint in the Asia-Pacific region. This global reach necessitates tailoring brand messaging and product offerings to resonate with distinct local tastes and cultural preferences.

For instance, in 2023, Campari Group reported that its net sales in the Americas accounted for approximately 45% of its total revenue, highlighting the region's significance. Europe remained a substantial market, contributing around 35% of net sales. The company's expansion into emerging markets, particularly in Asia-Pacific, is a key growth driver, aiming to capture new consumer segments.

- European Strength: Campari Group maintains a dominant presence in key European markets, leveraging established brand loyalty.

- Americas Focus: The Americas represent a significant revenue stream, with ongoing investment in brand building and distribution.

- Asia-Pacific Growth: Strategic initiatives are in place to increase market penetration and consumer adoption in the Asia-Pacific region.

- Localized Strategies: Brand campaigns and product innovations are adapted to suit the cultural nuances and consumer behaviors of each target geography.

Younger Adult Consumers (Legal Drinking Age)

Campari Group actively targets younger adult consumers, those of legal drinking age, recognizing their importance for future brand loyalty and market share. In 2024, the company continued to invest in digital marketing, utilizing platforms such as TikTok and Instagram to connect with this demographic. This approach is vital for maintaining brand relevance in a rapidly evolving consumer landscape.

The company's strategy for this segment focuses on creating engaging content and fostering community around its brands. For instance, Campari has been observed running influencer campaigns and sponsoring events popular with Gen Z and younger Millennials. This proactive engagement ensures that Campari brands remain top-of-mind as these consumers mature and their purchasing power grows.

- Digital Engagement: Campari utilizes platforms like TikTok and Instagram for marketing campaigns targeting legal drinking age consumers.

- Brand Relevance: The company aims to build long-term brand loyalty by connecting with new generations of drinkers.

- Future Growth: This demographic is identified as crucial for Campari Group's sustained growth and market position.

Campari Group's customer base is diverse, encompassing premium spirit enthusiasts who value heritage and quality, and cocktail culture participants who appreciate the artistry of mixology. Social drinkers seeking conviviality and memorable moments are also key, often associating brands like Aperol with leisure. The company also actively engages younger adult consumers, of legal drinking age, through digital platforms to cultivate future brand loyalty.

| Customer Segment | Key Characteristics | Campari Group's Approach |

|---|---|---|

| Premium Spirit Enthusiasts | Seek high-quality, artisanal spirits; value heritage and unique flavors; willing to pay a premium. | Portfolio of premium brands (Campari, Grand Marnier); premium activations and brand storytelling. |

| Cocktail Culture Participants | Engage with mixed drinks; value experience and artistry; foundational brands for popular cocktails. | Brands like Campari (Negroni) and Aperol (Spritz) are central to cocktail creation. |

| Social Drinkers/Conviviality Seekers | View beverages as catalysts for shared experiences; seek drinks that enhance social gatherings. | Aperol Spritz is a signature drink for this segment, fostering leisure and celebration. |

| Younger Adult Consumers (Legal Drinking Age) | Targeted for future brand loyalty; important for market share growth. | Invests in digital marketing (TikTok, Instagram); influencer campaigns and event sponsorships. |

Cost Structure

Campari Group's Cost of Goods Sold (COGS) encompasses the direct expenses tied to creating their diverse beverage portfolio. This includes crucial elements like the cost of raw materials such as botanicals, fruits, and spirits, alongside packaging materials and direct manufacturing labor and overhead. For instance, in 2023, Campari Group reported a Cost of Sales of €1,781.5 million, reflecting these significant production outlays.

To navigate rising input costs, Campari Group actively employs strategies like price adjustments and optimizing their sales mix. This means focusing on selling higher-margin products to help absorb any increases in raw material prices or manufacturing expenses. Their approach is designed to maintain profitability even when facing economic pressures on their supply chain.

Campari Group heavily invests in Advertising and Promotion (A&P) to cultivate strong brand recognition and boost sales across its diverse portfolio. For instance, in 2023, A&P expenses represented a significant portion of their cost structure, crucial for supporting global marketing initiatives, digital outreach, and engaging consumer experiences.

These A&P expenditures are strategically managed, allowing for flexibility in their phasing to achieve margin improvements. The company's commitment to impactful campaigns is evident in their consistent allocation towards building brand equity, which is vital for maintaining a competitive edge in the dynamic spirits market.

Selling, General, and Administrative (SG&A) expenses for Campari Group cover vital areas like managing their sales force, overseeing distribution, and handling core administrative functions. These costs also include general operational overhead necessary to keep the business running smoothly.

Campari Group has experienced an upward trend in SG&A. This increase is directly linked to their ongoing commitment to strengthening commercial and marketing capabilities. Furthermore, the establishment of new in-market companies has contributed to these rising costs.

For instance, in 2023, Campari's SG&A expenses amounted to €1,255.4 million, representing 28.9% of net sales. This figure highlights the significant investment in building out their sales and marketing infrastructure to support global growth.

Distribution and Logistics Costs

Campari Group's distribution and logistics costs are substantial due to its worldwide reach. These expenses cover warehousing, moving products across continents, and maintaining partnerships with numerous third-party distributors. In 2023, the group's total cost of sales was €2.17 billion, highlighting the significant portion these operational costs represent.

Optimizing this complex network is crucial for profitability. Campari's investment in efficient supply chain management directly impacts its ability to deliver products reliably and cost-effectively to diverse markets.

- Warehousing: Costs associated with storing finished goods and raw materials in strategically located facilities globally.

- Transportation: Expenses incurred for shipping products via sea, air, and land freight to reach various markets and customers.

- Distributor Management: Costs related to managing relationships, contracts, and performance of third-party distribution partners worldwide.

Acquisition and Integration Costs

Campari Group's aggressive mergers and acquisitions strategy means that acquisition and integration costs are a significant and recurring component of its cost structure. These expenses encompass a range of activities necessary to bring new brands and businesses into the Campari fold.

Key elements of these costs include the rigorous due diligence processes, substantial legal and advisory fees associated with deal closure, and the often complex and resource-intensive integration of acquired operations. For instance, the acquisition of Courvoisier, completed in late 2023, involved significant upfront costs for the transaction itself and ongoing investments to harmonize systems, supply chains, and organizational structures.

- Due Diligence Expenses: Costs incurred for financial, legal, and operational reviews of potential acquisition targets.

- Transaction Fees: Payments to investment banks, legal counsel, and other advisors for facilitating the acquisition.

- Integration Costs: Expenses related to merging acquired businesses, including IT system alignment, rebranding, and workforce integration.

- Brand Portfolio Expansion: These costs directly support Campari's strategy to broaden its premium spirits portfolio.

Campari Group's cost structure is multifaceted, encompassing direct production expenses, significant marketing investments, operational overhead, and strategic acquisition costs. These elements collectively drive the group's ability to maintain its premium brand positioning and global market presence.

In 2023, Campari Group's Cost of Sales reached €1,781.5 million, reflecting the direct costs of producing its beverages. Simultaneously, Selling, General, and Administrative (SG&A) expenses amounted to €1,255.4 million, representing 28.9% of net sales, underscoring the investment in commercial and marketing capabilities. Advertising and Promotion (A&P) expenses were also a substantial cost, vital for brand building and market penetration.

| Cost Category | 2023 Amount (€ million) | Percentage of Net Sales |

| Cost of Sales | 1,781.5 | 41.0% |

| SG&A | 1,255.4 | 28.9% |

| Advertising & Promotion (A&P) | (Included within SG&A or reported separately depending on financial statement breakdown) | Significant investment |

Revenue Streams

Campari Group's main income comes from selling its wide range of premium and super-premium spirits. Think of well-known names like Campari, Aperol, Espolòn, and Grand Marnier. This is how they make most of their money, by selling these popular drinks around the world.

The success of these sales relies on selling more bottles and setting the right prices. In 2023, Campari Group reported a net sales increase of 8.1% to €2,965.4 million, showing strong performance in their core business.

Campari Group generates substantial revenue from its portfolio of wines and aperitifs. Brands like Aperol have become global powerhouses, driving significant sales volumes.

The company's strategic emphasis on aperitifs, particularly within the European and American markets, has yielded impressive growth. In 2023, Campari reported that Aperol saw a notable increase in sales, contributing significantly to the group's overall performance.

Campari Group's revenue streams are significantly diversified across key geographical regions. The Americas, particularly the United States, represent a substantial portion of sales, driven by strong demand for premium spirits. In 2024, the Americas continued to be a primary growth engine for the company.

The EMEA (Europe, Middle East, and Africa) region also contributes significantly to revenue, with established markets in Italy and strong performance in emerging European economies. Sales growth in these areas is closely tied to evolving consumer preferences for aperitifs and premium spirits, as well as the effectiveness of Campari's localized marketing campaigns and distribution networks.

On-Premise and Off-Premise Sales

Campari Group generates revenue from both on-premise sales, such as bars and restaurants, and off-premise sales, including supermarkets and liquor stores. The company reported that in 2023, the on-premise channel showed particularly strong sell-out data, indicating a robust recovery and consumer demand in these venues. Campari is actively working to maintain balanced growth trends across both these crucial sales channels, recognizing the importance of each for overall market penetration and brand visibility.

The strategic focus on the on-premise channel is paying off, with recent performance highlighting its significance. For instance, the company's premiumization strategy often sees stronger margins in the on-premise environment. Campari aims to leverage this momentum while simultaneously strengthening its off-premise presence, ensuring accessibility and convenience for a broader consumer base. This dual approach is key to their revenue diversification and market resilience.

- On-Premise Sales: Revenue derived from consumption at bars, restaurants, and hospitality venues.

- Off-Premise Sales: Revenue generated from retail channels like supermarkets, liquor stores, and online platforms.

- 2023 Performance: Campari observed strong sell-out data in the strategic on-premise channel during 2023.

- Strategic Goal: To achieve and maintain balanced growth trends across both on-premise and off-premise sales channels.

New Brand Acquisitions and Portfolio Expansion

Campari Group's revenue streams are significantly bolstered by strategic acquisitions, which add established brands and broaden the company's geographical and category presence. These moves are crucial for sustained growth and market share expansion.

The integration of newly acquired brands, like the cognac house Courvoisier which Campari acquired in late 2023 for €1.2 billion, directly contributes to top-line sales. This influx of revenue from established, premium brands enhances Campari's overall financial performance and market standing.

- Strategic Acquisitions Fuel Growth: Campari Group actively pursues acquisitions to integrate new brands, thereby expanding its market reach and revenue base.

- Courvoisier Integration Impact: The acquisition of Courvoisier, a significant move in the premium spirits market, directly contributes to Campari's consolidated sales figures.

- Portfolio Diversification: New brand acquisitions diversify Campari's portfolio, reducing reliance on individual brands and creating a more resilient revenue model.

Campari Group's revenue is primarily driven by the sale of its premium and super-premium spirits portfolio. Brands such as Campari, Aperol, and Grand Marnier are key contributors, with sales volume and pricing strategies directly impacting overall income. In 2023, the company reported net sales of €2,965.4 million, an increase of 8.1% compared to the previous year, underscoring the strength of its core spirits business.

The company also generates significant revenue from its wine and aperitif offerings, with Aperol experiencing particularly strong global demand. This strategic focus on aperitifs, especially in Europe and the Americas, has been a major growth driver. The Americas, led by the United States, remain a crucial market, with continued strong performance in 2024.

Campari's revenue streams are further diversified through on-premise and off-premise sales channels. The on-premise sector, including bars and restaurants, showed robust sell-out data in 2023. The company is actively working to balance growth across both channels to maximize market penetration and brand visibility.

Strategic acquisitions also play a vital role in Campari's revenue generation. The acquisition of Courvoisier in late 2023 for €1.2 billion significantly bolstered the company's portfolio and revenue base, contributing directly to consolidated sales figures and enhancing market standing.

| Revenue Stream | Key Brands/Activities | 2023 Net Sales (EUR Million) | Growth vs. 2022 | Key Markets |

| Premium & Super-Premium Spirits | Campari, Aperol, Espolòn, Grand Marnier | 2,965.4 | 8.1% | Global, particularly Americas & Europe |

| Aperitifs | Aperol | Significant Contributor | Strong Growth | Europe, Americas |

| Wines | Various premium wine brands | Contributing Revenue | - | Global |

| On-Premise Sales | Bars, Restaurants, Hospitality | Strong Sell-out Data | Robust Demand | Global |

| Off-Premise Sales | Supermarkets, Liquor Stores, Online | Balanced Growth Focus | - | Global |

| Acquisitions | Courvoisier (acquired late 2023) | Direct Contribution to Sales | - | Global Premium Spirits Market |

Business Model Canvas Data Sources

The Campari Group Business Model Canvas is built upon a foundation of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic initiatives.