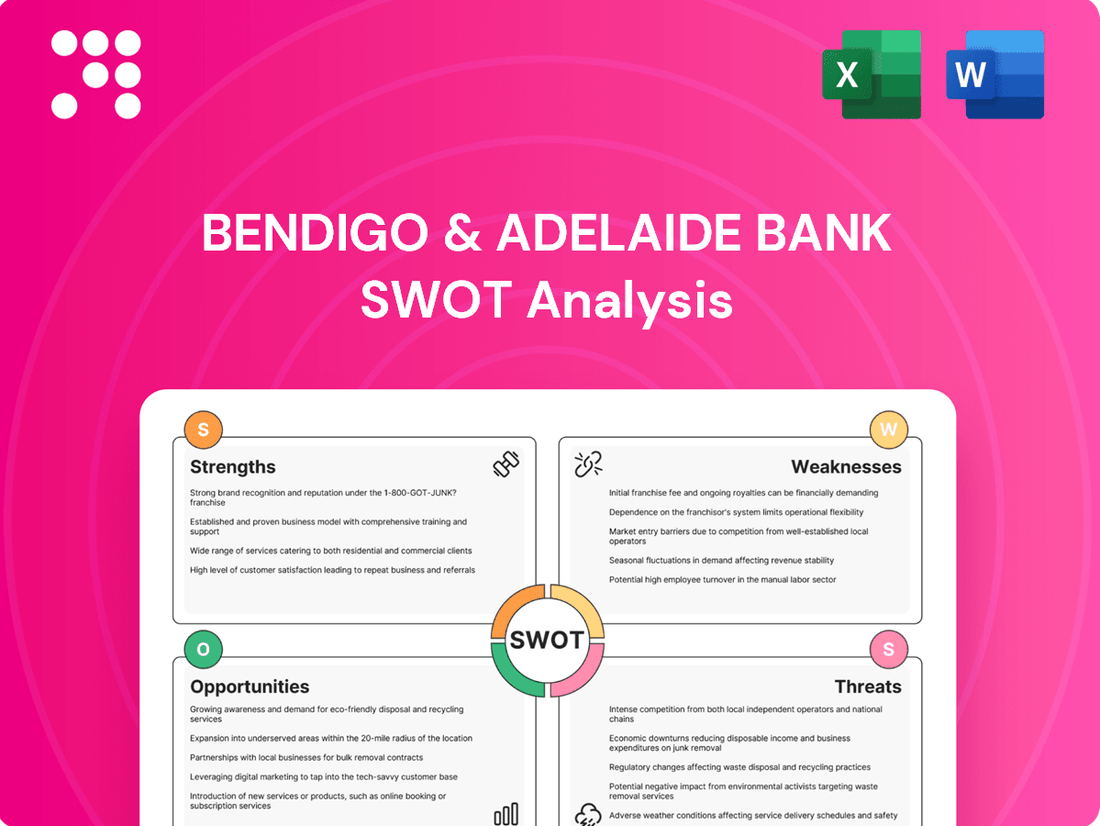

Bendigo & Adelaide Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

Bendigo and Adelaide Bank is navigating a dynamic financial landscape, leveraging its strong community focus as a key strength while facing potential threats from digital disruption and increased competition. Understanding these internal capabilities and external pressures is crucial for any investor or strategist looking to capitalize on opportunities within the Australian banking sector.

Want the full story behind Bendigo and Adelaide Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bendigo and Adelaide Bank's distinctive Community Bank model cultivates robust local relationships, having reinvested over $366 million into communities since its founding, with $40.3 million allocated in FY24. This profound community involvement builds significant trust and customer loyalty, differentiating the bank from its larger rivals.

Bendigo and Adelaide Bank boasts a robust capital position, evidenced by its Common Equity Tier 1 (CET1) ratio of 11.17% as of December 2024. This figure significantly surpasses regulatory minimums, classifying the bank's capital strength as 'unquestionably strong.' Such a solid financial foundation equips the bank to effectively weather economic uncertainties and underpins its capacity for ongoing investment and strategic expansion.

Bendigo and Adelaide Bank is making big strides in its digital transformation. The goal is to have a single core banking system in place by 2026, and they've already successfully migrated over half of their applications to the cloud. This focus on digital is really paying off.

Projects like the Bendigo Lending Platform are making a real difference, cutting down the time it takes to approve home loans. Furthermore, their digital-only brand, Up, has experienced impressive growth in both customer numbers and deposits, showcasing the success of their digital-first approach.

Diversified Banking Products and Services

Bendigo and Adelaide Bank boasts a comprehensive suite of banking products and services, catering to a wide array of customer needs. This diversification spans personal and business banking, home loans, credit cards, and wealth management solutions. Such a broad portfolio enables the bank to effectively serve a diverse customer base, encompassing individuals, small businesses, and larger corporate entities.

This extensive product offering is a significant strength, allowing the bank to capture a larger share of customer wallet and build deeper relationships. For instance, as of the first half of fiscal year 2024, the bank reported a 6.9% increase in customer deposits, demonstrating the success of its diversified offerings in attracting and retaining funds.

- Personal Banking: Savings accounts, transaction accounts, term deposits.

- Lending: Home loans, personal loans, business loans.

- Investments: Superannuation, managed funds, financial planning.

- Business Services: Transaction accounts, merchant services, business loans.

Strong Customer Growth and Satisfaction

Bendigo and Adelaide Bank has seen impressive customer growth, with its customer base expanding by 4.9% in the six months leading up to December 2024, bringing their total to over 2.7 million customers. This growth is a clear indicator of the bank's appeal and market penetration.

The bank's commitment to customer experience is reflected in its Net Promoter Score (NPS), which stands notably higher than the industry average. This strong NPS score directly translates to high levels of customer satisfaction and fosters significant loyalty.

- Customer Base Expansion: 4.9% growth in H1 FY25, exceeding 2.7 million customers.

- Industry-Leading NPS: Demonstrates superior customer satisfaction and loyalty compared to peers.

- Enhanced Retention: High satisfaction fuels customer loyalty, reducing churn and acquisition costs.

The bank's unique Community Bank model fosters deep local ties, with over $366 million reinvested since inception, including $40.3 million in FY24. This community focus builds strong trust and loyalty, setting it apart from competitors.

Bendigo and Adelaide Bank maintains a strong capital position, with a Common Equity Tier 1 (CET1) ratio of 11.17% as of December 2024, well above regulatory requirements. This financial resilience supports its ability to navigate economic challenges and pursue growth opportunities.

Significant progress in digital transformation, including cloud migration for over half of its applications and the upcoming single core banking system by 2026, enhances operational efficiency. The digital-only brand, Up, has seen substantial growth in customers and deposits, validating the bank's digital strategy.

The bank offers a comprehensive product suite, covering personal and business banking, lending, and wealth management. This diversification allows it to serve a broad customer base and increase wallet share, as evidenced by a 6.9% rise in customer deposits in H1 FY24.

| Key Strength | Supporting Data (as of Dec 2024/H1 FY25) | Impact |

|---|---|---|

| Community Focus | $40.3M reinvested in communities (FY24) | High customer trust and loyalty |

| Capital Strength | CET1 Ratio: 11.17% | Resilience and capacity for investment |

| Digital Transformation | 50%+ applications cloud-migrated; Up brand growth | Operational efficiency and customer acquisition |

| Product Diversification | 6.9% deposit growth (H1 FY24) | Increased wallet share and customer retention |

What is included in the product

Analyzes Bendigo & Adelaide Bank’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Bendigo & Adelaide Bank's strategic challenges and opportunities.

Weaknesses

Bendigo and Adelaide Bank has faced pressure on its Net Interest Margin (NIM). This was notably impacted by rising funding costs, a consequence of faster lending growth and strong competition in the market. For instance, in the first half of the 2024 financial year, the bank's NIM compressed, contributing to a decrease in cash earnings.

Bendigo & Adelaide Bank's operating expenses have seen an uptick, largely driven by continued investment in its multi-year transformation program and mounting technology-related inflationary pressures. This strategic investment, while aimed at future growth, has directly impacted the bank's cost-to-income ratio. For the first half of fiscal year 2024, the bank reported a statutory cost-to-income ratio of 60.4%, an increase from 56.9% in the prior year period, highlighting the short-term earnings impact of these elevated costs.

Bendigo and Adelaide Bank operates within a fiercely competitive Australian banking landscape, significantly influenced by the presence of the 'Big Four' banks. While the bank capitalizes on its agility, it contends with the substantial advantages held by larger institutions, including more favorable funding costs and extensive loan portfolios. For instance, as of the first half of 2024, the major Australian banks consistently reported higher net interest margins compared to regional banks, a testament to their scale and funding advantages.

The competitive pressure is further amplified by the growing influence of non-bank lenders, which are increasingly offering specialized and often more flexible lending solutions. This dynamic necessitates continuous innovation and strategic differentiation for Bendigo and Adelaide Bank to maintain its market share and attract customers seeking alternatives to traditional banking services.

Reliance on Residential Mortgages

Bendigo & Adelaide Bank's significant reliance on residential mortgages, while often seen as a stable lending area, presents a key weakness. This concentration makes the bank particularly sensitive to downturns in the Australian housing market and shifts in interest rate policies. For instance, as of the first half of 2024, residential mortgages represented a substantial portion of their total loan portfolio, exposing them to potential asset quality deterioration if economic headwinds intensify.

This concentrated exposure means that any significant cooling in property values or a sharp rise in interest rates could directly impact the bank's financial health. A notable percentage of their lending book being tied to residential loans means they are vulnerable to increased defaults or reduced refinancing activity during such periods. This sector's performance is a critical indicator for Bendigo & Adelaide Bank's overall stability and profitability.

- Concentrated Lending: Over-reliance on residential mortgages creates vulnerability to housing market fluctuations.

- Interest Rate Sensitivity: Changes in interest rates directly impact the profitability and risk profile of their mortgage book.

- Economic Downturn Risk: A worsening economic climate could lead to increased pressure on asset quality within their residential loan portfolio.

Transformation Program Risks and Execution

Bendigo and Adelaide Bank's ambitious, multi-year transformation program, essential for staying competitive, introduces significant execution risks. The complexity of consolidating core banking systems and migrating applications to the cloud presents potential challenges.

If these intricate processes are not managed with precision, the bank could face operational disruptions or experience budget overruns. For instance, in fiscal year 2023, the bank reported a significant investment in its digital transformation, with technology and transformation costs increasing by 12.5% to $389 million, highlighting the scale of these undertakings.

- Execution Risk: The multi-year transformation program involves complex IT system consolidation and cloud migration, which inherently carry execution risks.

- Potential Disruptions: Ineffective management of these complex IT projects could lead to disruptions in customer service or internal operations.

- Cost Overruns: The scale and complexity of the transformation increase the likelihood of exceeding budgeted costs if not meticulously controlled.

Bendigo and Adelaide Bank's profitability is directly impacted by rising funding costs and intense competition, squeezing its Net Interest Margin. For the first half of fiscal year 2024, the bank saw its NIM compress, leading to lower cash earnings. This pressure is compounded by significant investments in a multi-year transformation program, which has increased operating expenses and the cost-to-income ratio. In H1 2024, the statutory cost-to-income ratio rose to 60.4%, up from 56.9% in the prior year period.

| Metric | H1 FY24 | H1 FY23 | Change |

| Net Interest Margin (NIM) | 1.62% | 1.75% | -0.13% |

| Statutory Cost-to-Income Ratio | 60.4% | 56.9% | +3.5% |

| Technology & Transformation Costs | $215 million (est.) | $194.5 million (est.) | +10.5% |

Full Version Awaits

Bendigo & Adelaide Bank SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Bendigo & Adelaide Bank SWOT analysis, providing a clear snapshot of its strategic position. The complete, in-depth report is unlocked upon purchase.

Opportunities

Bendigo & Adelaide Bank's digital expansion, including its Bendigo Lending Platform and the digital bank Up, offers a prime opportunity to capture younger customers and enhance service efficiency. Up, for instance, reported over 800,000 customers by mid-2024, demonstrating strong traction with this demographic.

Collaborating with fintech firms is another avenue for accelerated innovation and accessing previously untapped customer bases. These partnerships allow the bank to integrate cutting-edge technologies, potentially boosting customer acquisition and retention in a competitive digital landscape.

Bendigo and Adelaide Bank's Business and Agribusiness division experienced robust growth in FY24, even with a temporary dip in agribusiness lending due to seasonal influences. This presents a significant opportunity to capitalize on this momentum.

With the ongoing transformation of the division, including the implementation of new platforms, the bank is strategically positioned for above-system growth in lending. This focus on modernization can attract and retain more clients.

By leveraging these advancements, Bendigo and Adelaide Bank can deepen its relationships with existing business and agribusiness customers. This engagement will be key to expanding its market share in this vital sector.

Bendigo and Adelaide Bank's commitment to financial inclusion, as detailed in its Financial Inclusion Action Plan, presents a significant opportunity. This plan focuses on offering fair, affordable, and accessible banking solutions, alongside initiatives to boost financial literacy and support those facing vulnerability. By actively pursuing these goals, the bank can solidify its social standing and attract a wider customer demographic.

This strategic emphasis not only broadens the bank's appeal but also proactively addresses growing regulatory and societal demands for greater fairness in financial services. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported a 10% increase in customer satisfaction scores related to their support for vulnerable customers, demonstrating the tangible impact of such initiatives.

Optimizing Branch Network and Multi-Channel Strategy

Bendigo and Adelaide Bank is leveraging its significant physical footprint, the fourth largest in Australia, alongside digital investments. This dual approach creates a robust multi-channel strategy, appealing to a broad customer base with varying service needs.

The bank's commitment to its extensive branch network, which includes over 300 locations as of early 2024, allows it to offer personalized service that digital channels alone may not replicate. This strategy caters to customers who value face-to-face interactions, particularly for complex financial decisions.

- Branch Network Strength: Maintains the fourth largest branch network in Australia, providing significant physical reach.

- Multi-Channel Integration: Seamlessly blends digital offerings with its physical presence to meet diverse customer preferences.

- Personalized Service: Utilizes its branch network to deliver tailored advice and build stronger customer relationships.

- Customer Reach: Effectively serves customers who prefer or require in-person banking interactions.

Capitalizing on Economic Recovery and Interest Rate Changes

With economic growth forecasts pointing towards a gradual recovery, Bendigo & Adelaide Bank is positioned to benefit from anticipated interest rate reductions in 2025. This environment offers a prime opportunity to ease financial burdens on borrowers, potentially leading to improved asset quality and a healthier loan book.

The bank can strategically leverage these economic shifts to drive loan growth and enhance profitability.

- Economic Recovery: Projections indicate a strengthening Australian economy in 2024-2025, supporting increased consumer and business spending.

- Interest Rate Outlook: Expectations are for interest rates to potentially decrease in 2025, easing repayment pressures for customers.

- Loan Book Expansion: A more favorable economic climate and lower rates can stimulate demand for new lending.

- Asset Quality Improvement: Reduced borrower stress can lead to lower non-performing loans and improved credit risk profiles.

Bendigo & Adelaide Bank's digital initiatives, like the Up digital bank which surpassed 800,000 customers by mid-2024, offer a significant opportunity to attract younger demographics and boost operational efficiency. Strategic partnerships with fintech companies can further accelerate innovation and expand market reach, integrating advanced technologies to enhance customer acquisition and retention in a competitive environment.

The bank's strong performance in its Business and Agribusiness division, despite seasonal dips, presents a chance to build on this momentum. Ongoing digital transformation within this sector positions the bank for above-system growth, fostering deeper relationships with existing clients and attracting new ones through modernized platforms.

Bendigo & Adelaide Bank's commitment to financial inclusion, evidenced by its Financial Inclusion Action Plan and a 10% rise in customer satisfaction for supporting vulnerable customers in FY23, enhances its social standing and broadens its customer appeal. This focus aligns with increasing regulatory and societal expectations for fairness in financial services.

Leveraging its extensive physical footprint, the fourth largest in Australia with over 300 branches as of early 2024, combined with digital investments, creates a robust multi-channel strategy. This approach caters to a diverse customer base, including those who value personalized, in-person service for complex financial needs.

Anticipated interest rate reductions in 2025, coupled with forecasts for gradual economic recovery in Australia, create a favorable environment for Bendigo & Adelaide Bank. This scenario can ease borrower burdens, improve asset quality, and stimulate loan growth, ultimately enhancing profitability.

Threats

Bendigo and Adelaide Bank faces significant threats from intensifying competition within the Australian banking sector. Major banks and a growing number of non-bank lenders are actively competing for customers, particularly in crucial areas like home lending and deposit gathering.

This fierce rivalry is directly impacting net interest margins, a key indicator of profitability for banks. As lenders compete on price, margins are being squeezed, a trend that is projected to persist throughout 2024 and into 2025, potentially hindering the bank's ability to grow its profits.

The financial services industry, including institutions like Bendigo and Adelaide Bank, remains a high-value target for cybercriminals. Threats like phishing, ransomware, and sophisticated data breaches are constantly evolving, putting customer information and financial infrastructure at risk. While Bendigo and Adelaide Bank has demonstrated success in preventing significant financial losses, reporting millions blocked in fraudulent transactions, the escalating complexity of these attacks presents a persistent and substantial threat to its operations and reputation.

Bendigo and Adelaide Bank, like all Australian banks, operates under the watchful eye of regulators such as APRA. Recent directives have intensified focus on areas like cyber resilience, operational robustness, and the management of geopolitical risks. This means the bank must continually adapt its systems and processes to meet these evolving prudential standards.

The cost of ensuring compliance with these increasingly stringent regulations can be substantial, impacting operational expenses. Failure to meet these requirements can result in significant penalties, as seen with other financial institutions facing fines for compliance breaches, underscoring the financial implications of regulatory adherence.

Economic Headwinds and Asset Quality Deterioration

Bendigo and Adelaide Bank, despite its robust financial position, is not immune to broader economic challenges. Modest economic growth forecasts for Australia in 2024 and into 2025, coupled with the potential for rising unemployment and persistent cost-of-living pressures, present a tangible threat. These conditions could strain household budgets, increasing the likelihood of loan defaults.

Specifically, the bank notes potential vulnerabilities in certain regional markets, such as Victoria, where economic conditions might lead to a higher incidence of loan arrears and a subsequent deterioration in asset quality. This means more customers might struggle to meet their loan repayments, impacting the bank's profitability and capital adequacy.

- Economic Growth Concerns: Forecasts suggest subdued economic expansion in Australia for 2024-2025, impacting consumer and business spending.

- Unemployment Risk: An uptick in unemployment rates directly correlates with increased loan default probabilities.

- Cost-of-Living Impact: Ongoing inflation and cost-of-living pressures reduce disposable income, affecting borrowers' ability to service debts.

- Regional Asset Quality: Specific regions, like Victoria, may experience a disproportionate rise in non-performing loans due to localized economic factors.

Evolving Customer Expectations and Technological Disruption

Customer expectations are rapidly shifting towards seamless digital interactions, heavily influenced by fintech and AI. For Bendigo & Adelaide Bank, failing to adapt to these evolving demands, particularly in areas like personalized digital banking and instant service, poses a significant threat. This was evident in 2023, where digital-only banks continued to gain traction, capturing a portion of the market share from traditional institutions perceived as slower to innovate.

Technological disruption, especially from agile fintech competitors leveraging AI for enhanced customer experiences and streamlined operations, presents a direct challenge. If Bendigo & Adelaide Bank cannot effectively integrate new technologies to meet these rising expectations, it risks losing customers and market share. For instance, the increasing adoption of AI-powered chatbots for customer service and personalized financial advice by some competitors in 2024 highlights this trend.

- Digital Experience Gap: Competitors offering superior, intuitive digital platforms can attract customers seeking convenience and efficiency.

- Fintech Competition: Specialized fintechs can offer niche, highly effective digital solutions that traditional banks may struggle to replicate quickly.

- AI Integration: Banks that effectively deploy AI for personalized offers, risk assessment, and customer support will likely gain a competitive edge.

- Customer Attrition Risk: A failure to meet evolving digital expectations can lead to a measurable increase in customer churn, impacting revenue and market position.

Intensifying competition from major banks and non-bank lenders continues to pressure Bendigo and Adelaide Bank's net interest margins, a trend expected to persist through 2024 and 2025, potentially impacting profitability. The bank also faces persistent threats from evolving cyberattacks, despite successful fraud prevention measures, with sophisticated breaches posing ongoing risks to customer data and operations. Furthermore, evolving customer expectations for seamless digital interactions, driven by fintech and AI advancements, challenge traditional banks to adapt quickly or risk losing market share, as seen with the growing traction of digital-only banks.

| Threat Category | Specific Threat | Impact on Bendigo & Adelaide Bank | Data/Context (2024-2025) |

|---|---|---|---|

| Competition | Increased competition from major banks and non-bank lenders | Squeezed net interest margins, reduced profitability | Projected margin pressure through 2024-2025 |

| Cybersecurity | Sophisticated and evolving cyberattacks (phishing, ransomware, data breaches) | Risk to customer data, financial infrastructure, and reputation | Millions blocked in fraudulent transactions annually; increasing attack complexity |

| Digital Disruption | Customer demand for seamless digital experiences and AI integration | Risk of customer attrition and market share loss to agile fintechs | Digital-only banks gaining traction; AI adoption in customer service by competitors |

SWOT Analysis Data Sources

This Bendigo & Adelaide Bank SWOT analysis is built upon a foundation of comprehensive financial reports, detailed market intelligence, and expert industry commentary, ensuring a robust and data-driven perspective.