Bendigo & Adelaide Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

Bendigo & Adelaide Bank operates within a dynamic banking landscape, where understanding the interplay of competitive forces is crucial for strategic success. This analysis delves into the intensity of rivalry, the power of buyers and suppliers, and the ever-present threats of new entrants and substitutes.

The complete report reveals the real forces shaping Bendigo & Adelaide Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Reserve Bank of Australia (RBA) and the Australian Prudential Regulation Authority (APRA) wield substantial influence over Bendigo & Adelaide Bank. The RBA's monetary policy, particularly its cash rate decisions, directly affects the bank's cost of borrowing funds. For instance, the RBA's cash rate target was 4.35% as of November 2023, a key factor influencing lending and deposit rates across the industry.

APRA's capital adequacy requirements and prudential standards dictate the minimum capital levels Bendigo & Adelaide Bank must maintain. These regulations ensure the bank's financial stability and resilience. APRA's data, such as the quarterly statistics on Authorised Deposit-taking Institutions (ADIs), provides insights into the sector's health and the regulatory landscape impacting all banks.

Decisions on lending standards and overall financial stability by these bodies significantly shape the operational environment for Bendigo & Adelaide Bank. The RBA's Financial Stability Reviews, released periodically, highlight systemic risks and regulatory considerations that can impact the bank's strategic planning and risk management practices.

The increasing reliance on digital platforms and advanced analytics in financial services significantly boosts the bargaining power of specialized technology and software providers. Bendigo & Adelaide Bank's need for robust IT infrastructure, cybersecurity, and digital tools means these vendors are crucial partners.

Dependence on a limited number of key suppliers for critical systems, such as core banking software or cloud services, can amplify their leverage. For instance, in 2023, the global IT spending by financial services firms was projected to reach over $300 billion, highlighting the scale of investment and the importance of these technology relationships.

Bendigo & Adelaide Bank's reliance on skilled professionals, especially in digital transformation, cybersecurity, and data analytics, significantly impacts its operational costs and ability to innovate. A scarcity of talent in these crucial areas can drive up wage expectations and recruitment expenses, thereby amplifying the bargaining power of these specialized employees.

The ongoing digital evolution within the banking sector underscores this dependency. For instance, in 2024, the demand for cybersecurity experts remained exceptionally high, with reports indicating average salaries for senior cybersecurity analysts in Australia exceeding AUD $150,000 annually, reflecting the competitive landscape for such critical skills.

Capital Markets and Depositors

Bendigo and Adelaide Bank, like other financial institutions, relies heavily on depositors as a primary funding source. While individual retail depositors generally hold limited bargaining power, large institutional depositors can exert more influence, particularly when seeking competitive interest rates. In 2023, the Australian banking sector saw deposit growth, with major banks experiencing an increase in their deposit books, reflecting a general trend of customers seeking stability.

Beyond retail deposits, access to wholesale capital markets is vital for funding and liquidity management. The cost of raising capital in these markets is directly influenced by the broader economic outlook and investor sentiment. For instance, during periods of economic uncertainty, the yields demanded by investors for bank debt tend to rise, increasing funding costs for institutions like Bendigo and Adelaide Bank.

- Depositor Concentration: While retail depositors form the bedrock, a significant portion of funding can come from a smaller number of large corporate or institutional depositors, giving them greater negotiation leverage.

- Wholesale Funding Costs: The cost of issuing bonds or accessing other wholesale funding sources in mid-2024 is influenced by benchmark interest rates and credit spreads, which reflect market perceptions of risk.

- Regulatory Environment: Banking regulations, such as liquidity coverage ratios, also impact a bank's need for stable funding, indirectly affecting the bargaining power of its funding providers.

Payment Network Providers

Payment network providers, like Visa and Mastercard, are essential suppliers for Bendigo & Adelaide Bank. These networks process the vast majority of card transactions, making them critical infrastructure. In 2024, the reliance on these established networks continues, as they offer global reach and established consumer trust.

Any shifts in the fees or operational terms set by these payment giants can directly influence the bank's operational costs and, consequently, its profitability. This dependency highlights a significant leverage point for these network providers.

- Visa and Mastercard dominate global card processing, giving them substantial bargaining power.

- Banks like Bendigo & Adelaide Bank are dependent on these networks for transaction processing capabilities.

- Changes in interchange fees or network access terms can significantly impact a bank's revenue and cost structure.

The bargaining power of suppliers for Bendigo & Adelaide Bank is moderate, primarily influenced by the concentration and criticality of certain providers. While the bank has diverse funding sources, key technology and payment network providers hold significant leverage due to their essential services and market dominance.

For instance, payment networks like Visa and Mastercard are indispensable for card transactions, and their fee structures directly impact the bank's revenue. Similarly, specialized IT providers for core banking systems and cybersecurity are critical, with a limited pool of highly skilled vendors potentially commanding higher prices. The bank's reliance on these essential services, particularly in an increasingly digital financial landscape, grants these suppliers considerable influence.

| Supplier Type | Key Providers | Bargaining Power Factor | Impact on Bendigo & Adelaide Bank |

|---|---|---|---|

| Payment Networks | Visa, Mastercard | Market Dominance, Network Effects | Influence on transaction fees, operational costs |

| Core Banking Technology | Specialized Software Vendors | Criticality of systems, vendor concentration | Impact on IT infrastructure costs, system upgrades |

| Talent/Skills | Highly skilled IT professionals (Cybersecurity, Data Analytics) | Scarcity of specialized talent | Affects recruitment costs, wage pressures |

What is included in the product

Tailored exclusively for Bendigo & Adelaide Bank, this analysis dissects the competitive forces shaping its industry, revealing threats from rivals, the bargaining power of customers and suppliers, and the potential impact of new entrants and substitutes.

Quickly assess competitive intensity with a visual breakdown of rivals, new entrants, and substitute threats, enabling proactive strategy adjustments.

Customers Bargaining Power

For everyday banking products like savings and transaction accounts, customers can often switch providers without much hassle. This is especially true now with digital tools making it easier to open new accounts and move money. This low barrier to switching means customers have more sway when looking for better deals or services.

The ability to easily compare and switch banks puts pressure on institutions to offer competitive rates and good service. For instance, in 2024, many neobanks and challenger banks continued to attract customers with higher interest rates on savings accounts, demonstrating this customer power. This increased financial awareness means customers are more likely to shop around, further amplifying their bargaining strength.

The digital revolution has dramatically increased information transparency in banking. Customers can now effortlessly compare interest rates, fees, and product features across numerous institutions using online comparison tools and financial aggregators. This ease of access to data empowers consumers, allowing them to make more informed decisions and actively seek out the best deals available.

This heightened transparency directly impacts the bargaining power of customers. For instance, in 2024, the Australian banking sector saw continued competition on savings account interest rates, with major banks and smaller institutions alike adjusting their offerings to attract deposits. Bendigo & Adelaide Bank, like its peers, must remain competitive in its pricing and product features to retain and attract customers in this environment.

Bendigo & Adelaide Bank caters to a wide array of customers, from individuals and small businesses to larger corporations. While individual retail clients typically wield less power, significant corporate clients or astute investors can exert considerable bargaining influence due to the substantial volume of their transactions and their capacity to negotiate favorable terms.

The bank's strategic emphasis on community banking fosters robust relationships with local clientele, potentially mitigating some of the bargaining power of individual customers by building loyalty and shared value.

Competitive Market Offerings

The Australian banking landscape is characterized by robust competition, with a multitude of institutions actively seeking customer engagement. This environment, featuring major banks, other regional players, and a growing number of fintech innovators, presents consumers with a broad spectrum of choices, significantly amplifying their bargaining power. For Bendigo & Adelaide Bank, maintaining a competitive edge necessitates ongoing efforts to differentiate its product and service offerings to effectively attract and retain its customer base.

Customer bargaining power is further influenced by the accessibility of information and the ease with which consumers can switch providers. In 2024, the digital transformation within the financial sector has lowered switching costs considerably, allowing customers to compare rates and services more readily. This heightened transparency and reduced friction empower customers to demand better terms and more tailored financial solutions.

- High Customer Choice: The presence of major banks like Commonwealth Bank, Westpac, ANZ, and NAB, alongside other regional banks and over 100 fintech companies, provides consumers with extensive options in 2024.

- Digital Switching Ease: Online platforms and mobile banking apps have streamlined the process of opening new accounts and closing old ones, reducing the effort required for customers to switch banks.

- Price Sensitivity: Customers are increasingly sensitive to interest rates on savings and loans, as well as fees, actively seeking the most advantageous financial products available.

- Demand for Digital Services: A significant portion of Australian banking customers, particularly younger demographics, expect seamless digital experiences, pushing banks to invest heavily in technology to meet these demands.

Impact of Economic Conditions on Customer Behavior

Economic factors, such as fluctuating interest rates and rising cost of living pressures, significantly shape how customers approach borrowing and saving. For instance, in 2024, as central banks continued to navigate inflation, many consumers prioritized higher savings yields, directly impacting deposit growth strategies for banks like Bendigo and Adelaide Bank.

Periods of economic uncertainty, like those experienced in early 2024 with ongoing global supply chain adjustments, often lead customers to seek more flexible credit options and potentially delay major purchases. This heightened sensitivity to economic conditions empowers customers, giving them greater leverage in selecting financial products and services that best align with their evolving financial circumstances.

- Interest Rate Sensitivity: In Q1 2024, Australian households faced a continued tightening of monetary policy, with the Reserve Bank of Australia maintaining its cash rate. This environment incentivized a shift towards higher-yield savings accounts, increasing customer bargaining power for better deposit rates.

- Cost of Living Impact: Elevated inflation throughout 2023 and into 2024 placed significant pressure on household budgets. This led to a greater demand for competitive loan products and fee structures, as customers actively sought ways to manage their expenses.

- Demand for Flexibility: Economic volatility encouraged customers to demand more adaptable financial solutions, including flexible repayment options on loans and accessible savings products, thereby enhancing their negotiating position with financial institutions.

Customers of Bendigo & Adelaide Bank possess significant bargaining power due to the ease of switching between financial institutions and the widespread availability of information. This allows them to readily compare offerings and demand competitive rates and services, a trend amplified in 2024 by the continued digital transformation in banking.

The Australian banking sector in 2024 is highly competitive, with numerous banks and fintechs offering diverse products. This abundance of choice empowers customers to seek out the best deals, putting pressure on banks like Bendigo & Adelaide to innovate and maintain attractive pricing and service levels to retain their customer base.

Economic conditions in 2024, such as persistent inflation and interest rate sensitivity, further bolster customer leverage. Consumers are actively seeking higher returns on savings and more flexible loan terms, forcing financial institutions to adapt their strategies to meet these evolving demands and remain competitive.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Ease of Switching | High | Digital platforms continue to lower switching costs, making it simple for customers to move funds and accounts. |

| Information Transparency | High | Online comparison tools and financial aggregators provide readily accessible data on rates, fees, and product features. |

| Competitive Landscape | High | Over 100 fintech companies and numerous traditional banks offer a wide array of choices, increasing customer options. |

| Economic Sensitivity | Moderate to High | Inflation and interest rate changes in 2024 have made customers more price-conscious, especially for savings and loans. |

Same Document Delivered

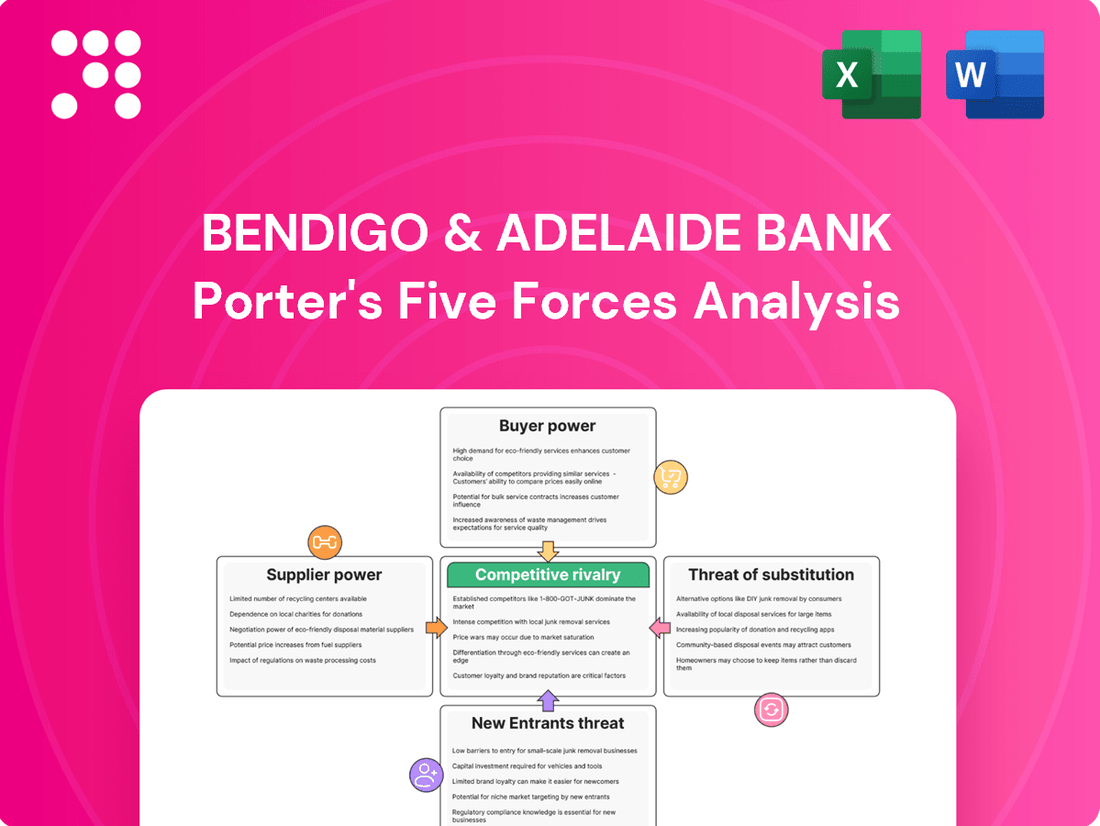

Bendigo & Adelaide Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Bendigo & Adelaide Bank, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you will receive instantly upon purchase, offering immediate insights into the bank's industry positioning. This includes an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, all presented professionally and ready for your immediate use.

Rivalry Among Competitors

The Australian banking sector is heavily concentrated, with the four major banks – Commonwealth Bank, Westpac, National Australia Bank (NAB), and Australia and New Zealand Banking Group (ANZ) – holding substantial market power. These institutions command vast resources, extensive physical and digital footprints, and a significant portion of the nation's banking business. For instance, as of late 2023, the major banks collectively held over 70% of total Australian banking assets, highlighting their dominant position.

Bendigo and Adelaide Bank, as a prominent regional player, finds itself in direct competition with these giants across all core banking products. This rivalry is particularly fierce in high-volume areas such as home lending and business banking, where the majors leverage their scale and brand recognition to attract and retain customers. This intense competition directly impacts Bendigo and Adelaide Bank's ability to grow its market share and can put pressure on profit margins.

Bendigo & Adelaide Bank faces significant competition not only from the major national players but also from a diverse array of regional banks and credit unions. These institutions frequently vie for the same customer bases, often presenting compelling rates and specialized services that directly challenge Bendigo & Adelaide Bank's market position. For instance, many credit unions, supported by their member-owned structures, can offer more favorable terms on loans and deposits.

The competitive landscape is further intensified by the localized strengths of regional banks, which often possess deep community ties and a strong understanding of local economic needs. This allows them to tailor offerings and build customer loyalty in ways that larger, more standardized banks might struggle with. In 2024, the Australian Prudential Regulation Authority (APRA) reported that regional banks and credit unions collectively hold a substantial portion of the retail banking market, underscoring the persistent pressure on mid-tier banks.

The competitive rivalry for Bendigo & Adelaide Bank is intensifying due to digital disruption. The emergence of digital-only banks and fintechs offering specialized services like payments and lending is a key factor. These nimble competitors often use technology to provide more efficient, cost-effective, and user-friendly solutions, pressuring established institutions to upgrade their digital offerings.

By the end of 2024, the Australian fintech sector is projected to see continued growth, with digital banking solutions playing a significant role. For instance, neobanks have been steadily gaining market share, attracting customers with their seamless digital experiences and often more competitive pricing structures compared to traditional banks.

Product Homogeneity and Price Sensitivity

Many core banking products, like simple savings accounts and common home loans, are quite similar across institutions. This lack of clear differentiation means customers often focus on price, making them very sensitive to interest rates and fees. For example, in 2024, the average variable mortgage rate for owner-occupiers in Australia hovered around 6.5%, a key battleground for banks.

This intense price competition puts pressure on banks, including Bendigo & Adelaide Bank, to keep their margins tight. When customers can easily switch for a slightly better rate, banks are compelled to compete aggressively on pricing. This dynamic forces a constant focus on operational efficiency and finding ways to stand out beyond just the cost of services.

- Product Similarity: Basic savings accounts and standard home loans often lack unique features, making them easily comparable.

- Price Sensitivity: Customers frequently choose providers based on the lowest interest rates or fees.

- Margin Compression: Aggressive pricing strategies can reduce profitability for banks.

- Value Beyond Price: Banks must innovate with services, customer experience, or specialized offerings to attract and retain customers without solely relying on price competition.

Regulatory Environment and Capital Requirements

The regulatory environment, overseen by entities like the Australian Prudential Regulation Authority (APRA), significantly shapes competitive rivalry. While these regulations act as a barrier to new entrants, they also impose substantial compliance costs and capital requirements on existing players, influencing how they compete and innovate. For instance, APRA's prudential standards dictate capital adequacy ratios, impacting a bank's capacity to lend and invest, thereby affecting the intensity of competition across the sector.

These stringent requirements, including robust capital and liquidity buffers, are a key factor in the resilience of Australian banks. For Bendigo & Adelaide Bank, adhering to these evolving regulations means that competition often centers on efficiency in compliance and the ability to leverage regulatory frameworks to their advantage. The need to maintain strong capital positions, such as the Common Equity Tier 1 (CET1) ratios, directly influences strategic decisions and the competitive positioning of all banks.

- APRA's Oversight: APRA sets capital adequacy ratios and liquidity requirements, influencing how banks operate and compete.

- Compliance Costs: Adhering to regulations incurs significant operational expenses for all banks, including Bendigo & Adelaide Bank.

- Innovation Constraints: Regulatory frameworks can sometimes limit the speed at which banks can introduce new products or services, affecting competitive dynamics.

- Capital Buffers: Strong capital and liquidity buffers are essential for stability and are a key performance indicator in the competitive landscape.

Bendigo & Adelaide Bank faces intense competition from major national banks, regional players, and emerging fintechs. The similarity of core products like savings accounts and home loans drives price sensitivity, with customers frequently switching for better rates, for example, the average variable mortgage rate for owner-occupiers in Australia was around 6.5% in 2024. This necessitates a focus on operational efficiency and differentiation beyond price.

| Competitor Type | Key Competitive Factors | Impact on Bendigo & Adelaide Bank |

| Major Banks (e.g., CBA, Westpac) | Scale, brand recognition, extensive networks, deep pockets | Significant pressure on market share and pricing power |

| Regional Banks & Credit Unions | Local ties, tailored offerings, potentially better rates | Competition for specific customer segments and geographic markets |

| Fintechs & Neobanks | Digital innovation, cost efficiency, niche services | Disruption of traditional models, pressure to enhance digital offerings |

SSubstitutes Threaten

The rise of fintech solutions and digital wallets presents a significant threat of substitutes for Bendigo & Adelaide Bank. These digital platforms, like PayPal and Apple Pay, offer streamlined payment processes and often lower transaction costs, directly competing with traditional banking services. In 2023, digital wallet usage continued its upward trajectory, with global transaction volumes reaching trillions of dollars, indicating a growing consumer preference for these convenient alternatives.

The rise of direct investment platforms presents a significant threat of substitutes for traditional bank wealth management services. Customers can now easily access online brokerages and robo-advisors, bypassing banks for their investment needs.

These platforms often boast lower fees and a more intuitive user experience, making them attractive alternatives. For instance, the global robo-advisor market was valued at approximately $1.5 trillion in assets under management (AUM) by the end of 2023, a figure projected to grow substantially in the coming years, highlighting the increasing customer preference for these digital solutions.

Buy Now Pay Later (BNPL) services present a significant threat by offering consumers an alternative to traditional credit cards and personal loans, especially for retail spending. These platforms allow for interest-free deferred payments, attracting customers who desire payment flexibility without the traditional credit application process.

This growing trend directly impacts Bendigo & Adelaide Bank's revenue streams from its credit products, as consumers increasingly opt for BNPL for everyday purchases. For instance, BNPL transaction volumes in Australia saw substantial growth, with estimates suggesting the market could reach tens of billions of dollars annually by 2025, diverting potential interest income from banks.

Cryptocurrencies and Blockchain-based Services

Cryptocurrencies and blockchain technology present a nascent but evolving threat of substitutes for traditional banking services. While not yet a mainstream replacement for everyday banking, these decentralized systems offer alternative methods for value storage and transfer. For instance, the global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating growing investor interest and technological development.

As these technologies mature and regulatory clarity improves, they could potentially disintermediate banks from core functions like payments and lending. For example, stablecoins, pegged to fiat currencies, are increasingly being explored for cross-border payments, offering a potentially faster and cheaper alternative to traditional correspondent banking networks. This disruptive potential, though longer-term, necessitates ongoing monitoring by institutions like Bendigo & Adelaide Bank.

- Growing Market Capitalization: The global cryptocurrency market cap exceeding $2 trillion in 2024 signifies increasing adoption and potential for alternative financial systems.

- Stablecoin Adoption: The rise of stablecoins for payments, particularly in cross-border transactions, offers a direct substitute for traditional payment rails.

- Decentralized Finance (DeFi): DeFi platforms, built on blockchain, are beginning to offer banking-like services such as lending and borrowing without traditional intermediaries.

- Regulatory Evolution: As regulatory frameworks adapt, the legitimacy and usability of crypto-assets as financial substitutes are likely to increase.

Non-Bank Lenders and Specialist Finance Providers

The rise of non-bank lenders and specialist finance providers presents a significant threat. These entities, offering specialized loans like mortgages or business finance, often boast more flexible criteria and quicker approvals than traditional banks.

This agility allows them to attract customers seeking alternatives or those underserved by conventional banking. For instance, in 2024, non-bank lenders continued to capture market share in specific lending segments, particularly in areas like equipment finance and certain mortgage types, challenging the established dominance of banks.

Their ability to tailor products and processes to niche markets means they can siphon off profitable customer segments from incumbent banks like Bendigo & Adelaide Bank.

- Increased Competition: Non-bank lenders directly compete for loan origination.

- Customer Attrition: Flexible criteria and faster processing can lure customers away.

- Market Share Erosion: Specialist providers are steadily gaining ground in key lending areas.

- Niche Specialization: Their focus on specific loan types allows for superior product offerings.

The threat of substitutes for Bendigo & Adelaide Bank is substantial, driven by evolving consumer preferences and technological advancements. Fintech solutions, digital wallets, and online investment platforms offer convenient and often cheaper alternatives to traditional banking services, directly impacting revenue streams. For example, global digital wallet transaction volumes continued to surge in 2023, reaching trillions of dollars, while the robo-advisor market surpassed $1.5 trillion in AUM by the end of the same year.

Buy Now Pay Later (BNPL) services are also siphoning off potential interest income from credit products, with Australian BNPL transaction volumes projected to reach tens of billions annually by 2025. Furthermore, cryptocurrencies and decentralized finance (DeFi) platforms, though still developing, offer alternative methods for value storage and transfer, with the global crypto market capitalization exceeding $2 trillion in early 2024. Non-bank lenders also pose a threat by capturing market share in specialized lending segments with their agile and customer-centric approaches.

| Substitute Category | Key Characteristics | Impact on Bendigo & Adelaide Bank | Market Trend (2023-2024 Data) |

|---|---|---|---|

| Fintech & Digital Wallets | Streamlined payments, lower fees, enhanced user experience | Reduced transaction fees, potential loss of payment processing revenue | Global digital wallet transactions in trillions (2023); continued growth in adoption. |

| Online Investment Platforms (Robo-advisors) | Lower fees, accessible investment tools, automated portfolio management | Loss of wealth management and advisory fees | Global robo-advisor AUM exceeded $1.5 trillion (end of 2023). |

| Buy Now Pay Later (BNPL) | Interest-free deferred payments, flexible spending options | Diverted interest income from credit cards and personal loans | Australian BNPL market projected to reach tens of billions annually by 2025. |

| Cryptocurrencies & DeFi | Decentralized value storage and transfer, alternative lending/borrowing | Potential disintermediation from core banking functions (payments, lending) | Global crypto market cap exceeded $2 trillion (early 2024); growing stablecoin use for payments. |

| Non-Bank Lenders | Specialized loan products, flexible criteria, faster approvals | Erosion of market share in specific lending segments (e.g., mortgages, equipment finance) | Continued market share gains in niche lending areas (2024). |

Entrants Threaten

The Australian banking sector is characterized by high regulatory barriers, primarily enforced by the Australian Prudential Regulation Authority (APRA). These stringent licensing requirements, coupled with demanding capital adequacy standards and comprehensive prudential frameworks, necessitate substantial investment and specialized expertise. For instance, APRA's capital requirements mean new banks must hold significant reserves, a considerable hurdle for potential entrants.

Establishing a new bank demands substantial capital, often in the hundreds of millions of dollars, to satisfy stringent regulatory capital adequacy ratios and build essential infrastructure. This significant financial hurdle naturally deters many potential entrants, favoring established players or those with highly innovative, capital-light models like certain fintech challengers.

Established banks like Bendigo & Adelaide Bank benefit from decades of built-up brand recognition and customer trust, essential in the sensitive financial sector. Newcomers must invest heavily and patiently to cultivate similar credibility.

For instance, Bendigo Bank was recognized as Australia's most trusted bank in 2023, a significant advantage that new entrants struggle to replicate quickly.

Economies of Scale and Scope

Established banks like Bendigo & Adelaide Bank leverage significant economies of scale, which translates into lower per-unit costs for operations, technology infrastructure, and marketing efforts. This allows them to offer more competitive pricing on loans and other financial products.

New entrants face a substantial hurdle in matching these efficiencies. For instance, the cost of developing and maintaining advanced digital banking platforms, a critical differentiator in 2024, requires massive upfront investment. Without the existing customer base to spread these costs, new players are at a distinct cost disadvantage.

- Cost Disadvantage: New entrants struggle to achieve the same operational efficiencies as established banks, leading to higher per-unit costs.

- Technology Investment: Significant capital is needed for modern digital platforms, a barrier for newcomers.

- Product Breadth: Incumbents offer a wider range of services due to their scale, making it difficult for new entrants to compete comprehensively.

Customer Acquisition Costs and Network Effects

Attracting customers in the established banking sector is a significant hurdle for new players, largely due to high customer acquisition costs. For instance, in 2024, major banks continued to invest heavily in digital marketing and promotional offers to gain market share, often exceeding tens of millions of dollars annually.

Existing institutions, like Bendigo and Adelaide Bank, benefit from powerful network effects. These include extensive ATM and branch networks, established digital platforms, and deeply integrated customer ecosystems that make switching inconvenient for many. This existing infrastructure creates a substantial competitive advantage.

New entrants must therefore allocate substantial capital towards marketing, customer incentives, and building comparable infrastructure to even approach parity. This financial commitment acts as a considerable barrier, discouraging many potential competitors from entering the market.

Bendigo's unique Community Bank model fosters a distinct local network effect, strengthening customer loyalty and engagement within specific communities, further solidifying its competitive position against potential new entrants.

The threat of new entrants for Bendigo & Adelaide Bank is generally low, primarily due to significant regulatory hurdles and high capital requirements. APRA's stringent licensing and capital adequacy standards mean new banks must invest heavily, often hundreds of millions of dollars, creating a substantial financial barrier. Furthermore, established players benefit from strong brand loyalty and economies of scale that new entrants struggle to replicate quickly.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | APRA licensing, capital adequacy, prudential frameworks | High financial investment and expertise needed |

| Capital Investment | Hundreds of millions for licensing and infrastructure | Deters most potential entrants |

| Brand Recognition & Trust | Decades of built-up customer loyalty | Requires significant marketing and time to build |

| Economies of Scale | Lower per-unit costs for operations and technology | Creates a cost disadvantage for newcomers |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bendigo and Adelaide Bank is built upon comprehensive data from the bank's annual reports, ASX filings, and industry-specific publications. We also leverage insights from financial news outlets and market research reports to provide a robust understanding of the competitive landscape.