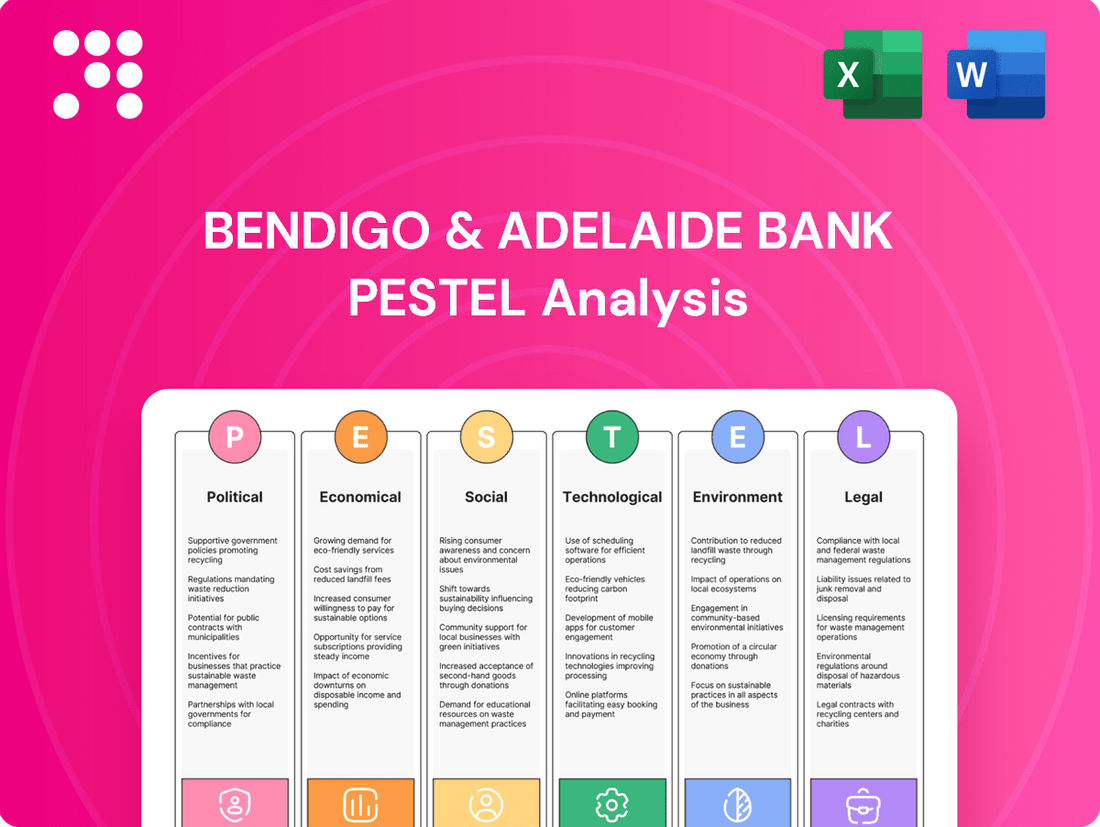

Bendigo & Adelaide Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

Uncover the critical political, economic, and social factors shaping Bendigo & Adelaide Bank's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate the ever-changing financial landscape. Understand the opportunities and threats to make informed strategic decisions. Download the full report now to gain a competitive edge.

Political factors

The Australian banking sector operates under a stringent regulatory framework, with bodies like the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) setting the rules. These regulations, including changes to financial services legislation and consumer protection laws, directly shape Bendigo and Adelaide Bank's operational strategies and product development.

For example, the forthcoming Banking Code of Practice, expected to be fully implemented by 2025, introduces more robust protections for small businesses and vulnerable customers. Adherence to these updated standards will necessitate adjustments in how the bank engages with these customer segments, potentially impacting service delivery and compliance costs.

The Financial Accountability Regime (FAR) is a significant regulatory development impacting Australian financial institutions, including Bendigo and Adelaide Bank. This framework places a strong emphasis on individual accountability for senior executives and directors within these organizations. Bendigo and Adelaide Bank must demonstrate that it has implemented comprehensive governance and risk management systems to meet FAR requirements, a process that will be closely scrutinized by regulators.

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) are jointly responsible for overseeing the implementation of FAR. The regime's expansion beyond banks to include superannuation and insurance sectors by 2025 highlights its broad impact on the financial services industry. This means Bendigo and Adelaide Bank operates within an evolving regulatory landscape where clear lines of responsibility are paramount.

The Australian government is finalizing reforms to regulate Buy Now, Pay Later (BNPL) services as consumer credit, with these changes expected to be in place by mid-2025. This move aims to enhance consumer protection and introduces new compliance obligations for financial providers. For Bendigo and Adelaide Bank, this means a need to ensure any BNPL offerings align with these evolving credit regulations, potentially impacting operational costs and product design.

Climate-Related Financial Disclosures

Mandatory climate-related financial disclosure requirements are set to fully phase in for large businesses and financial institutions starting January 2025. As a major financial player, Bendigo and Adelaide Bank will need to produce annual sustainability reports and disclose climate-related financial information, directly impacting its strategic planning and operational reporting.

These new regulations are designed to provide greater transparency on climate-related risks and opportunities. For Bendigo and Adelaide Bank, this means a heightened focus on integrating climate considerations into its risk management frameworks and business strategies.

- Increased Reporting Burden: Bendigo and Adelaide Bank must allocate resources to gather, analyze, and report on climate-related data, including Scope 1, 2, and potentially Scope 3 emissions.

- Enhanced Investor Scrutiny: The disclosures will allow investors to better assess the bank's exposure to climate transition and physical risks, potentially influencing its cost of capital and investor relations.

- Strategic Alignment: The bank will likely need to align its lending and investment portfolios with net-zero targets, influencing product development and customer engagement strategies.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF)

Bendigo and Adelaide Bank faces heightened regulatory scrutiny under Australia's strengthened Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. AUSTRAC's 2025-2026 priorities signal a push to expand these regulations to new industries, placing greater demands on financial institutions to bolster their compliance frameworks. This includes enhancing risk management systems and reporting capabilities to effectively combat financial crime.

The expansion of AML/CTF regulations means Bendigo and Adelaide Bank must invest further in technology and personnel to meet evolving compliance standards. AUSTRAC's focus on 'tranche 2' industries underscores the government's commitment to a more robust financial crime prevention regime. This proactive approach aims to mitigate risks associated with illicit financial flows, safeguarding the integrity of the Australian financial system.

- Increased Compliance Burden: Financial institutions like Bendigo and Adelaide Bank will need to adapt to potentially broader reporting requirements and more stringent due diligence processes.

- Investment in Technology: Enhanced AML/CTF compliance often necessitates significant investment in advanced transaction monitoring systems and data analytics tools.

- Reputational Risk: Failure to adequately comply with AML/CTF regulations can lead to substantial fines and severe reputational damage, impacting customer trust and market standing.

- AUSTRAC's Enforcement Actions: In 2023, AUSTRAC imposed over $1.5 billion in infringement notices and court-imposed penalties, highlighting the serious consequences of non-compliance.

The Australian political landscape significantly influences Bendigo and Adelaide Bank through evolving regulations and government priorities. Key policy shifts, such as the implementation of the Financial Accountability Regime (FAR) by 2025, underscore a drive for greater executive accountability within financial institutions, directly impacting governance structures.

Furthermore, the government's move to regulate Buy Now, Pay Later (BNPL) services as consumer credit by mid-2025 will necessitate compliance adjustments for any BNPL offerings by the bank, aiming to bolster consumer protection. These regulatory developments, alongside mandatory climate-related financial disclosures from January 2025, signal a more transparent and accountable operating environment for the bank.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Bendigo & Adelaide Bank, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by highlighting key opportunities and threats derived from current trends and market dynamics.

A concise, PESTLE-driven overview of Bendigo & Adelaide Bank's external environment, offering actionable insights to navigate market shifts and mitigate potential risks.

Economic factors

The Australian banking sector is navigating a shift towards a lower-growth, lower-interest-rate landscape, with projections indicating a potential decline in rates during 2025. This environment directly impacts banks' net interest margins (NIMs), a crucial measure of their profitability.

Bendigo and Adelaide Bank, alongside other major financial institutions, faces the challenge of managing its lending and deposit strategies within this evolving interest rate structure. For instance, in the first half of 2024, the Reserve Bank of Australia maintained its cash rate at 4.35%, a level that has already influenced NIMs across the industry.

A sustained period of lower rates could compress NIMs further, as the spread between interest earned on loans and interest paid on deposits narrows. This necessitates strategic adjustments in how Bendigo and Adelaide Bank prices its products and manages its funding costs to maintain profitability.

Subpar economic growth and lingering geopolitical instability are creating a cloud of uncertainty for banks. While inflation has cooled, the broader economic picture, particularly how consumers are spending and managing their household budgets, directly impacts how much people want to borrow, how likely they are to repay loans, and ultimately, how well banks like Bendigo and Adelaide Bank perform financially.

The Australian banking landscape is seeing increased competition, with traditional big banks facing challenges from agile digital banks and burgeoning fintech companies. This intensified rivalry, especially in areas like home loans and everyday banking, puts pressure on Bendigo and Adelaide Bank's market share and earnings.

In 2024, the Australian Prudential Regulation Authority (APRA) reported that while the major banks still hold a significant portion of assets, the market share for smaller and non-bank lenders, including digital-first institutions, has been steadily growing, particularly in the mortgage market.

This competitive environment necessitates that Bendigo and Adelaide Bank prioritizes customer retention through enhanced loyalty programs and by consistently introducing innovative digital products and services to stay relevant and maintain its profitability.

Household Debt and Loan Arrears

Despite generally low loan losses observed in 2024, a noticeable uptick in the proportion of non-performing loans has emerged, largely concentrated within the housing loan segment. This trend is directly attributable to the persistent pressures of inflation and elevated interest rates, which have significantly strained household budgets across the nation.

Looking ahead, financial institutions, including Bendigo and Adelaide Bank, anticipate that loan arrears will likely reach their highest point in 2025. This projected peak necessitates a vigilant approach to monitoring credit quality and proactively managing potential loan losses to safeguard financial stability.

- Housing loan arrears are a primary driver of the rising non-performing loan share.

- Inflation and interest rate hikes are key contributors to household financial strain.

- Loan arrears are expected to peak in 2025, requiring careful credit risk management.

Investment and Lending Activities

Broader economic conditions significantly shape Bendigo and Adelaide Bank's investment and lending operations. These conditions directly impact the bank's capacity to extend credit and support both individual and business growth.

For instance, Bendigo and Adelaide Bank reported cash earnings of $562.0 million for the financial year 2024. This figure, alongside a net interest margin of 1.90%, provides a snapshot of the bank's financial strength and its potential to engage in lending activities.

- Economic Resilience: The bank's lending activities are sensitive to economic cycles, with stronger conditions generally leading to increased demand for loans and investments.

- Interest Rate Environment: Fluctuations in interest rates directly affect the bank's net interest margin and the cost of borrowing for its customers, influencing lending volumes.

- Consumer and Business Confidence: Higher confidence levels typically translate to greater willingness to invest and borrow, boosting the bank's core activities.

- Inflationary Pressures: Persistent inflation can impact disposable income and business profitability, potentially affecting loan repayment capacity and demand.

The economic landscape presents a mixed outlook for Bendigo and Adelaide Bank. While inflation has shown signs of cooling, persistent pressures and elevated interest rates are straining household budgets, leading to a projected peak in loan arrears in 2025. This necessitates careful credit risk management.

Bendigo and Adelaide Bank's financial performance, exemplified by its $562.0 million cash earnings in FY24 and a net interest margin of 1.90%, is intrinsically linked to broader economic conditions. Consumer and business confidence, alongside the interest rate environment, will significantly influence lending volumes and profitability.

The Australian banking sector is also adapting to a lower-growth, potentially lower-rate environment, which could further compress net interest margins. This requires strategic pricing and funding management to maintain profitability in a competitive market.

| Economic Factor | Impact on Bendigo & Adelaide Bank | Key Data Point (2024/2025 Projections) |

| Interest Rate Environment | Affects Net Interest Margins (NIMs) and borrowing costs. | RBA Cash Rate: 4.35% (maintained through H1 2024); potential decline in 2025. |

| Economic Growth | Influences loan demand and business investment. | Subpar growth creates uncertainty; FY24 Cash Earnings: $562.0 million. |

| Inflation | Impacts household budgets and loan repayment capacity. | Cooling inflation, but persistent pressures noted. |

| Loan Arrears | Indicates credit quality and potential loan losses. | Uptick in non-performing loans, primarily housing; expected peak in 2025. |

Same Document Delivered

Bendigo & Adelaide Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bendigo & Adelaide Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. Understand the critical external influences shaping its strategy and operations.

Sociological factors

Customers are increasingly opting for digital banking channels, with a notable surge in online and mobile transactions. This shift is evident in the growing adoption rates of digital banking services across the sector.

This preference for digital-first interactions, coupled with a strong demand for personalized and frictionless experiences, directly influences Bendigo and Adelaide Bank's strategic focus on digital transformation. Initiatives like streamlined digital onboarding and the integration of AI for enhanced customer service are key responses to these evolving expectations.

For instance, by the end of the 2023 financial year, Bendigo and Adelaide Bank reported a significant increase in digital transactions, with over 70% of customer interactions occurring through digital channels, underscoring the critical importance of their digital strategy.

Bendigo and Adelaide Bank's commitment to community engagement is a cornerstone of its social strategy, exemplified by its distinctive Community Bank model. This model directly channels profits back into local areas, fostering economic growth and strengthening community bonds. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported a statutory profit after tax of $974 million, with a significant portion of its success tied to the positive impact of its community-focused initiatives.

Maintaining public trust is paramount for Bendigo and Adelaide Bank, directly influencing its social license to operate and customer retention. The bank's ongoing investment in community development and its reputation for ethical practices are crucial for building and sustaining this trust. This focus on social responsibility not only enhances customer loyalty but also differentiates it in a competitive banking landscape.

Bendigo and Adelaide Bank, like all financial institutions, must navigate evolving societal expectations around financial inclusion. The updated Banking Code of Practice, effective from July 1, 2024, places a strong emphasis on accessibility for vulnerable customers. This includes individuals with disabilities, older Australians, and those with limited English proficiency.

Meeting these requirements means Bendigo and Adelaide Bank needs to actively ensure its digital platforms and physical branches are accessible. For instance, providing clear signage, large print options, and staff trained to assist customers with diverse needs are crucial. Furthermore, offering services like telephone interpreter assistance, as mandated by the code, is vital for customers who may struggle with English, thereby fostering greater trust and engagement.

Digital Literacy and Scam Awareness

As digital banking becomes more prevalent, equipping customers with strong digital literacy and heightened scam awareness is crucial for preventing financial crime. Bendigo and Adelaide Bank recognizes this, offering programs like 'Banking Safely Online' to educate users. These efforts are vital as reports indicate a significant rise in digital scams targeting Australian bank customers, with losses escalating year-on-year.

The bank's investment in advanced fraud detection systems complements these educational initiatives. For instance, in the 2023 financial year, Australian financial institutions collectively reported over $500 million in scam losses, highlighting the persistent threat and the need for robust protective measures.

- Digital literacy programs are essential to combat increasing online financial fraud.

- Bendigo and Adelaide Bank actively promotes online safety through educational sessions.

- Investment in fraud detection technology is a key component of customer protection.

- Australian financial institutions faced substantial scam losses, underscoring the societal impact.

Workforce Transformation and Talent Management

Bendigo and Adelaide Bank is actively transforming its workforce to meet evolving customer demands and drive growth, with a significant focus on digital skills and the integration of artificial intelligence. This strategic shift necessitates attracting and retaining talent proficient in these new areas within the competitive financial services sector.

The bank's commitment to digital transformation is evident in its reported investments, aiming to equip its employees with the necessary skills for a future-ready workforce. For instance, in the financial year 2023, Bendigo and Adelaide Bank reported a 12.5% increase in their digital banking adoption rate among customers, highlighting the demand for digitally adept staff.

- Digital Upskilling Initiatives: The bank is investing in training programs to enhance employees' digital capabilities, including data analytics and AI literacy.

- Talent Acquisition Focus: Recruitment strategies are being refined to attract individuals with expertise in emerging financial technologies and customer experience management.

- Retention Strategies: Efforts are underway to foster a positive work environment and offer competitive benefits to retain skilled employees amidst industry competition.

Societal expectations are shifting towards greater financial inclusion and accessibility, prompting banks like Bendigo and Adelaide Bank to adapt their services. The updated Banking Code of Practice, effective July 2024, mandates enhanced support for vulnerable customers, including those with disabilities or limited English proficiency.

Bendigo and Adelaide Bank is responding by ensuring its digital and physical channels are accessible, offering features like telephone interpreter assistance and staff training to meet diverse customer needs. This focus on inclusivity not only aligns with regulatory requirements but also builds stronger customer relationships and trust.

The bank's commitment to community engagement, particularly through its Community Bank model, remains a significant sociological factor, reinforcing its social license to operate. This model directly benefits local economies, fostering goodwill and customer loyalty, as demonstrated by its reported statutory profit after tax of $974 million in the 2023 financial year.

Technological factors

Bendigo and Adelaide Bank is heavily invested in digital transformation, with a key milestone being the consolidation onto a single core banking system by 2025. This strategic move is designed to streamline its IT infrastructure and enhance operational efficiency.

The bank’s modernization efforts include a significant shift towards cloud-based services, which is expected to improve scalability and agility. This transition is crucial for automating processes and enabling a more integrated, multi-channel customer experience, aligning with evolving digital expectations.

By 2025, the bank anticipates this digital overhaul will lead to a more robust and responsive operational framework. This technological advancement is a critical factor in maintaining competitiveness within the rapidly digitizing financial services sector.

Bendigo and Adelaide Bank is actively integrating Artificial Intelligence (AI) and automation across its operations. This includes using AI to modernize legacy systems, improve customer interactions, and streamline commercial lending processes. For instance, in 2024, the bank continued its focus on enhancing digital capabilities, with AI playing a crucial role in personalizing customer experiences and optimizing back-office functions.

These technological advancements are pivotal for gaining deeper customer insights and bolstering fraud detection capabilities. By automating routine tasks, the bank aims to significantly boost operational efficiency. In the 2024 financial year, continued investment in these areas was evident, contributing to a more agile and responsive banking environment, with early indicators showing positive impacts on processing times and risk management.

Bendigo and Adelaide Bank is prioritizing the delivery of Open Banking according to industry schedules, aiming to integrate these new capabilities into its customer product suite. This strategic move is designed to enhance customer offerings and foster innovation.

The bank is actively expanding its Cloud and API capabilities, recognizing their importance in building seamless, connected experiences for customers. This is essential for unifying services across its diverse brands and numerous partnerships, ensuring a consistent and efficient user journey.

By leveraging these technological advancements, Bendigo and Adelaide Bank seeks to streamline operations and unlock new revenue streams. For instance, in the first half of FY24, the bank reported a 7.1% increase in its digital customer base, highlighting the growing adoption of digitally-enabled services.

Cybersecurity and Data Privacy

As Bendigo and Adelaide Bank's digital presence grows, so does the threat landscape for cyber fraud and data breaches. The bank has responded by significantly boosting its investment in advanced scam and fraud detection technologies. This proactive approach saw them block millions in fraudulent transactions during the 2023 financial year, demonstrating a commitment to safeguarding customer assets and sensitive information.

Upholding robust data handling standards is paramount to maintaining customer trust in an increasingly digital environment. Bendigo and Adelaide Bank continues to refine its practices, ensuring compliance with evolving privacy regulations and implementing stringent security measures to protect customer data from unauthorized access. This focus on data privacy is crucial for long-term customer loyalty and the bank's reputation.

Key initiatives and impacts include:

- Increased investment in cybersecurity: Allocating substantial resources to enhance fraud detection and prevention capabilities.

- Millions in fraudulent transactions blocked: A clear indicator of the effectiveness of their security measures in the 2023 financial year.

- Uplifted data handling standards: Continuous improvement in processes to ensure customer data privacy and security.

- Maintaining customer trust: Prioritizing cybersecurity and data privacy as foundational elements for customer confidence.

Fintech Partnerships and Innovation

Bendigo and Adelaide Bank is actively leveraging fintech partnerships to drive innovation. A prime example is their collaboration with Tic:Toc, which streamlines the digital home loan application process, aiming to reduce turnaround times significantly. This strategic move directly addresses the growing demand for faster, more convenient digital banking experiences.

The acquisition of Ferocia, the company behind the popular digital banking app Up, further solidifies the bank's commitment to technological advancement. This move allows Bendigo and Adelaide Bank to integrate cutting-edge digital capabilities and attract a younger, tech-oriented customer base. By embracing these partnerships, the bank aims to enhance its product offerings and maintain a competitive edge in the rapidly evolving financial landscape.

These collaborations are not just about adopting new technologies; they are about fundamentally transforming how the bank interacts with its customers.

- Digital Home Loans: Partnerships like Tic:Toc aim to cut processing times for home loans, potentially reducing them from weeks to days.

- Customer Acquisition: The Up app, acquired from Ferocia, had over 700,000 customers as of late 2023, demonstrating the potential for rapid digital customer growth.

- Innovation Acceleration: By working with fintechs, Bendigo and Adelaide Bank can bring new digital products and services to market faster than developing them entirely in-house.

- Competitive Positioning: These technological integrations are vital for staying relevant against neobanks and other digitally native financial institutions.

Bendigo and Adelaide Bank is heavily focused on digital transformation, aiming to complete its core banking system consolidation by 2025. This strategic move is supported by significant investment in cloud services and API capabilities to create seamless customer experiences across its brands and partnerships.

The bank is actively integrating AI and automation to modernize systems, enhance customer interactions, and streamline processes like commercial lending. In FY24, the bank saw a 7.1% increase in its digital customer base, underscoring the growing adoption of these digital services.

Cybersecurity is a major technological focus, with substantial investment in advanced fraud detection. This proactive stance led to blocking millions in fraudulent transactions in FY23, reinforcing customer trust through robust data handling and privacy standards.

Fintech partnerships, such as with Tic:Toc for digital home loans and the acquisition of the Up app from Ferocia (over 700,000 customers by late 2023), are accelerating innovation and customer acquisition in the digital space.

Legal factors

The Australian Banking Association's updated Banking Code of Practice, effective from February 2025 and approved by ASIC, introduces stronger consumer and small business protections. Bendigo and Adelaide Bank, as a signatory, will need to align with these updated standards, which include a broader definition of small business and greater inclusivity.

The Consumer Data Right (CDR) in Australia, particularly its open banking component, has been a significant legal factor since its 2020 implementation. This framework mandates that banks like Bendigo and Adelaide Bank share customer data with accredited third parties upon consumer consent.

Bendigo and Adelaide Bank must adhere to these CDR obligations, which are designed to enhance competition and drive innovation within the financial services sector. This compliance means investing in secure data sharing infrastructure and ensuring customer privacy is paramount.

By enabling consumers to access and share their financial data, the CDR fosters the creation of new, personalized financial products and services. This can lead to improved customer experiences and potentially new revenue streams for the bank, but also requires careful management of data security and customer trust.

Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws are a significant consideration for Bendigo and Adelaide Bank. AUSTRAC, the country's financial intelligence agency, continues to enhance its regulatory framework, which includes extending oversight to a broader range of industries. This means banks like Bendigo and Adelaide Bank must maintain sophisticated systems and procedures to actively combat financial crime and meet all mandatory reporting requirements.

Financial Services Licensing and Disclosure Obligations

Financial services licensing and disclosure obligations are critical for Bendigo and Adelaide Bank. In Australia, financial services providers, including fintechs, must adhere to strict regulations set by the Australian Securities and Investments Commission (ASIC). This includes obtaining and maintaining appropriate financial services and consumer credit licenses, alongside fulfilling ongoing registration and disclosure duties. For instance, in the 2023 financial year, ASIC reported a significant increase in enforcement actions related to disclosure failures, underscoring the importance of compliance for institutions like Bendigo and Adelaide Bank.

Bendigo and Adelaide Bank's operations and product offerings must consistently align with ASIC's licensing and disclosure mandates. This involves ensuring transparency in all customer interactions and product documentation, which is a key focus area for regulators. Recent ASIC reviews of banking practices in 2024 have highlighted the need for enhanced clarity in product terms and conditions, with a particular emphasis on fees and charges. Failure to comply can result in substantial penalties and reputational damage.

- Licensing Requirements: Bendigo and Adelaide Bank must hold the relevant Australian Financial Services Licence (AFSL) and Australian Credit Licence (ACL) to operate.

- Disclosure Obligations: The bank is legally bound to provide clear, concise, and accurate information to customers about its products and services. This includes Product Disclosure Statements (PDS) and other key information documents.

- ASIC Oversight: The Australian Securities and Investments Commission (ASIC) actively monitors and enforces compliance with these licensing and disclosure laws.

- Consumer Protection: These regulations are designed to protect consumers by ensuring they receive adequate information to make informed financial decisions.

Privacy Laws and Data Handling Standards

Privacy regulations are paramount in the financial industry, and Bendigo and Adelaide Bank places a strong emphasis on adhering to these stringent requirements. The bank is dedicated to maintaining robust data privacy and security measures to safeguard customer information.

Upholding high data handling standards is an ongoing commitment for Bendigo and Adelaide Bank, reflecting both a legal obligation and a core ethical principle. This dedication ensures the protection of sensitive customer data against unauthorized access or misuse.

- Australian Privacy Principles (APPs): Bendigo and Adelaide Bank must comply with the APPs outlined in the Privacy Act 1988 (Cth), which govern the collection, use, disclosure, and storage of personal information.

- Financial Sector Specific Regulations: Beyond general privacy laws, the bank is subject to specific regulations within the financial sector concerning data security and customer data handling, such as those mandated by the Australian Prudential Regulation Authority (APRA).

- Data Breach Notification: In the event of a data breach, the bank is legally required to notify affected individuals and the Office of the Australian Information Commissioner (OAIC) promptly, as per the Notifiable Data Breaches (NDB) scheme.

- Customer Consent and Transparency: The bank must ensure it obtains appropriate consent for data collection and usage, maintaining transparency with customers about how their information is handled.

The evolving legal landscape in Australia significantly impacts Bendigo and Adelaide Bank. New consumer protection measures, like the updated Banking Code of Practice from February 2025, necessitate adjustments to align with broader definitions of small businesses and increased inclusivity. Furthermore, the Consumer Data Right (CDR) framework, particularly open banking, requires the bank to facilitate secure customer data sharing with accredited third parties, fostering competition and innovation while demanding robust data security protocols.

Compliance with Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws, overseen by AUSTRAC, remains critical. Bendigo and Adelaide Bank must maintain sophisticated systems to combat financial crime and meet reporting obligations. The bank also faces stringent licensing and disclosure requirements from ASIC, with recent enforcement actions in 2023 highlighting the importance of transparency in product terms and conditions, especially regarding fees and charges.

Privacy regulations, including the Australian Privacy Principles (APPs) under the Privacy Act 1988, are paramount. Bendigo and Adelaide Bank must ensure robust data handling, secure customer information, and comply with data breach notification requirements under the NDB scheme. Customer consent and transparency in data usage are key to maintaining trust and adhering to these legal mandates.

Environmental factors

Bendigo and Adelaide Bank acknowledges climate change as a material risk, evidenced by its board-approved Climate Change Policy Statement and a dedicated Climate & Nature Action Plan for 2024-2026. This strategic approach underscores the bank's commitment to achieving net zero emissions by 2050.

The bank's action plan actively integrates climate mitigation and adaptation strategies across its operations, aiming to support a sustainable transition. This includes evaluating climate-related risks and opportunities within its lending portfolios and business practices, aligning with evolving regulatory expectations and stakeholder demands for environmental responsibility.

Bendigo and Adelaide Bank is actively pursuing significant emissions reductions, targeting a 50% decrease in absolute emissions by 2030 and a 95% reduction by 2040, encompassing both operational and financed emissions.

The bank is also committed to sourcing 100% renewable electricity by 2025, demonstrating a clear move towards sustainable energy practices.

Maintaining its carbon neutral status remains a key environmental objective, reflecting a broader commitment to mitigating its climate impact.

Bendigo and Adelaide Bank actively steers clear of direct financing for fossil fuel industries and native forest logging, demonstrating a commitment to environmental sustainability. This policy aligns with a growing global demand for responsible investment, which saw sustainable finance grow significantly, with global sustainable debt issuance reaching an estimated USD 1.5 trillion in 2024.

The bank champions customer-led emissions reduction through initiatives like promoting energy efficiency and offering sustainability-linked loans. As of early 2025, the Australian market for green loans and sustainability-linked loans has seen robust growth, with several major banks reporting increased uptake, reflecting a trend towards performance-based financial instruments tied to environmental outcomes.

Climate Risk Management and Disclosure

Bendigo and Adelaide Bank is enhancing its approach to climate change risk, focusing on robust governance and risk management. This includes detailed physical risk scenario analysis to understand potential impacts.

The bank is committed to transparency, actively disclosing its financed emissions. This aligns with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and prepares the institution for upcoming mandatory climate-related financial reporting requirements.

- Climate Risk Governance: Optimizing frameworks for better management.

- Physical Risk Analysis: Conducting scenario analysis to assess impacts.

- Emissions Disclosure: Reporting financed emissions in line with TCFD.

- Regulatory Preparedness: Aligning with upcoming mandatory disclosure rules.

Environmental Sustainability in Operations

Bendigo and Adelaide Bank is actively integrating environmental sustainability into its core operations. Its key corporate locations are engineered for energy efficiency, incorporating advanced systems such as water treatment facilities and on-site solar power generation. This strategic focus aims to minimize the bank's direct environmental impact.

The bank has set ambitious targets for reducing its operational carbon footprint. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported a 16% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress towards its climate goals.

- Energy Efficiency: Major corporate sites feature design elements for reduced energy consumption.

- Renewable Energy: Installation of solar power at key locations contributes to a cleaner energy mix.

- Water Management: Water treatment plants are in place to conserve and responsibly manage water resources.

- Carbon Footprint Reduction: The bank is actively working to lower its overall greenhouse gas emissions.

Bendigo and Adelaide Bank is actively addressing climate change, with a board-approved Climate Change Policy Statement and a 2024-2026 Climate & Nature Action Plan. The bank aims for net zero emissions by 2050, targeting a 50% absolute emissions reduction by 2030 and 95% by 2040, covering both operations and financed emissions.

The bank is committed to 100% renewable electricity sourcing by 2025 and maintains its carbon neutral status. It avoids direct financing for fossil fuels and native forest logging, aligning with the growing sustainable finance market, which saw global sustainable debt issuance reach an estimated USD 1.5 trillion in 2024.

Bendigo and Adelaide Bank is enhancing its climate risk management, focusing on governance and physical risk scenario analysis. They are also transparently disclosing financed emissions, preparing for mandatory climate-related financial reporting, and promoting customer emissions reduction through initiatives like sustainability-linked loans.

| Environmental Target | Current Status/Progress | Year |

|---|---|---|

| Net Zero Emissions | Target set | 2050 |

| Absolute Emissions Reduction | Target: 50% reduction | 2030 |

| Absolute Emissions Reduction | Target: 95% reduction | 2040 |

| Renewable Electricity Sourcing | Target: 100% | 2025 |

| Operational Emissions Reduction (Scope 1 & 2) | 16% reduction from 2019 baseline | FY23 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bendigo & Adelaide Bank is meticulously constructed using data from reputable financial news outlets, Reserve Bank of Australia reports, and Australian Bureau of Statistics publications. We ensure a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.