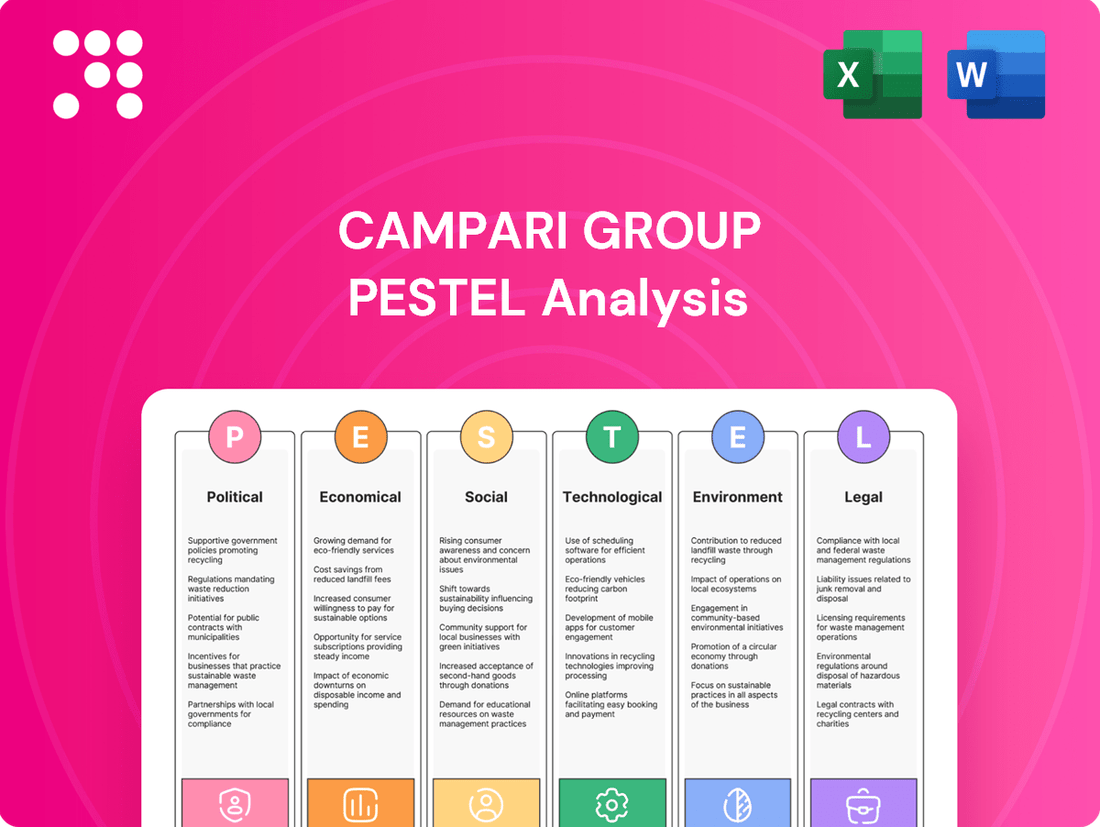

Campari Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Navigate the complex external forces shaping Campari Group's future. Our PESTLE analysis dives deep into political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks impacting the spirits industry. Gain a critical understanding of these drivers to inform your strategic decisions. Download the full PESTLE analysis now and unlock actionable insights to strengthen your market position.

Political factors

Government policies, including excise taxes and marketing restrictions, are critical. For instance, the potential 25% import duties in the US on products from Mexico, Canada, and Europe, as discussed in late 2023 and early 2024, could significantly impact Campari Group's operational costs and pricing strategies in key markets.

Geopolitical shifts and ongoing trade disputes present a significant challenge for Campari Group. For instance, the US government's imposition of tariffs directly impacts the cost of imported goods, creating a substantial risk to Campari's supply chain efficiency and overall profitability.

Campari Group itself has projected a negative financial impact ranging from €90 million to €100 million specifically due to these tariffs in the year 2025. This figure underscores the tangible financial consequences of international trade policies on the company's bottom line.

Political stability in Campari Group's key markets, such as Italy, the United States, and Mexico, directly impacts its operational continuity and sales performance. For instance, the 2024 Italian general election results, while not causing immediate widespread disruption, highlighted potential shifts in economic policy that could influence consumer spending on premium spirits. Similarly, upcoming elections in the United States in late 2024 will be closely watched for any policy changes affecting import duties or taxation on alcoholic beverages, which could affect Campari's significant North American revenue stream.

Regulatory Compliance and Enforcement

Campari Group faces a dynamic regulatory environment, requiring strict adherence to evolving compliance standards. For instance, the implementation of the European Sustainability Reporting Standards (ESRS) and the EU Corporate Sustainability Reporting Directive (CSRD) significantly impacts its 2024 sustainability disclosures, demanding greater transparency and data accuracy.

The company must also navigate differing alcohol and advertising regulations across its global markets. For example, stricter rules on alcohol advertising in some countries can affect marketing strategies and reach. Enforcement of these regulations can lead to fines or operational restrictions, directly impacting financial performance and brand reputation.

- ESRS and CSRD Compliance: Campari Group's 2024 sustainability reporting will be shaped by these new EU directives, necessitating robust data collection and reporting mechanisms.

- Global Alcohol Regulations: Variations in advertising, sales, and taxation laws for alcoholic beverages across different countries require tailored market approaches.

- Enforcement Risks: Non-compliance can result in substantial financial penalties and reputational damage, influencing operational costs and market access.

Government Support and Industry Lobbying

Government support, such as tax incentives or grants for production and export, significantly impacts Campari Group's operational costs and market access. For instance, favorable trade agreements negotiated by governments can reduce import duties, boosting Campari's competitiveness in key international markets. In 2023, the European Union continued to advocate for reduced tariffs on spirits, a trend beneficial to major European producers like Campari.

Industry lobbying plays a crucial role in shaping the regulatory landscape. Trade associations actively engage with policymakers to influence legislation concerning alcohol advertising, taxation, and product standards. These efforts aim to create a more stable and predictable operating environment, allowing Campari to plan investments and market strategies with greater confidence. For example, lobbying efforts in 2024 focused on harmonizing alcohol taxation across EU member states to prevent market distortions.

- Government subsidies and grants can directly lower production costs for Campari, enhancing its price competitiveness.

- Favorable trade agreements, like those pursued by the EU in 2023, reduce barriers to international market entry and expansion.

- Industry lobbying influences regulations on advertising and taxation, creating a more favorable business climate.

- Lobbying efforts in 2024 aimed at tax harmonization across the EU seek to level the playing field for spirit producers.

Government policies, including excise taxes and marketing regulations, significantly shape Campari Group's operational landscape. For instance, potential US import duties discussed in late 2023 and early 2024 could impact costs, while the company projected a €90-100 million negative financial impact in 2025 due to tariffs.

Political stability in key markets like Italy and the US is crucial, with upcoming elections in late 2024 potentially influencing economic policies affecting consumer spending on premium spirits.

Campari must also navigate evolving compliance standards, such as the ESRS and CSRD impacting its 2024 sustainability disclosures, and varying global alcohol advertising rules which can lead to fines or operational restrictions.

Government support, like favorable trade agreements pursued by the EU in 2023 to reduce tariffs, and industry lobbying efforts in 2024 for tax harmonization, directly influence Campari's competitiveness and operating environment.

What is included in the product

This PESTLE analysis for the Campari Group dissects the intricate interplay of Political, Economic, Social, Technological, Environmental, and Legal forces shaping its global operations and strategic direction.

It provides a comprehensive framework for understanding the macro-environmental landscape, enabling informed decision-making and proactive strategy development for the premium spirits company.

A concise PESTLE analysis for Campari Group that highlights key external factors, acting as a pain point reliever by providing clarity on potential market challenges and opportunities for strategic planning.

Economic factors

Rising inflation, particularly in energy and key agricultural commodities like sugarcane and grapes, directly impacts Campari Group's cost of goods sold. For instance, global commodity prices saw significant increases throughout 2024, with some raw materials experiencing double-digit percentage hikes compared to 2023 levels.

These elevated input costs can compress Campari's profit margins if not effectively passed on to consumers or offset by operational improvements. The company's strategy to mitigate this involves rigorous cost efficiency programs and supply chain optimization, aiming to absorb some of the inflationary impact.

Global economic conditions and consumer disposable income are crucial for Campari Group, as they directly impact demand for premium and super-premium spirits. When economies are strong, consumers tend to have more discretionary funds, leading to increased spending on higher-end beverages. For instance, in 2024, many developed economies saw continued, albeit moderating, growth in disposable income, supporting premiumization trends in the spirits market.

However, a challenging macroeconomic environment can significantly alter consumer spending patterns. Inflationary pressures and potential recessions in key markets can lead consumers to cut back on non-essential purchases, including premium spirits, opting for more budget-friendly alternatives. This shift can directly impact Campari's sales volumes, particularly in segments reliant on discretionary spending.

As a global powerhouse with operations spanning over 190 countries, Campari Group is inherently exposed to the volatility of currency exchange rates. These fluctuations can significantly influence the company's reported financial performance.

When foreign earnings are converted back into Campari's reporting currency, the Euro, unfavorable exchange rate movements can lead to a reduction in both reported revenues and overall profitability. For instance, if the Euro strengthens against a key operating currency like the US Dollar, the value of USD-denominated profits will decrease when translated into EUR.

In 2023, Campari reported that currency fluctuations had a negative impact on its net sales, reducing them by 2.2%. This highlights the tangible effect that currency volatility can have on the group's top-line performance, underscoring the importance of robust currency risk management strategies.

Economic Growth in Key Regions

Campari Group's sales are closely tied to economic expansion in its key operating areas. For instance, the Americas and EMEA regions are significant contributors to the company's revenue streams. Strong economic performance in these areas typically translates to increased consumer spending on premium spirits, directly benefiting Campari.

Looking at recent trends, the economic landscape presented a mixed picture for Campari in 2024. The United States, a crucial market, demonstrated robust growth, bolstering sales. Similarly, Brazil also experienced positive economic momentum, supporting Campari's performance in that territory.

However, the Asia-Pacific (APAC) region presented challenges, with some markets experiencing economic slowdowns that led to sales declines for Campari. This highlights the importance of regional economic health for the company's overall financial results.

- Americas & EMEA Growth: Economic expansion in these regions directly boosts Campari's sales.

- US Market Strength: The United States showed significant economic growth in 2024, benefiting Campari.

- Brazil's Positive Trend: Brazil's economic performance also supported Campari's sales in 2024.

- APAC Challenges: Declines in some APAC markets due to economic factors impacted overall sales.

Interest Rates and Debt Management

Rising interest rates present a significant challenge for Campari Group, directly impacting the cost of servicing its debt. As borrowing becomes more expensive, the company's interest expenses are likely to climb, potentially squeezing profit margins.

Campari's financial position in 2024 saw an increase in net financial debt, partly fueled by strategic acquisitions such as the purchase of Courvoisier. This growth in debt, coupled with a higher interest rate environment, elevates the financial risk for the group.

- Increased Financing Costs: Higher interest rates directly translate to greater expenses for Campari Group when it needs to borrow money for operations or acquisitions.

- Debt Servicing Burden: With net debt rising in 2024, an elevated interest rate environment makes it more costly for Campari to manage and repay its existing and future borrowings.

- Impact on Profitability: Elevated interest expenses can reduce net income, affecting the company's overall financial health and its ability to reinvest in growth or return capital to shareholders.

Economic factors significantly influence Campari Group's performance, with inflation impacting raw material costs and consumer spending power. Currency fluctuations also play a critical role, as seen in the 2.2% reduction in net sales due to currency impacts in 2023. While the Americas and EMEA regions showed economic strength in 2024, the APAC region presented challenges, demonstrating the varied economic landscapes Campari navigates.

Preview the Actual Deliverable

Campari Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Campari Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumer tastes are shifting, with a notable rise in demand for aperitifs and premium spirits like tequila, which directly benefits Campari Group's diverse brand portfolio. This evolution presents clear opportunities for the company to expand its market share in these growing categories.

However, Campari also faces the challenge of a younger demographic showing a decreased interest in alcohol consumption overall. This trend, particularly prevalent in Western markets, necessitates strategic adjustments to marketing and product development to remain relevant.

In 2024, the global spirits market continued to see growth in premium segments, with tequila sales in the US alone projected to reach $14.4 billion by 2027, up from $10.7 billion in 2022, according to Statista. Campari's investment in brands like Espolòn Tequila positions it well to capture this expansion.

Growing consumer focus on health and well-being is reshaping the beverage industry. This trend can reduce overall alcohol consumption or drive demand for lower-alcohol and zero-proof options. For instance, the global non-alcoholic beverage market, including mocktails and low-ABV spirits, is projected to reach $1.9 trillion by 2027, demonstrating a significant shift.

Campari Group is proactively responding to this by emphasizing responsible drinking initiatives and expanding its portfolio to include more sophisticated non-alcoholic choices. This strategic alignment with consumer preferences for healthier lifestyles is crucial for sustained growth and market relevance in the evolving beverage landscape.

Demographic shifts, particularly the ageing populations in developed markets like Europe and North America, significantly impact beverage consumption patterns. As consumers age, preferences can lean towards lower-alcohol or non-alcoholic options, influencing demand for Campari Group's traditional spirits.

For instance, in 2024, the 65+ population in the EU is projected to represent over 22% of the total population, a trend expected to continue. Campari Group's strategy must therefore adapt by developing and promoting products that cater to evolving tastes across all age demographics, including premium non-alcoholic spirits and lighter alcoholic beverages.

Social Media and Influencer Marketing

Social media and influencer marketing are reshaping how brands connect with consumers in the spirits sector. Campari Group, for instance, can harness these channels to build brand loyalty and expand its reach. Their 'We Are Cinema' campaign exemplifies this, demonstrating how engaging content can resonate deeply with audiences.

The effectiveness of influencer collaborations is substantial, with studies indicating that influencer marketing campaigns in the consumer goods sector can yield an average ROI of $5.20 for every dollar spent. This highlights the financial incentive for Campari to strategically partner with key voices.

- Brand Perception: Social media allows for direct engagement, shaping how consumers view Campari's brands, from classic aperitifs to newer innovations.

- Consumer Engagement: Platforms like Instagram and TikTok facilitate interactive campaigns, contests, and user-generated content, fostering a stronger connection with the target demographic.

- Audience Reach: Influencer marketing, particularly with micro and macro-influencers in the lifestyle and gastronomy space, can expose Campari's portfolio to millions of potential new customers.

- Campaign Effectiveness: Successful campaigns, like 'We Are Cinema,' demonstrate the power of storytelling and cultural relevance in driving brand recall and purchase intent.

Cultural Acceptance of Alcohol Consumption

Cultural norms surrounding alcohol consumption significantly shape Campari Group's market approach. For instance, while spirits are widely accepted in many European markets, attitudes in some Asian or Middle Eastern countries may necessitate a more cautious or localized product strategy. In 2024, Campari Group's success hinges on adapting its marketing to these diverse cultural landscapes, ensuring its premium brands resonate respectfully with local consumers.

Campari Group's global presence means navigating a complex tapestry of societal attitudes towards alcohol. This requires tailoring marketing campaigns and product offerings to align with regional cultural acceptance. For example, the company's strategy in markets with strong traditions of aperitivo culture, like Italy, differs from its approach in regions where spirits consumption is more associated with specific social occasions.

Understanding these cultural nuances is critical for Campari Group's expansion. Consider that in 2023, global alcoholic beverage market growth was projected to be around 3-4%, but this varied significantly by region, influenced heavily by cultural factors. Campari's ability to adapt its brand messaging and distribution to fit local customs is paramount for sustained growth.

- Regional Variations: Cultural acceptance of alcohol varies significantly, impacting market penetration.

- Marketing Adaptation: Campari Group must tailor marketing to respect local cultural contexts.

- Growth Impact: Cultural norms directly influence the pace and nature of market growth for Campari's brands.

Societal shifts towards health and wellness are influencing beverage choices, with a growing demand for lower-alcohol and non-alcoholic options. This trend is evidenced by the global non-alcoholic beverage market projected to reach $1.9 trillion by 2027, a significant indicator of changing consumer priorities that Campari Group is addressing with strategic portfolio adjustments.

Demographic changes, such as aging populations in developed markets, also shape consumption patterns, potentially favoring lighter or non-alcoholic drinks. The EU's aging demographic, with the 65+ population exceeding 22% in 2024, underscores the need for Campari to cater to diverse age-related preferences.

Social media and influencer marketing play a crucial role in brand perception and consumer engagement, with influencer campaigns in consumer goods showing a strong ROI. Campari's successful campaigns highlight the power of digital channels in building brand loyalty and expanding reach within target demographics.

Cultural norms surrounding alcohol consumption necessitate tailored marketing strategies for Campari Group's global expansion. For instance, the company's approach in regions with strong aperitivo traditions differs from markets where spirits are consumed differently, reflecting the impact of local customs on market growth, which saw global alcoholic beverage market growth around 3-4% in 2023, with regional variations.

Technological factors

The ongoing digital transformation is fundamentally reshaping the alcoholic beverage industry, with e-commerce channels experiencing significant growth. For instance, global e-commerce sales in the beverage alcohol sector are projected to reach $50 billion by 2025, a substantial increase from previous years.

Campari Group can leverage this trend by strengthening its digital footprint and direct-to-consumer (DTC) initiatives. By investing in online platforms and optimizing digital marketing, the company can tap into new customer segments and expand its market reach beyond traditional retail, potentially boosting sales by an estimated 10-15% in key digital markets.

Campari Group's strategic use of advanced data analytics is crucial for understanding evolving consumer preferences and market dynamics. By leveraging these tools, the company can gain granular insights into purchasing patterns and emerging trends, as seen in the continued growth of premium spirits, a segment where data-driven marketing can significantly boost engagement.

In 2024, the beverage industry is increasingly reliant on data to refine product development and personalize marketing campaigns. Campari's investment in data analytics platforms allows for more precise targeting, potentially increasing marketing ROI by identifying high-potential consumer segments and tailoring offerings, a strategy that proved effective in driving sales of its aperitif brands in key European markets during 2023.

Automation technologies are significantly boosting efficiency and consistency across Campari Group's production and supply chain. For instance, the company's substantial investments, such as the approximately €120 million expansion of its Aperol production facility in Italy, are designed to leverage these advancements. This modernization directly addresses the need for increased output while maintaining product quality and reducing operational costs.

Artificial Intelligence and Workflow Optimization

Campari Group is leveraging artificial intelligence to streamline its operations. By integrating tools like Microsoft 365 Copilot, the company aims to automate repetitive tasks, freeing up employee time. This focus on AI-driven workflow optimization is expected to boost overall productivity and efficiency across various departments.

The adoption of AI is particularly impactful in areas such as email management and content generation. These improvements allow employees to concentrate on more strategic and value-added activities. For instance, early reports suggest significant time savings on routine administrative work, directly contributing to a more agile and responsive organization.

- AI Adoption: Campari Group is implementing AI tools like Microsoft 365 Copilot.

- Workflow Optimization: The goal is to automate tasks like email management and content creation.

- Productivity Gains: Expected outcomes include increased employee productivity and time savings on routine tasks.

- Strategic Focus: Employees can redirect their efforts towards higher-impact strategic initiatives.

Innovation in Product Development and Packaging

Technological advancements are key drivers for Campari Group's product innovation. For instance, advancements in distillation and fermentation techniques allow for the creation of novel spirits and low-alcohol or no-alcohol alternatives, directly addressing growing consumer preferences for healthier options. In 2024, the global low/no-alcohol beverage market is projected to reach over $11 billion, a significant opportunity Campari is poised to capitalize on through its R&D.

Furthermore, technology plays a crucial role in developing sustainable packaging solutions. Campari Group is investing in research for lighter materials, recycled content, and innovative designs that reduce environmental impact. This aligns with consumer demand for eco-conscious brands; a 2025 survey indicated that 65% of consumers consider sustainability when purchasing beverages.

These innovations are not just about new products but also about enhancing the consumer experience and brand image. Campari's focus on technological integration in product development and packaging allows them to remain competitive and responsive to market shifts and environmental imperatives.

- Innovation in Flavors: Campari is exploring new flavor profiles and spirit bases driven by advancements in food science and beverage technology.

- Low/No-Alcohol Options: Leveraging new production methods to create appealing alternatives, tapping into a market segment that saw significant growth in 2024.

- Sustainable Packaging: Implementing lighter, recyclable, and biodegradable materials, responding to environmental concerns and regulations.

- Consumer Engagement: Utilizing technology for personalized marketing and transparent sourcing information related to product ingredients and packaging.

Campari Group is embracing digital transformation, with e-commerce sales in the beverage alcohol sector projected to hit $50 billion by 2025, offering significant growth avenues. The company's investment in advanced data analytics allows for precise consumer targeting, enhancing marketing ROI and driving engagement with premium spirit segments. Automation and AI are key to operational efficiency, with initiatives like integrating Microsoft 365 Copilot expected to boost productivity by streamlining tasks.

Technological advancements are fueling product innovation, particularly in low/no-alcohol beverages, a market expected to exceed $11 billion in 2024, and in sustainable packaging solutions, which 65% of consumers consider in 2025. These technological integrations are crucial for Campari to remain competitive and responsive to evolving consumer demands and environmental considerations.

| Technological Factor | Impact on Campari Group | Supporting Data/Trend |

|---|---|---|

| E-commerce Growth | Expanded market reach and DTC opportunities | Global beverage alcohol e-commerce projected to reach $50 billion by 2025 |

| Data Analytics | Improved consumer insights and marketing effectiveness | Data-driven marketing boosts engagement in premium spirits |

| Automation & AI | Enhanced operational efficiency and productivity | AI tools like Microsoft 365 Copilot streamline tasks; €120M investment in production expansion |

| Product Innovation | Development of new products and sustainable packaging | Low/no-alcohol market to exceed $11 billion in 2024; 65% of consumers consider sustainability in 2025 |

Legal factors

Campari Group navigates a complex web of alcoholic beverage regulations globally. These laws govern everything from production and labeling to distribution, advertising, and point-of-sale practices. For instance, in 2024, the European Union continued to refine its rules on geographical indications and product authenticity, impacting Campari's premium spirits portfolio.

Compliance is non-negotiable, as violations can lead to hefty fines, license revocations, and significant reputational damage. In 2025, countries like the United States are anticipated to see ongoing scrutiny of digital marketing practices for alcohol brands, requiring Campari to adapt its promotional strategies to adhere to evolving digital advertising standards.

Trade tariffs, like the 25% U.S. import duties on certain goods, directly increase Campari Group's costs for imported raw materials and finished products, affecting its pricing and profitability. For example, in 2023, the spirits industry faced ongoing discussions and potential adjustments to trade policies that could influence Campari's supply chain and market access in key regions.

Campari Group is proactively evaluating strategies to navigate these trade barriers, which may include diversifying sourcing locations or adjusting its product mix in affected markets to maintain competitiveness. The company's 2024 outlook continues to monitor evolving global trade regulations and their potential financial implications.

Campari Group actively protects its vast portfolio of over 50 premium and super-premium brands through stringent intellectual property rights management. This is crucial for maintaining brand integrity and preventing unauthorized use across all its operating markets.

The company has demonstrated its commitment by pursuing legal action to safeguard its brands. For instance, Campari Group has filed lawsuits to combat the unauthorized importation of its products, notably citing cases involving Aperol in Russia, highlighting the need for vigilance against trademark infringement.

Consumer Protection and Advertising Laws

Campari Group operates under strict consumer protection and advertising laws, particularly concerning alcoholic beverages. These regulations mandate responsible marketing, ensuring campaigns do not target minors or promote excessive consumption. For instance, in 2023, the UK's Advertising Standards Authority (ASA) continued to enforce rules against misleading alcohol advertising, with several campaigns facing scrutiny for their messaging.

Clear and accurate product labeling is also a critical legal factor. This includes detailing alcohol content, ingredients, and potential health warnings, thereby preventing consumers from being misled about the product. Campari must ensure its packaging and promotional materials comply with varying international standards, such as the EU's Alcohol Intergroup guidelines on responsible promotion.

- Responsible Marketing: Adherence to guidelines preventing targeting of minors and promotion of binge drinking.

- Accurate Labeling: Ensuring clear disclosure of alcohol content, ingredients, and health warnings on all products.

- Advertising Compliance: Meeting national and international advertising standards to avoid misleading claims or imagery.

- Consumer Information: Providing readily accessible information about products to empower informed purchasing decisions.

Labor Laws and Employment Regulations

Campari Group, operating globally, navigates a complex web of labor laws and employment regulations across its various markets. These regulations cover everything from the specifics of employment contracts and minimum wage requirements to workplace safety standards and employee benefits. For instance, in 2024, the European Union continued to refine directives impacting worker rights and working conditions, which Campari must integrate into its HR practices across its European subsidiaries.

The company must also adhere to regulations concerning collective bargaining agreements and employee representation, which vary significantly by country. As of early 2025, many European nations are seeing increased union activity and demands for better pay and conditions, potentially impacting Campari's operational costs and flexibility in workforce management.

Furthermore, any potential restructuring or workforce reductions, such as those that might occur in response to market shifts or strategic realignments, are heavily scrutinized under local labor laws. For example, French labor laws, known for their protective stance towards employees, impose strict procedures and notification periods for layoffs, requiring significant planning and consultation.

- Global Compliance: Campari must comply with diverse labor laws in all operating countries, impacting employment contracts, working conditions, and employee rights.

- EU Regulations: Ongoing EU directives in 2024 and 2025 shape worker rights and working conditions, necessitating adaptation of HR policies across European operations.

- Collective Bargaining: Adherence to country-specific collective bargaining agreements and employee representation laws is crucial for workforce management.

- Restructuring Impact: Labor laws in regions like France impose stringent procedures for workforce reductions, requiring careful strategic planning and employee consultation.

Campari Group operates under stringent legal frameworks governing the alcoholic beverage industry worldwide. These regulations impact everything from product formulation and marketing to distribution and sales. For instance, in 2024, the EU continued to focus on harmonizing rules around alcohol content labeling and health warnings, a key area for Campari's diverse portfolio.

Compliance with advertising standards is paramount, as demonstrated by ongoing enforcement actions by bodies like the UK's Advertising Standards Authority (ASA) in 2023, which scrutinizes campaigns for responsible messaging. Furthermore, intellectual property rights are fiercely protected, with Campari actively pursuing legal avenues against trademark infringement, as seen in past actions concerning unauthorized imports of its brands.

Trade policies and tariffs remain a significant legal consideration. For example, in 2023, the spirits sector continued to monitor potential adjustments to international trade agreements and import duties, which can directly affect Campari's cost of goods and market access. The company's 2024 strategy includes adapting to these evolving trade landscapes, potentially through supply chain diversification or product portfolio adjustments in affected markets.

Labor laws also present a complex legal landscape. In 2024, European Union directives continued to shape worker rights and conditions, requiring Campari to ensure compliance across its operations. Additionally, country-specific regulations, such as those in France concerning workforce reductions, necessitate careful planning and adherence to strict procedural requirements.

| Legal Factor | 2023/2024/2025 Focus | Impact on Campari |

| Alcohol Regulations | EU labeling, health warnings, responsible marketing | Ensures product compliance, shapes marketing strategies |

| Advertising Standards | ASA scrutiny, digital marketing compliance | Requires adherence to avoid penalties, impacts promotional content |

| Intellectual Property | Trademark protection, anti-counterfeiting measures | Safeguards brand value and market exclusivity |

| Trade Policies | Tariffs, import duties, trade agreements | Affects costs, pricing, and market access |

| Labor Laws | EU worker rights, country-specific employment rules | Influences HR practices, workforce management, and restructuring costs |

Environmental factors

Campari Group views climate change as a major hurdle, actively pursuing ambitious goals to cut greenhouse gas emissions. They aim for a substantial 55% reduction in their direct operations by 2025, a critical step towards their ultimate goal of achieving net-zero emissions by 2050.

This commitment is underscored by their progress; for instance, in 2023, Campari reported a 16.6% reduction in Scope 1 and 2 emissions compared to their 2019 baseline, demonstrating tangible movement towards their 2025 target.

Campari Group prioritizes responsible water usage as a core environmental commitment, setting ambitious targets to significantly reduce water consumption throughout its global operations and extended supply chain. This focus is critical given the increasing global scarcity of fresh water resources, a trend projected to intensify in the coming years.

In 2023, Campari Group reported a 5% reduction in water withdrawal intensity compared to their 2019 baseline, demonstrating tangible progress towards their sustainability goals. For instance, their facility in Jamaica achieved a 15% year-on-year reduction in water intensity by implementing advanced water recycling technologies.

Campari Group is increasingly focused on waste management, aiming for a circular economy model. This involves optimizing how materials are used, enhancing recycling and reuse efforts, and boosting the recovery of organic waste from its production facilities. For instance, in 2023, the company reported an increase in its waste recovery rate, with a significant portion of production waste now being recycled or reused.

Sustainable Sourcing of Ingredients

Campari Group's commitment to sustainable sourcing, particularly for key ingredients like agave used in its tequila brands, is fundamental to its environmental strategy and supply chain stability. The company recognizes that responsible agricultural practices not only protect ecosystems but also ensure a consistent supply of high-quality raw materials for the future. This focus is increasingly important as global demand for spirits continues to grow.

For instance, the agave sector faces challenges related to water scarcity and land use. Campari is actively working with its suppliers to implement practices that conserve water and promote biodiversity. By investing in these initiatives, Campari aims to mitigate risks associated with climate change and ensure the long-term viability of its ingredient supply.

- Agave Sustainability: Campari is investing in programs to support sustainable agave farming, addressing water usage and land management practices.

- Supply Chain Resilience: Ensuring responsible sourcing enhances the resilience of Campari's supply chain against environmental disruptions.

- Biodiversity Focus: Efforts are underway to promote biodiversity in agricultural areas that supply Campari's key ingredients.

Environmental Reporting and Transparency

Campari Group is stepping up its environmental reporting, making its sustainability efforts a core part of its annual financial statements. This move aligns with new European regulations, specifically the European Sustainability Reporting Standards (ESRS) and the EU Corporate Sustainability Reporting Directive (CSRD), which came into full effect for many companies starting in the 2024 financial year, with reporting for 2023 data being a key focus. This ensures investors and stakeholders get a clearer, more standardized view of the company's environmental impact.

The integration of a sustainability statement directly into the annual report signifies a commitment to transparency. For instance, Campari's 2023 Integrated Report, released in early 2024, details significant progress in reducing its carbon footprint. The company reported a 14.1% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible environmental action.

- Enhanced Transparency: Campari's commitment to integrating sustainability reporting under ESRS and CSRD provides a more standardized and comparable view of its environmental performance for stakeholders.

- Data-Driven Accountability: The company's 2023 report highlights a 14.1% reduction in Scope 1 and 2 emissions against a 2019 baseline, showcasing concrete environmental achievements.

- Regulatory Compliance: Adherence to directives like CSRD ensures Campari meets evolving European Union standards for corporate sustainability disclosure.

- Investor Confidence: Clear and consistent environmental reporting can bolster investor confidence and attract capital from environmentally conscious funds.

Campari Group is actively addressing climate change by setting ambitious emission reduction targets, aiming for a 55% decrease in Scope 1 and 2 emissions by 2025 from a 2019 baseline. The company reported a 14.1% reduction in these emissions by the end of 2023, showcasing significant progress toward its sustainability goals. This focus extends to responsible water management, with a 5% reduction in water withdrawal intensity achieved by 2023, demonstrating tangible efforts to conserve this vital resource amidst growing global scarcity.

| Environmental Factor | 2023 Performance | Target | Baseline Year |

| Scope 1 & 2 Emissions Reduction | 14.1% reduction | 55% reduction by 2025 | 2019 |

| Water Withdrawal Intensity Reduction | 5% reduction | To be specified | 2019 |

| Waste Recovery Rate | Increased | Circular economy model | To be specified |

PESTLE Analysis Data Sources

Our Campari Group PESTLE Analysis is built on a robust foundation of data from reputable sources, including official government publications, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the beverage industry.